IQE PLC Iqe Plc: Director/Pdmr Shareholding

06 Agosto 2019 - 8:00AM

UK Regulatory

TIDMIQE

06 August 2019

IQE plc

("IQE" or the "Company")

Director/PDMR Shareholding

Cardiff, UK. 6(th) August 2019: IQE plc (AIM: IQE), the leading global

supplier of advanced wafer products and materials solutions to the

semiconductor industry, was notified on 02 August 2019 that Dr Drew

Nelson, Chief Executive Officer of the Company, has entered into a sale

and repurchase agreement with Equities First Holdings ("EFH") for

11,000,000 ordinary shares of 1 pence each in the Company ("EFH Sale

Shares"), out of his total beneficial holding (including persons closely

associated) of 36,140,417 ordinary shares (the "Agreement").

Under the terms of the Agreement, he is obligated to repurchase (and EFH

is obligated to sell to Dr Nelson) all these EFH Sale Shares at the end

of a three year term, ending on 02 August 2022. The price at which he

has sold and is required to repurchase the EFH Sale Shares is 43.96

pence per share. The Agreement provides that he has transferred all

title and waives his voting rights in these EFH Sale Shares. However,

under the terms of the agreement, EFH is prohibited from short selling

or voting the EFH Sale Shares during the term of the agreement.

Furthermore, EFH will pay Dr Nelson income that reflects any dividends

as they arise from all of these EFH Sale Shares during the entire period,

as if Dr Nelson had continued to own all the EFH Sale Shares himself.

The monies raised will principally be used to satisfy income tax and NI

obligations following the exercise of 7,681,199 share options by Dr

Nelson, as announced on 29 April 2019. Under HMRC rules, income tax and

National Insurance becomes payable through PAYE directly upon the

exercise of share options. Consequently, Directors often need to

immediately sell at least half of the exercised shares to cover this tax

and NI liability. In the case of Dr Nelson, he has elected to raise the

tax and NI monies through these arrangements in order to retain all of

the ordinary shares resulting from the exercise of share options,

thereby maximising his overall shareholding in the Company. The

remainder of the monies raised are intended to be used to fund future

tax liabilities and NI due on the exercise of share options if they

arise, as well as fund further potential share purchases and cover any

margin calls which may occur under the Agreement. The share option

exercises of 29 April were part of IQE's LTIP, and Dr Nelson was under

no time obligation to exercise such share options, but chose to do so at

this time in order to maximise his shareholding in the Company. He used

an identical share sale and repurchase agreement with EFH in October

2014, for the same purposes, which resulted in the repurchase of

18,000,000 ordinary shares by Dr Nelson from EFH in September 2017.

Following the transaction, Dr Nelson has a beneficial interest in

36,140,417 ordinary shares, representing 4.56% of the Company's issued

share capital.

The notification set out below is provided in accordance with the

requirements of the EU Market Abuse Regulation.

Notification of a Transaction pursuant to Article 19(1) of Regulation

(EU) No. 596/2014

1. Details of the Person discharging managerial responsibilities

("PDMR") / person closely associated with them ("PCA")

--------------------------------------------------------------------------------

a) Name Dr Andrew Nelson

----------------------- -------------------------------------------------------

2. Reason for the notification

--------------------------------------------------------------------------------

a) Position / status PDMR (CEO)

----------------------- -------------------------------------------------------

b) Initial notification / Initial notification

amendment

----------------------- -------------------------------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

--------------------------------------------------------------------------------

a) Name IQE plc

----------------------- -------------------------------------------------------

b) Legal Entity Identifier 213800Y33WHD3ESJJP16

----------------------- -------------------------------------------------------

4. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of

transaction; (iii) each date; and (iv) each place

where transactions have been conducted

--------------------------------------------------------------------------------

a) Description of the Ordinary shares of 1 pence each in the Company

financial instrument GB0009619924

----------------------- -------------------------------------------------------

b) Nature of the Entered into a sale and repurchase agreement with

transaction Equities First Holdings for 11,000,000 Ordinary Shares

----------------------- -------------------------------------------------------

c) Price(s) and volume(s) 11,000,000 ordinary shares at 43.96 pence per share

----------------------- -------------------------------------------------------

d) Aggregated information

-- Aggregated volume 11,000,000 ordinary shares at 43.96 pence per share

-- Aggregated price

----------------------- -------------------------------------------------------

e) Date of the 02 August 2019

transaction(s)

----------------------- -------------------------------------------------------

f) Place of the Outside a trading venue

transaction

----------------------- -------------------------------------------------------

CONTACTS:

IQE plc

+44 (0) 29 2083 9400

Drew Nelson

Tim Pullen

Peel Hunt LLP (Nomad and Joint Broker)

+44 (0) 20 7418 8900

Edward Knight

Nick Prowting

Citigroup Global Markets Limited (Joint Broker)

+44 (0) 20 7986 4000

Christopher Wren

Peter Catterall

Headland Consultancy

Andy Rivett-Carnac: +44 (0) 7968 997 365

Chloe Francklin: +44 (0) 7834 974 624

ABOUT IQE

http://iqep.com

IQE is the leading global supplier of advanced semiconductor wafers that

enable a diverse range of applications. IQE uses advanced crystal growth

technology (epitaxy) to manufacture and supply bespoke semiconductor

wafers 'epi-wafers' to the major chip manufacturing companies, who then

use these wafers to make the chips.

IQE's products are found in many leading-edge consumer, communication,

computing and industrial applications, including a complete range of

wafer products for the wireless industry, such as smartphones and

wireless infrastructure, Wi-Fi, base stations, and satellite

communications; optical communications, optical storage, printing,

thermal imagers, leading-edge medical technologies, automotive and

aerospace technologies, a variety of advanced silicon based systems and

high efficiency concentrator photovoltaic (CPV) solar cells.

IQE is headquartered in Cardiff UK and operates manufacturing and R&D

facilities worldwide.

(END) Dow Jones Newswires

August 06, 2019 02:00 ET (06:00 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

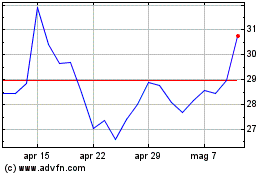

Grafico Azioni Iqe (LSE:IQE)

Storico

Da Mar 2024 a Apr 2024

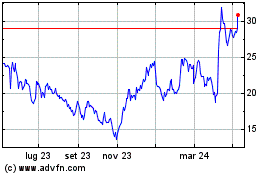

Grafico Azioni Iqe (LSE:IQE)

Storico

Da Apr 2023 a Apr 2024