TIDMBOOM

RNS Number : 6768A

Audioboom Group PLC

31 May 2019

This announcement contains inside information as stipulated

under the Market Abuse Regulations (EU) no. 596/2014 ("MAR").

31 May 2019

Audioboom Group plc

("Audioboom" or the "Company")

Final audited results for 13-month period ended 31 December

2018

Audioboom (AIM: BOOM), the leading global podcast company,

announces its final audited results for the 13-month period ended

31 December 2018.

Financial highlights

-- Revenue increased 92% to US$11.7 million (12 months ended 30

November 2017: US$6.1 million), with significant growth in the

final three months of the period

-- Adjusted EBITDA* loss reduced to US$5.1 million (12 months

ended 30 November 2017: loss of US$5.6 million), with much improved

performance in the final three months of the period

-- Group cash as at 31 December 2018 of US$1.6 million (30

November 2017: US$1.0 million) - operating cash flow breakeven

achieved in the final three months of the period

*earnings before interest, tax, depreciation, amortisation,

share based payments and before material one-off items (including

the costs of the aborted Triton Digital transaction and corporate

restructuring)

Operational highlights and KPIs

-- Key performance indicators ('KPIs') all delivered significant growth:

o Revenue per 1,000 listens in the US (eCPM) increased to

US$25.87 in December 2018, up 74% from US$14.87 in November

2017

o Brand advertiser count of 160 in December 2018, up 65% from 97

in November 2017, with new tier one advertisers including Bose and

TiVo

o Total available premium advertising impressions grew to a

total of 1,015m in the 2018 financial period, up from 671m in 2017,

an increase of 51%

-- Company's focus on working with the most prominent podcasts

demonstrated with notable new content including a multi-year

contract for 'Casefile', a popular true crime podcast, and 'And

That's Why We Drink', one of the biggest new podcasts of 2018; and

the re-signing of 'No Such Thing As A Fish' and 'The Totally

Football Show', two of the UK's biggest podcasts by listens

-- Co-production partnerships established with leading existing

brands and broadcasters, including 'Beyond the Grid' with Formula

One, to enhance gross margins

-- Audioboom Original Network (AON) traction and growth

continues with 11 shows produced from the Group's New York and

London studios, creating original intellectual property and

generating higher margins than third party podcasts

-- Successful launch of Sonic Influencer Marketing, a platform

enabling brands to secure advertising within any globally available

podcast

-- Completed Spotify API integration; sales agreement with

Starburns Audio, a new podcasting network created by Starburns

Industries; and international sales partnership agreement with The

Podcast Exchange in Canada

-- Withdrew from proposed reverse acquisition of Triton Digital

Canada Inc, a leading technology provider to the online audio

industry when, despite significant demand, it was not possible to

complete the associated fundraise

Post-period end highlights

-- KPIs for Q1 2019 all demonstrated further significant growth over prior year**:

o Trading ahead of management expectations with record quarterly

revenue of c.US$4.6 million, up 180% on Q1 2018 (US$1.6

million)

o Brand advertiser count of 178 as at 31 March 2019, up 55% on

the same period last year (31 March 2018: 115)

o Revenue per 1,000 listens in the US (eCPM) at US$23.77, up 67%

on same quarter last year (Q1 2018: US$14.27). Note, this was lower

than Q4 2018 due to higher inventory being available in Q1 2019

o Total available premium advertising impressions of 305

million, up 28% from same period last year (Q1 2018: 239

million)

**The financial period ended 31 December 2018 was a 13-month

period. In order to provide appropriate like-for-like comparisons,

the Q1 2018 comparable period referred to herein is 1 January - 31

March 2018

-- Raised a total of GBP4.3 million (before expenses) from a

placing and subscriptions to secure leading podcasting talent and

shows, and develop co-production and AON opportunities, which are

expected to further improve the Group's performance over the course

of 2019 and beyond

-- Strong pipeline of high revenue producing podcast content and

talent and other opportunities

-- Ongoing cost control continues as the Company recognises the

reduction and repurposing of headcount costs and the savings made

from renegotiated hosting, bandwidth and ad serving costs

Rob Proctor, CEO of Audioboom, commented: "I am delighted the

significant investments we've made in people and technology over

the past couple of years have been reflected in these financial

results with revenue increasing 92% for the period and the Company

achieving cashflow break-even over the final three months.

"We signed some impressive new content during the period,

including 'Casefile', 'And That's Why We Drink' and also re-signed

two of the UK's biggest podcasts, by number of listens. I am

particularly pleased with the success of our Audioboom Originals

Network programming with both the London and New York studios

creating more than 11 shows, which expands our operating margins

and creates valuable intellectual property for the Company. The

entire audio entertainment industry is already beginning to value

intellectual property within the sector and we have already seen

several large industry players, such as Spotify, acquiring

podcasting businesses over the past 12 months and Luminary, a

podcast start up, raise US$100m.

"The recent successful placing and subscription for new shares

in the Company positions us well to acquire even more talent and

valuable third-party podcasts to both maintain our leading market

position across the United States and Europe, and drive further

material revenue growth this year."

Notice of AGM

Audioboom will today issue and post to its registered

shareholders its Annual Report and Accounts for the 13-month period

ended 31 December 2018, including a notice convening the Annual

General Meeting ("AGM"). This document will shortly be available

for viewing on the Company's website (www.audioboomplc.com).

The AGM is to be held at the offices of Fladgate LLP at 16 Great

Queen Street, London WC2B 5DG at 10.00am on Thursday 20 June

2019.

Registered shareholders and/or duly authorised corporate

representatives or proxies intending to attend the AGM are advised

to bring evidence of their shareholding or authorisation with

them.

Enquiries

Audioboom Group plc Tel: +44(0)20 7403 6688

Rob Proctor, Chief Executive Officer

Brad Clarke, Chief Financial Officer

Allenby Capital Limited (Nominated adviser Tel: +44(0)20 3328 5656

and Broker)

David Hart /Alex Brearley/Asha Chotai

Walbrook PR Limited (PR & IR Advisers) Tel: +44(0)20 7933 8780

Paul Cornelius / Nick Rome / Sam Allen or audioboom@walbrookpr.com

About Audioboom

Audioboom is the leading global podcast company, consolidating

the business of on-demand audio, making content accessible,

wide-reaching and profitable for podcasters, advertisers and

brands. Audioboom operates internationally, with operations and

global partnerships across North America, Europe, Asia and

Australia, and addresses the issue of disparate podcast services by

putting all of the pieces of the puzzle together under one

umbrella, creating a user-friendly, economical experience.

Audioboom hosts over 13,000 content channels, with key partners

including A+E Networks (US), Associated Press (US), 'Astonishing

Legends' (US), 'Casefile True Crime' (Aus), Edith Bowman (UK),

'Felon True Crime Podcast' (Aus), Jonathan Ross (UK), 'Moneycontrol

Podcast' (India), 'No Such Thing As A Fish' (UK), Red FM (India),

Starburns Audio (US), 'The Cycling Podcast' (UK), 'The Totally

Football Show' (UK), 'The True Geordie Podcast' (UK) and

'Undisclosed' (US).

Original content produced by Audioboom includes 'Formula 1(R):

Beyond the Grid' (UK), 'And That's Why We Drink' (US), 'Dead Man

Talking' (UK), 'Blank Check' (US), 'The 45th' (US), 'Covert' (US),

'Deliberations' (US), 'It's Happening with Snooki & Joey' (US),

'Mafia' (US) and 'Night Call' (US).

The platform receives over 90 million listens per month and

allows partners to share their content via Apple Podcasts,

BookMyShow, Deezer, Google Podcasts, iHeartRadio, RadioPublic,

Saavn, Spotify, Stitcher, Facebook and Twitter as well as their own

websites and mobile apps.

For more information, visit audioboom.com.

CHAIRMAN'S STATEMENT

Having joined the Board of your Company on 1 September 2018, I

am pleased to present my first Chairman's Statement.

Prior to my arrival, the Company had faced significant

challenges in 2018, created in large part by the distraction and

financial cost of the aborted Triton Digital acquisition earlier in

the year. It is therefore testament to the Company's staff and

supportive shareholders and partners that, driven by the strong

recovery in performance in the final three months of the year, the

Company continues to enhance its position as the leading global

podcast company. The continued rapid growth in the podcasting

industry and growing recognition by advertisers, particularly in

the US, positions Audioboom strongly to continue to take advantage

of the opportunities ahead.

In his CEO Review, Rob Proctor provides detail around the

Company's strategy, operational and financial performance, and

recent update and outlook. The Board is delighted with the strong

growth in revenue and performance across all operational KPIs in

2018, the continued focus on cost control, and the strong start to

2019.

We were pleased to secure an additional GBP4.3 million in growth

funding post-period end, with GBP2.8 million of this recently

raised at a premium to the prevailing market price and at almost

double the price of the initial raise earlier this year. This will

allow the Company to acquire high revenue producing, established

podcasts and talent which will further drive revenues and

strengthen Audioboom's core US operations. Once again, the support

of our existing shareholders has been crucial and we were delighted

to welcome a number of new investors to our register. The Board

also hopes to be able to secure a new guarantee facility which

would provide the Company with further financial means to assist in

the acquisition of new podcast talent in our high growth

market.

In terms of Board changes, Brad Clarke was appointed to the

Board as Chief Financial Officer on 1 September 2018 (having joined

the Company in March 2018) and Malcolm Wall stepped down as

non-executive Chairman at the same time after four years on the

Board. Brad has already made a significant positive impact on the

Company's financial controls, reporting and budgeting and the Board

takes great confidence from his involvement. The Board would again

like to thank Malcolm Wall for steering the Company through its

early, and often challenging, years on AIM.

I would like to take this opportunity to thank the entire

Audioboom team for their continuing professionalism and commitment

and also to thank our shareholders and partners for their loyalty

and vision in supporting Audioboom as it continues to grow,

particularly given the challenges of last year. Given the momentum

generated in the final three months of 2018 and in the year to

date, the Board is optimistic and excited about the opportunities

that lie ahead for the balance of 2019 and beyond, with further

strong growth in revenue expected.

Michael Tobin OBE

Chairman

30 May 2019

CHIEF EXECUTIVE OFFICER'S REVIEW

Introduction

Audioboom is one of the world's largest spoken word platforms

and a digital online market-place that matches advertisers and

brands with targeted audiences that listen to digital spoken word

content across different audio genres including, but not limited

to, news, sport, current affairs, true crime and entertainment.

Each piece of audio provides an opportunity for the Company to

place traditional audio or video advertisements ('ads') at the

beginning, middle and end of the content ('pre, mid and post roll

advertising'), as well as opportunities for 'live host read' or 'in

read' advertising, and it is our vision to become the world's

leading B2B advertising and digital audio content distribution

company for both content creators and publishers.

2018 posed exceptional challenges for the business with the

considerable distraction of the aborted Triton acquisition. Against

this backdrop, it was hugely satisfying that our revenues have

almost doubled and our adjusted EBITDA loss reduced. More

significant was the Company's cash flow break even performance in

the final three months of the period, which was achieved through

higher revenues, continued cost control and improved financial

processes.

As the profile of podcasts and on-demand audio continued to

expand in 2018, audiences and digital advertising budgets continue

to flock to the podcast medium - representing a tremendous

validation of our business model. During 2018, Audioboom

consolidated its position as the 'go to' platform for top talent

and broadcasters such as The Official Formula 1 Podcast 'Beyond The

Grid', Fox Broadcasting's 'Dish Nation', Studio 71's 'Something

Scary', as well as top tier independent podcasts like 'Casefile',

'And That's Why We Drink' and 'Morning Toast'.

The excellent results for the final three months of 2018,

together with 2019 year-to-date performance, pre-booked advertising

campaigns and content acquisition pipeline, all point towards

further significant improvements in 2019.

Strategy

The Company has currently sold the majority of its available

advertising inventory for 2019 across its top ten podcasts, whilst

at the same time recording substantial growth in the number of

active advertisers. The Company's strategy is therefore now heavily

focused on accelerating its acquisition of established, popular

podcasts and production of its own podcasts, as the Board believes

that substantial growth opportunities are available to Audioboom

via the acquisition of both established 'Tier 1' podcasts and the

creation of Audioboom Originals content.

Where appropriate, leading podcasters and podcast content

providers can seek upfront advance payments (which are fully

recoupable over the life of the contract) and minimum revenue

guarantees in podcast acquisition negotiations. In addition, the

Board believes that there are listener and revenue benefits to be

gained from supporting podcasts on the Audioboom network with

modest marketing and promotional budgets, in order to accelerate

monetisable audience sizes. Typically, established Tier 1 podcasts

require high, yet commensurate, minimum guarantees and advances,

whilst new podcasts typically require only a low (or no) minimum

revenue guarantee.

The Board believes that the Company is now able to provide

increasingly accurate forecast revenues for major, established

podcasts. Using podcast frequency and listener data, conservative

assumptions regarding the revenue per 1,000 listens (eCPM) rates

that a particular show will command, anticipated sell through rates

and the number of advertising slots per episode, Audioboom is able

to generate a minimum and maximum range of predicted gross annual

revenues.

Audioboom's strategy involves using these revenue predictions to

determine the appropriate levels of advances that can be offered in

order to win or renew established, revenue generating podcasts.

Audioboom has also used its forecasting process to determine a

number of non-preferred podcast content acquisition opportunities,

where the cost-effectiveness of the minimum guarantees required are

not as attractive as other opportunities. The Board believes that

this strategy will assist in managing the balance of potential

risks and rewards in relation to Audioboom providing minimum

guarantees or advances.

The established listener bases of existing Tier 1 podcasts can

be brought onto Audioboom's platform quickly via a redirection of

their RSS feeds following acquisition, which ensures predictable

and repetitive revenues.

Additionally, Audioboom will continue to roll out its

co-productions and Audioboom Original Network productions, thus

enhancing its long-term IP position and improving its overall gross

margins.

Geographically, Audioboom is fully committed to growing its

market share in its key markets of the USA and UK, whilst

continuing to develop strong local partnerships in India, Australia

and Canada.

Overview of the market

The global podcast market goes from strength to strength,

especially in Audioboom's major market, the USA. The latest

Infinite Dial survey for 2019 highlights some of the following

trends:

-- 70% of the US population aged 12 years and over is now

familiar with podcasting, up from 64% in 2018

-- 51% of this US population (c. 144 million people) have now

listened to a podcast, up from 44% in 2018

-- 32% (c. 90 million people) have listened to a podcast in the

last month, up from 26% in 2018

-- 22% (c. 62 million people) now listen weekly to podcasts, up from 17% in 2018

-- Growth amongst 12-24 year olds is up a full 10% points

-- Monthly podcast listening on Spotify has increased to 53% of

its total user base, up from 32% in 2018

-- 52% of the US listening population listen to 4 or more podcasts per week

Operational review

I am pleased to report upon another important year in terms of

monetisation, financial results and operational progress across all

our key performance indicators ('KPIs').

KPIs

-- Revenue per 1,000 listens in the US (eCPM) increased to

US$25.87 in December 2018, up 74% from US$14.87 in November

2017

-- Brand advertiser count of 160 in December 2018, up 65% from

97 in November 2017, with new tier one advertisers including Bose

and TiVo

-- Total available premium advertising impressions grew to a

total of 1,015m in the 2018 financial period, up from 671m in 2017,

an increase of 51%

Content partners

The Company's focus on working with the most prominent podcasts

was demonstrated with notable new content including 'Casefile', a

major true-crime podcast, and 'And That's Why We Drink', one of the

biggest new podcasts of 2018. Together with the re-signing of 'No

Such Thing As A Fish' and 'The Totally Football Show', this

reflects the growing industry recognition of Audioboom as the

'go-to' podcast advertising company for podcasters and advertisers

across the globe.

Casefile

In January 2018, Audioboom announced that it had signed a

multi-year contract to host and monetise Casefile, a true crime

podcast which was originally launched in January 2016. Casefile has

been downloaded more than 154 million times since partnering with

Audioboom.

And That's Why We Drink

In September 2018, Audioboom signed a commercial agreement to

distribute and monetise one of the biggest new podcasts of the

year, 'And That's Why We Drink'. The podcast has been downloaded

more than 22 million times since the start of the partnership and

Audioboom sold 100% of the available advertising inventory for the

podcast during Q1 2019.

No Such Thing As A Fish and The Totally Football Show

The Company was delighted to have extended its commercial

partnerships with these two podcast partners during the period. As

two of the UK's biggest podcasts by listens, the extended

relationship should help further drive unique users and advertising

impressions as the Company builds on the strong momentum achieved

to date. Combined, the two shows have been downloaded more than 216

million times in the past year.

Audioboom Originals

During 2018, Audioboom continued to develop the Audioboom

Originals Network. This initiative is central to the Audioboom

business model, creating original intellectual property and helping

to grow gross margin.

Audioboom produces 11 'owned and operated' shows from its New

York and London studios, including 'Blank Check', 'Night Call',

'Deliberations', 'It's Happening', 'The 45(th) ', and 'Chrisley

Confessions'. Audioboom Originals is creating more than six million

available 'in-read' advertising impressions per month.

In 2019, we expect that the Audioboom Originals Network will

continue to grow significantly, making a material contribution to

the Company's revenue mix. The roster of productions continues to

develop well, with second or later seasons of 'Mafia', 'Covert',

'Dead Man Talking' and 'INBOX' all due to be available in 2019. New

podcasts launching during 2019 on the Audioboom Originals Network

include 'Truth Vs Hollywood', 'Notorious Killers', 'A Life Lived',

'Truly' and 'Teachers'.

Co-productions

Audioboom's co-production partnerships enable existing brands

and broadcasters to develop a podcasting footprint by utilising

Audioboom's production expertise and distribution capability.

Audioboom works closely with a brand to develop and produce high

quality content and the brand leverages its owned properties to

grow audience for the show, with Audioboom also acting as the

exclusive advertising sales partner. This initiative is key to

growing our gross margin.

Formula 1(R) Podcast

In June 2018, the Company announced that it had signed an

agreement with Formula One Digital Media Limited for an official

weekly podcast, titled 'Beyond the Grid' with the podcast being

co-produced, hosted and distributed by Audioboom. The partnership

was extended in February 2019 through to February 2021.

'Beyond the Grid' has been downloaded more than 2.5 million

times since the start of the 2019 Formula One season.

The podcast is sponsored by Bose, while other advertisers can

pay for episodic live reads throughout the podcast series.

Subscription service

Audioboom launched its own podcast subscription service in 2017,

which allows content creators with smaller audiences to host

content, measure and distribute their podcasts to all the major

consumption platforms, and opt into advertising, should they wish

to. The entry subscription service costs US$9.99 per month and

applies to podcast creators on the Audioboom platform achieving

fewer than 10,000 downloads per month.

In February 2019, a second tier was added to the subscription

service for podcast creators achieving between 10,000 and 25,000

downloads per month. This tier costs US$19.99 per month.

Sonic Influencer Marketing

In August 2018 Audioboom launched Sonic Influencer Marketing

('Sonic'), a platform enabling brands to secure advertising within

any globally available podcast. Sonic manages the full podcast

advertising process for its brand clients, including campaign

execution, billing and performance optimisation.

More than 22 brands already utilise Sonic including Sony UK,

Article, Instacart, HumanN and Outerknown.

SONR News Limited

During the period the majority of SONR staff left the Company as

Audioboom focused its resources on revenue generating initiatives.

SONR is currently exploring opportunities and partnerships to

exploit its NLP and AI technology.

Key commercial agreements

Spotify - integration of API

In June 2018, Audioboom announced a review of the first year of

its strategic partnership with Spotify Technology SA

('Spotify').

Audioboom's listens and live read ad inventory via the Spotify

streaming service had increased over the twelve-month period to 31

May 2018 to approximately 10% of its total listenership, following

the successful implementation of a distribution partnership with

Spotify. This increase could be attributed to just 1% of

Audioboom's content being available on the Spotify platform at that

time.

The Company has now completed its technical API integration,

which now allows for all of Audioboom's content to be available to

Spotify. This fulsome integration also ensures that Audioboom is

able to track listenership metrics for its content within the

Spotify ecosystem and thus enhance its attractiveness to agencies

and brands looking to advertise on its premium podcast content. As

a result, Spotify is now established as the Company's second

biggest distribution platform after Apple Podcasts, with

Audioboom's on-demand podcasts, such as 'Mafia' and 'Drink Champs',

now featured on the Spotify platform across multiple content

categories.

Importantly, the ability to deliver embedded Audioboom host read

advertising and programmatic advertising inside the Spotify

platform has resulted in increased revenue for Audioboom and its

podcast partners as more listeners are on-boarded.

Increased listens and advertising revenues as a result of

partnerships are a key part of the Company's future growth

strategy, which involves utilising third-party relationships and

technology platforms to widen reach and the ability to grow

additional revenue streams.

Starburns Audio ('SBA')

In June 2018, Audioboom announced that Starburns Audio, a new

podcasting network created by Starburns Industries, the production

studio behind Rick and Morty, HBO's Animals, and the Academy

Award-nominated Anomalisa, had entered into an advertising sales

agreement. Its network of shows is a mix of Apple Podcasts' comedy

Top 50 mainstays and exciting new shows, including: 'Harmontown',

'Small Doses' with Amanda Seales, 'Dumb People Town', 'Glowing Up',

and 'Natch Beaut'. The partnership has since been extended until

April 2021.

The Podcast Exchange ('TPX')

An agreement with TPX focuses on the Canadian region and makes

Audioboom the first podcast platform to partner with this network.

Launched in February 2018, TPX, which does not make or sell its own

content, combines research-driven strategy, advanced metrics, sales

expertise and geo-targeting, providing advertisers with better

monetisation opportunities within the Canadian podcast

audience.

Aborted Triton Digital deal

In February 2018, the Company announced its intention to acquire

the entire issued share capital of Triton Digital Canada Inc

('Triton'), the parent company of Triton Digital, Inc., for a cash

consideration of US$185 million (approximately GBP134 million).

Triton is a leading technology provider to the online audio

industry, headquartered in the USA.

In May 2018, Audioboom announced that the Company's proposed

acquisition would not be proceeding as the Company was unable,

despite significant investor interest, to raise the necessary funds

required to complete the transaction.

Audioboom incurred c. US$1.7 million of costs in relation to

this aborted transaction. The Board is of the view that the Company

lost a total of approximately US$5 million in revenues over the

first nine months of 2018, due to the aborted acquisition, as the

costs of this transaction prevented a number of podcast renewals

and the acquisition of new podcast content. The Board is pleased

that, following this disruption, the Company's growth trajectory

has been re-established, as evidenced by trading for the final

three months of 2018 and the first quarter ended 31 March 2019.

Financial review

In 2018, the Company recorded revenue growth which significantly

outperformed the growth in the overall podcast advertising market.

This was achieved despite the enormous operational challenges that

the Company faced in 2018 and, with more money now flowing into the

space, some of our major competitors now being backed by companies

with access to significant resources.

Revenue growth accelerated in our core revenue segment; premium

in-read advertising for our podcast partners. This core segment was

assisted by the breakthrough year for our UK sales operation, who

have now established a premium advertising sales market in this

territory. Encouraging revenue contributions were also made through

the launch of Sonic Influencer Marketing in August 2018 and by the

Audioboom Originals Network, in its first full year and with a

roster of exciting new shows.

Revenue increased by 92% to US$11.7 million for the 13 months to

31 December 2018 from US$6.1 million (12 months to 30 November

2017), with significant growth recorded in the final three months

of the period. In 2018, 83% of Group revenue was generated in the

United States, which is the largest and most developed market for

podcasting. US revenue represented 90% of Group revenue in 2017,

with the change in contribution being due to the increased revenue

generated from the UK sales operation, proving that the premium

advertising sales model works in that territory.

The Company continued to control overheads and a 'benefit' of

the aborted Triton Digital transaction meant that the Company had

to scrutinise all aspects of its cost base to ensure only required,

and appropriate, resources were dedicated to operational areas. The

Company underwent a restructuring programme in 2018, removing a

number of non-revenue generating employees, and repurposed part of

that headcount to revenue generating sales and production staff.

The Company implemented a number of cost reduction procedures in

2018, including; closing its Australian office and moving to a

partnership agreement in that territory, and also renegotiating the

contracts for hosting and bandwidth costs incurred, a material part

of the Company's cost base. This renegotiation will yield in excess

of a 20% annualised saving for hosting and bandwidth costs. We

continue to monitor the cost base closely and align it to the

Company's operational demands and in 2019 we will recognise the

full year impact of those headcount reductions and hosting and

bandwidth savings secured in 2018.

The Company's overall trading for the period, as measured by

adjusted EBITDA (earnings before interest, tax, depreciation,

amortisation, share based payments and before exceptional items

(including the costs of the aborted Triton Digital transaction and

corporate restructuring)), recorded an improvement to a loss of

US$5.1 million (13 months to 31 December 2018) from US$5.6 million

(12 months to 30 November 2017), with much improved performance in

the final three months of the period.

The cash outflow from operating activities fell to US$7.3

million for the 13-month period (12 months to 30 November 2017:

US$8.1 million), with operating cash flow breakeven achieved in the

final three months of the period. It should be noted that the 2018

cash outflow from operating activities of US$7.3 million included

US$1.7 million of costs of the aborted Triton Digital transaction.

Excluding these costs, cash outflow for the 13-month period was

US$5.6 million, a 30% reduction in cash outflow versus 2017.

The encouraging stability of the cash position in the final

three months of the period was a result of a combination of

positive working capital factors; sustained revenue growth during

the second half of 2018; significantly improved cash collection in

the second half of 2018, as supported by the reduction in

collection days from 139 days in 2017 to 94 days in 2018; and the

implementation of a new bespoke global podcast advertising booking

system which has significantly reduced the time taken to distribute

invoices to customers. Trade payable days are in line with

expectations given the increased trading in the final three months

of 2018 and the payment terms offered to podcast partners.

During the period, the Company raised US$7.7 million (before

expenses) from the issue of convertible loan notes and a placing

and subscription of ordinary shares for working capital and growth

initiatives. Net cash at the period end was US$1.6 million (30

November 2017: US$1.0 million).

The financial results shown above, in particular in respect of

the final three months of the period, illustrate that the drive to

increase revenues whilst maintaining strong cost management is

working and should deliver significant shareholder value as the

Company continues its journey towards positive cash-flow.

Financial year end and reporting currency

The Company has changed its accounting reference date and

financial year end from 30 November to 31 December, with the period

under review covering 13 months to 31 December 2018. Further, given

that the Company derives the majority of its revenues in US

Dollars, the Company has moved to reporting in US Dollars for the

period under review and going forward.

Recent fundraising

Post period end, the Company raised GBP1.5 million in February

2019 by way of a subscription at a price of 1.3 pence per share and

recently completed a placing and subscription to raise a further

GBP2.8 million of new equity funding at a price of 2.5 pence per

share.

In order to support and continue the strong revenue growth

experienced by Audioboom in Q4 2018 and Q1 2019, the net proceeds

of these funding rounds have been, and will be, predominantly used

to:

-- accelerate established podcast content acquisition, where

such opportunities have predictable revenues

-- further develop co-production content partnerships, with a

view to increasing gross revenues and gross margins

-- grow the Company's slate of Audioboom Originals productions,

with a view to increasing gross revenues, gross margins and

delivering valuable original content

Guarantee arrangements

As previously announced, in order for the Group to secure

additional leading podcast content and talent, over and above that

to be secured with the proceeds of the recent fundraise and without

tying up further working capital, Michael Tobin, the Company's

Chairman, and Candy Ventures sarl, a substantial shareholder in the

Company, intend to enter into an agreement for a facility that can

provide the necessary minimum revenue guarantees to the relevant

content partners.

These guarantees are expected to be provided via a special

purpose vehicle ('SPV'). It is expected that the SPV will provide

the content partners with guarantees of up to approximately US$4

million in aggregate, securing the minimum guaranteed advertising

revenue share payable to the content partners pursuant to their

commercial agreements with Audioboom.

In return for providing the guarantees, Audioboom will agree to

pay the SPV an amount equivalent to 8% of the net advertising

revenue received by Audioboom in respect of the relevant content

partners' podcasts for which the guarantee has been provided (after

paying the content partner its share). In addition, the providers

of the guarantees will be granted warrants to subscribe for

ordinary shares in the Company on the basis of 2.5 million warrants

(in aggregate and prior to the proposed share consolidation

described below) for each US$1 million of guarantee provided (the

'Warrants'). The exercise price of the Warrants will be at a

premium to the Company's current mid-market share price.

There is no guarantee that the agreement for the provision of

the necessary minimum revenue guarantees to relevant content

partners will proceed, nor as to the timing or terms thereof,

however, significant progress has been made in these respects and

the Company would hope to make an appropriate announcement with

further details in the near future. Given that Michael Tobin and

Candy Ventures sarl are related parties of Audioboom in accordance

with rule 13 of the AIM Rules, any such transactions involving

Michael Tobin and Candy Ventures sarl will be subject to

confirmation from the Company's independent Directors, having

consulted with the Company's nominated adviser, Allenby Capital

Limited, that the transactions are considered to be fair and

reasonable insofar as Shareholders are concerned.

Proposed share consolidation

At this year's Annual General Meeting, the Board will be seeking

shareholder approval for the consolidation of all the existing

ordinary shares of no par value each of the Company into new

ordinary shares of no par value each on the basis that each 100

existing ordinary shares will be consolidated into one new ordinary

share (disregarding fractions), effective immediately upon the

conclusion of the AGM.

Shareholders with a holding of existing ordinary shares which is

not exactly divisible by 100 will have their holdings rounded down

to the nearest whole number of new ordinary shares. Holders of

fewer than 100 existing ordinary shares will not be entitled to

receive any new ordinary shares following the proposed share

consolidation. Any fractional entitlements arising from the share

consolidation will be aggregated and sold in the market and,

subject to article 50 of the Company's articles of association

('Articles'), the net proceeds will be distributed among the

persons entitled to them in accordance with the Articles.

The Board believes that the consolidation of the Company's share

capital will result in a more appropriate number of shares in issue

for the Company and may help to make the new ordinary shares more

attractive to investors.

Immediately following the share consolidation, Shareholders will

still hold the same proportion of the Company's ordinary share

capital as before the share consolidation (save in respect of the

fractional entitlements). The record date for the share

consolidation will be 20 June 2019. The new ordinary shares will

carry equivalent rights under the Articles to the existing ordinary

shares.

All entitlements under outstanding options and warrants shall be

recalculated accordingly as a result of the share consolidation

with entitlements rounded down to the nearest whole share.

Following the share consolidation, the existing ordinary shares

will no longer be in issue in their current form and certificates

in respect of the same will be invalid. New share certificates in

respect of new ordinary shares are expected to be posted, at the

risk of shareholders, by 5 July 2019 to those shareholders who

currently hold their existing ordinary shares in certificated form

(and who hold more than 100 existing ordinary shares). These will

replace existing certificates which should be destroyed. Pending

the receipt of new certificates, transfers of new ordinary shares

held in certificated form will be certified against the register of

members of the Company.

Current trading

On 3 April 2019, the Company reported impressive and continued

growth in all of its KPIs for the first quarter of this year*:

-- Trading ahead of management expectations with record

quarterly revenue of c.US$4.6 million, up 180% on Q1 2018 (US$1.6

million)

-- Brand advertiser count of 178 as at 31 March 2019, up 11% on

last quarter (31 December 2018: 160) and up 55% on the same period

last year (31 March 2018: 115)

-- Revenue per 1,000 listens in the US (eCPM) at US$23.77, up

67% on same quarter last year (Q1 2018: US$14.27)

-- Total available premium advertising impressions of 305

million, up 28% from same period last year (Q1 2018: 239

million)

*The financial period ended 31 December 2018 was a 13-month

period. In order to provide appropriate like-for-like comparisons,

the Q1 2018 comparable period referred to above is 1 January - 31

March 2018

On 25 February 2019, Audioboom announced that the forward

in-read advertising bookings and monthly recurring revenues from

programmatic advertising and podcast subscriptions for 2019 already

exceeded the Company's total revenues for the 13-month period ended

31 December 2018. Audioboom continues to book forward in-read

advertising revenue to drive further past the 2018 revenue

total.

Some of the notable content partnerships recently negotiated by

the Company include:

- Studio71 (Los Angeles) - a leading digital video studio and

network with 7 billion monthly Youtube views;

- SBI Audio and its slate of 50 established shows;

- Formula1(R) and 'Beyond the Grid'; and

- Main Event Media - a production company that is part of All3Media.

Outlook

We are delighted with our performance in 2019 to date, with the

recent funding allowing the Company to accelerate the signing of

great new podcasts and a meaningful plan for an extended slate of

co-produced and original podcasts, which will be delivered over the

second half of 2019 and through 2020.

The increased volume of premium content is being matched by our

industry leading sell through rates. Record quarterly revenue of

US$4.6 million was reported for the first quarter of 2019, which is

typically the quietest quarter in the year, and we expect for this

growth to continue through the rest of 2019. The sales teams in our

major territories have done an exceptional job of pre-booking

campaigns across the whole of 2019, which means that we have great

visibility on our year end revenues and our forecasting is now the

most accurate it has been in the Company's history.

In addition, Sonic Influencer Marketing, our new platform

enabling brands to secure advertising within any globally available

podcast which launched in July 2018, hit the ground running,

creating US$0.8 million in revenue in the second half of 2018.

Growth in the first quarter and advanced bookings for 2019 mean

that Sonic will significantly contribute to Audioboom's overall

revenues for 2019. Podcasting is now a significant growth sector in

digital media for brands and broadcasters looking to consolidate or

add podcast creation and content to their platforms and we are

involved in more content negotiations and commercial opportunities

than ever before. We are ideally positioned to benefit from this;

and the continued corporate activity within the sector demonstrates

Audioboom's potential to deliver significant shareholder value this

year.

Rob Proctor

Chief Executive Officer

30 May 2019

AUDIOBOOM GROUP PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE PERIODED 31 DECEMBER 2018

13 months 12 months

to 31 December to 30 November

2018 2017

Notes US$'000 US$'000

Continuing operations

Revenue 2 11,656 6,056

Cost of sales (8,505) (4,198)

----------------- -----------------

Gross profit 3,151 1,858

Administrative expenses (11,381) (8,266)

----------------- -----------------

-------------------------------------------- ------ ------------------ ------------------

Adjusted operating loss (5,089) (5,629)

- Costs of acquisition - (128)

- Amortisation of intangible assets (578) (442)

- Share based payments 8 (385) (155)

- Depreciation (77) (54)

- Corporate transaction costs 4 (1,708) -

- Restructuring costs (393) -

---------------- ----------------

-------------------------------------------- ------ ------------------ ------------------

Operating loss (8,230) (6,408)

Finance income - 1

Finance costs (130) -

---------------- ----------------

Loss before tax (8,360) (6,407)

Income tax credit 272 266

---------------- ----------------

Loss for the financial period attributable

to equity holders of the parent (8,088) (6,141)

---------------- ----------------

Other comprehensive loss

Foreign currency translation difference (450) (67)

---------------- ----------------

Total comprehensive loss for the period (8,538) (6,208)

======== ========

Loss per share

from continuing operations

Basic and diluted 5 (0.77) cents (0.73) cents

============ ============

All results for both periods are derived from continuing

operations.

AUDIOBOOM GROUP PLC

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2018

As at 31 December As at 30 November

2018 2017

Notes US$'000 US$'000 US$'000 US$'000

ASSETS

Non-current assets

Intangible assets 2,420 3,181

Property, plant and equipment 152 122

--------------- ---------------

2,572 3,303

Current assets

Trade and other receivables 4,169 3,312

Cash and cash equivalents 1,581 968

--------------- ---------------

5,750 4,280

------------------- -------------------

TOTAL ASSETS 8,322 7,583

------------------- -------------------

Current liabilities

Trade and other payables (4,087) (2,674)

Deferred taxation (203) (383)

------------------- -------------------

NET CURRENT ASSETS 1,460 1,223

------------------- -------------------

NET ASSETS 4,032 4,526

========= =========

EQUITY

Share capital 6 - -

Share premium 6 50,883 43,224

Issue cost reserve (2,048) (2,048)

Foreign exchange translation

reserve (530) (80)

Reverse acquisition reserve (3,380) (3,380)

Retained earnings (40,893) (33,190)

---------------- ----------------

TOTAL EQUITY 4,032 4,526

======== ========

AUDIOBOOM GROUP PLC

CONSOLIDATED CASH FLOW STATEMENT

FOR THE PERIODED 31 DECEMBER 2018

13 months 12 months

to 31 December to 30 November

2018 2017

US$'000 US$'000

Loss from continuing operations (8,088) (6,141)

---------------- ----------------

Loss for the period (8,088) (6,141)

Adjustments for:

Taxation credit (272) (266)

Amortisation of intangible assets 578 442

Effect of retranslation of intangible 183 -

assets

Depreciation of fixed assets 77 54

Effect of retranslation of fixed assets 25 14

Share based payments 385 155

Increase in trade and other receivables (856) (1,399)

Increase in trade and other payables 1,413 1,497

Foreign exchange loss (715) (2,416)

---------------- ----------------

Cash flows from operating activities (7,270) (8,060)

Taxation received 214 -

---------------- ----------------

Net cash used in operating activities (7,056) (8,060)

---------------- ----------------

Investing activities

Purchase of intangible assets - (575)

Purchase of property, plant and equipment (82) (123)

Cash on acquisition of subsidiary - 18

Interest receivable - 1

---------------- ----------------

Net cash used in investing activities (82) (679)

---------------- ----------------

Financing activities

Convertible loan interest and fees (130) -

Proceeds from convertible loan notes 1,995 -

Proceeds from issue of ordinary share

capital 5,794 8,456

---------------- ----------------

Net cash generated from financing activities 7,659 8,456

======== ========

Net increase/(decrease) in cash and

cash equivalents 521 (283)

---------------- ----------------

Cash and cash equivalents at beginning

of period 968 858

Effect of foreign exchange rate changes 92 393

---------------- ----------------

Cash and cash equivalents at end of

period 1,581 968

======== ========

AUDIOBOOM GROUP PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE PERIODED 31 DECEMBER 2018

Share Share Issue Reverse Foreign Retained Total

capital premium cost acquisition exchange earnings equity

reserve reserve translation

reserve

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

------------------- ------------------- ------------------- ------------------- ------------------- ------------------- -------------------

At 30 November

2016 - 34,768 (2,048) (3,380) (13) (27,204) 2,123

------------------- ------------------- ------------------- ------------------- ------------------- ------------------- -------------------

Loss for the

period - - - - - (6,141) (6,141)

Issue of shares - 8,456 - - - - 8,456

Equity-settled

share-based

payments - - - - - 155 155

Other

comprehensive

income - - - - (67) - (67)

------------------- ------------------- ------------------- ------------------- ------------------- ------------------- -------------------

At 30 November

2017 - 43,224 (2,048) (3,380) (80) (33,190) 4,526

------------------- ------------------- ------------------- ------------------- ------------------- ------------------- -------------------

Loss for the

period - - - - - (8,088) (8,088)

Issue of shares - 7,659 - - - - 7,659

Equity-settled

share-based

payments - - - - - 385 385

Other

comprehensive

income - - - - (450) - (450)

------------------- ------------------- ------------------- ------------------- ------------------- ------------------- -------------------

At 31 December

2018 - 50,883 (2,048) (3,380) (530) (40,893) 4,032

------------------- ------------------- ------------------- ------------------- ------------------- ------------------- -------------------

Share premium

Share premium represents the consideration paid for shares in

excess of par value, less directly attributable costs.

Issue cost reserve

The issue cost reserve arose from expenses incurred on share

issues.

Reverse acquisition reserve

The reverse acquisition reserve relates to the reverse

acquisition of Audioboom Limited by Audioboom Group plc on 20 May

2014.

Foreign exchange translation reserve

The foreign exchange translation reserve is used to record

exchange differences arising from the translation of the financial

statements of foreign operations.

AUDIOBOOM GROUP PLC

NOTES TO THE FINANCIAL STATEMENTS

FOR THE PERIODED 31 DECEMBER 2018

1. GENERAL INFORMATION AND BASIS OF PREPARATION

Audioboom Group plc is incorporated in Jersey under the

Companies (Jersey) Law 1991. The Company's shares are traded on

AIM, the market of that name, operated by the London Stock

Exchange.

The Group prepares its consolidated financial statements in

accordance with International Accounting Standards ('IAS') and

International Financial Reporting Standards ('IFRS') as adopted by

the EU. The financial statements have been prepared on the

historical cost basis, except for the revaluation of financial

instruments. The consolidated financial statements have been

prepared in accordance with and in compliance with the Companies

(Jersey) Law 1991 and were approved by the Board on 30 May

2019.

These results are audited, however the financial information set

out in this announcement does not constitute the Group's statutory

accounts for the period ended 31 December 2018, but is derived from

the 2018 Annual Report. The auditors have reported on those

accounts; their report was unqualified.

The preparation of financial statements in accordance with IFRS

requires the use of estimates and assumptions that affect the

reported amounts of assets and liabilities, and disclosure of

contingent assets and liabilities at the date of the financial

statement and the reported amounts of revenue and expenses during

the reporting period. Although these estimates are based on

management's best knowledge of current events and actions, actual

results may ultimately differ from those estimates.

The accounting policies used in completing this financial

information have been consistently applied in all periods

shown.

Going concern

The financial statements have been prepared on the going concern

basis, which assumes that the Group will have sufficient funds to

continue in operational existence for the foreseeable future.

Following the recently completed placing and subscription to raise

GBP2.8 million, the Board's forecasts for the Group, including due

consideration of the continued operating losses, projected increase

in revenues and decreasing cash-burn of the Group (and taking

account of reasonably possible changes in trading performance),

indicate that the Group will have sufficient cash available to

continue in operational existence for the next 12 months and

beyond. The Board believes that the Group is well placed to manage

its business risks, and longer term strategic objectives,

successfully. Therefore the Directors consider the going concern

basis appropriate.

2. REVENUE 13 months 12 months

to 31 December to 30 November

2018 2017

US$'000 US$'000

Subscription 199 99

Advertising 11,457 5,957

-------------- --------------

11,656 6,056

======= =======

The Directors consider the Group to operate within one operating

segment, content related revenue, and consequently expenditure and

balance sheet analysis is not presented between subscription and

advertising services.

Geographical information

The Group's operations are principally located in the UK and the

USA. The main assets of the Group, cash and cash equivalents, are

held in Jersey.

The Group's revenue from external customers by geographical

location is detailed below:

13 months 12 months

to 31 December to 30 November

2018 2017

US$'000 US$'000

United Kingdom 1,901 381

Rest of the World 42 200

USA 9,713 5,475

-------------- --------------

11,656 6,056

======= =======

The Group invoiced 44% of its income to two customers who

represented more than 10% of the reported revenues.

The Group currently has three geographic revenue regions,

however, as the Group's controlling operations are primarily based

in the UK, there is no separation of income, expenditure and

sections of the balance sheet for the purposes of segmental

reporting.

3. STAFF COSTS 13 months 12 months

to 31 December to 30 November

2018 2017

Number Number

Average number of production, editorial

and sales staff 36 38

Average number of management and administrative

staff 11 11

-------------- ---------------

47 49

======= =======

US$'000 US$'000

Wages and salaries 4,490 3,773

Social security costs 556 362

Pension costs (defined contribution scheme) 81 50

Share based payments 175 155

-------------- ---------------

5,302 4,340

======= =======

4. CORPORATE TRANSACTION COSTS

On 13 February 2018, the Group announced its intention to

acquire the entire issued share capital of Triton Digital Canada

Inc for a cash consideration of US$185 million. On 15 May 2018, the

Group announced that the proposed acquisition would not be

proceeding as it was not possible to complete the placing required

to raise the required funds. The Group did however incur US$1.7

million of costs in relation to corporate fees incurred during the

aborted acquisition process.

5. LOSS PER SHARE

Basic earnings per share is calculated by dividing the loss

attributable to shareholders by the weighted average number of

ordinary shares in issue during the period.

IAS 33 requires presentation of diluted EPS when a company could

be called upon to issue shares that would decrease earnings per

share, or increase the loss per share. For a loss-making company

with outstanding share options, the net loss per share would be

decreased by the exercise of options. Therefore, as per IAS33:36,

the anti-dilutive potential ordinary shares are disregarded in the

calculation of diluted EPS.

Reconciliation of the loss and weighted average number of shares

used in the calculation are set out below:

Weighted average Per

Loss number of share amount

shares

13 months ended

31 December 2018

US$'000 Thousand Cents

Basic and diluted EPS

Loss attributable to shareholders: (8,088) 1,047,439 (0.77)

- Continuing and discontinued ========= ========= =========

operations

12 months ended

30 November 2017

US$'000 Thousand Cents

Basic and diluted EPS

Loss attributable to shareholders:

- Continuing and discontinued

operations (6,141) 837,547 (0.73)

========= ========= =========

6. STATED CAPITAL ACCOUNT No. of Share Share

shares capital premium

US$'000 US$'000

At 30 November 2016 638,021,678 - 34,768

Shares issued in the year

Shares issued at 1.5p each 15,076,262 - 289

Shares issued at 2.5p each 180,000,000 - 5,396

Shares issued at 2p each 40,613,698 - 1,006

Shares issued at 2.5p each as

consideration for the acquisition

of SONR News Limited 56,938,216 - 1,765

---------------------- ------------------- ---------------------

At 30 November 2017 930,649,854 - 43,224

---------------------- ------------------- ---------------------

Shares issued in the period

Shares issued at 2p each 76,041,095 - 2,023

Shares issued at 3p each 166,600,000 - 5,636

-------------------- --------------------- -----------------------

At 31 December 2018 1,173,290,949 - 50,883

=========== =========== ===========

There is no authorised share capital and all shares rank pari

passu. All issued share capital is fully paid up. All ordinary

shares have nil par value.

7. RELATED PARTY TRANSACTIONS

Transactions between the Company and its subsidiaries, which are

related parties, have been eliminated on consolidation and are not

disclosed in this note.

In April and May 2018, the Group issued convertible loan notes

for up to GBP1.5 million to Candy Ventures sarl, an investment

vehicle owned 90% by Nick Candy, the Group's largest shareholder,

and a former non-executive Director. Steven Smith, a Director of

the Company, is a 10% shareholder of Candy Ventures sarl. The terms

of the loan note provided for interest at a rate of 10% per annum

and an aggregate arrangement fee of GBP75,000. Pursuant to the

terms of the loan note, the Company had covenanted to maintain

sufficient shareholder authority to satisfy conversion of the

notes. Candy Ventures sarl agreed to waive this covenant, in order

to allow the Company to utilise its then existing share authorities

for its June 2018 fundraise. The Group drew down the full balance

of the loan note before converting the loan (and accrued interest)

into shares, in accordance with its terms, at 2p per share, at the

time of the Group's GBP4.5 million fund raise which concluded in

June 2018. Candy Ventures sarl also subscribed for 33,333,333

shares at 3p per share in that fund raise.

Roger Maddock, a non-executive Director of the Company,

subscribed for 3,333,334 shares at 3p per share on 8 June 2018

pursuant to the placing and subscription.

In conjunction with his appointment, Michael Tobin, the

non-executive Chairman of the Company, was awarded 30,000,000

warrants over new ordinary shares of no par value in the Company. A

first tranche of 10,000,000 warrants will be exercisable at a price

of 2.4p per share after 3 March 2019 and for five years thereafter.

A second tranche of 10,000,000 warrants will vest if the Company's

share price exceeds 4.4p for 60 days within any rolling six-month

period. The second tranche warrants will be exercisable at a price

of 4.4p from six months after vesting and for five years from that

date. A third tranche of 10,000,000 warrants will vest if the

Company's share price exceeds 6.4p for 60 days within any rolling

six-month period. The third tranche warrants will be exercisable at

a price of 6.4p from six months after vesting and for five years

from that date. Post period end the share price hurdles and

exercise prices were amended (see note 9). The warrants can only

vest if Michael Tobin is Chairman at the relevant time, however,

once vested, they remain exercisable throughout the relevant

exercise window irrespective of whether he is Chairman at the time

of exercise. The warrants are not transferable.

Following the departure of the Company's former chief financial

officer on 27 July 2017, various financial and accounting services

were provided under contract by an individual provided by Candy

Capital Limited ('Candy Capital'). Candy Capital is 100 per cent.

owned by Nick Candy, who is also a 90 per cent. shareholder of

Candy Ventures sarl, which is a substantial shareholder in the

Company. The aggregate fees invoiced to the Company by Candy

Capital in the period was US$75k (2017: US$46k), excluding value

added tax. Steven Smith, a director of the Company, is also a

director and 10 per cent. shareholder of Candy Ventures sarl.

8. SHARE-BASED PAYMENTS

2018 2017

US$'000 US$'000

Share option charge 4 155

Warrant charge 381 -

-------------- --------------

385 155

======== ========

The Company has share option schemes for employees of the Group.

Details of the share options granted during the period are as

follows:

2018 2017

Weighted Weighted

Average Average

Number of Exercise Number of exercise

Share options Price (GBP) Share options Price (GBP)

Outstanding at beginning

of period 62,174,511 0.020 66,710,418 0.021

Granted during the period 7,500,000 0.024 7,983,971 0.022

Forfeited/lapsed during

the period (13,310,106) 0.032 (12,519,878) 0.030

Exercised during the period - - - -

-------------------- ---------------------

Outstanding at end of

period 56,364,405 0.019 62,174,511 0.020

============= =============

Exercisable at end of

period 39,969,967 0.027 40,688,002 0.017

============= =============

The options outstanding at 31 December 2018 had a weighted

average exercise price of 1.9 pence, and a weighted average

remaining contractual life of 6 years.

During the period, the Company issued warrants to subscribe for

ordinary shares to Michael Tobin, the non-executive Chairman of the

Company, details of which are disclosed in note 7.

In addition, in December 2017, the Company issued 4,500,000

warrants to subscribe for ordinary shares in the Company to one of

its largest US podcast partners. The warrants have an exercise

price of 3.125p and become exercisable in three equal tranches of

1,500,000 on each of 1 August 2018, 1 August 2019 and 1 August

2020, provided that the partner continues to engage with the

Company. The warrants have a final exercise date of 1 August

2022.

At the period end the Company had in issue outstanding share

warrants for a total of 70,571,500 shares with a weighted average

exercise price of 6.0 pence. 27,571,500 of the warrants were

exercisable at the period end, and the balance may become

exercisable subject to performance conditions.

9. POST BALANCE SHEET EVENTS

In February 2019, the Company announced a subscription to raise

GBP1.5 million to fund its rapidly increasing portfolio of

podcasting content. 115,384,670 shares were issued at a price of

1.3 pence per share with the proceeds predominantly being used to

meet the upfront payments required to secure new and existing

podcast content and their audiences. Michael Tobin and Roger

Maddock, non-executive Directors of the Company, each subscribed

for 3,846,160 shares representing an approximate amount of

GBP50,000 each. Candy Ventures sarl, an investment vehicle owned

90% by Nick Candy, the Group's largest shareholder, subscribed for

46,153,850 shares, representing an approximate amount of

GBP600,000.

In order to allow the subscription shares to be issued on a

timely basis and within the Company's existing share allotment

authorities and without the need to convene an extraordinary

general meeting of the Company, Michael Tobin agreed that the

exercise of his 30,000,000 warrants (split into three tranches of

10,000,000 warrants) over new ordinary shares awarded to him on 3

September 2018 (see note 7) be made conditional upon the Company

obtaining shareholder authorities to allot and issue the new shares

arising on exercise of the warrants free of pre-emption rights.

Such authority was granted at a general meeting held on 21 May

2019. In addition, in recognition that such warrants should be an

incentive, the Company agreed to (a) lower the exercise prices of

the warrants from 2.4p, 4.4p and 6.4p to 1.3p, 3.3p and 5.3p

respectively and (b) lower the share price hurdle for exercise of

the second and third tranche of the warrants from 4.4p and 6.4p to

3.3p and 5.3p respectively.

In addition, and in order to obtain a substantial participation

in the subscription, the Company agreed with Nick Candy to extend

the exercise period of 12,000,000 warrants over new ordinary shares

held by him, granted pursuant to an agreement dated 2 April 2016,

from 2 April 2019 to 31 March 2024. These warrants have an exercise

price of 2.5 pence per ordinary share.

In May 2019, the Company concluded a placing and subscription

raising a further GBP2.8 million to fund growth to accelerate the

acquisition of established podcast content and their audiences,

development of co-production content partnerships and Audioboom

Originals production, to deliver valuable original content. Candy

Ventures sarl subscribed for 42,000,000 new ordinary shares at

2.5p. Michael Tobin, Roger Maddock and the Preston Trust (being a

trust for the benefit of the family of Roger Maddock) subscribed

for 3,600,000, 2,000,000 and 4,000,000 new ordinary shares at 2.5p

respectively.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR CKKDPFBKDQPN

(END) Dow Jones Newswires

May 31, 2019 02:00 ET (06:00 GMT)

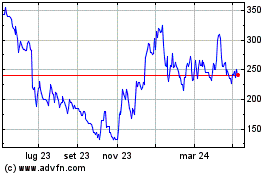

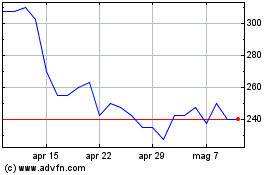

Grafico Azioni Audioboom (LSE:BOOM)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Audioboom (LSE:BOOM)

Storico

Da Apr 2023 a Apr 2024