TIDMFAR

RNS Number : 5258K

Ferro-Alloy Resources Limited

29 August 2019

Ferro-Alloy Resources Limited ("FAR" or "the Company" or "the

Group")

Interim Results for the six months ended 30 June 2019

Ferro-Alloy Resources Limited, the vanadium producer and

developer of the large Balasausqandiq vanadium deposit in Southern

Kazakhstan, announces its unaudited results for the six months

ended 30 June 2019.

Highlights:

-- Admitted to trading on the London Stock Exchange on 28 March 2019, raising $6.9m (GBP5.3m) before expenses

-- Continuous production maintained during major expansion and improvement work at the existing vanadium concentrate

processing operation ("Existing Operation")

-- 55% year-on-year increase in production at the Existing Operation; production of vanadium pentoxide in H1 2019

totalled 71.5 tonnes

-- Incremental improvements to the Existing Operation already increasing production; record monthly production of

vanadium pentoxide achieved in June 2019 of 17.6 tonnes

-- Completion of first batch of improvements to the Existing Operation targeted for the end of Q3 2019 resulting in

an anticipated significant increase in production in Q4 2019

-- Development continuing at the large Balasausqandiq Vanadium Project (the "Project"); which has a NPV of $2

billion at a long-term forecast vanadium pentoxide price of $7.50/lb

-- Upgrade of the local feasibility study on the Project continuing

For further information, visit www.ferro-alloy.com or

contact:

Ferro-Alloy Resources Nick Bridgen (CEO) info@ferro-alloy.com

Limited

Shore Capital

(Corporate Broker) Jerry Keen/Toby Gibbs +44 207 408 4090

St Brides Partners

Limited

(Financial PR & IR Catherine Leftley/Gaby

Adviser) Jenner +44 207 236 1177

Operations Review

The Existing Operation

Production at the Existing Operation was maintained throughout

H1 2019 with only minor interruptions in spite of significant

levels of capital development work being undertaken at the plant.

Installation of new equipment and the renovation of the existing

belt filter meant that plant availability averaged only 75% in the

period but despite this, overall production reached 71.5 tonnes,

representing a 55% increase to that achieved in the H1 2018.

Incremental expansion and improvement work already completed has

resulted in record production in June 2019 of 17.6 tonnes of

vanadium pentoxide.

The main work carried out in H1 to expand and improve production

at the Existing Operation included:

-- construction of a 990m2 extension to the plant facility;

-- installation of electrometallurgical and recrystallisation equipment;

-- construction of a 15,000m2 evaporation pond;

-- detailed engineering for the construction of a connecting line and transformer station to the adjacent 110 kV

power-line;

-- addition of substantial new equipment to increase capacity of existing production processes; and

-- construction of supporting worker accommodation

Equipment delivered to site during H1 2019 included:

-- a rotating pre-roasting furnace for the pre-roasting of concentrates;

-- a second main concentrate roasting oven;

-- a furnace for the decomposition of ammonium metavanadate ("AMV") into vanadium pentoxide;

-- three new 16 cubic meters tanks with cooling systems for increasing the capacity for sedimentation of AMV;

-- two new 16 cubic metre tanks with steam heating for the leaching with sodium carbonate of vanadium concentrates;

-- a new 16 cubic metre tank for the preliminary leaching of roasted vanadium concentrates; and

-- a new press-filter

Outlook for the Existing Operation

Whilst record production has already been reported as a result

of recent improvement work, the most significant increases are

expected to come in Q4 2019.

Completion of the process plant building expansion and

installation and commissioning of the first phase of new equipment

is targeted at the end of Q3 2019 resulting in an increase in

name-plate capacity to over 50 tonnes of vanadium pentoxide per

month, over four times higher than the average for H1 2019.

However, operations are likely to be impacted by unreliability of

the current power supply until the connection is made to a new high

voltage power line, expected around the end of Q1 2020.

The new equipment includes a dissociation oven which will enable

the Company to produce vanadium pentoxide powder and eliminate the

discount which applies to the current production of AMV. Work is

progressing on the second part of the capital programme which is

expected to further increase production later in 2020.

Balasausqandiq

Development of the large Balasausqandiq vanadium deposit is

on-going in parallel with the Existing Operation.

Balasausquandiq has a significant advantage when compared to

most other vanadium deposits and producers in that the ore is not

vanadiferous titano-magnetite ("VTM") and therefore does not

require the expensive concentrating and high temperature roasting

which VTM requires. This reduces both capital and operating costs

by about 60% and is likely to make the Group the lowest cost

primary producer. The proposed development is planned in two phases

to produce up to 22,400 tonnes per year of vanadium pentoxide

which, at a long-term price assumption of $7.50/lb of vanadium

pentoxide, will result in a Net Present Value (at 10% discount

rate) of over $2 billion.

The Company has previously completed a feasibility study to

locally required standards, supplemented by a western-style JORC

reserve and resource estimate and the construction and operation of

a 15,000 tpy pilot plant which has also proved the feasibility of

the proposed process. A completed gap analysis has highlighted

relatively small areas where further work is required to meet the

standards of a typical western banking feasibility study. This will

be carried out simultaneously with the already-planned confirmatory

work to test the potential of using simpler vertical autoclaves

instead of the more complex and expensive horizontal autoclaves

that the pilot plant operation has indicated are not required.

Corporate

On 28 March 2019 the Company was admitted to listing on the

London Stock Exchange.

On 25(th) of July 2019 Ferro-Alloy Resources Limited appointed

Shore Capital to act as Corporate Broker.

Vanadium prices in the period

Prices of vanadium pentoxide have been volatile in the reporting

period, starting the year at around US$16/lb before falling to

around US$7/lb by the end of the H1 reporting period. The fall in

vanadium prices from the high levels experienced in 2018 was

expected by the industry, although the timing was more sudden than

had been forecast. As a result of industry trading practices and

the application of the Company's accounting policies, the fall in

price has resulted in certain charges to profit in the year that

are not expected to recur.

During the period the Group procured certain raw materials at

prices based on the prevailing spot vanadium prices and, as these

materials can take several months for delivery and processing,

these were purchased at higher prices than those prevailing when

the end product was sold, having the effect of reducing trading

profits during periods of falling prices.

Furthermore, as is the norm in the industry, revenue, and the

corresponding trade receivable are recognised at the time of

transfer of control of products to the customer, but the final

pricing determination is based on assay and prices around the time

of arrival of the goods at the port of destination which can be

several months later. Therefore, receivables relating to shipments

made in Q4 2018 which had been valued at fair value based on the

price prevailing at the end of 2018, realised less than the

carrying value. The loss, together with the fair value adjustments

to further sales made in H1, is included in note 2 as Other

Revenues.

In accordance with the Company's accounting policy, shipments

made in H1 2019, which had not yet been assayed and priced at

destination by the end of the period, have been valued on the basis

of the price prevailing as at 30 June 2019 of around $7/lb.

Vanadium prices are now very close to the level that the Company

expects in the long-term, so the directors do not anticipate

further significant falls or increases. However, there is

uncertainty over the extent of future Chinese enforcement of new

steel standards which might increase demand and price volatility.

Stable prices will lessen the accounting effects detailed above and

as production rises in Q4 2019 and the Company starts to produce

vanadium pentoxide instead of AMV, it is expected that

profitability will be very much enhanced.

Earnings and cash flow

The Group generated revenues of US$1.1m for the period compared

to US$1.7m for the first six months of 2018, reflecting the falling

market prices and the negative Other Revenue detailed above and

below. Cost of sales increased to US$1.3m from US$0.7m for the

first six months of 2018 reflecting the increased volumes and the

relatively high price at which raw materials were acquired.

Administrative expenses of US$0.9m (H1 2018: US$0.6m) included

non-recurring listing costs of $0.3m, with the remainder

principally comprising employee costs, audit and professional

services, reflecting the higher costs associated with the Company

being listed on the London Stock Exchange.

The Group made a net loss before and after tax of US$1.3m (H1

2018: profit of US$0.3m).

Net cash outflows from operating activities totalled US$2.3m (H1

2018: US$0m) principally reflecting the decrease in selling prices.

Net cash outflows from investing activities included US$0.5m (H1

2018: US$0.2m) of capital expenditure associated with expanding the

processing operation. Net cash inflows from financing activities

totalled US$6.6m (H1 2018: US$0.2m) being the proceeds, net of

commissions, from the offer at the time of listing on the London

Stock Exchange.

Balance sheet review

Non-current assets increased to US$3.3m at 30 June 2019 (2018:

US$2.8m), reflecting the capital expenditure in existing

operations.

Current assets excluding cash balances increased to US$2.4m from

US$1.1m year before. The increase was driven by increases in

production resulting in higher inventories (US$1.6m from US$0.9m)

and an increase in prepayments (US$0.7m from US$0.1m)

The Group had cash of US$4.6m at 30 June 2019 (2018:

US$0.9m).

Description of principal risks, uncertainties and how they are

managed

Risks and uncertainties which the Group is facing are as set out

in the financial statements for the year ended 31 December 2019 in

the CEO's Report on Operations as published on 30 April 2019. In

addition, the timing and extent of the increase in production

anticipated in the fourth quarter of 2019 is uncertain because it

depends on the performance of sub-contractors and unforeseen

commissioning delay. Furthermore, until the connection to the new

power-line, expected around the end of the first quarter of 2020,

there may be interruptions to production outside the control of the

Company. Since the changes being made to the process plant are in

the nature of expansions and improvements to the existing processes

without any significant change in the style of equipment or

technology, the directors are confident that any such outcomes can

be relatively easily managed but recognises that some delay may be

possible.

Responsibility statements

Directors Responsibility Statement

We confirm that to the best of our knowledge:

a) the Condensed set of Interim Financial Statements has been

prepared in accordance with IAS 34 Interim Financial Reporting;

b) the interim management report includes a fair review of the

information required by DTR 4.2.7R (indication of important events

during the first six months and description of principal risks and

uncertainties for the remaining six months of the year);

c) the interim management report includes a fair review of the

information required by DTR 4.2.8R (disclosure of related

partiestransactions and changes therein); and

d) the condensed set of interim financial statements, which has

been prepared in accordance with the applicable set of accounting

standards, gives a true and fair view of the assets, liabilities,

financial position and profit or loss of the issuer, or the

undertakings included in the consolidation as a whole as required

by DTR 4.2.4R.

This Half Yearly Report has been approved by the Board and

signed on its behalf by:

James Turian

Director

29.08.2019

Condensed unaudited Consolidated Statement of Comprehensive

Income

Unaudited Unaudited

six-month six-month

period ended period ended

30 June 2019 30 June 2018

Note $000 $000

------------- ------------------------

Revenue 2 1,108 1,661

Cost of sales 3 (1,323) (658)

------------- ------------------------

Gross (loss) profit (215) 1,003

Administrative expenses 4 (947) (604)

Distribution expenses (58) (42)

Other expenses (1) (1)

------------- ------------------------

(Loss) profit from operating

activities (1,221) 356

------------- ------------------------

Net finance income/(costs) 6 (89) (25)

------------- ------------------------

Profit (loss) before income

tax (1,310) 331

============= ========================

Income tax - (1)

(Loss) profit for the period (1,310) 330

Other comprehensive (loss)

income

Items that may be reclassified

to profit or loss

Exchange differences arising

on translation of foreign

operations 9 11

------------- ------------------------

Total comprehensive (loss)

income for the period (1,301) 341

============= ========================

(Loss)/earnings/per share

(basic and diluted), US$ 14 (0.004) 0.001

------------- ------------------------

Condensed unaudited Consolidated Statement of Financial

Position

Unaudited

31 December

30 June 2019 2018

Note $000 $000

-------------- -----------

ASSETS

Non-current assets

Property, plant and equipment 7 2,515 2,203

Exploration and evaluation

assets 8 60 59

Intangible assets 9 25 25

Long-term VAT receivable 11 429 237

Prepayments 12 251 249

Total non-current assets 3,280 2,773

-------------- -----------

Current assets

Inventories 10 1,616 929

Trade and other receivables 11 56 38

Prepayments 12 686 91

Cash and cash equivalents 13 4,623 892

Total current assets 6,981 1,950

-------------- -----------

Total assets 10,261 4,723

============== ===========

EQUITY AND LIABILITIES

Equity

Share capital 14 33,978 27,330

Additional paid-in capital 397 380

Foreign currency translation

reserve (2,956) (2,965)

Accumulated losses (22,585) (21,275)

-------------- -----------

Total equity 8,834 3,470

-------------- -----------

Non-current liabilities

Provisions 60 60

Total non-current liabilities 60 60

-------------- -----------

Current liabilities

Trade and other payables 16 1,011 929

Contract liability 15 356 264

-------------- -----------

Total current liabilities 1,367 1,193

-------------- -----------

Total liabilities 1,427 1,253

-------------- -----------

Total equity and liabilities 10,261 4,723

============== ===========

Condensed unaudited Consolidated Statement of Changes in

Equity

Additional Foreign currency

Share Share paid in capital translation Accumulated

capital premium $000 reserve losses Total

$000 $000 $000 $000 $000

-------- ---------- ---------------- ---------------- ------------------ -------

Balance at 1 January

2018 15 26,904 380 (2,672) (24,238) 389

Profit for the period - - - - 330 330

Other comprehensive

income

Exchange differences

arising on

translation

of foreign

operations - - - 11 - 11

-------- ---------- ---------------- ---------------- ------------------ -------

Total comprehensive

income (loss)

for the period - - - 11 330 341

-------- ---------- ---------------- ---------------- ------------------ -------

Transactions with

owners, recorded

directly in equity

Shares issued - 181 - - - 181

Balance at 30 June

2018 15 27,085 380 (2,661) (23,908) 911

======== ========== ================ ================ ================== =======

Balance at 1 January

2019 27,330 - 380 (2,965) (21,275) 3,470

Loss for the period - - - - (1,310) (1,310)

Other comprehensive

expense

Exchange differences

arising on

translation

of foreign

operations - - - 9 - 9

-------- ---------- ---------------- ---------------- ------------------ -------

Total comprehensive

income (loss)

for the period - - - 9 (1,310) (1,301)

-------- ---------- ---------------- ---------------- ------------------ -------

Transactions with

owners, recorded

directly in equity

Shares issued (note

14) 6,648 - - - - 6,648

Other transactions

recognised directly

in equity (note 14) - - 17 - - 17

-------- ---------- ---------------- ---------------- ------------------ -------

Balance at 30 June

2019 33,978 - 397 (2,956) (22,585) 8,834

======== ========== ================ ================ ================== =======

Condensed unaudited Consolidated Statement

of Cash Flow

------------- -------------

Unaudited Unaudited

six-month six-month

period ended period ended

30 June 2019 30 June 2018

$000 $000

------------- -------------

Cash flows from operating activities

(Loss) income for the period (1,310) 331

Adjustments for:

Depreciation and amortisation 257 18

Loss on write-off of property, plant and

equipment - 15

Expenses on credit loss provisions and impairment

of prepayments 21 -

Income tax - (1)

Net finance costs / (income) 89 25

Cash from operating activities before changes

in working capital (943) 388

Change in inventories (680) (3)

Change in trade and other receivables (231) (416)

Change in prepayments (595) (31)

Change in trade and other payables 82 116

Change in contract liability 92 -

------------- -------------

Net cash from operating activities (2,275) 54

------------- -------------

Cash flows from investing activities

Acquisition of property, plant and equipment (519) (169)

Net cash used in investing activities (519) (169)

------------- -------------

Cash flows from financing activities

Proceeds from issue of share capital 6,880 181

Transaction costs on shares subscription (232) -

Net cash from financing activities 6,648 181

------------- -------------

Net increase in cash and cash equivalents 3,854 66

Cash and cash equivalents at the beginning

of the period 892 267

------------- -------------

Effect of movements in exchange rates on

cash and cash equivalents (123) (24)

------------- -------------

Cash and cash equivalents at the end of

the period 4,623 309

============= =============

Unaudited notes to the Financial Statements for the 6 months

period ended 30 June 2019

1 Basis of preparation

These Condensed Unaudited Financial Statements have been

prepared in accordance with IAS34 Interim Financial Reporting. The

same accounting policies and basis of preparation have been

followed as in the annual financial statements of the Group which

were published in 30 April 2019.

The consolidated financial statements are prepared in accordance

with IFRS on a going concern basis. The Directors have reviewed the

Group's cash flow forecasts for at least 12 months following the

reporting date, including sensitivities and mitigating actions.

After taking into account available cash and forecast cash flow

from operations, the Directors consider that the Group has adequate

resources to continue its operational existence for the foreseeable

future. For this reason, they continue to adopt the going concern

basis in preparing the financial statements.

These Condensed Unaudited Financial Statements have not been

approved or reviewed by the Corporate Auditor.

IFRS 16, Leases, has been applied for the first time but its

impact is not material.

2 Revenue

Unaudited Unaudited

six-month six-month

period ended period ended

30 June 2019 30 June 2018

$000 $000

------------- -------------

Revenue from sales of vanadium

products 1,972 1,661

Sales of gravel and waste rock 1 -

Total revenue from customers 1,973 1,661

------------- -------------

Other revenues Ð change in

fair value of customer contract (865) -

============= =============

1,108 1,661

============= =============

Vanadium products

Under certain sales contracts the single performance obligation

is the delivery of AMV to the designated delivery point at which

point possession, title and risk on the product transfers to the

buyer. The buyer makes an initial provisional payment based on

volumes and quantities assessed by the Company and market spot

prices at the date of shipment. The final payment is received once

the product has reached its final destination with adjustments for

quality / quantity and pricing. The final pricing is based on the

historical average market prices during a quotation period based on

the date the product reaches the port of destination and an

adjusting payment or receipt will be made to the initially received

revenue. Where the final payment for a shipment made prior to the

end of an accounting period has not been determined before the end

of that period, the revenue is recognised based on the spot price

that prevails at the end of the accounting period, with adjustments

for the value of money and the carry costs where significant.

Other revenue related to the change in the fair value of amounts

receivable under the sales contracts between the date of initial

recognition and year end resulting from market prices are recorded

as other revenue. Refer to note 17 for details of contract

liabilities recorded at fair value.

3 Cost of sales

Unaudited Unaudited

six-month six-month

period ended period ended

30 June 2019 30 June 2018

$000 $000

------------- -------------

Materials 753 360

Wages, salaries and related taxes 257 219

Depreciation 244 22

Electricity 58 37

Other 11 20

------------- -------------

1,323 658

============= =============

4 Administrative expenses

Unaudited Unaudited

six-month six-month

period ended period ended

30 June 2019 30 June 2018

$000 $000

------------- -------------

Wages, salaries and related taxes 422 391

Listing & reorganisation expenses 336 105

Audit 61 -

Professional services 43 17

Materials 24 22

Business trip expenses 15 13

Depreciation and amortization 13 6

Security 8 9

Communication and information services 3 3

Bank fees 2 4

Other 20 34

------------- -------------

947 604

============= =============

5 Personnel costs

Unaudited Unaudited

six-month six-month

period ended period ended

30 June 2019 30 June 2018

$000 $000

------------- -------------

Wages, salaries and related taxes 639 584

-------------

639 584

============= =============

6 Finance costs

Unaudited Unaudited

six-month six-month

period ended period ended

30 June 2019 30 June 2018

$000 $000

------------- -------------

Net foreign exchange costs 89 25

Net finance costs/(income) 89 25

============= =============

7 Property, plant and equipment

Plant and Construction

Land and buildings equipment Vehicles Computers Other in progress Total

$000 $000 $000 $000 $000 $000 $000

------------------ ---------- -------- --------- ----- ------------ -------

Cost

Balance at 1 January

2018 1,853 2,015 364 13 42 202 4,489

Additions 9 131 123 13 47 350 673

Disposals - (27) - - (4) (17) (48)

Foreign currency

translation

difference (251) (283) (61) (3) (10) (61) (669)

------------------ ---------- -------- --------- ----- ------------ -------

Balance at 31 December

2018 1,611 1,836 426 23 75 474 4,445

================== ========== ======== ========= ===== ============ =======

Balance at 1 January

2019 1,611 1,836 426 23 75 474 4,445

Additions 63 200 155 14 17 70 519

Transfers - 181 - - - (181) -

Foreign currency

translation

difference 14 16 3 1 2 5 41

------------------ ---------- -------- --------- ----- ------------ -------

Balance at 30 June 2019 1,688 2,233 584 38 94 368 5,005

================== ========== ======== ========= ===== ============ =======

Depreciation

Balance at 1 January

2018 1,853 2,015 295 13 32 202 4,410

Depreciation for the

period - 10 29 1 5 - 45

Disposals - (27) - - - - (27)

Reversal of impairment (1,022) (393) - - - (175) (1,590)

Foreign currency

translation

difference (250) (270) (42) (2) (5) (27) (596)

------------------ ---------- -------- --------- ----- ------------ -------

Balance at 31 December

2018 581 1,335 282 12 32 - 2,242

================== ========== ======== ========= ===== ============ =======

Balance at 1 January

2019 581 1,335 282 12 32 - 2,242

Depreciation for the

period 28 171 22 2 4 - 227

Transfers - - - - - - -

Foreign currency

translation

difference 5 13 3 1 (1) - 21

------------------ ---------- -------- --------- ----- ------------ -------

Balance at 30 June 2019 614 1,519 307 15 35 - 2,490

================== ========== ======== ========= ===== ============ =======

Carrying amounts

At 1 January 2018 - - 69 - 10 - 79

================== ========== ======== ========= ===== ============ =======

At 31 December 2018 1,030 501 144 11 43 474 2,203

================== ========== ======== ========= ===== ============ =======

At 30 June 2019 1,074 714 277 23 59 368 2,515

================== ========== ======== ========= ===== ============ =======

.

8 Exploration and evaluation assets

The Group's exploration and evaluation assets relate to

Balasausqandiq deposit. During the six months period ended 30 June

2019 the Group did not capitalise any exploration and evaluation

assets (in 2018: US$nil). As at 30 June 2019 the carrying value of

exploration and evaluation assets was US$0.060m (2018:

US$0.059m).

9 Intangible assets

Mineral Computer

rights Patents software Total

$000 $000 $000 $000

-------- -------- ---------- ------

Cost

Balance at 1 January

2018 115 36 4 155

Additions - 2 - 2

Foreign currency translation

difference (16) (5) (1) (22)

-------- -------- ---------- ------

Balance at 31 December

2018 99 33 3 135

======== ======== ========== ======

Balance at 1 January

2019 99 33 3 135

Additions - - - -

Foreign currency translation

difference 1 1 - 2

-------- -------- ---------- ------

Balance at 30 June 2019 100 34 3 137

======== ======== ========== ======

Amortisation

Balance at 1 January

2018 115 36 2 153

Amortisation for the

year - - 1 1

Reversal of impairment - (23) - (23)

Foreign currency translation

difference (16) (4) (1) (21)

-------- -------- ---------- ------

Balance at 31 December

2018 99 9 2 110

======== ======== ========== ======

Balance at 1 January

2019 99 9 2 110

Amortisation for the

year - 1 - 1

Foreign currency translation

difference 1 (1) 1 1

-------- -------- ---------- ------

Balance at 30 June 2019 100 9 3 112

======== ======== ========== ======

Carrying amounts

At 1 January 2018 - - 2 2

======== ======== ========== ======

At 31 December 2018 - 25 - 25

======== ======== ========== ======

At 30 June 2019 - 25 - 25

======== ======== ========== ======

10 Inventories

Unaudited

31 December

30 June 2019 2018

$000 $000

-------------- -----------

Raw materials and consumables 1,162 527

Finished goods 448 184

Goods in transit - 218

Work in progress 6 -

1,616 929

============== ===========

11 Trade and other receivables

Unaudited 31 December

Non-current 30 June 2019 2018

$000 $000

------------- -----------

VAT receivable 789 594

Provision for VAT receivable (360) (357)

429 237

============= ===========

Unaudited 31 December

Current 30 June 2019 2018

$000 $000

------------- -----------

Trade receivables from third

parties 26 21

Due from employees - 24

Other receivables 51 14

------------- -----------

77 59

Expected credit loss provision (21) (21)

-------------

56 38

============= ===========

The expected credit loss provision relates to credit impaired

receivables which are in default and the Group considers the

probability of collection to be remote given the age of the

receivable and default status.

12 Prepayments

Unaudited

31 December

30 June 2019 2018

$000 $000

-------------- -----------

Non-current

Prepayments for equipment 251 249

-------------- -----------

251 249

============== ===========

Current

Prepayments for goods and services 686 91

-------------- -----------

686 91

============== ===========

13 Cash and cash equivalents

Unaudited

31 December

30 June 2019 2018

$000 $000

-------------- -----------

Bank balances and other cash

deposits 4,623 885

Petty cash - 7

Cash and cash equivalents 4,623 892

============== ===========

14 Equity

(a) Share capital

Number of shares unless otherwise stated Ordinary shares

Unaudited 31 December

30 June 2019 2018

------------- -----------

Par value - -

Outstanding at beginning of

year 305,471,087 1,523,732

Shares issued prior to share

split - 1,493

Share reorganisation (split) - 305,045,000

Shares issued post share split 7,507,761 426,087

-------------

Outstanding at end of year 312,978,848 305,471,087

============= ===========

Ordinary shares

All shares rank equally. The holders of ordinary shares are

entitled to receive dividends as declared from time to time and are

entitled to one vote per share at meetings of the Company.

In July 2018 the Company's shareholders voted by ordinary

resolution to subdivide each share into 200 new shares of no par

value so that the listed shares will be of a value within the

normal range for listing companies. As a result, the share premium

was transferred to share capital in 2018.

Reserves

Share capital: Value of shares issued less costs of issuance.

Prior to the share restructuring share capital related to the

nominal value of shares issued.

Additional paid in capital: Amounts due to shareholders which

were waived.

Foreign currency translation reserve: Foreign currency

differences on retranslation of results from functional to

presentational currency and foreign exchange movements on

intercompany balances considered to represent net investments which

are permanent as equity.

Accumulated losses: Cumulative net losses.

(b) Dividends

No dividends were declared for the six-month period ended 30

June 2019.

(c) (Loss) earnings per share (basic and diluted)

The calculation of basic and diluted earnings / (loss) per share

has been based on the following (loss) profit attributable to

ordinary shareholders and weighted-average number of ordinary

shares outstanding.

(i) (Loss) profit attributable to ordinary shareholders (basic and diluted)

Unaudited Unaudited

six-month six-month

period ended period ended

30 June 2019 30 June 2018

$000 $000

------------- -------------

(Loss) profit for the year, attributable

to owners of the Company (1,310) 330

------------- -------------

(Loss) profit attributable to ordinary

shareholders (1,310) 330

============= =============

(ii) Weighted-average number of ordinary shares (basic and diluted)

Unaudited

Unaudited six-month

six-month period ended

period ended 30 June 2018

Shares 30 June 2019 Restated

------------- -------------

Issued ordinary shares at 1 January

(after subdivision) 305,471,087 304,746,400

Effect of shares issued (weighted) 5,718,240 101,000

Weighted-average number of ordinary

shares at

30 June 311,189,327 304,847,400

============= =============

(Loss) earnings per share of common

stock attributable to the Company

(basic and diluted) (0.004) 0.001

------------- -------------

The 2018 comparative has been revised to reflect the share split

as if it had occurred on 1 January 2018 for comparability purposes.

There are no significant dilutive or potentially dilutive

instruments.

15 Loans and borrowings

There were no outstanding loans at 30 June 2019 (31 December

2018: US$nil) and no borrowings or loan repayments in the six month

period ended 30 June 2019 (in 2018: the borrowing was US$ nil).

16 Trade and other payables

Unaudited

31 December

30 June 2019 2018

$000 $000

-------------- -----------

Trade payables 594 302

Advances received 159 5

Due to directors/key management 146 547

Due to employees 57 44

Other taxes 55 31

1,011 929

============== ===========

17 Contract liability (trade and other payables at FVPL)

Unaudited

31 December

30 June 2019 2018

$000 $000

-------------- -----------

Contract liability (trade and other

payables at FVPL) 356 264

356 264

============== ===========

18 Contingencies

(a) Insurance

The insurance industry in the Kazakhstan is in a developing

state and many forms of insurance protection common in other parts

of the world are not yet generally or economically available. The

Group does not have full coverage for its plant facilities,

business interruption, or third party liability in respect of

property or environmental damage arising from accidents on Group

property or relating to Group operations. There is a risk that the

loss or destruction of certain assets could have a material adverse

effect on the GroupÕs operations and financial position.

(b) Taxation contingencies

The taxation system in Kazakhstan is relatively new and is

characterised by frequent changes in legislation, official

pronouncements and court decisions which are often unclear,

contradictory and subject to varying interpretations by different

tax authorities. Taxes are subject to review and investigation by

various levels of authorities which have the authority to impose

severe fines, penalties and interest charges. A tax year generally

remains open for review by the tax authorities for five subsequent

calendar years but under certain circumstances a tax year may

remain open longer.

These circumstances may create tax risks in Kazakhstan that are

more significant than in other countries. Management believes that

it has provided adequately for tax liabilities based on its

interpretations of applicable tax legislation, official

pronouncements and court decisions. However, the interpretations of

the relevant authorities could differ and the effect on these

consolidated financial statements, if the authorities were

successful in enforcing their interpretations, could be

significant.

There are no tax claims or disputes at present.

19 Segment reporting

The Group's operations are split into three segments based on

the nature of operations: processing, subsoil operations (being

operations related to exploration and mining) and corporate segment

for the purposes of IFRS 8 Operating Segments. The GroupÕs assets

are primarily concentrated in the Republic of Kazakhstan and the

GroupÕs revenues are derived from operations in, and connected

with, the Republic of Kazakhstan.

Unaudited six-month

period ended 30 June

2019

Processing Subsoil Corporate Total

$000 $000 $000 $000

---------- ------- --------- -------

Revenue 1,108 - - 1,108

Cost of sales (1,323) - - (1,323)

Administrative expenses (278) (14) (656) (1,271)

Distribution & other

expenses (59) - - (59)

Finance costs 9 - (98) (89)

(Loss)/Profit before

tax (543) (14) (753) (1,310)

========== ======= ========= =======

Unaudited six-month

period ended 30 June

2018

Processing Subsoil Corporate Total

$000 $000 $000 $000

---------- ------- --------- -------

Revenue 1,661 - - 1,661

Cost of sales (658) - - (658)

Administrative expenses (229) (20) (355) (604)

Distribution & other

expenses (43) - - (43)

Finance costs 1 - (26) (25)

---------- ------- --------- -------

Profit before tax 732 (20) (381) 331

========== ======= ========= =======

20 Related party transactions

(a) Transactions with management and close family members

Management remuneration

Key management personnel received the following remuneration

during the year, which is included in personnel costs (see Note

5):

Unaudited Unaudited

six-month six-month

period ended period ended

30 June 2019 30 June 2018

$000 $000

------------- -------------

Wages, salaries and related

taxes 190 178

------------- -------------

(b) Transactions with other related parties

There were no other related party transactions.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR CKCDBPBKKCFB

(END) Dow Jones Newswires

August 29, 2019 02:01 ET (06:01 GMT)

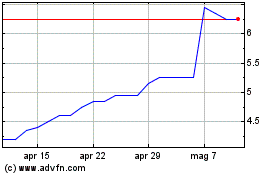

Grafico Azioni Ferro-alloy Resources (LSE:FAR)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Ferro-alloy Resources (LSE:FAR)

Storico

Da Apr 2023 a Apr 2024