By Ted Mann

HORNELL, N.Y. -- The future of American high-speed rail is

sitting in a building older than the Battle of Gettysburg: a

cavernous factory that holds the first shells of a $2 billion fleet

of Amtrak Acela trains due to begin running from Washington, D.C.,

to Boston two years from now.

Even as Congress moves toward renewed debates over the future of

both Amtrak and high-speed rail, the first of 28 new Acela train

sets are starting to take shape here. They are the first new

generation of passenger trains on the railroad since the Acela's

debut in 2000.

For Amtrak, that means a chance to relaunch a service that has

been both a commercial success and a procurement headache -- and

still the nearest approximation in the U.S. to the high-speed

trains that whisk travelers among major cities in Europe and

Asia.

Amtrak is buying 28 new sets of power cars and passenger coaches

from French manufacturer Alstom SA, which is assembling the trains

at its complex of plants in New York's Southern Tier. The train

model, known as Avelia Liberty, is from a family of trains already

in use in France and Italy, Amtrak executives say.

The new trains will be slowly entering the existing Acela

service and will have a top speed of 160 miles an hour, up from 150

miles an hour on the current fleet. The trains will be built to

tilt up to 6.3 degrees, allowing trains to run faster in curves and

save energy by avoiding braking for some turns.

Average speeds will be much lower, since the Acela will still

run on the Northeast Corridor, whose curves will limit trains to

top speed in just a few spots. And unlike high-speed trains in

Europe and Asia, the Acela shares tracks with commuter trains and

freight lines, requiring it to reduce speeds. The new trains will

be capable of going up to 186 miles an hour if tracks are later

upgraded, Alstom says.

The new Acelas will be just one meter (about three feet) longer

than the current trains, but with shorter power cars and redesigned

passenger cars. Amtrak says they will carry one-third more

passengers with a maximum capacity of 378, up from the current

304.

Amtrak says the new trains will have upgraded interiors,

including outlets and USB ports at each seat and wheelchair

accessibility in every restroom. The railroad also said the

lightweight design will improve efficiency by 20%, while a

regenerative braking system will return some power to the overhead

catenary wire system. Track improvements and the new trains'

suspension system will allow for a smoother ride, Amtrak says.

The first of the 28 new Acelas is scheduled to enter service in

summer 2021, replacing the existing fleet of 20 trains by the end

of 2022. Amtrak says the larger fleet will allow more frequent,

half-hourly Acela service at peak periods.

Eventually, railroad officials say they could offer limited-stop

and nonstop service between Washington and New York.

The railroad is hoping for a smoother launch than the first time

around. The first Acela train set was delivered to Amtrak in

October 2000, more than one year late, by a consortium of Alstom

and Canada's Bombardier Inc.

Amtrak pulled Acela trains from service in 2002 after cracks

developed in critical shock absorbers. Amtrak and the consortium

filed dueling $200 million lawsuits, which were later settled.

In 2005, Amtrak pulled the trains from service again after

cracks were found in braking equipment. The trains returned to

service after the trouble was traced to a supplier.

Despite the complications, the Acela became a success. Even

without meeting the target time of two hours, 11 minutes between

Washington and New York, the railroad succeeded in peeling

passengers away from airline shuttles. Acelas carried more than 3.4

million passengers in fiscal 2018, and Amtrak said adjusted

operating earnings for Acela trips was $318.8 million, more than

60% of the $524.1 million Amtrak earned overall on the Northeast

Corridor.

For its new Acela fleet, Amtrak selected Alstom alone, using a

$2.45 billion federal loan from the Federal Railroad

Administration. Amtrak says it will pay back the loan entirely with

revenues from its Northeast Corridor operations, with no need for

federal grants.

Roughly $2 billion of the loan will pay for the 28 train sets,

spare parts, management and contingency costs, and service

upgrades, an Amtrak spokeswoman said. Other funds will go toward

safety improvements and upgrades to tracks and stations.

Alstom says 95% of the trains' content are produced in the U.S.,

in keeping with the Buy America provisions of Amtrak's loan. But

the railroad did receive a waiver to import the extruded aluminum

shells of the passenger cars, whose honeycomb structure helps limit

the trains' weight and improve efficiency, from Alstom's factory in

Savigliano, Italy.

In Hornell, the Amtrak contract is changing the face of a

factory complex that dates to the dawn of the railroad age. Hornell

has been a center for railroad manufacturing, and the boom-and-bust

cycles of that industry, since the New York and Erie Railroad

opened a locomotive plant in 1850.

One April morning, workers in a massive plant built in 1860 were

working on an overhaul of a light railcar from Baltimore, while an

adjoining building held the final few double-decker commuter

coaches from a fleet Alstom is refurbishing for the Massachusetts

Bay Transportation Authority.

Alstom is the largest employer in town. Its three plants around

Hornell employ about 800 people, of whom about 250 are working on

the new Acela fleet, a company spokeswoman said.

Alstom recently broke ground on a new building to house Acela

equipment for its formal acceptance by Amtrak, bought a new shunter

locomotive capable of pushing around the million-pound completed

trains, and doubled the length of an existing test track, to 1.4

kilometers (just under a mile), including a new bridge over the

adjacent, flood-prone Canisteo River.

At peak capacity, the Hornell factories will be producing a

passenger car a day, one power car every five days, and one cafe

car every 10 days, said Michael MacDonald, the company's managing

director for high-speed trains in North America.

Amtrak and Alstom officials both say they hope that the

railroad's big investment will help foster the growth of an

American supply chain for high-speed rail equipment. The absence of

such a supply network raised costs and limited design choice for

the original Acela, and railroad officials blamed reliance on a

narrow, specialized supplier base, in part, for the 2005 disruption

in Acela service.

Alstom says the Amtrak contract is helping seed new expertise in

their industry.

Mr. MacDonald noted the example of TTA Systems LLC, which has

worked with Alstom in Hornell for years. TTA Systems is now

building the tilting "bogies" -- the crucial assemblies that

connect to train cars and carry their wheels.

"They've overhauled 30-year-old bogies for years that are on a

metro car that's going 30 miles an hour," Mr. MacDonald said. "This

is going to 170 miles an hour, and it's going to tilt. It's a

different animal."

Write to Ted Mann at ted.mann@wsj.com

(END) Dow Jones Newswires

May 12, 2019 08:14 ET (12:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

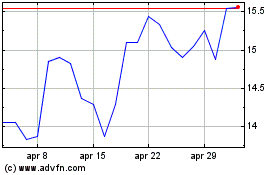

Grafico Azioni Alstom (EU:ALO)

Storico

Da Mar 2024 a Apr 2024

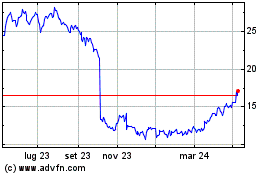

Grafico Azioni Alstom (EU:ALO)

Storico

Da Apr 2023 a Apr 2024