TIDMLSR

RNS Number : 6596J

Local Shopping REIT (The) PLC

20 August 2019

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY (IN WHOLE OR IN PART), IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF

THAT JURISDICTION.

FOR IMMEDIATE RELEASE

The Local Shopping REIT plc ("the Company")

Result of General Meeting

20 August 2019

The board of directors of the Company (the "LSR Board") is

pleased to announce that the two special resolutions proposed at

the general meeting of the Company held this morning were duly

passed. Voting on the resolutions, which was by way of a poll, was

as follows:

Resolution For Against Total Total No. of

votes votes votes

validly cast withheld

cast* as %

of shares

in issue

No. of % of No. of %

votes votes votes of

cast votes

cast

----------- ------- ------- -------

1. THAT, subject

to the confirmation

of the High Court

of England and

Wales:

1.1 the issued

share capital

of the Company

be reduced by

cancelling and

extinguishing

capital to the

extent of GBP0.19

on each fully

paid up issued

ordinary share

of GBP0.20 each

in the capital

of the Company

(an "Ordinary

Share") and reducing

the nominal value

of each issued

fully paid up

Ordinary Share

from GBP0.20 to

GBP0.01; and

1.2 the amount

standing to the

credit of the

Company's capital

redemption reserve

be cancelled and

extinguished. 55,873,234 100% 0 0% 55,873,234 67.72% 5,000

----------- ------- ------- ------- ----------- ----------- ----------

2. THAT, subject

to the passing

of Resolution

1 above, the Company

be and is hereby

generally and

unconditionally

authorised for

the purposes of

section 701 of

the Companies

Act 2006 (the

"CA 2006") to

make one or more

market purchases

(within the meaning

of section 693(4)

of the CA 2006)

of its own Ordinary

Shares pursuant

to, and for the

purposes of, or

in connection

with a tender

offer for Ordinary

Shares on the

terms and in accordance

with the arrangements

set out or referred

to in the Circular

or otherwise contemplated

by arrangements

set out or referred

to in the Circular,

provided that:

2.1 the maximum

number of Ordinary

Shares hereby

authorised to

be purchased is

61,484,576;

2.2 the maximum

and minimum price,

exclusive of all

expenses, which

may be paid for

an Ordinary Share

is GBP0.3133 (or

31.33 pence),

being the Tender

Price (as defined

in the Circular);

and

2.3 the authority

conferred by this

Resolution shall

expire on the

date which is

15 months from

the date of the

notice of this

meeting, save

that the Company

may before the

expiry of such

authority make

a contract to

purchase Ordinary

Shares which will

or may be executed

wholly or partly

after such expiry

and the Company

may make a purchase

of such Ordinary

Shares after such

expiry pursuant

to such contract. 55,873,234 100% 0 0% 55,873,234 67.72% 5,000

----------- ------- ------- ------- ----------- ----------- ----------

*Excluding votes withheld.

As at 6:30pm on 16 August 2019, being the record date for the

General Meeting, the total number of shares in issue (excluding

shares held in treasury) was 82,505,853.

The result of the General Meeting will also be made available on

the Company's website: www.localshoppingreit.co.uk.

The resolutions were proposed at the meeting in contemplation of

the Board's proposal to return capital to LSR Shareholders by way

of a Tender Offer to repurchase LSR Shares set out in the Board's

circular to LSR Shareholders published on 25 July 2019 (the

"Circular").

The Board urges LSR Shareholders to carefully read the Circular,

which provides information about the background to, and reasons

for, the Board's proposals, and explains why the Board considers

those proposals to be in the best interests of the Company and LSR

Shareholders as a whole. The Circular can also be found on the

Company's website.

The Tender offer remains open until 1.00 p.m. on 12 September

2019, unless otherwise extended in accordance with the terms and

conditions set out in Part 4 of the Circular.

[S]

Enquiries:

The Local Shopping REIT plc

William A Heaney

Company Secretary

020 7355 8800

BDO LLP (Independent Rule 3 Adviser to the Company)

John Stephan

Susan Jarram

020 7486 5888

Important Notices

BDO LLP ("BDO"), which is authorised and regulated by the

Financial Conduct Authority in the United Kingdom, is acting

exclusively as financial adviser to the Company and no one else in

connection with the Offer and will not be responsible to anyone

other than the Company for providing the protections afforded to

clients of BDO or for providing advice in connection with the Offer

or any other matter referred to in this announcement.

This announcement is not intended to, and does not, constitute

or form part of any offer, invitation or solicitation of any offer

to purchase, otherwise acquire, subscribe for, sell or otherwise

dispose of any securities or the solicitation of any vote or

approval in any jurisdiction. Any offer (if made) will be made

solely by certain offer documentation which will contain the full

terms and conditions of any offer (if made), including details of

how such offer may be accepted. This announcement has been prepared

in accordance with English law and the Code and information

disclosed may not be the same as that which would have been

prepared in accordance with laws outside the United Kingdom. The

release, distribution or publication of this announcement in

jurisdictions outside the United Kingdom may be restricted by the

laws of the relevant jurisdictions and therefore persons into whose

possession this announcement comes should inform themselves about,

and observe, any such restrictions. Any failure to comply with the

restrictions may constitute a violation of the securities laws of

any such jurisdiction.

Disclosure requirements of the Takeover Code (the "Code")

Under Rule 8.3(a) of the Code, any person who is interested in

1% or more of any class of relevant securities of an offeree

company or of any securities exchange offeror (being any offeror

other than an offeror in respect of which it has been announced

that its offer is, or is likely to be, solely in cash) must make an

Opening Position Disclosure following the commencement of the offer

period and, if later, following the announcement in which any

securities exchange offeror is first identified. An Opening

Position Disclosure must contain details of the person's interests

and short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any

securities exchange offeror(s). An Opening Position Disclosure by a

person to whom Rule 8.3(a) applies must be made by no later than

3.30 pm (London time) on the 10th business day following the

commencement of the offer period and, if appropriate, by no later

than 3.30 pm (London time) on the 10th business day following the

announcement in which any securities exchange offeror is first

identified. Relevant persons who deal in the relevant securities of

the offeree company or of a securities exchange offeror prior to

the deadline for making an Opening Position Disclosure must instead

make a Dealing Disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes,

interested in 1% or more of any class of relevant securities of the

offeree company or of any securities exchange offeror must make a

Dealing Disclosure if the person deals in any relevant securities

of the offeree company or of any securities exchange offeror. A

Dealing Disclosure must contain details of the dealing concerned

and of the person's interests and short positions in, and rights to

subscribe for, any relevant securities of each of (i) the offeree

company and (ii) any securities exchange offeror(s), save to the

extent that these details have previously been disclosed under Rule

8. A Dealing Disclosure by a person to whom Rule 8.3(b) applies

must be made by no later than 3.30 pm (London time) on the business

day following the date of the relevant dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree

company and by any offeror and Dealing Disclosures must also be

made by the offeree company, by any offeror and by any persons

acting in concert with any of them (see Rules 8.1, 8.2 and

8.4).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the Disclosure Table on

the Takeover Panel's website at www.thetakeoverpanel.org.uk,

including details of the number of relevant securities in issue,

when the offer period commenced and when any offeror was first

identified. You should contact the Panel's Market Surveillance Unit

on +44 (0)20 7638 0129 if you are in any doubt as to whether you

are required to make an Opening Position Disclosure or a Dealing

Disclosure.

Publication on website

A copy of this announcement will, subject to certain

restrictions relating to persons resident in restricted

jurisdictions, be available on the Company's website at

www.localshoppingreit.co.uk by no later than 12 noon on the

Business Day following the date of this announcement. For the

avoidance of doubt, the content of the website referred to above is

not incorporated into and does not form part of this

announcement.

Forward-looking statements

This announcement contains statements that are or may be

forward-looking with respect to the financial condition, results of

operations and businesses and achievements of the Company. These

statements can be identified by the use of forward-looking

terminology such as "believe", "anticipate", "expect", "prospect",

"estimated", "should", "may" or the negative thereof, or other

variations thereof, or comparable terminology indicating

expectations or beliefs concerning future events. These

forward-looking statements include risk and uncertainty because

they relate to events and depend on circumstances that will occur

in the future. There are a number of factors which could or may

cause actual results, achievements or developments to differ

materially from those expressed or implied by such forward-looking

statements. The Company assumes no obligation to update or correct

the information contained in this announcement, whether as a result

of new information, future events or otherwise, except to the

extent required by law or regulation. The statements contained in

this announcement are made as at the date of this announcement,

unless some other time is specified in relation to them, and

publication of this announcement shall not give rise to any

implication that there has been no change in the facts set out in

this announcement since such date. Unless expressly stated to the

contrary in this announcement, no statement in this announcement is

intended as a profit forecast or estimate for any period and no

statement in this document should be interpreted to mean that

earnings for the Company or earnings per LSR Share, as appropriate,

for the current or further financial years would necessarily match

or exceed the historical published earnings for the Company or

earnings per LSR Share.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ROMLLFILTSIIFIA

(END) Dow Jones Newswires

August 20, 2019 07:08 ET (11:08 GMT)

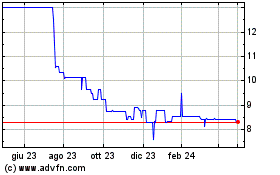

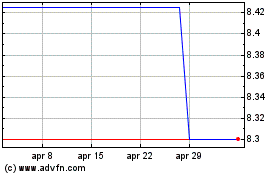

Grafico Azioni Alina (LSE:ALNA)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Alina (LSE:ALNA)

Storico

Da Apr 2023 a Apr 2024