TIDMFTV

FORESIGHT VCT PLC

Financial Highlights

-- Total net assets GBP132.3 million.

-- An interim dividend of 5.0p per share was paid on 3 May 2019, costing

GBP8.8 million.

-- The portfolio has seen an uplift in valuation of GBP4.8 million in

the last six months.

-- Net Asset Value per share increased by 2.9% from 78.1p at 31 December

2018 to 80.4p before dividends. After payment of a 5.0p dividend made on

3 May 2019, NAV per share at 30 June 2019 reduced to 75.4p.

-- Four new VCT qualifying investments, totalling GBP9.0 million were

made during the period.

Chairman's Statement

I am pleased to present the Unaudited Half-Yearly Financial Report for

Foresight VCT plc for the period ended 30 June 2019.

STRATEGY

The Directors, together with the Manager, continue to pursue a strategy

for the Company which includes the following four key objectives:

-- Increasing and then maintaining the Company's net asset value (NAV)

significantly above GBP150 million;

-- Paying an annual dividend to shareholders and endeavouring to

maintain, or increase, NAV per share year on year, after payment of

dividends;

-- Completing a significant number of new and follow on qualifying

investments every year; and

-- Offering a programme of regular share buy backs at a discount of

approximately 10% to the prevailing NAV.

NET ASSET VALUE

During the period ended 30 June 2019 the NAV per share rose by 2.3p, an

increase of 2.9%. However, following the payment of a 5.0p per share

dividend on 3 May 2019, which is detailed below, the NAV of the Company

decreased from GBP136.7 million at 31 December 2018 to GBP132.3 million

as at 30 June 2019.

At 30 June 2019 the cash resources of the Company were GBP19.8 million

and in line with the current strategy, the Directors will give

consideration to the benefits which might arise from further fund

raising in the coming months.

DIVIDS

The interim dividend of 5.0p per share was paid on 3 May 2019 based on

an ex-dividend date of 11 April 2019, with a record date of 12 April

2019. The cost of this dividend was a total of GBP8.8 million, including

shares allotted under the dividend reinvestment scheme.

The Company has achieved or exceeded its target of paying an annual

dividend of at least 5.0p per share for each of the past nine years.

Since establishing the current dividend strategy major changes have

taken place to the VCT rules and, as I have highlighted in recent

Statements to Shareholders, these have been intended to shift investment

into earlier stage, higher risk companies. By their nature these

companies normally take longer to mature and, though eventual returns

should be similar, the Board anticipates that for the coming few years

enhancement to investment values, realisations and income will all be

more volatile. As a consequence, although the total amount of

distributions over the longer term could be similar, the Board believes

that it would be prudent to move the dividend policy towards a targeted

annual dividend yield of 5% of NAV per annum. This should be enhanced by

additional 'special' dividends as and when particularly successful

portfolio exits are made.

The total return per share from an investment made five years ago would

be 12.6%, which is materially below the target return set by the

Directors, and it is the future achievement of this target that is at

the centre of the Company's current and future portfolio management

strategy.

INVESTMENT PERFORMANCE AND PORTFOLIO ACTIVITY

A detailed analysis of the investment portfolio performance over the

period is given in the Manager's Review.

Before the payment of dividends, the Company's NAV increased in the

period by GBP4.4 million. The Board believes that this reflects the

benefit of the enlarged and diversified portfolio of qualifying

investments which the Manager has built up over the past few years. The

Company started the current year with 85% of its assets invested in a

range of unquoted growth capital investments; the Board and Manager

believe that, in aggregate, these investments will continue to mature

and should help improve the future rate of growth in NAV.

During the period under review the Manager completed four new VCT

qualifying investments amounting to GBP9.0 million. Details of each of

these new portfolio companies can be found in the Manager's Review.

The Manager expects that the current pipeline of opportunities should

support completion of a number of additional new investments during the

remainder of the current year.

The Board is aware that Foresight 4 VCT plc ('Foresight 4') has over the

past two years raised a considerable amount of new money, much of which

needs to be invested in the near future. The Company and Foresight 4

have the same Manager and share similar investment policies. The Board

closely monitors the extent and nature of the pipeline of investment

opportunities and is reassured by the Manager's confidence in being able

to increase the level of new investments without compromising quality

during 2019 and beyond, so as to be in a position to satisfy the

investment needs of both the Company and Foresight 4.

BUYBACKS

During the period the Company repurchased 1.5 million shares for

cancellation at an average discount of 10.0%. The Board and the Manager

consider that the ability to offer to buy back shares at a target

discount of approximately 10% is fair to both continuing and selling

shareholders and is an appropriate way to help underpin the discount to

NAV at which the shares trade.

Share buybacks are timed during the year taking account of the Company's

closed periods. These will generally take place, subject to demand,

during the following times of year:

-- April, after the Annual Report has been published;

-- June, prior to the Half-Yearly reporting period date of 30 June;

-- September, after the Half- Yearly Financial Report has been

published; and

-- December, prior to the end of the financial year.

MANAGEMENT CHARGES, CO-INVESTMENT AND INCENTIVE ARRANGEMENTS

The annual management fee is an amount equal to 2.0% of net assets,

excluding cash balances above GBP20 million, which are charged at a

reduced rate of 1.0%. This has resulted in ongoing charges for the

period ended 30 June 2019 being 2.3% of net assets, which is at the

lower end of the range when compared to competitor VCTs.

Since March 2017, co-investments made by the Manager and individual

members of Foresight Group's private equity team have totalled GBP0.6

million alongside the Company's investments of GBP41.4 million. Under

the terms of the Incentive Arrangements, the 'Total NAV Return Hurdle'

has not yet been achieved and no performance incentive payment is due.

BOARD COMPOSITION

The Board continues regularly to review its own performance and

undertakes succession planning to maintain an appropriate level of

independence, experience, diversity and skills in order to be in a

position to discharge all its responsibilities. There is no present

intention to alter the composition of the Board and the first planned

change is scheduled to take effect during 2021.

SHAREHOLDER COMMUNICATION

As part of its commitment to high quality investor relations, Foresight

Group continues to host its popular investor forums. In addition to an

annual event in London, several regional investor forums have been or

will be held around the country. Details of regional events will be sent

to Shareholders resident in the locality as and when they are organised.

The Board is offering shareholders the opportunity to elect the method

by which they receive shareholder communications in the future. Details

of this are included in the letter enclosed with this report. The Board

believes that, in addition to promoting sustainability, a shift towards

electronic communications will result in cost savings for the Company.

AUDITOR

The Board regularly reviews the Company's ongoing costs and launched a

tender for its audit contract following the signing of the 2018 Annual

Report and Accounts. The previous auditor, KPMG LLP, was invited to

tender alongside several other firms. Following this competitive tender

process, I am pleased to confirm that Deloitte LLP have been appointed

as company auditor for the year ending 31 December 2019. The Board would

like to thank KPMG for their service over the past eight years. As

announced earlier today, KPMG's section 519 statement will be enclosed

with this report.

OUTLOOK

The persisting uncertainty over Brexit and worrying indicators for

various areas of world trade are unhelpful for business in general.

Foresight VCT invests primarily in developing companies which by their

nature benefit from general economic growth, and the current environment

places additional demands upon them and their management teams.

Foresight Group's private equity team is well aware of the management

and business needs of each of the companies within the investment

portfolio and is working closely with them to ensure that they are able

to make progress during these testing times. The Board and the Manager

are optimistic that the existing portfolio has potential to grow further

during the current year and beyond and that the present pipeline of

potential investments includes some attractive opportunities.

John Gregory

Chairman

Telephone 01296 682751

Email: j.greg@btconnect.com

30 August 2019

Manager's Review

The Company has appointed Foresight Group CI Limited as its manager

("The Manager") to provide investment management and administration

services. Foresight Group CI Limited has appointed Foresight Group LLP

to be its investment adviser. The Manager has also delegated secretarial,

accounting and other administration services to Foresight Group LLP.

References to "the Manager" throughout this report refer to the

activities of Foresight Group CI Limited and include the activities of

Foresight Group LLP when acting as the Manager's investment adviser and

administrative delegate.

Overview

We were pleased to deliver an uplift in portfolio value of GBP4.8

million in the period, although NAV was reduced by payment of an GBP8.8

million dividend and performance was therefore behind target. Good

progress was made in regards new investments with four completed in the

six-month period, deploying GBP9.0 million. We continue to manage the

Company's resources to ensure sufficient liquidity for new and follow-on

investments, dividends and regular buybacks, with the Company

repurchasing 1.5 million shares at an average discount of 10% in the

period under review.

As the portfolio mix evolves in line with the new VCT rules we believe

the Board's new target dividend of 5% of NAV per annum, enhanced by the

opportunity for 'special' dividends following successful portfolio exits,

more appropriately reflects likely returns from the underlying

portfolio.

Portfolio Summary

As at 30 June 2019 the Company's portfolio comprised 42 investments with

a total cost of GBP85.7 million and a valuation of GBP112.8 million. The

portfolio is diversified by sector, transaction type and maturity

profile.

NEW INVESTMENTS AND FOLLOW-ON FUNDING

The Company invested a total of GBP9.0 million during the first six

months of 2019. This included Clubspark, a sports management software

company, Steamforged Games, a developer and retailer of tabletop games,

Fourth Wall Creative, a technology-led sports merchandising business and

most recently Ten Health & Fitness, a boutique group of health and

fitness studios.

CLUBSPARK

In January 2019 the Company made a c.GBP1.3 million investment into

Sportlabs Technology Limited, trading as ClubSpark, a specialist

software company providing sports management software to sports clubs,

venues, coaches and participants. ClubSpark was founded in 2012 by two

ex-Lawn Tennis Association employees who spotted an opportunity to

develop a platform to manage operations for the LTA member clubs. The

investment will be used to establish an international presence, enhance

the platform and expand into new sports markets.

STEAMFORGED GAMES

In March 2019 the Company invested c.GBP2.4 million in Steamforged Games,

a developer and retailer of tabletop games with a portfolio of miniature

role playing, board and card games. Founded in 2014, Steamforged Games

has successfully carved out a niche in the market developing tabletop

games based on popular video game titles, as well as their own original

content. The investment will be used to fund growth through product

development and international expansion.

FOURTHWALL CREATIVE

The Company invested c.GBP3.0 million in Fourth Wall Creative, a

technology-led sports merchandising business. Founded in 2010, their

core business is the design and distribution of membership welcome packs

on behalf of football clubs. The investment will fund growth through the

development of new services, expanding the customer base and exploring

other sports opportunities.

TEN HEALTH & FITNESS

In June 2019 the Company invested c.GBP2.4 million in Ten Health, a

group of boutique fitness studios offering a range of services including

physiotherapy, massage therapy and fitness classes. Founded in 2007, Ten

Health was developed to bridge the gap in the market between traditional

healthcare and mainstream fitness. The investment will be used to

further develop Ten Health's non-fitness services and to support a

roll-out of new studios.

FOLLOW-ON INVESTMENTS

There have been no follow-on investments during the six months to 30

June 2019.

PIPELINE

Foresight Group continues to see a strong pipeline of potential

investments and has a number of opportunities under exclusivity or in

due diligence. Our investment team currently consists of 24 experienced

private equity professionals operating from six offices in the UK, due

to be expanded to seven later in 2019. We review nearly 1,500 business

plans of potential investee companies per year, with an increasing

number of prospects originated directly by our investment team. This

approach allows us to seek off-market opportunities which are often

better value as there is less competition in the process. During the

first half of 2019 we are on track to review a record number of

businesses thanks to our expanding regional footprint. The Company

focuses on SMEs in all sectors across the UK, seeking funding of GBP1-5

million.

At 30 June 2019, the Company had cash balances of GBP19.8 million, which

will be used to fund new and follow-on investments, buybacks and running

expenses. The Company remains well positioned to continue pursuing the

potential investment opportunities in the pipeline.

EXITS AND REALISATIONS

The Business Advisory Limited repaid a GBP45,000 loan in the period.

Other than this there have been no exits during the six months to 30

June 2019. Foresight Group continues to engage with a range of potential

acquirers of several portfolio companies, with demand for these high

growth businesses demonstrated by both private equity and trade buyers.

In May 2019 LGDA Limited (formerly Autologic Diagnostics Group Limited)

was dissolved, realising a loss of GBP3,782,272. The investment in

Autologic had been valued at GBPnil since 2017. This loss results from

the transfer from unrealised to realised reserves and has no impact on

NAV in the current period.

KEY PORTFOLIO DEVELOPMENTS

Overall, the value of unquoted investments held rose to GBP112.8 million,

driven by GBP9.0 million of deployment and an increase in the value of

existing investments by GBP4.8 million. Material changes in valuation,

defined as increasing or decreasing by GBP1.0 million or more since 31

December 2018, are detailed below. Updates on these companies are

included below;

Company Valuation (GBP) Valuation Change (GBP)

----------------------------- --------------- ----------------------

FFX Group Limited 7,408,267 2,320,670

----------------------------- --------------- ----------------------

Specac International Limited 6,315,005 1,267,684

----------------------------- --------------- ----------------------

Ixaris Systems Limited 5,580,716 1,017,326

----------------------------- --------------- ----------------------

Datapath Group Limited 7,782,267 (1,027,677)

----------------------------- --------------- ----------------------

Online Poundshop Limited 933,187 (1,041,399)

----------------------------- --------------- ----------------------

Powerlinks Media Limited 411,358 (1,129,666)

----------------------------- --------------- ----------------------

ONLINE POUNDSHOP

Online retailer Poundshop has had a soft period of trading primarily due

to the seasonality of their business combined with unusually hot weather

and a reduced level of stock. Sales are down, however management are

working on improving gross margins and their cash management to reduce

further losses.

POWERLINKS MEDIA

PowerLinks Media, a real-time trading platform for native digital

advertisements, has converted several large new clients over the past

six months. Sales however remain behind expectations. To help fund

growth, PowerLinks Media undertook a small private capital raise in Q2

and will continue to focus on managing its cost base.

OUTLOOK

There remains uncertainty around the UK's withdrawal from the EU and it

is likely that economic growth will stay subdued, or even slip into

negative territory, over the coming year. Generally, the business

environment remains uncertain with the Bank of England keeping interest

rates low and with employment still at record levels. This was reflected

through muted levels of UK consumer confidence in July, and this is

anticipated to fall again in August due to rising concerns over a

no-deal Brexit. The Bank of England also cut its outlook for growth in

2020 to 1.3%, from a previous projection of 1.6%. There is a likely

period of volatility ahead, nonetheless Foresight Group remains positive

about the prospects for the Company's diversified portfolio. We continue

to see encouraging levels of activity from smaller UK companies seeking

growth capital, as well as from potential acquirers of portfolio

companies. Your investment management team remains focused on targeting

companies in markets with sound fundamentals, with attractive growth

attributes and strong management teams.

Foresight Group has undertaken a further review of the impact of Brexit

on the investment portfolio, attempting to identify and mitigate

potential risks that could arise as a result of Brexit, as well as

identifying opportunities that could result from it. Given the lack of

clarity on timing or type of Brexit and the relatively limited resources

available to small companies, mitigation planning is clearly

challenging. However, given the diverse nature of businesses in the

portfolio, with a combination of UK-centric businesses and companies

that are net importers/net exporters from and to the EU and the rest of

the world, Foresight Group remains confident the Company is reasonably

well positioned to deal with potential volatility. Nevertheless, the

investment team is scenario planning for all eventual outcomes. We will

continue to monitor investments closely and adapt to market changes to

ensure the Company's portfolio is well-placed to deliver returns to its

investors.

Russell Healey

Head of Private Equity

Foresight Group

30 August 2019

Unaudited Half-Yearly Results and Responsibilities Statements

Principal Risks and Uncertainties

The principal risks faced by the Company are as follows:

-- Performance;

-- Regulatory;

-- Operational; and

-- Financial.

The Board reported on the principal risks and uncertainties faced by the

Company in the Annual Report and Accounts for the year ended 31 December

2018. A detailed explanation can be found on page 27 of the Annual

Report and Accounts which is available on Foresight Group's website

www.foresightgroup.eu or by writing to Foresight Group at The Shard, 32

London Bridge Street, London, SE1 9SG.

In the view of the Board, there have been no changes to the fundamental

nature of these risks since the previous report and these principal

risks and uncertainties are equally applicable to the remaining six

months of the financial year as they were to the six months under

review.

DIRECTORS' RESPONSIBILITY STATEMENT

The Disclosure and Transparency Rules ('DTR') of the UK Listing

Authority require the Directors to confirm their responsibilities in

relation to the preparation and publication of the Interim Report and

financial statements.

The Directors confirm to the best of their knowledge that:

1. the summarised set of financial statements has been prepared in

accordance with FRS 104;

2. the interim management report includes a fair review of the information

required by DTR 4.2.7R (indication of important events during the first

six months and description of principal risks and uncertainties for the

remaining six months of the year);

3. the summarised set of financial statements gives a true and fair view of

the assets, liabilities, financial position and profit or loss of the

Company as required by DTR 4.2.4R; and

4. the interim management report includes a fair review of the information

required by DTR 4.2.8R (disclosure of related parties' transactions and

changes therein).

GOING CONCERN

The Company's business activities, together with the factors likely to

affect its future development, performance and position, are set out in

the Strategic Report of the Annual Report. The financial position of the

Company, its cash flows, liquidity position and borrowing facilities are

described in the Chairman's Statement, Strategic Report and Notes to the

Accounts of the 31 December 2018 Annual Report. In addition, the Annual

Report includes the Company's objectives, policies and processes for

managing its capital; its financial risk management objectives; details

of its financial instruments; and its exposures to credit risk and

liquidity risk.

The Company has considerable financial resources together with

investments and income generated therefrom across a variety of

industries and sectors. As a consequence, the Directors believe that the

Company is well placed to manage its business risks successfully.

The Directors have reasonable expectation that the Company has adequate

resources to continue in operational existence for the foreseeable

future. Thus they continue to adopt the going concern basis of

accounting in preparing the annual financial statements.

The Half-Yearly Financial Report has not been audited nor reviewed by

the auditors.

On behalf of the Board

John Gregory

Chairman

30 August 2019

Unaudited Income Statement

for the six months ended 30 June 2019

Six months ended Six months ended 30 Year ended 31 December

30 June 2019 (Unaudited) June 2018 (Unaudited) 2018 (Audited)

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Realised (losses)/

gains on investments - (3,341) (3,341) - 2,192 2,192 - 921 921

Investment holding

gains - 8,204 8,204 - 523 523 - 5,916 5,916

Income 677 - 677 735 - 735 1,398 - 1,398

Investment management

fees (314) (943) (1,257) (293) (879) (1,172) (595) (1,784) (2,379)

Other expenses (289) - (289) (213) - (213) (472) - (472)

Return on ordinary

activities before

taxation 74 3,920 3,994 229 1,836 2,065 331 5,053 5,384

Taxation - - - (32) 32 - (34) 34 -

Return on ordinary

activities after

taxation 74 3,920 3,994 197 1,868 2,065 297 5,087 5,384

Return per share:

0.1p 2.2p 2.3p 0.1p 1.1p 1.2p 0.2p 2.9p 3.1p

The total column of this statement is the profit and loss account of the

Company and the revenue and capital columns represent supplementary

information.

All revenue and capital items in the above Income Statement are derived

from continuing operations. No operations were acquired or discontinued

in the period.

The Company has no recognised gains or losses other than those shown

above, therefore no separate statement of total recognised gains and

losses has been presented.

Unaudited Balance Sheet

at 30 June 2019

Registered Number: 03421340

As at

As at As at 31 December

30 June 2019 30 June 2018 2018

GBP'000 GBP'000 GBP'000

Fixed assets

Investments held at fair value

through profit or loss 112,774 85,407 99,065

Current assets

Debtors 235 723 542

Money market securities and other

deposits 17,323 44,582 34,723

Cash 2,487 3,669 2,696

20,045 48,974 37,961

Creditors

Amounts falling due within one

year (479) (181) (300)

Net current assets 19,566 48,793 37,661

Net assets 132,340 134,200 136,726

Capital and reserves

Called-up share capital 1,755 1,762 1,751

Share premium account 100,495 99,172 99,115

Capital redemption reserve 935 908 920

Distributable reserve 3,224 13,566 12,929

Capital reserve (862) 5,596 3,422

Revaluation reserve 26,793 13,196 18,589

Equity shareholders' funds 132,340 134,200 136,726

Net asset value per share:

75.4p 76.2p 78.1p

Unaudited Reconciliation of Movements in Shareholders' Funds

for the six months ended 30 June 2019

Called-up Share Capital

share premium redemption Distributable Capital Revaluation

capital account reserve reserve reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1 January 2019 1,751 99,115 920 12,929 3,422 18,589 136,726

Share issues in the

period* 19 1,426 - - - - 1,445

Expenses in relation

to share issues - (46) - - - - (46)

Repurchase of shares (15) - 15 (1,026) - - (1,026)

Realised losses on disposal

of investments - - - - (3,341) - (3,341)

Investment holding gains - - - - - 8,204 8,204

Dividend paid - - - (8,753) - - (8,753)

Management fees charged

to capital - - - - (943) - (943)

Revenue return for the

period - - - 74 - - 74

As at 30 June 2019 1,755 100,495 935 3,224 (862) 26,793 132,340

*Relating to the dividend reinvestment scheme.

Distributable reserves at 30 June 2019 totalled GBP2.4 million. Share

premium totalling GBP21.6 million was cancelled on 30 July 2019,

increasing distributable reserves by this amount.

Unaudited Cash Flow Statement

for the six months ended 30 June 2019

Six months Six months Year ended

ended 30 ended 30 31 December

June 2019 June 2018 2018

GBP'000 GBP'000 GBP'000

Cash flow from operating activities

Investment income received 494 577 1,180

Deposit and similar interest received 107 108 258

Investment management fees paid (1,257) (1,172) (2,379)

Secretarial fees paid (62) (56) (115)

Other cash payments (257) (319) (495)

Net cash outflow from operating

activities (975) (862) (1,551)

Cash flow from investing activities

Purchase of investments (8,956) (7,936) (17,705)

Net proceeds on sale of investments 45 3,019 3,380

Net proceeds on deferred consideration 441 339 310

Net proceeds on liquidation of

investments - 20 20

Net cash outflow from investing

activities (8,470) (4,558) (13,995)

Cash flow from financing activities

Expenses of fund raising (46) (48) (95)

Repurchase of own shares (810) (1,104) (1,763)

Dividends paid (7,308) (7,176) (7,176)

Movement in money market funds 17,400 15,900 25,759

Net cash inflow from financing

activities 9,236 7,572 16,725

Net (outflow)/ inflow of cash in

the period (209) 2,152 1,179

Reconciliation of net cash flow to

movement in net funds

(Decrease)/increase in cash and cash

equivalents for the period (209) 2,152 1,179

Net cash and cash equivalents at

the start of period 2,696 1,517 1,517

Net cash and cash equivalents at

the end of period 2,487 3,669 2,696

Analysis of changes in net debt

At 1 January At 30 June

2019 Cash Flow 2019

GBP'000 GBP'000 GBP'000

Cash and cash equivalents 2,696 (209) 2,487

Notes to the Unaudited Half-Yearly Results

1. The Unaudited Half-Yearly Financial Report has been prepared on the basis

of the accounting policies set out in the statutory accounts of the

Company for the year ended 31 December 2018. Unquoted investments have

been valued in accordance with IPEV Valuation Guidelines.

2. These are not statutory accounts in accordance with S436 of the Companies

Act 2006 and the financial information for the six months ended 30 June

2019 and 30 June 2018 has been neither audited nor formally reviewed.

Statutory accounts in respect of the year ended 31 December 2018 have

been audited and reported on by the Company's auditors and delivered to

the Registrar of Companies and included the report of the auditors which

was unqualified and did not contain a statement under S498(2) or S498(3)

of the Companies Act 2006. No statutory accounts in respect of any period

after 31 December 2018 have been reported on by the Company's auditors or

delivered to the Registrar of Companies.

3. Copies of the Unaudited Half-Yearly Financial Report will be sent to

shareholders and will be available for inspection at the Registered

Office of the Company at The Shard, 32 London Bridge Street, London, SE1

9SG.

4. Net asset value per share

The net asset value per share is based on net assets at the end of the

period and on the number of shares in issue at the date.

Number of

Shares in

Net assets Issue

30 June 2019 GBP132,340,000 175,481,093

30 June 2018 GBP134,200,000 176,180,654

31 December

2018 GBP136,726,000 175,051,026

1. Return per share

The weighted average number of shares used to calculate the respective

returns are shown in the table below.

Shares

Six months ended 30 June

2019 175,365,523

Six months ended 30 June

2018 175,775,983

Year ended 31 December

2018 175,834,593

Earnings for the period should not be taken as a guide to the results

for the full year.

6) Income

Six months Six months Year ended

ended 30 ended 30 31 December

June 2019 June 2018 2018

GBP'000 GBP'000 GBP'000

Loan stock interest 457 568 985

Dividends 113 60 155

Overseas based Open Ended Investment

Companies ("OEICs") 100 100 241

Bank interest 7 7 17

677 735 1,398

7) Investments at fair value through profit or loss

GBP'000

Book cost as at 1 January 2019 80,527

Investment holding gains 18,538

Valuation at 1 January 2019 99,065

Movements in the period:

Purchases 8,956

Disposal proceeds (45)

Realised gains* (3,782)

Investment holding gains** 8,580

Valuation at 30 June 2019 112,774

Book cost at 30 June 2019 85,656

Investment holding gains 27,118

Valuation at 30 June 2019 112,774

*Realised losses in the income statement include deferred consideration

of GBP441,000 received from the sale of Trilogy Communications Limited.

**Investment holding gains in the income statement have been reduced by

the offset in the deferred consideration debtor of GBP376,000, relating

to Trilogy Communications Limited.

8) Related party transactions

No Director has an interest in any contract to which the Company is a

party other than their appointment and payment as directors.

9) Transactions with the Manager

Foresight Group CI Limited acts as manager to the Company. During the

period, services of a total cost of GBP1,257,000 (30 June 2018:

GBP1,172,000; 31 December 2018: GBP2,379,000) were purchased by the

Company from Foresight Group CI Limited. At 30 June 2019, the amount due

to Foresight Group CI Limited was GBPnil (30 June 2018: GBPnil; 31

December 2018: GBPnil).

During the period, administration services of a total cost of GBP60,000

(30 June 2018: GBP56,000; 31 December 2018: GBP117,000) were delivered

to the Company by Foresight Group LLP, Company Secretary. At 30 June

2019 the amount due to Foresight Group LLP was GBPnil (30 June 2018:

GBPnil; 31 December 2018: GBP2,000).

10) Post-Balance sheet events

On 30 July 2019 share premium totalling GBP21.6 million was cancelled,

increasing distributable reserves by this amount.

END

(END) Dow Jones Newswires

August 30, 2019 10:02 ET (14:02 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

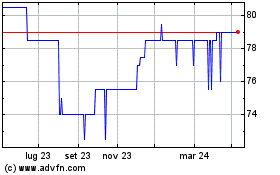

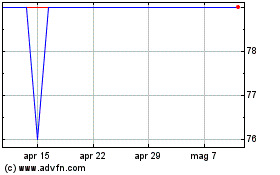

Grafico Azioni Foresight Vct (LSE:FTV)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Foresight Vct (LSE:FTV)

Storico

Da Apr 2023 a Apr 2024