By Asa Fitch

Nvidia Corp., the computer-graphics giant that made a successful

bet on chips purpose-built for artificial intelligence, is facing

new threats to its market dominance as rivals enter a

multibillion-dollar race to power everything from customer-service

chatbots to robotic lawn mowers.

Qualcomm Inc., long the leading designer of silicon for

smartphones, unveiled a new AI chip last month for use in cloud

computing that it plans to sell next year. Graphcore, a U.K.

chip-making startup that recently secured $200 million in new

funding from investors including Microsoft Corp., is testing its

chips and plans to release them commercially in the second half of

this year.

Underlining the commercial prospects for AI hardware, Hewlett

Packard Enterprise Co. on Friday reached a deal to acquire Cray

Inc., a company that makes high-end equipment for supercomputers

that are increasingly being deployed for AI research.

Demand for chips specialized for AI is growing at such a pace

the industry can barely keep up. Sales of such chips are expected

to double this year to around $8 billion and reach more than $34

billion by 2023, according to Gartner projections.

That growth is creating opportunities for everyone. But with

increasing competition, it will be harder for a single company to

stay on top of the race for performance, said Linley Gwennap, the

president of the Linley Group, a Silicon Valley research

outfit.

"When you have so many different companies, there's a new chip

coming out every month, and if that one happens to grab the lead,

how long are they going to stay there?" he said. "There is going to

be a lot of this leapfrogging going on."

Nvidia owns about three-quarters of the market for AI chips,

based on Gartner estimates. Jensen Huang, Nvidia's chief executive,

said some of the most sophisticated AI algorithms recently had been

developed using Nvidia hardware.

He said Nvidia also is working to make its portfolio more

flexible for customers by customizing its robust general-purpose

chips with AI-specific circuitry -- and developing software to

speed things up further. "I think that's a really great advantage,"

he said.

AI software enables computers to mimic human activity such as

having conversations, making recommendations and avoiding obstacles

on the street. Such systems require machines to perform a

gargantuan number of simple calculations at the same time. That

kind of math has traditionally been done by the central processing

unit, or CPU -- the brain of a computer. Yet CPUs, which make their

calculations one after another, aren't as good at the task as chips

with lots of small brains making calculations at the same time.

Nearly a decade ago, Nvidia recognized graphics processing units

it sold for videogame enthusiasts and other niche buyers -- chips

that calculate how to display animated pixels on a computer screen

-- were well-suited to AI because they work largely in

parallel.

The Santa Clara, Calif., company plowed investment into adapting

its chips for AI, positioning itself for a boom. Nvidia booked

almost $3 billion in revenue last year from selling AI chips used

in data centers. Its stock price has risen more than eightfold over

the past five years.

On Thursday, Nvidia reported quarterly earnings that fell 68%

but beat analysts' expectations. A slowdown in data centers where

the company's AI chips primarily reside was one factor that led to

the decline. Cloud companies that made significant purchases last

year are getting the most out of existing chips before buying new

ones, Mr. Huang said.

Chip companies aren't the only ones building AI silicon.

Cloud-computing giants like Amazon.com Inc. and Alphabet Inc., huge

buyers of Nvidia's chips, have started to design their own to meet

their customers' specific needs. Their size -- Amazon's cloud unit

had $25.66 billion in revenue last year -- give them ample

resources to fund the high cost of development.

"We can aggregate a bunch of customer demand on any workload

type and justify investing in one of the specialized chips," said

Peter DeSantis, vice president of global infrastructure at Amazon

Web Services. In November, the Amazon cloud unit unveiled a custom

processor called Inferentia optimized for a form of artificial

intelligence called machine learning. The processors are to be

deployed on AWS; Amazon doesn't plan to offer them to other

companies.

Intel Corp., already the biggest supplier of chips for computer

servers, has gained a sizable foothold in AI chips for data centers

by tweaking some of its most powerful CPUs to do better at AI

tasks.

Smaller companies, too, are building AI chips from the ground

up. They include startups Mythic Inc., Graphcore and Habana Labs

Ltd., which have drawn a surge of venture-capital interest after

many years during which early-stage investors shunned chips.

Nigel Toon, CEO of three-year-old Graphcore, said the company is

hiring hundreds of people in anticipation of its first commercial

products.

The advances that the coming wave of chips enable won't be

immediately apparent to most consumers. But people's interactions

with digital assistants like Amazon's Alexa and Apple Inc.'s Siri

should become more fluid, and devices will be able to tailor their

machine brains specifically to their owners -- such as allowing a

video security system to recognize a house's occupants so it can

distinguish them from intruders.

Despite the rapid progress seen in recent years, AI chip

development still has a long way to go before it reaches maturity,

said Naveen Rao, head of Intel's AI chip business.

"It's a very interesting point in time, kind of like the early

1900s and the introduction of flight, where the basic principles of

flight were discovered," he said. "Once you know these basic ideas,

then you iterate on them."

Write to Asa Fitch at asa.fitch@wsj.com

(END) Dow Jones Newswires

May 19, 2019 12:14 ET (16:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

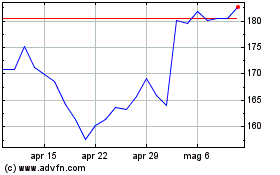

Grafico Azioni QUALCOMM (NASDAQ:QCOM)

Storico

Da Mar 2024 a Apr 2024

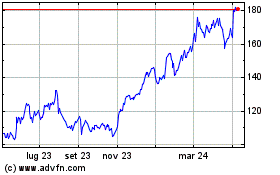

Grafico Azioni QUALCOMM (NASDAQ:QCOM)

Storico

Da Apr 2023 a Apr 2024