TIDMTXP

RNS Number : 9464I

Touchstone Exploration Inc.

14 August 2019

TOUCHSTONE ANNOUNCES RESULTS FOR THE THREE AND SIX MONTHSED JUNE

30, 2019

Calgary, Alberta, August 14, 2019 - Touchstone Exploration Inc.

("Touchstone", "we", "our", "us" or the "Company") (TSX, LSE: TXP)

announces its financial and operational results for the three and

six months ended June 30, 2019. Selected information is outlined

below and should be read in conjunction with Touchstone's June 30,

2019 unaudited interim consolidated financial statements and

related Management's discussion and analysis, both of which will be

available under the Company's profile on SEDAR (www.sedar.com) and

the Company's website (www.touchstoneexploration.com). Unless

otherwise stated, all financial amounts herein are rounded to

thousands of United States dollars.

Highlights

-- Achieved crude oil sales of 1,768 bbls/d and 1,944 bbls/d for the three and six months ended June 30, 2019,

respectively, representing increases of 3% and 19% relative to the prior year comparative periods.

-- Generated an operating netback of $26.85 per barrel in the second quarter of 2019 and $28.20 year to date 2019.

-- Delivered funds flow from operations of $1,310,000 ($0.01 per share) and $3,740,000 ($0.02 per share) during the

second quarter and year to date June 30, 2019, respectively.

-- Exited the quarter with cash of $7,250,000 and net debt of $10,010,000, representing 1.3 times net debt to

trailing twelve-month funds flow from operations.

-- Subsequent to June 30, 2019, spudded the Company's first exploration well on our Ortoire property.

Financial and Operating Results Summary

Three months ended % change Six months ended % change

June 30, June 30,

--------- ---------

2019 2018 2019 2018

------------------------------- ---------- --------- --------- ----------- ----------- ---------

Operating Highlights

Average daily oil

production (bbls/d) 1,768 1,717 3 1,944 1,631 19

Net wells drilled - 3 n/a - 5 n/a

Brent benchmark price

($/bbl) 69.01 74.53 (7) 66.03 70.67 (7)

Operating netback(1)

($/bbl)

Realized sales price 60.33 61.97 (3) 58.91 60.63 (3)

Royalties (17.25) (17.49) (1) (16.19) (17.18) (6)

Operating expenses (16.23) (14.90) 9 (14.52) (15.31) (5)

------------------------------- ---------- --------- --------- ----------- ----------- ---------

26.85 29.58 (9) 28.20 28.14 -

Financial Highlights

($000's except as

indicated)

Petroleum sales 9,708 9,685 - 20,723 17,897 16

Cash flow from operating

activities 1,832 4,711 (61) 4,569 3,690 24

Funds flow from operations(2) 1,310 2,507 (48) 3,740 4,569 (18)

Per share - basic

and diluted(1)(2) 0.01 0.02 (50) 0.02 0.04 (50)

Net loss (833) (523) 59 (1,018) (393) 159

Per share - basic

and diluted (0.01) (0.00) n/a (0.01) (0.00) n/a

Notes:

(1) Non-GAAP financial measure that does not have a standardized

meaning prescribed by International Financial Reporting Standards

("IFRS") and therefore may not be comparable with the calculation

of similar measures presented by other companies. See "Advisories:

Non-GAAP Measures".

(2) Additional GAAP financial measure included in the Company's

consolidated statements of cash flows. See "Advisories: Non-GAAP

Measures".

Three months ended % change Six months ended % change

June 30, June 30,

--------- ---------

2019 2018 2019 2018

------------------------- ---------- --------- --------- ----------- ----------- ---------

Exploration capital

expenditures 681 334 104 1,041 511 104

Development capital

expenditures 315 3,506 (91) 714 6,358 (89)

Net debt(1) - end

of period 10,010 8,576 17

Share Information

(000's)

Weighted average shares

outstanding - basic

and diluted 160,688 129,021 25 150,891 129,021 17

Outstanding shares

- end of period 160,688 129,021 25

Note:

(1) Non-GAAP financial measure that does not have a standardized

meaning prescribed by IFRS and therefore may not be comparable with

the calculation of similar measures presented by other companies.

See "Advisories: Non-GAAP Measures".

Operating results

In the first half of 2019, Touchstone conducted minimal capital

development activities and continued to focus on prudently managing

working capital, maintaining net debt levels and preparing for the

initial Ortoire exploration well that spudded on August 7, 2019.

Second quarter development capital expenditures totaled $315,000

which included continuing recompletion activities.

Second quarter 2019 crude oil production averaged 1,768 bbls/d,

a 3% increase relative to the 1,717 bbls/d produced in the second

quarter of 2018. Second quarter average daily production decreased

by 17% from the first quarter of 2019. First quarter 2019 volumes

were buoyed by flush production from wells drilled in the fourth

quarter of 2018. As this flush production declined, the Company

focused on converting the wells to pump as well as recompleting

initial low rate producing wells. As a result of these initiatives,

various wells and associated production were off-line during the

second quarter. Production from the 2018 development drilling

campaign contributed an average of approximately 413 bbls/d of

incremental production in the second quarter of 2019 versus 692

incremental bbls/d in the first quarter of 2019.

Financial results

Our second quarter operating netback was $26.85 per barrel

compared to $29.58 per barrel in the second quarter of 2018.

Realized second quarter 2019 crude oil pricing was $60.33 per

barrel, 3% less than the $61.97 per barrel received in the

equivalent quarter of 2018. Second quarter 2019 royalty expenses

were consistent with the second quarter of 2018, both on a per

barrel basis and as a percentage of petroleum sales. In comparison

to the second quarter of 2018, operating expenses on a per barrel

basis increased 9%, predominately due to extensive well servicing

activities conducted during the three months ended June 30,

2019.

Touchstone generated second quarter 2019 funds flow from

operations of $1,310,000 ($0.01 per share), representing a decrease

of $1,197,000 or 48% from the prior year comparative period. The

variance was mainly a result of increased current income taxes

recorded in the 2019 second quarter, as increased supplemental

petroleum tax was incurred based on minimal developmental capital

activity in the second quarter of 2019. As a result, we recognized

a net loss of $833,000 ($0.01 per share) in the second quarter of

2019 versus a net loss of $523,000 ($0.00 per share) in the

equivalent prior year quarter.

Touchstone exited the second quarter with a cash balance of

$7,250,000, a working capital surplus of $2,062,000 and a C$15

million principal term loan balance. Our June 30, 2019 net debt

position of $10,010,000 represented net debt to trailing

twelve-month funds flow from operations of 1.3 times. As a result

of an extension executed in the first quarter of 2019, our credit

facility does not require the commencement of principal payments

until January 1, 2021, and we continued to be comfortably within

the financial covenants as at June 30, 2019.

Paul R. Baay, President and Chief Executive Officer,

commented:

"Touchstone continues to operate from a comfortable financial

position, with stable operating netbacks and positive cash flows.

Following the spudding of our Coho-1 well last week, we are fully

focused on progressing our Ortoire block exploration drilling

programme. Last week's announcement represents the start of a

potentially transformational period in the Company's history, and

we look forward to updating the market on the Coho-1 well results

over the course of the next two months."

About Touchstone

Touchstone Exploration Inc. is a Calgary based company engaged

in the business of acquiring interests in petroleum and natural gas

rights and the exploration, development, production and sale of

petroleum and natural gas. Touchstone is currently active in

onshore properties located in the Republic of Trinidad and Tobago.

The Company's common shares are traded on the Toronto Stock

Exchange and the AIM market of the London Stock Exchange under the

symbol "TXP".

For Further Information:

Touchstone Exploration Inc.

Mr. Paul Baay, President and Chief Executive Officer Tel: +1

(403) 750-4487

Mr. Scott Budau, Chief Financial Officer

Mr. James Shipka, Chief Operating Officer

www.touchstoneexploration.com

Shore Capital (Nominated Advisor and Joint Broker)

Nominated Advisor: Edward Mansfield / Mark Percy / Daniel Bush Tel: +44 (0) 207 408 4090

Corporate Broking: Jerry Keen

GMP FirstEnergy (Joint Broker)

Jonathan Wright / Hugh Sanderson Tel: +44 (0) 207 448 0200

Camarco (Financial PR)

Nick Hennis / Jane Glover Tel: +44 (0) 203 781 8330

Advisories

Non-GAAP Measures

This announcement contains terms commonly used in the oil and

natural gas industry, including funds flow from operations, funds

flow from operations per share, operating netback and net debt.

These terms do not have a standardized meaning under IFRS and may

not be comparable to similar measures presented by other companies.

Shareholders and investors are cautioned that these measures should

not be construed as alternatives to cash flow from operating

activities, net income, total liabilities, or other measures of

financial performance as determined in accordance with Generally

Accepted Accounting Principles ("GAAP"). Management uses these

Non-GAAP measures for its own performance measurement and to

provide stakeholders with measures to compare the Company's

operations over time.

Funds flow from operations is an additional GAAP measure

included in the Company's consolidated statements of cash flows.

The Company calculates funds flow from operations per share by

dividing funds flow from operations by the weighted average number

of common shares outstanding during the applicable period.

The Company uses operating netback as a key performance

indicator of field results. Operating netback is presented on a

total and per barrel basis and is calculated by deducting royalties

and operating expenses from petroleum sales. If applicable, the

Company also discloses operating netback both prior to realized

gains or losses on derivatives and after the impacts of derivatives

are included. Realized gains or losses represent the portion of

risk management contracts that have settled in cash during the

period, and disclosing this impact provides Management and

investors with transparent measures that reflect how the Company's

risk management program can impact netback metrics. The Company

considers operating netback to be a key measure as it demonstrates

Touchstone's profitability relative to current commodity prices.

This measurement assists Management and investors with evaluating

operating results on a historical basis.

The Company closely monitors its capital structure with a goal

of maintaining a strong financial position in order to fund current

operations and the future growth of the Company. The Company

monitors working capital and net debt as part of its capital

structure to assess its true debt and liquidity position and to

manage capital and liquidity risk. Working capital is calculated as

current assets minus current liabilities as they appear on the

consolidated statements of financial position. Net debt is

calculated by summing the Company's working capital, long-term

lease liabilities and the principal (undiscounted) amount of

long-term debt.

Forward-Looking Statements

Certain information provided in this announcement may constitute

forward-looking statements within the meaning of applicable

securities laws. Forward-looking information in this announcement

may include, but is not limited to, statements relating to the

potential undertaking, timing, locations, production rates and

costs of future exploration well drilling, and the sufficiency of

resources and available financing to fund future exploration,

drilling and completion operations. Although the Company believes

that the expectations and assumptions on which the forward-looking

statements are based are reasonable, undue reliance should not be

placed on the forward-looking statements because the Company can

give no assurance that they will prove to be correct. Since

forward-looking statements address future events and conditions, by

their very nature they involve inherent risks and uncertainties.

Actual results could differ materially from those currently

anticipated due to a number of factors and risks. Certain of these

risks are set out in more detail in the Company's December 31, 2018

Annual Information Form dated March 26, 2019 which has been filed

on SEDAR and can be accessed at www.sedar.com. The forward-looking

statements contained in this announcement are made as of the date

hereof, and except as may be required by applicable securities

laws, the Company assumes no obligation to update publicly or

revise any forward-looking statements made herein or otherwise,

whether as a result of new information, future events or

otherwise.

Interim Consolidated Statements of Financial Position

(unaudited)

(US$ thousands) June 30, December January

Note 2019 31, 2018 1, 2018

-------------------------------------- ----- --------- ---------- ---------

(note 3) (note 3)

Assets 10

Current assets

Cash $7,250 $3,554 $11,089

Accounts receivable 5 9,398 11,893 6,803

Crude oil inventory 123 150 134

Prepaid expenses 551 257 378

Financial derivatives 14 196 - -

-------------------------------------- ----- --------- ---------- ---------

17,518 15,854 18,404

Exploration assets 6 4,543 3,644 1,659

Property and equipment 3,7 62,119 63,041 50,045

Restricted cash 16 271 271 299

Other assets 1,199 1,330 1,486

Abandonment fund 11 1,050 966 835

Total assets $86,700 $85,106 $72,728

-------------------------------------- ----- --------- ---------- ---------

Liabilities

Current liabilities

Accounts payable and accrued

liabilities 8 $11,585 $16,262 $10,330

Income taxes payable 8 3,678 2,730 2,441

Term loan and associated liabilities 10 193 180 208

-------------------------------------- ----- --------- ---------- ---------

15,456 19,172 12,979

Provisions 3 - 125 53

Lease liabilities 3,9 613 - -

Term loan and associated liabilities 10 10,878 10,683 11,657

Decommissioning liabilities 11 8,644 8,915 9,438

Deferred income taxes 16,544 14,994 8,185

-------------------------------------- ----- --------- ---------- ---------

Total liabilities 52,135 53,889 42,312

-------------------------------------- ----- --------- ---------- ---------

Shareholders' equity

Shareholders' capital 12 61,483 56,987 56,987

Contributed surplus 2,263 2,172 2,035

Accumulated other comprehensive

loss (14,648) (14,427) (14,733)

Accumulated deficit (14,533) (13,515) (13,873)

-------------------------------------- ----- --------- ---------- ---------

Total shareholders' equity 34,565 31,217 30,416

-------------------------------------- ----- --------- ---------- ---------

Total liabilities and shareholders'

equity $86,700 $85,106 $72,728

-------------------------------------- ----- --------- ---------- ---------

Commitments and contingencies (Note 16)

See accompanying notes to these unaudited interim consolidated

financial statements.

Interim Consolidated Statements of Comprehensive Income (Loss)

(unaudited)

(US$ thousands, except Three months ended Six months ended

per share amounts) June 30, June 30,

---------------------------------- -----

Note 2019 2018 2019 2018

---------------------------------- ----- ---------- --------- --------- ---------

(note (note

3) 3)

Revenues

Petroleum sales $9,708 $ 9,685 $20,723 $17,897

Royalties (2,776) (2,734) (5,695) (5,071)

---------------------------------- ----- ---------- --------- --------- ---------

Petroleum revenue 6,932 6,951 15,028 12,826

Gain (loss) on financial

derivatives 14 25 (87) 25 (143)

Other income 3 - 11 375

---------------------------------- ----- ---------- --------- --------- ---------

6,960 6,864 15,064 13,058

---------------------------------- ----- ---------- --------- --------- ---------

Expenses

Operating 2,612 2,329 5,107 4,520

General and administrative 1,487 1,449 2,802 2,822

Net finance 13 251 308 572 755

Foreign exchange loss (gain) 14 91 20 129 (249)

Share-based compensation 12 49 31 80 56

Depletion and depreciation 7 1,249 1,041 2,700 1,935

Impairment 6 63 85 141 241

Loss on decommissioning

liabilities - 9 - 9

5,802 5,272 11,531 10,089

---------------------------------- ----- ---------- --------- --------- ---------

Earnings before income

taxes 1,158 1,592 3,533 2,969

Income taxes

Current tax expense 1,435 470 3,053 761

Deferred tax expense 556 1,645 1,498 2,601

---------------------------------- ----- ---------- --------- --------- ---------

1,991 2,115 4,551 3,362

---------------------------------- ----- ---------- --------- --------- ---------

Net loss (833) (523) (1,018) (393)

Currency translation adjustments (188) 267 (221) 542

---------------------------------- ----- ---------- --------- --------- ---------

Comprehensive (loss) income $(1,021) $ (256) $(1,239) $ 149

---------------------------------- ----- ---------- --------- --------- ---------

Net loss per common share

Basic and diluted 12 $(0.01) $ (0.00) $(0.01) $ (0.00)

---------------------------------- ----- ---------- --------- --------- ---------

See accompanying notes to these unaudited interim consolidated

financial statements.

Interim Consolidated Statements of Changes in Shareholders'

Equity (unaudited)

(US$ thousands) Accumulated

Shareholders' Contributed other comprehensive Accumulated Shareholders'

capital surplus loss deficit equity

-------------------------- -------------- ------------ --------------------- ------------------ ----------------

January 1, 2018

(note 3) $56,987 $2,035 $(14,733) $(13,873) $30,416

Net loss - - - (393) (393)

Other comprehensive

income - - 542 - 542

Share-based compensation

expense (note 12) - 56 - - 56

Share-based compensation

capitalized (note

7) - 10 - - 10

June 30, 2018 $56,987 $2,101 $(14,191) $(14,266) $30,631

-------------------------- -------------- ------------ --------------------- ------------------ ----------------

January 1, 2019

(note 3) $56,987 $2,172 $(14,427) $(13,515) $31,217

Net loss - - - (1,018) (1,018)

Other comprehensive

loss - - (221) - (221)

Private placement

(note 12) 4,496 - - - 4,496

Share-based compensation

expense (note 12) - 80 - - 80

Share-based compensation

capitalized (note

7) - 11 - - 11

June 30, 2019 $61,483 $2,263 $(14,648) $(14,533) $34,565

-------------------------- -------------- ------------ --------------------- ------------------ ----------------

See accompanying notes to these unaudited interim consolidated

financial statements.

Interim Consolidated Statements of Cash Flows (unaudited)

(US$ thousands) Three months ended Six months ended

June 30, June 30,

--------------------------------- -----

Note 2019 2018 2019 2018

--------------------------------- ----- --------- ---------- --------- ---------

(note 3) (note 3)

Cash provided by (used

in) the following activities:

Operating activities

Net loss for the period $(833) $(523) $(1,018) $(393)

Items not involving cash from

operations:

Non-cash (gain) loss on

financial derivatives 14 (25) 87 (25) 143

Unrealized foreign exchange

loss (gain) 14 70 5 128 (276)

Share-based compensation 12 49 31 80 56

Depletion and depreciation 7 1,249 1,041 2,700 1,935

Impairment 6 63 85 141 241

Other 165 116 236 328

Loss on decommissioning

liabilities - 9 - 9

Deferred income tax expense 556 1,645 1,498 2,601

Decommissioning expenditures 11 16 11 - (75)

--------------------------------- ----- --------- ---------- --------- ---------

Funds flow from operations 1,310 2,507 3,740 4,569

Change in non-cash working

capital 693 2,204 1,000 (726)

Costs related to financial

derivatives 14 (171) - (171) (153)

--------------------------------- ----- --------- ---------- --------- ---------

Cash flow from operating

activities 1,832 4,711 4,569 3,690

--------------------------------- ----- --------- ---------- --------- ---------

Investing activities

Exploration asset expenditures 6 (681) (334) (1,041) (511)

Property and equipment

expenditures 7 (315) (3,506) (714) (6,358)

Abandonment fund expenditures 11 (37) (34) (81) (64)

Change in non-cash working

capital (873) (490) (2,982) 261

--------------------------------- ----- --------- ---------- --------- ---------

Cash flow used in investing

activities (1,906) (4,364) (4,818) (6,672)

---------------------------------------- --------- ---------- --------- ---------

Financing activities

Payment of term loan production

obligation 10 (97) (97) (207) (179)

Term loan amendment fees 10 - (119) (112) (119)

Finance lease (payments)

receipts (80) 58 (112) 117

Issuance of common shares 12 - - 4,496 -

Change in non-cash working

capital (11) (174) 3 (166)

Cash flow (used in) from financing

activities (188) (332) 4,068 (347)

---------------------------------------- --------- ---------- --------- ---------

(Decrease) increase in

cash (262) 15 3,819 (3,329)

Cash, beginning of period 7,586 8,026 3,554 11,089

Impact of foreign exchange

on foreign denominated cash

balances (74) (5) (123) 276

Cash, end of period $7,250 $8,036 $7,250 $8,036

--------------------------------- ----- --------- ---------- --------- ---------

The following are included

in cash flow from operating

activities:

Interest paid in cash 221 226 448 454

Income taxes paid in cash 1,424 252 2,011 449

--------------------------------- ----- --------- ---------- --------- ---------

See accompanying notes to these unaudited interim consolidated

financial statements.

Notes to the Interim Consolidated Financial Statements

(unaudited)

As at June 30, 2019 and for the three and six months ended June

30, 2019 and 2018

1. Reporting Entity

Touchstone Exploration Inc. and its subsidiaries (collectively,

the "Company") are engaged in the business of crude oil and natural

gas exploration, development, acquisition and production. The

Company is currently active in the Republic of Trinidad and Tobago

("Trinidad").

Touchstone Exploration Inc. is incorporated under the laws of

Alberta, Canada with its head and principal office located at 4100,

350 7(th) Avenue SW, Calgary, Alberta, T2P 3N9. The Company's

common shares are listed on the Toronto Stock Exchange and on the

AIM market of the London Stock Exchange under the symbol "TXP".

2. Basis of Preparation and Statement of Compliance

These unaudited condensed interim consolidated financial

statements (the "financial statements") have been prepared in

accordance with International Accounting Standard ("IAS") 34

Interim Financial Reporting using accounting policies consistent

with International Financial Reporting Standards ("IFRS") as issued

by the International Accounting Standards Board. These financial

statements are condensed as they do not include all the information

required by IFRS for annual financial statements and therefore

should be read in conjunction with the Company's audited

consolidated financial statements for the year ended December 31,

2018. Certain reclassification adjustments have been made to these

financial statements to conform to the current presentation.

Unless otherwise stated, amounts presented in these financial

statements are rounded to thousands of United States dollars ("$"

or "US$), and tabular amounts are stated in thousands of United

States dollars, as described further in Note 3 "Changes to

Accounting Policies".

The financial statements have been prepared on a historical cost

basis, except as detailed in the accounting policies disclosed in

Note 3 "Summary of Significant Accounting Policies" of the

Company's audited consolidated financial statements for the year

ended December 31, 2018. All accounting policies and methods of

computation followed in the preparation of these financial

statements are consistent with those of the previous financial

year, except as disclosed in Note 3 "Changes to Accounting

Policies". There have been no significant changes to the use of

estimates or judgments since December 31, 2018, except as noted in

Note 4 "Use of Estimates, Judgements and Assumptions".

All intercompany transactions have been eliminated upon

consolidation between Touchstone and its subsidiaries in these

financial statements. The Company's operations are viewed as a

single operating segment by the chief operating decision makers of

the Company for the purposes of resource allocation and assessing

performance.

These financial statements were authorized for issue by the

Company's Board of Directors on August 13, 2019.

3. Changes to Accounting Policies

(a) Change in presentation currency

The Company changed its presentation currency from Canadian

dollars to United States dollars effective January 1, 2019, with

retrospective application on comparative figures in accordance with

IAS 8 Accounting Policies, Changes in Accounting Estimates and

Errors and IAS 21 Foreign Currency ("IAS 21"). The change in

accounting policy was made to better reflect the Company's

international business activities and to improve comparability of

the Company's financial results with other internationally focused

junior oil and gas companies.

The Company did not change its functional currency, nor did it

change the functional currencies of any of its subsidiaries. The

functional currency of the parent company is the Canadian dollar

("C$"), the functional currency of the Company's Barbadian entity

is the US$, and the functional currency of its three operational

Trinidadian subsidiaries is the Trinidad and Tobago dollar

("TT$").

For comparative purposes, historical consolidated financial

statements have been restated to reflect financial results had they

been presented in US$ since the Company's inception. The current

and comparative results and financial position of the Company's

consolidated subsidiaries that have a functional currency different

from the presentation currency have been translated into the US$

presentation currency in accordance with IAS 21 as follows:

-- assets and liabilities for each statement of financial

position presented were translated at the reporting date closing

rate;

-- shareholders' equity items for each statement of financial

position presented were translated at the rates prevailing on the

dates of the transactions;

-- revenue and expenses and certain cash flow items for each

period were translated at average monthly exchange rates (unless

this was not a reasonable approximation of the cumulative effect of

the rates prevailing on the transaction dates, in which case

revenue and expenses were translated at the dates of the

transactions);

-- all resulting exchange differences were recognized in

accumulated other comprehensive loss, a separate component of

equity; and

-- all foreign exchange rates used were extracted from the

Company's underlying financial records.

As such, the change in presentation currency does not have an

economic impact on the Company's underlying operations and

transactions. The change in presentation currency simply converts

the consolidated financial statement amounts to US$ as described

above. In addition to the comparative consolidated statement of

financial position, the Company has presented a third consolidated

statement of financial position as at January 1, 2018 as a result

of the change in presentation currency.

The Company's shareholders previously approved a special

resolution approving the reduction of the stated capital of the

Company's common shares by an aggregate amount of up to C$150

million, which was partially implemented on November 30, 2017

thereby reducing the Company's C$ accumulated deficit to $nil. The

change in presentation currency created an accumulated deficit at

that time, as the Company's historical accumulated deficit balance

presented in US$ exceeded the translated C$ capital reduction on

November 30, 2017.

(b) Adoption of IFRS 16 Leases ("IFRS 16")

Effective January 1, 2019, the Company adopted IFRS 16. The

standard supersedes IAS 17 Leases ("IAS 17") and requires the

recognition of a right-of-use ("ROU") asset and lease obligation on

the statement of financial position for most leases where the

entity is acting as a lessee. For lessees, IFRS 16 removes the

classification of leases as either operating leases or finance

leases, effectively treating all leases as finance leases. IFRS 16

allows lessors to continue with the dual classification model for

recognized leases with the resultant accounting remaining unchanged

from IAS 17. The Company is the lessee in the majority of its lease

arrangements; however, the Company does have one material lease

arrangement where it acts as the lessor.

The Company has elected to apply IFRS 16 using the modified

retrospective approach which does not require the restatement of

prior period financial information. Modified retrospective

application recognizes the cumulative effect of IFRS 16 as an

adjustment to opening accumulated deficit at January 1, 2019 and

applies the standard prospectively. Accordingly, comparative

information before adoption has not been restated and continues to

be reported under IAS 17.

On adoption of IFRS 16, the Company recognized lease liabilities

in relation to leases under the principles of the new standard

measured at the present value of the remaining lease payments,

discounted using the interest rate implicit in the lease or the

Company's incremental borrowing rate as at January 1, 2019. The

Company used a weighted average incremental borrowing rate of 8

percent to measure the present value of future lease payments on

January 1, 2019. The associated ROU assets (included in property

and equipment) were measured at the amount equal to the lease

liability on January 1, 2019 less any amount previously recognized

for office lease inducements, with no impact on opening accumulated

deficit.

On January 1, 2019, the Company elected to utilize the following

practical expedients permitted in the standard:

-- the Company recognized leases with terms ending within twelve

months of initial adoption as short-term leases, with lease

payments recognized in the financial statements as incurred;

-- on January 1, 2019, the provision for office lease

inducements previously recognized was applied to the value of the

associated ROU asset; and

-- certain leases having similar characteristics have been

measured as a portfolio by applying a single discount rate.

The Company identified ROU lease assets and liabilities related

to head office space, oilfield service equipment, motor vehicles

and office equipment. The following table sets forth the impact of

the adoption of IFRS 16 on the consolidated statement of financial

position as at January 1, 2019.

January

1, 2019

----------------------

ROU asset (included in property and equipment) $ 1,194

---------------------------------------------------- ----------------------

Increase in total assets $ 1,194

---------------------------------------------------- ----------------------

Short-term portion of lease liabilities (included

in accounts payable and accrued liabilities) $ 482

Provisions and accounts payable and accrued

liabilities (158)

Long-term portion of lease liabilities 870

---------------------------------------------------- ----------------------

Increase in total liabilities and shareholders'

equity $ 1,194

---------------------------------------------------- ----------------------

Upon adoption of IFRS 16, lease liability amounts are now

included in the Company's term loan financial covenants (see Note

10 "Term Loan and Associated Liabilities).

The adoption of IFRS 16 did not affect its finance lease where

the Company is the lessor.

Update to Significant Accounting Policies

The Company applied IFRS 16 using the modified retrospective

approach; therefore, the comparative information provided continues

to be accounted for in accordance with the Company's previous

accounting policy found in the audited consolidated financial

statements for the year ended December 31, 2018. The accounting

policy set forth below is applicable from January 1, 2019.

Lease arrangements

The Company assesses whether an arrangement is a lease based on

whether the contract conveys the right to control the use of an

identified asset for a period of time in exchange for

consideration.

As lessee

When the Company is a lessee, leases are recognized as a

right-of-use asset and a corresponding lease liability at the date

on which the leased asset is available for use by the Company.

Assets and liabilities arising from a lease are measured on a

present value basis. Lease liabilities include the net present

value of fixed payments, variable lease payments that are based on

an index or a rate, amounts expected to be paid by the lessee under

residual value guarantees, the exercise price of purchase options

if the lessee is reasonably certain to exercise that option, and

payments of penalties for terminating the lease, less any lease

incentives receivable. The future payments are discounted using the

interest rate implicit in the lease or, when that rate cannot be

readily determined, the Company's incremental borrowing rate. The

Company uses a single discount rate for a portfolio of leases with

reasonably similar characteristics.

Lease payments are allocated between the lease liability and

finance expenses. Finance expenses are charged to the consolidated

statements of comprehensive income (loss) over the lease term.

Associated ROU assets are initially measured at cost, which

comprises the initial amount of the lease liability, any initial

direct costs incurred, and an estimate of costs to dismantle and

remove the underlying asset or to restore the underlying asset,

less any lease payments made at or before the commencement date.

ROU assets are depreciated on a straight-line basis over the

shorter of the estimated useful life of the asset or the lease

term. ROU assets may be adjusted for certain remeasurements of the

lease liability and impairment losses.

Leases that have terms of less than twelve months or leases on

which the underlying asset is of low value are recognized as an

expense in the consolidated statement of comprehensive income

(loss) on a straight-line basis over the lease term.

As lessor

Where the Company is the lessor in a lease arrangement, the

Company assesses at inception whether the lease is a finance or

operating lease. Leases where the Company transfers substantially

all of the risk and rewards incidental to ownership of the

underlying asset are classified as financing leases. Under a

finance lease, the Company records the short-term portion of the

finance lease in accounts receivable and the long-term portion in

other assets. Finance income related to the lease is recognized

using an approach that equals a constant rate of return on the net

investment of the lease. The net investment of the lease is the

aggregate of the net minimum lease payments and unearned finance

income discounted at the interest rate implicit in the lease.

Unearned finance income is deferred and recognized in the

statements of comprehensive income over the lease term. The Company

recognizes lease payments received under operating leases as income

on a straight-line basis over the lease term as other income.

(c) Adoption of IFRIC 23 Uncertainty over Income Tax Treatments ("IFRIC 23")

IFRIC 23 clarifies how the recognition and measurement

requirements of IAS 12 Income Taxes are applied where there is

uncertainty over income tax treatments. IFRIC 23 is effective for

years beginning on or after January 1, 2019. The adoption of this

amendment did not have a material impact on the Company's financial

statements or previously reported results.

(d) Future accounting policies

There are no other standards or interpretations issued, but not

yet effective, that the Company anticipates may have a material

effect on the financial statements once adopted.

4. Use of Estimates, Judgements and Assumptions

Leases

Management applies judgment in reviewing each of its contractual

arrangements to determine whether the arrangement contains a lease

within the scope of IFRS 16. Leases that are recognized are subject

to further Management judgment and estimation in various areas

specific to the contractual arrangements. In determining the lease

term to be recognized, Management considers all facts and

circumstances that create an economic incentive to exercise an

extension option or not to exercise a termination option.

Lease obligations are estimated using a discount rate equal to

the interest rate implicit in the lease or, if that rate cannot be

readily determined, the Company's incremental borrowing rate. The

Company's incremental borrowing rate represents the rate that the

Company would incur to obtain the funds necessary to purchase an

asset of a similar value, with similar payment terms and security

in a similar economic environment.

5. Financial Assets and Credit Risk

Credit risk arises from the potential that the Company may incur

a loss if a counterparty to a financial instrument fails to meet

its obligation in accordance with agreed terms. As at June 30,

2019, the Company was exposed to credit risk with respect to its

accounts receivable and other assets, which includes finance lease

receivable and deferred consideration from a property

disposition.

The credit risk associated with the Company's finance lease

receivable is considered to be low as the asset is secured by the

underlying fixed assets, with ownership transferring to the

counterparty subsequent to the final payment. The credit risk

associated with the Company's deferred consideration is also

considered low as the Company is selling the counterparty's crude

oil produced from the disposed assets through its facilities and

currently has the right to net the quarterly payment from the gross

proceeds received.

The Company's crude oil production is sold, as determined by

market-based prices adjusted for quality differentials, to Heritage

Petroleum Company Limited ("Heritage") (formerly the Petroleum

Company of Trinidad and Tobago Limited). Typically, the Company's

maximum credit exposure is petroleum sales for two months, of which

$3,215,000 was included in accounts receivable as at June 30, 2019,

which represented approximately 34 percent of the total balance

(December 31, 2018 - $5,165,000 and 43 percent, respectively). In

addition, $5,438,000 in value added tax due from the Trinidad

government was included in accounts receivable as at June 30, 2019,

which represented approximately 58 percent of the accounts

receivable balance (December 31, 2018 - $6,006,000 and 51 percent,

respectively).

As at June 30, 2019, the Company determined that the average

expected credit loss on the Company's accounts receivables was nil.

The Company believes that the accounts receivable balances that are

past due are ultimately collectible, as the majority are due from

Trinidad government agencies for value added taxes, and the Company

has historically not experienced any collection issues. The aging

of accounts receivable as at June 30, 2019 and December 31, 2018 is

disclosed in the following table.

June 30, December

31, 2018

2019

--------------------------------- ---- --------------------- ---------------------

Not past due $ 3,541 $ 6,731

Past due (greater than 90 days) 5,857 5,162

--------------------------------------- --------------------- ---------------------

Accounts receivable $ 9,398 $ 11,893

--------------------------------------- --------------------- ---------------------

6. Exploration Assets

Exploration assets consist of the Company's projects in the

exploration and evaluation stage which are pending determination of

technical and commercial feasibility. The following table is a

continuity schedule of the Company's exploration assets at the end

of the respective periods.

Six months Year ended

ended December

June 30, 31, 2018

2019

------------------------------ ----------------------- ------------------------

Balance, beginning of period $ 3,644 $ 1,659

Additions 1,041 2,557

Impairments (157) (548)

Effect of change in foreign

exchange rates 15 (24)

------------------------------- ----------------------- ------------------------

Balance, end of period $ 4,543 $ 3,644

------------------------------- ----------------------- ------------------------

During the three and six months ended June 30, 2019, $38,000 and

$95,000 of general and administrative expenses were capitalized to

exploration assets, respectively (2018 - $17,000 and $24,000).

During the three and six months ended June 30, 2019, the Company

incurred $63,000 and $141,000 in lease expenses relating to its

East Brighton property respectively (2018 - $92,000 and $185,000).

These fees were impaired given the property's estimated recoverable

value was $nil.

The June 30, 2019 $4,543,000 exploration asset balance was

included in the Ortoire cash-generating unit. No indicators of

impairment were identified by the Company as at June 30, 2019.

7. Property and Equipment

The following table is a continuity schedule of the Company's

property and equipment at the end of the respective periods.

Petroleum Corporate Total

assets assets

----------------------------------- -------------------- ---------------- --------------------

Cost

Balance, January 1, 2018 $ 120,100 $ 1,960 $ 122,060

Additions 15,194 13 15,207

Dispositions (142) - (142)

Effect of change in foreign

exchange rates (844) (156) (1,000)

Balance, December 31, 2018 $ 134,308 $ 1,817 $ 136,125

Additions 631 - 631

Right-of-use assets (note 3) 1,114 80 1,194

Effect of change in foreign

exchange rates 554 78 632

Balance, June 30, 2019 $ 136,607 $ 1,975 $ 138,582

----------------------------------- -------------------- ---------------- --------------------

Accumulated depletion, depreciation and

impairments

Balance, January 1, 2018 $ 70,465 $ 1,550 $ 72,015

Depletion and depreciation 3,992 124 4,116

Impairment recoveries (3,724) - (3,724)

Decommissioning obligation change

in estimate 1,171 - 1,171

Effect of change in foreign

exchange rates (366) (128) (494)

Balance, December 31, 2018 $ 71,538 $ 1,546 $ 73,084

Depletion and depreciation 2,628 72 2,700

Decommissioning obligation change

in estimate 371 - 371

Effect of change in foreign

exchange rates 243 65 308

Balance, June 30, 2019 $ 74,780 $ 1,683 $ 76,463

----------------------------------- -------------------- ---------------- --------------------

Carrying amounts:

Balance, December 31, 2018 $ 62,770 $ 271 $ 63,041

Balance, June 30, 2019 $ 61,827 $ 292 $ 62,119

----------------------------------- -------------------- ---------------- --------------------

As at June 30, 2019, $68,390,000 in future development costs

were included in petroleum asset cost bases for depletion

calculation purposes (December 31, 2018 - $68,644,000). During the

three and six months ended June 30, 2019, $115,000 and $308,000 in

general and administrative expenses were capitalized to property

and equipment, respectively (2018 - $226,000 and $431,000). During

the three and six months ended June 30, 2019, $7,000 and $11,000 in

share-based compensation expenses were capitalized to property and

equipment, respectively (2018 - $4,000 and $10,000).

At June 30, 2019, the Company evaluated its petroleum assets for

indicators of any potential impairment or related reversal. As a

result of this assessment, no indicators were identified, and no

impairment or related reversal was recorded.

(a) Exploration and production licence

The Company's Palo Seco exploration and production agreement

with the Trinidad and Tobago Minister of Energy and Energy

Industries ("MEEI") expired on August 19, 2013. The Company is

currently negotiating a renewal or extension of the licence and has

permission from the MEEI to operate in the interim period. The

Company has no indication that the licence will not be renewed.

During the three and six months ended June 30, 2019, production

volumes produced under the expired licence represented 0.6 percent

and 0.5 percent of total production, respectively (2018 - 0.8

percent and 0.8 percent).

(b) Private lease agreements

The Company is operating under a number of private lease

agreements which have expired and are currently being renewed.

Based on legal opinions received, the Company is continuing to

recognize petroleum sales on the producing properties because the

Company is the operator, is paying all associated royalties and

taxes, and no title to the producing properties have been disputed.

The Company currently has no indication that any of the producing

expired leases will not be renewed. The continuation of production

from expired private leases during the renegotiation process is

common in Trinidad based on antiquated land title processes. During

the three and six months ended June 30, 2019, production volumes

produced under expired private lease agreements represented 1.8

percent and 1.7 percent of total production, respectively (2018 -

2.4 percent and 2.5 percent).

8. Financial Liabilities and Liquidity Risk

Liquidity risk is the risk that the Company will not be able to

meet its financial obligations as they become due. The Company's

approach to managing liquidity is to ensure that it will have

sufficient liquidity to meet liabilities when due, under both

normal and unusual conditions without incurring unacceptable losses

or jeopardizing the Company's business objectives. The Company's

liquidity is dependent on the Company's expected business growth

and changes in its business environment. The Company manages this

risk by continuously monitoring actual and forecasted cash flows

from operating, financing and investing activities and

opportunities to extend its existing debt facility or to issue

additional equity. Management believes that future cash flows

generated from these activities will be adequate to settle the

Company's future liabilities. Given that the Company has minimal

developmental work obligations and guarantees, the Company will

continue to manage its capital expenditures to reflect current

financial resources in the interest of sustaining long-term

viability.

The following table sets forth estimated undiscounted cash

outflows relating to financial liabilities as at June 30, 2019.

Undiscounted Less than 1 to 3 4 to 5

amount 1 year years years

----------------------- ------------- ----------- --------- --------

Accounts payable and

accrued liabilities $ 11,585 $ 11,585 $ - $ -

Income taxes payable 3,678 3,678 - -

Term loan principal 11,459 - 3,713 7,746

Term loan production

payments 1,438 290 709 439

Term loan interest

payments 3,129 918 1,573 638

Lease liabilities 1,226 584 518 124

Financial liabilities $ 32,515 $ 17,055 $ 6,513 $ 8,947

----------------------- ------------- ----------- --------- --------

Refer to Note 10 "Term Loan and Associated Liabilities" and Note

15 "Capital Management" for further details regarding the Company's

debt structure and capital management objectives.

9. Lease Liabilities

The following table details the movements of the Company's lease

liabilities for the six-month period ended June 30, 2019.

Total

--------------------------------------- ------------------------

Balance, January 1, 2019 (note

3) $ 1,352

Interest expense 42

Payments (274)

Effect of change in foreign

exchange rates 8

----------------------------------------- ------------------------

Balance, June 30, 2019 $ 1,128

----------------------------------------- ------------------------

Current (included in accounts payable

and accrued liabilities) 515

Non-current 613

----------------------------------------- ------------------------

Lease liabilities $ 1,128

----------------------------------------- ------------------------

The Company has lease liabilities for head office space,

oilfield service equipment, motor vehicles and office equipment.

The lease contracts are effective from two to four years. Discount

rates used in calculating the present values of lease payments

during the three and six months ended June 30, 2019 were between 5

and 10 percent. Leases are negotiated on an individual basis and

contain a wide range of varying terms and conditions. The following

table details the undiscounted cash flows which include both

principal and interest components of the Company's lease

liabilities as at June 30, 2019.

June 30,

2019

----------------------

Less than one year $ 584

1 to 3 years 518

4 years 124

Undiscounted cash flows related to lease liabilities $ 1,226

------------------------------------------------------ ----------------------

Payments recognized in the financial statements relating to

short-term leases for the three and six months ended June 30, 2019

were $32,000 and $64,000, respectively. These leases related to

short-term motor vehicle and office equipment and were recognized

in operating expenses and general administrative expenses,

respectively.

10. Term Loan and Associated Liabilities

On November 23, 2016, the Company completed an arrangement for a

C$15 million, five-year term credit facility from a Canadian

investment fund. The term loan bears a fixed interest rate of 8

percent per annum, compounded and payable quarterly.

Effective June 15, 2018, the Company and the lender entered into

a Second Amending Agreement to the Credit Agreement, which extended

the term loan maturity date to November 23, 2022 and extended all

principal payments by one year. Effective March 29, 2019, the

Company and the lender entered into a Third Amending Agreement to

the Credit Agreement (the "2019 Amendment"), which extended the

term loan maturity date to November 23, 2023. The Company is

required to repay C$810,000 per quarter commencing on January 1,

2021 through October 1, 2023, and the then outstanding principal

balance is repayable on the maturity date. As consideration for the

2019 Amendment, the Company paid the lender a financing fee of

C$150,000 ($112,000).

In connection with the term loan, the Company granted the lender

a production payment equal to 1 percent of total petroleum sales

from then current Company land holdings in Trinidad. Concurrent

with the execution of the 2019 Amendment, the Company and the

lender extended the production payment agreement to mature on

October 31, 2023 regardless of any repayment or prepayment of the

term loan. The Company may prepay any principal portion of the term

loan and has the option to negotiate a buyout of the future

production payment obligation if the term loan balance is prepaid

in full. The term loan and the Company's obligations in respect of

the production payment are principally secured by fixed and

floating security interests over all present and after acquired

assets of the Company and its subsidiaries.

The debt instrument is comprised of two financial liability

components: the term loan liability and the production payment

liability. At inception the term loan liability was measured at

fair value, net of all transaction fees, using a discount rate of

12 percent. The term loan was revalued based on the 2019 Amendment,

resulting in a gain of $277,000 recognized during the six months

ended June 30, 2019 (2018 - $219,000). The production payment

liability is revalued at each reporting period based on internally

estimated future production and forward crude oil pricing forecasts

using a discount rate of 15 percent. As a result of these changes

in estimates and the 2019 Amendment, a revaluation gain of $23,000

and a net revaluation loss of $209,000 were recognized during the

three and six months ended June 30, 2019 (2018 - losses of $194,000

and $320,000). The following is a continuity schedule of the term

loan and associated liabilities balances at the end of the

respective periods.

Term loan Production Total

liability payment

liability

-------------------------------------- ------------------------- ------------------------- ------------------------

Balance, January 1, 2018 $ 11,031 $ 834 $ 11,865

Revaluation (gain) loss (219) 341 122

Accretion 301 - 301

Payments / transfers to accounts

payable (119) (377) (496)

Effect of change in foreign

exchange rates (864) (65) (929)

Balance, December 31, 2018 $ 10,130 $ 733 $ 10,863

Revaluation (gain) loss (277) 209 (68)

Accretion 151 - 151

Payments / transfers to accounts

payable (112) (207) (319)

Effect of change in foreign

exchange rates 413 31 444

-------------------------------------- ------------------------- ------------------------- ------------------------

Balance, June 30, 2019 $ 10,305 $ 766 $ 11,071

-------------------------------------- ------------------------- ------------------------- ------------------------

Current - 193 193

Non-current 10,305 573 10,878

-------------------------------------- ------------------------- ------------------------- ------------------------

Term loan and associated liabilities $ 10,305 $ 766 $ 11,071

-------------------------------------- ------------------------- ------------------------- ------------------------

The term loan arrangement contains industry standard

representations and warranties, positive and negative covenants and

events of default. The financial covenants and the Company's

estimated position as at June 30, 2019 are summarized in the

following table.

Covenant Covenant threshold Six months

ended June

30, 2019

----------------------------------- ------------------- ------------

Net funded debt to equity ratio(1) < 0.50 times 0.12 times

Net funded debt to EBITDA ratio(2) < 2.50 times 0.42 times

Notes:

(1) Net funded debt is defined as interest-bearing debt

including lease liabilities, less cash balances. Equity is defined

as book value of shareholders' equity less accumulated other

comprehensive loss.

(2) Means the ratio of net funded debt to EBITDA for the

trailing twelve-month period. EBITDA is defined as net earnings

before interest, income taxes and non-cash items.

11. Decommissioning Liabilities and Abandonment Fund

The Company's decommissioning liabilities relate to future site

restoration and well abandonment costs including the costs of

production equipment removal and land reclamation based on current

environmental regulations. The provision is estimated by Management

based on the Company's net ownership interest in all wells and

facilities, estimated costs to reclaim and abandon these wells and

facilities, and the estimated timing of the costs to be incurred in

future periods. Payments to settle the obligations occur over the

operating lives of the underlying assets, estimated to be from

three to twenty-two years, with the majority of the costs estimated

to be incurred subsequent to 2031. The liabilities are expected to

be funded from the abandonment fund and the Company's internal

resources available at the time of settlement.

Pursuant to Heritage and MEEI production and exploration

licences, the Company is obligated to remit payments into an

abandonment fund based on production. The Company remits $0.25 per

barrel of crude oil sold, and the funds will be used for the future

abandonment of wells in the related licenced area. As at June 30,

2019, the Company classified $1,050,000 of accrued or paid fund

contributions as long-term abandonment fund assets (December 31,

2018 - $966,000).

The Company estimated the net present value of the cash flows

required to settle its decommissioning liabilities to be $8,644,000

as at June 30, 2019 based on an inflation adjusted future liability

of $28,919,000 (December 31, 2018 - $8,915,000 and $31,606,000,

respectively). The following table summarizes the Company's

estimated decommissioning obligation provision at the end of the

respective periods.

Six months Year ended

ended December

31,

June 30, 2018

2019

-----------

Balance, beginning of period $ 8,915 $ 9,438

Liabilities incurred 3 208

Liabilities settled - (66)

Accretion expense 180 262

Revision to estimates (484) (828)

Dispositions - (62)

Effect of change in foreign exchange

rates 30 (37)

Balance, end of period $ 8,644 $ 8,915

-------------------------------------- ----------- -----------

At June 30, 2019, decommissioning liabilities were valued using

a long-term risk-free rate of 7.9 percent and a long-term inflation

rate of 3.3 percent (December 31, 2018 - 7.9 percent and 3.7

percent, respectively).

12. Shareholders' Capital

(a) Issued and outstanding common shares

The Company has authorized an unlimited number of voting common

shares without nominal or par value. The following table is a

continuity schedule of the Company's common shares outstanding and

shareholders' capital.

Number of Balance

shares

--------------------------------------- -------------- -----------------------

Balance, January 1, 2018 and December

31, 2018 129,021,428 $ 56,987

Issued pursuant to private placement 31,666,667 4,496

Balance, June 30, 2019 160,688,095 $ 61,483

--------------------------------------- -------------- -----------------------

(b) February 2019 private placement

On February 26, 2019, the Company completed a private placement

directed toward United Kingdom institutional investors, whereby

gross proceeds of $5,013,000 (GBP3,800,000) were raised by way of a

placing of 31,666,667 new common shares at a price of C$0.21 (12

pence) per common share. Fees incurred from the private placement

were $517,000, which included brokerage commissions and legal,

accounting and corporate finance advisory fees. Net proceeds of the

private placement were $4,496,000.

(c) Share option plans

The Company has a share option plan pursuant to which options to

purchase common shares of the Company may be granted by the Board

of Directors to directors, officers, employees and consultants of

the Company. The exercise price of each option may not be less than

the closing price of the common shares prior to the date of grant.

Compensation expense is recognized as the options vest. Unless

otherwise determined by the Board of Directors, vesting typically

occurs one third on each of the next three anniversaries of the

date of the grant as recipients render continuous service to the

Company, and the share options typically expire five years from the

date of the grant. The following table summarizes the share options

outstanding at the end of the respective periods.

Number of Weighted

share options average

exercise

price

------------------------------ ----------------- ----------------------

Outstanding, January 1, 2018 6,870,840 C$ 0.50

Granted 1,688,800 0.23

Forfeited (25,000) 2.10

------------------------------ ----------------- ----------------------

Outstanding, January 1, 2019 8,534,640 C$ 0.44

Granted 2,550,000 0.23

Expired (1,955,240) 0.89

------------------------------ ----------------- ----------------------

Outstanding, June 30, 2019 9,129,400 C$ 0.29

Exercisable, June 30, 2019 4,896,439 0.34

------------------------------ ----------------- ----------------------

The Company has an incentive share compensation option plan

which provides for the grant of incentive share options to purchase

common shares of the Company at a C$0.05 exercise price. A maximum

of one million common shares have been approved for issuance under

this plan. Unless otherwise determined by the Board of Directors,

vesting typically occurs one third on each of the next three

anniversaries of the date of the grant, and the incentive share

options typically expire five years from the date of the grant. As

at June 30, 2019, 15,000 incentive share options were outstanding

and exercisable with an exercise price of C$0.10 per incentive

share.

The maximum number of common shares issuable on the exercise of

outstanding share options and incentive share options at any time

is limited to 10 percent of the issued and outstanding common

shares.

During the three and six months ended June 30, 2019, the Company

recorded share-based compensation expenses of $49,000 and $80,000

in relation to share option plans, respectively (2018 - $31,000 and

$56,000).

(d) Weighted average common shares

The weighted average common shares used in calculating net loss

per common share was calculated as follows.

Three months ended June 30, 2019 Six months ended

June 30,

2019 2018 2019 2018

------------------ ----------------------- ----------------------- ----------------------- -----------------------

Weighted average

common

shares, basic 160,688,095 129,021,428 150,890,673 129,021,428

Dilutive impact - - - -

of

share-based

compensation

Weighted average

common

shares, diluted 160,688,095 129,021,428 150,890,673 129,021,428

------------------ ----------------------- ----------------------- ----------------------- -----------------------

There was no dilutive impact to the weighted average number of

common shares for the three and six months ended June 30, 2019 and

2018, as all share options and incentive share options were

excluded from the weighted average dilutive share calculations

because their effect would be anti-dilutive.

13. Net Finance Expenses

The following table summarizes net finance expenses recorded

during the three and six months ended June 30, 2019 and 2018.

Three months ended June 30, 2019 Six months ended

June 30,

2019 2018 2019 2018

--------------------- ---------------------- ----------------------- --------------------- -----------------------

Interest income $ (29) $ (46) $ (60) $ (90)

Term loan interest

expense 223 232 445 463

Term loan

revaluation

gain - (219) (277) (219)

Production payment

liability

revaluation

(gain) loss (23) 194 209 320

Accretion on term

loan 78 78 151 148

Accretion on decom.

liabilities 90 65 180 129

Lease liability

interest

expense 24 - 50 -

Other (112) 4 (126) 4

Net finance expenses $ 251 $ 308 $ 572 $ 755

--------------------- ---------------------- ----------------------- --------------------- -----------------------

14. Financial Derivatives and Market Risk Management

Management of cash flow variability is an integral component of

the Company's business strategy. Changing business conditions are

monitored regularly and, where material, reviewed with the Board of

Directors to establish risk management guidelines to be used by

Management. The risk exposures inherent in the movements of the

price of crude oil and fluctuations in foreign exchange rates are

proactively reviewed by the Company and may be managed through the

use of derivative contracts as considered appropriate.

(a) Commodity price risk

The nature of crude oil operations exposes the Company to risks

associated with commodity prices. The Company maintains a risk

management strategy to protect funds flow from operations from the

volatility of commodity prices. The Company's strategy focuses on

the periodic use of puts, costless collars, swaps or fixed price

contracts to limit exposure to fluctuations in commodity prices

while allowing for participation in commodity price increases.

In April 2019, the Company purchased put option contracts from a

financial institution for 800 bbls/d at a strike price of Brent

US$56.10 per barrel from June 1, 2019 to December 31, 2019. The

options may be settled on a monthly basis during the option

exercise period. The June 2019 options expired out of the

money.

The Company recognized the $171,000 premium for the put options

as a derivative financial asset. The financial derivatives are

subsequently recorded at their estimated fair value based on the

difference between the contracted price and the period-end forward

price using quoted market prices. As at June 30, 2019, the Company

recognized a financial derivative asset of $196,000 related to the

put options (December 31, 2018 - $nil). For the three and six

months ended June 30, 2019, the Company recorded derivative gains

of $25,000 and $25,000, respectively (2018 - losses of $87,000 and

$143,000) related to commodity management contracts.

(b) Foreign currency risk

Foreign currency exchange risk arises from changes in foreign

exchange rates that may affect the fair value or future cash flows

of the Company's financial assets or liabilities. As the Company

primarily operates in Trinidad, fluctuations in the exchange rate

between the TT$ and the US$ could have a significant effect on

reported results, as the sales prices of crude oil are determined

by reference to US$ denominated benchmark prices and the majority

of the Company's operating costs are denominated in TT$. This is

currently mitigated by the fact that the TT$ is informally pegged

to the US$. The Company is also subject to foreign exchange

exposure relating to Canadian head office expenses and its term

loan, which are denominated in C$. Any material movements in the C$

to US$ exchange rate may have a material effect on the Company's

reporting results. The Company also has foreign exchange exposure

on costs denominated in pounds sterling required to maintain its

AIM listing.

The Company's foreign currency policy is to monitor foreign

currency risk exposure in its areas of operations and mitigate that

risk where possible by matching foreign currency denominated

expenses with petroleum sales denominated in foreign currencies.

The Company attempts to limit its exposure to foreign currency

through collecting and paying foreign currency denominated balances

in a timely fashion. The Company had no contracts in place to

manage foreign currency risk as at or during the three and six

months ended June 30, 2019 and 2018.

During the three and the six months ended June 30, 2019, the C$

depreciated 4% and the TT$ weakened by 1% relative to the US$ in

comparison to the equivalent periods of 2018, respectively. As a

result, the Company recorded foreign exchange losses of $91,000 and

$129,000 during the three and six months ended June 30, 2019,

respectively (2018 - loss of $20,000 and gain of $249,000). The

majority of the 2019 translation differences in each period were

unrealized in nature and may be reversed in the future as a result

of fluctuations in prevailing exchange rates.

15. Capital Management

The basis for the Company's capital structure is dependent on

the Company's expected business growth and any changes in the

business and commodity price environment. The Company's long-term

goal is to fund current period decommissioning and capital

expenditures necessary for the replacement of production declines

using only funds flow from operations. Profitable growth activities

will be financed with a combination of funds flow from operations

and other sources of capital. The Company typically uses equity and

term debt to raise capital.

The Company's objective is to maintain net debt to trailing

twelve-month funds flow from operations at or below a ratio of 2.0

times. Net debt is a Non-IFRS measure calculated by summing the

Company's working capital and the principal (undiscounted) amounts

of long-term debt and lease liabilities. Working capital is a

Non-IFRS measure calculated as current assets minus current

liabilities as they appear on the consolidated statements of

financial position. Net debt is used by Management as a key measure

to assess the Company's liquidity. Funds flow from operations is an

additional GAAP measure included in the Company's consolidated

statements of cash flows.

The Company also monitors its capital management through the net

debt to net debt plus equity ratio. The Company's strategy is to

utilize more equity than debt, thereby targeting net debt to net

debt plus shareholders' equity at a ratio of less than 0.4 to 1.

The Company's internal capital management calculations for the six

months ended June 30, 2019 and the year ended December 31, 2018 are

summarized below.

Target measure June 30, December

31, 2018

2019

----------------------------------- ---------------- --------------------- ---------------------

Current assets $ (17,518) $ (15,854)

Current liabilities 15,456 19,172

----------------------------------------------------- --------------------- ---------------------

Working capital (surplus) deficit $ (2,062) $ 3,318

Principal long-term portion

of term loan 11,459 11,004

Long-term lease liabilities 613 -

Net debt $ 10,010 $ 14,322

Shareholders' equity 34,565 31,217

----------------------------------------------------- --------------------- ---------------------

Net debt plus equity $ 44,575 $ 45,539

----------------------------------------------------- --------------------- ---------------------

Trailing twelve-month funds

flow from operations(1) $ 7,585 $ 8,414

----------------------------------------------------- --------------------- ---------------------

Net debt to funds flow from

operations < 2.0 times 1.3 1.7

----------------------------------- ---------------- --------------------- ---------------------

Net debt to net debt plus equity < 0.4 times 0.2 0.3

----------------------------------- ---------------- --------------------- ---------------------

Note:

(1) Trailing twelve-month funds flow from operations as at June

30, 2019 include funds flow from operations for the six months

ended June 30, 2019 plus funds flow from operations for the July 1,

2018 through December 31, 2018 interim period.

16. Commitments and Contingencies

The Company has minimum work obligations under various operating

agreements with Heritage, exploration commitments under exploration

and production agreements with the MEEI and various lease

commitments for office space and equipment.

The following table outlines the Company's estimated minimum

contractual capital requirements as at June 30, 2019.

Total 2019 2020 2021 Thereafter

------------------------ --------------- --------------- --------------- ------------------- -------------------

Operating agreements $ 3,169 $ 154 $ 884 $ 296 $ 1,835

Exploration agreements 10,192 2,922 7,270 - -

Office leases 714 136 300 278 -

Equipment leases 263 111 146 6 -

------------------------ --------------- --------------- --------------- ------------------- -------------------

Minimum payments $ 14,338 $ 3,323 $ 8,600 $ 580 $ 1,835

------------------------ --------------- --------------- --------------- ------------------- -------------------

Under the terms of its operating agreements, the Company must

fulfill minimum work obligations on an annual basis over the

specific licence term. In aggregate, the Company is obligated to

drill 12 wells and perform 18 well recompletions prior to the end

of 2021. As of June 30, 2019, 10 wells were drilled, and 15 well

recompletions were completed with respect to these obligations. The

Company has provided $271,000 in cash collateralized guarantees to

Heritage to support its operating agreement work commitments

(December 31, 2018 - $271,000). The balance is classified as

long-term restricted cash on the consolidated statements of

financial position.

Under the terms of its exploration licences, the Company must

drill five wells prior to the end of December 31, 2020; none of

which have been completed as of June 30, 2019.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR BCGDIUUBBGCX

(END) Dow Jones Newswires

August 14, 2019 02:01 ET (06:01 GMT)

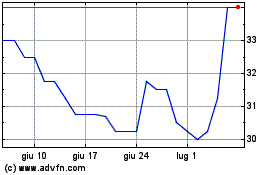

Grafico Azioni Touchstone Exploration (LSE:TXP)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Touchstone Exploration (LSE:TXP)

Storico

Da Apr 2023 a Apr 2024