TIDMSVE

RNS Number : 5146C

Starvest PLC

17 June 2019

17 June 2019

Half-year report - six months ended 31 March 2019

Chairman's statement

The latter half of 2018 saw a marginal recovery in the mining

and resources sector but a decline in commodity prices adversely

affected share prices through Q1 2019. Despite this environment we

saw a 39% increase in our Net Asset Value (NAV) from GBP1.65m at 30

September 2018 to GBP2.30m as at 31 March 2019. From March 2019,

the company implemented a more transparent and objective valuation

method for portfolio stocks, making use of market prices without an

applied discount, and approximately 13 percentage points of the 39%

increase in NAV is attributable to this change.

We saw an increase in Net Asset Value Per Share over the six

months to 31 March 2019 from 3.33p per share to 4.15p per share.

Over the same period the daily closing share price remained at a

discount to NAV of approximately 35%.

The Company earned an operating profit of GBP640,414 during the

reporting period mainly attributable to significant increases in

selected portfolio stocks such as Greatland Gold plc (LON:GGP).

This operating profit resulted in earnings per share of 1.02p on a

fully diluted basis for the six-month period.

The Company continues its historical policy of investing in

companies with early-stage mining resource projects, but we also

have a mandate to invest directly in projects. Several projects are

under review focused on precious and base metals. We are also

evaluating other commodities such as lithium, cobalt and rare earth

elements which are forecast to increase in use and demand over the

medium to long term.

Several of our investee companies remain extremely active and

have provided very positive news flow over the reporting

period.

Greatland Gold (LON:GGP) continued exploration on its Paterson

area licences with drilling at Havieron producing exciting results

including 118m at 3.08g/t gold and 0.84% copper from 459m and 157m

at 6.04g/t gold and 0.44% copper from 660m. Peak grades of 211.3g/t

gold, 12.38% copper and 4,104ppm cobalt were established at

Havieron. The Company has subsequently signed a US$65m farm-in deal

with Newcrest with a minimum commitment of US$5m over an initial

12-month period with the potential for Newcrest to earn up to a 70%

interest through total expenditure of US$65m over a six-year

period. Newcrest may acquire an additional 5% interest at the end

of the farm-in period at fair market value for cash. Greatland is

well-funded to pursue its exploration work on the remaining parts

of the Havieron licence and two other Paterson licences, as well as

its five other project areas in Australia, with the potential to

add other exciting mineral exploration discoveries.

Cora Gold (LON:CORA) has continued exploration activities on its

flagship Sanankoro project, extending identified zones of gold

mineralisation within a 14km long structural corridor yet to be

fully tested. Independent consultants have calculated an initial

exploration target of between 30-50mt of ore at an average grade of

1.0-1.3g/t for 1.0-2.0moz gold. To date mineralisation has been

delineated to a depth of 100m, most of which is hosted within

weathered material which ranges in depth from around 50m to in

excess of 100m across the exploration target area. The relatively

soft oxidised rock would potentially allow for a low-cost open pit

operation.

Kefi Minerals (LON:KEFI) has taken significant steps toward mine

construction with the Ethiopian government giving approval for the

resettlement plan. The company has received all relevant consents

from federal agencies, including an endorsement by the Prime

Minster of the finance structure, with only minor aspects of the

plan yet to be finalised. The principal project contractors have

confirmed a 24-month development schedule set to commence in Q4

2019 while off-site project work such as power and roads

construction have already commenced.

Ariana Resources (LON:AAU) continues to report good production

results from its Kiziltepe Mine with 7,296oz extracted in Q1 2019,

exceeding annualised quarterly guidance by 17%. The company also

continues with exploration at its Kizilcukur, Tavsan and Salinbas

projects.

Other investee companies push ahead such as Oracle Power

(LOM:ORCP), which named a new CEO and has progressed its proposed

coal mine and power plant by securing the required capital to

proceed with development. Salt Lake Potash (LON:SO4) continues with

exploration at its Western Australia projects and is progressing

with test scale processing at one of its sites. Similarly, Sunrise

Resources (LON:SRES) has continued to test its pozzolan resource in

the USA with encouraging results.

Whilst the commodities market remains flat the board of Starvest

believes the Company is well positioned when the sector enters its

next upcycle. We continue to expect robust demand for energy and

metals over the medium and long term and look forward to providing

further updates to investors and the market.

Callum N Baxter

Chairman & Chief Executive

17 June 2019

Income Statement

6 months 6 months Year ended

to 31 March to 31 March 30 September

2019 2018 2018

Unaudited Unaudited Audited

GBP GBP GBP

Revenue 27,165 - -

Cost of sales (16,257) - -

------------- --------------- ---------------

Gross profit 10,908 - -

Administrative expenses (127,149) (128,922) (250,147)

Amounts written off against

trade investments (133,086) (415,421) (686,932)

Amounts written back against

trade investments 889,741 28,725 615,008

Operating profit / (loss) 640,414 (515,618) (322,071)

Interest receivable 37 2,945 5,829

------------- --------------- ---------------

Profit / (loss) on ordinary

activities before tax 640,451 (512,673) (316,242)

Tax on profit on ordinary activities - - -

------------- --------------- ---------------

Profit / (loss) / profit attributable

to Equity holders of the Company 640,451 (512,673) (316,242)

============= =============== ===============

Earnings/(loss) per share -

see note 3 1.18 pence (0.97) pence (0.60) pence

Basic 1.02 pence (0.83) pence (0.51) pence

Diluted

Statement of Financial Position

6 months 6 months Year ended

ended 31 ended 31 30 September

March 2019 March 2018 2018

Unaudited Unaudited Audited

GBP GBP GBP

Current assets

Trade and other receivables 16,331 18,552 55,992

Trade investments 2,258,694 1,183,287 1,498,059

Cash and cash equivalents 36,429 270,995 153,849

------------ ------------ --------------

Total current assets 2,311,454 1,472,834 1,707,900

------------ ------------ --------------

Current liabilities

Trade and other payables (44,504) (104,766) (119,401)

------------ ------------ --------------

Total current liabilities (44,504) (104,766) (119,401)

------------ ------------ --------------

Net current assets 2,266,950 1,368,068 1,588,499

============ ============ ==============

Capital and reserves

Called up share capital 552,927 528,982 539,649

Share premium account 1,681,431 1,640,876 1,654,209

Profit and loss account 32,592 (804,290) (607,859)

Equity reserve - 2,500 2,500

------------ ------------ --------------

Total equity shareholders'

funds 2,266,950 1,368,068 1,588,499

============ ============ ==============

Statement of Cash Flows

6 months 6 months Year ended

ended 31 ended 31 30 September

March 2019 March 2018 2018

Unaudited Unaudited Audited

GBP GBP GBP

Cash flows from operating activities

Operating profit/(loss) 640,414 (515,619) (322,071)

Net interest receivable 37 2,945 5,829

Share based payment charge 40,500 - 24,000

Decrease in trade and other

receivables 39,660 11,037 (26,403)

(Decrease)/increase in trade

and other payables (77,396) 3,154 17,788

------------ ------------ --------------

Net cash flows from operating

activities 643,215 (498,483) (300,857)

------------ ------------ --------------

Cash flows from investing activities

Purchase of current asset investments - (50,000) (50,000)

Loan converted to shares (20,000) - -

Sale of current asset investments 26,928 - -

Profit on sale of current asset (10,908) - -

investments

Increase in investment provisions 133,086 415,421 686,932

Decrease in investment provisions (889,741) (28,725) (615,008)

------------ ------------ --------------

Net cash flows from investing

activities (760,635) 336,696 21,924

------------ ------------ --------------

Net (decrease)/increase in cash

and cash equivalents (117,420) (161,787) (278,933)

Cash and cash equivalents at

beginning of period 153,849 432,782 432,782

------------ ------------ --------------

Cash and cash equivalents at

end of period 36,429 270,995 153,849

============ ============ ==============

Statement of Changes in Equity

Equity reserve Total Equity

attributable to

Share capital Share premium Profit and loss account shareholders

GBP GBP GBP GBP GBP

As at 30 September 2017 528,982 1,640,876 2,500 (291,617) 1,880,741

============= ============= ============== ======================= ======================

(Loss) for the period - - - (512,673) (512,673)

------------- ------------- -------------- ----------------------- ----------------------

Total recognised income

and expenses for the

period - - - (512,673) (512,673)

Shares issued - - - - -

Total contribution by

and distributions to -

owners - - - -

As at 31 March 2018 528,982 1,640,876 2,500 (804,290) 1,368,068

============= ============= ============== ======================= ======================

As at 30 September 2018 539,649 1,654,209 2,500 (607,859) 1,588,499

============= ============= ============== ======================= ======================

Profit for the period - - - 640,451 640,451

Total recognised income

and expenses for the

period - - - 640,451 640,451

Shares issued 13,278 27,222 - - 40,500

Equity component of

convertible loan - - (2,500) - (2,500)

------------- ------------- -------------- ----------------------- ----------------------

Total contributions by

and distributions to

owners 13,278 27,222 (2,500) - 38,000

As at 31 March 2019 552,927 1,681,431 - 32,592 2,266,950

============= ============= ============== ======================= ======================

Interim report notes

1. Interim report

The information relating to the six-month periods to 31 March

2019 and 31 March 2018 is unaudited.

The information relating to the year ended 30 September 2018 is

extracted from the audited accounts of the Company which have been

filed at Companies House and on which the auditors issued an

unqualified audit report.

2. Basis of preparation

This report has been prepared in accordance with applicable

United Kingdom accounting standards, including Financial Reporting

Standard 102 - 'The Financial Reporting Standard applicable in the

United Kingdom and Republic of Ireland' ('FRS102'), and with the

Companies Act 2006. Although the information included herein does

not constitute statutory accounts within the meaning of section 435

of the Companies Act 2006, the accounting policies that have been

applied are consistent with those adopted for the statutory

accounts for the year ended 30 September 2018.

The Company will report again for the full year to 30 September

2019.

The Company's investments at 31 March 2019 are stated at the

lower of cost and net realisable value or the valuation adopted at

30 September 2018 or the current market value based on market

quoted prices at the close of business. The Chairman's statement

includes a valuation based on market quoted prices at 31 March

2019.

3. Earnings per share

6 months 6 months Year ended

ended 31 ended 31 30 September

March 2019 March 2018 2018

Unaudited Unaudited Audited

GBP GBP GBP

Profit/(loss) for the period: 640,451 (512,673) (316,242)

------------- --------------- ---------------

Weighted average number of

Ordinary shares of GBP0.01

in issue 54,460,957 52,898,163 53,012,136

Earnings/(loss) per share 1.18 pence (0.97) pence (0.60) pence

- basic

------------- --------------- ---------------

Warrants in issue 8,500,000 8,500,000 8,500.000

Weighted average number of

Diluted Ordinary shares of

GBP0.01 in issue 62,960,957 61,398,163 61,512,136

Earnings/(loss) per share 1.02 pence (0.83) pence (0.51) pence

- diluted

------------- --------------- ---------------

Investment portfolio

Starvest now holds trade investments in the companies listed

below, which in aggregate comprise 95% of the portfolio value as at

31 March 2019:

Exploration for oil in England,

* Alba Mineral Resources plc lead-zinc in Ireland, uranium in

Mauritania and graphite in Greenland

www.albamineralresources.com

Gold-silver production and exploration

* Ariana Resources plc in Turkey

www.arianaresources.com

Gold exploration in West Africa

* Cora Gold Limited www.coragold.com

Gold exploration in Australia

* Greatland Gold plc www.greatlandgold.com

Gold and copper exploration in Ethiopia

* Kefi Minerals plc and Saudi Arabia

www.kefi-minerals.com

Coal mining in Pakistan

* Oracle Coalfields plc www.oraclecoalfields.com

Other direct and indirect mineral exploration companies:

Oil and gas exploration in Bulgaria

* Block Energy plc (formerly Goldcrest Resources plc) www.goldcrestresourcesplc.com

Investment banking and corporate

* Marechale Capital plc finance www.marechalecapital.com

Gold exploration in South America

* Minera IRL Limited www.minera-irl.com

Potash in Australia

* Salt Lake Potash Limited www.saltlaketpotash.com.au

Exploration for industrial minerals

* Sunrise Resources plc in United States, Finland, Australia

and Ireland

www.sunriseresourcesplc.com

Other investee companies are listed in the Company's 2018 annual

report available on request or from the Company web site -

www.starvest.co.uk

Copies of this interim report are available free of charge by

application in writing to the Company Secretary at the Company's

registered office, Salisbury House, London Wall, London EC2M 5PS,

by email to info@starvest.co.uk or from the Company's website -

www.starvest.co.uk

Enquiries to:

Starvest PLC

Callum Baxter or Gemma Cryan 02077 696 876

info@starvest.co.uk

Grant Thornton UK LLP (Nomad)

Colin Aaronson, Harrison Clarke or Seamus Fricker 02073 835

100

SI Capital Ltd (Broker)

Nick Emerson or Alan Gunn 01483 413 500

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR UBOSRKRANAAR

(END) Dow Jones Newswires

June 17, 2019 10:35 ET (14:35 GMT)

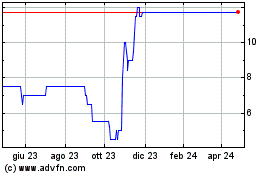

Grafico Azioni Starvest (LSE:SVE)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Starvest (LSE:SVE)

Storico

Da Apr 2023 a Apr 2024