Rio Tinto to Pay Special Dividend, Write Down Mongolia Copper Asset

01 Agosto 2019 - 9:03AM

Dow Jones News

By Rhiannon Hoyle

SYDNEY--Rio Tinto PLC (RIO.LN) said it would pay a special

dividend and raise its midyear payout, even as its first-half net

profit was cut by a write down of the value of a major copper

investment in Mongolia.

Rio Tinto, the world's second-biggest mining company by market

value, said on Thursday it would pay a special dividend worth

US$1.0 billion and raise its interim dividend to US$1.51 a share,

up from US$1.27 a share a year ago.

That was underpinned by a 12% lift in underlying earnings to

US$4.93 billion, missing a US$5.16 billion median forecast of seven

analysts' forecasts compiled by The Wall Street Journal. Rio Tinto

ships more iron ore from Australia than any other company, and has

benefited from prices of the industrial commodity surging to more

than five-year highs in the six-month period.

Still, the miner's net profit fell by 6% to US$4.13 billion

after management wrote down its investment in the Oyu Tolgoi copper

deposit in Mongolia by US$800 million. Rio Tinto said last month it

will take longer and cost more to finish building an underground

mine at Oyu Tolgoi, after early engineering work pointed to a

heightened risk of rock falls.

-Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

August 01, 2019 02:48 ET (06:48 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

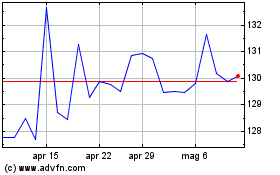

Grafico Azioni Rio Tinto (ASX:RIO)

Storico

Da Mar 2024 a Apr 2024

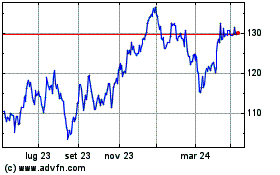

Grafico Azioni Rio Tinto (ASX:RIO)

Storico

Da Apr 2023 a Apr 2024