TIDMBOOM

RNS Number : 9047F

Audioboom Group PLC

18 July 2019

This announcement contains inside information as stipulated

under the Market Abuse Regulations (EU) no. 596/2014 ("MAR")

Audioboom Group plc

("Audioboom", the "Group" or the "Company")

Half-Year Report

Audioboom (AIM: BOOM), the leading global podcast company,

announces its unaudited half-year results for the six months ended

30 June 2019.

Financial Highlights*

-- Revenue increased 171% to US$9.8 million (H1 2018: US$3.6 million)

-- Adjusted EBITDA** loss almost halved to US$1.4 million (H1 2018: US$2.8 million)

-- Overall loss for the period materially reduced to US$2.8 million (H1 2018: US$5.2 million)

-- Group cash as at 30 June 2019 of US$3.4 million (31 May 2018: US$0.4 million)

-- Raised GBP4.3 million (before expenses) through a placing and

subscriptions to secure leading podcasting content, and develop

co-production and Audioboom Original Network ('AON')

opportunities

-- New content funding facility with SPV Investments Ltd,

providing up to US$4 million of minimum guarantees to certain

leading content partners of the Company

Operational Highlights and KPIs*

-- Key performance indicators ('KPIs') all delivered significant growth

o Revenue per 1,000 listens (eCPM)*** increased to US$26.38 in

June 2019, up 51% from US$17.43 in May 2018

o Brand advertiser count of 212 as at 30 June 2019, up 63% on 31

May 2018 (130)

o Total H1 2019 available premium advertising impressions of 691

million, up 36% on H1 2018 (508 million)

-- Audioboom continues to work with the most prominent podcasts

through renewed advertising and distribution deals, including

'Undisclosed' and the official Formula 1 podcast 'Beyond the

Grid'

-- New exclusive commercial partnerships agreed with podcasts

including 'A Cast of Kings', 'What Happened When' and Studio 71, a

leading digital video studio and network with seven billion monthly

YouTube views. Audioboom has a roster of new commercial

partnerships to announce in H2 2019

-- AON development has continued with a slate of new AON podcasts expected to launch in H2 2019, complementing returning seasons of 'Mafia', 'INBOX' and 'Covert', as the Company targets the higher gross margins that AON podcasts deliver

-- Since launching in August 2018, 22 brands have utilised the

Sonic IM platform, which enables brands to secure advertising

within any globally available podcast

-- A new subscription service tier was launched alongside annual

payment options for smaller podcast partners and/or those that

don't carry advertising

-- Audioboom and its podcast partners won seven awards at the British Podcast Awards

* H1 2019 represents 1 January 2019 to 30 June 2019. H1 2018

represents 1 December 2017 to 31 May 2018, following the change to

the Company's accounting reference date and financial year end from

30 November to 31 December

** earnings before interest, tax, depreciation, amortisation,

share based payments and material one-off items

*** Audioboom now reports a combined US and UK eCPM number,

rather than solely a US eCPM number, due to improvements made to

internal reporting. In order to provide like-for-like comparisons,

both the 2019 and 2018 eCPM metrics are stated on a combined US and

UK eCPM basis

Rob Proctor, CEO of Audioboom, commented:

"We are delighted with the Company's performance during this

period, with strong progress in every area of the business. Revenue

growth of 171% on H1 last year is over four times that forecast by

the IAB for the US podcast advertising industry from 2018 to 2019.

This in turn is driving significant improvements for the Company in

its journey to profitability. With gross margin tracking to plan

and overheads remaining under tight control, we are now starting to

see the impact of our improved operational gearing.

With a record 135 million individuals listening to at least one

Audioboom podcast in June 2019, the Company's global reach presents

many possibilities within the digital marketplace. This platform

will create new commercial opportunities as podcasting and audio

continue to attract global investors.

Forward sales for H2 2019 are already at record levels and I

anticipate continued strong performance for the second half of this

year. Content creators and advertisers continue to join our global

platform, and I look forward to updating shareholders with future

developments during H2."

Enquiries

Audioboom Group plc

Rob Proctor, Chief Executive Officer Tel: +44(0)20 7403 6688

Brad Clarke, Chief Financial Officer

Allenby Capital Limited (Nominated Adviser Tel: +44(0)20 3328 5656

and Broker)

David Hart /Alex Brearley/Asha Chotai

Walbrook PR Limited (PR & IR Advisers) Tel: +44(0)20 7933 8780

Paul Cornelius / Nick Rome / Sam Allen or audioboom@walbrookpr.com

About Audioboom

Audioboom is the leading global podcast company, consolidating

the business of on-demand audio, making content accessible,

wide-reaching and profitable for podcasters, advertisers and

brands. Audioboom operates internationally, with operations and

global partnerships across North America, Europe, Asia and

Australia, and addresses the issue of disparate podcast services by

putting all of the pieces of the puzzle together under one

umbrella, creating a user-friendly, economical experience.

Audioboom hosts over 13,000 content channels, with key partners

including A+E Networks (US), Associated Press (US), 'Astonishing

Legends' (US), 'Casefile True Crime' (Aus), Edith Bowman (UK),

'Felon True Crime Podcast' (Aus), Jonathan Ross (UK), 'Moneycontrol

Podcast' (India), 'No Such Thing As A Fish' (UK), Red FM (India),

Starburns Audio (US), 'The Cycling Podcast' (UK), 'The Totally

Football Show' (UK), 'The True Geordie Podcast' (UK) and

'Undisclosed' (US).

Original content produced by Audioboom includes 'Formula 1(R):

Beyond the Grid' (UK), 'And That's Why We Drink' (US), 'Dead Man

Talking' (UK), 'Blank Check' (US), 'The 45th' (US), 'Covert' (US),

'Deliberations' (US), 'It's Happening with Snooki & Joey' (US),

'Mafia' (US) and 'Night Call' (US).

The platform receives over 90 million listens per month and

allows partners to share their content via Apple Podcasts,

BookMyShow, Deezer, Google Podcasts, iHeartRadio, RadioPublic,

Saavn, Spotify, Stitcher, Facebook and Twitter as well as their own

websites and mobile apps.

For more information, visit audioboom.com.

Chief Executive's Report

The Board and management are pleased to report that the Company

has built on the improved performance achieved in 2018 and has

experienced excellent growth in all key financial and operating

KPIs. Our revenue growth continues to outperform the wider podcast

market and we look forward to updating the market on our

performance in the second half of 2019 in due course.

Operational Review

Key Performance Indicators

The Company's key performance indicators all delivered

significant growth in the period. The KPIs relate to Audioboom's

main revenue stream of "host endorsed" podcast advertising:

o Revenue per 1,000 listens (eCPM) increased to US$26.38 in June

2019, up 51% from US$17.43 in May 2018. As a result of improved

internal reporting, Audioboom now reports a combined US and UK eCPM

number, with the 2019 and 2018 eCPM now reflecting the combined

eCPM number. eCPM measures revenue per 1,000 downloads of content,

creating a standard rate card that can be used to compare different

types of content, territories and business strands. It also allows

Audioboom to compare itself against competitors and the industry as

a whole. Standalone US eCPM, being the previously reported eCPM

KPI, in June 2019 was US$29.97, up 58% from US$19.02 in May

2018.

o Brand advertiser count of 212 as at 30 June 2019, up 63% on 31

May 2018 (130). As more brands realise and understand the potential

and engagement levels of podcast advertising, Audioboom expects to

work with an increasing number.

o Total H1 2019 available premium advertising impressions of 691

million, up 36% on H1 2018 (508 million). Premium advertising

impressions relate to the number of host endorsed advertising slots

that are available on podcasts, typically three to four each

episode. As Audioboom continues to partner with more third-party

podcast content providers, and as new AON content is released,

premium advertising impressions are expected to increase.

Content Partnership Renewals

During H1 2019, Audioboom renewed advertising sales and

distribution contracts with some of its leading podcast partners,

including 'True Crime Obsessed', the official Formula 1 podcast

'Beyond The Grid', 'Astonishing Legends', 'Undisclosed', 'The

Totally Football Show', 'The Morning Toast' and 'Dish Nation', as

well as SBI Audio and its slate of 50 established shows. These

shows are currently downloaded more than 12 million times per month

in aggregate.

Advertising sell through rates (the number of sold premium

advertising slots in a podcast) for Audioboom's Top 10 podcasts

averaged more than 84% in H1 2019. This strong performance has

enabled the Company to lengthen the terms of its contracts with

certain key partners, with these agreements being signed for terms

of 18 or 24 months.

New Content Partnerships

Audioboom signed exclusive commercial partnerships with several

major podcasts during the period, including 'A Cast Of Kings',

'What Happened When', 'Chatty Broads' and 'Small Town Dicks'. The

partnership with Studio 71 was extended to include major new shows

'OHoney' and 'Waveform' with Marques Brownlee.

An agreement was also signed with Main Event Media for Audioboom

to provide sales representation and technology platforming for Main

Event Media's podcast division, which will include a new show from

Jodie Sweetin and a podcast called 'TrumpMania'.

Audioboom Originals Network ('AON')

Audioboom continues to shift focus to the development of content

for the Audioboom Originals Network, which is home to owned and

operated podcasts that are fully developed through the Company's

in-house production teams, and co-productions whereby Audioboom

provides production, marketing and distribution support to its

production partners. AON podcasts typically deliver higher gross

margins, increased IP ownership and benefit from strategic

marketing and promotional activities across the entire network to

drive audience growth.

In H1 2019, Audioboom developed a new slate of AON podcasts to

complement its existing roster of 11 shows. Audioboom's current AON

podcast launch programme includes 'A Life Lived' (October), 'Truth

Vs Hollywood' (September), 'Notorious Killers' (September), 'Truly'

(October), and 'The Keto Guido Show'(August).

Established AON podcasts returning for new seasons in 2019

include 'Mafia', 'INBOX', and 'Covert'.

In July 2019, Audioboom completed construction of a new

recording studio complex within its New York City offices. The new

studios more than double the production capacity of the Audioboom

Originals Network.

The AON production 'Dead Man Talking' won the Silver Award at

the 2019 British Podcasting Awards in May 2019.

Sonic Influencer Marketing (Sonic IM)

The Sonic IM platform - which is part of the Audioboom Group,

but a separate and distinct brand to Audioboom, enabling brands to

secure advertising within any globally available podcast -

materially contributed to the Group's revenue in H1 2019. Since

launching in August 2018, more than 22 brands have utilised the

platform including Article, Sony Music UK, Instacart and

Outerknown.

Subscription Platform

In February 2019, the Company launched a new tier for its

podcast subscription service and also added new annual payment

options. The new 'Plus Plan' gives podcasters who do not have

advertising agreements with the Company, and who are achieving more

than 10,000 downloads per month, the ability to pay US$19.99 per

month to utilise Audioboom's hosting, distribution and analytics

platform. The 'Standard Plan' costs US$9.99 per month and limits

podcasters to 10,000 downloads per month. Users can now pay for

their subscription on an upfront, annual basis - where tiers are

priced at US$99 per year for the Standard Plan and US$199 per year

for the Plus Plan.

Market Overview

On 3 June 2019, the Interactive Advertising Bureau (IAB)

released the 2018 Podcast Ad Revenue Study, a detailed analysis of

the US podcast advertising industry, for which Audioboom was a

sponsor and contributor. The study reported that US podcast

advertising industry revenue for 2018 was US$479 million,

representing growth of 53% over 2017. The report also projected

that US podcast advertising industry revenue would be US$679

million in 2019 - representing year on year growth of 42% - and

that the US industry would generate revenues in excess of US$1

billion in 2021. Audioboom's year-on-year revenue growth for H1

2019 over H1 2018 was 171% - over four times the IAB growth rate

forecast for revenues of the US podcasting industry from 2018 to

2019.

Financial Review

Group revenue increased by 171% to US$9.8 million (H1 2018:

US$3.6 million). Adjusted EBITDA loss (earnings before interest,

tax, depreciation, amortisation, share based payments and material

one-off items) reduced by 49% to US$1.4 million (H1 2018: US$2.8

million). Total loss for the period materially reduced to US$2.8

million (H1 2018: US$5.2 million). The Company's financial

performance during the period was underpinned by above market-wide

revenue growth, particularly in our core US market, and the

material new revenue contribution of Sonic IM.

In this emerging podcast industry, Audioboom has developed

several revenue streams, all of which can take different forms,

yield different gross margins, but importantly, have all grown in

H1 2019. Adverts placed by Audioboom on third party content

typically generate gross margins of circa 25%, whereas adverts

placed on AON content generate gross margins of 40% and higher,

hence the focus on AON content.

Sonic IM, a Group company, generates revenue from brands

securing advertising within any global podcast and typically yields

a 15% gross margin. As Sonic IM continues to grow, Audioboom's

group gross margin is expected to be circa 25% due to the expected

mix of revenue and associated margin. All revenue streams are

contributing to the overall growth of the Company and, importantly,

are expected to continue to grow.

The significant majority of Audioboom's revenue is generated

through placing Host Endorsed Advertising on podcasts. Audioboom

focuses on Host Endorsed Advertising due to the high value and high

engagement factors associated with this form of advertising, which,

as a result, yield higher eCPM rates than Pre-Recorded Spot

Advertising. Due to the relatively low value, engagement and eCPM

rates associated with Pre-Recorded Spot Advertising, this is

expected to continue to be a relatively small part of Audioboom's

revenue mix going forwards. A further small, but growing, part of

Audioboom's revenue mix are headline sponsorship advertising deals

for podcasts which allow for advertising placements for an entire

content series. Finally, Audioboom has a number of subscribers

paying monthly or annual fees in order to access Audioboom's

hosting, distribution and analytics platform. Margins are

attractive for this revenue stream due to the relatively small

amount of content released and low hosting and distribution costs

incurred.

Cost control continues to be of upmost importance and, in H1

2019, we continued to align our cost base to our operational

demands. The savings made through the 2018 headcount reductions in

Audioboom are now being recognised with these savings being offset

following redeployment of resources into revenue generating sales

and content departments. We have also deployed new staff into Sonic

IM. We continue to see improving key financial metrics of reduced

debtor collection days, despite increasing revenue volume, and

creditor payments continue to be in line with our contractual

payment obligations with trade payables and accrued costs (US$3.7

million) remaining comparable with December 2018 (US$3.9

million).

The GBP4.3 million of growth funding raised in H1 2019 allows

Audioboom to fund its rapidly increasing portfolio of high revenue

producing, established podcasts and talent, specifically in its

core US operations. The Company is able to compete for and win

established podcasts by offering highly competitive, fully

recoupable advance payments and minimum monthly guarantees to the

creators of popular podcasts, due to its accurate podcast revenue

forecasting capability.

Operating cash outflow before working capital movements has

significantly reduced from US$4.9 million (H1 2018) to US$1.8

million (H1 2019) as a result of the overall loss of the Company

materially reducing. Adverse working capital movements have been

incurred in H1 2019 due to the Company fulfilling a number of

material recoupable advance payments to retain existing and attract

new podcast partners. Furthermore, increased revenue volume in H1

2019 has led to a US$1.2 million increase in trade debtors since 31

December 2018. This has resulted in operating cash outflow of

US$3.8 million in H1 2019 (H1 2018: US$2.5 million).

The new content funding facility agreement with SPV Investments

Ltd announced on 17 June 2019 will, to an extent, decrease the

pressure on the capital required to secure the aforementioned high

revenue producing podcasts. The special purpose vehicle ('SPV'),

which has been established and is owned equally by Michael Tobin,

the Company's Chairman, and Candy Ventures sarl, the Company's

largest shareholder, will provide minimum revenue guarantees to

certain leading content partners of the Company. Audioboom will pay

the SPV 8% of the net advertising revenue (after paying the content

partner its share) received by Audioboom, in relation to those

podcasts.

Share Consolidation

Following the passing of resolutions at the Annual General

Meeting on 20 June 2019, the share consolidation was effected on 21

June 2019 such that every 100 existing ordinary shares of no par

value were consolidated into one new ordinary share of no par

value.

Outlook

The strong growth recognised in H2 2018 has continued into H1

2019 with impressive revenue performance and, importantly, a

materially reduced EBITDA and total loss position. The internal

improvements made on how we book inventory and associated

advertising revenue gives us the visibility that this strong

performance has continued into H2 2019, and as such, we expect to

meet the current market expectations for the year.

I would like to take this opportunity to thank the management

team and staff for their continued hard work and commitment during

the first half of 2019 and look forward to the second half of the

year with renewed and increased optimism.

Rob Proctor

Chief Executive Officer

Audioboom Group PLC

Consolidated Statement of Comprehensive Income

Unaudited Unaudited Audited

6 months 6 months 13

to 30 June to 31 May months

2019 2018 to 31 Dec

2018

Notes US$'000 US$'000 US$'000

Continuing operations

Revenue 2 9,844 3,639 11,656

Cost of sales (7,553) (2,759) (8,505)

------------ ----------- -----------

Gross profit 2,291 880 3,151

Administrative expenses (5,043) (6,104) (11,381)

Adjusted operating loss (1,418) (2,807) (4,678)

- Amortisation of intangible

assets (205) (270) (578)

- Share based payments (882) (110) (385)

- Depreciation (30) (44) (77)

- Corporate transaction

costs - (1,647) (1,708)

- Depreciation - leases

/ Rent - leases 1 (166) (233) (411)

- Restructuring costs (51) (113) (393)

Operating loss (2,752) (5,224) (8,230)

Finance costs (18) (59) (130)

------------ ----------- -----------

Loss before tax (2,770) (5,283) (8,360)

Income tax credit 1 128 272

------------ ----------- -----------

Loss for the financial

period (2,769) (5,155) (8,088)

Other comprehensive income

Foreign currency translation

difference (134) (22) (450)

------------ ----------- -----------

Total comprehensive loss

for the period (2,903) (5,177) (8,538)

============ =========== ===========

Loss per share

from continuing operations

Basic and diluted 3 (23) cents (55) cents (77) cents

Audioboom Group PLC

Consolidated Statement of Financial Position

Unaudited Unaudited Audited

as at 30 as at 31 as at

June 2019 May 2018 31 Dec

2018

Notes US$'000 US$'000 US$'000

ASSETS

Non-current assets

Intangible assets 5 2,237 2,870 2,420

Property, plant and equipment 110 148 152

Leases 1,631 - -

3,978 3,018 2,572

----------- ---------- ---------

Current assets

Trade and other receivables 6 6,171 3,613 4,169

Cash and cash equivalents 3,351 440 1,581

9,522 4,053 5,750

----------- ---------- ---------

TOTAL ASSETS 13,500 7,071 8,322

----------- ---------- ---------

Current liabilities

Trade and other payables 7 (5,752) (5,354) (4,087)

Borrowings and other financial - (2,006) -

liabilities

Deferred taxation (197) (252) (203)

(5,949) (7,612) (4,290)

----------- ---------- ---------

Net current assets / (liabilities) 3,573 (3,559) 1,460

----------- ---------- ---------

NET ASSETS / (LIABILITIES) 7,551 (541) 4,032

=========== ========== =========

Equity

Share capital - - -

Share premium 4 56,423 43,224 50,883

Issue cost reserve (2,048) (2,048) (2,048)

Foreign exchange translation

reserve (664) (103) (530)

Reverse acquisition reserve (3,380) (3,380) (3,380)

Retained earnings (42,780) (38,234) (40,893)

TOTAL EQUITY 7,551 (541) 4,032

=========== ========== =========

Audioboom Group PLC

Consolidated Cash Flow Statement

Unaudited Unaudited Audited

six months six months 13 months

to 30 June to 31 May to 31 Dec

2019 2018 2018

US$'000 US$'000 US$'000

Loss from continuing operations (2,769) (5,155) (8,088)

------------ ------------ -----------

Loss for the period (2,769) (5,155) (8,088)

Adjustments for:

Taxation (1) (128) (272)

Interest 18 59 -

Depreciation of fixed assets 30 44 77

Effect of retranslation of

fixed assets 13 2 25

Amortisation of intangible

assets 205 270 578

Effect of retranslation of

intangible assets (22) 41 183

Share based payments 882 110 385

Taxation - - 214

Foreign exchange loss (153) (100) (715)

------------ ------------ -----------

Cash flows from operating

activities before working

capital movements (1,797) (4,857) (7,613)

Increase in trade and other

receivables (2,003) (302) (856)

Increase in trade and other

payables (excluding leases) 34 2,679 1,413

Net cash used in operating

activities (3,766) (2,480) (7,056)

------------ ------------ -----------

Investing activities

Purchase of property, plant

and equipment - (71) (82)

------------ ------------ -----------

Net cash used in investing activities - (71) (82)

------------ ------------ -----------

Financing activities

Proceeds from issue of convertible

loan instrument - 2,082 1,995

Convertible loan interest

and fee - (59) (130)

Proceeds from issue of ordinary

share capital 5,540 - 5,794

------------ ------------ -----------

Net cash generated from financing

activities 5,540 2,023 7,659

------------ ------------ -----------

Net increase/(decrease) in cash

and cash equivalents 1,774 (528) 521

------------ ------------ -----------

Cash and cash equivalents at beginning

of period 1,581 968 968

Effect of foreign exchange

rate changes (4) - 92

------------ ------------ -----------

Cash and cash equivalents

at end of period 3,351 440 1,581

============ ============ ===========

Audioboom Group PLC

Consolidated Statement of Changes in Equity

Share premium Other reserves Retained Total equity

earnings

US$'000 US$'000 US$'000 US$'000

-------------- --------------- ---------- -------------

At 30 November

2017 43,224 (5,508) (33,190) 4,526

-------------- --------------- ---------- -------------

Loss for

the period - - (5,155) (5,155)

Issue of - - - -

shares

Equity-settled

share-based

payments - - 110 110

Other comprehensive

income - (22) - (22)

At 31 May

2018 43,224 (5,530) (38,235) (541)

-------------- --------------- ---------- -------------

Loss for

the period - - (2,933) (2,933)

Issue of

shares 7,659 - - 7,659

Equity-settled

share-based

payments - - 275 275

Other comprehensive

income - (428) - (428)

At 31 December

2018 50,883 (5,958) (40,893) 4,032

-------------- --------------- ---------- -------------

Loss for

the period - - (2,769) (2,769)

Issue of

shares 5,540 - - 5,540

Equity-settled

share-based

payments - - 882 882

Other comprehensive

income - (134) - (134)

At 30 June

2019 56,423 (6,092) (42,780) 7,551

-------------- --------------- ---------- -------------

Other reserves relate to the following reserves: Issue Cost

Reserve, Foreign Exchange Translation Reserve and the Reverse

Acquisition Reserve. Full details are disclosed in the 2018 Annual

Report.

Audioboom Group plc

Notes to the financial statements

1. General information and basis of preparation

Audioboom Group plc is incorporated in Jersey under the

Companies (Jersey) Law 1991. The Company's ordinary shares of no

par value are traded on AIM, a market operated by the London Stock

Exchange ("AIM").

These consolidated interim financial statements, which are

unaudited, have been approved by the Board of Directors on 17 July

2019. They have been drawn up using the accounting policies and the

basis of presentation expected to be adopted in the Group's full

financial statements for the year ending 31 December 2019, which

are not expected to be significantly different to those set out in

note 1 to the Company's audited financial statements for the 13

month period ending 31 December 2018.

The consolidated interim financial statements have been prepared

under the historical cost convention and in accordance with

International Financial Reporting Standards ("IFRS") and with IAS

34 "Interim financial reporting", as adopted by the EU.

The preparation of financial statements in accordance with IFRS

requires the use of estimates and assumptions that affect the

reported amounts of assets and liabilities, and disclosure of

contingent assets and liabilities as at the date of the financial

statements and the reported amounts of revenues and expenses during

the reporting period. Although these estimates are based on

management's best knowledge of current events and actions, actual

results may ultimately differ from those estimates.

Going concern

These interim financial statements have been prepared on the

going concern basis, which assumes that the Group will have

sufficient funds to continue in operational existence for the

foreseeable future. Following the placing and subscriptions to

raise a total of GBP4.3 million (before expenses) in H1 2019, the

Board's forecasts for the Group, including due consideration of the

continued operating losses, projected increase in revenues and

decreasing cash-burn of the Group (and taking account of reasonably

possible changes in trading performance), indicate that the Group

will have sufficient cash available to continue in operational

existence for the next 12 months and beyond. The Board believes

that the Group is well placed to manage its business risks, and

longer-term strategic objectives, successfully. Therefore, the

Directors consider the going concern basis appropriate.

IFRS 16: leases

The modified retrospective approach to IFRS 16 transition has

been applied. There is deemed to be no impact on reserves brought

forward. The retrospective charge for lease rental during prior

periods has been stated so as to display comparative figures.

2. Revenue

The Group's operations are principally located in the UK and the

USA. The main assets of the Group, cash and cash equivalents, are

held in Jersey. The Group's revenue from external customers by

geographical location is detailed below:

Unaudited Unaudited Audited

six months six months 13 months

to 30 June to 31 May to 31 Dec

2019 2018 2018

US$'000 US$'000 US$'000

United Kingdom 1,095 507 1,901

Rest of World 13 30 42

USA 8,736 3,102 9,713

------------ ------------ -----------

Total 9,844 3,639 11,656

============ ============ ===========

3. Loss per share

Basic earnings per share is calculated by dividing the loss

attributable to shareholders by the weighted average number of

ordinary shares in issue during the period.

IAS 33 requires presentation of diluted EPS when a company could

be called upon to issue shares that would decrease earnings per

share, or increase the loss per share. For a loss-making company

with outstanding share options, net loss per share would be

decreased by the exercise of share options. Therefore, as per IAS

33:36, the antidilutive potential ordinary shares are disregarded

on the calculation of diluted EPS.

On 21 June 2019, the Company consolidated every 100 existing

ordinary shares of no par value into one new ordinary share of no

par value.

Reconciliation of the loss and weighted average number of

ordinary shares used in the calculation detailed in this note have

been updated historically to represent the 100:1 share

consolidation on 21 June 2019:

30-Jun-19

Loss Weighted average Per share

number of shares amount

Basic and Diluted EPS US$'000 Thousand Cents

Loss attributable to shareholders:

- Continuing and discontinued

operations (2,769) 12,238 (23)

31-May-18

Loss Weighted average Per share

number of shares amount

Basic and Diluted EPS US$'000 Thousand Cents

Loss attributable to shareholders:

- Continuing and discontinued

operations (5,155) 9,306 (55)

31-Dec-18

Loss Weighted average Per share

number of shares amount

Basic and Diluted EPS US$'000 Thousand Cents

Loss attributable to shareholders:

- Continuing and discontinued

operations (8,088) 10,474 (77)

4. Share Capital

On 21 June 2019, the Company consolidated every 100 existing

ordinary shares of no par value into one new ordinary share of no

par value.

The issued and fully paid ordinary shares of no par value

detailed in this note have been updated historically to represent

the 100:1 share consolidation on 21 June 2019.

Issued and fully paid - ordinary shares of no par value

At 31 December 2018 (adjusted

for share consolidation) 11,732,909

At 30 June 2019 14,006,757

The total number of instruments over equity (including both

share options and warrants) outstanding at the period end was

1,985,244.

Those amounts raised via subscriptions and placings are stated

in sterling in supporting notes and commentary as the Group raises

funds primarily in sterling. Equity is translated on the

consolidated statement of financial position in US dollars as the

Group's primary reporting currency is US dollars.

The following share subscription notes are quoted before (and

after) the 100:1 share consolidation, which was completed on 21

June 2019.

In February 2019, the Company announced a subscription to raise

gross proceeds of GBP1.5 million to fund its rapidly increasing

portfolio of podcasting content. 115,384,670 (1,153,847) ordinary

shares were issued at a price of 1.3p (GBP1.30) per ordinary share

with the proceeds predominantly being used to meet the upfront

payments required to secure new and existing podcast content and

their audiences.

In May 2019, the Company concluded a placing and subscription

raising further gross proceeds of GBP2.8 million to fund growth.

112,000,000 (1,120,000) ordinary shares were issued at a price of

2.5p (GBP2.50) per ordinary share with the proceeds predominantly

being used to accelerate the acquisition of established podcast

content and their audiences, development of co-production content

partnerships and AON productions, to deliver valuable original

content.

5. Intangible assets

Cost Software Intellectual

development property Goodwill Total US$'000

US$'000 US$'000 US$'000

At 31 December 2018 and

30 June 2019 576 2,164 883 3,623

Amortisation charged in

the period (54) (151) - (205)

Foreign exchange effect 6 16 - 22

Carried forward at 30 June

2019 (171) (1,215) - (1,386)

Net book value 30 June

2019 405 949 883 2,237

-------------- -------------- ----------- ----------------

Net book value 31 December

2018 453 1,084 883 2,420

============== ============== =========== ================

Software development and intellectual property are being

amortised over a period of five years and have economic useful

lives of between four and five years remaining.

6. Trade and other receivables

The trade and other receivables at the end of the period

comprised US$4.4 million relating to trade debtors and accrued

sales income, and US$1.8 million relating to deposits, prepaid

expenses and advance talent payments.

7. Trade and other payables

The trade and other payables at the end of the period comprised

US$3.7 million relating to trade payables and accrued content

partner costs. The Company currently accrues all costs based on

contract terms. Due to a minimum payable value, some partners have

not attained the threshold level to receive a payment. Other

payables total US$0.5 million. Payables relating to leases total

US$1.6 million, following the modified retrospective approach to

IFRS 16 transition being applied.

8. Related party transactions

The following share subscription, issue of warrants and special

purpose vehicle notes are quoted before (and after) the 100:1 share

consolidation, which was completed on 21 June 2019.

Share subscriptions

Candy Ventures sarl subscribed for 46,153,850 (461,539) new

ordinary shares at 1.3p (GBP1.30) in February 2019 and a further

42,400,000 (424,000) new ordinary shares at 2.5p (GBP2.50) in May

2019. Candy Ventures sarl is the Company's largest shareholder and

an investment vehicle 90% owned by Nick Candy. Steven Smith, a

non-executive Director of the Company, is a 10% shareholder and

director of Candy Ventures sarl.

Michael Tobin, non-executive Chairman of the Company, subscribed

for 3,846,160 (38,462) ordinary shares at 1.3p (GBP1.30) in

February 2019 and a further 3,600,000 (36,000) ordinary shares at

2.5p (GBP2.50) in May 2019.

Roger Maddock, a non-executive Director of the Company,

subscribed for 3,846,160 (38,462) ordinary shares at 1.5p (GBP1.50)

in February 2019 and a further 2,000,000 (20,000) ordinary shares

at 2.5p (GBP2.50) in May 2019. The Preston Trust (being a trust for

the benefit of the family of Roger Maddock) subscribed for

4,000,000 (40,000) ordinary shares at 2.5p (GBP2.50) in May

2019.

Warrants

In order to allow the subscription shares in February 2019 to be

issued on a timely basis and within the Company's existing share

allotment authorities and without the need to convene an

extraordinary general meeting of the Company, Michael Tobin agreed

that the exercise of his 30,000,000 (300,000) warrants (split into

three tranches of 10,000,000 (100,000) warrants) over new ordinary

shares, awarded to him on 3 September 2018, be made conditional

upon the Company obtaining shareholder authorities to allot and

issue the new ordinary shares arising on exercise of the warrants

free of pre-emption rights. Such authority was granted at a general

meeting held on 21 May 2019. In return, and in recognition that

such warrants should be an incentive, the Company agreed to (a)

lower the exercise prices of the warrants from 2.4p (GBP2.40), 4.4p

(GBP4.40) and 6.4p (GBP6.40) to 1.3p (GBP1.30), 3.3p (GBP3.30) and

5.3p (GBP5.30) respectively and (b) lower the share price hurdle

for exercise of the second and third tranche of the warrants from

4.4p (GBP4.40) and 6.4p (GBP6.40) to 3.3p (GBP3.30) and 5.3p

(GBP5.30) respectively.

In addition, and in order to obtain a substantial participation

in the subscription, the Company agreed with Nick Candy to extend

the exercise period of 12,000,000 (120,000) warrants over new

ordinary shares held by him, granted pursuant to an agreement dated

2 April 2016, from 2 April 2019 to 31 March 2024. These warrants

have an exercise price of 2.5p (GBP2.50) per ordinary share.

Special Purpose Vehicle

On 17 June 2019, the Company agreed a new content funding

facility with SPV Investments Ltd, a special purpose vehicle

('SPV') which has been established and is owned equally by Michael

Tobin, the Company's Chairman, and Candy Ventures sarl, the

Company's largest shareholder. The SPV will provide minimum revenue

guarantees to certain leading new content partners of the Company.

Audioboom will pay the SPV 8% of the net advertising revenue (after

paying the content partner its share) received by Audioboom, in

relation to those podcasts. The underlying providers of the

guarantees will be granted 2,500,000 (25,000) warrants to subscribe

for ordinary shares in the Company for every US$1 million of

guarantee provided, subject to a maximum of 10,000,000 (100,000)

warrants. The exercise price of these warrants will be 3.3p

(GBP3.30) per ordinary share each, with such warrants being

exercisable for five years from grant. The first guarantee provided

by the SPV in June 2019 led to an initial grant of an aggregate of

2,500,000 (25,000) warrants split equally between Michael Tobin and

Candy Ventures sarl.

9. Share-based payments

The following share-based payments notes are quoted before (and

after) the 100:1 share consolidation, which was completed on 21

June 2019.

The Company has share option schemes for employees of the

Company and, in March 2019, the Company made grants of options to

subscribe for new ordinary shares in the Company to certain of its

Directors and employees. These included grants to Rob Proctor,

Chief Executive Officer, of 25,000,000 (250,000) options with an

exercise price of 1.3p (GBP1.30) and to Brad Clarke, Chief

Financial Officer, of 12,000,000 (120,000) options with an exercise

price of 1.3p (GBP1.30). Following these grants and the share

consolidation, the total options held by Rob Proctor are 457,231

and by Brad Clarke are 185,000.

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR VDLFFKDFXBBV

(END) Dow Jones Newswires

July 18, 2019 02:00 ET (06:00 GMT)

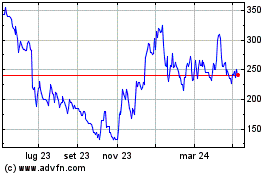

Grafico Azioni Audioboom (LSE:BOOM)

Storico

Da Mar 2024 a Apr 2024

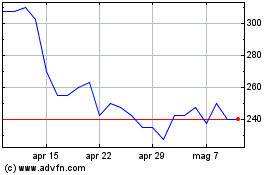

Grafico Azioni Audioboom (LSE:BOOM)

Storico

Da Apr 2023 a Apr 2024