TIDMLPA

RNS Number : 8232C

LPA Group PLC

20 June 2019

LPA GROUP PLC

Interim unaudited results for the six months ended 31 March

2019

LPA Group Plc ("LPA" or the "Group"), the high reliability LED

lighting and electro-mechanical system manufacturer and

distributor, announces its results for the six months to 31 March

2019 and a growing order book.

KEY POINTS

-- Revenue GBP10.1m (2018: GBP13.9m)

-- Operating profit before exceptional items(1) GBP0.2m, (2018: GBP1.1m)

-- Loss before tax, after exceptional item, GBP0.2m (2018: Profit GBP1.0m)

-- Loss per share 1.20p (2018: Diluted Earnings 6.51p)

-- Interim dividend 1.10p (2018: 1.10p)

-- Strong order entry GBP15.4m (2018: GBP8.4m)

-- Growing order book GBP19m (2018: GBP16m)

-- Gearing 22%, (2018: 31%)

Notes:

(1) Exceptional costs GBP0.4m - relating to Guaranteed Minimum

Pension equalisation (2018: GBP0.1m restructuring)

Peter Pollock, Chairman, commented:

In the Trading Statement dated 23 May 2019, I reported that

while the delay in delivery of some contracts was disappointing,

order entry remained very strong, the outlook in the medium term is

improving and the Group was well placed to meet both the challenges

and to take advantage of the opportunities available. The outlook

has remained unchanged, and the Board is able to look to the future

with sufficient confidence to maintain the Interim Dividend at the

rate of 1.10p per share.

PETER POLLOCK

Chairman

19 June 2019

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

Enquires: www.lpa-group.com Tel:

------------------------------------- --------------------- ---------------

LPA Group Plc

Peter Pollock Chairman 01799 512844

Paul Curtis COO 01799 512858

Chris Buckenham CFO 01799 512859

020 7213

Cairn Financial Advisers (Nominated Adviser) 0880

James Caithie / Tony Rawlinson

020 7220

finnCap (Broker) 0500

Ed Frisby / Teddy Whiley (Corporate

Finance)

Tim Redfern / Malar Velaigam

(ECM & Sales)

020 7457

Instinctif Partners (PR Adviser) 2020

Rosie Driscoll / Christine Galloway

/ Mark Garraway

CHAIRMAN'S STATEMENT

In my comments to the Annual General Meeting on 21 March 2019

and the subsequent Trading Statement on 23 May 2019, I referred to

the quiet start to the year and the further delays to major UK

projects, including CrossRail, which had persisted longer than

anticipated and which would affect not only the first half but also

the year as a whole.

As expected, output in the first half fell short of the

exceptionally strong performance last year with sales amounting to

GBP10.1m (2018: GBP13.9m) and Operating Profit before exceptional

items of GBP0.2m (2018: GBP1.1m).

The exceptional item recognised, in line with the High Court

ruling in October 2018, requiring all UK companies to remove

inequalities between men and women in scheme benefits that arose

under Guaranteed Minimum Pensions (GMP), amounted to GBP0.4m. Thus,

the surplus on the Group's defined benefit pension scheme, which

was GBP2.4m at 30 September 2018, is reduced by GBP0.4m. This is a

historical cost which as advised previously has been recognised in

the current financial year.

This exceptional charge results in a loss before tax of GBP0.2m

(2018: Profit GBP1.0m) and a loss per share of 1.20p (2018 earnings

per share 6.51p) to be recorded. Despite this loss, the Interim

Dividend will be maintained at 1.10p, reflecting the board's

confidence in the future. This confidence is underpinned by the

significant increase in order entry in the period of GBP15.4m

(2018: GBP8.4m) and the large orders subsequently won during April

and May, announced in last month's Trading Update, a strong

pipeline and funnel of potential future business.

Both Electro-mechanical and Lighting Systems suffered from the

well flagged contract delays during the first half and while

Electro-mechanical is expected to recover in the second half,

Lighting Systems is likely to suffer further contract delays,

before recovering next year as contracts already won come on

stream. Engineered Component Distribution had a strong first half

trading, and is well placed for this year and beyond. Despite the

delivery delays, our order intake at GBP15.4m represents an 83%

increase (2018: GBP8.4m), with an increased order book at GBP19m

(2018: GBP16m).

We are working our way through the impact of the change in DfT

rolling stock procurement, which has negatively affected the supply

chain, with significant restructuring among major rolling stock

maintenance and refurbishment companies. The Group is fortunate not

to be entirely reliant on the UK Rail Industry, but has a

significant export business as well as Aerospace, Aircraft Ground

Support and Industrial market exposure.

We are actively investing in new product lines to increase our

presence in these markets; our increased R&D spend is

reflective of this. We are also extremely cost conscious, having

already reduced manning levels by 18% compared with last year,

largely through ending temporary contracts. We are maintaining our

investment in plant & equipment and management methods to

improve productivity.

In April 2019 the Group refreshed its long-term financing, which

now comprises a mortgage facility, increased by GBP0.5m to GBP2.6m,

remaining secured on the Group's freehold properties, over a

fifteen-year repayment period, with a refinance due by March 2024.

The Group will adopt IFRS 16 (Accounting for Leases) with effect

from 1 October 2019, but the board, having reviewed its impact does

not consider the overall impact to be material.

The Group embraces the digital era and with its green

credentials seeks to reduce waste. Over the next eighteen months we

are planning to move shareholder communication from paper reports

to digital reports available for download from our website. Indeed,

all our communications are already available digitally from our

website. finnCap have been appointed stockbrokers to the Group with

effect from 3 June 2019.

I am pleased to report that the rejuvenated board is working

well together in challenging circumstances. We expect to appoint a

further non-executive director during the next year and that Paul

Curtis will be promoted to Chief Executive Officer in due course.

The Chairman of LPA Pensions Trustees has retired, an executive

role which I shall discharge until I retire in September 2021. We

have adopted the QCA Corporate Governance Code and a road map to

full compliance; this is set out in our Annual Report and on our

website.

The interim dividend will be paid on 27 September 2019 to those

shareholders registered at the close of business on 6 September

2019; the ex-dividend date being 5 September 2019. Despite the

softer performance in the first half, the Group is in fine fettle

and the board looks forward to the future with confidence.

Peter Pollock - Chairman - 19 June 2019

CONSOLIDATED INCOME STATEMENT

6 months 6 months

to to Year to

30 Sept

31 Mar 19 31 Mar 18 18

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Revenue 10,091 13,929 27,979

--------------------------- -------------------------- ----------------------------

Operating profit before

exceptional

items 174 1,122 2,244

Pension; reorganisation and

other nonrecurring costs (364) (111) (175)

Operating (loss) / profit (190) 1,012 2,069

Finance costs (43) (43) (80)

Finance income 34 18 35

(Loss) / Profit before tax (199) 987 2,024

Taxation 50 (127) (253)

(Loss) / Profit for the

period (149) 860 1,771

=========================== ========================== ============================

Attributable to:

- Equity holders of the

parent (149) 860 1,771

=========================== ========================== ============================

(Loss)/Earnings per share (see

note 3)

- Basic -1.20p 6.95p 14.34p

- Diluted -1.20p 6.51p 13.44p

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

6 months 6 months

to to Year to

30 Sept

31 Mar 19 31 Mar 18 18

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

(Loss) / Profit for the period (149) 860 1,771

--------------------------- -------------------------- ----------------------------

Other comprehensive income /

(expense)

Actuarial (loss) / gain on

pension

scheme (516) (396) 962

Tax on actuarial (loss) / gain 94 65 (178)

Other comprehensive (expense)

/ income net of tax (422) (331) 784

--------------------------- -------------------------- ----------------------------

Total comprehensive income for

the period (571) 529 2,555

=========================== ========================== ============================

Attributable to:

- Equity holders of the

parent (571) 529 2,555

=========================== ========================== ============================

CONSOLIDATED BALANCE As at As at As at

SHEET

31 Mar 19 31 Mar 30 Sept

18 18

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Non-current assets

Intangible assets 1,248 1,187 1,200

Property, plant and

equipment 7,267 6,842 7,216

Retirement benefits 1,613 983 2,409

10,128 9,012 10,825

---------------------------- --------------------------- -----------------------------

Current assets

Inventories 3,746 4,820 3,881

Trade and other

receivables 4,800 6,041 5,540

Cash and cash equivalents 304 44 956

---------------------------- --------------------------- -----------------------------

8,850 10,904 10,377

---------------------------- --------------------------- -----------------------------

Total assets 18,978 19,918 21,202

Current liabilities

Bank overdraft - (817) -

Bank loans and other

borrowings (355) (251) (322)

Current tax payable (283) (188) (266)

Trade and other payables (3,602) (4,947) (4,868)

(4,240) (6,203) (5,456)

---------------------------- --------------------------- -----------------------------

Non-current liabilities

Bank loans and other

borrowings (2,576) (2,420) (2,605)

Deferred tax liabilities (212) (159) (430)

Other payables - (90) -

(2,788) (2,669) (3,035)

---------------------------- --------------------------- -----------------------------

Total liabilities -7,028 -8,872 -8,491

Net assets 11,950 11,046 12,711

============================ =========================== =============================

Equity

Share capital 1,261 1,238 1,238

Investment in own shares (324) - (214)

Share premium account 688 628 628

Un-issued shares reserve 123 134 122

Merger reserve 230 230 230

Retained earnings 9,972 8,816 10,707

Equity attributable to

shareholders

of the parent 11,950 11,046 12,711

============================ =========================== =============================

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

6 months 6 months

to to Year to

31 Mar 30 Sept

31 Mar 19 18 18

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Opening equity 12,711 10,720 10,721

Total comprehensive

income (571) 529 2,555

Transactions with

owners:

Dividends (222) (204) (339)

Proceeds from issue of

shares 83 - -

Cost of Investment in

Own Shares (110) - (214)

Tax benefit on share

based payments 58 - (14)

Share-based payments 1 - 2

Closing equity 11,950 11,046 12,711

============================ =========================== =============================

CONSOLIDATED CASH FLOW 6 months 6 months

STATEMENT to to Year to

31 Mar 30 Sept

31 Mar 19 18 18

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

(Loss) / Profit before

tax (199) 987 2,024

Finance costs 43 43 80

Finance income (34) (18) (35)

Operating profit (190) 1,012 2,069

Adjustments for:

Depreciation 361 319 652

Amortisation of

intangible assets 12 6 12

(Gain) on sale of

property, plant

and equipment - (8) (10)

Retirement benefits

provisions 364 - -

547 1,329 2,723

Movements in working

capital:

Change in inventories 135 (404) 536

Change in trade and other

receivables 924 (986) (486)

Change in trade and other

payables (1,447) (22) (190)

Cash generated from

operations 159 (83) 2,583

Income taxes paid - - (35)

Retirement benefits (50) (50) (100)

Net cash from operating

activities 109 (133) 2,448

---------------------------- --------------------------- -----------------------------

Purchase of property,

plant and

equipment (245) (173) (496)

Proceeds from sale of

property,

plant and equipment - 8 10

Capitalised development

expenditure (60) (8) (27)

Purchase of Own Shares (110) - (214)

Net cash (used in)

investing

activities (415) (173) (727)

---------------------------- --------------------------- -----------------------------

Drawdown of bank loans - - -

Repayment of bank loans (99) (98) (196)

Repayment of obligations

under

finance leases (94) (53) (109)

Interest paid (14) (15) (24)

Proceeds from issue of

share

capital 83 - -

Dividends paid (222) (204) (339)

Net cash (used in)

financing

activities (346) (370) (668)

---------------------------- --------------------------- -----------------------------

Net (decrease) / increase

in

cash and cash

equivalents (652) (676) 1,053

Cash and cash equivalents

at

start of the period 956 (97) (97)

Cash and cash equivalents

at

end of the period 304 (773) 956

============================ =========================== =============================

Reconciliation of cash

and cash

equivalents

6 months 6 months

to to Year to

31 Mar 30 Sept

31 Mar 19 18 18

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Cash and cash equivalents

in

current assets 304 44 956

Bank overdraft in current

liabilities - (817) -

Cash and cash equivalents

at

end of the period 304 (773) 956

============================ =========================== =============================

NOTES

1 - BASIS OF PREPARATION

These interim consolidated financial statements are for the six

months ended 31 March 2019. They do not include all the information

required for full annual financial statements and should be read in

conjunction with the consolidated financial statements of the

Group, for the year ended 30 September 2018.

They have been prepared in accordance with International

Financial Reporting Standards as adopted by the EU and applicable

law (IFRS) and in accordance with the provisions of the Companies

Act 2006 applicable to companies applying IFRS. These financial

statements have been prepared under the historical cost convention

with the exception of certain items which are measured at fair

value.

These consolidated interim financial statements have been

prepared in accordance with the accounting policies adopted in the

last annual financial statements for the year to 30 September 2018.

The accounting policies have been applied consistently throughout

the Group for the purposes of preparation of these interim

financial statements and are expected to be followed throughout the

year ending 30 September 2019.

2 - Summary of Significant Accounting Policies

New standards and interpretation adopted by the Group

These statements include a historic provision for Guaranteed

Minimum Pension (GMP) equalisation, which whilst remains an

estimate, is believed to be a full provision. This is in line with

the High Court ruling in October 2018 requiring all UK companies to

remove inequalities between men and women in scheme benefits that

arose under GMP. As the basis of calculation was not previously

available the ruling is considered to create a new obligation,

leading to accounting for the increase in liabilities as a past

service cost, which is recognised in the current period profit and

loss account as an exceptional cost.

3 - EARNINGS PER SHARE

The calculations of earnings per share are based upon the

loss/profit after tax attributable to ordinary equity shareholders

and the weighted average number of ordinary shares in issue during

the period. Diluted earnings per share are based on the weighted

average number of ordinary shares; share options and warrants in

issue in the period.

* Basic and diluted earnings per share are equal for the 6

months to 31 March 2019, since where a loss is incurred the effect

of outstanding share options and warrants is considered

anti-dilutive and is ignored for the purpose of the loss per share

calculation. As at 31 March 2019 there were 1,025,000 outstanding

share options, of which 875,000 were exercisable.

Details are as follows:

6 months 6 months

to to Year to

31 Mar 30 Sept

31 Mar 19 18 18

Unaudited Unaudited Audited

(Loss) / Profit for the period

- GBP000 (149) 860 1,771

-------------------------- ------------------------- -------------------------

Weighted average number of ordinary

shares in issue during the period

(million) 12.435 12.186 12.350

Dilutive effect of share options

* - 0.995 0.813

Number of shares for diluted

earnings per share 12.435 13.181 13.163

========================== ========================= =========================

Basic (loss) / earnings per share -1.20p 6.95p 14.34p

Diluted (loss) / earnings per

share * -1.20p 6.51p 13.44p

4 - ANALYSIS OF NET DEBT

Bank loans Finance Cash and Net debt

lease obligations cash equivalents

GBP000 GBP000 GBP000 GBP000

At 1 October

2018 2,170 757 (956) 1,971

New finance

lease

obligations - 168 - 168

Interest and

arrangement

fees 29 - 29

Repayment of

borrowings (99) (94) 193 -

Cash

absorbed - - 459 459

At 31 March

19 2,100 831 (304) 2,627

========================== ============================== ============================ ========================

5 - INFORMATION

LPA Group Plc is the Group's ultimate parent company. It is

incorporated in England and Wales and domiciled in the UK, Company

Number 686429. The address of LPA Group Plc's registered office,

which is also its principal place of business, is Light & Power

House, Shire Hill, Saffron Walden, CB11 3AQ. LPA Group Plc's shares

are quoted on the AIM market of the London Stock Exchange.

LPA Group Plc's consolidated interim financial statements are

presented in Pounds Sterling (GBP000), which is also the functional

currency of the parent company. These consolidated interim

financial statements have been approved for issue by the Board of

Directors on 19 June 2019. The financial information for the year

ended 30 September 2018 set out in this interim report does not

constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. The Group's statutory financial statements for

the year ended 30 September 2018 have been filed with the Registrar

of Companies. The auditor's report on those financial statements

was unqualified and did not contain statements under Section 498(2)

or Section 498(3) of the Companies Act 2006.

Summarised copies of this Interim Report are being sent to

shareholders. Copies are also available from the Company's

registered office address as above, from the Company's Registrar,

or are available on the Company's website (www.lpa-group.com).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR EAPKNFLXNEFF

(END) Dow Jones Newswires

June 20, 2019 02:00 ET (06:00 GMT)

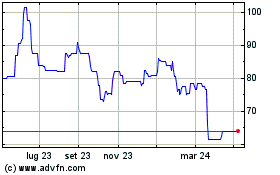

Grafico Azioni Lpa (LSE:LPA)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Lpa (LSE:LPA)

Storico

Da Apr 2023 a Apr 2024