TIDMFKE

RNS Number : 8146J

Fiske PLC

21 August 2019

21 August 2019

FISKE PLC

("Fiske" or the "Company" or the "Group")

Final Results

Fiske (AIM:FKE) is pleased to announce its final audited

financial results for the year ended 31 May 2019.

Copies of the 2019 Annual Report and Accounts, including the

Notice of AGM and Proxy Voting form will be posted to shareholders

shortly.

In accordance with rule 26 of the AIM Rules for Companies, this

information is also available under the Investor Relations section

of the Company's website, http://www.fiskeplc.com.

The Annual General Meeting of the Company will be held at

Salisbury House, London Wall, London EC2M 5QS on 3 October 2019 at

12.30 pm.

Contact:

Fiske PLC

James Harrison (CEO) Tel: +44 (0) 20 8448 4700

Gerard Luchini (Company Secretary

)

Grant Thornton UK LLP (Nominated Adviser) Tel: +44 (0) 20 7383 5100

Samantha Harrison / Harrison Clarke

Abridged Chairman's Statement

Trading

Full year revenues were GBP4.28m (2018: GBP4.38m) which is

slightly below the prior year.

After a very difficult first half, commission revenues picked up

in the second half of the year. Overall, commission income was only

15% lower, at GBP2.08m for the year, as markets recovered quickly

in January from the weakness that prevailed in the fourth quarter

of 2018. The prevailing sentiment in markets improved generally in

the first quarter of 2019 which was beneficial to client portfolio

valuations and general trading activity.

Meanwhile, investment management fees rose 21% over the year to

GBP2.21m (2018: GBP1.83m). This improvement is in part due to

consolidating a full year of fee income from Fieldings but also a

continuation in the general trend within the business to migrate

clients to our discretionary and advisory managed fee based

services.

As a result of the softer commissions and stronger management

fee revenues the balance has swung in favour of management fees for

the first time. Management fees represented 52% of commission and

fee revenues with commissions representing 48%.

Asset Management

In May 2019 our unit trust, Ocean UK Equity, passed its first

anniversary. We are pleased to report a successful first year with

the fund in the top quartile in each of the last three, six and

twelve month periods. It was also ahead of its benchmark the CBOE

UK All Companies Total Return Index over the period. As at the end

of June 2019 the fund was valued at GBP5.8m.

Investment Managers

Towards the end of the year we welcomed two new investment

managers to the firm. We believe that with our traditional values,

modern systems and up to date regulatory framework we provide an

attractive place to work for aspiring, independently minded private

client investment managers.

Costs & Outturn

Operating expenses have risen by GBP1.02m to GBP5.04m in the

year to 31 May 2019 (2018: GBP4.02m) an increase of 25.3%.

Part of this increase in expenses is a result of charging

non-recurring items amounting to GBP335k which includes GBP217k for

deferred consideration bonuses payable as part of the Fieldings

acquisition. In addition it continues to be our policy to amortise

the value of the client relationships acquired with the Fieldings

business, resulting in a further charge of GBP131k. These items

total GBP466k.

Apart from these items, costs have increased due to compliance

with various regulatory requirements and investment in

strengthening our systems and controls.

After reporting a pre-tax loss of GBP492k in H1, we have

incurred a much reduced loss of GBP150k in the second half to

result in a full year loss of GBP642k. This overall result was

exacerbated by our being without the usual dividend (of some

GBP100k) from Euroclear due to timing changes as elaborated

below.

Euroclear

Euroclear completed a re-domiciliation exercise in 2018/19

moving its headquarters from Switzerland to Belgium. This benefits

the majority of shareholders such as Fiske plc as now our holding

will qualify as a strategic asset under Belgian asset holding

regulations and thus dividends paid will not be subject to

withholding tax. However due to the particular timing of the

re-domiciliation Euroclear have not paid a dividend during our year

to 31 May 2019 (2018: GBP103k).

In January 2019 the London Stock Exchange Group made a strategic

acquisition of some 4.9% of Euroclear at a price of EUR1,798 per

share. In light of this purchase and the appointment of Goldman

Sachs earlier this year to review how to improve the liquidity of

shares in Euroclear we arrived at a fair value of our holding as

EUR1,798 per share. This has resulted in our carrying value rising

by 132% to EUR6.51m which is GBP5.81m at the prevailing exchange

rate of GBP1: EUR1.12.

Net assets

Shareholder's funds have increased by 38% in the year to GBP7.6m

reflecting the increase in the fair value of our holding in

Euroclear. Within this we continue to hold some GBP2.1m of

cash.

Strategy

Following the successful acquisition of Fieldings and the

addition of a growing number of new investment managers we continue

to implement our ongoing strategy to welcome new investment

managers with established client relationships to increase our

assets under management and advice. In addition we are actively

migrating our customers to fee focussed rather than commission

based relationships.

Dividend

The Board has resolved not to pay a dividend for the year to 31

May 2019 (2018: GBPnil).

Regulation

As referred to in the interim statement, significant time and

effort has been and continues to be devoted across the company to

compliance with new regulations. This has focussed in particular on

the costs and charges element of the Markets in Financial

Instruments Directive II ('MiFID II'). We continue to upgrade our

systems and invest time in training our staff members. These

software and training related costs, which have been absorbed by

the business are a recurring feature. In the new financial year we

will be implementing the new Senior Managers & Certification

Regime.

Staff

In the last four years we have successfully migrated the

business onto a new integrated front & back office software

system, acquired and integrated the Fieldings business, brought new

investment managers and their clients onto our platform and managed

the implementation of a constant flow of regulatory changes. In

this light I would like to extend my thanks to all my fellow

Directors, Investment Managers, Associates and members of the

operations team for their hard work and commitment to the future

success of the Company.

Markets

In the long bull-run that markets are enjoying the unusual

feature of this year is that bonds as well as equities are reaching

new highs. A more common feature is this is all happening at a time

of market complacency towards the disturbing features in the

worldwide macro-economic landscape. The realignment of the US/China

trade relations, well overdue but never confronted until now, is

the most prominent feature.

Though perhaps even more serious a problem in the background is

the astonishing levels of debt that have been built up and continue

to increase at both the corporate level and the emerging market

government level. The EU is bordering on recession, the UK has

Brexit to contend with, whilst the US is experiencing the end of

the stimulus of the major corporate tax reductions that the Trump

administration introduced. Added to which most emerging markets

have borrowed in dollars and are now facing the problems of a

currency mismatch.

All the signs suggest we are in the last stages of one of the

greatest bull markets in modern times. Whilst we should of course

be concerned we must also remember that often the final phase of

the bull market gives investors their best gains. It is expensive

and painful to miss out on the final exuberance of a bull market.

To add to concerns, one of the best signs that we may be in the

final phase is the recent resurgence in the gold price. This

traditional safe haven usually comes to life when problems are

serious. It has now reached a six-year high and shows signs of

gathering momentum.

For investors the danger month is traditionally October. Last

year we had a rehearsal, maybe this year we will have the real

thing. Long-term investors should take advantage of the

liquidity-driven surges in asset prices to bolster holdings in

investments that are less correlated to equity markets. In

particular cash positions not only reduce overall risk but provide

dry powder with which to take advantage of dislocations that tend

to damage markets in an indiscriminate fashion.

Outlook

The new financial year has begun with business levels in line

with the more positive second half of the year just reported. Your

board is striving for a very much more positive outturn in the

current year.

Clive Harrison

Chairman

20 August 2019

Consolidated Statement of Total Comprehensive Income

For the year ended 31 May 2019

Notes 2019 2018

GBP'000 GBP'000

---------------------------------------------------- ----- --------- ---------

Continuing Operations

Fee and commission income 4,289 4,283

Other (loss) / income (1) 80

(Loss) / Profit on investments sold (1) 18

Total Revenue 2 4,287 4,381

---------------------------------------------------- ----- --------- ---------

Operating expenses (5,037) (4,020)

Operating (loss) / profit (750) 361

Investment revenue - 103

Finance income 108 -

Finance costs - -

(Loss) / Profit on ordinary activities before

taxation (642) 464

Taxation 3 - (4)

---------------------------------------------------- ----- --------- ---------

(Loss) / Profit on ordinary activities after

taxation (642) 460

---------------------------------------------------- ----- --------- ---------

Other comprehensive income

Items that may subsequently be reclassified

to profit or loss

Movement in unrealised appreciation of investments 3,289 26

Deferred tax on movement in unrealised appreciation

of investments (583) 12

---------------------------------------------------- ----- --------- ---------

Net other comprehensive income 2,706 38

---------------------------------------------------- ----- --------- ---------

Total comprehensive income attributable to

equity shareholders 2,064 498

---------------------------------------------------- ----- --------- ---------

(Loss) / Earnings per ordinary share

Basic 4 (5.5p) 4.2p

Diluted 4 (5.5p) 4.2p

---------------------------------------------------- ----- --------- ---------

All results are from continuing operations.

Consolidated Statement of Financial Position

31 May 2019

Notes 2019 2018

GBP'000 GBP'000

---------------------------------------------- ----- --------- ---------

Non-current Assets

Intangible assets 5 1,445 1,576

Other intangible assets 6 97 130

Property, plant and equipment 7 30 35

Fair Value Through Other Comprehensive Income

('FVTOCI') 8 5,759 2,470

Total non-current assets 7,331 4,211

---------------------------------------------- ----- --------- ---------

Current Assets

Trade and other receivables 9 2,545 4,087

Cash and cash equivalents 2,073 2,453

---------------------------------------------- ----- --------- ---------

Total current assets 4,618 6,540

---------------------------------------------- ----- --------- ---------

Current liabilities

Trade and other payables 10 3,504 4,965

Current tax liabilities - 36

Total current liabilities 3,504 5,001

---------------------------------------------- ----- --------- ---------

Net current assets 1,114 1,539

---------------------------------------------- ----- --------- ---------

Non-current liabilities

Deferred tax liabilities 11 797 214

---------------------------------------------- ----- --------- ---------

Total non-current liabilities 797 214

---------------------------------------------- ----- --------- ---------

Net Assets 7,648 5,536

---------------------------------------------- ----- --------- ---------

EQUITY

Share capital 12 2,904 2,890

Share premium 2,029 1,997

Revaluation reserve 4,203 1,497

Retained losses (1,488) (848)

---------------------------------------------- ----- --------- ---------

Shareholders' equity 7,648 5,536

---------------------------------------------- ----- --------- ---------

These financial statements were approved by the Board of

Directors and authorised for issue on 20 August 2019.

Signed on behalf of the Board of Directors

J P Q Harrison

Chief Executive Officer

Group Company Statement of Changes in Equity

For the year ended 31 May 2019

Share Share Revaluation Retained

Group capital premium reserve losses Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------- --------- --------- ------------ --------- --------

Balance at 1 June 2017 2,115 1,222 1,459 (1,309) 3,487

Profit for the financial

year - - - 460 460

Revaluation of available-for-sale

investments - - 26 - 26

Deferred tax on revaluation

of available-for-sale investments - - 12 - 12

------------------------------------- --------- --------- ------------ --------- --------

Total comprehensive income

for the year - - 38 460 498

------------------------------------- --------- --------- ------------ --------- --------

Share based payment transactions - - - 1 1

Issue of ordinary share

capital 775 775 - - 1,550

Balance at 1 June 2018 2,890 1,997 1,497 (848) 5,536

Loss for the financial year - - - (642) (642)

Movement in unrealised appreciation

of investments - - 3,289 - 3,289

Deferred tax on movement

in unrealised appreciation

of investments - - (583) - (583)

Total comprehensive income

/ (expense) for the year - - 2,706 (642) 2,064

------------------------------------- --------- --------- ------------ --------- --------

Share based payment transactions - - - 2 2

Issue of ordinary share

capital 14 32 - - 46

------------------------------------- --------- --------- ------------ --------- --------

Total transactions with

owners, recognised directly

in equity 14 32 - 2 48

Balance at 31 May 2019 2,904 2,029 4,203 (1,488) 7,648

------------------------------------- --------- --------- ------------ --------- --------

Group Company Statement of Cash Flows

For the year ended 31 May 2019

2019 2018

Group Group

GBP'000 GBP'000

----------------------------------------- --------- ---------

Operating (loss) / profit (750) 361

Profit on disposal of available-for-sale

investments - -

Amortisation of intangibles 33 26

Depreciation of property, plant

and equipment 22 20

Amortisation of intangible asset

- customer relationships 131 131

Expenses settled by the issue

of shares 2 -

Decrease in investments held for

trading - 19

Decrease / (increase) in receivables 1,354 (1,397)

(Decrease) / increase in payables (1,273) 730

----------------------------------------- --------- ---------

Cash used in operations (481) (110)

Tax (paid) (36) (38)

----------------------------------------- --------- ---------

Net cash used in operating activities (517) (148)

Investing activities

Interest received 108 -

Investment income received - 103

Payment to acquire subsidiary

undertaking - (2,092)

Dividend paid to parent company

as part of acquisition - -

Purchases of property, plant and

equipment (17) (45)

Purchases of other intangible

assets - (12)

Cash acquired with subsidiary

undertaking - 2,320

Cash received on share buy-back

by subsidiary - -

Net cash generated / (used) from

investing activities 91 274

----------------------------------------- --------- ---------

Financing activities

Proceeds from issue of ordinary

share capital 46 1,292

Dividends paid - -

----------------------------------------- --------- ---------

Net cash generated from financing

activities 46 1,292

----------------------------------------- --------- ---------

Net (decrease) / increase in cash

and cash equivalents (380) 1,418

Cash and cash equivalents at beginning

of year 2,453 1,035

Cash and cash equivalents at end

of year 2,073 2,453

----------------------------------------- --------- ---------

1

Notes to the Accounts

For the year ended 31 May 2019

1 Basis of preparation

These financial statements have been prepared in accordance with

the requirements of IFRS implemented by the Group for the year

ended 31 May 2019 as adopted by the European Union and

International Financial Reporting Interpretations Committee and

with the Companies Act 2006. The Group financial statements have

been prepared under the historical cost convention, with the

exception of financial instruments, which are stated in accordance

with IAS 39 Financial Instruments: recognition and measurement.

2 Total revenue and segmental analysis

IFRS 8 requires operating segments to be identified on the basis

of internal reports about components of the Group that are

regularly reviewed by management to allocate resources to the

segments and to assess their performance. Following the acquisition

of Fieldings Investment Management Limited in August 2017, their

staff and operations have been integrated into the management team

of Fiske plc. Pursuant to this, the Group continues to identify a

single reportable segment, being UK-based financial intermediation.

Within this single reportable segment, total revenue comprises:

2019 2018

GBP'000 GBP'000

------------------------------------------------ ------- -------

Commission receivable 2,078 2,454

Investment management fees 2,211 1,829

(Loss) / profit on investments held for trading (1) 18

------------------------------------------------ ------- -------

4,288 4,301

Other (loss) / income (1) 80

------------------------------------------------ ------- -------

4,287 4,381

------------------------------------------------ ------- -------

Substantially all revenue in the current and prior year is

generated in the UK and derives solely from the provision of

financial intermediation.

3 Tax

Analysis of tax on ordinary activities:

2019 2018

GBP'000 GBP'000

----------------------------------------------- ------- -------

Current tax

Current year - 4

Prior year adjustment - -

----------------------------------------------- ------- -------

- 4

Deferred tax

Current year - -

Prior year adjustment - -

----------------------------------------------- ------- -------

Total tax charge to Statement of Comprehensive

Income - 4

----------------------------------------------- ------- -------

Factors affecting the tax charge for the year

The standard rate of tax for the year, based on the United

Kingdom standard rate of corporation tax, is 19.00% (2018:

19.00%).

The charge/(credit) for the year can be reconciled to the profit

per the Statement of Comprehensive Income as follows:

2019 2018

GBP'000 GBP'000

--------------------------------------------------- ------- -------

(Loss) / Profit before tax (642) 464

--------------------------------------------------- ------- -------

(Credit) / Charge on profit on ordinary activities

at standard rate (124) 86

Effect of:

Expenses not deductible in determining taxable

profit 9 9

Non-taxable income (0) (20)

Tax losses not recognised 115 -

Carry back tax relief - (71)

- 4

--------------------------------------------------- ------- -------

4 Earnings per share

Basic earnings per share has been calculated by dividing the

profit on ordinary activities after taxation by the weighted

average number of shares in issue during the year. Diluted earnings

per share is basic earnings per share adjusted for the effect of

conversion into fully paid shares of the weighted average number of

share options during the year.

31 May 2019 Basic Diluted

Basic

GBP'000 GBP'000

------------------------------------------------ -------- --------

(Loss) on ordinary activities after taxation (642) (642)

Adjustment to reflect impact of dilutive share - -

options

------------------------------------------------ -------- --------

(Loss) (642) (642)

------------------------------------------------ -------- --------

Number of shares (000's) 11,603 11,645

------------------------------------------------ -------- --------

(Loss) per share (pence) (5.5) (5.5)

------------------------------------------------ -------- --------

31 May 2018 Basic Diluted

Basic

GBP'000 GBP'000

------------------------------------------------ -------- --------

Profit on ordinary activities after taxation 460 460

Adjustment to reflect impact of dilutive share

options - 1

------------------------------------------------ -------- --------

Earnings 460 461

------------------------------------------------ -------- --------

Number of shares (000's) 10,906 10,980

------------------------------------------------ -------- --------

Earnings per share (pence) 4.2 4.2

------------------------------------------------ -------- --------

31 May 2019 31 May

2018

--------------------------------------- ----------- ------

Number of shares (000's):

Weighted average number of shares 11,603 10,906

Dilutive effect of share option scheme 42 74

--------------------------------------- ----------- ------

11,645 10,980

--------------------------------------- ----------- ------

5 Intangible assets arising on consolidation

Customer Goodwill Total

relationships

--------------------------

GBP'000 GBP'000 GBP'000

-------------------------- --------------- ---------- --------

Cost

At 1 June 2018 1,312 1,311 2,623

Additions - - -

-------------------------- --------------- ---------- --------

At 31 May 2019 1,312 1,311 2,623

-------------------------- --------------- ---------- --------

Accumulated amortisation

At 1 June 2018 (131) (916) (1,047)

Charge in year (131) - (131)

-------------------------- --------------- ---------- --------

At 31 May 2019 (262) (916) (1,178)

-------------------------- --------------- ---------- --------

Net book value

At 31 May 2019 1,050 395 1,445

-------------------------- --------------- ---------- --------

At 1 June 2018 1,181 395 1,576

-------------------------- --------------- ---------- --------

Goodwill arising through business combinations is allocated to

individual cash-generating units ('CGUs') being acquired

subsidiaries, reflecting the lowest level at which the Group

monitors and test goodwill for impairment purposes. The CGUs to

which goodwill is attributed are as follows:

CGU 2019 2018

GBP'000 GBP'000

---------------------------- --------- ---------

Vor Financial Strategy 230 230

Ionian Group Limited 165 165

----------------------------- --------- ---------

Goodwill allocated to CGUs 395 395

----------------------------- --------- ---------

Determining whether goodwill is impaired requires an estimation

of the recoverable amount of each CGU. The recoverable amount is

the higher of its value in use ('VIU') or its fair value less cost

of disposal ('FVLCD').

As at 31 May 2019 none of the Group's CGUs are impaired with the

recoverable amount for each CGU having been based on its FVLCD. The

fair value has been calculated as 2.5 % of assets under

management.

Under the above valuation approach each CGU had a FVLCD in

excess of its carrying value by GBP19k at Vor (2018: GBP62k) and

GBP48k at Ionian (2018: GBP53k).

A 17% reduction in funds under management for Ionian from

GBP11.1m to GBP9.2m would result in a potential impairment trigger.

Vor is less sensitive to such an impairment trigger requiring a

fall of 11% of funds under management from GBP7.4m to GBP6.6m.

If fair value was calculated using 2.1% as opposed to 2.5% of

funds under management for Ionian then, all other things being

equal, there would be a potential impairment trigger. Vor would

require a decrease to 1.8% of funds under management to trigger a

potential impairment.

6 Other intangible assets

Systems Total

licence

GBP'000 GBP'000

-------------------------- --------- --------

Cost

At 1 June 2017 180 180

Additions 12 12

At 1 June 2018 192 192

Additions - -

At 31 May 2019 192 192

---------------------------- --------- --------

Accumulated amortisation

At 1 June 2017 (36) (36)

Charge for the year (26) (26)

At 1 June 2018 (62) (62)

Charge for the year (33) (33)

At 31 May 2019 (95) (95)

---------------------------- --------- --------

Net book value

At 31 May 2019 97 97

---------------------------- --------- --------

At 31 May 2018 130 130

---------------------------- --------- --------

7 Property, plant and equipment

Office furniture Computer Office refurbishment Total

and equipment equipment

GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- ----------------- ------------ ---------------------- --------

Cost

At 1 June 2017 137 177 175 489

Additions 25 20 - 45

Disposals - - - -

-------------------------- ----------------- ------------ ---------------------- --------

At 1 June 2018 162 197 175 534

Additions - 17 - 17

At 31 May 2019 162 214 175 551

-------------------------- ----------------- ------------ ---------------------- --------

Accumulated depreciation

At 1 June 2017 (135) (169) (175) (479)

Charge for the year (7) (13) - (20)

At 1 June 2018 (142) (182) (175) (499)

Charge for the year (7) (15) - (22)

At 31 May 2019 (149) (197) (175) (521)

-------------------------- ----------------- ------------ ---------------------- --------

Net book value

At 31 May 2019 13 17 - 30

-------------------------- ----------------- ------------ ---------------------- --------

At 31 May 2018 20 15 - 35

-------------------------- ----------------- ------------ ---------------------- --------

8 Investments

2019 2018

GBP'000 GBP'000

----------------------------------------- ------- -------

At 1 June 2018:

Valuation 2,470 2,444

Unrealised appreciation (1,806) (1,780)

----------------------------------------- ------- -------

Cost 664 664

Additions - -

Cost of disposals - -

----------------------------------------- ------- -------

At 31 May 2019:

Cost 664 664

Unrealised appreciation 5,095 1,806

----------------------------------------- ------- -------

Valuation 5,759 2,470

----------------------------------------- ------- -------

being:

Listed 5 6

Unlisted 5,754 2,464

----------------------------------------- ------- -------

FVTOCI investments carried at fair value 5,759 2,470

----------------------------------------- ------- -------

The investments included above are represented by holdings of

equity securities. These shares are not held for trading. At May

2018 these were classified as available-for-sale. During the year

they were re-designated as Fair Value through Other Comprehensive

Income.

9 Trade and other receivables

2019 2018

Group Group

Group and Company GBP'000 GBP'000

----------------------------------- -------- --------

Counterparty receivables 1,388 2,462

Trade (payables) / receivables (164) 515

----------------------------------- -------- --------

1,224 2,977

Corporation tax recoverable - -

Amount owed by group undertakings - -

Other debtors 371 229

Prepayments and accrued income 950 881

----------------------------------- -------- --------

2,545 4,087

----------------------------------- -------- --------

Counterparty receivables

Included in the Group's counterparty receivables are debtors

with a carrying amount of GBPnil (2018: GBP55,000) which are past

due at the reporting date for which the Group has not provided as

there has not been a significant change in credit quality and the

amounts were still considered recoverable, and were subsequently

recovered.

Ageing of past due but not impaired counterparty

receivables:

2019 2018

GBP'000 GBP'000

------------- ------- -------

0 - 15 days - 39

16 - 30 days - 16

31 - 45 days - -

46 - 60 days - -

------------- ------- -------

- 55

------------- ------- -------

Trade receivables

Included in the Group's trade receivables balance are debtors

with a carrying amount of GBP338,000 (2018: GBP318,000) which are

past due at the reporting date for which the Group has not provided

as there has not been a significant change in credit quality and

the amounts were still considered recoverable, and were

subsequently recovered.

Ageing of past due but not impaired trade receivables:

2019 2018

GBP'000 GBP'000

------------- ------- -------

0 - 15 days 306 280

16 - 30 days 15 38

31 - 60 days 17 -

------------- ------- -------

338 318

------------- ------- -------

10 Trade and other payables

2019 2018

Group Group

GBP'000 GBP'000

----------------------- -------- --------

Counterparty payables 1,542 3,273

Trade payables - -

----------------------- -------- --------

1,542 3,273

Sundry creditors and

accruals 1,962 1,692

----------------------- -------- --------

3,504 4,965

----------------------- -------- --------

11 Deferred taxation

Capital Tax Deferred

allowances Investments Losses tax liability

Group and Company GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------------------- ------------- ------------ --------- ----------------

At 1 June 2018 (1) 309 (94) 214

Charge for the year - - - -

Charge to Statement of Comprehensive

Income

* in respect of current year - 583 - 583

- - - -

* in respect of change in corporation tax rate

------------------------------------------------------- ------------- ------------ --------- ----------------

At 31 May 2019 (1) 892 (94) 797

------------------------------------------------------- ------------- ------------ --------- ----------------

Deferred tax assets and liabilities are recognised at a rate

which is substantively enacted at the balance sheet date. The rate

to be taken in this case is 18%, being the anticipated rate of

taxation applicable to the Company in the future.

12 Called up share capital

2019 2018

No. of GBP'000 No. of GBP'000

shares shares

-------------------------- ----------- -------- ----------- --------

Authorised:

Ordinary shares of 25p 12,000,000 3,000 12,000,000 3,000

-------------------------- ----------- -------- ----------- --------

Allotted and fully paid:

Ordinary shares of 25p

Opening balance 11,560,205 2,890 8,460,205 2,115

Shares issued 57,392 14 3,100,000 775

-------------------------- ----------- -------- ----------- --------

Closing balance 11,617,597 2,904 11,560,205 2,890

-------------------------- ----------- -------- ----------- --------

Included within the allotted and fully paid share capital were

9,490 ordinary shares of 25p each (2018: 9,490 ordinary shares of

25p each) held for the benefit of employees.

At 31 May 2019 there were 325,000 outstanding options to

subscribe for ordinary shares at a weighted average exercise price

of 60p.

13 Clients' money

At 31 May 2019 amounts held by the Company on behalf of clients

in accordance with the Client Money Rules of the Financial Conduct

Authority amounted to GBP46,014,796 (2018: GBP40,760,214). The

Company has no beneficial interest in these amounts and accordingly

they are not included in the balance sheet.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR CKDDKNBKDNFB

(END) Dow Jones Newswires

August 21, 2019 09:07 ET (13:07 GMT)

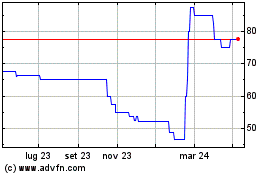

Grafico Azioni Fiske (LSE:FKE)

Storico

Da Mar 2024 a Apr 2024

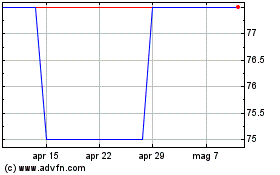

Grafico Azioni Fiske (LSE:FKE)

Storico

Da Apr 2023 a Apr 2024