TIDMBOOM

RNS Number : 3910C

Audioboom Group PLC

17 June 2019

This announcement contains inside information as stipulated

under the Market Abuse Regulations (EU) no. 596/2014 ("MAR").

17 June 2019

Audioboom Group plc

("Audioboom", the "Group" or the "Company")

Podcast content funding guarantee arrangement

Up to US$4m of payment guarantees for new and existing leading

podcasts

Issue of warrants at 3.3p per share

Related party transactions

Audioboom (AIM: BOOM), the leading global podcast company, has

agreed a new content funding facility with SPV Investments Ltd, a

special purpose vehicle ('SPV'), which has been established and is

owned equally by Michael Tobin, the Company's Chairman, and Candy

Ventures sarl, the Company's largest shareholder.

The SPV will provide minimum revenue guarantees to certain

leading new content partners of the Company. In addition, the SPV

will provide minimum revenue guarantees to certain leading existing

Audioboom content partners when these contracts are being renewed.

The SPV will provide guarantees of up to US$4 million in aggregate,

to secure the minimum guaranteed advertising revenue share payable

to the content partners pursuant to their commercial agreements

with Audioboom. The provision of guarantees remains very much an

exception when negotiating terms with content partners and the

guarantees from the SPV will be used only to secure leading, high

profile, high revenue producing podcasts.

The use of third-party guarantees will allow Audioboom to sign

and renew certain leading podcast talent without tying up working

capital. In return, Audioboom will pay the SPV 8% of the net

advertising revenue (after paying the content partner its share)

received by Audioboom from podcasts for which the guarantee has

been provided. In addition, the underlying providers of the

guarantees will be granted 2.5 million warrants to subscribe for

ordinary shares in the Company for every US$1 million of guarantee

provided, subject to a maximum of 10 million warrants. The exercise

price of these warrants will be 3.3p per share each, with such

warrants being exercisable for five years from grant.

Initial use of the facility

The first use of the SPV will be for a guarantee of US$1 million

in relation to the renewal of one of Audioboom's most popular

entertainment podcasts. Audioboom has renewed an exclusive sales

and distribution contract with this show for 18 months with the

opportunity to work with the content partner on further podcast

projects together. Since launching with Audioboom this podcast has

been downloaded more than 20 million times. In Q1 2019, Audioboom

sold 100% of its available advertising inventory against this

podcast and the Directors believe that the new deal will more than

double the inventory that the Group can sell on this content.

This first guarantee provided by the SPV leads to an initial

grant of an aggregate of 2.5 million warrants split equally between

Michael Tobin and Candy Ventures sarl.

Audioboom is currently in negotiations in respect of the

acquisition of further new top tier content and it is anticipated

that more renewals and new podcasts with established, leading

podcast talent will be secured using the guarantee facility and

announced in the future.

Rob Proctor, CEO of Audioboom, commented: "Notwithstanding the

considerable revenue growth that Audioboom is currently enjoying

and - most importantly - improved cash flow position, we are

delighted that this guarantee facility has been put in place,

reflecting a huge vote of confidence from our Chairman and our

largest shareholder, Candy Ventures.

I am delighted that the first use of the guarantee from the SPV

is for the renewal of one of our most popular podcasts. I

anticipate that the SPV's guarantees will further allow us to

acquire new top tier content, much of which is currently being

negotiated. I look forward to the Company making further

announcements when these deals have completed.

The warrants issued to the guarantors are currently

significantly 'out of the money', which further demonstrates our

Chairman and largest shareholder's faith in Audioboom's future.

This structure means minimal dilution to shareholders compared to

an equity raise at current share price levels, yet provides

Audioboom with US$4 million of firepower to access new content that

will appeal to our ever growing roster of advertisers.

PWC recently forecast that podcast advertising in the US alone

will reach US$1 billion in 2021. Given the continued investment in

the sector and consolidation of key players by multi-national media

companies, I am very excited about the future for Audioboom, and

its shareholders."

Related party transactions

The SPV is owned 50/50 by Tobin Ventures Limited (a company

controlled by Michael Tobin, Audioboom's Chairman) and Candy

Ventures sarl (a substantial shareholder in the Company which

currently holds 24.08% of the Company's voting rights, and of which

Steven Smith, a non-executive Director of Audioboom, is a director

and 10% shareholder). Consequently, the entry into the revenue

share agreement with the SPV and the granting of warrants as

contemplated by the revenue share agreement, constitute related

party transactions under rule 13 of the AIM Rules.

The independent Directors (being Roger Maddock, Rob Proctor and

Brad Clarke) consider, having consulted with the Company's

nominated adviser Allenby Capital, that the terms of the revenue

sharing agreement (including the granting of warrants as

contemplated by the revenue share agreement) are fair and

reasonable insofar as the Company's shareholders are concerned.

The FCA notifications in respect of the Warrants, made in

accordance with the requirements of the EU Market Abuse Regulation,

are appended below.

Enquiries

Audioboom Group plc

Rob Proctor, Chief Executive Officer Tel: +44(0)20 7403 6688

Allenby Capital Limited (Nominated adviser Tel: +44(0)20 3328 5656

and joint broker)

David Hart /Alex Brearley/Asha Chotai

Novum Securities (Joint broker) Tel: +44(0)20 7399 9400

Colin Rowbury/Jon Belliss

Walbrook PR Limited (PR & IR Advisers) Tel: +44(0)20 7933 8780

Paul Cornelius / Sam Allen or audioboom@walbrookpr.com

About Audioboom

Audioboom is the leading global podcast company, consolidating

the business of on-demand audio, making content accessible,

wide-reaching and profitable for podcasters, advertisers and

brands. Audioboom operates internationally, with operations and

global partnerships across North America, Europe, Asia and

Australia, and addresses the issue of disparate podcast services by

putting all of the pieces of the puzzle together under one

umbrella, creating a user-friendly, economical experience.

Audioboom hosts over 13,000 content channels, with key partners

including A+E Networks (US), Associated Press (US), 'Astonishing

Legends' (US), 'Casefile True Crime' (Aus), Edith Bowman (UK),

'Felon True Crime Podcast' (Aus), Jonathan Ross (UK), 'Moneycontrol

Podcast' (India), 'No Such Thing As A Fish' (UK), Red FM (India),

Starburns Audio (US), 'The Cycling Podcast' (UK), 'The Totally

Football Show' (UK), 'The True Geordie Podcast' (UK) and

'Undisclosed' (US).

Original content produced by Audioboom includes 'Formula 1(R):

Beyond the Grid' (UK), 'And That's Why We Drink' (US), 'Dead Man

Talking' (UK), 'Blank Check' (US), 'The 45th' (US), 'Covert' (US),

'Deliberations' (US), 'It's Happening with Snooki & Joey' (US),

'Mafia' (US) and 'Night Call' (US).

The platform receives over 90 million listens per month and

allows partners to share their content via Apple Podcasts,

BookMyShow, Deezer, Google Podcasts, iHeartRadio, RadioPublic,

Saavn, Spotify, Stitcher, Facebook and Twitter as well as their own

websites and mobile apps.

For more information, visit audioboom.com.

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them:

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Candy Ventures SARL

------------------ ----------------------------------------------------

2 Reason for the notification

------------------------------------------------------------------------

a) Position/status Candy Ventures SARL is a person closely associated

with Audioboom Group plc's Non-Executive

Director, Steven Smith who is a person discharging

managerial responsibilities

------------------ ----------------------------------------------------

b) Initial Initial notification

notification

/Amendment

------------------ ----------------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

------------------------------------------------------------------------

a) Name Audioboom Group plc

------------------ ----------------------------------------------------

b) LEI 213800QO681575J97813

------------------ ----------------------------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

------------------------------------------------------------------------

a) Description Warrants over ordinary shares of no par value

of the financial

instrument,

type of ISIN: JE00B5NFKB77

instrument

Identification

code

------------------ ----------------------------------------------------

b) Nature of Grant of Warrants

the transaction

------------------ ----------------------------------------------------

c) Price(s) Price(s) Volume(s)

and volume(s) Exercise price of

3.3p per share 1,250,000

----------

------------------ ----------------------------------------------------

d) Aggregated 1,250,000

information

- Aggregated Exercise price of 3.3p per share

volume

- Average

Price

------------------ ----------------------------------------------------

e) Date of 14 June 2019

the transaction

------------------ ----------------------------------------------------

f) Place of Outside of trading venue - grant of Warrants

the transaction

------------------ ----------------------------------------------------

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Michael Tobin

------------------ ----------------------------------------------

2 Reason for the notification

------------------------------------------------------------------

a) Position/status Non-Executive Chairman

------------------ ----------------------------------------------

b) Initial Initial notification

notification

/Amendment

------------------ ----------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

------------------------------------------------------------------

a) Name Audioboom Group plc

------------------ ----------------------------------------------

b) LEI 213800QO681575J97813

------------------ ----------------------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

------------------------------------------------------------------

a) Description Warrants over ordinary shares of no par value

of the financial

instrument,

type of ISIN: JE00B5NFKB77

instrument

Identification

code

------------------ ----------------------------------------------

b) Nature of Grant of Warrants

the transaction

------------------ ----------------------------------------------

c) Price(s) Price(s) Volume(s)

and volume(s) Exercise price of

3.3p per share 1,250,000

----------

------------------ ----------------------------------------------

d) Aggregated 1,250,000

information

- Aggregated Exercise price of 3.3p per share

volume

- Average

Price

------------------ ----------------------------------------------

e) Date of 14 June 2019

the transaction

------------------ ----------------------------------------------

f) Place of Outside of trading venue - grant of Warrants

the transaction

------------------ ----------------------------------------------

-ENDS-

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCLLFVLRDIELIA

(END) Dow Jones Newswires

June 17, 2019 02:00 ET (06:00 GMT)

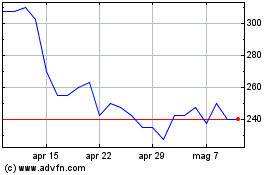

Grafico Azioni Audioboom (LSE:BOOM)

Storico

Da Mar 2024 a Apr 2024

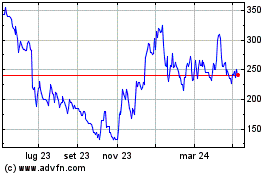

Grafico Azioni Audioboom (LSE:BOOM)

Storico

Da Apr 2023 a Apr 2024