TIDMQTX

RNS Number : 4803G

Quartix Holdings PLC

24 July 2019

24 July 2019

Quartix Holdings plc

("Quartix", "the Group" or "the Company")

Interim Results

Quartix Holdings plc (AIM:QTX), a leading supplier of vehicle

tracking systems and services to the fleet and insurance sectors,

is pleased to announce its unaudited results for the half year

ended 30 June 2019.

Financial highlights:

-- Group revenue decreased by 3% to GBP12.5m (2018: GBP12.9m)

o Fleet revenue grew by 11% to GBP10.1m (2018: GBP9.1m)

o Insurance revenue declined by 35% to GBP2.5m (2018:

GBP3.8m)

-- Operating profit of GBP3.2m (2018: GBP3.8m)

-- Adjusted EBITDA(1) of GBP3.5m (2018: GBP4.1m)

-- Profit before tax of GBP3.2m (2018: GBP3.9m)

-- Diluted earnings per share of 5.67p (2018: 6.86p)

-- Free cash flow(2) increased by 12% to GBP3.2m (2018: GBP2.8m)

-- Cash generated from operations increased by 5% to GBP3.5m (2018: GBP3.3m)

-- Net cash increased to GBP5.1m (2018: GBP4.9m)

-- Operating cash conversion(3) of 109% (2018: 86%)

-- Interim dividend of 2.4p per share proposed

(1) Earnings before interest, tax, depreciation, amortisation

and share based payment expense (see note 3)

(2) Cash flow from operations after tax and investing

activities

(3) Cash generated from operations of GBP3.5m divided by

operating profit of GBP3.2m

Operational highlights

Fleet

Excellent progress in the main fleet business

-- Subscription base grew by 12% to 138,081 vehicles (31(st) December 2018: 123,157)

-- Annual value of subscription base increased by GBP1.2m to

GBP20.0m on a constant-currency basis (6 months 30 June 2018:

GBP0.7m to GBP17.7m)

-- Fleet installations grew by 48% to 22,505 (6ms 30 June 2018: 15,220)

-- Customer base increased by 13% to 14,851 (31(st) December 2018: 13,176)

-- Fleet invoiced recurring revenue increased by 12% to GBP9.4m (6ms 30 June 2018: GBP8.4m)

-- Attrition(1) on a rolling 12-month basis was 10.5% (12 months 30 June 2018: 12.0%)

-- Significant increase in marketing, sales resource,

distribution, tracking systems and installation spend to drive

subscription growth.

(1) Attrition is calculated as the difference between the number

of new unit installations and the increase in active subscriptions

between 1 July 2018 and 30 June 2019, expressed as a percentage of

the mean subscription base between those two points in time:

(38,740-25,551)/125,305 = 10.5%

UK

-- New fleet installations increased by 49% to 13,360 units (6 months June 2018: 8,990)

-- 99,055 active vehicle subscriptions, up 9% (31 December 2018: 91,137)

-- 9,431 customers, up 9% (31 December 2018: 8,675)

France

-- New fleet installations increased by 58% to 4,465 (6 months June 2018: 2,820)

-- 22,440 active vehicle subscriptions, up 19% (31 December 2018: 18,803)

-- 2,967 customers, up 20% (31 December 2018: 2,474)

Other European (Ireland, Poland, Spain)

-- 482 active vehicle subscriptions

-- 121 customers

USA

-- New fleet installations increased by 28% to 4,365 units (6 months June 2018: 3,400)

-- 16,104 active vehicle subscriptions, up 23% (31 December 2018: 13,133)

-- 2,332 customers, up 16% (31 December 2018: 2,007)

Insurance

-- Insurance installations declined by 29% at 17,069 (6 months June 2018: 23,969).

-- Insurance revenue declined by GBP1.3m (35%) to GBP2.5m (6 months June 2018: GBP3.8m).

Andy Walters, Chief Executive Officer of Quartix, commented:

"We are delighted with the expansion of our fleet subscription

base in the First Half, which resulted from an increased level of

investment in customer acquisition. New fleet installations grew by

48% compared with the same period last year. We also invested in

R&D, business systems and new market development, having

successfully launched our telematics services in Poland and

Spain.

We are well positioned for future growth in our fleet business

and continue to review the opportunities to invest in this further.

We remain confident of at least meeting expectations for revenue,

profit and cashflow for the year."

For further information, please contact:

Quartix (www.quartix.net) 01686 806 663

Andrew Walters, Chief Executive Officer

Daniel Mendis, Chief Financial Officer

finnCap (Nominated Adviser and Broker) 020 7200 0500

Matt Goode /Scott Mathieson (Corporate Finance)

Alice Lane (Corporate Broking)

Cantor Fitzgerald Europe (Joint Broker) 020 7894 7000

Phil Davies & Richard Salmond (Corporate Finance)

Caspar Shand-Kydd & Arthur Gordon (Sales)

The information communicated in this announcement is inside

information for the purposes of Article 7 of Regulation

596/2014.

Interim Financial Results Report

The Group's Interim Financial Statements for the 6 months ended

30 June 2019 are available in the "Investors" section of our

website at: www.quartix.net/investors

About Quartix

Founded in 2001, Quartix is a leading supplier of

subscription-based vehicle tracking systems, software and services.

The Group provides an integrated tracking and telematics data

analysis solution for fleets of commercial vehicles and motor

insurance providers which improves productivity and safety and

which lowers costs by capturing, analysing and reporting vehicle

and driver data.

Quartix is based in the UK and is listed on the AIM market of

the London Stock Exchange (AIM:QTX).

Chairman's Statement

Summary

Increased investment in our fleet tracking business has driven

strong growth in the subscription base

It is pleasing to report very strong growth in new fleet

installations, which increased by 48% to 22,505 units in the first

half year (6 months 30 June 2018: 15,220 units). We ended the

period with a committed subscription base of 138,081 vehicles

having an annualised value of GBP20.0m (30 June 2018: 112,530, with

value of GBP17.7m on a constant currency basis), and we added 1,675

customers to the client base, reaching 14,851 in total.

In the 5 years since 30 June 2014 (the Company's year of

admission to AIM), Quartix has maintained a CAGR of 21.0% in its

subscription base (from 53,197 to 138,081 vehicles), of which the

annualised value has almost doubled from GBP10.2m to its current

level of GBP20.0m.

We significantly increased investment in marketing, sales

resource, distribution, tracking systems and installation costs for

our fleet operations. In line with the Company's accounting

policies these costs were all expensed as incurred, amounting to an

increase of GBP1.0m compared to the same period in 2018. This

investment will generate strong recurring revenues for the future

and it is pleasing to be able to report a strong set of financial

results even with this investment in the future. A more detailed

breakdown of investments in customer acquisition is shown in the

segmental analysis (note 2). This analysis demonstrates the

increased profitability attributable to our fleet customer base and

the growth in investment made to accelerate our customer

acquisition activities, as detailed above.

The following paragraphs provide a summary of activity and

results in each market

UK

Total sales in the UK were GBP10.1m (2018: GBP11.1m). Sales to

fleet customers in this market increased by 5% to GBP7.7m (2018:

GBP7.3m) and the subscription base grew to 99,055 vehicles,

representing an increase of 15% over the past 12 months (30 June

2018: 86,217). This rate of growth compared to last year resulted

from new installations which were 49% higher, at 13,360 vehicles,

than in the prior year (2018: 8,990). This success was driven by

improvements in the management of each of our channels: field

sales, direct telesales, price comparison sites and distribution.

We have identified further opportunities for improvement and will

continue to invest in each channel.

France

The Group made excellent progress in France, where the

subscription base rose by 46% over the past year to 22,440 vehicles

(30 June 2018: 15,390). Development of each channel to market is

ongoing and revenue in France in the first half increased by 33% in

local currency to EUR1.7m (2018: EUR1.3m). Our distribution network

provided the strongest contribution to growth, but we also achieved

impressive sales performance through our direct telesales and price

comparison channels. All three channels will receive further

investment in the second half.

USA

The Group continued to develop its operations successfully in

the USA, taking its subscription base to 16,104 vehicles. This is

49% higher than it was 12 months ago (30 June 2018: 10,840).

Revenue increased by 30% to $1.2m (2018: $0.9m). Growth was equally

split between our direct telesales and price comparison channels.

We significantly increased the size of the sales team for the

latter during the period and, now that training has been completed,

we intend to increase our marketing budgets for both channels. A

significant amount of resource and time was dedicated to creating a

distribution support team for the USA, and initial results were

being seen by the end of the period. We believe that this offers an

additional growth opportunity.

Poland, Spain, Ireland and Hispanic market of the USA

Initial results from the Company's marketing initiatives in

Poland and Spain have been encouraging, with approximately 50 new

clients won in each market so far. A Spanish-language version of

the US website went live in May, as the Company believes that SME

businesses in the Hispanic community represent a significant market

opportunity. A dedicated website for Ireland was also launched.

Italy and further regional developments

The Company launched a marketing website for the Italian market

earlier this month (www.quartix.it) and this is expected to be

followed by an equivalent for Germany together with full

application support in Italian and German. In each case these

developments will be backed by sales recruitment in the UK and

initial marketing investments.

R&D and systems developments

The Company's "new-look" browser-based and mobile applications,

which were launched in October 2018, have been well received by

clients and prospects alike. They have also formed the basis of

each of the launches in new territories listed above. New

telematics system designs, particularly those offering easy

self-installation options, have also contributed strongly to the

Company's growth in the period. Quartix received carrier-level and

PTCRB certification of its new 4G telematics system for the USA,

and the core of this design (hardware and firmware) will eventually

provide the basis for both its European and American product

offerings.

A dedicated team of systems and software developers is focused

exclusively on the enhancement of the Company's internal processes,

and a significant number of improvements in process efficiency were

achieved in the first half, and more are planned for the rest of

the year.

Insurance

The Company's strategy of focusing on fleet operations, and of

reducing its commitment to the insurance telematics market has

started to show strong results, as highlighted above. Technology

and services developed for the insurance sector have been a

contributory factor in many of the new fleet contracts won in the

first half.

It has become clear that some telematics companies which have

focused on the insurance sector are showing some signs of weakness

in terms of service levels or financial performance. Quartix will

therefore continue to consider insurance business which is cash

generative and which properly values the technology and service

quality it provides. Revenue in this sector declined by 35% to

GBP2.5m, which now represents 20% of turnover. New installations

for our insurance clients decreased by 29% to 17,069.

Further information on the contribution from this business can

be seen in the segmental analysis (note 2).

Results

Group revenue for the half year was GBP12.5m (2018: GBP12.9m).

Fleet revenue grew by 11% to GBP10.1m (2018: GBP9.1m) and insurance

revenue declined to GBP2.5m (2018: GBP3.8m). Sales to the insurance

sector as a percentage of overall revenue reduced to 20% (2018:

29%). Increased focus on our core fleet business led to the

recurring element of subscriptions growing to represent 75% of

Group turnover (2018: 65%) and the fleet business representing 83%

of segmental profit before central costs (see note 2) (2018: 74%).

Although the higher level of this subscription revenue helps to

improve the margin mix, we also funded growth of 48% in new fleet

installations for the period (2019: 22,505 units installed; 2018:

15,220 units installed). The cost of all new fleet tracking systems

and installations is absorbed in cost of sales. Consequently, gross

profit decreased by 6% to GBP8.0m and gross margin to 63% (2018:

65%). With the impact of investment in marketing activities,

operating profit for the half year decreased by 17% to GBP3.2m

(2018: GBP3.8m). Profit before tax for the half year also therefore

decreased by 17% to GBP3.2m (2018: GBP3.9m).

Operating cash conversion was 109% (2018: 86%), resulting in

pre-tax cash generated from operations of GBP3.5m (2018: GBP3.3m).

Free cash flow conversion, being free cash flow as a proportion of

profit for the period, was 117%, resulting in free cash flow from

operations after tax and investing activities of GBP3.2m (2018:

GBP2.8m). The Group had net cash of GBP5.1m as at 30 June 2019

(GBP4.9m at 30 June 2018), having paid a dividend of GBP4.8m in

May.

Earnings per share

Basic earnings per share were 5.67p (2018: 6.89p). On a diluted

basis earnings per share were 5.67p (2018: 6.86p).

Dividend

The Board has recommended an interim dividend of 2.4p (2018:

2.4p) per share, amounting to GBP1,150,520 in aggregate. This was

approved by the Board on 23 July 2019. The interim dividend will be

paid on 13 September 2019 to shareholders on the register as at 16

August 2019.

Dividend Policy

The Board will consider a final dividend for the year with the

aggregate of the interim and final dividend set at approximately

50% of cash flow from operating activities, which is calculated

after taxation paid but before capital expenditure. The Board will

also consider distributing the excess of cash balances over GBP2m

by way of supplementary dividends. The surplus cash would be

calculated by taking the year end cash balance and deducting the

proposed regular dividend. The policy will be subject to

review.

Governance and the Board

The Board is comprised of two Non-Executive Directors: myself

and Jim Warwick, and two Executive Directors: Andrew Walters and

Daniel Mendis.

For further details regarding Corporate Governance and the

Board, please see the "Investors" section of our website

(www.quartix.net/investors).

Outlook

The Group has made a good start to the second half, in line with

management's expectations. The high levels of recurring revenue and

opportunities to grow in the UK, USA, France, the rest of Europe in

fleet underpin our confidence for the rest of the year and beyond.

We will continue to use the financial strength of the business to

invest in our core fleet operations.

Paul Boughton

Chairman

Consolidated Statement of Comprehensive Income

31 December

30 June 2019 30 June 2018 2018

Half year ended 30 June 2019 Unaudited Unaudited Unaudited

Notes GBP'000 GBP'000 GBP'000

============= ============= =============

Revenue 2 12,552 12,913 25,706

Cost of sales (4,596) (4,457) (8,543)

------------- ------------- -------------

Gross profit 7,956 8,456 17,163

Administrative expenses (4,773) (4,612) (9,122)

------------- ------------- -------------

Operating profit 3,183 3,844 8,041

Finance income receivable 19 14 29

Finance costs payable (11) - -

Profit for the period before taxation 3,191 3,858 8,070

Tax expense (473) (576) (1,210)

Profit for the period 2,718 3,282 6,860

Other Comprehensive income:

Items that may be reclassified subsequently to profit or

loss:

Exchange difference on translating foreign operations (20) (66) (158)

Other comprehensive income for the year, net of tax (20) (66) (158)

============= ============= =============

Total comprehensive income attributable to the equity

shareholders of Quartix Holdings plc 2,698 3,216 6,702

============= ============= =============

Adjusted EBITDA 3 3,508 4,061 8,334

----------------------------------------------------------- ------ ------------- ------------- -------------

Earnings per ordinary share (pence) 4

Basic 5.67 6.89 14.38

Diluted 5.67 6.86 14.19

============= ============= =============

Consolidated Statement of Financial Position

Company registration number: 06395159

30 June 2019 30 June 2018 31 December 2018

Unaudited Unaudited Unaudited

Assets Notes GBP'000 GBP'000 GBP'000

============= =============== ===================

Non-current assets

Goodwill 14,029 14,029 14,029

Property, plant and equipment 360 221 433

Right-of-use asset 407 - -

Deferred tax assets - 577 9

============= =============== ===================

Total non-current assets 14,796 14,827 14,471

Current assets

Inventories 923 813 771

Trade and other receivables 2,970 3,009 2,937

Cash and cash equivalents 5,077 4,886 6,779

------------- --------------- -------------------

Total current assets 8,970 8,708 10,487

Total assets 23,766 23,535 24,958

Current liabilities

Trade and other payables 2,917 2,771 2,814

Finance lease liabilities 7 169 - --

Contract liabilities 4,662 5,460 4,655

Current tax liabilities 285 429 99

============= =============== ===================

8,033 8,660 7,568

Non-current liabilities

Finance lease liabilities 7 282 - -

Deferred tax liabilities 42 - -

324 - -

Total liabilities 8,357 8,660 7,568

Net assets 15,409 14,875 17,390

============= =============== ===================

Equity

Called up share capital 6 480 477 478

Share premium account 6 5,230 4,925 5,196

Equity reserve 410 555 390

Capital redemption reserve 4,663 4,663 4,663

Translation reserve (281) (169) (261)

Retained earnings 4,907 4,424 6,924

============= =============== ===================

Total equity attributable to equity shareholders of

Quartix Holdings plc 15,409 14,875 17,390

============= =============== ===================

Consolidated Statement of Changes in Equity

Share Capital

Share premium redemption Equity Translation Retained

capital account reserve reserve reserve earnings Total equity

GBP'000 GBP,000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------- ------------ ------------ ------------- ------------- ------------- -------------

Balance at 31

December 2017 476 4,869 4,663 529 (103) 9,018 19,452

IFRS 15

adjustment - - - - - (2,645) (2,645)

Restated 31

December 2016 476 4,869 4,663 529 (103) 6,373 16,807

Shares issued 1 56 - - - - 57

Increase in

equity

reserve in

relation to

options

issued - - - 140 - - 140

Adjustment for

exercised

options - - - (64) - 64 -

Deferred tax

on share

options (50) (50)

Dividend paid - - - - - (5,295) (5,295)

------------- ------------ ------------ ------------- ------------- ------------- -------------

Transactions

with owners 1 56 - 26 - (5,231) (5,148)

------------- ------------ ------------ ------------- ------------- ------------- -------------

Foreign

currency

translation

differences - - - - (66) - (66)

Profit for the

period

restated - - - - - 3,282 3,282

------------- ------------ ------------ ------------- ------------- ------------- -------------

Total

comprehensive

income - - - - (66) 3,282 3,216

------------- ------------ ------------ ------------- ------------- ------------- -------------

Balance at 30

June 2018 477 4,925 4,663 555 (169) 4,424 14,875

============= ============ ============ ============= ============= ============= =============

Shares issued 1 271 - - - - 272

Increase in

equity

reserve in

relation to

options

issued - - - (32) - - (32)

Adjustment for

exercised

options - - - (69) - 69 -

Deferred tax

on share

options - - - (64) - - (64)

Dividend paid (1,147) (1,147)

Transactions

with owners 1 271 - (165) - (1,078) (971)

============= ============ ============ ============= ============= ============= =============

Foreign

currency

translation

differences - - - - (92) - (92)

Profit for the

period

restated - - - - - 3,578 3,578

============= ============ ============ ============= ============= ============= =============

Total

comprehensive

income - - - - (92) 3,578 3,486

------------- ------------ ------------ ------------- ------------- ------------- -------------

Balance at 31

December 2018 478 5,196 4,663 390 (261) 6,924 17,390

------------- ------------ ------------ ------------- ------------- ------------- -------------

Shares issued 2 34 - - - - 36

Increase in

equity

reserve in

relation to

options

issued - - - 134 - - 134

Adjustment for

exercised

options - - - (59) - 59 -

Deferred tax

on share

options - - - (55) - - (55)

Dividend paid - - - - - (4,794) (4,794)

============= ============ ============ ============= ============= ============= =============

Transactions

with owners 2 34 - 20 - (4,735) (4,679)

============= ============ ============ ============= ============= ============= =============

Foreign

currency

translation

differences - - - - (20) - (20)

Profit for the

period - - - - - 2,718 2,718

============= ============ ============ ============= ============= ============= =============

Total

comprehensive

income - - - - (20) 2,718 2,698

============= ============ ============ ============= ============= ============= =============

Balance at 30

June 2019 480 5,230 4,663 410 (281) 4,907 15,409

============= ============ ============ ============= ============= ============= =============

Consolidated Statement of Cash Flows

30 June 2019 30 June 2018 31 December 2018

Unaudited Unaudited Unaudited

Notes GBP'000 GBP'000 GBP'000

============= ============= ====================

Cash generated from operations 5 3,482 3,318 6,825

Taxes paid (291) (430) (889)

============= ============= ====================

Cash flow from operating activities 3,191 2,888 5,936

Investing activities

Additions to property, plant and equipment (21) (63) (382)

Interest received 19 14 29

============= ============= ====================

Cash flow from investing activities (2) (49) (353)

Cash flow from operating activities after investing

activities (free cash flow) 3,189 2,839 5,583

Financing activities

Interest paid (10) - -

Repayment of lease liabilities (124) - -

Proceeds from share issues 6 36 57 329

Dividend paid (4,794) (5,295) (6,442)

============= ============= ====================

Cash flow from financing activities (4,892) (5,238) (6,113)

Net changes in cash and cash equivalents (1,703) (2,399) (530)

Cash and cash equivalents, beginning of period 6,779 7,312 7,312

Exchange differences on cash & cash equivalents 1 (27) (3)

============= ============= ====================

Cash and cash equivalents, end of period 5,077 4,886 6,779

============= ============= ====================

Notes to the Financial Statements (unaudited)

1 Significant accounting policies

Basis of preparation

The financial information has been prepared in accordance with

recognition and measurement principles of International Financial

Reporting Standards ("IFRS") and International Financial Reporting

Interpretations Committee ("IFRIC") interpretations that had been

published by 30 June 2019 as endorsed by the European Union ("EU").

With the exception of IFRS 16: Leases (see Leases policy below),

the accounting policies adopted are consistent with those of the

financial statements for the year ended 31 December 2018, as

described in those financial statements. In preparing these interim

financial statements, the Board has not sought to adopt IAS 34

"Interim financial reporting".

The figures for the six-month periods ended 30 June 2019 and 30

June 2018 have not been audited. The figures for the year ended 31

December 2018 have been extracted from, but do not constitute, the

consolidated financial statements of Quartix Holdings plc for that

year. The original financial statements for the year ended 31

December 2018 have been delivered to the Registrar of Companies and

included an Auditors' Report, which was unqualified and did not

contain a statement under section 498(2) or section 498(3) of the

Companies Act 2006.

Going concern

The Group's forecasts and projections, taking account of

reasonably possible changes in trading performance, show that the

Group is able to generate sufficient liquidity.

The Group enjoys a strong income stream from its fleet

subscription base while current liabilities include a substantial

provision for deferred revenue which is a non-cash item.

After assessing the forecasts and liquidity of the business to

the end of the following calendar year and the longer term

strategic plans, the Directors have a reasonable expectation that

the Group has adequate resources to continue in operational

existence for the foreseeable future. The Group therefore continues

to adopt the going concern basis in preparing the interim

results.

Segmental reporting

The Group has adopted segmental reporting for the first time in

these interim accounts. Historically, the information used by the

Group's chief operating decision maker was presented on a

consolidated Group basis. All revenue, costs, assets and

liabilities related to a single activity, being the design,

development and marketing of vehicle tracking devices and the

provision of related data services, and it concluded that it

operated only one operating segment as defined by IFRS 8.

Whilst information is still largely presented on a consolidated

basis, and the telematic services are very similar, the Group's

chief operating decision maker has been provided with additional

information to make decisions about the allocation of resources and

assessing performance. The main drivers for this have been the

impact assessment of the Group's strategy to reduce its involvement

in lower-margin insurance tracking operations in order to focus on

growth in its fleet telematics business and the Group's commitment

to providing investors with clear and timely information regarding

its performance against both financial and strategic

objectives.

The Group will therefore include segmental financial information

for its insurance and fleet operations in future. These two

segments have been identified as they are managed separately, with

different marketing approaches for the discrete market sectors and

for which the Group has different strategies. Their reported

revenue each meet the quantitative thresholds of IFRS 8.

The Group has aggregated fleet operations for all geographical

markets with fleet operations. However, to increase transparency,

the Group has decided to include an additional voluntary disclosure

analysing the fleet segment by two sub-categories in order to

highlight the different costs structures within the business:

-- Customer acquisition, for new customer contracts; and

-- Fleet telematics services for repeat contracts with existing customers.

There are no inter segment transfers between the insurance and

fleet segments. The Group uses the same measurement policies as

those used in its financial statements, except for certain items

not included in determining the segmental profit of the operating

segments, since these relate to both the fleet and insurance

segments. These include Central overhead costs such as Director

salaries, development, audit and legal fees, property costs and

infrastructure costs. Detailed segmental information, including a

reconciliation to the financial statements, are included in note

2.

The Group's chief operating decision maker has been provided

with only consolidated information on the Group's financial

position as it is not possible to provide segmentation of total

assets or total liabilities. With the exception of insurance trade

receivables and contract obligations, where the customer base is

clearly identifiable, it is not possible to segregate the other

assets or liabilities. For example, tangible assets for IT servers

and cash can't be allocated since they are shared between the

segments.

Incremental costs of obtaining a contract

The large majority of contracts which the Group enters into with

customers are 12 months in length and the Group therefore chooses

to use the practical expedient under IFRS15 to expense these

commissions as incurred. As highlighted in the 2018 Financial

Statements, this policy is being kept under review; to this end,

the Group is continuing to assess the structure and materiality of

the commissions it pays.

Leases

The Group has adopted IFRS 16 'Leases' (hereinafter referred to

as 'IFRS 16') with effect from 1 January 2019 under which leases

will be recorded in the statement of financial position in the form

of a right-of-use asset and a lease lability.

The Group has adopted IFRS 16 retrospectively from 1 January

2019, but has not restated comparatives for the 2018 reporting

period, as permitted under the specific transitional provisions in

the standard. The reclassifications and the adjustments arising

from the new leasing rules are therefore recognised in the opening

balance sheet on 1 January 2019.

Further information on the impact of the new policy is disclosed

in note 7.

For any new contracts entered into on or after 1 January 2019,

the Group considers whether a contract is, or contains a lease. A

lease is defined as 'a contract, or part of a contract, that

conveys the right to use an asset (the underlying asset) for a

period of time in exchange for consideration'.

At lease commencement date, the Group recognises a right-of-use

asset and a lease liability on the balance sheet. The right-of-use

asset is measured at cost, which is made up of the initial

measurement of the lease liability, any initial direct costs

incurred by the Group, an estimate of any costs to dismantle and

remove the asset, or restore a property, at the end of the lease,

and any lease payments made in advance of the lease commencement

date (net of any incentives received).

The Group depreciates the right-of-use assets on a straight-line

basis from the lease commencement date to the earlier of the end of

the useful life of the right-of-use asset or the end of the lease

term. The Group also assesses the right-of-use asset for impairment

when such indicators exist.

At the commencement date, the Group measures the lease liability

at the present value of the lease payments unpaid at that date,

discounted using the interest rate implicit in the lease if that

rate is readily available or the Group's incremental borrowing

rate.

Lease payments included in the measurement of the lease

liability are made up of fixed payments (including in substance

fixed), variable payments based on an index or rate, amounts

expected to be payable under a residual value guarantee and

payments arising from options reasonably certain to be

exercised.

Subsequent to initial measurement, the liability will be reduced

for payments made and increased for interest. It is remeasured to

reflect any reassessment or modification, or if there are changes

in in-substance fixed payments.

When the lease liability is remeasured, the corresponding

adjustment is reflected in the right-of-use asset, or profit and

loss if the right-of-use asset is already reduced to zero.

The Group has elected to account for short-term leases and

leases of low-value assets using the practical expedients. Instead

of recognising a right-of-use asset and lease liability, the

payments in relation to these are recognised as an expense in

profit or loss on a straight-line basis over the lease term.

In the statement of financial position, for these interim

accounts, the right-of-use assets and lease liabilities have been

included separately in the statement.

2 Segmental analysis

As highlighted in note 1, Significant accounting policies

(Segmental reporting), the Group has adopted segmental analysis for

the first time. The Group has identified two operating segments

(see below) which are now monitored by the Group's chief operating

decision maker and strategic decisions are made on the basis of

adjusted segment operating results. The main sources of revenue for

all segments is from the provision of vehicle telematics

services.

The information used by the Group's chief operating decision

maker with regard to the Group's assets and liabilities is

presented on a consolidated Group basis and accordingly no

segmental analysis is presented for these.

The Group has two reportable segments: Total Fleet and

Insurance. The Total Fleet segment has been sub-divided into two

further categories. This has been done to give clarity as to the

level of upfront investment the Group is making in acquiring new

customers, as well as the associated impact on recurring revenue.

The two categories are:

-- Customer Acquisition: This is the sales and marketing cost of

acquiring new fleet customers and the cost associated with units

installed for those customers. Recurring subscription revenue is

not recognised in this segment, although upfront receipts are

recognised (for example where the Group makes a sale of a unit to a

new customer for an upfront fee).

-- Fleet Telematics Services: This is the recurring revenue

associated with the Group's active subscription base and the cost

of servicing that subscription base. The costs in this category

include the cost of installing additional units for existing

customers, as well as the associated marketing costs.

These two elements, together with central fleet costs, make up

the Total Fleet segment.

Estimated allocations of cost have been made between the

segments and within the Total Fleet segment, particularly in

relation to equipment and installations. These allocations have

been performed by reviewing the products sold to each segment,

their associated cost of manufacture or installation and whether

those products were installed by the customer. These costs are then

applied to each segment as appropriate.

Segmental analysis

6ms to 30 June 2019 Customer Acquisition Fleet Telematics Services Total Fleet Insurance Total Business

Unaudited GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------- ------------------------- ----------- --------- --------------

Recurring revenue - 9,389 9,389 - 9,389

Other sales 175 527 702 2,461 3,163

-------------------- ------------------------- ----------- --------- --------------

Total revenue 175 9,916 10,091 2,461 12,552

Sales & marketing (2,084) (385) (2,469) - (2,469)

Equipment, installations,

carriage (1,029) (613) (1,642) (1,343) (2,985)

Costs of Service - (995) (995) (201) (1,196)

-------------------- -------------------------

Profit before central fleet

costs (2,938) 7,923 4,985 917 5,902

-------------------- ------------------------- ----------- --------- --------------

Central fleet costs (359) - (359)

----------- --------- --------------

Segmental profit 4,626 917 5,543

----------- --------- --------------

Central costs (2,035)

--------------

Adjusted EBITDA 3,508

Share based payments (134)

Depreciation (191)

--------------

Operating profit 3,183

Finance income receivable 19

Finance costs payable (11)

--------------

Profit before taxation 3,191

--------------

Segmental analysis

6ms to 30 June 2018 Customer Acquisition Fleet Telematics Services Total Fleet Insurance Total Business

Unaudited GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------- ------------------------- ----------- --------- --------------

Recurring revenue - 8,407 8,407 - 8,407

Other sales 171 553 724 3,782 4,506

-------------------- ------------------------- ----------- --------- --------------

Total revenue 171 8,960 9,131 3,782 12,913

Sales & marketing (1,578) (356) (1,934) - (1,934)

Equipment, installations,

carriage (643) (515) (1,158) (1,790) (2,948)

Costs of Service - (1,073) (1,073) (356) (1,429)

-------------------- -------------------------

Profit before central fleet

costs (2,050) 7,016 4,966 1,636 6,602

-------------------- ------------------------- ----------- --------- --------------

Central fleet costs (276) - (276)

----------- --------- --------------

Segmental profit 4,690 1,636 6,326

----------- --------- --------------

Central costs (2,265)

--------------

Adjusted EBITDA 4,061

Share based payments (140)

Depreciation (77)

--------------

Operating profit 3,844

Finance income receivable 14

Finance costs payable -

--------------

Profit before taxation 3,858

--------------

Segmental analysis

12ms to 31 December 2018 Customer Acquisition Fleet Telematics Services Total Fleet Insurance Total Business

Unaudited GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------- ------------------------- ----------- --------- --------------

Recurring revenue - 17,246 17,246 - 17,246

Other sales 335 1,170 1,505 6,955 8,460

-------------------- ------------------------- ----------- --------- --------------

Total revenue 335 18,416 18,751 6,955 25,706

Sales & marketing (3,396) (712) (4,108) - (4,108)

Equipment, installations,

carriage (1,374) (1,093) (2,467) (3,153) (5,620)

Costs of Service - (1,983) (1,983) (568) (2,551)

-------------------- -------------------------

Profit before central fleet

costs (4,435) 14,628 10,193 3,234 13,427

-------------------- ------------------------- ----------- --------- --------------

Central fleet costs (575) - (575)

----------- --------- --------------

Segmental profit 9,618 3,234 12,852

----------- --------- --------------

Central costs (4,518)

--------------

Adjusted EBITDA 8,334

Share based payments (108)

Depreciation (185)

--------------

Operating profit 8,041

Finance income receivable 29

Finance costs payable -

--------------

Profit before taxation 8,070

--------------

During the 6 month period to 30 June 2019, GBP2,008,000 or 16%

(2018: GBP2,839,000 or 22%) of the Group's revenues depended on a

single customer in the insurance segment.

Revenues from external customers in the Group's major markets

have been identified on the basis of the customer's geographical

location and are disclosed below.

30 June 2019 30 June 2018 31 December 2018

Unaudited Unaudited Unaudited

GBP'000 GBP'000 GBP'000

============ ============ ================

Geographical analysis by destination

United Kingdom 10,117 11,092 21,709

France 1,494 1,137 2,471

Rest of Europe 8 7 13

United States of America 933 677 1,513

============ ============ ================

12,552 12,913 25,706

============ ============ ================

3 Adjusted earnings before interest, tax, depreciation and amortisation (EBITDA)

30 June 2019 30 June 2018 31 December 2018

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

============ ============ ================

Operating profit 3,183 3,844 8,041

Depreciation 191 77 185

------------ ------------ ----------------

EBITDA 3,374 3,921 8,226

Share-based payment expense 134 140 108

------------ ------------ ----------------

Adjusted EBITDA 3,508 4,061 8,334

============ ============ ================

4 Earnings per share

The calculation of the basic earnings per share is based on the

profits attributable to the shareholders of Quartix Holdings plc

divided by the weighted average number of shares in issue during

the period. The earnings per share calculation relates to

continuing operations of the Group.

Fully

diluted Fully

Weighted Basic weighted diluted

Profits average profit average profit

attributable number per share number per share

to shareholders of shares amount of shares amount

GBP'000 in pence in pence

----------------- ----------- ----------- ----------- ------------

Earnings per ordinary

share

Period ended 30 June

2019 2,718 47,894,961 5.67 47,904,443 5.67

Period ended 30 June

2018 3,282 47,641,307 6.89 47,856,077 6.86

Year ended 31 December

2018 6,860 47,713,566 14.38 48,354,756 14.19

For diluted earnings per share, the weighted average number of

ordinary shares is adjusted to assume the conversion of all

dilutive potential ordinary shares. Dilutive potential ordinary

shares are those share options where the exercise price is less

than the average market price of the Company's ordinary shares

during the period.

5 Note to the cash flow statement

Cash flow adjustments and changes in working capital:

30 June 2019 30 June 2018 31 December 2018

Unaudited Unaudited Unaudited

GBP'000 GBP'000 GBP'000

============ ============ ================

Profit before tax 3,191 3,858 8,070

Foreign exchange (17) (39) (153)

Depreciation 191 77 185

Interest income (19) (14) (29)

Interest expense 11 - -

Share based payment expense 134 140 108

Operating cash flow before movement in working capital 3,491 4,022 8,181

(Increase)/decrease in trade and other receivables (35) (1) 83

Decrease/(increase) in inventories (151) (109) (67)

(Decrease)/increase in trade and other payables 77 (594) (42)

(Decrease)/increase in contract liabilities 100 (517) (1,330)

============ ============ ================

Cash generated from operations 3,482 3,318 6,825

============ ============ ================

6 Equity

Number of ordinary shares of

GBP0.01 each Share capital GBP'000 Share premium GBP'000

================================== ===================== =====================

Allotted, called up and fully paid

At 1 January 2018 47,568,354 476 4,869

Shares issued 141,250 1 56

At 30 June 2018 47,709,604 477 4,925

Shares issued 136,956 1 271

At 31 December 2018 47,846,560 478 5,196

Shares issued 91,760 2 34

================================== ===================== =====================

At 30 June 2019 47,709,604 480 5,230

================================== ===================== =====================

All shares issued in the period to 30 June 2019 relate to the

exercise of share options.

7 Explanation of transition to IFRS 16: Leases

As highlighted in note 1, Significant accounting policies under

"Leases", the Group has adopted IFRS 16 with effect from 1 January

2019 under which leases will be recorded in the statement of

financial position in the form of a right-of-use asset and a lease

lability. As permitted, it has applied IFRS 16 retrospectively with

the cumulative effect of initially applying the Standard recognised

at the date of initial application and has not, therefore, restated

comparative information. Instead, the Group has recognised the

cumulative effect as an adjustment to the opening net assets at 1

January 2019.

The Group has historically purchased plant and equipment, the

exception being a small number of leased vehicles for the UK field

sales team. However, it has lease contracts for office

accommodation in the UK and USA. The financial impact of the

adoption of IFRS 16, will result in a reduction in the Group's

annual operating expenses of GBP0.2m and additional depreciation

costs of GBP0.2m and finance costs payable of GBP0.02m. Details of

lease obligations and right of use assets are provided below.

On adoption of IFRS 16, the Group recognised a lease liability

at the date of initial application, for leases previously

classified as an operating lease under IAS17, at the present value

of the remaining lease payments, discounted using the Group's

estimated incremental borrowing rate as of 1 January 2019. The

weighted average lessee's incremental borrowing rate applied to the

lease liabilities on 1 January 2019 was 4.3%.

As permitted under the Standard, the Group has adopted the

practical expedients of applying a single discount rate to its

property leases and elected not to apply the requirements of IFRS

16 to leases for which the lease term ends within 12 months. The

Group will recognise the lease payments associated with those

leases as an expense on a straight-line basis.

The following is a reconciliation of total operating lease

commitments at 31 December 2018 to the lease liabilities recognised

at 1 January 2019:

GBP'000 GBP'000

Total operating lease commitments disclosed at 31 December 2018 518

Recognition exemptions:

Leases with remaining lease term of less than 12 months (29)

Variance lease payments not recognised 93

Other minor adjustments relating to commitment disclosures 39

-------

103

-------

Operating lease liabilities before discounting 621

Discounting using incremental borrowing rate (48)

-------

Total lease liabilities recognised under IFRS 16 at 1 January 2019 573

-------

The Group has elected not to include initial direct costs in the

measurement of the right-of-use asset for operating leases in

existence at the date of initial application of IFRS 16, being 1

January 2019. At this date, the Group has also elected to measure

the right of use asset, for leases previously classified as an

operating lease under IAS17, at an amount equal to the lease

liability, adjusted by the amount of any prepaid or accrued lease

payments relating to that lease recognised in the statement of

financial position immediately before the date of initial

application.

There were no onerous lease contracts that would have required

an adjustment to the right-of-use assets at the date of initial

application.

The recognised right-of-use assets relate to the following types

of assets:

30 June 2019 1 January 2019

GBP'000 GBP'000

Properties 401 490

Motor vehicles 6 12

------------ --------------

Total right-of-use assets 407 502

------------ --------------

The change in accounting policy affected the following items in

the balance sheet on 1 January 2019:

GBP'000

Right-of use assets - increase 502

Prepayments - decrease (23)

Accruals - decrease 94

Lease liability - increase (573)

There was no impact on retained earnings on 1 January 2019.

Minimum lease payments due:

Within one year One to five years After five years Total

GBP'000 GBP'000 GBP'000 GBP'000

--------------- ----------------- ---------------- -------

Lease payments 185 302 - 487

Finance charge (16) (20) - (36)

--------------- ----------------- ---------------- -------

Net present value 169 282 - 451

--------------- ----------------- ---------------- -------

The Group has elected not to recognise a lease liability for

short term leases (leases with an expected term of 12 months or

less). Payments made under such leases are expensed on a

straight-line basis.

The expense relating to payments not included in the measurement

of a lease liability for the 6 months to 30 June 2019 was

GBP35,000.

In June 2019 the Group entered into a number of agreements

concerning properties in Powys, with the intention of entering into

a new ten-year lease for new premises, subject to completion of a

refurbishment project, and to surrender and assign two existing

leases. The anticipated date for completion is June 2020. At that

date there would be a reduction in the existing lease liabilities

and corresponding reduction in the right of use asset of around

GBP90,000 and additional lease liabilities and right-of use asset

of around GBP800,000.

In addition, a new lease to replace the existing Chicago office

lease, which expires in November 2019, was also signed in June 2019

for commencement on 31 August 2019. At that date, there will be

additional lease liabilities and right-of use asset of around

GBP70,000.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR QXLFLKDFBBBQ

(END) Dow Jones Newswires

July 24, 2019 02:00 ET (06:00 GMT)

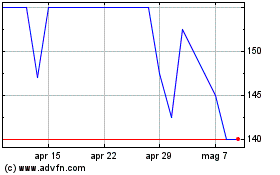

Grafico Azioni Quartix Technologies (LSE:QTX)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Quartix Technologies (LSE:QTX)

Storico

Da Apr 2023 a Apr 2024