TIDMVP.

RNS Number : 0040B

Vp PLC

04 June 2019

For immediate release 4 June 2019

Vp plc

('Vp', the 'Group' or the 'Company')

Preliminary Results (unaudited)

Vp plc, the equipment rental specialist, today announces its

Preliminary Results for the year ended 31 March 2019.

Highlights

* 15% increase in profit before tax, amortisation and

exceptional items to record level of GBP46.8 million

(2018: GBP40.6 million)

* 26% growth in revenues to GBP382.8 million (2018:

GBP303.6 million)

* Basic earnings per share, pre-amortisation, increased

12% to 95.1 pence (2018: 84.9 pence)

* Final dividend proposed of 22.0 pence per share,

making a total of 30.2 pence for the full year (2018:

26.0 pence), an increase of 16%

* EBITDA before exceptionals up 20% to GBP101.4 million

(2018: GBP84.3 million)

* Reduced net debt of GBP168.1 million (2018: GBP179.2

million) after funding:

o Capital investment in the rental fleet of GBP63.8 million

(2018: GBP64.9 million)

* Return on average capital employed 14.5% (2018:

14.8%)

* Profit before taxation of GBP33.6 million (2018:

GBP30.8 million) and statutory earnings per share of

65.2 pence (2018: 61.7 pence)

* Exceptional costs of GBP8.6 million (2018: GBP1.7

million) resulting from acquisition integration costs,

business restructuring and regulatory review costs

* The statutory accounts for the year ended 31 March

2019 will be finalised on the basis of the financial

information presented by the Directors in these

preliminary results.

Commenting on the Preliminary Results, Jeremy Pilkington,

Chairman of Vp plc, said:

"Today Vp is reporting another strong set of full year results,

with key financial metrics ahead of last year. In light of these

excellent figures, I am pleased to announce a final dividend

recommendation of 22.0 pence per share, making a total for the year

of 30.2 pence per share, an increase of 16% on last year.

"We have entered the new financial year in excellent shape and

we look forward to the challenges and opportunities of the future

with confidence and excitement."

Neil Stothard, Chief Executive of Vp plc, added: "Vp has started

the new financial year positively and in line with our

expectations. We anticipate that our main markets in the UK will

continue to be supportive, but with slightly slower overall growth

than experienced in recent years influenced by the current

political and economic uncertainty.

I am pleased to say that the international backdrop is also

broadly positive, with opportunities in Australasia with TR Group

and the wider oil and gas exploration and maintenance sectors

too.

"The year ended 31 March 2019 was one of significant development

for Vp, and we were particularly pleased with the quality of the

Brandon Hire integration.

"We were delighted to acquire Sandhurst Ltd just after the

financial year end and look forward to developing the business

further under our ownership."

- Ends -

Enquiries:

Vp plc

Jeremy Pilkington, Chairman Tel: +44 (0) 1423 533 400

jeremypilkington@vpplc.com

Neil Stothard, Chief Executive Tel: +44 (0) 1423 533 400

neil.stothard@vpplc.com

Allison Bainbridge, Group Finance Tel: +44 (0) 1423 533 400

Director

allison.bainbridge@vpplc.com www.vpplc.com

Media enquiries:

Buchanan

Henry Harrison-Topham / Jamie Hooper / Madeleine Tel: +44 (0) 20 7466

Seacombe 5000

Vp@buchanan.uk.com www.buchanan.uk.com

Notes on alternative performance measures:

-- All performance measures stated as before amortisation are

also before impairment of intangibles.

-- Basic earnings per share pre amortisation and exceptionals is

reconciled to basic earnings per share in note 3.

-- Profit before tax, amortisation and exceptionals is

reconciled to profit before tax in the Income Statement.

-- Return on average capital employed is based on profit before

tax, interest, amortisation and exceptionals divided by average

capital employed on a monthly basis using the management accounts.

Profit before tax, interest, amortisation and exceptionals is

reconciled to profit before interest and tax in the Income

Statement.

CHAIRMAN'S STATEMENT

I am delighted to be able to report another set of excellent

results for the Group.

Profits before tax, amortisation and exceptional items increased

15% to GBP46.8 million (2018: GBP40.6 million) on revenues ahead by

26% to GBP382.8 million (2018: GBP303.6 million). Profit before

taxation was GBP33.6 million (2018: GBP30.8 million). Net debt at

the year-end was GBP168.1 million (2018: GBP179.2 million) after

funding GBP63.8 million capital investment in the rental fleet

(2018: GBP64.9 million). Our characteristically strong cash flow of

GBP101.4 million (2018 GBP84.3 million) supports a healthy net debt

and EBITDA ratio of 1.7x. There were no acquisitions in the

period.

Return on average capital employed remained strong at 14.5%

(2018: 14.8%) and earnings per share increased 12% to 95.1 pence

per share (2018: 84.9 pence per share).

On the basis of what we consider to be an excellent set of

results, particularly given the current uncertain political and

economic environment, your Board is recommending a final dividend

of 22.0 pence per share, making a total for the year of 30.2 pence

per share, an increase of 16%. Subject to shareholders approval at

the Annual General Meeting to be held on 25 July 2019, it is

proposed to pay the final dividend on 8 August 2019 to members

registered at 28 June 2019.

Following the acquisition of Brandon Hire in November 2017, the

integration process has progressed well and will be largely

concluded by the end of this calendar year. The combined business

now trades as Brandon Hire Station. Integrating 1,500 people, 200

branches and 200,000 items of rental equipment has been a huge task

for both management teams and it is appropriate for me to single

them out for special praise for their exceptional work this year.

The combined business has traded in line with our expectations at

the time of the acquisition and we are confident that Brandon Hire

Station will deliver significant benefits for the Group and its

shareholders.

The shareholders will no doubt already be aware of the

announcement issued by the Competition and Markets Authority (CMA)

on 9 April 2019 that it had reached a provisional determination

that Vp, together with two other companies, had acted in a manner

deemed to be uncompetitive in the market for certain elements of

temporary groundworks. Vp is in the process of reviewing these

alleged breaches and we expect to be in a position to respond to

the CMA shortly. Following accounting standards, as explained in

note 2, we have made a theoretical provision for costs which is

included in the exceptional items. In the meantime, we will

continue to co-operate fully with their investigation.

Post the year end, on 10 May 2019, we announced the acquisition

of Sandhurst Limited for GBP3.325 million. Sandhurst is engaged in

the rental of specialist excavator attachments to the construction

and civil engineering sectors from five locations across the UK.

Going forward, Sandhurst will work alongside the Groundforce piling

division to offer an enhanced range of products and services.

The Group's primary business objective is to focus on leveraging

our specialist rental expertise to deliver enhanced value creation

for shareholders over the long term. We seek to be both provider

and employer of choice and we pursue market leadership through the

delivery of outstanding levels of customer service and

satisfaction. We are characterised by a change positive business

culture and a dedication to innovation. We strongly believe that

these business objectives remain as relevant and valid today as

when we first articulated them nearly twenty years ago.

It remains my great pleasure to thank all our employees for

their contribution to these excellent results. Our employees are

our unique and defining asset and lie behind whatever success we

may continue to enjoy.

We have entered the new financial year in excellent shape and we

look forward to the challenges and opportunities of the future with

confidence and excitement.

Jeremy Pilkington

Chairman

4 June 2019

BUSINESS REVIEW

OVERVIEW

Vp plc is a rental business providing specialist products and

services to a diverse range of end markets including

infrastructure, construction, housebuilding, and oil and gas. The

Group comprises a UK and an International Division.

Year ended Year ended

31 March 2019 31 March 2018

--------------------------------------

Revenue GBP382.8 million GBP303.6 million

----------------- -----------------

Operating profit before amortisation GBP51.6 million GBP44.0 million

and exceptionals

----------------- -----------------

Operating margin 13.5% 14.5%

----------------- -----------------

Investment in rental fleet GBP63.8 million GBP64.9 million

----------------- -----------------

Return on average capital employed 14.5% 14.8%

----------------- -----------------

Operating profit GBP38.3 million GBP34.2 million

----------------- -----------------

The financial year ended 31 March 2019 saw the business deliver

significant progress and growth with an increase of 17% in

operating profit before amortisation and exceptional items.

Group operating profits before amortisation and exceptional

items were GBP51.6 million which compares with prior year GBP44.0

million. Operating margins remained healthy at 13.5% and our key

measure of profit quality, return on average capital employed

(ROACE), continued to be robust at 14.5%, marginally down on prior

year. Revenues grew by 26% to 382.8 million (2018 GBP303.6

million).

The core end markets which we serve have once again provided a

resilient environment for the Group's trading operations, despite

the ongoing political and economic uncertainties in the UK, our

largest geographic market.

Strong cash generation is a positive characteristic of the Vp

business model and EBITDA before exceptionals remained strong,

increasing by 20% to GBP101.4 million (2018: GBP84.3 million). Net

debt at 31 March 2019 was reduced to GBP168.1 million (2018:

GBP179.2 million).

We continued to invest in our rental fleet with robust gross

capital expenditure of GBP63.8 million very close to last year's

peak capex of GBP64.9 million. Fleet disposal proceeds were

improved at GBP20.0 million (2018: GBP18.5 million), and generated

profit on disposal of GBP7.6 million (2018: GBP6.1 million). There

were no business acquisitions in the financial year.

After the end of the financial year, on 10 May 2019, we

announced the acquisition of the entire issued share capital of

Sandhurst Limited for a cash consideration of GBP3.325million.

Sandhurst is engaged in the rental of specialist excavator

attachments to the construction and civil engineering sectors from

five locations across the UK, and will complement our existing

piling business.

UK DIVISION

Year ended Year ended

31 March 2019 31 March 2018

=====================================

Revenue GBP350.3 million GBP272.0 million

================= =================

Operating profit before amortisation GBP49.9 million GBP43.0 million

and exceptionals

================= =================

Investment in rental fleet GBP57.4 million GBP59.7 million

================= =================

The UK division produced another strong trading performance in

the year reporting a 16% increase in operating profit before

amortisation and exceptionals to GBP49.9 million (2018: GBP43.0

million). Revenues were GBP350.3 million, 29% ahead of prior year

(2018: GBP272.0 million).

The UK division comprises seven main business groupings: UK

Forks, Groundforce, TPA, Brandon Hire Station, ESS Safeforce, MEP,

and Torrent Trackside; which have exposure to the infrastructure,

housebuilding, construction and industrial sectors, primarily

within the UK, but with a growing presence in mainland Europe.

Trading within the UK Forks division was mixed with solid

support from the housebuilding sector being balanced by a more

challenging environment in general construction. Activity in the

telecoms sector was subdued as the scheduled 5G roll out across the

UK remained delayed. Investment in fleet was strong, but slightly

down on prior year.

In Groundforce / TPA, solid demand from the infrastructure

sector, particularly in support of the water industry's Asset

Management Programme 6 (AMP 6) underpinned a strong performance in

the UK shoring business, with additional demand derived from

housing, utilities and highways during the year. Geographically the

South and North regions traded well but the Scottish region

experiencing softer demand. A number of important major projects

were supported including Battersea Power Station, Hinkley Point and

the Luton Airport Dart scheme. Elsewhere, the Groundforce Ireland

business also traded well, though the Piling division experienced

softer demand through the year.

The temporary roadways business TPA delivered a year of

improvement in the UK as efficiency and productivity gains improved

margins, further supported by good transmission and rail sector

demand in the UK. The TPA and Groundforce businesses in mainland

Europe made further progress after a soft start to the financial

year.

The year under review is the first full year of ownership of the

Brandon Hire business, acquired in November 2017. Progress in

integrating the Hire Station tools business with Brandon Hire under

a single management team has been very good. The combined, newly

named, specialist tool hire division, Brandon Hire Station will

operate a 200 branch network across the UK on a common IT platform.

The two year integration plan will be completed by the end of the

calendar year 2019, as originally envisaged. The exceptional costs

of integration are disclosed in note 2. Whilst the construction

markets within which Brandon Hire Station operates have been

relatively flat, synergies identified pre and post the acquisition

have already been delivered, and margins and returns have improved

considerably as a result. The longer term fleet refreshment

programme has proceeded well with strong capex combined with a

pro-active divestment programme of old and non-core hire fleet

items.

The MEP low level access and press fitting activity had another

good year and opened two new locations in support of further

regional expansion. ESS Safeforce, our safety, survey and

communications business delivered strong revenue growth in the

year, driven particularly by success in supporting petrochemical

shutdowns in both the UK and the Netherlands. We anticipate further

progress in these industrial sectors in the coming year. Fleet

investment was healthy and the division opened new locations and

expanded existing facilities in support of these initiatives.

The Torrent Trackside business traded well in what has been a

particularly volatile period for the UK rail infrastructure sector.

The demise of Carillion initially impacted activity levels in the

UK rail market with associated work streams paused or cancelled.

Eventually this work re-emerged through different channels and

Torrent Trackside provided significant support to the associated

contractors. The Control Period 5 (CP5) slowed in its final year

ahead of the new five year programme, CP6 which commences in 2020.

The business continued to reap success by maintaining a keen focus

on managing costs and improving service delivery to customers. The

CP6 programme comes with a GBP48 billion budget and Torrent

Trackside are well placed to support this over the next five

years.

INTERNATIONAL DIVISION

Year ended Year ended

31 March 2019 31 March 2018

=====================================

Revenue GBP32.5 million GBP31.6 million

================ ================

Operating profit before amortisation GBP1.7 million GBP1.0 million

and exceptionals

================ ================

Investment in rental fleet GBP6.4 million GBP5.1 million

================ ================

The International division delivered improved profit margins in

the year as operating profit before amortisation grew by 70% to

GBP1.7 million (2018: GBP1.0 million) from revenues up 3% to

GBP32.5 million (2018: GBP31.6 million).

The International division comprises two main business

groupings: Airpac Bukom a global supplier to the oil and gas sector

with regional hubs in the UK, Australia and Singapore and TR Group

which has operations in Australia, New Zealand, Malaysia and

Singapore.

Airpac Bukom supports a wide range of onshore and offshore oil

and gas markets: well test; pipeline testing; rig and maintenance;

and LNG markets worldwide. Whilst progress has been relatively

modest, Airpac Bukom did experience tentative signs of improvement

in the sector. The historically strong well test market has

remained weak in recent years due to reduced exploration and

production (E&P) spend by the oil majors. The business has been

active in growing alternative onshore markets which also utilise

Airpac Bukom's product and service expertise. The market recovery

is slow but we remain confident of delivering future improvement

going forward.

The TR Group which is Australasia's leading technical equipment

rental business provides test and measurement, communications,

calibration and audio visual solutions across the region. The year

was one of further progress, in particular, in Australia and

Malaysia. Overall the TR Group has a number of progressive new

product and service offers which are planned to deliver further

business momentum in the coming year and beyond.

OUTLOOK

The Group has started the new financial year positively and in

line with expectations. We believe that our main markets in the UK

will be largely supportive, but with a slower growth than

experienced in recent years. The International backdrop is also

broadly positive and we expect to deliver on fresh initiatives in

both Australasia for TR, and the wider oil and gas exploration and

maintenance sectors.

The year just finished was one of significant development for

the Group, and we are particularly pleased with the quality of the

Brandon Hire integration process.

We continue to assist the CMA investigation into the groundworks

rental market.

We were delighted to acquire Sandhurst Ltd just after the

financial year end and look forward to developing the business

further under our ownership. We will continue to pursue

opportunities to progressively expand the Vp business, as we have

always done. Whilst the UK in particular has some wider political

and economic uncertainties, we remain confident that we can deliver

further positive development for the Group over the next financial

year.

Neil Stothard

Chief Executive

4 June 2019

Consolidated Income Statement (unaudited)

for the year ended 31 March 2019

Note 2019 2018

Unaudited Audited

GBP000 GBP000

----------- ----------

Revenue 1 382,830 303,639

Cost of sales (295,539) (229,477)

Gross profit 87,291 74,162

Administrative expenses (48,968) (39,927)

----------- ----------

Operating profit before amortisation

and exceptional items 1 51,571 44,018

Amortisation and impairment 1 (4,632) (8,101)

Exceptional items 2 (8,616) (1,682)

----------- ----------

Operating profit 38,323 34,235

Net financial expense (4,742) (3,421)

Profit before taxation, amortisation

and exceptional items 46,829 40,597

Amortisation and impairment 1 (4,632) (8,101)

Exceptional items (8,616) (1,682)

----------- ----------

Profit before taxation 33,581 30,814

Taxation 5 (7,759) (6,448)

----------- ----------

Profit attributable to owners

of the parent 25,822 24,366

----------- ----------

Pence Pence

Basic earnings per share 3 65.20 61.72

Diluted earnings per share 3 63.66 60.95

Dividend per share paid and proposed 6 30.20 26.00

Consolidated Statement of Comprehensive Income (unaudited)

for the year ended 31 March 2019

2019 2018

Unaudited Audited

GBP000 GBP000

----------- ---------

Profit for the year 25,822 24,366

Other comprehensive income/(expense):

Items that will not be reclassified to

profit or loss

Re-measurements of defined benefit pension

schemes 536 275

Tax on items taken to other comprehensive

income (1) (50)

Impact of tax rate change - (65)

Items that may be subsequently reclassified

to profit

or loss

Foreign exchange translation difference (493) (900)

Effective portion of changes in fair value

of cash flow hedges (614) 444

Total other comprehensive income (572) (296)

Total comprehensive income for the year 25,250 24,070

----------- ---------

Consolidated Statement of Changes in Equity (unaudited)

for the year ended 31 March 2019

2019 2018

Unaudited Audited

GBP000 GBP000

------------------------------------------------------- -------------

Total comprehensive income for the year 25,250 24,070

Dividends paid (10,853) (8,983)

Net movement relating to shares held by Vp

Employee Trust (3,297) (822)

Share option charge in the year 2,395 2,446

Tax movements to equity 944 444

Impact of tax rate change - (25)

Change in Equity 14,439 17,130

Equity at start of year 154,446 137,316

--------- ---------

Equity at end of year 168,885 154,446

--------- ---------

Consolidated Balance Sheet (unaudited)

as at 31 March 2019

Note 2019 2018

Unaudited Audited

Restated*

GBP000 GBP000

----------- ----------

Non-current assets

Property, plant and equipment 248,651 239,739

Intangible assets 89,670 94,317

Employee benefits 2,732 2,230

----------- ----------

Total non-current assets 341,053 336,286

----------- ----------

Current assets

Inventories 7,809 8,620

Trade and other receivables 80,433 70,872

Cash and cash equivalents 4 29,044 18,194

----------- ----------

Total current assets 117,286 97,686

----------- ----------

Total assets 458,339 433,972

----------- ----------

Current liabilities

Interest bearing loans and borrowings 4 (17,659) (10,218)

Income tax payable (2,184) (2,365)

Trade and other payables (81,720) (70,455)

----------- ----------

Total current liabilities (101,563) (83,038)

Non-current liabilities

Interest bearing loans and borrowings 4 (179,485) (187,148)

Deferred tax liabilities (8,406) (9,340)

----------- ----------

Total non-current liabilities (187,891) (196,488)

----------- ----------

Total liabilities (289,454) (279,526)

----------- ----------

Net assets 168,885 154,446

----------- ----------

Equity

Issued share capital 2,008 2,008

Capital redemption reserve 301 301

Share premium account 16,192 16,192

Foreign currency translation

reserve (780) (287)

Hedging reserve (323) 291

Retained earnings 151,460 135,914

----------- ----------

Total equity attributable to equity holders

of the parent 168,858 154,419

Non-controlling interests 27 27

----------- ----------

Total equity 168,885 154,446

----------- ----------

*The restatement of the prior year consolidated balance sheet

reflects the fair value adjustments in regards to prior year

acquisitions as disclosed in Notes 9, 10 and 26 of the Annual

Report and Accounts for the year ended 31 March 2019.

Consolidated Statement of Cash Flows (unaudited)

for the year ended 31 March 2019

2019 2018

Unaudited Audited

Note GBP000 GBP000

---------------------------------------------------- ----- ---------- -----------

Cash flow from operating activities

Profit before taxation 33,581 30,814

Share based payment charge 2,395 2,446

Depreciation 1 49,768 40,319

Amortisation and impairment 1 4,632 8,101

Financial expense 4,830 3,496

Financial income (88) (75)

Profit on sale of property, plant and equipment (7,583) (6,095)

---------- -----------

Operating cash flow before changes in working

capital 87,535 79,006

Decrease / (increase) in inventories 853 (1,049)

Increase in trade and other receivables (9,518) (6,225)

Increase in trade and other payables 13,818 1,907

---------- -----------

Cash generated from operations 92,688 73,639

Interest paid (4,696) (3,190)

Interest element of finance lease rental

payments (221) (213)

Interest received 88 75

Income tax paid (7,948) (7,014)

---------- -----------

Net cash generated from operating activities 79,911 63,297

---------- -----------

Cash flow from investing activities

Disposal of property, plant and equipment 19,969 18,518

Purchase of property, plant and equipment (74,588) (71,571)

Acquisition of businesses and subsidiaries

(net of cash acquired) - (49,660)

---------- -----------

Net cash used in investing activities (54,619) (102,713))

---------- -----------

Cash flow from financing activities

Purchase of own shares by Employee Trust (3,297) (822)

Repayment of borrowings (44,000) (29,036)

Proceeds from new loans 37,000 79,000

New finance leases 108 348

Capital element of hire purchase/finance

lease agreements (1,551) (1,275)

Dividends paid (10,853) (8,983)

---------- -----------

Net cash (used in) /generated from financing

activities (22,593) 39,232

---------- -----------

Increase / (decrease) in cash and cash equivalents 2,699 (184)

Effect of exchange rate fluctuations on

cash held (70) (395)

Cash and cash equivalents at the beginning

of the year 9,503 10,082

----------

Cash and cash equivalents at the end of

the year 12,132 9,503

---------- -----------

NOTES

The preliminary results have been prepared on the basis of the

accounting policies which are set out in Vp plc's annual report and

accounts for the year ended 31 March 2019. With the exception of

the new standards below, the accounting policies applied are in

line with those applied in the annual financial statements for the

year ended 31 March 2018.

EU Law (IAS Regulation EC1606/2002) requires that the

consolidated accounts of the Group for the year ended 31 March 2019

be prepared in accordance with International Financial Reporting

Standards ("IFRSs") as adopted for use in the EU ('adopted

IFRSs').

Whilst the financial information included in this preliminary

announcement has been computed in accordance with adopted IFRSs,

this announcement does not itself contain sufficient information to

comply with IFRSs. The Company expects to publish full financial

statements in June 2019.

The financial information set out above does not constitute the

Company's statutory accounts for the year ended 31 March 2019 or

2018. Statutory accounts for 31 March 2018 have been delivered to

the registrar of companies, and those for 31 March 2019 will be

delivered in due course. The auditor has reported on those

accounts; the reports were (i) unqualified, (ii) did not include a

reference to any matters to which the auditor drew attention by way

of emphasis without qualifying the report and (iii) did not contain

a statement under section 498 (2) or (3) of the Companies Act 2006

in respect of the accounts for 31 March 2018. The statutory

accounts for the year ended 31 March 2019 will be finalised on the

basis of the financial information presented by the Directors in

these preliminary results and will be delivered to the registrar of

companies following the Annual General Meeting of Vp plc.

The Group has applied IFRS 9 Financial Instruments which

replaces IAS 39 related to the recognition, classification and

measurement of financial assets and financial liabilities,

derecognition of financial instruments, impairment of financial

assets and hedge accounting. The adoption of IFRS 9 from 1 April

2018 primarily resulted in changes in the Group's accounting policy

for impairment of financial assets. In accordance with the

transitional provisions of IFRS 9, comparative figures have not

been restated. In addition, the impact of IFRS 9 has not been

adjusted within opening reserves due to the revised policy having

an immaterial impact of GBP0.1 million as of 31 March 2018.

The Group has applied IFRS 15 Revenue from Contracts with

Customers as issued in May 2014. In accordance with the new

transition provisions of IFRS 15 the new rules have been adopted

retrospectively. There was GBPnil cumulative effect of initially

applying this Standard as an adjustment to the opening balance of

retained earnings. The adoption of IFRS 15 did not result in

significant changes to the Group's accounting policies and had no

impact to the amounts recognised in the consolidated financial

statements.

The financial statements were approved by the Board of Directors

on 4 June 2019.

1. Business Segments

Revenue Depreciation, Operating profit

amortisation before amortisation

and and exceptional items

impairment

2019 2018 2019 2018 2019 2018

Unaudited Audited Unaudited Audited Unaudited Audited

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------------- ---------- -------- ---------- -------- ------------- ----------

UK 350,308 271,989 48,282 37,966 49,838 43,001

International 32,522 31,650 6,118 10,454 1,733 1,017

--------------- ---------- -------- ---------- -------- ------------- ----------

Total 382,830 303,639 54,400 48,420 51,571 44,018

--------------- ---------- -------- ---------- -------- ------------- ----------

Operating profit before amortisation and exceptional items is

reconciled to profit before tax in the Income Statement. In

addition, all performance measures stated as before amortisation

are also before impairment of intangibles.

The amortisation and impairment charge of GBP4.6 million (2018:

GBP8.1 million) includes GBP0.7 million (2018: GBP5.3 million) in

relation to impairment of goodwill and intangibles.

Furthermore, return on average capital employed is based on

profit before tax, interest, amortisation and exceptionals divided

by average capital employed on a monthly basis.

2. Exceptional Items

During the year, the Group incurred GBP8,616,000 (2018:

GBP1,682,000) of exceptional costs in relation to regulatory review

costs; integration of the Brandon Hire Group Holdings Limited

acquisition; together with restructuring costs in relation to

severance payments and depot closure costs within Hire Station and

Airpac.

The Competition and Markets Authority (CMA) announced on 9 April

2019 that it is investigating three major suppliers of groundworks

products to the construction industry. The CMA has provisionally

found that the 3 businesses, including a part of the Group's

excavation support system business (Groundforce), were involved in

suspected anti-competitive behaviour. The CMA's findings are, at

this stage in its investigation provisional and do not necessarily

lead to a decision that the companies have breached competition

law. We continue to work on our response to the CMA's findings. At

this point in the process we cannot make an accurate estimate of

the likely cost that may subsequently arise in the event that the

CMA were to decide in the future that a breach of competition law

has taken place. However, accounting standard IAS 37 requires us to

provide an amount in these accounts and accordingly we have

included a figure of GBP4.5 million as an exceptional cost. This

figure is in the arithmetic midpoint of a range of possible outcome

(GBP0 to GBP9.0 million) that we have calculated based upon

previous cases and CMA published guidance and without any admission

of culpability.

In the prior year GBP1,682,000 in relation to the acquisition of

Brandon Hire Group Holdings Limited. These one off costs related to

the professional fees and legal costs associated with the

acquisition process and the Competition and Markets Authority (CMA)

review of the acquisition, together with restructuring costs in

relation to severance payments and depot closure costs. The CMA

review was subsequently concluded in March 2018 with the

acquisition being cleared by the CMA. These are analysed as

follows:

2019 2018

Unaudited Audited

GBP000 GBP000

Professional fees, legal costs and CMA

costs - 1,141

Regulatory review costs 4,500 -

Integration costs 3,004 -

Restructuring costs 1,112 541

Total 8,616 1,682

----------- ---------

3. Earnings Per Share

The calculation of basic earnings per share of 65.20 pence

(2018: 61.72 pence) is based on the profit attributable to equity

holders of the parent of GBP25,822,000 (2018: GBP24,366,000) and a

weighted average number of ordinary shares outstanding during the

year ended 31 March 2019 of 39,603,000 (2018: 39,476,000),

calculated as follows:

2019 2018

Unaudited Audited

Shares Shares

000s 000s

Issued ordinary shares 40,154 40,154

Effect of own shares held (551) (678)

----------- ---------

Weighted average number of ordinary shares 39,603 39,476

----------- ---------

Basic earnings per share before the amortisation of intangibles

was 95.14 pence (2018: 84.91 pence) and is based on an after tax

add back of GBP11,855,000 (2018: GBP9,154,000) in respect of the

amortisation of intangibles and exceptional items.

The calculation of diluted earnings per share of 63.66 pence

(2018: 60.95 pence) is based on profit attributable to equity

holders of the parent of GBP25,822,000 (2018: GBP24,366,000) and a

weighted average number of ordinary shares outstanding during the

year ended 31 March 2019 of 40,564,000 (2018: 39,976,000),

calculated as follows:

2019 2018

Unaudited Audited

Shares Shares

000s 000s

Weighted average number of ordinary shares 39,603 39,476

Effect of share options in issue 961 500

----------- ---------

Weighted average number of ordinary shares

(diluted) 40,564 39,976

----------- ---------

Diluted earnings per share before the amortisation of

intangibles and exceptional items was 92.88 pence (2018: 83.85

pence).

4. Analysis of Net Debt At At

31 March 1 April

2019 2018

Unaudited Audited

GBP000 GBP000

Cash and cash equivalents (29,044) (18,194)

Bank overdraft 16,912 8,691

----------- ---------

Cash and cash equivalents as per cash

flow statement (12,132) (9,503)

Current finance lease debt 747 1,527

Non current debt 179,485 187,148

----------- ---------

Net debt 168,100 179,172

----------- ---------

Year end gearing (calculated as net debt expressed as a

percentage of shareholders' funds) stands at 100% (2018: 116%).

As at 31 March 2019 the Group had GBP200 million (2018: GBP200

million) of committed revolving credit facilities. In addition to

the committed facilities, the Group net overdraft facility at the

year-end was GBP7.5 million (2018: GBP5 million).

5. Taxation

The charge for taxation for the year represents an effective tax

rate of 23.1% (2018: 20.9%). The rate of tax is expected to reduce

to 17% in the year ending 31 March 2021. The effective tax rate

excluding prior year adjustments and disallowable expenses is 20.6%

(2018: 19.4%).

6. Dividend

The Board has proposed a final dividend of 22.0 pence per share

to be paid on 8 August 2019 to shareholders on the register at 28

June 2019. This, together with the interim dividend of 8.20 pence

per share paid on 11 January 2019, makes a total dividend for the

year of 30.2 pence per share (2018: 26.00 pence per share). The

ex-dividend date will be 27 June 2019 and the last day to elect to

participate in the dividend reinvestment plan will be 12 July

2019.

7. Principal risks and uncertainties

The Board is responsible for determining the level and nature of

risks it is appropriate to take in delivering the Group's

objectives, and for creating the Group's risk management framework.

The Board recognises that good risk management aids effective

decision making and helps ensure that risks taken on by the Group

are adequately assessed and challenged.

The Group has an established risk management strategy in place

and regularly reviews divisional and department risk registers as

well as the summary risk registers used at board level. A risk

register is prepared as part of the due diligence carried out on

acquisitions and the methodology is subsequently embedded.

All risk registers have a documented action plan to mitigate

each risk identified. The progress made on the action plan is

considered as part of the risk review process. The summary

divisional and departmental risk registers and action plans were

reviewed at risk meetings held in May 2019. In all cases it is

considered that the risk registers are being used as working

documents which provides the required assurance that existing risks

are being managed appropriately. In addition, the risk registers

provide a process for recognising, scoring and thus appropriately

managing new risks.

The risk registers are reviewed at the start (to facilitate the

planning process) and at the end of each internal audit project. A

post audit risk rating is agreed with management. If new risks are

identified following an audit project they are added to the

relevant risk register. Heat maps illustrating post audit risk

ratings and new risks are provided to the board in each published

internal audit report.

To promote risk awareness amongst group and divisional

employees, risk registers have now been disseminated further down

levels of management.

Further information is provided below on our principal risks and

mitigating actions to address them.

Market risk

Risk description

An economic downturn (as a result of economic cycles, political

and Brexit related uncertainty) could result in worse than expected

performance of the business, due to lower activity levels or

prices.

Mitigation

Vp provides products and services to a diverse range of markets

with increasing geographic spread. The Group regularly monitors

economic conditions and our investment in fleet can be flexed with

market demand. We have reviewed potential Brexit related risks

including exchange rates, tariffs, human resources and legislation

and have concluded that other than market uncertainty the risks are

assessed as relatively low impact.

Competition

Risk description

The equipment rental market is already competitive, and could

become more so, potentially impacting market share, revenues and

margins.

Mitigation

Vp aims to provide a first class service to its customers and

maintains significant market presence in a range of specialist

niche sectors. The Group monitors market share, market conditions

and competitor performance and has the financial strength to

maximise opportunities.

Investment/product management

Risk description

In order to grow, it is essential the Group obtains first class

products at attractive prices and keeps them well maintained.

Mitigation

Vp has well established processes to manage its fleet from

investment decision to disposal. The Group's return on average

capital employed was a healthy 14.5% (2018: 14.8%) in 2018/19. The

quality of the Group's fleet disposal margins also demonstrate

robust asset management and appropriate depreciation policies.

People

Risk description

Retaining and attracting the best people is key to our aim of

exceeding customer expectations and enhancing shareholder

value.

Mitigation

Vp offers well structured reward and benefit packages, and

nurtures a positive working environment. We also try to ensure our

people fulfil their potential to the benefit of both the individual

and the Group, by providing appropriate career advancement and

training.

Safety

Risk description

The Group operates in industries where safety is a key

consideration for both the well-being of our employees and the

customers that hire our equipment. Failure in this area would

impact our results and reputation.

Mitigation

The Group has robust health and safety policies, and management

systems. Our induction and training programmes reinforce these

policies. We have compliance teams in each division.

We provide support to our customers exercising their

responsibility to their own workforces when using our

equipment.

Financial risks

Risk description

To develop the business Vp must have access to funding at a

reasonable cost. The Group is also exposed to interest rate and

foreign exchange fluctuations which may impact profitability and

has exposure to credit risk relating to customers who hire our

equipment.

Mitigation

The Group has a revolving credit facility of GBP200 million and

maintains strong relationships with all banking contacts. Our

treasury policy defines the level of risk that the Board deems

acceptable. Vp continues to benefit from a strong balance sheet,

with growing EBITDA, which allows us to invest into

opportunities.

Our treasury policy requires a significant proportion of debt to

be at fixed interest rates and we facilitate this through interest

rate swaps. We have agreements in place to buy or sell currencies

to hedge against foreign exchange movements. We have strong credit

control practices and use credit insurance where it is cost

effective. Average debtor days were 58 (2018: 59) days and bad

debts, as a percentage of revenue remained low at 0.5% (2018:

0.5%).

Contractual risks

Risk description

Ensuring that the Group commits to appropriate contractual terms

is essential; commitment to inappropriate terms may expose the

Group to financial and reputational damage.

Mitigation

The Group mainly engages in supply only contracts. The majority

of the Group's hire contracts are governed by the hire industry

standard terms and conditions. Vp has defined and robust procedures

for managing non-standard contractual obligations.

Legal and regulatory requirements

Risk description

Failure to comply with legal or regulatory obligations

culminating in financial penalty and/or reputational damage.

Mitigation

The Group mitigates this risk utilising:

-- Specialist Project Committees (e.g. GDPR) with ongoing

responsibility to review key compliance areas and investigate

breaches and non-conformance;

-- Assurance routines from Group Internal Audit and External Auditors;

-- Comprehensive training and awareness programmes rolled out to wider business (including GDPR, Modern Slavery, Competition Law, Bribery and Corruption) by representatives from Group Finance, HR, Internal Audit and IT;

-- Established whistleblowing policy circulated to all employees;

-- Use of legal advisers where required.

8. Forward Looking Statements

The Chairman's Statement and Business Review include statements

that are forward looking in nature. Forward looking statements

involve known and unknown risks, assumptions, uncertainties and

other factors which may cause the actual results, performance or

achievements of the Group to be materially different from any

future results, performance or achievements expressed or implied by

such forward looking statements. Except as required by the Listing

Rules and applicable law, the Company undertakes no obligation to

update, review or change any forward looking statements to reflect

events or developments occurring after the date of this report.

9. Annual Report and Accounts

The Annual Report and Accounts for the year ended 31 March 2019

will be posted to shareholders before the end of June 2019.

Directors' Responsibility Statement in Respect of the Annual

Financial Report (extracted from the Annual Financial Report)

We confirm that to the best of our knowledge:

-- The Group and Parent Company financial statements which have

been prepared in accordance with IFRSs as adopted by the European

Union, give a true and fair view of the assets, liabilities,

financial position and profit of the Group and Parent Company;

and

-- The Business Review and Financial Review, which form part of

the Directors' Report, include a fair review of the development and

performance of the business and the position of the Company and the

undertakings included in the consolidation taken as a whole,

together with the description of the principal risks and

uncertainties that they face.

10. Alternative Performance Measures

(i) All performance measures stated as before amortisation are

also before impairment of intangibles.

(ii) Basic earnings per share pre amortisation and exceptionals

is reconciled to basic earnings per share in note 3.

(iii) Profit before tax, amortisation and exceptionals is

reconciled to profit before tax in the Income Statement.

(iv) Return on average capital employed is based on profit

before tax, interest, amortisation and exceptionals divided by

average capital employed on a monthly basis using the management

accounts. Profit before tax, interest, amortisation and

exceptionals is reconciled to profit before interest and tax in the

Income Statement.

For and on behalf of the Board of Directors.

J F G Pilkington A M Bainbridge

Director Director

- Ends -

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR UGUWWQUPBGBW

(END) Dow Jones Newswires

June 04, 2019 02:00 ET (06:00 GMT)

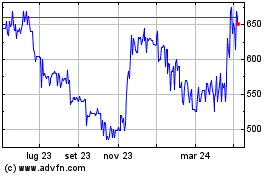

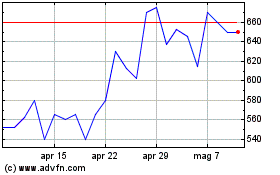

Grafico Azioni Vp (LSE:VP.)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Vp (LSE:VP.)

Storico

Da Apr 2023 a Apr 2024