TIDMEZJ

RNS Number : 9036F

easyJet PLC

18 July 2019

EASYJET TRADING STATEMENT FOR THE QUARTERED - 30 June 2019

easyJet's Q3 performance in line with expectations.

No change to cost and revenue guidance.

Summary

easyJet has delivered a robust performance in the quarter.

Revenue per seat was positive, including a strong late yield

performance which benefitted from easyJet's revenue initiatives as

well as positive ancillary revenue growth and a solid Easter

performance, while cost per seat ex fuel decreased for the quarter

as easyJet made good progress with its underlying cost and

operational performance. This was mainly driven by the continued

focus on operational resilience which is driving improvements in

customer service and significantly fewer long costly delays and

cancellations.

Commenting; Johan Lundgren, easyJet Chief Executive said:

"easyJet's third quarter performance was robust and despite the

tougher macroeconomic conditions was in line with expectations.

Revenue increased by over 11% with RPS increasing through a

combination of successful revenue initiatives, a solid Easter

performance and a focus on late yield initiatives, with passenger

numbers climbing by two million to over 26 million. Our customers

experienced significantly reduced cancellations and long delays

largely as a result of our investment in operational resilience,

which also contributed significantly to driving down cost per seat

ex fuel at constant currency by 4% in the period."

"We were also very proud to win the award for Best Low-Cost

Airline in Europe at the Skytrax World Airlines Awards 2019, the

first time in 9 years."

"We remain very focused on delivering our revenue initiatives

and driving costs down to enhance our profitability per seat. With

second half forward bookings at 78% we have better visibility on

the second half and expect to deliver a profit before tax of

between GBP400 million and GBP440 million, in line with market

expectations."

Revenue

Total revenue for the quarter ending 30 June 2019 increased by

11.4% to GBP1,761 million. Passenger revenue increased by 10.7% to

GBP1,387 million and ancillary revenue increased by 14.3% to GBP374

million.

Passenger(1) numbers in the quarter increased by 8% to 26.4

million, driven by an increase in capacity(2) of 10% to 28.8

million seats. Load factor(3) decreased, as anticipated, by 1.7

percentage points to 91.7%, due to late yield initiatives as well

as high prior year comparatives due to industrial action in France

and Monarch's bankruptcy.

Total revenue per seat increased by 0.7% at constant currency,

in line with expectations. This performance has been driven by:

-- Increases due to:

- A solid yield performance supported in particular by easyJet's

focus on initiatives to optimise late yields and capacity

discipline by competitors on easyJet's markets

- Seasonality - the movement of Easter to the second half of the

financial year (impact of c.GBP40 million), with the later timing

of the Ascension and Pentecost public holidays also having a

positive impact on the quarter

- The move to IFRS 15 accounting (c.GBP10 million revenue benefit in Q3)

- Continued growth in ancillary revenue per seat through better

bag and allocated seating sales

-- Partially offset by:

- Headwinds from one-off prior year revenue benefits, including

the bankruptcies at Monarch and Air Berlin and the impact of French

industrial action

- Softening of demand due to tougher macroeconomic conditions

across Europe as well as Brexit-related consumer uncertainty in the

UK

- A competitive environment and typical new market ramp-up in

Berlin - which is maturing in line with other new bases we have

seen, and showing solid unit revenue improvement

Cost

easyJet's cost performance has been strong and in line with

expectations. Headline cost per seat excluding fuel at constant

currency decreased by 4.0% in the quarter reflecting:

-- Decreases due to:

- Investments in operational resilience continuing to drive down

costs with lower overall levels of disruption, cancellations and

costly delays over three hours

- Wet leasing fewer aircraft, mainly due to the Tegel ramp up in Q3 2018

- Lower employee incentive payment accruals

-- Partially offset by:

- Ownership costs reflecting new aircraft deliveries

- Annualisation of crew pay deals and better than expected crew retention

Customer and operational performance

easyJet has improved its On-Time Performance (OTP) since the

difficult 2018 summer. Despite the air traffic environment

remaining challenging, easyJet's focus for this summer is on

ensuring flight fulfilment and reducing severe delays for its

customers. easyJet experienced 847 cancellations in Q3 2019

compared to 2,606 cancellations in Q3 2018, while delays of greater

than 3hrs decreased by 32% compared to Q3 2018. This helped drive a

strong CSAT score of 72.6% for the quarter.

OTP % arrivals within Apr May Jun Q3

15 minutes

----------------------- ------ ------ ------ ------

2019 80.5% 76.2% 64.7% 73.7%

2018 80.7% 72.3% 65.6% 72.8%

----------------------- ------ ------ ------ ------

Traffic statistics

Load factor was slightly lower than Q3 2018, as expected due to

high prior year comparatives and revenue pricing strategies, with

passenger growth in line with expectations.

Apr May Jun Q3

---------------------- ------ ------ ------ ------

Passengers (million) 8.5 8.9 9.0 26.4

Passenger growth 7.6% 8.3% 8.1% 8.0%

Load factor 90.7% 91.1% 93.3% 91.7%

---------------------- ------ ------ ------ ------

Brexit - Shareholder register update

easyJet has increased its ownership by qualifying EEA (excluding

UK) nationals to 50.6% (as at 30 June 2019).

Should they be necessary easyJet has in place a number of

options to maintain its ownership by qualifying nationals,

including the use of the provisions contained in its Articles of

Association which would permit it to suspend rights to attend and

vote at meetings of shareholders and/or forcing the sale of shares

owned by non-qualifying nationals as well as other potential

actions(6) .

A strong balance sheet

easyJet is financially very strong. During the quarter easyJet

issued a EUR500 million bond under its Euro Medium Term Note

programme which was 3.4 times over-subscribed and carried a coupon

of 0.875%. easyJet's investment grade ratings remain

industry-leading at Baa1 (stable) by Moody's and BBB+ (stable) by

Standard & Poor's.

As part of its focus on driving profit per seat and cash flow

easyJet plans to grow capacity at the lower end of its historic

growth rates in Financial Year 2020, particularly in Winter, which

includes expected fleet growth to reach 332 aircraft by the end of

Financial Year 2019, 349 aircraft by the end of Financial Year 2020

and 352 aircraft by the end of Financial Year 2021(7) .

Management update

easyJet has announced today that Peter Bellew will be joining

easyJet as Chief Operating Officer. He will be a member of the

Airline Management Board and will report to easyJet's CEO, Johan

Lundgren.

Peter joins the airline from Ryanair where he has been Chief

Operations Officer since December 2017, responsible for all aspects

of Ryanair's flight operations.

Outlook

For the year ending 30 September 2019 easyJet expects:

- Full Year capacity to grow by c.10%, H2 capacity to grow by c.7% - unchanged

- H2 revenue per seat at constant currency to be slightly down - unchanged

- Full Year headline cost per seat excluding fuel at constant

currency to be down, assuming normal levels of disruption in Q4 -

unchanged

- Full Year unit fuel bill is likely to be GBP30 million to

GBP50 million adverse(4) . The total fuel bill is expected to be

c.GBP1.4 billion

- Foreign exchange(4) movements will have a c.GBP5 million

adverse impact on headline profit before tax

With 78% of second half seats sold we have better full year

visibility and headline profit before tax for the 12 months to 30

September 2019 is expected to be between GBP400 million and GBP440

million, in line with market expectations(5) .

easyJet remains focused on driving future returns, positive free

cash flow over the longer term and maximising headline profit per

seat as it continues to deliver value for customers and

shareholders.

KEY Q3 FINANCIALS

Three months ended 30 June 2019 30 June 2018 Change

Fav./(adv.)

Passengers (million) (1) 26.4 24.4 8.0%

------------- ------------- -------------

Seats flown (million) 28.8 26.2 10.0%

------------- ------------- -------------

Load factor (%) (3) 91.7 93.4 (1.7ppts)

------------- ------------- -------------

Total revenue (GBP million) 1,761 1,581 11.4%

------------- ------------- -------------

Passenger revenue (GBP million) 1,387 1,253 10.7%

------------- ------------- -------------

Ancillary revenue (GBP million) 374 328 14.3%

------------- ------------- -------------

Total revenue per seat reported

(GBP) 61.22 60.44 1.3%

------------- ------------- -------------

Total revenue per seat constant

currency (GBP) 60.84 60.44 0.7%

------------- ------------- -------------

Total headline cost per seat

reported (GBP) (55.16) (55.45) 0.5%

------------- ------------- -------------

Total headline cost per seat

at constant currency (GBP) (54.49) (55.45) 1.7%

------------- ------------- -------------

Headline cost per seat excluding

fuel at constant currency (GBP) (41.42) (43.14) 4.0%

------------- ------------- -------------

ASKs (million) 32,129 29,041 10.6%

------------- ------------- -------------

RPKs (million) 29,861 27,459 8.7%

------------- ------------- -------------

Average sector length (km) 1,117 1,110 0.6%

------------- ------------- -------------

For further details please contact easyJet plc:

Institutional investors and analysts:

Stuart Morgan Investor Relations +44 (0) 7989 665 484

Michael Barker Investor Relations +44 (0) 7985 890 939

Media:

Anna Knowles Corporate Communications +44 (0) 7985 873 313

Dorothy Burwell Finsbury +44 (0) 207 251 3801

+44 (0) 7733 294 930

Conference call details

Time: 8:00am BST

Standard International Access: +44 (0) 20 3003 2666

UK Toll Free: 0808 109 0700

Password: easyJet

Notes:

1. Represents the number of earned seats flown. Earned seats

include seats that are flown whether or not the passenger turns up

as easyJet is a no-refund airline, and once a flight has departed a

no-show customer is generally not entitled to change flights or

seek a refund. Earned seats also include seats provided for

promotional purposes and to staff for business travel.

2. Capacity based on actual number of seats flown.

3. Represents the number of passengers as a proportion of the

number of seats available for passengers. No weighting of the load

factor is carried out to recognise the effect of varying flight (or

"sector") lengths.

4. Based on fuel spot price range of $575 to $700. US $ to GBP

sterling 1.26, Euro to GBP sterling 1.12

5. Internally compiled, Headline PBT, market consensus as at

July 2019 is GBP423 million

6.

http://corporate.easyjet.com/investors/shareholder-services/eu-share-ownership

7. Includes owned and dry leased aircraft

A copy of this Trading Statement is available at

http://corporate.easyjet.com/investors

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTUBSBRKBABAAR

(END) Dow Jones Newswires

July 18, 2019 02:00 ET (06:00 GMT)

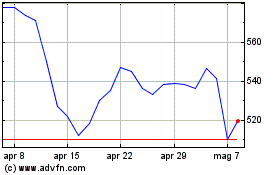

Grafico Azioni Easyjet (LSE:EZJ)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Easyjet (LSE:EZJ)

Storico

Da Apr 2023 a Apr 2024