TIDMSTCM

RNS Number : 9333Y

Steppe Cement Limited

15 May 2019

CEO STATEMENT

In 2018, Steppe Cement posted a net profit of USD 8.9 million.

Steppe Cement's EBITDA increased to USD 21.3 million from USD 11.6

million in 2017 mostly due to higher prices and volumes.

The overall domestic cement market decreased by 4% to 8.6

million tonnes, but our sales volume increased by 6% mostly due to

an increase of 63% in exports, helped by the continued weakness of

the KZT against the neighbouring currencies. The delivered price in

USD increased by 18%.

In 2018 our cost of production per tonne in KZT increased by 6%,

in line with inflation.

Steppe Cement operated both lines at 90% of their current

combined capacity (which is 1.1 million tonnes for line 5 and 0.8

million tonnes for line 6). We aim to increase their utilization

and we are planning to increase the capacity of line 6 to 0.9

million tonnes in late 2019.

Shareholders' funds decreased to USD55.9 million from USD59.5

million after dividend distribution of USD3 million to shareholders

and due to the devaluation of the KZT. However, the replacement

cost of the Company's assets remains many times higher than their

current book value.

Key financials Year ended Year ended Inc/(Dec)%

31- Dec-18 31- Dec-17

Sales (tonnes of cement) 1,720,629 1,630,230 6

------------ ------------ -----------

Consolidated turnover (KZT million) 28,342 21,443 32

------------ ------------ -----------

Consolidated turnover (USD million) 82.2 65.9 25

------------ ------------ -----------

Consolidated profit before tax

(USD million) 10.7 1.9 >400

------------ ------------ -----------

Consolidated profit after tax

(USD million) 8.9 1.2 >700

------------ ------------ -----------

Profit per share (US cents) 4.1 0.6 >600

------------ ------------ -----------

Shareholders' funds (USD million) 55.9 59.5 (6)

------------ ------------ -----------

Average exchange rate (USD/KZT) 345 326 6

------------ ------------ -----------

Exchange rate as at year end (USD/KZT) 384 332 13

------------ ------------ -----------

The Kazakh cement market decreased by 4% in 2018 but we expect

it to improve in 2019

The Kazakh cement market in 2018 was 8.6 million tonnes, a

decrease of 4% from 2017. Imports into Kazakshtan decreased by 4%

to 0.65 million tonnes or 8% of the total market. Exports from

local producers increased by 118% to 1.9 million tonnes.

Our expectations are that overall market demand in 2019 will

increase by 5% reflecting a recovering of the market from 2018. The

Kazakh population has reached 18 million people and therefore

consumption represents 500 kg/person per year.

Improving exports mostly to Uzbekistan and Kyrgyzstan helped

local companies to increase their overall volumes by 7%. The

companies that benefited most were the ones in the south. In the

west, a new competitor has started near Kyzylorda and is expected

to increase its production steadily during the year.

In 2019, the local cement factories should maintain these trends

with similar level of exports. Imports into Kazakhstan should

remain contained to regions near the Russian border and be subject

to competiton from a new factory.

Steppe Cement's average cement selling prices increased by 25%

in KZT and by 18% in USD, to USD 47.7 per tonne delivered.

Line 5 produced 993,850 tonnes of cement while Line 6 produced

726,767. We continue to make small improvements in Line 6 that we

expect will contribute to an additional 80,000 tonnes in 2019.

Capital investment in 2018 was directed to the improvement of

packing and logistics and we will continue to do so in 2019

The new packing line for 1,800 bags per hour was commisionned in

the summer of 2018 and we have doubled the capacity of the big bag

facility to 100 tonnes per hour. Capital investment was increased

slightly to USD2.7 million from USD1.6 million in 2017.

In 2019, we will plan the following capital investments:

- Increase the capacity of the 50 kg bags packing line to 2,400

bags per hour, equivalent to 120 tonnes per hour.

- Commission the fully automated loading of wagons and trucks.

- Installation of a separator in cement mill number four.

- Change the two preheater fans in Line 6 to improve energy efficiency.

- Automatize the silos and loading in the wet line mill area.

Cost per tonne were maintained as volumes increased

The average cash production cost of cement was maintained at

USD23/tonne as production and sales increased offsetting some of

inflation increases. Some of the variable costs have been

reassigned to fixed costs in 2018 - if we compare with the same

cost base 2017 and 2018, the variable cost has increased by around

USD0.7/tonne or 3%.

Selling expenses, reflecting mostly cement delivery costs,

increased to USD9/tonne from USD7/tonne in 2017, due to higher

export volumes (+63%) and transportation tariffs.

General and administrative expenses

General and administrative expenses increased by 19% to USD 6.2

million from USD 5.2 million in 2017. The general expenses have

been adjusted both for 2017 and 2018 and include expense previously

included in the production costs.

In 2017, we transferred USD1 million from cost of production to

general expenses of which USD0.65 million were transfers of

management salaries and USD0.35 million were provisions for

obsolete inventory. Cost of production for 2017 was therefore

decreased by 0.6 USD/tonne.

After taking into consideration these adjustments, the general

expenses in 2018 have still increased by USD1 million. This is

broken down as follows:

- USD0.28 million as transfers of maintenance and logistic from production to general expenses.

- USD0.25 million as a provision of doubtful receivables in accordance with changes in IFRS9.

- USD0.15 million as increased salaries, extra half month bonus

and other compensation as company performance has improved.

- USD0.06 million in increased bank commission as we try to reduce the cash payments.

The balance represents an effective increase of 5% which is in

line with the increase of volumes.

On 31 March 2019 the labour count stood at 735 the same level as

last year.

Financial position: Continuous debt reduction

During the year, our total loans outstanding were reduced from

USD20 million to USD11.8 million.

Long term loans were reduced from USD9.8 million to USD 6.6

million as we continued to repay principals to Halyk Bank for the

long term loan for wagons and various government subsidised loans

for capex. In addition, due to devaluation, the KZT denominated

loans were reduced in USD.

The effective interest rate in the long term loans in USD and

KZT was maintained at 6.2% per annum (p.a.).

Our short term loans and current part of the long term loans

were significantly reduced from USD10.2 million in 2017 to USD5.2

million in 2018, while the cash position at the end of the year was

increased from USD3 million to USD5.7 million.

We consider the risk of a sharp devaluation is now much lower

but we have not borrowed significantly since December 2018. We have

drawn subsidized short term loans at 6% p.a. in KZT and short term

loans at 10% p.a. in KZT when the banks offered them.

We maintain three short term credit lines available as stand

by:

- KZT3 billion from Halyk Bank at 6% p.a. in USD or 12% p.a. in

KZT which includes a government subsidized program of KZT0.5

billion in KZT at 6% p.a.

- KZT0.9 billion from Altyn Bank at 10% p.a. in KZT.

- KZT3 billion from VTB Bank Kazakhstan at 11.5% p.a. signed in March 2018.

In 2017, finance costs decreased to USD1.6 million from USD2.2

million in 2017 due to the continuous repayment of loan

principals.

All covenants under the various credit lines have been met

comfortably.

Depreciation stayed the same in 2018 at USD7.3 million.

The statutory corporate income tax rate remains at 20% in

Kazakhstan.

Javier del Ser

Chief Executive Officer

2018 Annual Report and Annual General Meeting

Steppe Cement expects to release its 2018 Annual Report on its

web site at www.steppecement.com during the week commencing 15 May

2019.

The Company's Annual General Meeting is expected to take place

at its Malaysian Office at Suite 10.1, 10th Floor, West Wing, Rohas

Perkasa, 8 Jalan Perak, Kuala Lumpur Malaysia on Wednesday, 12 June

2019 at 2:30 p.m.

Steppe Cement's AIM nominated adviser and broker is RFC Ambrian

Limited.

Nominated Adviser contact: Stephen Allen or Andrew Thomson on

+61 8 9480 2500.

Broker contact: Charlie Cryer at +44 20 3440 6800.

STEPPE CEMENT LTD

(Incorporated in Labuan FT, Malaysia under the Labuan Companies

Act, 1990)

STATEMENTS OF PROFIT OR LOSS

FOR THE YEARED 31 DECEMBER 2018

The Group The Company

2018 2017 2018 2017

USD USD USD USD

Revenue 82,184,670 65,855,137 8,912,843 3,535,005

Cost of sales (46,871,195) (45,211,517) - -

------------ ------------ --------- ---------

Gross profit 35,313,475 20,643,620 8,912,843 3,535,005

Selling expenses (15,612,203) (11,819,521) - -

General and administrative

expenses (6,226,994) (5,245,588) (300,517) (270,136)

Interest income 42,649 61,449 458 39

Finance costs (1,637,834) (2,236,516) - -

Net foreign exchange

(loss)/gain (1,786,724) (205,610) 26,141 (81,355)

Other income,

net 576,570 736,727 (4,855) -

Profit before

income tax 10,668,939 1,934,561 8,634,070 3,183,553

Income tax expense (1,744,486) (703,091) - (4,941)

------------ ------------ --------- ---------

Profit for the

year 8,924,453 1,231,470 8,634,070 3,178,612

============ ============ ========= =========

Attributable to:

Shareholders of

the Company 8,924,453 1,231,470 8,634,070 3,178,612

============ ============ ========= =========

Earnings per share:

Basic and diluted

(cents) 4.1 0.6

============ ============

STATEMENTS OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME

FOR THE YEARED 31 DECEMBER 2018

The Group The Company

2018 2017 2018 2017

USD USD USD USD

Profit for the year 8,924,453 1,231,470 8,634,070 3,178,612

Other comprehensive

(loss)/income:

Items that may be

reclassified subsequently

to profit or loss:

---------------------------------

Exchange differences

arising on translation

of foreign operations (9,525,368) 244,646 - -

Total other (loss)/comprehensive

income (9,525,368) 244,646 - -

----------- --------- --------- ---------

Total comprehensive

(loss/)income for

the year (600,915) 1,476,116 8,634,070 3,178,612

Attributable to:

Shareholders of the

Company (600,915) 1,476,116 8,634,070 3,178,612

=========== ========= ========= =========

STATEMENTS OF FINANCIAL POSITION

AS OF 31 DECEMBER 2018

The Group The Company

2018 2017 2018 2017

USD USD USD USD

Assets

Non-Current Assets:

Property, plant

and equipment 54,611,723 67,358,584 - -

Investment in subsidiary

companies - - 26,500,001 26,500,001

Loan to subsidiary

company - - 30,170,000 -

Advances 191,242 508,555 - -

Other assets 2,203,459 1,247,835 - -

Total Non-Current

Assets 57,006,424 69,114,974 56,670,001 26,500,001

---------- ---------- ---------- ----------

Current Assets

Inventories 13,381,295 13,013,642 - -

Trade and other

receivables 3,500,468 3,101,667 8,883,956 3,435,005

Income tax recoverable 175,336 127,208 - -

Loans and advances

to subsidiary companies - - 9,634,325 39,605,291

Advances and prepaid

expenses 2,312,534 3,477,179 6,704 6,579

Cash and cash equivalents 5,719,491 3,045,336 23,570 12,985

---------- ---------- ---------- ----------

Total Current Assets 25,089,124 22,765,032 18,548,555 43,059,860

---------- ---------- ---------- ----------

Total Assets 82,095,548 91,880,006 75,218,556 69,559,861

========== ========== ========== ==========

The Group The Company

2018 2017 2018 2017

USD USD USD USD

Equity and Liabilities

Capital and Reserves

Share capital 73,760,924 73,760,924 73,760,924 73,760,924

Revaluation reserve 2,349,282 2,680,003 - -

Translation reserve (116,266,492) (106,741,124) - -

Retained earnings/

(Accumulated losses) 96,112,997 89,817,170 399.237 (5,275,486)

------------- ------------- ---------- -----------

Total Equity 55,956,711 59,516,973 74,160,161 68,485,438

------------- ------------- ---------- -----------

Non-Current Liabilities

Borrowings 6,606,910 9,834,719 - -

Deferred taxes 2,054,758 637,777 - -

Deferred income 1,629,508 1,519,487 - -

Provision for site

restoration 65,354 66,861 - -

Total Non-Current

Liabilities 10,356,530 12,058,844 - -

------------- ------------- ---------- -----------

Current liabilities

Trade and other

payables 6,614,604 7,684,371 - -

Accrued and other

liabilities 2,682,569 2,229,254 1,058,395 1,069,482

Borrowings 5,217,009 10,194,584 - -

Taxes payable 1,268,125 195,980 - 4,941

Total Current Liabilities 15,782,307 20,304,189 1,058,395 1,074,423

------------- -------------

Total Liabilities 26,138,837 32,363,033 1,058,395 1,074,423

------------- -------------

Total Equity and

Liabilities 82,095,548 91,880,006 75,218,556 69,559,861

============= ============= ========== ===========

STATEMENTS OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2018

Distributable

The Group Share capital Revaluation Translation Retained Total

reserve reserve earnings

USD USD USD USD USD

Balance as at 1 January

2018 73,760,924 2,680,003 (106,741,124) 89,817,170 59,516,973

-------------- ------------ -------------- -------------- ------------

Profit for the year - - - 8,924,453 8,924,453

Other comprehensive loss - - (9,525,368) - (9,525,368)

-------------- ------------ -------------- -------------- ------------

Total comprehensive (loss)/income

for the year - - (9,525,368) 8,924,453 (600,915)

Other transactions impacting

equity:

Dividends paid - - - (2,957,347) (2,957,347)

Transfer on revaluation

reserve relating to property,

plant and equipment through

use - (330,721) - 330,721 -

-------------- ------------ -------------- -------------- ------------

Balance as at 31 December

2018 73,760,924 2,349,282 (116,266,492) 96,112,997 55,956,711

============== ============ ============== ============== ============

Distributable

The Group Share capital Revaluation Translation Retained Total

reserve reserve earnings

USD USD USD USD USD

Balance as at 1 January

2017 73,760,924 3,062,343 (106,985,770) 88,203,360 58,040,857

-------------- ------------ -------------- -------------- -----------

Profit for the year - - - 1,231,470 1,231,470

Other comprehensive income - - 244,646 - 244,646

-------------- ------------ -------------- -------------- -----------

Total comprehensive income

for the year - - 244,646 1,231,470 1,476,116

Other transactions impacting

equity:

Transfer on revaluation

reserve relating to property,

plant and equipment through

use - (382,340) - 382,340 -

-------------- ------------ -------------- -------------- -----------

Balance as at 31 December

2017 73,760,924 2,680,003 (106,741,124) 89,817,170 59,516,973

============== ============ ============== ============== ===========

STATEMENTS OF CASH FLOWS

FOR THE YEAR ENDED 31 DECEMBER 2018

The Group The Company

2018 2017 2018 2017

USD USD USD USD

CASH FLOWS FROM/(USED

IN) OPERATING ACTIVITIES

Profit before income

tax 10,668,939 1,934,561 8,634,070 3,183,553

Adjustments for:

Depreciation of property,

plant and equipment 7,272,439 7,265,935 - -

Amortisation of quarry

stripping costs 4,654 30,398 - -

Amortisation of site

restoration costs 1,566 1,656 - -

Dividend income - - (8,389,233) (3,435,005)

Reversal of dividend

accrued - - 4,855 -

Loss on disposal of property,

plant and equipment 30,925 72,728 - -

Interest income (42,649) (61,449) (524,068) -

Finance costs 1,637,834 2,236,516 - -

Net foreign exchange

loss/(gain) 1,786,724 205,610 (50,676) 79,897

Provision for obsolete

inventories 46,562 33,175 - -

Credit loss allowance

for doubtful receivables 168,365 25,532 - -

Allowance for advances

paid to third parties 139,979 43,782 - -

Reversal of provision

for obsolete inventories (346,533) (356,280) - -

Deferred income (41,192) (49,096) - -

Reversal of doubtful

receivables - (138) - -

Write-off of inventories - 46,820 - -

21,327,613 11,429,750 (325,052) (171,555)

Movement in working capital:

Decrease/(Increase) in:

Inventories (2,304,350) 2.606.085 - -

Trade and other receivables (2,434,470) 430,552 (125) -

Loans and advances to

subsidiary companies - - (199,034) 104,828

Advances and prepaid

expenses - (2,682,456) - 2,549

Increase/(Decrease) in:

Trade and other payables (161,809) (140,863) - -

Accrued and other liabilities 2,244,060 570,636 39,589 3,527

------------ ------------ ----------- -----------

Cash Generated From/(Used

In) Operations 18,671,044 12,213,704 (484,622) (60,651)

Income tax paid (151,305) - (4,941) -

Cash Generated From/(Used

In) Operating Activities 18,519,739 12,213,704 (489,563) (60,651)

------------ ------------ ----------- -----------

CASH FLOWS FROM/(USED

IN) INVESTING ACTIVITIES

Purchase of property,

plant and equipment (3,138,098) (2,104,293) - -

Purchase of other assets (25,621) (68,273) - -

Proceeds from disposal

of property, plant and

equipment - 476,689 - -

Dividends received from

subsidiary - - 3,430,150 -

Interest received 42,649 61,449 29,345 -

------------ ------------ ----------- -----------

Net Cash Used In/(From)

Investing Activities (3,121,070) (1,634,428) 3,459,495 -

------------ ------------ ----------- -----------

CASH FLOWS FROM/(USED

IN) FINANCING ACTIVITIES

Redemption of bonds - (4,483,495) - -

Proceeds from bank borrowings 9,363,949 18,201,873 - -

Repayment of bank borrowings (16,732,905) (20,045,342) - -

Dividends paid (2,959,347) - (2,959,347) -

Interest paid (1,650,182) (2,235,965) - -

------------ ------------ ----------- -----------

Net Cash Used In Financing

Activities (11,978,485) (8,562,929) (2,959,347) -

------------ ------------ ----------- -----------

NET INCREASE/(DECREASE)

IN CASH AND CASH EQUIVALENTS 3,420,184 2,016,347 10,585 (60,651)

EEFFECTS OF FOREIGN EXCHANGE

RATE CHANGES (746,029) 5,784 - -

CASH AND CASH EQUIVALENTS

AT BEGINNING OF YEAR 3,045,336 1,023,205 12,985 73,636

------------ ------------ ----------- -----------

CASH AND CASH EQUIVALENTS

AT END OF YEAR 5,719,491 3,045,336 23,570 12,985

============ ============ =========== ===========

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCZZLBFKEFLBBD

(END) Dow Jones Newswires

May 15, 2019 02:00 ET (06:00 GMT)

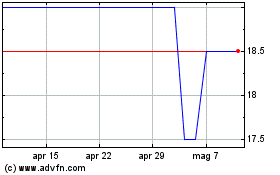

Grafico Azioni Steppe Cement (LSE:STCM)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Steppe Cement (LSE:STCM)

Storico

Da Apr 2023 a Apr 2024