TIDMTON

RNS Number : 0203Z

Titon Holdings PLC

15 May 2019

LEI: 213800ZHXS8G27RM1DD7

15 May 2019

Titon Holdings PLC

Unaudited interim results for the six months to 31 March

2019

Titon Holdings Plc ("Titon", the "Group" or the "Company"), a

leading international manufacturer and supplier of ventilation

systems and window and door hardware, today announces its Interim

Results for the six months ended 31 March 2019.

Financial Results

Six months Six months % Change

ended 31 March ended 31 March

2019 2018 (restated)*

Net revenue GBP14.29m GBP14.24m -

Underlying EBITDA(1) GBP1.35m GBP1.05m +29%

EBITDA GBP1.17m GBP1.05m +12%

Underlying profit before

tax(1) GBP1.30m GBP1.04m +26%

Profit before tax GBP1.12m GBP1.04m +8%

Underlying earnings per

share(1) 8.69p 7.25p +20%

Interim dividend per

share 1.75p 1.75p -

Financial highlights

-- Underlying EBITDA increased 29% to GBP1.35 million

-- Underlying profit before tax rose 26% to GBP1.30 million

-- Underlying earnings per share ("EPS") were 20% higher at 8.69 pence

-- Interim dividend is maintained at 1.75 pence per share

-- Net cash of GBP3.84 million (2018: GBP2.74 million)

-- Return on net assets ("RONA") (2) was 19.9% (2018: 16.3%)

Operational highlights

-- South Korea's profit before tax increased 21% to GBP0.9

million; and it remains the Group's largest income generator

-- Strong sales growth in mechanical ventilation systems in the UK and Continental Europe

-- Revenue in the US rose 55% to GBP0.5 million

-- The mechanical ventilation product range for the UK and

Continental Europe was expanded in the period, including a new

mechanical ventilation heat recovery ("MVHR") unit for larger

homes

-- UK showroom and meeting area upgraded

Executive Chairman Keith Ritchie said: "By any yardstick, the

Group's first half performance was a very good one with both

underlying profit before tax and earnings rising by a fifth or

more. Despite the previously announced weak housing market in

Korea, group net revenue was resilient and against these headwinds

our Korean business performed well".

"Titon has a diversified and growing presence in international

markets, together with an established and expanding range of

products. We have a strong balance sheet and a team that I am proud

of. As previously announced, testing conditions continue in South

Korea but I look forward to results for the Group in the second

half of the year in line with market expectations".

*Prior period figures for the year to 30 September 2018 and the

six months to 31 March 2018 have been restated pursuant to the

announcement made by the Company on 19 March 2019, further details

of which are included in note 2 of the Interim Statement.

For further information please contact

Titon Holdings Plc

Keith Ritchie: +44 (0) 1206 713821

Shore Capital

Dru Danford +44 (0)20 7408 4090

Edward Mansfield

Daniel Bush

Notes:

(1) Underlying EBITDA, Operating profit, Profit before tax and

EPS in the period are calculated by adding back an exceptional item

of GBP181,000 which relates to transaction related costs in respect

of a potential acquisition which did not proceed

(2) RONA is calculated by dividing Underlying profit before tax

by Net Assets (including non-controlling interests, net of cash and

intangibles) and expressed as an annualised figure. Asset Turn is

calculated by dividing the group's net revenue by Net Assets as

defined above.

Titon Holdings PLC

Interim results for the six months to 31 March 2019

Chairman's statement

Income Statement

In the six months to 31 March 2019, Titon's net revenue (which

excludes inter-segment activity) rose 0.4%, to GBP14.3 million

(2018: GBP14.2 million). The 2018 comparatives have been restated,

where appropriate, due to an accounting change, which is explained

below.

Gross margin improved to 29.3% (2018: 27.6%) due to the

geographical mix of sales with the European and US operations

providing an increased contribution in the period and an

improvement in the profitability of mechanical ventilation systems

in the UK and in Europe. At the same time, underlying EBITDA(1) was

29% higher at GBP1.35 million (2018: GBP1.05 million), whilst

underlying operating profit(1) increased by 40% to GBP0.98 million

(2018: GBP0.70 million) which meant that the Group's operating

margin also rose to 6.9% (2018: 4.9%). The share of profits from

the Group's associate, Browntech Sales Co., Ltd (BTS) in South

Korea, dipped marginally to GBP0.31 million (2018: GBP0.33 million)

as a result of the previously announced weaker housing market in

Korea. In turn, underlying profit before tax(1) was 26% higher at

GBP1.30 million (2018: GBP1.04 million).

Reported profit before tax rose by 8%, to GBP1.12 million (2018:

GBP1.04 million). This is stated net of GBP181,000 of costs

relating to a potential acquisition under consideration during the

period which did not proceed, and which is shown separately in the

income statement.

Underlying earnings per share(1) increased by a fifth to 8.69

pence (2018: 7.25 pence) with the apportionment of profits to

minority shareholders higher at GBP0.22 million (2018: GBP0.16

million) which reflected the higher contribution from the Group's

51% owned subsidiary, Titon Korea.

An unchanged interim dividend in respect of the six months ended

31 March 2019 of 1.75 pence per share (2018: 1.75 pence) was

approved by the Directors of Titon Holdings Plc on 14 May 2019. The

interim dividend is payable on 21 June 2019 to shareholders on the

register at 24 May 2019. The ex-dividend date is 23 May 2019.

Restatement

In an announcement on 19 March 2019, the Group explained that

certain costs associated with products sold by Titon Korea in

earlier accounting periods, up to and including 30 September 2018,

had, in error, not been wholly taken into account in the relevant

periods. This related to the incorrect accounting apportionment of

costs and revenues between first and second fix installations of

products manufactured by our 51% owned subsidiary Titon Korea and

sold by BTS, our 49% owned associated company. We have now

completed an analysis of this issue and I can confirm that the

total equity attributable to equity holders of Titon as at 30

September 2018 has been reduced by GBP826,000 (or 5.1%) from the

figure shown in the 2018 Annual Report. Subsequently, this and

other comparative 2018 numbers, where they were impacted by the

adjustment, have been restated. In terms of the income statement,

there has also been a restatement of the results for the six months

to 31 March 2018 and for the year to 30 September 2018. In the six

months to 31 March 2018 revenue has been reduced by GBP248,000 to

GBP14.2 million and profit before tax by GBP301,000 to GBP1.04

million. Similarly, in the fiscal year to 30 September 2018,

revenue has been reduced by GBP172,000 to GBP29.8 million and

profit before tax has been reduced by GBP209,000 to GBP2.77

million. See note 2 of the Interim Statement for further

details.

Balance sheet and cash flow

Net assets including non-controlling interests rose 9.9% or

GBP1.59 million to GBP17.6 million (31 March 2018: GBP16.0 million)

with net cash of GBP3.84 million (31 March 2018: GBP2.74 million,

30 September 2018: GBP3.42 million) which is equivalent to 21.8% of

net assets (31 March 2018: 17.1%, 30 September 2018: 19.9%). Of

this net cash, GBP1.01 million (31 March 2018: GBP0.04 million) is

held in Titon Korea and we expect a proportion of this amount to be

distributed to the Company and to minority shareholders as a

dividend in the second half of the year.

The half year saw cash generated from operations of GBP1.45

million (2018: outflow of GBP0.28 million). Of the GBP1.45 million,

almost GBP1.33 million has been generated in Titon Korea where

there has been a GBP0.75 million reduction in inventories since the

year-end and where other working capital components have fallen in

line with reducing levels of activity as noted in the segmental and

operational review below. In the UK, inventories have increased by

GBP0.30 million in the half year due to the decision to make

additional purchases from Continental Europe ahead of the planned

Brexit deadline of 29 March 2019. Capital expenditure in the period

was also higher at GBP0.46 million (2018: GBP0.13 million) as we

invested in new moulding machines, specialist tooling for new

mechanical ventilation products plus the refurbishment of our

showroom and meeting facilities at Haverhill. Net current assets

were GBP10.0 million (2018: GBP9.5 million) with a Quick Ratio(3)

of 2.08 (2018: 1.67).

RONA(2) was 19.9% (2018: 16.3%) with Asset Turn at 2.19 (2018:

2.24).

Segmental and operational review

UK and Continental Europe

Revenue in the UK increased 4% to GBP7.6 million (2018: GBP7.3

million) despite a degree of economic uncertainty in and around the

run up to the planned Brexit date of 29 March 2019. In our Window

and Door Hardware business in the UK, this included increased

demand for our trickle vents, whilst sales of Titon's branded

window and door hardware products also rose. I am pleased to

report, too, that our UK Ventilation Systems division sales

increased by more than 6% in the period as the reorganisation of

our sales force began to make itself felt. We also have a number of

new products in the research and development pipeline which we

expect will contribute to our leading market positions when they

emerge. The UK's segmental underlying profit before tax(1) declined

in the period by 5% to GBP461,000 (2018: GBP484,000), which was due

to higher costs in our Window and Door Hardware division.

Export sales of Ventilation Systems products also grew in the

period by 28%. In fact, the majority of our key markets in Western

Europe have seen good growth and we are beginning to establish good

levels of business in Eastern Europe, where we have developed cold

climate products for our customers.

Once again, we have expanded the range of mechanical ventilation

products for UK and European markets and have introduced our

largest heat recovery unit to date. The latter should prove

particularly popular in export markets, where house sizes are

typically larger than in the UK.

South Korea

On 14 February 2019, we announced a trading update in respect of

our South Korean business. During the period, two factors

contributed to the Group's performance in South Korea. Firstly, the

domestic residential development market slowed down much faster

than anticipated, which is reflected in a decline in housing

permits issued of 13.7% in calendar 2018 in South Korea. At the

same time, virulent dust-based air pollution, largely from China,

intensified. The latter effect meant that demand for mechanical

ventilation units rose at the expense of natural ventilation

products. In turn, this meant that the trading performance of Titon

Korea was expected to be substantially lower than market forecasts

at that time. However, overheads have been reduced and the gross

margin actually improved in the period.

BTS, the Group's associate company, which primarily distributes

ventilation products in South Korea, was also affected by lower

sales in the half year. Here again, a focus on reducing costs has

meant that its contribution has not been significantly impacted. As

noted earlier, the profit recognised in respect of associates

(which is all BTS) was just 4% lower at GBP313,000 (2018:

GBP326,000). In addition to its trading activities, there have been

no changes in the status of BTS's investments in the residential

real estate market.

In terms of the segmental contribution from South Korea, the two

businesses, Titon Korea and BTS are added together. The revenue is

solely Titon Korea (because the Company's share of BTS's profits

are accounted for as an associate) which was 12% lower at GBP4.8

million (2018: GBP5.4 million). The profit contribution for South

Korea, however, was 21% higher at GBP864,000. Note, too, that South

Korea is the largest contributor to Group underlying profit before

tax(1) with a 66% share in the first six months of fiscal 2019

(2018: 69%). At the post-tax level the contribution from Korea for

the period was GBP743,000 (2018: GBP629,000) which represents 63%

(2018: 66%) of the Group's underlying post-tax profits(1) .

The Group has continued to take steps to re-design its existing

natural ventilation products and to introduce new products for the

Korean market. We expect that that these will be available for sale

early in 2020.

United States

The results from our US business have improved significantly in

the period following the sharp decline experienced last year. Sales

for the six months increased by 55% year-on-year to GBP510,000

(2018: GBP330,000) and we are pleased that the pipeline of

opportunities remains healthy. Although Titon Inc. recorded a small

statutory loss for the period under review (GBP12,000) this was

sharply reduced from the 2018 half year loss (GBP77,000). It is

important to note, too, that when the results are combined with the

inter-segmental profits made in our UK factory on products sold in

North America, the overall contribution is positive and exceeded

our budget.

Website

I am pleased to report that we have upgraded our website to one

which, we believe, possesses a much more contemporary feel. It also

contains a lot more information about our products, which customers

will find useful, plus we have added new product selector tools to

assist users in easily finding the product they need. Please visit

www.titon.com which also includes a new Investors tab.

Board

I would like to welcome Bernd Ratzke to the Titon Board. He

joined at the end of March as an independent Non-Executive Director

and brings a wealth of business experience from his long career as

a corporate lawyer in the City and specifically as a former Head of

Corporate at Baker & McKenzie. We look forward to his

contribution and counsel.

Employees

Once again, I am indebted to all of Titon's employees for their

talent and hard work. Without them, we would not have such a high

quality and diversified business. To all of them, I offer my and

the Board's sincere thanks.

Investors

We continue to work with Hardman & Co., the corporate

research house, to raise our visibility in investment markets with,

in my view, high quality research on the Group. The Company, last

year, moved from the Main Market of the London Stock Exchange to

AIM. The Board believes that AIM provides a more suitable

regulatory environment for a business of Titon's size and

structure, and provides more flexibility in relation to corporate

transactions and equity fundraising, should such opportunities or

initiatives arise or become relevant to the Group in the future.

Once again, I reiterate the existence of Titon's dividend

reinvestment programme. This is a straight-forward and

cost-effective potential way to increase a shareholding in Titon;

and it can be accessed by visiting the portal for our Registrars,

Link Market Services Limited.

Outlook

By any yardstick, the Group's first half performance was a very

good one with both underlying profit before tax(1) and earnings

rising by a fifth or more. In February, however, we updated the

market on current trading in our prime market of South Korea, where

there has been a slow-down and a structural shift in product

preference; both of which will impact the Group this year. It is

not in Titon's nature to sit on its hands and already we have

reduced overheads in South Korea and will be bringing on new

products early next year.

Titon has operated in South Korea since 2008 and it is the

market leader in natural ventilation products. For a number of

years, too, South Korea has been the Group's largest profit

contributor and in the half year, this remained the case with South

Korea accounting for 63% of underlying profit after tax(1) . The

domestic economy also ranks number 12 in the World and, although

GDP growth forecasts have been reduced, Statista is forecasting GDP

growth of 2.6% in 2019 and 2.8% in 2020, the envy of many of South

Korea's peers. Specifically, too, government expenditure is rising

and serving to replace some private sector activity; and we

anticipate that this will underpin a modest return to growth in the

housing market over the coming years. However, we also believe that

the growing popularity of mechanical ventilation units at the

expense of natural products will continue and we have already

agreed with our South Korean partners to develop and sell

mechanical units, which will happen in 2020. At the same time,

domestic building regulations in South Korea continue to provide

for the use of natural ventilation, which is cost effective,

sustainable and environmentally friendly. Consequently, we are

designing new natural ventilation products with a much higher level

of filtering to deal with the intensity of the dust-borne

pollution, for our customers that wish to continue with this cost

effective and environmentally friendly means of providing

ventilation.

In the UK we had reasonable growth in the markets for our

products through the winter. UK GDP rose by 0.5% in the three

months to end January this year and, whilst GDP is set to grow

below historical trends, consensus forecasts are for GDP to

increase at between 1% and 2% per annum in 2019 and 2020

respectively. Similarly, Experian is forecasting average volume

growth in UK housebuilding of 3.3% per annum in 2019 through to

2021. This is despite the continued uncertainty surrounding the

Brexit negotiations and the fact that the UK did not leave the EU,

as scheduled, on 29 March 2019. The uncertainty is not helpful to

business and particularly for medium sized companies like Titon,

which do not have the resources to cater for every possible outcome

of Brexit.

The Government has announced that there will be a review of

building regulations concerning ventilation, as part of its

response to the Hackitt report following the desperately tragic

Grenfell fire. A consultation paper is to be issued over the summer

and any change in regulations may create new opportunities for

Titon; I believe that we are very well positioned to benefit from

these. Above all, the Government and the industry want to make

buildings safer, more sustainable and healthier.

Titon has a diversified and growing spread of international

markets together with an established and expanding range of

attractive products. We have a strong balance sheet and a team that

I am proud of. As previously announced, testing conditions continue

in South Korea but I look forward to results for the Group in the

second half of the year in line with prevailing market

expectations.

Principal risk and uncertainties

The key financial and non-financial risks faced by the Group are

disclosed in the Group's Annual Report and Accounts for the year

ended 30 September 2018 within the Strategic Report (page 6)

available at www.titon.com. The Board considers that these remain a

current reflection of the risks and uncertainties facing the

business. The Board also considers that it is appropriate to adopt

the going concern basis of accounting in preparing these financial

statements and has not identified any material uncertainties which

would prevent us so doing.

A list of current directors is maintained on the Group's website

www.titonholdings.com.

On behalf of the Board

KA Ritchie

Chairman

14 May 2019

Notes

1 Underlying EBITDA, Operating profit, Profit before tax and EPS

in the period are calculated by adding back an exceptional item of

GBP181,000 which relates to transaction related costs in respect of

a potential acquisition which did not proceed

2 RONA is calculated by dividing Underlying profit before tax by

Net Assets (including non-controlling interests, net of cash and

intangibles) and expressed as an annualised figure. Asset Turn is

calculated by dividing the group's net revenue by Net Assets as

defined above.

3. The Quick Ratio measures liquidity and is calculated by

dividing Current Assets-less-inventories by Current Liabilities

Titon Holdings Plc

Consolidated Interim Income Statement

for the six months ended 31 March 2019

6 months 6 months Year to

to 31.3.19 to 31.3.18 30.9.18

restated* restated*

unaudited unaudited audited

Note GBP'000 GBP'000 GBP'000

Revenue 2,3 14,290 14,237 29,774

Cost of sales 2 (10,097) (10,300) (21,170)

---------------------------------------- ---- ---------- ---------- ----------

Gross profit 4,193 3,937 8,604

Distribution costs 2 (728) (714) (1,454)

Administrative expenses (2,258) (2,278) (4,707)

Research and development expenses (232) (247) (446)

Transaction related expenses (181) - -

Other income 6 3 19

---------------------------------------- ---- ---------- ---------- ----------

Operating profit 800 701 2,016

Finance income 7 9 13

Share of post-tax profits from

associates 313 326 741

---------------------------------------- ---- ---------- ---------- ----------

Profit before tax 1,120 1,036 2,770

Income tax expense 4 (118) (78) (315)

Profit after income tax 1,002 958 2,455

---------------------------------------- ---- ---------- ---------- ----------

Attributable to:

Equity holders of the parent 782 795 2,007

Non-controlling interest 220 163 448

---------------------------------------- ---- ---------- ---------- ----------

Profit for the period 1,002 958 2,455

---------------------------------------- ---- ---------- ---------- ----------

Earnings per share attributed to equity

holders of the parent:

Basic 6 7.06p 7.25p 18.21p

Diluted 6 6.97p 7.15p 17.94p

* See note 2 for details regarding the restatement of prior year

results

Consolidated Interim Statement of Comprehensive Income

for the six months ended 31 March 2019

6 months 6 months Year to

to 31.3.19 to 31.3.18 30.9.18

restated* restated*

unaudited unaudited audited

GBP'000 GBP'000 GBP'000

Profit for the period 1,002 958 2,455

Other comprehensive income - items

which may be reclassified to profit

or loss in subsequent periods:

Exchange difference on re-translation

of net assets of overseas operations (219) 195 423

-------------------------------------- ---------- ---------- ----------

Total comprehensive income for the

period 783 1,153 2,878

Attributable to:

Equity holders of the parent 649 930 2,293

Non-controlling interest 134 223 585

-------------------------------------- ---------- ---------- ----------

783 1,153 2,878

-------------------------------------- ---------- ---------- ----------

* See note 2 for details regarding the restatement of prior year

results

Titon Holdings Plc

Consolidated Interim Statement of Financial Position

at 31 March 2019

31.3.19 31.3.18 30.9.18 30.9.17

restated* restated* restated*

unaudited unaudited audited audited

Note GBP'000 GBP'000 GBP'000 GBP'000

Assets

Property, plant and equipment 3,853 3,418 3,655 3,548

Intangible assets 687 530 737 638

Investments in associates 2,831 2,105 2,586 1,713

Deferred tax assets 204 436 348 375

--------- ---------- ---------- ----------

Total non-current assets 7,575 6,489 7,326 6,274

--------- ---------- ---------- ----------

Inventories 5,246 5,721 5,667 4,670

Trade and other receivables 5,977 8,103 7,799 6,644

Income tax receivable 33 79 12 79

Cash and cash equivalents 3,839 2,735 3,415 3,269

--------- ---------- ---------- ----------

Total current assets 15,095 16,638 16,893 14,662

Total Assets 22,670 23,127 24,219 20,936

---------------------------------------------- --------- ---------- ---------- ----------

Liabilities

Deferred tax liability 11 51 37 39

--------- ---------- ---------- ----------

Total non-current liabilities 11 51 37 39

--------- ---------- ---------- ----------

Trade and other payables 5,088 6,859 6,901 5,802

Income tax payable - 235 154 63

Total current liabilities 5,088 7,094 7,055 5,865

Total Liabilities 5,099 7,145 7,092 5,904

---------------------------------------------- --------- ---------- ---------- ----------

Equity

Share capital 1,113 1,113 1,113 1,098

Share premium reserve 1,049 1,049 1,049 985

Capital redemption reserve 56 56 56 56

Treasury shares (27) (27) (27) (27)

Foreign exchange reserve 369 351 502 216

Retained earnings 13,171 11,680 12,728 11,167

---------------------------------------------- --------- ---------- ---------- ----------

Total Equity attributable

to the equity holders

of the parent 15,731 14,222 15,421 13,495

Non-controlling Interest 1,840 1,760 1,706 1,537

Total Equity 17,571 15,982 17,127 15,032

Total Liabilities and

Equity 22,670 23,127 24,219 20,936

---------------------------------------------- --------- ---------- ---------- ----------

* See note 2 for details regarding the restatement of prior year

results

Titon Holdings Plc

Consolidated Interim Statement of Changes in Equity

at 31 March 2019

Share Share Capital Foreign Treasury Retained Total Non- Total

capital premium redemption exchange Shares earnings controlling Equity

reserve reserve reserve interest

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 30

September

2017 as

previously

stated 1,098 985 56 216 (27) 11,887 14,215 1,986 16,201

--------------- --------- --------- ----------- --------- --------- ---------- -------- ------------ --------

Restatement

of post-tax

profit for

prior

years * - - - - - (720) (720) (449) (1,169)

At 30

September

2017 (as

restated) 1,098 985 56 216 (27) 11,167 13,495 1,537 15,032

Translation

differences

on overseas

operations - - - 135 - - 135 60 195

Profit for the

period (as

restated) - - - - - 795 795 163 958

--------------- --------- --------- ----------- --------- --------- ---------- -------- ------------ --------

Total

comprehensive

income for

the

period - - - 135 - 795 930 223 1,153

--------------- --------- --------- ----------- --------- --------- ---------- -------- ------------ --------

Dividends paid - - - - - (295) (295) - (295)

Share-based

payment

credit - - - - - 13 13 - 13

Ordinary

shares

issued 15 64 - - - - 79 - 79

At 31 March

2018 (as

restated) 1,113 1,049 56 351 (27) 11,680 14,222 1,760 15,982

--------------- --------- --------- ----------- --------- --------- ---------- -------- ------------ --------

Translation

differences

on overseas

operations - - - 151 - - 151 77 228

Profit for the

period (as

restated) - - - - - 1,212 1,212 285 1,497

--------------- --------- --------- ----------- --------- --------- ---------- -------- ------------ --------

Total

comprehensive

income for

the

period - - - 151 - 1,212 1,363 362 1,725

--------------- --------- --------- ----------- --------- --------- ---------- -------- ------------ --------

Dividends paid - - - - - (194) (194) - (194)

Dividends paid

to NCI in

subsidiary - - - - - - - (416) (416)

Share-based

payment

credit - - - - - 30 30 - 30

At 30

September

2018 (as

restated) 1,113 1,049 56 502 (27) 12,728 15,421 1,706 17,127

--------------- --------- --------- ----------- --------- --------- ---------- -------- ------------ --------

Accounting

policy

change IFRS

9 - - - - - (38) (38) - (38)

At 1 October

2018 1,113 1,049 56 502 (27) 12,690 15,383 1,706 17,089

Translation

differences

on overseas

operations - - - (133) - - (133) (86) (219)

Profit for the

period - - - - - 782 782 220 1,002

--------------- --------- --------- ----------- --------- --------- ---------- -------- ------------ --------

Total

comprehensive

income for

the

period - - - (133) - 782 649 134 783

--------------- --------- --------- ----------- --------- --------- ---------- -------- ------------ --------

Dividends paid - - - - - (332) (332) - (332)

Share-based

payment

credit - - - - - 31 31 - 31

At 31 March

2019 1,113 1,049 56 369 (27) 13,171 15,731 1,840 17,571

--------------- --------- --------- ----------- --------- --------- ---------- -------- ------------ --------

* See note 2 for details regarding the restatement of prior year

results

Titon Holdings Plc

Consolidated Interim Statement of Cash Flow

for the year ended 31 March 2019

6 months 6 months Year to

to 31.3.19 to 31.3.18 30.9.18

restated* restated*

unaudited unaudited audited

Note GBP'000 GBP'000 GBP'000

Cash generated from operating activities

Profit before tax 1,120 1,036 2,770

Depreciation of property, plant &

equipment 266 233 448

Amortisation of intangible assets 107 112 209

Profit on sale of plant & equipment - (12) (16)

Share based payment - equity settled 31 13 43

Finance income (7) (9) (13)

Share of associate's post-tax profit (313) (326) (741)

----------

1,204 1,047 2,700

Decrease / (increase) in inventories 335 (934) (836)

Decrease / (increase) in receivables 1,675 (1,235) (890)

(Decrease) / increase in payables

and other current liabilities (1,769) 845 964

------------------------------------------- ---- ------------ ---------- ----------

Cash generated / (used) from operations 1,445 (277) 1,938

------------------------------------------- ---- ------------ ---------- ----------

Income taxes (paid) / refunded (175) 45 (132)

------------------------------------------- ---- ------------ ---------- ----------

Net cash generated from/(used in)

from operating activities 1,270 (232) 1,806

------------------------------------------- ---- ------------ ---------- ----------

Cash flows from investing activities

Purchase of plant & equipment (464) (125) (578)

Purchase of intangible assets (57) (4) (315)

Proceeds from sale of plant & equipment - 34 46

Finance income 7 9 13

Net cash used in investing activities (514) (86) (834)

------------------------------------------- ---- ------------ ---------- ----------

Cash flows from financing activities

Exercise of share options - 79 79

Dividends paid to equity shareholders

of the parent 5 (332) (295) (489)

Dividends paid to Non-controlling

shareholders of a subsidiary - - (416)

Cash withdrawn from / (transferred

to) treasury deposit accounts 900 (300) 300

Net cash generated from/(used in)

from operating activities 568 (516) (526)

------------------------------------------- ---- ------------ ---------- ----------

Net increase / (decrease) in cash

(excluding movement on treasury deposits) 1,324 (834) 446

Cash at beginning of the period (excluding

treasury deposits) 2,515 2,069 2,069

------------------------------------------- ---- ------------ ---------- ----------

Cash at end of the period (excluding

treasury deposits) 3,839 1,235 2,515

------------------------------------------- ---- ------------ ---------- ----------

The Group cash and cash equivalents figure on the Consolidated

Interim Statement of Financial Position includes both the cash at

31 March 2019 and the cash on treasury deposit of GBPnil (March

2018: GBP1,500,000, September 2018: GBP900,000) and totals

GBP3,839,000 at 31 March 2019 (March 2018: GBP2,735,000, September

2018: GBP3,415,000).

In respect of this change in presentation of the Consolidated

Interim Statement of Cash Flows, the comparative figures have been

amended.

Notes to the Condensed Consolidated Interim Statements

at 31 March 2019

1 Accounting policies

a) General information

Titon Holdings Plc (the 'Company') is incorporated and domiciled

in England and its shares are publicly traded on AIM. The

registered office address is 894 The Crescent, Colchester Business

Park, Colchester, Essex, CO4 9YQ. The company's registered number

is 1604952. The principal activities of the Group are as described

in Note 3.

The Board considers the principal risks and uncertainties

relating to the Group for the next six months to be the same as

detailed in the last Annual Report and Financial Statements to 30

September 2018. The Group's financial risk management objectives

and policies are consistent with those disclosed in the

consolidated financial statements as at and for the year ended 30

September 2018.

b) Basis of preparation

These condensed consolidated interim financial statements of the

Group for the six months ended 31 March 2019 comprise the Company

and its subsidiaries (together referred to as the 'Group'). The

prior year results for the six months to 31 March 2018 and twelve

months to 30 September 2018 shown throughout this interim report

have been restated where appropriate. See Note 2.

The condensed consolidated interim financial statements have

been prepared in accordance with the AIM rules. Neither the six

months results for 2019 nor the restated 6 months results for 2018

have been audited nor reviewed pursuant to guidance issued by the

Auditing Practices Board. This condensed Interim Group financial

Statements do not comprise statutory accounts within the meaning of

Section 435 of the Companies Act 2006. The comparative figures for

the year ended 30 September 2018 do not constitute statutory

accounts within the meaning of Section 435 of the Companies Act

2006, but they have been derived from the audited Report and

Accounts for that year, which have been filed with the Registrar of

Companies as amended by the restatement described. The independent

auditors' report on those accounts was unqualified, did not draw

attention to any matters by way of emphasis and did not contain a

statement under Section 498(2) or (3) of the Companies Act

2006.

This report should be read in conjunction with the Group's

Annual Report and Accounts for the year ended 30 September 2018,

which have been prepared in accordance with IFRS's as adopted by

the European Union.

These unaudited interim Group financial Statements were approved

for issue on 14 May 2019. Copies will be sent to shareholders

within the next few weeks and is available on the Group's website

at www.titonholdings.com and from the Company's registered office

at 894 The Crescent, Colchester Business Park, Colchester, Essex

CO4 9YQ

c) Accounting policies

These condensed consolidated interim financial statements have

been prepared in accordance with the recognition and measurement

requirements of International Financial Reporting Standards as

adopted by the European Union as effective for periods beginning on

or after 1 January 2018.

In preparing these condensed consolidated interim financial

statements the Board have considered the impact of new standards

which will be applied in the 2019 Annual Report and Accounts. Other

than the adoption of IFRS 15 Revenue from Contracts with Customers

and IFRS 9 Financial Instruments, which are both effective for

accounting periods starting on or after 1 January 2018, there are

not expected to be any changes in the accounting policies compared

to those applied at 30 September 2018.

A full description of accounting policies is contained with our

2018 Annual Report and Financial Statement, which is available on

our website.

New accounting standards

The Group has adopted the following new standards (effective 1

January 2018) in these condensed consolidated interim financial

statements:

-- IFRS 15 Revenue from contracts with customers. IFRS 15 sets

out a single and comprehensive framework for revenue recognition.

The guidance in IFRS 15 is considerably more detailed than previous

IFRS's for revenue recognition (IAS 11 Construction Contracts and

IAS 18 Revenue and associated Interpretations). An assessment of

the impact of IFRS 15 has been completed, including a comprehensive

review of the contracts that exist across the Group's revenue

streams.

The key performance obligation of the Group has been identified

as the point at which it delivers its products to its customers;

apart from in Korea, where the additional performance obligation

requiring the product to be installed to the customer's

satisfaction has also been identified. As such, the Group's sale of

goods performance obligations are satisfied when the customer

receives the goods, apart from in Korea, where it is the point when

the customer accepts that the product has been satisfactorily

installed.

Revenue is recognised by the Group at a single point in time

when control of goods passes on delivery, except for in Korea,

where revenue is recognised over time when initial and secondary

activities are completed.

In carrying out the review, no differences were identified

between the effects of using the risk and rewards approach to

determining when to recognise revenue under IAS 18 and the passing

of control over goods and services for satisfied performance

obligations under IFRS 15. As a result no material changes have

been identified.

-- IFRS 9 Financial instruments. IFRS 9 addresses the

classification and measurement of financial assets and liabilities

and replaces IAS 39. Among other things, the standard introduces a

forward-looking credit loss impairment model whereby entities need

to consider and take into account losses that may occur in the

future (an "expected loss" model). The Board has considered the

potential impact of the introduction of IFRS9 and determined that a

reduction in reserves of GBP38,000 as at 30 September 2018 is

necessary. This amount relates to a provision against amounts due

from the Group's associate. No additional provisions are considered

necessary for the transition of the Group's previous methodology to

the expected credit loss approach.

The impact of new standards that have been issued but are not

yet effective has also been considered, the most significant being

IFRS 16. Whilst the Board has reviewed the implications for the

Group and determined the likely impact, they have decided that

early adoption is not appropriate.

-- IFRS 16 Leases. IFRS 16 sets out the principles for

recognition, measurement, presentation and disclosure of leases and

will replace IAS 17 Leases. Adoption of IFRS 16 will result in the

Group recognising right of use assets and lease liabilities for all

qualifying contracts that are, or contain, a lease. Instead of

recognising an operating expense for its operating lease payments,

the Group will instead recognise interest on its lease liabilities

and amortisation on its right-of-use assets, impacting profit from

operations and the finance expense. The standard is effective for

accounting periods beginning on or after 1 January 2019 and

contains several options and exemptions which are available at

initial adoption. The Board has reviewed the expected impact of

this standard and their current assessment, based on applying the

modified retrospective transition method and adopting certain

practical expedients, is that there will be a material impact on

the Group's Statement of Financial Position when they are accounted

for differently under IFRS16.

2 Restatement of prior year results

In March 2019 the Company discovered that correct accounting

policy had not been followed at its Korean subsidiary and associate

and that the Consolidated Statement of Financial Position as at

previous year ends, up to and including 30 September 2018, had been

misstated. A full explanation of the reason for the adjustment is

included within the Chairman's Statement above and the required

restatements have been included within these interim results.

The effect of the restatement on the relevant lines within the

Consolidated Statement of Financial Position as at 30 September

2017 and 30 September 2018 is as follows:

Originally Adjustment Restated Originally Adjustment Restated

stated as at stated as at

as at 30/09/2017 as at 30/09/2018

30/09/2017 30/09/2018

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Assets

Investments in

Associates 1,966 (253) 1,713 2,876 (290) 2,586

Deferred tax assets 116 259 375 52 296 348

------------ ----------- ------------ ------------ ----------- ------------

2,082 6 2,088 2,928 6 2,934

Liabilities

Trade and other

payables 4,627 1,175 5,802 5,554 1,347 6,901

Equity

Total Equity attributable

to the equity

holders of the

parent 14,215 (720) 13,495 16,247 (826) 15,421

Non-controlling

interest 1,986 (449) 1,537 2,221 (515) 1,706

--------------------------- ------------ ----------- ------------ ------------ ----------- ------------

Total Equity 16,201 (1,169) 15,032 18,468 (1,341) 17,127

--------------------------- ------------ ----------- ------------ ------------ ----------- ------------

The effect on the relevant lines of the Income Statement for the

6 months to March 2018 and the 12 months to September 2018 is as

follows:

6 months to March 2018 12 months to September

2018

Originally Adjustment Restated Originally Adjustment Restated

stated stated

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 14,485 (248) 14,237 29,946 (172) 29,774

Profit before

tax 1,337 (301) 1,036 2,979 (209) 2,770

Income tax (expense)/credit (132) 54 (78) (352) 37 (315)

----------------------------- ----------- ----------- --------- ----------- ----------- ---------

Profit after income

tax 1,205 (247) 958 2,627 (172) 2,455

----------------------------- ----------- ----------- --------- ----------- ----------- ---------

Attributable to:

Equity holders

of the parent 947 (152) 795 2,113 (106) 2,007

Non-controlling

interest 258 (95) 163 514 (66) 448

Earnings per share

attributable to

equity holders

of the parent

Basic 8.64p 7.25p 19.17p 18.21p

Diluted 8.53p 7.15p 18.88p 17.94p

Additionally, during the period, the Directors have determined

that it better reflects the classifications on the Income Statement

to show carriage outwards as a Distribution Cost rather than being

included within Cost of Sales. As a result of this, Distribution

Costs for the 6 month period ended 31 March 2018 have been

increased by GBP386,000 to GBP714,000 (previously reported as

GBP328,000) and for the 12 month period to 30 September 2018 have

been increased by GBP750,000 to GBP1,454,000 (previously reported

as GBP704,000). Cost of Sales for the 6 month period ended 31 March

2018 have been reduced by GBP386,000 to GBP10,300,000 (previously

reported as GBP10,686,000) and for the 12 month period to 30

September 2018 have been reduced by GBP750,000 to GBP21,170,000

(previously reported as GBP21,920,000). There has been no overall

impact on profit before tax or any Statement of Financial Position

line item in any period as a result of this reclassification.

3 Revenue and segmental information

In identifying its operating segments, management follows the

Group's reporting lines, which represent the main geographic

markets in which the Group operates. The segment reporting below is

shown in a manner consistent with the internal reporting provided

to the Board, which is the Chief Operating Decision Maker (CODM).

These operating segments are monitored and strategic decisions are

made on the basis of segment operating results. The Group operates

four main business segments which are:

Segment Activities undertaken include:

United Kingdom Sales of passive and powered ventilation products

to house builders, electrical contractors and window

and door manufacturers. In addition to this, it

is a leading supplier of window and door hardware.

South Korea Sales of passive ventilation products to construction

companies.

North America Sales of passive ventilation products to window

and door manufacturers.

All other Sales of passive and powered ventilation products

countries to distributors, window manufacturers and construction

companies

Inter-segment revenue is transacted on an arm's length basis and

charged at prevailing market prices for a specific product and

market or cost plus where no direct comparative market price is

available. Segment results include items directly attributable to a

segment as well as those that can be allocated on a reasonable

basis. Research and development entity-wide financial expenses are

allocated to the business activities for which R&D is

specifically performed. Sales Administration and Other Expenses are

currently allocated to operating segments in the Group's reporting

to the CODM. Other Expenses include mainly central and parent

company overheads relating to Group management, the finance

function and regulatory requirements.

The measurement policies the Group uses for segment reporting

under IFRS 8 are the same as those used in its financial

statements.

The total assets for the segments represent the consolidated

total assets attributable to these reporting segments. Parent

company results and consolidation adjustments reconciling the

segmental results and total assets to the consolidated financial

statements are included within the United Kingdom segment figures

stated over below.

Operating segment United South North All other Total

Kingdom Korea America countries

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

6 months ended 31 March

2019

Segment revenue 7,819 4,769 510 1,449 14,547

Inter-segment revenue (257) - - - (257)

------------------------------- --------- -------- --------- ----------- --------

Total Revenue 7,562 4,769 510 1,449 14,290

------------------------------- --------- -------- --------- ----------- --------

Segment profit / (loss) 280* 864 (12) (12) 1,120

Income tax expense (118)

------------------------------- --------- -------- --------- ----------- --------

Profit for the period 1,002

------------------------------- --------- -------- --------- ----------- --------

Depreciation and amortisation 334 39 - - 373

------------------------------- --------- -------- --------- ----------- --------

Total assets 14,034 8,246 381 - 22,670

------------------------------- --------- -------- --------- ----------- --------

Total assets include:

Investments in associates 2,831 - - - 2,831

Additions to non-current

assets (other than financial

instruments and deferred

tax assets) 521 - - - 521

------------------------------- --------- -------- --------- ----------- --------

* Costs charged to the United Kingdom segment include GBP181,000

of transaction related costs.

The South Korean Segment profit includes the Group's share of

the post-tax profit from the Group's associate undertaking,

Browntech Sales Co. Ltd. Sales to Browntech Sales Co. Ltd. of

GBP4.8 million represent 33% of Group Revenue. There are no other

concentrations of revenue above 10% during the year. (see Note 7 -

Related party transactions).'

IFRS 8 requires entity-wide disclosures to be made about the

regions in which it earns its revenues and holds its non-current

assets which are shown below.

6 months ended 31 March United Europe North Asia All other Total

2019 Kingdom America regions

Revenues GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

by entities' country of

domicile 9,011 - 510 4,769 - 14,290

by country from which

derived 7,530 1,479 510 4,769 2 14,290

------------------------- --------- -------- --------- -------- ---------- --------

Non-current assets

By entities' country of

domicile 4,585 - 30 2,960 - 7,575

------------------------- --------- -------- --------- -------- ---------- --------

Operating segment United South North All other Total

Kingdom Korea America countries

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

6 months ended 31 March

2018

(restated)*

Segment revenue 7,457 5,417 330 1,237 14,441

Inter-segment revenue (204) - - - (204)

------------------------------- --------- -------- --------- ----------- --------

Total Revenue 7,253 5,417 330 1,237 14,237

------------------------------- --------- -------- --------- ----------- --------

Segment profit / (loss) 484 714 (77) (85) 1,036

Income tax expense (78)

------------------------------- --------- -------- --------- ----------- --------

Profit for the period 958

------------------------------- --------- -------- --------- ----------- --------

Depreciation and amortisation 299 46 - - 345

------------------------------- --------- -------- --------- ----------- --------

Total assets 12,815 9,972 340 - 23,127

------------------------------- --------- -------- --------- ----------- --------

Total assets include:

Investments in associates 2,105 - - - 2,105

Additions to non-current

assets (other than financial

instruments and deferred

tax assets) 129 - - - 129

------------------------------- --------- -------- --------- ----------- --------

* See note 2 for details regarding the restatement of prior year

results

The South Korean Segment profit includes the Group's share of

the post-tax profit from the Group's associate undertaking,

Browntech Sales Co., Ltd. Sales to Browntech Sales Co., Ltd of

GBP5.4 million represent 38% of Group Revenue. There are no other

concentrations of revenue above 10% during the year. (see Note 7 -

Related party transactions).

IFRS 8 requires entity-wide disclosures to be made about the

regions in which it earns its revenues and holds its non-current

assets which are shown below.

6 months ended 31 United Europe North Asia All other Total

March 2018 (restated)* Kingdom America regions

Revenues GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

by entities' country

of domicile 8,490 - 330 5,417 - 14,237

by country from

which derived 7,005 1,419 330 5,473 10 14,237

------------------------- --------- -------- --------- -------- ---------- --------

Non-current assets

By entities' country

of domicile 4,109 - 1 2,372 - 6,482

------------------------- --------- -------- --------- -------- ---------- --------

Operating segment United South North All other Total

Kingdom Korea America countries

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

12 months ended 30 September

2018 (restated)*

Segment revenue 15,221 11,389 652 2,941 30,203

Inter-segment revenue (429) - - - (429)

------------------------------- --------- -------- --------- ----------- --------

Total Revenue 14,792 11,389 652 2,941 29,774

------------------------------- --------- -------- --------- ----------- --------

Segment profit / (loss) 1,005 1,875 (109) (1) 2,770

Income tax expense (315)

------------------------------- --------- -------- --------- ----------- --------

Profit for the period 2,455

------------------------------- --------- -------- --------- ----------- --------

Depreciation and amortisation 607 49 1 - 657

------------------------------- --------- -------- --------- ----------- --------

Total assets 14,087 9,894 238 - 24,219

------------------------------- --------- -------- --------- ----------- --------

Total assets include:

Investments in associates 2,586 - - - 2,586

Additions to non-current

assets (other than financial

instruments and deferred

tax assets) 889 4 - - 893

------------------------------- --------- -------- --------- ----------- --------

* See note 2 for details regarding the restatement of prior year

results

The South Korea Segment profit includes the Group's share of the

post-tax profits from Browntech Sales Co. Ltd. Sales to Browntech

Sales Co. Ltd. of GBP11.4m represent 38% of Group Revenue. There

are no other concentrations of revenue above 10% during the year

(see Note 7 - Related party transactions).

IFRS 8 requires entity-wide disclosures to be made about the

regions in which it earns its revenues and holds its non-current

assets which are shown below.

12 months ended United Europe North Asia All other Total

Kingdom America regions

30 September 2018

(restated)*

Revenues GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

by entities' country

of domicile 17,733 - 652 11,389 - 29,744

by country from

which derived 14,792 2,804 652 11,389 137 29,744

---------------------- --------- -------- --------- -------- ---------- --------

Non-current assets

By entities' country

of domicile 4,439 - 23 2,858 - 7,320

---------------------- --------- -------- --------- -------- ---------- --------

4 Taxation

6 months 6 months Year to

to 31.3.19 to 31.3.18 30.9.18

Restated Restated

* *

Current income tax: GBP'000 GBP'000 GBP'000

Corporation tax expense - (127) (307)

Adjustment in respect of prior years - - 17

---------- ---------- --------

- (127) (290)

---------- ---------- --------

Deferred tax:

Origination and reversal of temporary

differences (118) 49 (25)

Income tax expense (118) (78) (315)

-------------------------------------- ---------- ---------- --------

Taxation for the interim period is charged at 10.5% (six months

to 31 March 2018: 13.8%) representing the best estimate of the

average annual income tax rate for the full financial year.

5 Dividends

An interim dividend in respect of the six months ended 31 March

2019 of 1.75p per share, amounting to a total dividend of

GBP193,965 was approved by the Directors of Titon Holdings Plc on

14 May 2019. These consolidated interim statements do not reflect

the dividend payable.

The interim dividend will be payable on 21 June 2019 to the

shareholders on the register on 24 May 2019. The ex-dividend date

is 23 May 2019.

The following dividends have been recognised and paid by the

Company:

6 months 6 months Year

to

to 31.3.19 to 31.3.18 30.9.18

Date Pence

Paid per GBP'000 GBP'000 GBP'000

share

Final in respect of the

year end 30.09.17 27.02.18 2.70 - 295 295

Interim in respect of the

year end 30.09.18 22.06.18 1.75 - - 194

Final in respect of the

year end 30.09.18 26.02.19 3.00 332 - -

---------- ---------- ---------

332 295 489

---------- ---------- ---------

6 Earnings per ordinary share

Basic earnings per share has been calculated by dividing the

profits attributable to shareholders of Titon Holdings Plc by the

weighted average number of ordinary shares in issue during the

period, being 11,083,750 (six months ended 31 March 2018:

10,964,409; year ended 30 September 2018: 11,024,243).

Diluted earnings per share has been calculated by dividing the

profits attributable to shareholders by the weighted average number

of ordinary shares and potential dilutive ordinary shares during

the period, being 11,225,961 (six months ended 31 March 2018:

11,101,308; year ended 30 September 2018: 11,189,455).

7 Related party transactions

Transactions between the Company and its subsidiaries, which are

related parties, have been eliminated on consolidation and are not

disclosed in this note. Transactions between subsidiary companies

and the associate company, which is a related party, were as

follows:

Sale of goods Amount owed by related

party

6 months 6 months Year 6 months 6 months Year

to 31.3.19 to 31.3.18 to to 31.3.19 to 31.3.18 to

restated* to 30.9.18 restated* to 30.9.18

restated* restated*

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Browntech Sales

Co. Ltd 4,769 5,417 11,389 1,118 1,990 2,712

------------ ------------ ------------ ------------ ------------ ------------

*See note 2 for details regarding the restatement of prior year

results.

There have been no additional significant or unusual related

party transactions to those disclosed in the Group's Annual Report

for 30 September 2018.

8 Liability statement

Neither the Group nor the Directors accept any liability to any

person in relation to the interim statement except to the extent

that such liability could arise under English Law. Accordingly, any

liability to a person who has demonstrated reliance on any untrue

or misleading statement or omission shall be determined in

accordance with section 90A of the Financial Services and Markets

Act 2000.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR AIMATMBJBBIL

(END) Dow Jones Newswires

May 15, 2019 02:00 ET (06:00 GMT)

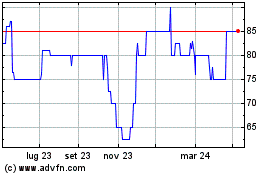

Grafico Azioni Titon (LSE:TON)

Storico

Da Mar 2024 a Apr 2024

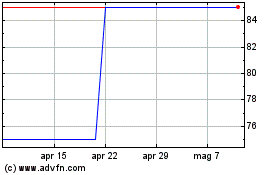

Grafico Azioni Titon (LSE:TON)

Storico

Da Apr 2023 a Apr 2024