Australian, NZ Dollars Rise After Strong China Inflation, Japan GDP Data

09 Agosto 2019 - 5:32AM

RTTF2

The Australian and the New Zealand dollars strengthened against

their major counterparts in the Asian session on Friday amid rising

risk appetite, as investor sentiment lifted up after better than

expected Japan gross domestic product data for the second quarter

and Chinese inflation data for July.

Data from the Cabinet Office showed that Japan's gross domestic

product gained a seasonally adjusted 0.4 percent on quarter in the

second quarter of 2019. That beat expectations for an increase of

0.1 percent following the upwardly revised 0.7 percent gain in the

previous three months.

China's July inflation rose at the fastest pace since February

2018 year-on-year, official data showed.

Consumer price inflation rose to 2.8 percent in July from 2.7

percent in June. The rate was forecast to remain unchanged at 2.7

percent.

However, worries about U.S.-China trade tensions resurfaced

after Bloomberg reported that the U.S. is delaying a decision about

licenses for American companies to restart business with Huawei

Technologies Co. following China's decision to halt purchases of

U.S. agricultural products.

The kiwi climbed to 2-day highs of 1.7221 against the euro,

0.6496 against the greenback and 68.88 against the yen, from its

early lows of 1.7299, 0.6456 and 68.41, respectively. The next

possible resistance for the kiwi is seen around 1.69 against the

euro, 0.66 against the greenback and 70.00 against the yen.

The New Zealand currency bounced off to 1.0482 against the

aussie, from a low of 1.0511 hit at 5:00 pm ET. Further uptrend is

likely to take the kiwi to a resistance around the 1.03 area.

The aussie edged higher to 0.6818 against the greenback, after

falling to 0.6777 at 5:15 pm ET. The aussie is seen finding

resistance around the 0.70 level.

Reversing from a low of 71.67 hit at 5:15 pm ET, the aussie

appreciated to 72.24 against the yen. On the upside, 75.00 is

possibly seen as the next resistance level for the aussie.

The aussie held steady against the loonie, after reaching as

high as 0.9017 at 8:45 pm ET. The aussie had declined to a 2-day

low of 0.8970 at the beginning of today's trading. Next likely

resistance for the aussie is seen around the 0.92 level.

The aussie strengthened to a 4-day high of 1.6406 against the

euro from yesterday's closing value of 1.6431. The aussie is likely

to find resistance around the 1.61 level, if it rises further.

Looking ahead, U.K. GDP data for the second quarter, trade data,

industrial production and construction out for June are due in the

European session.

Canada housing starts for July are set for release at 8:15 am

ET.

In the New York session, Canada building permits for June and

jobs data for June as well as U.S. producer prices for the same

month will be featured.

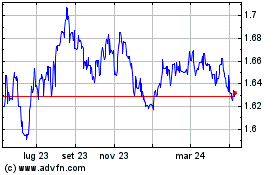

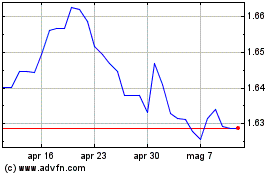

Grafico Cross Euro vs AUD (FX:EURAUD)

Da Mar 2024 a Apr 2024

Grafico Cross Euro vs AUD (FX:EURAUD)

Da Apr 2023 a Apr 2024