TIDMTHAL TIDMLSR

RNS Number : 0980Y

Thalassa Holdings Limited

03 May 2019

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD

CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION.

IN PARTICULAR, THIS ANNOUNCEMENT SHOULD NOT BE RELEASED, PUBLISHED,

DISTRIBUTED, FORWARDED OR TRANSMITTED, IN WHOLE OR IN PART, IN,

INTO OR FROM ANY RESTRICTED JURISDICTION, INCLUDING THE UNITED

STATES.

THIS ANNOUNCEMENT IS AN ADVERTISEMENT AND NOT A PROSPECTUS OR

PROSPECTUS EQUIVALENT DOCUMENT AND NO INVESTMENT DECISION IN

RELATION TO THE OFFER OR THE THALASSA CONSIDERATION SHARES SHOULD

BE MADE EXCEPT ON THE BASIS OF INFORMATION IN THE OFFER DOCUMENT

AND THE PROSPECTUS EQUIVALENT DOCUMENT.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (EU) NO. 596/2014.

FOR IMMEDIATE RELEASE

3 May 2019

Thalassa Holdings Ltd

("Thalassa", "THAL" or the "Company")

Lapse of Offer

On 6 March 2019, Thalassa published an offer document (the

"Offer Document") setting out the full terms and conditions of its

offer to acquire the entire issued share capital of the Local

Shopping REIT Plc ("LSR). On 2 May 2019, Thalassa announced an

extension of the Offer until 1.00 p.m. (London time) on 3 May 2019

("Extended Closing Date"). As set out below, the Acceptance

Condition was not satisfied as at the Extended Closing Date and

accordingly the Offer has now lapsed and is no longer capable of

acceptance.

The Thalassa Board remains baffled by the incomprehensible

opposition of the LSR Board to a certain exit opportunity for its

shareholders at an attractive premium to LSR's prevailing share

price and net asset values. LSR Shareholders are now faced with the

option of the LSR Board's uncertain and costly proposal to wind up

the company which was only supported by approximately 44.9% of

LSR's shareholders at the recent general meeting.

The Thalassa Board remains resolute in its stance that the Offer

was the best possible alternative for LSR Shareholders to receive

fair value for their LSR Shares after having seen the value of

their investment continue to decline, as it has every year since

inception.

The Thalassa Board still considers it important that any return

of capital by LSR to LSR Shareholders must be certain in value and

timing, and cost effective. The Thalassa Board has continuously

stated that it does not consider that a winding up of LSR is in the

best interest of all LSR Shareholders and neglects the value

inherent in that company.

Whilst vehemently opposed to the proposals put forward by the

LSR Board to date, the Thalassa Board remain, as they always have

been, open to working with the LSR Board to find a fair, certain

and equitable return of capital to LSR Shareholders.

Level of Acceptances

As at the deadline on the Extended Closing Date for receipt of

valid acceptances under the Offer, being 1.00 p.m. on 3 May 2019,

Thalassa had received valid acceptances in respect of a total of

11,363,414 LSR Shares, equivalent to approximately 18.5 per cent.

of the shares to which the Offer applies.

Accordingly, as at the Extended Closing Date, Thalassa either

owned or had received valid acceptances of the Offer in respect of

a total of 32,384,691 LSR Shares (all of which may be counted

towards the satisfaction of the Acceptance Condition), representing

approximately 39.3 per cent. of the current issued share capital of

LSR.

So far as Thalassa is aware, no acceptances have been received

from persons acting in concert with Thalassa or in respect of

shares which were subject to an irrevocable commitment or letters

of intent procured by Thalassa or any person acting in concert with

Thalassa. There are no further items to be disclosed pursuant to

Rule 17 of the Code.

The percentages listed in this announcement are based on a

current issued share capital of 82,505,853 LSR Shares.

In respect of LSR Shares held in certificated form, the Form of

Acceptance, share certificate(s) and/or other document(s) of title

will be returned by post (or by such other method as may be

approved by the Panel) within 14 days of the Offer lapsing to the

person or agent whose name and address outside the Restricted

Jurisdictions is set out in the relevant box on the Form of

Acceptance or, if none is set out, to the first-named or sole

holder of his registered address outside the Restricted

Jurisdictions. No such documents will be sent to an address in any

Restricted Jurisdiction.

In respect of LSR Shares held in uncertificated form, Link Asset

Services, the Receiving Agent, will, as soon as possible (or within

such longer period as the Panel may permit, not exceeding 14 days

after the lapsing of the Offer), give instructions to Euroclear to

transfer all LSR Shares held in escrow balances and in relation to

which it is the escrow agent for the purposes of the Offer to the

original available balances of the LSR Shareholders concerned.

Capitalised terms in this announcement ("Announcement"), unless

otherwise defined, have the same meanings as set out in the Offer

Document. Copies of this Announcement, the Offer Document and the

Prospectus are available free of charge (subject to certain

restrictions relating to persons in Restricted Jurisdictions) on

Thalassa's website at https://thalassaholdingsltd.com/offer.htm up

to and including the Effective Date or by calling the Receiving

Agent, Link Asset Services on 0371 664 0321 or, if calling from

outside the UK, +44 (0)371 664 0321. The contents of Thalassa's

websites are not incorporated into, and do not form part of, this

Announcement

Enquiries:

Thalassa Holdings Ltd

---------------------

+33 (0) 6 78 63 26

Duncan Soukup (Executive Chairman) 89

---------------------

finnCap (Financial Adviser to Thalassa) +44 (0) 207 220 0500

---------------------

Henrik Persson

Marc Milmo

Max Bullen-Smith

---------------------

Disclosure requirements of the City Code

Under Rule 8.3(a) of the City Code, any person who is interested

in 1% or more of any class of relevant securities of an offeree

company or of any securities exchange offeror (being any offeror

other than an offeror in respect of which it has been announced

that its offer is, or is likely to be, solely in cash) must make an

Opening Position Disclosure following the commencement of the offer

period and, if later, following the announcement in which any

securities exchange offeror is first identified. An Opening

Position Disclosure must contain details of the person's interests

and short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any

securities exchange offeror(s). An Opening Position Disclosure by a

person to whom Rule 8.3(a) applies must be made by no later than

3.30 p.m. on the 10(th) Business Day following the commencement of

the offer period and, if appropriate, by no later than 3.30 p.m. on

the 10(th) Business Day following the announcement in which any

securities exchange offeror is first identified. Relevant persons

who deal in the relevant securities of the offeree company or of a

securities exchange offeror prior to the deadline for making an

Opening Position Disclosure must instead make a Dealing

Disclosure.

Under Rule 8.3(b) of the City Code, any person who is, or

becomes, interested in 1% or more of any class of relevant

securities of the offeree company or of any securities exchange

offeror must make a Dealing Disclosure if the person deals in any

relevant securities of the offeree company or of any securities

exchange offeror. A Dealing Disclosure must contain details of the

dealing concerned and of the person's interests and short positions

in, and rights to subscribe for, any relevant securities of each of

(i) the offeree company and (ii) any securities exchange

offeror(s), save to the extent that these details have previously

been disclosed under Rule 8. A Dealing Disclosure by a person to

whom Rule 8.3(b) applies must be made by no later than 3.30 p.m. on

the Business Day following the date of the relevant dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree

company and by any offeror and Dealing Disclosures must also be

made by the offeree company, by any offeror and by any persons

acting in concert with any of them (see Rules 8.1, 8.2 and 8.4 of

the City Code).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the Disclosure Table on

the Panel's website at www.thetakeoverpanel.org.uk, including

details of the number of relevant securities in issue, when the

offer period commenced and when any offeror was first identified.

You should contact the Panel's Market Surveillance Unit on +44

(0)20 7638 0129 if you are in any doubt as to whether you are

required to make an Opening Position Disclosure or a Dealing

Disclosure.

Publication on website

Pursuant to rule 26 of the Code, a copy of this announcement

will be available, subject to certain restrictions relating to

persons resident in, or subject to the laws and/or regulations, of

Restricted Jurisdictions, for inspection on the Thalassa's website

at www.thalassaholdingsltd.com/offer promptly and in any event by

no later than 12 noon (London time) on the business day following

the date of this announcement. For the avoidance of doubt the

contents of those websites are not incorporated into, and do not

form part of, this announcement.

Rule 2.9 disclosure

In accordance with Rule 2.9 of the City Code on Takeovers and

Mergers, the Company now has in issue 17,410,275 ordinary shares

carrying one vote each (excluding the 8,157,247 ordinary shares

held in Treasury) and admitted to the standard listing segment of

the Official List of the UK Listing Authority (the "Official List")

and to trading on London Stock Exchange plc's main market ("Main

Market") for listed securities. Furthermore, Thalassa has in issue

16,982,238 preference shares (each carrying 10 votes), and are not

admitted to trading on any exchange. The ISIN for the Thalassa

ordinary shares is VGG878801031.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

OLAEAKSDEFKNEFF

(END) Dow Jones Newswires

May 03, 2019 12:20 ET (16:20 GMT)

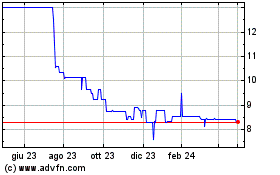

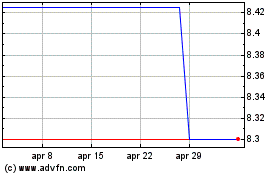

Grafico Azioni Alina (LSE:ALNA)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Alina (LSE:ALNA)

Storico

Da Apr 2023 a Apr 2024