TIDMSWC

RNS Number : 3897A

Summerway Capital PLC

29 May 2019

29 May 2019

Summerway Capital Plc

("Summerway" or the "Company")

Interim Report for the six months ended 28 February 2019

London, 29 May 2019 - Summerway Capital plc announces its

unaudited condensed interim results for the six months ended 28

February 2019.

Over the period, Summerway generated a loss after taxation of

GBP0.115 million, reflecting operating expenses and one-off costs

relating to the initial fund-raising. As at 28 February 2019,

Summerway held GBP5.688 million cash.

Alexander Anton, Summerway's Chairman, commented: "Against the

backdrop of Brexit, we continue to pursue our investment strategy

since admission to trading on AIM on 19(th) October 2018. We have

identified a number of potential acquisition opportunities which we

hope to progress in the year ahead. We look forward to updating

shareholders further in due course."

The Interim Report is also available on the Company's website at

www.summerwaycapital.co.uk

Enquiries:

Summerway Capital

Mark Farmiloe 020 7440 7520

N+1 Singer (Nominated Adviser and Broker)

Sandy Fraser / Lauren Kettle 020 7496 3000

LEI Code: 213800YXCATORT475807

CHAIRMAN'S STATEMENT

I am pleased to present to shareholders the Interim Condensed

Consolidated Financial Statements of Summerway Capital plc (the

"Company") for the six months ended 28 February 2019.

Strategy

The Company's investment strategy remains the same as outlined

in its Admission Document dated 16 October 2018.

Results and Developments in the Period

The Company was incorporated on 31 August 2018. The Group's loss

after taxation for the six months to 28 February 2019 was

GBP114,766, which comprised GBP74,670 of administrative expenses,

GBP40,096 one-off costs relating to the initial fund-raising and

interest received of GBP3,280. At the period end, the Company held

a cash balance of GBP5,687,979.

On listing in October 2018, Summerway successfully raised

GBP5.8million (after expenses).

Outlook

Against the backdrop of Brexit, we continue to pursue our

investment strategy since admission to trading on AIM on 19(th)

October 2018. We have identified a number of potential acquisition

opportunities which we hope to progress in the year ahead. We look

forward to updating shareholders further in due course.

Alexander Anton

Chairman

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Six months ended

28 February 2019

Note Unaudited

----------------------------------------------- ----- -----------------

GBP

Administrative expenses 3 (118,046)

-----------------

Operating loss (118,046)

Finance income 3,280

-----------------

Finance income 3,280

Loss before income tax (114,766)

-----------------

Income tax -

-----------------

Net loss for the period (114,766)

Total other comprehensive income -

-----------------

Total comprehensive loss (114,766)

=================

Attributable to:

Owners of the Company (114,766)

Loss per ordinary share

Basic loss per share attributable to ordinary

equity holders of the Company 4 (2.55)p

The Company's activities derive from continuing operations.

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at

28 February

2019

Note Unaudited

---------------------------------------------------- ---- -----------

GBP

Assets

Current assets

Cash and cash equivalents 5,687,979

Other receivables 6 71,178

-----------

Total current assets 5,759,157

Total assets 5,759,157

-----------

Current liabilities

Trade and other payables 7 40,037

-----------

Total liabilities 40,037

-----------

Net Assets 5,719,120

===========

Capital and reserves attributable to equity holders

of the parent

Share capital 8 61,300

Share premium reserve 9 5,711,086

Capital redemption reserve 9 49,500

Accumulated losses 9 (114,766)

-----------

Equity attributable to the equity holders of

the parent 5,707,120

Non-controlling interest 9 12,000

-----------

Total equity 5,719,120

===========

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share Capital Non-

Share Deferred Premium Redemption Accumulated controlling Total

Notes capital Shares reserve reserve losses Subtotal interest equity

--------- -------- ---------- ---------- ------------ ---------- ----------- ----------

GBP GBP GBP GBP GBP GBP GBP

Balance as

at 31 August

2018 (unaudited) 50,000 - - - - 50,000 - 50,000

Shares split (49,500) 49,500 - - - - - -

Cancellation

of deferred

shares - (49,500) - 49,500 - - - -

Issue of shares 60,800 - 6,019,200 - - 6,080,000 - 6,080,000

Share issue

costs - - (308,114) - - (308,114) - (308,114)

Non-controlling

interest - - - - - - 12,000 12,000

Loss for the

period - - - - (114,766) (114,766) - (114,766)

--------- -------- ---------- ---------- ------------ ---------- ----------- ----------

Balance as

at 28 February

2019 (unaudited) 61,300 - 5,711,086 49,500 (114,766) 5,707,120 12,000 5,719,120

========= ======== ========== ========== ============ ========== =========== ==========

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

Six months ended

28 February 2019

Note Unaudited

---------------------------------------------------- ----- -----------------

GBP

Cash flows from operating activities

Operating loss (118,046)

Adjustments to reconcile loss before income tax

to operating cash flows:

Increase in other receivables 6 (9,178)

Increase in trade and other payables 7 40,037

Bank interest received 3,280

-----------------

Net cash used in operating activities (83,907)

-----------------

Cash flows from financing activities

Proceeds from issue of share capital 6,080,000

Share issue costs (308,114)

-----------------

Net cash generated from financing activities 5,771,886

-----------------

Net increase in cash and cash equivalents 5,687,979

Cash and cash equivalents at beginning of the

period -

Cash and cash equivalents at the end of the period 5,687,979

=================

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

1. GENERAL INFORMATION

Summerway Capital plc is an investing company (for the purposes

of the AIM Rules for Companies) and is incorporated in England and

Wales and domiciled in the United Kingdom (company number:

11545912). It is a public limited company and the address of the

registered office is Fleetworks, 26 Farringdon Street, London EC4A

4AB. The Company is the parent company of Summerway Subco Limited

(company number: 11565845). The activity of the Company is the

acquisition and subsequent development of businesses which are

either headquartered in the UK, or that have substantial operations

in the UK. The Company is principally focused on opportunities in

the wider household and consumer goods sector, including retail and

consumer brands, particularly where there is an opportunity to

introduce operational and performance improvements, including new

technologies and associated operating and value leverage.

2. BASIS OF PREPARATION AND CHANGES TO THE GROUP'S ACCOUNTING POLICIES

(a) Basis of preparation

These Interim Condensed Consolidated Financial Statements for

the six months ended 28 February 2019 have been prepared in

accordance with the Disclosure Guidance and Transparency Rules of

the Financial Conduct Authority and with the recognition and

measurement principles of International Financial Reporting

Standards ("IFRS") as adopted by the EU that are expected to be

applicable to the financial statements for the year ended 31 August

2019 and on the basis of the accounting policies to be used in

those financial statements. The Interim Condensed Consolidated

Financial Statements do not include all the information required

for full annual financial statements and accordingly, whilst the

Interim Condensed Consolidated Financial Statements have been

prepared in accordance with the recognition and measurement

principles of IFRS, it cannot be construed as being in full

compliance with IFRS.

These Interim Condensed Consolidated Financial Statements do not

comprise statutory accounts within the meaning of section 434 of

the Companies Act 2006.

The Company was incorporated on 31 August 2018 and therefore

there are no comparative figures.

(b) New standards and amendments to International Financial Reporting Standards

Standards, amendments and interpretation effective and adopted

by the Group:

IFRS 9 'Financial Instruments' amends the classification and

measurement models for financial assets and adds new requirements

to address the impairment of financial assets. It also introduces a

new hedge accounting model to more closely align hedge accounting

with risk management strategy and objectives. The standard requires

companies to make an election on whether gains and losses on equity

instruments measured at fair value should be recognised in the

Statement of Comprehensive Income or other comprehensive income,

with no recycling. IFRS 9 has been adopted by the Group but has had

no material effect on the Group's results.

Standards issued but not yet effective:

The following standards are issued but not yet effective. The

Group intends to adopt these standards, if applicable, when they

become effective. It is not expected that these standards will have

a material impact on the Group.

Effective date

Standard (period commencing)

IFRS Leases 1 January 2019

16

IFRIC Uncertainty over Income Tax Treatments 1 January 2019

23

IFRS Insurance Contracts 1 January 2021

17

3. EXPENSES BY NATURE

Six months

ended 28

February

2019

-------------

GBP

Group expenses by nature

One-off costs related to the

listing 40,096

Staff related costs 22,500

Office costs 17,604

NOMAD, registrar and Stock Exchange

costs 17,552

Audit and accountancy costs 14,770

Other expenses 5,524

118,046

=============

4. LOSS PER ORDINARY SHARE

Basic loss per ordinary share is calculated by dividing the loss

attributable to equity holders of the Company by the weighted

average number of ordinary shares in issue during the period.

Six months

ended 28

February

2019

--------------

Loss attributable to the owners

of the Company GBP (114,766)

Weighted average number of ordinary

shares in issue 4,508,667

Basic loss per share (2.55) p

5. INVESTMENTS

Principal subsidiary undertakings of the Group

The Company directly owns the ordinary share capital of its

subsidiary undertakings as set out below:

Subsidiary Proportion Proportion

of A ordinary of B ordinary

Nature of Country shares held shares

business of incorporation by Company held by

Company

Incentive England

Summerway Subco Limited vehicle and Wales 100% 0%

The address of the registered office of Summerway Subco Limited

(the "Subsidiary") is Fleetworks, 26 Farringdon Street, London EC4A

4AB.

6. OTHER RECEIVABLES

All receivables are current. There is no material difference

between the book value and the fair value of receivables.

As at

28 February

2019

-------------

GBP

Amounts falling due within

one year

Prepayments 6,330

Other receivables 64,848

71,178

=============

7. TRADE AND OTHER PAYABLES

There is no material difference between the book value and the

fair value of the trade and other payables.

As at

28 February

2019

-------------

GBP

Trade payables 15,711

Accruals 21,490

Other tax and national insurance

payable 2,836

40,037

=============

8. SHARE CAPITAL

As at

28 February

2019

-------------

GBP

Issued

6,130,000 ordinary shares of 1p

each 61,300

61,300

=============

9. RESERVES

The following describes the nature and purpose of each reserve

within shareholders' equity:

Share premium reserve

A statutory, non-distributable reserve which represents the

premium paid for new shares above their nominal value.

Capital redemption reserve

A statutory, non-distributable reserve into which amounts are

transferred following the redemption or purchase of a Company's own

shares

Retained deficit

Cumulative net gains and losses recognised in the Statement of

Comprehensive Income.

Other reserves

Other reserves comprise 999,999 B Shares of GBP0.01 in the

Subsidiary issued to the Executive Directors of the Company on 17

September 2018 at a price of GBP0.012 per share (the "B

Shares").

10. RELATED PARTY TRANSACTIONS

Parties are considered to be related if one party has the

ability to control the other party or exercise significant

influence over the other party, or the parties are under common

control or influence, in making financial or operational

decisions.

Under the terms of their respective service agreements, the

Executive Directors are each paid a salary of GBP1,000 per calendar

month, in each case payable monthly in arrears. The Non-Executive

Director is paid a monthly fee of GBP1,500 per calendar month.

The Directors and their connected persons hold a total of

1,650,000 ordinary shares in the Company, representing 26.9 per

cent of the enlarged share capital following admission.

On 17 September 2018 the Executive Directors subscribed for, in

aggregate, 999,999 B Shares in the subsidiary, Summerway Subco

Limited pursuant to the Subsidiary Incentive Scheme.

11. COMMITMENTS AND CONTINGENT LIABILITIES

There were no commitments or contingent liabilities outstanding

at 28 February 2019 that require disclosure or adjustment in these

interim financial statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR SESFAAFUSEFI

(END) Dow Jones Newswires

May 29, 2019 02:00 ET (06:00 GMT)

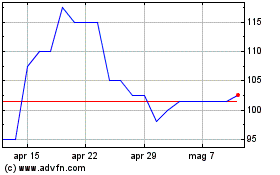

Grafico Azioni Celadon Pharmaceuticals (LSE:CEL)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Celadon Pharmaceuticals (LSE:CEL)

Storico

Da Apr 2023 a Apr 2024