Pound Slides Amid Risk Aversion

07 Maggio 2019 - 8:36AM

RTTF2

The pound depreciated against its major counterparts in the

European session on Tuesday amid risk aversion, as investors kept

an eye on the latest developments around U.S.-China trade talks and

data showed German factory orders rebounded less than expected in

March.

The U.S. has accused China of backtracking on commitments in

trade talks, but a Chinese negotiating team will still travel to

Washington this week to continue the stalled trade talks.

U.S. Trade Representative Robert Lighthizer said he expected top

Chinese negotiator Vice Premier Liu He would lead a delegation

coming from Beijing for talks in Washington on Thursday and

Friday.

Auto and resource stocks were the leading decliners driven by

their exposure to China.

The currency was trading higher against its major counterparts

in the Asian session.

The pound retreated to 1.3085 against the greenback, from a high

of 1.3131 hit at 12:30 am ET. On the downside, 1.29 is likely seen

as the next possible support for the pound.

The pound fell to a weekly low of 144.75 against the yen, after

rising to 145.37 at 2:45 am ET. The pound is seen finding support

around the 142.5 level.

Pulling away from a high of 1.3354 hit at 3:00 am ET, the pound

reversed direction and fell back to 1.3325 against the franc. The

next possible support for the pound is seen around the 1.32

region.

The U.K. currency hit a 4-day low of 0.8559 against the euro,

following a high of 0.8538 touched at 12:30 am ET. If the pound

slides further, 0.87 is likely seen as its next support level.

Preliminary data from the Federal Statistical Office showed that

German manufacturing orders grew less than forecast in March after

falling in the previous two months.

Factory orders grew 0.6 percent from February, when they fell 4

percent. Economists had forecast a 1.5 percent increase in orders

in the month.

Looking ahead, Canada Ivey PMI for April and U.S. consumer

credit for March will be out in the New York session.

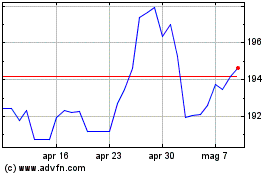

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Mar 2024 a Apr 2024

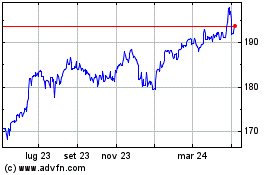

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Apr 2023 a Apr 2024