Air France-KLM results at 30 june 2019

31 July 2019

|

RESULTS AS AT 30 JUNE

2019Increased operating result and

improved passenger unit revenue |

SECOND QUARTER 2019

- Passenger growth +5.1% and load factor +1.3 point.

- Passenger unit revenue up by 0.8%.

- Unit costs decrease by -2.3% at constant currency and

fuel.

- Operating result at 400 million euros, up 54 millions euros

compared to the second quarter 2018 hit by Air France strikes1, and

reflecting unit cost improvement partly offset by an increased fuel

bill.

- Further reduction in Group net debt, down 466 million euros to

5.7 billion euros and Net debt/EBITDA ratio at 1.4x, an improvement

of -0.1pt compared to 31 December 2018.

OUTLOOK 2019

- Based on the current data for the Passenger network:

- Long-haul forward booking load factors from August to December

are on average ahead compared to last year.

- Network passenger unit revenue at constant currency expected to

be stable versus last year for the third quarter 2019.

- Full year guidance update:

- The Group will pursue initiatives to reduce unit costs, with a

targeted 2019 reduction of between -1% and 0% at constant currency

and fuel price.

- The 2019 fuel bill is expected to increase by 550 million euros

compared to 2018 to 5.5 billion euros, based on the forward curve

of 26 July 2019.

- Net debt/ EBITDA ratio below 1.5x.

Benjamin Smith, CEO of Air France-KLM Group,

said: “In a challenging environment, Air France-KLM Group posted a

robust second quarter. The slight increase in passenger unit

revenue that we had anticipated, together with continued execution

in unit cost reduction, enabled us to more than offset rising fuel

costs. These elements, combined with satisfactory long-haul forward

booking trends lead us to confirm our guidance for 2019. At the

same time, we continue to implement our strategic vision focused on

reducing costs and making our Group more robust in the very

competitive marketplace in Europe. We have also made key decisions

on the renewal of our fleet to transition to cleaner aircraft in

order to support a more environmentally responsible operation,

including the order of sixty Airbus A220s for short- and

medium-haul and the accelerated phasing out of ten Airbus A380 to

be replaced by more modern fuel efficient aircraft.”

|

Air France-KLM Group |

Second Quarter |

First half |

|

2019 |

Change1 |

2019 |

Change1 |

|

Passengers (thousands) |

27,800 |

+5.1% |

50,474 |

+4.2% |

|

Passenger Unit revenue per ASK2 (€ cts) |

6.75 |

+0.8% |

6.48 |

-0.4% |

|

Operating result (€m) |

400 |

+54 |

97 |

-131 |

|

Net income – Group part (€m) |

80 |

-30 |

-240 |

-81 |

|

Adj. operating free cash flow (€m) |

110 |

+111 |

351 |

+210 |

|

Net debt at end of period (€m) |

|

|

5,698 |

-466 |

Second quarter 2019 business review

Network: Solid revenue growth and

increase in operating result

|

Network |

Second Quarter |

First Half |

|

2019 |

Change |

Change constant currency |

2019 |

Change |

Change constant currency |

|

Capacity (ASK m) |

75,680 |

+3.9% |

|

145,440 |

+3.2% |

|

|

Total revenues (€m) |

6,016 |

+5.6% |

+3.9% |

11,191 |

+3.8% |

+2.6% |

|

Scheduled revenues (€m) |

5,708 |

+5.8% |

+4.0% |

10,601 |

+3.6% |

+2.3% |

|

Operating result (€m) |

291 |

+55 |

+77 |

12 |

-138 |

-68 |

Second quarter 2019 combined Passenger and Cargo

revenues increased by 3.9% at constant currency to 6.0 billion

euros, for capacity growth of 3.9%. The operating result amounted

to 291 million euros, a 77 million euro increase at constant

currency compared to last year, with the non-fuel unit cost

improvement partly offset by a higher fuel bill.

Passenger network: Long-haul driving the

improvement of unit revenue as anticipated

|

|

Second Quarter |

First Half |

|

Passenger network |

2019 |

Change |

Change constant currency |

2019 |

Change |

Change constant currency |

|

Passengers (thousands) |

22,906 |

+4.8% |

|

42,651 |

+3.7% |

|

|

Capacity (ASK m) |

75,680 |

+3.9% |

|

145,439 |

+3.2% |

|

|

Traffic (RPK m) |

67,020 |

+5.7% |

|

127,241 |

+3.8% |

|

|

Load factor |

88.6% |

+1.5

pt |

|

87.5% |

+0.6

pt |

|

|

Total passenger revenues (€m) |

5,482 |

+6.4% |

+4.8% |

10,110 |

+4.2% |

+3.2% |

|

Scheduled passenger revenues (€m) |

5,254 |

+6.6% |

+4.8% |

9,674 |

+4.2% |

+2.9% |

|

Unit revenue per ASK (€ cts) |

6.94 |

+2.6% |

+0.9% |

6.65 |

+1.0% |

-0.2% |

Second quarter 2019 capacity increased by 3.9%,

mainly driven by the South American, North Atlantic and Asian

networks, with respective growth of 7.8%, 6.7% and 4.0%. Taking

into account a positive calendar effect from the Easter shift, the

passenger network posted a positive unit revenue of +0.9% at

constant currency.

The industry capacity growth has been lower in

North America, Caribbean & Indian Ocean and Middle East network

in comparison to previous year. The long-haul network generated

positive load-factors and yields compared to last year in all

networks except in the Latin American network:

- The North American network posted positive unit revenue at

+2.6% compared to last year, with the strength driven in particular

by US points of sale.

- The Asian network unit revenue was up 3.9% in the second

quarter, driven by the continuing strength of the Japanese network,

partly offset by some competitive pressure on the Chinese

network.

- The Caribbean & Indian Ocean network posted a strong result

with the unit revenue +4.7%, driven by leisure demand.

- The Africa & Middle East network saw a substantial unit

revenue improvement of 8.7%, underpinned by positive results from

the West African networks and network rationalizations in the

Middle East.

- The unit revenue pressure in the Latin American network remains

ongoing for the time-being due to the current economic context in

Argentina and Brazil.

The medium-haul network showed a mixed picture

with a positive performance for the medium-haul hubs with the unit

revenue +0.2% and, as anticipated, pressure in the medium-haul

point-to-point network with unit revenue down

-9.1%.

Cargo network: Unit revenue impacted by

a challenging airfreight market

|

|

Second Quarter |

First Half |

|

Cargo business |

2019 |

Change |

Change constant currency |

2019 |

Change |

Change constant currency |

|

Tons (thousands) |

279 |

+1.5% |

|

549 |

+0.7% |

|

|

Capacity (ATK m) |

3,630 |

+2.8% |

|

7,092 |

+2.1% |

|

|

Traffic (RTK m) |

2,122 |

+1.2% |

|

4,168 |

+0.9% |

|

|

Load factor |

58.5% |

-0.9

pt |

|

58.8% |

-0.7

pt |

|

|

Total Cargo revenues (€m) |

534 |

-1.7% |

-4.1% |

1,081 |

-0.5% |

-2.7% |

|

Scheduled cargo revenues (€m) |

454 |

-2.8% |

-5.2% |

927 |

-1.7% |

-3.9% |

|

Unit revenue per ATK (€ cts ) |

12.54 |

-5.1% |

-7.5% |

13.09 |

-3.6% |

-5.7% |

Negative market dynamics and continued higher

industry capacity put pressure on the unit revenue during the

second quarter 2019. After two strong years, renewed overcapacity

in North America and Asia is putting pressure on freight rates,

resulting in unit revenue down -7.5% at constant currency. The

Group’s Cargo strategy is focused on maintaining and increasing

load factors where possible and taking a pro-active approach to new

opportunities.

Transavia: High capacity growth and

positive unit revenue

|

|

Second Quarter |

First Half |

|

Transavia |

2019 |

Change |

2019 |

Change |

|

Passengers (thousands) |

4,894 |

+6.7% |

7,823 |

+7.0% |

|

Capacity (ASK m) |

9,527 |

+9.2% |

15,353 |

+10.0% |

|

Traffic (RPK m) |

8,754 |

+9.1% |

14,122 |

+10.1% |

|

Load factor |

91.9% |

-0.1 pt |

92.0% |

+0.0 pt |

|

Total passenger revenues (€m) |

500 |

+10.4% |

748 |

+8.7% |

|

Unit revenue per ASK (€ cts) |

5.24 |

+1.3% |

4.83 |

-0.4% |

|

Unit cost per ASK (€ cts) |

4.70 |

+5.1% |

4.95 |

+2.6% |

|

Operating result (€m) |

52 |

-9 |

-19 |

-22 |

Strong capacity growth of 9.2% in the second

quarter 2019. The unit revenue was up by 1.3% compared to last

year, supported by the Easter shift, strong demand throughout the

network and a good ancillary revenue performance.The second quarter

2019 operating margin stands at a level of 10.4%, with an absolute

operating result of 52 million euros, 9 million euros down compared

to last year explained by fuel price and currency headwinds.

Maintenance: Strong third-party revenue growth and

margin improvement

|

|

Second Quarter |

First Half |

|

Maintenance |

2019 |

Change |

Change constant currency |

2019 |

Change |

Change constant currency |

|

Total revenues (€m) |

1,120 |

+11.2% |

|

2,290 |

+10.0% |

|

|

Third-party revenues (€m) |

527 |

+11.9% |

+5.0% |

1,081 |

+14.9% |

+7.6% |

|

Operating result (€m) |

55 |

+9 |

+1 |

102 |

+30 |

+18 |

|

Operating margin (%) |

4.9% |

+0.3 pt |

-0.2 pt |

4.5% |

+1.0 pt |

+0.6 pt |

Maintenance revenues increased compared to last

year with third-party revenues up by 11.9% and 5.0% at constant

currency, a continuation of the growth trend underpinned by the

inflow of new contracts. The Maintenance order book stood at 11.6

billion dollars at 30 June 2019, an increase of 0.2 billion dollars

compared to 31 December 2018. The operating margin expressed as a

percentage of total revenues stood at 4.9%, an increase of 0.3

point primarily driven by the components activity.

Air France-KLM Group: Operating result

at €400 million with positive passenger unit revenue and unit cost

improvement

|

|

Second Quarter |

First half |

|

|

2019 |

Change |

Change constant currency |

2019 |

Change |

Change constant currency |

|

Capacity (ASK m) |

85,207 |

+4.5% |

|

160,793 |

+3.8% |

|

|

Traffic (RPK m) |

75,774 |

+6.1% |

|

141,363 |

+4.4% |

|

|

Passenger unit revenue per ASK (€ cts) |

6.75 |

+2.4% |

+0.8% |

6.48 |

+0.8% |

-0.4% |

|

Group unit revenue per ASK (€ cts) |

7.28 |

+1.6% |

+0.0% |

7.05 |

+0.2% |

-1.0% |

|

Group unit cost per ASK (€ cts) at constant fuel |

6.82 |

-0.3% |

-2.3% |

6.99 |

+0.4% |

-1.4% |

|

Revenues (€m) |

7,050 |

+6.4% |

+4.5% |

13,036 |

+4.9% |

+3.3% |

|

EBITDA (€m) |

1,147 |

+98 |

+114 |

1,571 |

-99 |

-42 |

|

Operating result (€m) |

400 |

+54 |

+72 |

97 |

-131 |

-69 |

|

Operating margin (%) |

5.7% |

+0.5 pt |

+0.8 pt |

0.7% |

-1.1 pt |

-0.6 pt |

|

Net income - Group part (€m) |

80 |

-30 |

|

-240 |

-81 |

|

In the second quarter 2019, the Air France-KLM

Group posted an operating result of 400 million euros, up 54

million euros compared to last year, which was impacted by the Air

France strike for 260 million euros.

Compared to last year, the Group’s unit revenue

was stable, the positive passenger unit revenue impact of 53

million euros being offset by a -54 million euro negative impact

from Cargo.

The fuel bill including hedging amounted to

1,404 million euros for the second quarter 2019, up 220 million

euros. This increase is explained mainly by a lower hedge gain for

the second quarter 2019 (gain of 56 million euros compared to 212

million euro last year), and a negative currency effect on the fuel

bill of 89 million euros due to a stronger dollar.

Currencies had a positive 123 million euro

impact on revenues and a negative 52 million euro effect on costs

(ex-fuel) including currency hedging. Together with the 89 million

euro fuel currency effect, the net impact of currencies amounted to

a negative 18 million euros for the second quarter 2019.

Unit cost down confirming the full year

guidance On a constant currency and fuel price basis, unit

costs were down -2.3% in the second quarter 2019. This decrease is

supported by the successful execution of cost focus measures in Air

France and the high basis of comparaison last year due to the

strikes at Air France.However this was partly offset by higher unit

costs at KLM due to the implementation of last year’s labor wage

agreements.

Group net employee costs were up 4.6% in the

quarter compared to last year, explained by additional hires in

response to the capacity growth and the impact of wage agreement

implementation for Air France and KLM staff. The average number of

FTEs in the second quarter 2019 increased by 1,650 compared to last

year, including +700 Pilots and +650 Cabin Crew. However,

productivity measured in ASK per FTE increased by 3.1% in the

second quarter 2019. Net debt down, leverage ratio improved

slightly further, on track for full year guidance of below

1.5x

|

|

Second Quarter |

First Half |

|

In € million |

2019 |

Change |

2019 |

Change |

|

Cash flow before change in WCR and Voluntary Departure Plans,

continuing operations (€m) |

1,096 |

+175 |

1,465 |

+31 |

|

Cash out related to Voluntary Departure Plans (€m) |

-6 |

+92 |

-11 |

+110 |

|

Change in Working Capital Requirement (WCR) (€m) |

-19 |

-45 |

787 |

-46 |

|

Net cash flow from operating activities

(€m) |

1,071 |

+222 |

2,241 |

+95 |

|

Net investments before sale & lease-back* (€m) |

-711 |

-136 |

-1,389 |

+99 |

|

Operating free cash flow

(€m) |

360 |

+86 |

852 |

+194 |

|

Reduction of lease debt |

-250 |

+25 |

-501 |

+16 |

|

Adjusted operating free cash flow ** |

110 |

+111 |

351 |

+210 |

* Sum of ‘Purchase of property, plant and equipment and

intangible assets’ and ‘Proceeds on disposal of property, plant and

equipment and intangible assets’ as presented in the consolidated

cash flow statement.

** The “Adjusted operating free cash flow” is

operating free cash flow with deduction of the repayment of lease

debt.

Positive adjusted operating free cash

flowThe Group generated positive adjusted operating free

cash flow of 110 million euros, an increase of 111 million euros

compared to last year, mainly explained by lower capex in the

second quarter 2019 due to a year-on-year shift in the

investment-timing pattern.

Leverage on track with full year guidance of

<1.5x

| In € million |

30 Jun 2019 |

31 Dec 2018 |

|

Net debt |

5,698 |

6,164 |

| EBITDA

trailing 12 months |

4,118 |

4,217 |

|

Net debt/EBITDA trailing 12

months |

1.4 x |

1.5 x |

The Group reduced its net debt to 5,698 million

euros at 30 June 2019 versus 6,164 million euros at 31 December

2018, this 466 million euro reduction being driven by operating

free cash flow generation and the repayment of lease debt.The net

debt/EBITDA ratio stood at 1.4x at 30 June 2019, a decrease of 0.1

point compared to 31 December 2018, explained by the reduction in

net debt.

Air France improvement explained by last

year strike, KLM impacted by fuel

|

|

Second Quarter |

First Half |

|

|

2019 |

Change |

2019 |

Change |

|

Air France Group Operating result (€m) |

143 |

+130 |

-113 |

+51 |

|

Operating margin (%) |

3.3% |

+3.0 pt |

-1.4% |

+0.8 pt |

|

KLM Group Operating result (€m) |

258 |

-70 |

202 |

-186 |

|

Operating margin (%) |

8.9% |

-2.8 pt |

3.8% |

-3.7 pt |

Outlook

The global economic and geopolitical context

remains uncertain and the Group operates in a highly competitive

marketplace. Based on the current data for the

Passenger network:

- Long-haul forward booking load factors from August 2019 to

December 2019 are on average ahead compared to last year.

- Network passenger unit revenue at constant currency is expected

to be stable compared to last year for the third quarter 2019.

Capacity growth update:

- With the growth of Transavia France adjusted slightly

downwards, Transavia is expected to grow at a sustainable pace of

7% to 9% for full year 2019.

- Passenger network plan remains unchanged to moderately grow

capacity by 2% to 3% for the full year 2019 compared to last

year.

Full year guidance update:

- The Group will pursue initiatives to reduce unit costs1, with a

targeted 2019 reduction of between -1% to 0% at constant currency

and fuel price.

- The 2019 fuel bill is expected to increase by 550 million euros

compared to 2018 to 5.5 billion euros2, based on the forward curve

of 26 July 2019.

- The Group plans capital expenditure of 3.2 billion euros for

2019 and is targeting a Net debt/EBITDA ratio of below 1.5x.

*****

Limited review procedures were carried out by

the external auditors. Their limited review report was issued

following the Board meeting.

The results presentation is available at

www.airfranceklm.com on 31 July 2019 from 7:15 am

CET.

A conference call hosted by Mr. Smith (CEO) and Mr. Gagey (CFO)

will be held on 31 July 2019 at 09.30.

To connect to the conference call, please dial:

France: Local +33 (0)1 76 77 22 57Netherlands:

Local +31 (0)20 703 8261 UK: Local +44 (0)330 336 9411US:

Local +1 323 994 2093

Confirmation code: 3271997

To listen to the audio-replay of the conference

call, please dial:

- France: Local +33 (0) 1 70 48 00 94

- Netherlands: Local +31 (0) 20 721 8903

- UK: Local +44 (0)207 660 0134

- US: Local +1 719-457-0820

Investor

Relations

PressMarie-Agnès de

Peslouan

Wouter van

Beek

+33 1 49 89 52 59

+33 1 49 89 52

60

+33 1 41 56 56

00madepeslouan@airfranceklm.com

Wouter-van.Beek@airfranceklm.com

Income Statement

|

|

Second Quarter |

First Half |

| In millions euros |

2019 |

2018 |

Change |

2019 |

2018 |

Change |

|

Sales |

7,050 |

6,626 |

+6.4% |

13,036 |

12,432 |

+4.9% |

|

Other revenues |

0 |

1 |

-100.0% |

0 |

1 |

-100.0% |

|

Revenues |

7,050 |

6,626 |

+6.4% |

13,036 |

12,432 |

+4.9% |

| Aircraft

fuel |

-1,404 |

-1,184 |

+18.6% |

-2,605 |

-2,245 |

+16.0% |

|

Chartering costs |

-135 |

-146 |

-7.7% |

-269 |

-276 |

-2.5% |

| Landing

fees and en route charges |

-507 |

-479 |

+5.9% |

-941 |

-906 |

+3.9% |

|

Catering |

-208 |

-193 |

+7.8% |

-395 |

-375 |

+5.3% |

| Handling

charges and other operating costs |

-455 |

-504 |

-9.7% |

-909 |

-980 |

-7.2% |

| Aircraft

maintenance costs |

-646 |

-566 |

+14.1% |

-1,298 |

-1,183 |

+9.7% |

|

Commercial and distribution costs |

-267 |

-278 |

-4.1% |

-517 |

-510 |

+1.4% |

| Other

external expenses |

-433 |

-430 |

+0.7% |

-872 |

-824 |

+5.8% |

| Salaries

and related costs |

-2,048 |

-1,959 |

+4.6% |

-4,020 |

-3,812 |

+5.5% |

| Taxes

other than income taxes |

-41 |

-38 |

+6.6% |

-93 |

-87 |

+6.9% |

| Other

income and expenses |

241 |

200 |

+20.4% |

454 |

436 |

+4.1% |

|

EBITDA |

1,147 |

1,049 |

+9.3% |

1,571 |

1,670 |

-5.9% |

|

Amortization, depreciation and provisions |

-747 |

-703 |

+6.2% |

-1,474 |

-1,442 |

+2.2% |

|

Income from current operations |

400 |

346 |

+15.6% |

97 |

228 |

-57.5% |

| Sales of

aircraft equipment |

10 |

0 |

nm |

23 |

-4 |

nm |

| Other

non-current income and expenses |

-35 |

20 |

nm |

-30 |

-23 |

+30.4% |

|

Income from operating activities |

375 |

366 |

+2.5% |

90 |

201 |

-55.2% |

| Cost of

financial debt |

-115 |

-122 |

-5.8% |

-221 |

-236 |

-6.4% |

| Income

from cash and cash equivalent |

15 |

10 |

+55.2% |

27 |

20 |

+35.0% |

|

Net cost of financial debt |

-100 |

-112 |

-11.1% |

-194 |

-216 |

-10.2% |

| Other

financial income and expenses |

-39 |

-86 |

-54.7% |

-110 |

-74 |

+48.6% |

|

Income before tax |

236 |

168 |

+40.5% |

-214 |

-89 |

+140.4% |

| Income

taxes |

-161 |

-62 |

+160.7% |

-33 |

-68 |

-51.5% |

|

Net income of consolidated companies |

75 |

106 |

-29.2% |

-247 |

-157 |

+57.3% |

| Share of

profits (losses) of associates |

6 |

5 |

+20.0% |

8 |

-1 |

nm |

|

Income from continuing operations |

81 |

111 |

-27.0% |

-239 |

-158 |

+51.3% |

| Net

income from discontinued operations |

0 |

0 |

nm |

0 |

0 |

nm |

|

Net income for the period |

81 |

111 |

-26.4% |

-239 |

-158 |

+50.3% |

| Minority

interest |

1 |

1 |

0.0% |

1 |

1 |

0.0% |

|

Net income for the period – Group part |

80 |

110 |

-27.3% |

-240 |

-159 |

+50.9% |

Consolidated Balance Sheet

| Assets |

30 June 2019 |

31 Dec 2018 |

| In million euros |

|

Goodwill |

217 |

217 |

|

Intangible assets |

1,248 |

1,194 |

| Flight

equipment |

10,541 |

10,167 |

| Other

property, plant and equipment |

1,530 |

1,503 |

|

Right-of-use assets |

5,079 |

5,243 |

|

Investments in equity associates |

305 |

311 |

| Pension

assets |

174 |

331 |

| Other

financial assets |

1,384 |

1,487 |

| Deferred

tax assets |

441 |

544 |

| Other

non-current assets |

242 |

264 |

|

Total non-current assets |

21,161 |

21,261 |

| Assets

held for sale |

0 |

0 |

| Other

short-term financial assets |

469 |

325 |

|

Inventories |

702 |

633 |

| Trade

receivables |

2,558 |

2,191 |

| Other

current assets |

1,224 |

1,062 |

| Cash and

cash equivalents |

4,418 |

3,585 |

|

Total current assets |

9,371 |

7,796 |

|

Total assets |

30,532 |

29,057 |

| Liabilities and

equity |

30 June 2019 |

31 Dec 2018 |

| In million euros |

|

Issued capital |

429 |

429 |

|

Additional paid-in capital |

4,139 |

4,139 |

| Treasury

shares |

-67 |

-67 |

|

Perpetual |

403 |

403 |

| Reserves

and retained earnings |

-3,327 |

-3,051 |

|

Equity attributable to equity holders of Air

France-KLM |

1,577 |

1,853 |

|

Non-controlling interests |

13 |

12 |

|

Total Equity |

1,590 |

1,865 |

| Pension

provisions |

2,285 |

2,098 |

| Return

obligation liability and other provisions |

3,097 |

3,035 |

|

Financial debt |

5,949 |

5,733 |

| Lease

debt |

3,473 |

3,546 |

| Deferred

tax liabilities |

0 |

4 |

| Other

non-current liabilities |

293 |

459 |

|

Total non-current liabilities |

15,097 |

14,875 |

| Return

obligation liability and other provisions |

558 |

492 |

| Current

portion of financial debt |

1,080 |

826 |

| Current

portion of lease debt |

955 |

989 |

| Trade

payables |

2,500 |

2,460 |

| Deferred

revenue on ticket sales |

4,407 |

3,153 |

| Frequent

flyer program |

837 |

844 |

| Other

current liabilities |

3,505 |

3,548 |

| Bank

overdrafts |

3 |

5 |

|

Total current liabilities |

13,845 |

12,317 |

|

Total equity and liabilities |

30,532 |

29,057 |

Statement of Consolidated Cash Flows

from 1st January until 30th June 2019

| In million euros |

30 June 2019 |

30 June 2018 |

|

Net income from continuing operations |

-239 |

-158 |

| Net

income from discontinued operations |

0 |

0 |

|

Amortization, depreciation and operating provisions |

1,475 |

1,442 |

|

Financial provisions |

89 |

57 |

| Loss

(gain) on disposals of tangible and intangible assets |

-31 |

7 |

| Loss

(gain)on disposals of subsidiaries and associates |

-2 |

0 |

|

Derivatives – non monetary result |

24 |

-23 |

|

Unrealized foreign exchange gains and losses, net |

52 |

108 |

| Other

non-monetary items |

64 |

-182 |

| Share of

(profits) losses of associates |

-8 |

1 |

| Deferred

taxes |

30 |

61 |

|

Financial Capacity |

1,454 |

1,313 |

|

Of which discontinued operations |

0 |

0 |

|

(Increase) / decrease in inventories |

-73 |

-67 |

|

(Increase) / decrease in trade receivables |

-371 |

-517 |

| Increase

/ (decrease) in trade payables |

24 |

163 |

| Change

in other receivables and payables |

1,207 |

1,254 |

|

Change in working capital requirements |

787 |

833 |

| Change

in working capital from discontinued operations |

0 |

0 |

|

Net cash flow from operating activities |

2,241 |

2,146 |

| Purchase

of property, plant and equipment and intangible assets |

-1,464 |

-1,534 |

| Proceeds

on disposal of property, plant and equipment and intangible

assets |

75 |

46 |

| Proceeds

on disposal of subsidiaries, of shares in non-controlled

entities |

8 |

3 |

|

Acquisition of subsidiaries, of shares in non-controlled

entities |

0 |

-8 |

|

Dividends received |

7 |

3 |

| Decrease

(increase) in net investments, more than 3 months |

20 |

5 |

| Net cash

flow used in investing activities of discontinued operations |

0 |

0 |

|

Net cash flow used in investing activities |

-1,354 |

-1,485 |

| Increase

of equity due to new convertible bond |

54 |

0 |

|

Perpetual (including premium) |

0 |

0 |

| Issuance

of debt |

762 |

295 |

|

Repayment on financial debt |

-339 |

-998 |

| Payments

on lease debt |

-501 |

-517 |

| Decrease

(increase ) in loans, net |

-14 |

-49 |

|

Dividends and coupons on perpetual paid |

-1 |

-1 |

| Net cash

flow used in financing activities of discontinued operations |

0 |

0 |

|

Net cash flow from financing activities |

-39 |

-1,270 |

| Effect

of exchange rate on cash and cash equivalents and bank

overdrafts |

-13 |

8 |

| Effect

of exch. rate on cash and cash eq. and bank overdrafts of disc.

ops. |

0 |

0 |

|

Change in cash and cash equivalents and bank

overdrafts |

835 |

-601 |

| Cash and

cash equivalents and bank overdrafts at beginning of period |

3,580 |

4,667 |

| Cash and

cash equivalents and bank overdrafts at end of period |

4,415 |

4,066 |

|

Change in treasury of discontinued operations |

0 |

0 |

Key Performance Indicators

EBITDA

| |

Second Quarter |

First Half |

| In millions euros |

2019 |

2018 |

2019 |

2018 |

|

Income/(loss) from current operations |

400 |

346 |

97 |

228 |

|

Amortization, depreciation and provisions |

747 |

703 |

1,474 |

1,442 |

|

EBITDA |

1,147 |

1,049 |

1,571 |

1,670 |

Restated net result, group

share

| |

Second Quarter |

First Half |

| In million euros |

2019 |

2018 |

2019 |

2018 |

|

Net income/(loss), Group share |

80 |

110 |

-240 |

-159 |

| Net

income/(loss) from discontinued operations |

0 |

0 |

0 |

0 |

|

Unrealized foreign exchange gains and losses, net |

-12 |

132 |

52 |

108 |

| Change

in fair value of financial assets and liabilities

(derivatives) |

5 |

-74 |

-20 |

-60 |

|

Non-current income and expenses |

25 |

-20 |

7 |

27 |

|

Depreciation of shares available for sale |

-6 |

-22 |

-12 |

-22 |

|

De-recognition of deferred tax assets |

0 |

0 |

0 |

0 |

|

Restated net income/(loss), group part |

92 |

125 |

-213 |

-106 |

| Coupons

on perpetual |

-8 |

-12 |

-12 |

-12 |

|

Restated net income/(loss), group share including coupons

on perpetual (used to calculate earnings per share) |

84 |

113 |

-225 |

-118 |

|

Restated net income/(loss) per share (in €) |

0.20 |

0.26 |

-0.53 |

-0.28 |

Return on capital employed (ROCE)1

| In million euros |

30 June 2019 |

30 June 2018 |

30 June 2018 |

30 June 2017 |

|

Goodwill and intangible assets |

1,465 |

1,379 |

1,379 |

1,309 |

| Flight

equipment |

10,541 |

10,081 |

10,081 |

9,539 |

| Other

property, plant and equipment |

1,530 |

1,443 |

1,443 |

1,378 |

| Right of

use assets |

5,079 |

5,565 |

5,565 |

5,577 |

|

Investments in equity associates |

305 |

294 |

294 |

294 |

| Financial

assets excluding shares available for sale, marketable securities

and financial deposits |

133 |

122 |

122 |

106 |

|

Provisions, excluding pension, cargo litigation and

restructuring |

-3,243 |

-2,944 |

-2,944 |

-2,698 |

| WCR,

excluding market value of derivatives |

-6,942 |

-6,669 |

-6,669 |

-6,417 |

|

Capital employed |

8,868 |

9,271 |

9,271 |

9,088 |

|

Average capital employed (A) |

9,070 |

9,180 |

| Income

from current operations |

1,201 |

1,610 |

| -

Dividends received |

-1 |

-3 |

| - Share

of profits (losses) of associates |

6 |

13 |

| -

Normative income tax |

-358 |

-481 |

|

Income from current operations after tax (B) |

848 |

1,139 |

|

ROCE, trailing 12 months (B/A) |

9.3% |

12.4% |

Net debt

| |

Balance sheet at |

| In million euros |

30 June 2019 |

31 Dec 2018 |

|

Financial debt |

6,685 |

6,216 |

| Lease

debt |

4,340 |

4,450 |

| Financial

assets pledged (OCEANE swap) |

0 |

0 |

| Currency

hedge on financial debt |

5 |

7 |

| Accrued

interest |

-52 |

-67 |

|

Gross financial debt (A) |

10,978 |

10,606 |

| Cash and

cash equivalents |

4,418 |

3,585 |

|

Marketable securities |

49 |

74 |

| Cash

pledges |

269 |

265 |

| Deposits

(bonds) |

548 |

522 |

| Bank

overdrafts |

-3 |

-5 |

|

Other |

-1 |

1 |

|

Net cash (B) |

5,280 |

4,442 |

|

Net debt (A) – (B) |

5,698 |

6,164 |

Adjusted operating free cash

flow

| |

Second Quarter |

First Half |

| In million euros |

2019 |

2018 |

2019 |

2018 |

|

Net cash flow from operating activities, continued operations |

1,071 |

849 |

2,241 |

2,146 |

|

Investment in property, plant, equipment and intangible assets |

-747 |

-595 |

-1,465 |

-1,534 |

| Proceeds

on disposal of property, plant, equipment and intangible

assets |

36 |

20 |

76 |

46 |

|

Operating free cash flow |

360 |

274 |

852 |

658 |

|

Payments on lease debt |

-250 |

-275 |

-501 |

-517 |

|

Adjusted operating free cash flow |

110 |

-1 |

351 |

141 |

Unit cost: net cost per ASK

| |

Second Quarter |

First half |

| |

2019 |

2018 |

2019 |

2018 |

|

Revenues (in €m) |

7,050 |

6,627 |

13,036 |

12,432 |

|

Income/(loss) from current operations (in €m) -/- |

400 |

346 |

97 |

228 |

| Total

operating expense (in €m) |

6,650 |

6,281 |

12,939 |

12,204 |

| Passenger

network business – other revenues (in €m) |

-227 |

-226 |

-436 |

-414 |

| Cargo

network business – other revenues (in €m) |

-80 |

-76 |

-153 |

-143 |

|

Third-party revenues in the maintenance business (in €m) |

-527 |

-471 |

-1,081 |

-941 |

| Transavia

- other revenues (in €m) |

-1 |

-1 |

-9 |

-11 |

|

Third-party revenues of other businesses (in €m) |

-8 |

-8 |

-15 |

-17 |

|

Net cost (in €m) |

5,807 |

5,499 |

11,245 |

10,678 |

|

Capacity produced, reported in ASK* |

85,207 |

81,538 |

160,793 |

154,941 |

|

Net cost per ASK (in € cents per ASK) |

6.82 |

6.75 |

6.99 |

6.89 |

|

Gross change |

|

1.0% |

|

1.5% |

|

Currency effect on net costs (in €m) |

|

114 |

|

197 |

|

Change at constant currency |

|

-1.0% |

|

-0.3% |

|

Fuel price effect (in €m) |

|

76 |

|

121 |

|

Change on a constant currency and fuel price basis |

|

-2.3% |

|

-1.4% |

|

Net cost per ASK on a constant currency and fuel price

basis (in € cents per ASK) |

6.82 |

6.98 |

6.99 |

7.09 |

|

Change at constant currency and fuel price

basis |

|

-2.3% |

|

-1.4% |

* The capacity produced by the transportation activities is

combined by adding the capacity of the Passenger network (in ASK)

to that of Transavia (in ASK).

Airline results

Air France Group

| |

Second Quarter |

First Half |

| |

2019 |

Change |

2019 |

Change |

|

Revenue (in €m) |

4,284 |

+9.1% |

7,982 |

+6.7% |

| EBITDA

(in €m) |

609 |

+170 |

813 |

+69 |

|

Operating result (en m€) |

143 |

+130 |

-113 |

+51 |

|

Operating margin (%) |

3.3% |

+3.0 pt |

-1.4% |

+0.8 pt |

|

Operating cash flow before WCR and restructuring cash out (in

€m) |

589 |

+218 |

764 |

+127 |

|

Operating cash flow (before WCR and restructuring) margin |

13.8% |

+4.3 pt |

9.6% |

+1.1 pt |

| KLM

Group |

Second Quarter |

First Half |

| |

2019 |

Change |

2019 |

Change |

|

Revenue (in €m) |

2,899 |

+3.7% |

5,284 |

+2.0% |

| EBITDA

(in €m) |

537 |

-66 |

744 |

-172 |

|

Operating result (en m€) |

258 |

-70 |

202 |

-186 |

|

Operating margin (%) |

8.9% |

-2.8 pt |

3.8% |

-3.7 pt |

|

Operating cash flow before WCR and restructuring cash out (in

€m) |

507 |

-35 |

692 |

-95 |

|

Operating cash flow (before WCR and restructuring) margin |

17.5% |

-1.9 pt |

13.1% |

-2.1 pt |

NB: Sum of individual airline results does not add up to Air

France-KLM total due to intercompany eliminations at Group

level

Group fleet at 30 June 2019

|

Aircraft type |

AF (incl. HOP) |

KLM (incl. KLC & MP) |

Transavia |

Owned |

Finance lease |

Operating lease |

Total |

In operation |

Change / 31/12/18 |

|

B747-400 |

|

10 |

|

10 |

|

|

10 |

10 |

-1 |

|

B777-300 |

43 |

14 |

|

11 |

24 |

22 |

57 |

57 |

|

|

B777-200 |

25 |

15 |

|

24 |

1 |

15 |

40 |

40 |

|

|

B787-9 |

9 |

13 |

|

7 |

3 |

12 |

22 |

22 |

2 |

|

B787-10 |

|

1 |

|

1 |

|

|

1 |

1 |

|

|

A380-800 |

10 |

|

|

1 |

4 |

5 |

10 |

10 |

|

|

A340-300 |

5 |

|

|

5 |

|

|

5 |

5 |

-1 |

|

A330-300 |

|

5 |

|

|

|

5 |

5 |

5 |

|

|

A330-200 |

15 |

8 |

|

11 |

|

12 |

23 |

23 |

|

|

Total Long-Haul |

107 |

66 |

0 |

70 |

32 |

71 |

173 |

173 |

1 |

|

B737-900 |

|

5 |

|

2 |

|

3 |

5 |

5 |

|

|

B737-800 |

|

30 |

72 |

29 |

10 |

63 |

102 |

102 |

9 |

|

B737-700 |

|

16 |

7 |

3 |

5 |

15 |

23 |

23 |

-2 |

|

A321 |

20 |

|

|

11 |

|

9 |

20 |

20 |

|

|

A320 |

43 |

|

|

3 |

5 |

35 |

43 |

43 |

|

|

A319 |

33 |

|

|

20 |

|

13 |

33 |

33 |

-1 |

|

A318 |

18 |

|

|

16 |

2 |

|

18 |

18 |

|

|

Total Medium-Haul |

114 |

51 |

79 |

84 |

22 |

138 |

244 |

244 |

6 |

|

ATR72-600 |

6 |

|

|

|

|

6 |

6 |

5 |

-1 |

|

ATR72-500 |

1 |

|

|

|

|

1 |

1 |

|

-1 |

|

ATR42-500 |

3 |

|

|

|

|

3 |

3 |

|

-5 |

| Canadair

Jet 1000 |

14 |

|

|

14 |

|

|

14 |

14 |

|

| Canadair

Jet 700 |

11 |

|

|

11 |

|

|

11 |

10 |

2 |

| Embraer

190 |

12 |

32 |

|

7 |

14 |

23 |

44 |

44 |

2 |

| Embraer

175 |

|

17 |

|

3 |

14 |

|

17 |

17 |

|

| Embraer

170 |

15 |

|

|

9 |

1 |

5 |

15 |

15 |

|

| Embraer

145 |

17 |

|

|

14 |

3 |

|

17 |

13 |

|

|

Total Regional |

79 |

49 |

0 |

58 |

32 |

38 |

128 |

118 |

-3 |

|

B747-400ERF |

|

3 |

|

3 |

|

|

3 |

3 |

|

|

B747-400BCF |

|

1 |

|

1 |

|

|

1 |

1 |

|

|

B777-F |

2 |

|

|

2 |

|

|

2 |

2 |

|

|

Total Cargo |

2 |

4 |

0 |

6 |

0 |

0 |

6 |

6 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

Total |

302 |

170 |

79 |

218 |

86 |

247 |

551 |

541 |

4 |

1 The Air France strike had a -€260 million

impact on the second quarter operating result and a -€335m impact

on the half year operating result

2 Passenger unit revenue is the aggregate of Passenger network

and Transavia unit revenues, change at constant currency

1 To align with industry practice, as of 2019

the EASK metric will no longer be used.The new Unit Cost definition

will be: Net cost per Available Seat Kilometer at constant fuel and

currency. The impact of this change for the unit cost is -0.1pt for

2019

2 Based on the forward curves of 26 July 2019

average Brent price of USD 65, average jet fuel price of USD 684

per ton including into plane costs. Assuming exchange rate of

EUR/USD of 1.13 in 2019

1 The ROCE definition has been updated within

the framework of IFRS 16 implementation. The asset value linked to

the aircraft lease contracts now corresponds to the net book value

of the right-of-use asset of all the lease contracts. Moreover, the

“operating result, adjusted for operating leases” no longer

existing having been replaced by “income from current operations”

which, thanks to IFRS 16 implementation, no longer includes the

financial cost of lease contracts. Finally, the Group now uses a

normative income tax rate, calculated according to the tax rates

applied in France and in the Netherlands.

- Q2_2019 Press release EN_VDEF

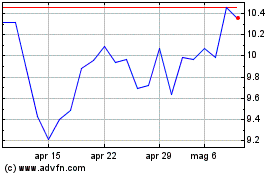

Grafico Azioni Air FranceKLM (EU:AF)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Air FranceKLM (EU:AF)

Storico

Da Apr 2023 a Apr 2024