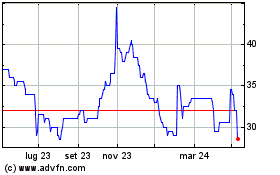

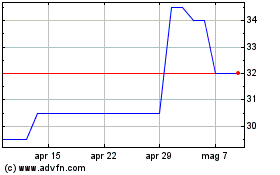

TIDMSYS

RNS Number : 4117D

SysGroup PLC

26 June 2019

26 June 2019

SysGroup plc

("SysGroup" or the "Company" or the "Group")

Final Results for the year ended 31 March 2019

SysGroup PLC (AIM:SYS), the multi award-winning managed IT

services and cloud hosting provider is pleased to announce its

final results for the year ended 31 March 2019.

HIGHLIGHTS

Financial

-- Revenue increased by 22% to GBP12.77m (2018: GBP10.45m)

o GBP9.47m of revenue is recurring in nature (2018:

GBP7.13m)

-- Adjusted EBITDA(1) increased by 41% to GBP1.41m (2018: GBP1.0m)

-- Adjusted PBT(2) growth of 39% to GBP0.75m (2018: GBP0.54m)

-- Cash generated from operations(3) increased 50% to GBP1.21m (2018: GBP0.80m)

-- Net cash/(debt)(4) of GBP0.47m (2018: GBP(0.92m))

2019 2018 Change

(%)

------------------------------

Revenue GBP12.77m GBP10.45m +22%

----------- ----------- -------

Recurring revenue % of total

revenue 74% 68% +6%

----------- ----------- -------

Gross Margin GBP7.78m GBP5.99m +30%

----------- ----------- -------

Gross Margin % 61% 57% +4%

----------- ----------- -------

Adjusted EBITDA(1) GBP1.41m GBP1.00m +41%

----------- ----------- -------

Adjusted PBT(2) GBP0.75m GBP0.54m +39%

----------- ----------- -------

Adjusted Basic EPS(5) 3.1p 2.3p +35%

----------- ----------- -------

Statutory loss before tax GBP(0.83)m GBP(0.01)m -

----------- ----------- -------

Basic EPS (2.8)p 1.0p -

----------- ----------- -------

Net cash/(debt)(4) GBP0.47m GBP(0.92)m -

----------- ----------- -------

Operational

-- Acquisition of Certus IT Limited in February 2019 for initial consideration of GBP8.0m

-- Successful placing of new ordinary shares raising GBP10.0m (gross) in February 2019

-- New 5-year bank facilities consisting of:

o GBP1.75m term loan

o GBP3.25m acquisition revolving credit facility

-- Implementation of Employee EMI Share Option Scheme

-- Completion of office refurbishment programme

Post period-end developments

-- Acquisition of Hub Network Services Limited for GBP1.45m in cash

-- Won Autotask International Partner of the Year 2019 Award

-- Certus IT acquired on a cash free debt free basis resulting

in a post completion adjustment to the initial consideration of

GBP0.25m cash returned to the Group

(1) Adjusted EBITDA, is earnings before interest, taxation,

depreciation, amortisation of intangible assets, exceptional items,

fair value adjustments and share based payments.

(2) Adjusted profit before tax ("Adjusted PBT") is profit before

tax after adding back amortisation of intangible assets,

exceptional items, fair value adjustments and share based

payments.

(3) Cash generated from operations represents Operational

cashflows adjusted to exclude cashflows for exceptional items

(4) Net cash/(debt) represents cash balances less bank loans,

finance lease liabilities and contingent consideration.

(5) Adjusted Basic EPS is profit after tax after adding back

amortisation of intangible assets, exceptional items, fair value

adjustments, share based payments and associated tax.

Adam Binks, Chief Executive Officer commented:

"I am delighted to announce another solid year for the Group, in

which we delivered double digit growth in revenue and adjusted

profit as well as achieving a number of strategic milestones. Our

scale, customer base and geographical coverage have grown

considerably and, importantly, so too has the quality of our

revenue streams. We are beginning to see the benefits of our

investment in sales and marketing and are well positioned to meet

the complex requirements of our customers and prospects. The post

period acquisition of Hub Network Services announced earlier this

week also further underpins our capabilities in being able to

source and deliver complementary acquisitions which is pivotal to

the successful delivery of our stated strategy."

"The momentum achieved in the year has carried over into the

start of the new financial year, and with the growth expected to

continue, I remain optimistic for the future."

For further information please contact: Tel: 0151 559 1777

SysGroup plc

Adam Binks, CEO

Martin Audcent, CFO

Shore Capital (Nomad and Broker) Tel: 020 7408 4090

Edward Mansfield / Daniel Bush / Anita Ghanekar

Alma PR (Financial PR) Tel: 020 3405 0205

Josh Royston / Hilary Buchanan / Helena Bogle

About SysGroup

SysGroup is a leading provider of Managed IT Services, Cloud

Hosting, and expert IT Consultancy. The Group delivers solutions

that enable clients to understand and benefit from industry leading

technologies and advanced hosting capabilities. SysGroup focuses on

a customer's strategic and operational requirements - enabling

clients to free up resources, grow their core business and avoid

the distractions and complexity of delivering IT services.

The Group has offices in Liverpool, Coventry, London, Telford

and Newport.

For more information, visit http://www.sysgroupplc.com

STRATEGIC REPORT

Chairman's statement

We are pleased to present the Group's final results for the year

ended 31 March 2019, delivering double digit growth in revenue and

Adjusted EBITDA and demonstrating the continued execution of the

Group's buy-and-build strategy. The Group achieved a number of

milestones during the year, progressing its journey of becoming the

leading provider of managed IT services.

The Group successfully raised GBP10.0m (gross) by way of an

equity placing ("Placing") in February 2019 to fund further

opportunities for growth. On behalf of the Company and the rest of

the Board, I would like to thank both our new and existing

shareholders for their continued support and commitment to our

vision. The support by investors has been mirrored by the

commitment of Santander to the Group through the provision of

GBP5.0m in new bank facilities. This commitment places the Group in

a strong position to continue to execute its growth strategy.

The Placing enabled the acquisition of Certus IT Limited

("Certus") by the Group in February. The deal was transformational

adding new customers, expertise, further scale and enhanced

geographical reach to the Group. We expect Certus to be trading

under the SysGroup brand later this financial year, and the

majority of the operations integration will take place in H2 FY20.

We will continue to assess complementary acquisition opportunities

in line with our growth strategy.

The restructuring of the Board was completed during the year

with the appointment of Martin Audcent as Chief Financial Officer

in July 2018, putting in place the last of the building blocks in

establishing the right mix of experience on the Board. These

results mark the first full year with Adam Binks as Chief Executive

Officer and the contribution his leadership and vision has

delivered to the Group is palpable. I believe we have the right

team in place to see the Company through to its next stages of

growth.

The market environment remains buoyant and the opportunities for

the Group as a trusted IT partner are long term. Furthermore, we

continue to invest in the business and our people and I would like

to thank all of our dedicated employees for their contribution to

the Group. I look forward to the new year with confidence.

Michael Edelson

Chairman

26 June 2019

Chief Executive Officer's report

Introduction

The 2019 financial year saw an acceleration of the Group's

growth strategy, delivering against our expectations and building

upon the newly-formed business foundations established in the prior

year.

The Company delivered revenue growth of 22% to GBP12.77m and

adjusted EBITDA growth of 41% to GBP1.41m which supported a 50%

increase in cash generation to GBP1.20m. Recurring revenues now

represent approximately 74% of the Group's total revenue (FY18:

68%), demonstrating our continued shift and strategic focus on

higher quality earnings over lower margin VAR. The addition of new

managed service customers to this base has contributed to a

steadily growing monthly run-rate of recurring revenues, which,

combined with the addition of Certus during the year, has launched

the business into the next stage of its growth roadmap.

We have spent considerable time during the year enhancing and

streamlining the business platform, and ensuring we remain close to

our customer base. During the year we undertook a re-branding

exercise, bringing all of the previously acquired businesses under

the SysGroup brand with a single go-to-market offering. We have

continued to invest in our people and systems to support the

Group's growth strategy.

Market

We are still in the infancy in the journey to cloud adoption and

fully outsourced IT, and customers and prospects are looking to

trusted IT partners to help them navigate the complexities of the

outsourced IT landscape. Security, compliance and IT governance

remain the key drivers for businesses seeking expert advice in

helping them to ultimately outsource to ensure they remain

protected and compliant.

The market for managed IT service providers remains highly

fragmented and characterised by a plethora of small, often

localised players. Many of these players reach a natural ceiling,

above which they do not have either the inclination or expertise to

grow. This provides significant opportunity for further

consolidation and we expect to continue to play a role in that in

line with our buy-and-build strategy.

Strategy

The Group's clear strategy remains consistent: to expand its

position as a trusted provider of Managed IT Services to clients in

the UK. The Board believes that a business focused on the provision

of Managed IT Services offers the highest growth opportunity and

the potential for increased margins and longer-term contracts,

thereby providing greater revenue visibility. In pursuit of this

strategy, the Group has positioned itself as an extension of a

customer's existing IT department, with an emphasis on

consultative-led sales to guide customers through the complexities

and developments in the market. The process is supplemented by

customer service and support. The Group invests in R&D to

ensure its clients take advantage of the latest and best solutions

available to them, with a vendor/cloud agnostic approach.

The Company's route to execute this strategy is through a

combination of organic and acquisitive growth whilst ensuring we

create cross-selling opportunities across our acquired customer

bases.

Acquisitions

The acquisition of Certus IT in February was in line with our

stated strategy of augmenting our growth with carefully selected

acquisitions. Certus is a well-established and growing managed

services provider which has a complementary service offering,

geographical reach and customer base to SysGroup. Certus has

bolstered the Group's existing managed service offerings, by

expanding the enlarged Group's current IaaS customer base,

significantly adding to its managed connectivity portfolio and

further strengthening the existing relationship with Dell EMC by

upgrading the Group to gold partner status.

Further, the Group announced the acquisition of Hub Network

Services Limited ("HNS") earlier this week for a cash consideration

of GBP1.45m on a cash free debt free basis. HNS is a

well-established B2B managed services provider with a primary focus

on delivering fast, low latency network connectivity and

co-location solutions. The integration of HNS into the Group's

existing operations has already commenced and we expect to be

leveraging the operational benefits of HNS from H2 FY20.

The Board continues to assess strategic acquisition

opportunities that fit within its strict criteria and importantly,

further the Group's customer acquisition priorities.

New Banking Facilities

In February, the Company re-financed its existing term loan

facility as a GBP1.75m term loan over five years and arranged a new

GBP3.25m acquisition revolving credit facility with Santander to

provide additional financial flexibility for the Group. The

continued support from Santander further underpins the external

confidence that has been placed in the Board to deliver on the

Group's growth strategy as well as providing the Group with the

capital to deliver subsequent acquisitions.

The banking facilities have a five-year term with covenants that

will be tested quarterly on a 12-month rolling basis relating to

interest cover, net debt to Adjusted EBITDA leverage and debt

service cover.

Sales and Marketing

The investments that we have made in sales and marketing have

already made a change to the business and we will continue to see

the benefits as we grow. The appointments that we have made to

date, and continue to make, include several highly skilled senior

individuals reflecting our consultancy first approach. Our clients

come to us with complex IT needs and it is therefore important that

our salespeople fully understand the options available to them and

are able to provide clients with a bespoke, end to end solution

that best suits these needs.

The brand consolidation work concluded in the financial year has

aided our sales effort and played a key role in growing our

pipeline of opportunities. Recognition of SysGroup is undoubtedly

growing in the marketplace and, with it, our reputation as a

trusted provider. The unified brand will also accelerate our

ability to integrate acquired businesses with ease.

Financial review

Group revenue for the year grew by 22% to GBP12.77m for the year

to 31 March 2019 (2018: GBP10.45m) with growth from existing

customers and from the post-acquisition trading of Certus IT,

acquired in February 2019. The revenue growth resulted from an

increase in higher quality Managed IT Services sales which is

principally contracted income on three-year contracts. Value Added

Resale revenue of GBP3.3m was consistent with the prior year

revenue of GBP3.3m. Value Added Resale is a complementary sell to

the customer base and is subject to the timing and size of

customer's IT asset refresh cycles.

2019 2019 2018 2018

Revenue by operating segment GBP'000 % GBP'000 %

============================== ======== ===== ======== =====

Managed IT Services 9,448 74% 7,130 68%

Value Added Reseller 3,325 26% 3,321 32%

============================== ======== ===== ======== =====

12,773 100% 10,451 100%

============================== ======== ===== ======== =====

The Group adopted "IFRS15 Revenue from Contracts with Customers"

and "IFRS9 Financial Instruments" in this years' financial

statements and the changes required have had no material impact to

the Group's financial statements. Further information on the

adoption of IFRS15, IFRS9 and the Group's revenue recognition

policy is included in note 1 to the Accounts.

Gross profit for the year was GBP7.78m (2018: GBP5.99m)

representing a gross margin of 61% (2018: 57%). The increase in

gross margin percentage is attributable to the change in sales mix

with the business focussed more on Managed IT Services growth this

year. In 2019, 74% of revenue (2018: 68%) came from Managed IT

Services which has a gross margin of 74% (2018: 75%). Value Added

Resale was 26% of revenue (2018: 32%) with gross margin percentage

increasing to 25% in 2019 (2018: 20%) which reflects improvements

made in our supplier procurement processes.

Operating expenses before depreciation, amortisation,

exceptional items, fair value adjustment and share based payments

increased from GBP5.0m in 2018 to GBP6.4m in 2019 reflecting an

increase in overhead costs from newly acquired businesses and an

increase in operational investment to enhance our Group Sales and

Marketing teams.

Adjusted EBITDA was GBP1.41m for the year to 31 March 2019, an

increase of GBP0.41m (+41%) compared to GBP1.0m in 2018. Adjusted

EBITDA is not a defined term and is calculated differently by each

company, the Directors consider that Adjusted EBITDA figure is the

most appropriate measure to assess the business performance since

this reflects the underlying trading performance of the Group. The

reconciliation of Operating (loss)/profit to Adjusted EBITDA is

shown below:

Reconciliation of operating 2019 2018

(loss)/profit to Adjusted GBP'000 GBP'000

EBITDA

============================= ========= =========

Operating (loss)/profit (659) 77

Depreciation 494 372

Amortisation of intangible

assets 723 500

=============================== ========= =========

EBITDA 558 949

=============================== ========= =========

Exceptional items 736 581

Fair value adjustment - (540)

Share based payments 119 10

=============================== ========= =========

Adjusted EBITDA 1,413 1,000

=============================== ========= =========

The Group has incurred exceptional costs during the year of

GBP0.74m (2018: GBP0.58m) comprising GBP0.55m for acquisitions,

GBP0.49m relating to the acquisition of Certus IT Limited and

GBP0.07m attributable to a terminated acquisition process.

Exceptional costs also include GBP0.18m of costs associated with

integrating acquired businesses and restructuring the Group's

internal operations. Amortisation of intangible assets was GBP0.72m

(2018: GBP0.50m), of which GBP0.66m (2018: GBP0.45m) relates to the

amortisation of acquired intangible assets.

The share-based payments charge has increased to GBP0.12m in

2019. The higher charge results from the grant of share options

under new EMI Schemes registered this year, to the Executive

Directors and, in November 2018, to all SysGroup employees who, at

the time of grant, had been employed by the Group for more than one

year.

The loss before tax for the year was GBP0.83m (2018: GBP0.007m)

and the loss position results from the impact of acquisition

related exceptional costs and amortisation of acquired intangible

assets. The prior year loss before tax includes a one-off GBP0.54m

credit in respect of a contingent consideration adjustment.

Cashflow and net debt

The cash inflow from operations for the year was GBP0.60m (2018:

GBP0.21m). This includes interest and tax payments and the GBP0.61m

exceptional cash costs from acquisitions, integration and

restructuring (2018: GBP0.59m). The underlying operational cash

conversion, i.e. excluding the costs of acquisitions, integration

and restructuring, was within expectations at 86% of Adjusted

EBITDA compared to 80% in 2018. The increase resulted from

improvements made to the Group's working capital management this

year with changes made to the timing of raising contract invoices

and a strengthening of our credit control processes.

Cash conversion 2019 2018

GBP'000 GBP'000

================================ ========= =========

Operational cashflows 601 207

Adjustments:

Exceptional cost cashflows 611 592

Cash generated from operations 1,212 799

================================== ========= =========

Adjusted EBITDA 1,413 1,000

================================== ========= =========

Cash conversion 86% 80%

================================== ========= =========

The cash balance increased by GBP2.06m to GBP3.38m (2018:

GBP1.32m), with GBP0.60m of the increase coming from operational

cashflows and net GBP1.46m from financing and investing activities.

The investment cashflows include GBP7.96m cash paid on completion

to acquire Certus IT Limited and a GBP0.95m cash balance was

acquired with the company. The acquisition was funded by a GBP10.0m

equity share placing of 26,315,792 1p ordinary shares with net

proceeds, after related professional fees, of GBP9.34m.

Net cash/(debt) comprises cash balances less bank loans, finance

lease liabilities and contingent consideration. At 31 March 2019,

the Group had a net cash balance of GBP0.47m (2018: net debt

balance of GBP0.92m), a cash positive movement of GBP1.39m.

Reconciliation of Net cash/(debt) 2019 2018

GBP'000 GBP'000

========================================== === ========= =========

Cash balances 3,376 1,315

Bank loans - current (224) (216)

Bank loans - non-current (1,397) (1,742)

Finance leases (285) (275)

Contingent consideration (1,000) -

Net cash/(debt) 470 (918)

================================================ ========= =========

Consolidated Statement of Financial Position

The principal movements on the consolidated statement of

financial position arise from the equity fund raise and the

acquisition of Certus IT Limited in February 2019. Non-current

assets of GBP23.1m (2018: GBP13.6m) have increased from the

GBP5.78m goodwill and GBP3.78m acquired intangible assets relating

to Certus. Net working capital including cash balances is GBP0.57m

(2018: GBP0.25m) and the impact of Certus working capital balances

is detailed in note 8. Non-current liabilities includes GBP1.00m

(2018: GBPNil) of fair value contingent consideration relating to

the Certus acquisition, this is payable three months after the earn

out period has expired in February 2020.

Following the GBP10.0m equity raise in February 2019, the equity

attributable to the shareholders of the company has increased by

GBP9.34m, representing the proceeds of the equity raise less the

related costs. The share capital of GBP0.49m (2018: GBP0.23m) has

increased by GBP0.26m and the excess of the net proceeds above the

par value of the shares, GBP9.08m, has been allocated to the share

premium account (2018: GBPNil).

Summary & Outlook

The momentum achieved in the year has carried over into the

start of the new financial year, and we expect that pace of growth

to continue. We have the right tools and strategic partnerships in

place to meet clients increasingly complex requirements and the

relevant expertise to guide our clients from consultation, through

to delivery and on-going support. Our scale, customer base and

geographical coverage have grown considerably and, importantly, so

too has the quality of our revenue streams. With a highly

fragmented market and the continuing opportunity to acquire good

businesses to complement increasing organic growth, we remain

optimistic for the future.

Adam Binks

Chief Executive Officer

26 June 2019

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 31 MARCH 2019

Notes 2019 2018

Group Group

GBP'000 GBP'000

----------------------------------- ------ --------- ---------

Revenue 3 12,773 10,451

Cost of sales (4,994) (4,456)

Gross profit 7,779 5,995

=================================== ====== ========= =========

Operating expenses before

depreciation, amortisation,

exceptional items, fair value

adjustment and share based

payments (6,366) (4,995)

=================================== ====== ========= =========

Adjusted EBITDA 1,413 1,000

=================================== ====== ========= =========

Depreciation 4 (494) (372)

Amortisation of intangibles 11 (723) (500)

Exceptional items 7 (736) (581)

Fair value adjustment - 540

Share based payments (119) (10)

=================================== ====== ========= =========

Administrative expenses (8,438) (5,918)

Operational (loss)/profit (659) 77

=================================== ====== ========= =========

Finance costs 5 (167) (84)

=================================== ====== ========= =========

Loss before taxation (826) (7)

=================================== ====== ========= =========

Taxation 10 104 245

=================================== ====== ========= =========

Total comprehensive (loss)/profit

attributable to the equity

holders of the company (722) 238

Basic earnings per share (EPS) 9 (2.8p) 1.0p

Diluted earnings per share

(EPS) 9 (2.8p) 1.0p

=================================== ====== ========= =========

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 MARCH 2019

2019 2018

Group Group

Notes GBP'000 GBP'000

=============================== ====== ======== ========

Assets

Non-current assets

Goodwill 11 15,508 9,727

Intangible assets 11 6,173 3,094

Property, plant and equipment 1,420 809

=============================== ====== ======== ========

23,101 13,630

=============================== ====== ======== ========

Current assets

Trade and other receivables 13 2,856 1,624

Cash and cash equivalents 3,376 1,315

=============================== ====== ======== ========

6,232 2,939

=============================== ====== ======== ========

Total Assets 29,333 16,569

=============================== ====== ======== ========

Equity attributable to the

equity shareholders of the

parent

Called up share capital 17 494 231

Share premium reserve 9,080 -

Other reserve 2,129 2,010

Translation reserve 4 4

Retained earnings 8,370 9,092

=============================== ====== ======== ========

20,077 11,337

=============================== ====== ======== ========

Non-current liabilities

Obligations under finance

leases 16 81 128

Contingent consideration

due on acquisitions 14 1,000 -

Bank loan 15 1,397 1,742

Deferred taxation 1,120 674

3,598 2,544

=============================== ====== ======== ========

Current liabilities

Trade and other payables 14 3,992 1,900

Contract liabilities 1,238 425

Bank loan 15 224 216

Obligations under finance

leases 16 204 147

=============================== ====== ======== ========

5,658 2,688

=============================== ====== ======== ========

Total Equity and Liabilities 29,333 16,569

=============================== ====== ======== ========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 MARCH 2019

Attributable to equity holders of the parent

======================== ==================================================================

Share

Share premium Other Translation Retained

capital account reserve reserve Profit Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

======================== ========= ========= ========= ============ ========= ========

At 31 March 2017 231 - 2,000 4 8,854 11,089

======================== ========= ========= ========= ============ ========= ========

Comprehensive income

Profit for the period - - - - 238 238

Total Comprehensive

income - - - - 238 238

======================== ========= ========= ========= ============ ========= ========

Distributions to

owners

Share options granted - - 10 - - 10

Total distributions

to owners - - 10 - - 10

======================== ========= ========= ========= ============ ========= ========

At 31 March 2018 231 - 2,010 4 9,092 11,337

======================== ========= ========= ========= ============ ========= ========

Comprehensive income

Loss for the period - - - - (722) (722)

Total Comprehensive

income - - - - (722) (722)

======================== ========= ========= ========= ============ ========= ========

Distributions to

owners

Share options granted - - 119 - - 119

Issue of share capital

- fees - (657) - - - (657)

Issue of share capital

- placing 263 9,737 - - - 10,000

======================== ========= ========= ========= ============ ========= ========

Total distributions

to owners 263 9,080 119 - - 9,462

======================== ========= ========= ========= ============ ========= ========

At 31 March 2019 494 9,080 2,129 4 8,370 20,077

======================== ========= ========= ========= ============ ========= ========

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE YEARED 31 MARCH 2019

2019 2018

Group Group

GBP'000 GBP'000

=================================================== === ========= =========

Cash flows used in operating activities

Profit after tax (722) 238

Adjustments for:

Depreciation and amortisation 4 1,226 872

Fair value adjustment on contingent consideration - (540)

Finance costs 5 167 84

Share based payments 119 10

Taxation 10 (104) (245)

=================================================== === ========= =========

Operating cash flows before movement in

working capital 686 419

=================================================== === ========= =========

(Increase)/decrease in trade and other

receivables (188) 190

Increase/(decrease) in trade and other

payables 275 (416)

Operating cashflows before interest and

tax 773 193

=================================================== === ========= =========

Interest paid (123) (66)

Taxation (paid)/refunded (49) 80

Operational cashflows 601 207

=================================================== === ========= =========

Cash flows from investing activities

Payments to acquire property, plant & equipment (296) (212)

Deferred consideration - (150)

Acquisition of subsidiary companies 8 (7,956) (3,850)

Cash acquired with acquisitions 8 949 327

=================================================== === ========= =========

Net cash used in investing activities (7,303) (3,885)

=================================================== === ========= =========

Cash flows from financing activities

Net proceeds from issue of ordinary share

capital 17 9,343 -

(Repayment)/utilisation of loan facility

including fees (383) 1,940

Capital repayment of finance leases (197) (228)

=================================================== === ========= =========

Net cash from financing activities 8,763 1,712

=================================================== === ========= =========

Net increase / (decrease) in cash and cash

equivalents from continuing operations 2,061 (1,966)

=================================================== === ========= =========

Cash flows from discontinued operations

=================================================== === ========= =========

Net cash used for operating activities - (192)

Net increase in cash and cash equivalents

from discontinued operations - (192)

=================================================== === ========= =========

Cash and cash equivalents at the beginning

of the year 1,315 3,473

=================================================== === ========= =========

Cash and cash equivalents at the end of

the year 3,376 1,315

=================================================== === ========= =========

NOTES TO THE CONSOLIDATED FINANCIAL INFORMATION

FOR THE YEARED 31 MARCH 2019

1. Accounting policies

SysGroup Plc (the 'Company') is a company incorporated and

domiciled in the United Kingdom. The company's registered office is

at Walker House, Exchange Flags, Liverpool, L2 3YL. These

consolidated financial statements comprise the Company and its

subsidiaries (together referred to as the 'Group').

Statement of compliance

The Group and Company financial information have been prepared

in accordance with International Financial Reporting Standards

(IFRSs and IFRIC interpretations) as endorsed by the European Union

("endorsed IFRS") and with those parts of the Companies Act 2006

applicable to companies preparing their accounts under endorsed

IFRS.

This consolidated financial information does not comprise

statutory accounts within the meaning of section 434 of the

Companies Act 2006. The comparative figures for the financial year

ended 31 March 2018 are an extract of the Company's statutory

accounts for the year ended 31 March 2018, prepared in accordance

with International Financial Reporting Standards (IFRS), approved

by the Board of Directors on 27 June 2018 and delivered to the

Registrar of Companies. The report of the auditor on those accounts

was unqualified, did not contain an emphasis of matter paragraph

and did not contain any statement under section 498 (2) or (3) of

the Companies Act 2006.

The statutory accounts for the year ended 31 March 2019 will be

delivered to the Registrar of Companies following the Company's

Annual General Meeting. The Auditors have reported on those

accounts; their report was unqualified, did not contain an emphasis

of matter paragraph and did not contain any statement under section

498 (2) or (3) of the Companies Act 2006.

Basis of preparation

The consolidated financial information is derived from the

Group's consolidated Financial Statements for the year ended 31

March 2019, which have been prepared in accordance with

International Financial Reporting Standards (IFRS), as endorsed by

the European Union (EU) and those parts of the Companies Act 2006

applicable to companies reporting under IFRS.

The principal accounting policies adopted in the preparation of

the Financial Statements are set out below. The policies have been

consistently applied to all the years presented, unless otherwise

stated. The consolidated financial statements have been prepared

under the historical cost basis, except for the revaluation of

certain financial liabilities which have been valued in accordance

with IFRS9.

The preparation of financial statements in compliance with

adopted IFRS requires the use of certain critical accounting

estimates. It also requires Group management to exercise judgement

in applying the Group's accounting policies. The areas where

significant judgements and estimates have been made in preparing

the financial statements and their effect are disclosed in note 2.

The financial statements are presented in pounds sterling, rounded

to the nearest thousand, unless otherwise stated.

Going concern

The Directors have prepared the financial statements on a going

concern basis which assumes that the Group and the company will

continue to meet liabilities as they fall due. The Directors have

reviewed forecasts prepared for the period ending 31 March 2021 and

considered the projected trading forecasts and resultant cashflows

together with the confirmed loan facilities and other sources of

finance. The Group's forecasts and projections, taking account of

reasonably possible changes in trading performance, show that the

Group can continue to operate within the current facilities

available to it.

The Directors therefore have a reasonable expectation that the

Group has adequate resources to continue in operational existence

for the foreseeable future and thus they continue to adopt the

going concern basis of accounting in preparing the financial

statements.

New standards and interpretations

A number of new standards and amendments to standards and

interpretations have been issued during the year ended 31 March

2019. The Group has adopted all of the new and revised standards

and interpretations issued by the IASB and the International

Financial Reporting Interpretations Committee (IFRIC) of the IASB,

as they have been adopted by the European Union, that are relevant

to its operations and effective for accounting years beginning on 1

January 2018.

IFRS15 Revenue from Contracts with Customers

The Group conducted a full review of IFRS15 to assess the impact

of the new standard on the Group's financial reporting processes.

The Group applied the retrospective method to adopt IFRS15 and

applied the practical expedient to not restate contracts starting

and completing in the same financial year. A report of the findings

was presented to the Audit Committee with two specific areas of

financial reporting identified requiring a change in accounting

treatment:

1. Costs to obtain contracts

In the financial year to 31 March 2019, sales commission was

paid in respect of managed service contracts with the commission

payable for the benefit of the full contract period. Under IFRS15,

the sales commission cost is therefore recoverable over the full

term of the managed service contract and is therefore capitalised

as a "Prepayment" with the cost charged to the Consolidated

Statement of Comprehensive Income on a straight-line basis over the

term of the related managed service contract. In the prior

financial year to 31 March 2018, sales commission was not

capitalised. The sales commission scheme in operation at that time

paid commission on a basis where the cost was appropriately matched

and recovered against the profits of the related managed service

contracts in the Consolidated Statement of Comprehensive Income as

such no adjustment is required to the previously recognised

figures.

2. Revenue and related costs recognition on set-up of lease lines

In some customer contracts, the Group sets up and installs new

lease line connections prior to managed services being delivered to

the customer. The set up and installation is usually delivered by a

third party supplier. Under IFRS15, we consider the set up and

installation to be an activity that relates directly to the

subsequent provision of the managed services and as such we have

deferred the one-off revenue and costs over the period of the

related managed service contract in the financial statements to 31

March 2019. Deferred revenue is included in contract liabilities.

Previously this revenue was recognised on delivery and not deferred

over the life of the contract. The accounting adjustment is not

material to the Group Statement of Comprehensive Income in the

current or prior year due to the quantum of such revenue.

Following the adoption of IFRS15, the Group's revenue

recognition policy has been outlined in greater detail and is

presented in the Revenue Recognition accounting policy note.

IFRS9 Financial Instruments

The Group has adopted IFRS 9 for the first time in the current

financial year. IFRS 9 replaces the provisions of IAS 39 that

relate to the recognition, classification and measurement of

financial assets and financial liabilities, derecognition of

financial instruments, impairment of financial assets and hedge

accounting. The Group applies the IFRS 9 simplified approach to

measuring expected credit losses which uses lifetime expected loss

allowances for all trade receivables.

The Group have reviewed their financial instruments and believe

that all assets held at amortised cost have a low credit risk at

the year end. The Group have also identified no assets which

include a significant financing component. Historically the Group's

debtor impairment has been immaterial, and this is not expected to

change in the near future, as such the Group have assessed the

recoverability of financial instruments on a case by case basis

which the Directors do not believe will give a material difference

to the impairment of such assets.

New standards not yet effective

New standards, amendments to standards and interpretations have

been issued but are not effective (and in some cases had not yet

been adopted by the EU) for the financial year beginning 1 January

2019. These have not been early adopted and the Directors are

considering the potential impact of IFRS 16 Leases.

IFRS16 Leases

IFRS16 replaces IAS17 Leases and substantively changes the

accounting for operating leases. Where a contract meets IFRS16's

definition of a lease, lease agreements will give rise to the

recognition of a non-current asset representing the right to use

the leased item, and a loan obligation for future lease payables.

Lease costs will be recognised in the form of depreciation of the

right to use asset and interest on the lease liability, which may

impact the phasing of operating profit and profit before tax,

compared to existing cost profiles and presentation in the income

statement, and will also impact the classification of associated

cash flows. The detailed assessment of the impact on the Group is

ongoing, with the current focus being on assessing the completeness

of lease contracts. The Group currently anticipate adopting the

modified retrospective approach in adopting IFRS16 but this is

still being considered by the Directors. It is thought that the

practical expedients on short term and low value leases will also

be utilised. The adoption is expected to have an impact on the

presentation of the Group's assets and liabilities, relating to

property leases and our initial assessment is that the standard

will increase lease assets by GBP0.4m, increase lease liabilities

by GBP0.5m and increase adjusted EBITDA by GBP0.2m but will have an

immaterial overall effect on profit before tax.

Basis of consolidation

Where the company has control over an investee, it is classified

as a subsidiary. The company controls an investee if all three of

the following elements are present: power over the investee;

exposure to variable returns from the investee; and the ability of

the investor to use its power to affect those variable returns.

Control is re-assessed whenever facts and circumstances indicate

that there may be a change in any of these elements of control.

The consolidated financial statements present the results of the

company and its subsidiaries (the Group) as if they formed a single

entity. Intercompany transactions and balances between group

companies are therefore eliminated in full.

The consolidated financial statements incorporate the results of

business combinations using the acquisition method. In the

statement of financial position, the acquirer's identifiable

assets, liabilities and contingent liabilities are initially

recognised at their fair values at the acquisition date. The

results of acquired operations are included in the consolidated

statement of comprehensive income from the date on which control is

obtained. They are deconsolidated from the date on which control

ceases.

Consolidated statement of cash flows

The Group have reclassified cash flows relating to exceptional

costs from investing activities to operating cashflows within the

company and consolidated cash flow statements. This has had no

overall effect on the prior year cash movement but has resulted in

GBP592,000 of cash outflows being reclassified from investing

activities to operating cashflows in the prior year.

Revenue

Revenue is recognised to the extent that it is probable that the

economic benefits associated with the transaction will flow into

the Group and revenue represents the fair value of amounts received

or receivable for goods and services provided net of trade

discounts and VAT.

The Group's income streams were reviewed in readiness for the

adoption of IFRS15 and three categories of performance obligation

have been identified: managed services, professional services and

value added resale. All customer sales are signed as contracts or

orders which separately specify the services and products to be

delivered and these are mapped to one of the three revenue

recognition categories. The contracts or orders specify, by service

and product, the sales price and the contracted term of the

services. As such, the separate performance obligations and

allocation of transaction price can be identified clearly from the

customer sales contracts.

The revenue recognition policies can be summarised as

follows:

Revenue category Performance delivery Revenue recognition

================= ==================================== ===================================

Managed services Contracted managed IT Revenue is recognised

services are delivered evenly over the duration

from an agreed commencement of the contract period

date and for a contracted based on the sales price

time period, typically as specified in the customer

three years with a twelve-month sales contract. This

automatic extension. is on the basis that

Managed services is comprised the customer receives

of different streams and consumes the services

including hosting and evenly over the term

support but due to the of the contract. Amounts

nature of this revenue invoiced in advance of

the streams are considered service delivery periods

inter-dependant. The are accounted for as

services are delivered contract liabilities

uniformly over the duration and recognised as revenue

of the contract and invoiced in the Consolidated Statement

either quarterly or monthly of Comprehensive Income

in advance of the service to match the period in

delivery period. which the services are

delivered.

================= ==================================== ===================================

Professional Professional services Revenue is recognised

services are delivered by a team based on chargeable days

of technical consultants delivered using the sales

based on a scope of work day rate specified in

agreed and signed with the customer contract.

a customer. The scope Revenue recognition is

of work includes a specification therefore matched to

of the work to be delivered, the timing of when the

an estimation of the customer receives the

number of consultancy benefit of the consultancy

days required, and a services which is in

sales value based on line with the day the

a day rate. Professional work is performed. The

services are invoiced relevant details of customer

either in advance of engagements and the time

work performed, in arrears delivered by consultants

after the service is is recorded on the Group's

delivered or as part financial systems. Professional

of a larger project contract services are either invoiced

milestone. in arrears for the actual

days delivered or invoiced

in advance. When invoiced

in advance, the sales

value is treated as contract

liabilities and recognised

as revenue in the Consolidated

Statement of Comprehensive

Income in the period

in which the consultancy

days are delivered.

================= ==================================== ===================================

Value added Value added resale ("VAR") Revenue is recognised

resale comprises sales of IT on delivery of the products

hardware, licences and from the supplier. Invoices

warranties ("products") are typically raised

where the Group satisfies in advance of delivery

its performance obligation and treated as contract

by procuring the products liabilities until delivery

from suppliers for delivery has been fulfilled. At

to the customer. There this point the revenue

are no further or ongoing and associated purchase

obligations to the Group cost is recognised in

after delivery. The sales the Consolidated Statement

price for each product of Comprehensive Income.

is separately specified

in the customer sales

contract. VAR sales are

either invoiced in full

in advance of delivery

or invoiced according

to an agreed contract

milestone if part of

a larger contract.

================= ==================================== ===================================

Segmental reporting

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision maker.

The chief operating decision maker has been identified as the Board

of Directors.

Exceptional costs

The Group presents as exceptional items on the face of the

Statement of Comprehensive Income those material items of income

and expense which the Directors consider, because of their size or

nature and expected non-recurrence, merit separate presentation to

facilitate financial comparison with prior periods and to assess

trends in financial performance. Exceptional items are included in

Administration expenses in the Consolidated Statement of

Comprehensive Income but excluded from Adjusted EBITDA as

management believe they should be considered separately to gain an

understanding of the underlying profitability of the trading

businesses.

Intangible assets

Intangible assets are recognised on business combinations if

they are separable from the acquired entity or give rise to other

contractual/legal rights. The amounts ascribed to such intangibles

are arrived at by using appropriate valuation techniques (see

section related to critical estimates and judgements below).

The significant intangibles recognised by the Group, their

estimated useful economic lives and the methods used to determine

the cost of intangibles acquired in business combinations are as

follows:

Intangible asset Estimated UEL Valuation method

Customer relationships 5-7 years Estimated discounted cash

flow

Software and web design costs 3-5 years Cost less amortisation

2 Significant accounting estimates and judgements

The preparation of this financial information requires

management to make estimates and judgements that affect the amounts

reported for assets and liabilities at the period end date and the

amounts reported for revenues and expenses during each period. The

nature of the estimation or judgement means that actual outcomes

could differ from the estimates and judgements taken in the

preparation of the financial statements.

Significant accounting estimates

Impairment of goodwill and other intangibles

The Group tests goodwill for impairment on an annual basis in

line with the accounting policy noted above. This involves

judgement regarding the future development of the business and the

estimation of the level of future profitability and cash flows to

support the carrying value of goodwill. An impairment review has

been performed at the reporting date taking into account

sensitivities around future business performance, covering a range

of outcomes and risks over levels of revenue, cost and cash

generation. No impairment has been identified. More details

including carrying values are included in note 11.

Valuation of intangible assets acquired in business

combinations

Determining the fair value of customer relationships acquired in

business combinations requires estimation of the value of the cash

flows related to those relationships and a suitable discount rate

in order to calculate the present value. More details including

carrying values are included in note 11.

Valuation of contingent consideration

The Group has contingent consideration payable which is based on

the future performance of acquired companies. When valuing the

contingent consideration still payable on acquisitions, the Group

considers various factors including the performance of the acquired

entity since acquisition together with an estimate of the expected

future trading performance for the period to the expiry of the

earn-out period. Contingent consideration is recognised at, and

carried thereafter at, fair value. All changes in fair value (other

than measurement period adjustments) are reflected in the income

statement.

Significant accounting judgements

Revenue

Management make judgements in determining the appropriate

application of revenue recognition policies to the sale of services

and products. An explanation of the Group's revenue recognition

policy is shown in note 1.

Assessment of CGU's and carrying value of intangible assets

A CGU is the smallest identifiable group of assets that generate

cash inflows that are largely independent of the cash inflows from

other assets or groups of assets and the Board of Directors use

judgement to identify the CGUs of the Group. The Board have

reviewed the Group's CGU's this year and exercised their judgement

to amend the CGUs following the integration of previously acquired

businesses and changes to the Group's management and reporting

structure in the current financial year. The Board have concluded

that the Group has a single CGU of "Managed IT Services". See note

11.

Useful economic lives of intangible assets

Intangible assets are amortised over their useful economic

lives. Useful lives are based on management's estimates of the

period over which the assets will generate revenue, which are

periodically reviewed for continued appropriateness. Changes to

estimates can result in changes in the carrying values and hence

amounts charged to the income statement in particular periods which

could be significant.

3 Segmental analysis

The chief operating decision maker for the Group is the Board of

Directors. The Group reports in two segments:

-- Managed IT Services - this segment provides all forms of

managed services to customers and includes professional

services.

-- Value Added Resale (VAR) - this segment provides all forms of

VAR sales where the business sells products and licences from

supplier partners.

The monthly management accounts reported to the Board of

Directors is reviewed at a consolidated level with the operating

segments representative of the business model for growth of

recurring contract income in Managed IT Services and VAR sales as a

complementary business activity. The Board review the results of

the operating segments at a revenue and gross profit level since

the Group's management and operational structure supports both

operational segments as group functions. In this respect, assets

and liabilities are also not reviewed on a segmental basis. All

assets are within the UK other than a low value of property, plant

& equipment in the USA.

All segments are continuing operations and there are no

transactions between segments.

2019 2019 2018 2018

Revenue by operating segment GBP'000 % GBP'000 %

================================================================ ============ ======== ======== ========

Managed IT Services 9,448 74% 7,130 68%

Value Added Resale 3,325 26% 3,321 32%

12,773 100% 10,451 100%

================================================================ ============ ======== ======== ========

No individual customer accounts for more than

5% of the Group's revenue.

The revenue by geographic location for where services are

delivered to customers is shown below.

2019 2019 2018 2018

GBP'000 % GBP'000 %

================================================================ ============ ======== ======== ========

UK 12,526 98% 10,213 98%

Rest of World 247 2% 238 2%

================================================================ ============ ======== ======== ========

12,773 100% 10,451 100%

================================================================ ============ ======== ======== ========

2019 2018

GBP'000 GBP'000

================================================================ ======== ================== ========

Revenue

Managed IT Services 9,448 7,130

Value Added Resale (VAR) 3,325 3,321

================================================================ ======== ================== ========

12,773 10,451

================================================================ ======== ================== ========

Gross Profit

Managed IT Services 6,959 5,329

Value Added Resale (VAR) 821 666

================================================================ ======== ================== ========

7,780 5,995

================================================================ ======== ================== ========

There were no sales between the two business segments, and

all revenue is earned from external customers. The business

segments' gross profit is reconciled to profit before taxation

as per the consolidated income statement. The Group's overheads

are managed centrally by the Board and consequently there

is no reconciliation to profit before tax at a segmental

level. Assets and liabilities related to contracts

with customers

The Group has recognised the following liabilities related

to contracts with customers. There are no assets arising

from contracts with customers

2019 2018

GBP'000 GBP'000

============================================== ======== ========

Current contract liabilities relating

to deposits from customers 1,238 425

============================================== ======== ========

The following table shows how much of the revenue recognised

in the current year relates to contract liabilities:

==================================================================

2019 2018

GBP'000 GBP'000

============================================== ======== ========

Release of contract liability recognised

in revenue which was included in the

contract liability balance at the beginning

of the year 425 465

============================================== ======== ========

------------------------------------------------------------------------------------------------------------

4 Operating (loss)/profit

2019 2018

GBP'000 GBP'000

================= =========================== ======== ========

Operating (loss)/profit is after charging

the following:

Auditor's remuneration:

Group: Audit 60 49

Other advisory - 5

Company: Audit 4 4

Depreciation of tangible fixed assets:

Owned 345 201

Held under finance leases 158 171

Amortisation of intangible assets 723 500

Staff costs (note 6) 4,710 3,972

Share based payments 119 10

Rentals payable under operating leases 168 156

Exceptional items (note 7) 736 581

=============================================== ======== ========

5 Finance expense

2019 2018

GBP'000 GBP'000

==================================== ======== ========

Interest payable on finance leases 13 17

Interest payable on bank loan 108 49

Arrangement fee amortisation on

bank loan 46 18

167 84

==================================== ======== ========

6 Staff numbers and costs

The average monthly number of full-time persons employed

by the Group, including executive Directors during the year

was:

==================================================================

2019 2018

========================================= =========== ==========

Research and Development 3 4

Technical Support 52 48

Sales and Marketing 17 11

Executive and Administration 15 11

========================================= =========== ==========

87 74

========================================= =========== ==========

The aggregate payroll costs including Executive Directors

and excluding Non-Executive Directors were as follows:

==================================================================

2019 2018

GBP'000 GBP'000

========================================= =========== ==========

Wages and salaries 4,154 3,548

Social security costs 441 365

Benefits in kind 26 22

Pension benefits 89 37

Share based payment expense 119 10

========================================= =========== ==========

4,829 3,982

========================================= =========== ==========

7 Exceptional costs

2019 2018

GBP'000 GBP'000

============================================== ============ ============

Acquisitions 554 186

Integration and restructuring 182 395

============================================== ============ ============

Total 736 581

============================================== ============ ============

The Directors believe these costs are exceptional as their

size and one-off nature are significant enough to the Group's

profit and loss to warrant separate consideration. The acquisitions

cost of GBP554,000 represents GBP66,000 professional fees

incurred on a terminated acquisition process and GBP498,000

professional fees and other costs relating to the Certus

IT acquisition. In the prior year, the GBP186,000 costs relate

to the acquisition of Rockford IT Limited. Integration and

restructuring costs represent the costs incurred for integrating

newly acquired companies and for restructuring the internal

business to manage the requirements of a larger group.

8 Acquisitions

In February 2019, the company acquired 100% of the share capital

of Certus IT Limited ("Certus"), a Managed IT Services company

registered in England & Wales with a head office in Newport,

South Wales. Certus provides Managed IT services, cloud hosting,

value added resale, and IT consultancy.

Certus was acquired for an initial GBP7,956,000 cash

consideration paid on completion, subject to final adjustment on

the completion accounts, with a maximum GBP1,000,000 additional

consideration payable in cash in twelve months' time depending on

Certus' profit performance in the twelve-month period following

completion and subject to 70% of the gross margin being achieved

from recurring income. In respect of the contingent consideration,

the company will pay GBP2.50 consideration for every GBP1.00 of

EBITDA achieved by Certus over and above a floor of GBP1.2m and up

to a maximum of GBP1.6m EBITDA.

The company incurred GBP498,000 of professional fees and other

acquisition costs in relation to this acquisition. These costs are

included as Exceptional costs in the Group's consolidated statement

of comprehensive income for the year ended 31 March 2019.

The Directors have considered the intangible assets acquired

with Certus and have accordingly recognized an intangible asset for

customer relationships which has been calculated using a discounted

cashflow method, based on the estimated level of profit to be

generated from the customers acquired. A post tax discount rate of

10.45% was used in the valuation and the customer relationships are

being amortised over an estimated useful life of 7 years. The

goodwill arising on this acquisition is attributable to the

technical skills of the workforce and cross-selling opportunities

achievable from combining the acquired customer bases and trade

with the existing Group.

The goodwill and intangible asset has been allocated to a new

CGU, Certus IT, given the company has its own management and

operational structure, cash generation and financial reporting

processes in place.

Since the acquisition date to 31 March 2019, Certus IT Limited

contributed GBP1.0m to Group revenue and GBP0.09m to Group EBITDA.

Had the acquisition taken place on 1 April 2018, the contribution

to Group revenue would have been GBP7.8m to Group revenue and

GBP1.1m to Group EBITDA.

Recognised amounts of net assets acquired Book Values Adj. Fair

and liabilities assumed GBP'000 GBP'000 Value

GBP'000

=========================================== ============ ========== =========

Cash and cash equivalents 949 - 949

Trade and other receivables 1,179 (135) 1,044

Property, plant and equipment 869 (32) 837

Stock and work in progress 32 (32) -

Intangible assets - 3,777 3,777

Trade and other payables (2,570) (2) (2,572)

Corporation tax (162) - (162)

Deferred tax liability (56) (642) (698)

=========================================== ============ ========== =========

Identifiable net assets 241 2,934 3,175

=========================================== ============ ========== =========

Goodwill 5,781

=========================================== ============ ========== =========

Total 8,956

=========================================== ============ ========== =========

Satisfied by:

Cash consideration - paid on acquisition 7,956

Contingent consideration 1,000

Total consideration 8,956

=========================================== ============ ========== =========

9 Earnings per share

2019 2018

=================================================== ============= ==============

(Loss)/profit for the financial year attributable (GBP722,000) GBP238,000

to shareholders

Weighted number of issued equity shares 25,843,624 23,103,898

Weighted number of equity shares for diluted

EPS calculation 26,999,313 23,298,898

Adjusted basic earnings per share (pence) 3.1p 2.3p

Basic earnings per share (pence) (2.8p) 1.0p

Diluted earnings per share (pence) (2.8p) 1.0p

=================================================== ============= ==============

Profit used in the Earnings per 2019 2018

Share calculation GBP'000 GBP'000

=================================== ========= =========

(Loss)/profit after tax used for

basic earnings per share (722) 238

Amortisation of intangible assets 723 500

Exceptional items 736 581

Fair value adjustment - (540)

Share based payments 119 10

===================================== ========= =========

Tax adjustments (47) (250)

===================================== ========= =========

Adjusted profit used for Adjusted

Earnings per Share 809 539

===================================== ========= =========

For diluted earnings per share, the weighted number of ordinary

shares in issue during the year is adjusted to include the weighted

average number of ordinary shares that would be issued on the conversion

of all the dilutive potential shares into ordinary shares.

10 Taxation

2019 2018

Current tax GBP'000 GBP'000

==================================================== =============== =======================

Current tax - current year 105 32

Adjustments in respect of prior years 55 (126)

Tax refund (12) (80)

====================================================

Total current tax debit/(credit) 148 (174)

==================================================== =============== =======================

Deferred tax

Deferred tax - timing differences (252) (71)

====================================================

Total deferred tax (252) (71)

==================================================== =============== =======================

Total tax credit (104) (245)

==================================================== =============== =======================

The effective tax rate for the year to 31 March 2019

is higher (2018: lower) than the standard rate of corporation

tax in the UK. The differences are explained below:

===================================================================== =======================

2019 2018

GBP'000 GBP'000

==================================================== =============== =======================

Loss on ordinary activities before tax (826) (7)

==================================================== =============== =======================

Loss on ordinary activities before taxation

multiplied by the standard rate of UK corporation

tax of 19% (2018:19%) (157) (1)

Effects of:

Expenses not deductible 10 33

Income not taxable (24) (106)

Prior year adjustment 55 (126)

Re-measurement of deferred tax due to changes

in UK rate - 5

Deferred tax not recognised - (130)

Tax refund 12 80

====================================================

Total tax credit (104) (245)

==================================================== =============== =======================

Factors affecting future tax charges:

The UK corporation tax rate will change from 19% to 17% on 1

April 2020.

11 Intangible assets

Group Website Software Customer

Cost & licences relationships Goodwill Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

===================== ======== ============ =============== ========= ========

Cost

At 1 April 2017 197 72 2,383 7,620 10,272

Additions 26 6 - - 32

Acquisitions - 95 1,850 2,107 4,052

At 31 March 2018 223 173 4,233 9,727 14,356

===================== ======== ============ =============== ========= ========

At 1 April 2018 223 173 4,233 9,727 14,356

Additions - 10 - - 10

Acquisitions - 16 3,777 5,781 9,574

===================== ======== ============ =============== ========= ========

At 31 March 2019 223 199 8,010 15,508 23,940

===================== ======== ============ =============== ========= ========

Amortisation

At 1 April 2017 191 30 814 - 1,035

Charge for the year 7 47 446 - 500

===================== ======== ============ =============== ========= ========

At 31 March 2018 198 77 1,260 - 1,535

===================== ======== ============ =============== ========= ========

At 1 April 2018 198 77 1,260 - 1,535

Charge for the year 8 59 656 - 723

===================== ======== ============ =============== ========= ========

At 31 March 2019 206 136 1,916 - 2,258

===================== ======== ============ =============== ========= ========

Net book value

At 31 March 2018 25 96 2,973 9,727 12,821

===================== ======== ============ =============== ========= ========

At 31 March 2019 17 62 6,094 15,508 21,682

===================== ======== ============ =============== ========= ========

All amortisation and impairment charges are included in the

depreciation, amortisation and impairment of non-financial assets

classification, which is disclosed as administrative expenses in

the statement of comprehensive income. Customer relationships have

a remaining amortisation period of between 2 and 7 years.

Cash-generating units

Goodwill and intangible assets are allocated to CGUs in order to

be assessed for potential impairment. During the year, the

Directors reconsidered the CGUs within the Group following the

unification of all Group management and operations under a single

brand, SysGroup, in April 2018. The Group has a Senior Management

Team that manages the SysGroup business within a single operational

and delivery structure having fully integrated previously acquired

Rockford IT, System Professional and Netplan businesses. The Board

of Directors review the Group's performance at a consolidated level

reflecting how the business is managed and controlled. In view of

these developments in the year, the Directors concluded that the

CGUs that represented the acquired businesses at the "statutory

entity" level is no longer appropriate and that the Group has a

single CGU of "Managed IT Services". As the Group acquires new

businesses, they will form their own CGU until they have been

integrated into the Group's core operational structure.

Accordingly, Certus IT Limited, acquired in February 2019 is

recognised as a separate CGU, "Certus IT", in this year's

impairment review.

The allocation of goodwill and carrying amounts of assets for

each CGU is as follows:

Allocation of goodwill Carrying value

of assets

2019 2018 2019 2018

GBP'000 GBP'000 GBP'000 GBP'000

===================== ============= ========== ======== ========

Managed IT Services 9,727 9,727 11,894 13,166

Certus IT 5,781 - 8,698 -

15,508 9,727 20,592 13,166

===================== ============= ========== ======== ========

Impairment review

When assessing impairment, the recoverable amount of each CGU is

based on value-in-use calculations (VIU). VIU calculations are an

area of material management estimate as set out in note 2. These

calculations require the use of estimates, specifically: pre-tax

cash flow projections; long-term growth rates; and a pre-tax

discount rate. Cash flow projections are based on the Group's

detailed annual operating plan for the forthcoming financial year

which has been approved by the Board.

The VIU calculation is determined based on a discounted cash

flow basis and is allocated to individual cash generating units.

Cash flows beyond the forthcoming financial year use estimated

growth rates which are stated below. The assumptions for growth

rates and margins are based on management's experience of growth

and knowledge of the industry sector, markets and our own internal

opportunities for growth and margin enhancement. The projections

beyond five years use an estimated long-term growth rate of 2.5%

(2018: 2.9%) for revenue. This represents management's best

estimate of a long-term annual growth rate aligned to an assessment

of long-term GDP growth rates. A higher sector-specific growth rate

would be a valid alternative estimate. A different set of

assumptions may be more appropriate in future years dependent on

changes in the macroeconomic environment.

The discount rates used are based on management's calculation of

the WACC using the capital asset pricing model to calculate the

cost of equity. Specific rates are used for each CGU in the VIU

calculation and the rates reflect management's assessment on the

level of relative risk in each respective CGU. Discount rates can

change relatively quickly for reasons both inside and outside

management control. Those outside management direct control or

influence include changes in the Group's Beta, changes in risk free

rates of return and changes in Equity Risk Premia. Matters inside

management control are the delivery of performance in line with

plans or budgets and the production of high or low risk plans.

At the year-end reporting date, goodwill was reviewed for

impairment in accordance with IAS 36 "Impairment of Assets". No

impairment charges arose as a result of this review.

The assumptions used for the impairment reviews are as

follows:

2019 Managed IT Services* Certus

IT

Discount rate 10.45% 10.45%

Revenue growth rate year 2

to year 5 5.0% 5.0%

Terminal growth rate 2.5% 2.5%

=============================== ===================== =========

2018 Managed IT Services* Certus

IT

Discount rate 10.13% -

Revenue growth rate year 2 5.0%-7.5% -

to year 5

Terminal growth rate 2.9% -

============================= ====================== =======

*In 2018, the CGU's were Rockford IT, System Professional and

Netplan.

12 Investments

Company 2019 2018

GBP'000 GBP'000

========================================================= =================== =========

Investment in Subsidiaries

At 1 April 2018 14,279 10,429