TIDMPIRI

RNS Number : 8023K

Pires Investments PLC

02 September 2019

2 September 2019

Pires Investments plc

("Pires" or the "Company")

Proposed amendment to investing policy and

proposed investment

Proposed amendment to investing policy

Pires, an investing company pursuant to the AIM Rules, announces

that it is to seek shareholder approval for an amendment to its

investing policy. The Company's existing investing policy is

principally focused on opportunities in the resources and energy

sectors. Building on the Company's successful investments to date

in these sectors, the Board believes that it is in the best

interests of shareholders to extend the Company's investing policy

to include the technology sector, as it believes that this is an

attractive sector for future investment. The Directors therefore

intend to seek shareholder approval for this amendment at the

Company's forthcoming annual general meeting ("AGM").

In addition to the proposed investment outlined below, the

Company will also seek to make both early and later stage

technology investments in the future should its amended investing

policy be approved by shareholders.

Proposed investment

Pursuant to the proposed amendment of its investing policy, the

Company has identified an initial investment in the technology

sector. It has agreed, in principle, to invest an initial GBP1.1

million into Sure Valley Ventures ("SVV"), a venture capital fund

focused on investing in the software technology sector. SVV

currently has a portfolio of ten investee companies at different

stages of development with specific focus on augmented and virtual

reality ("AR/VR"), artificial intelligence ("AI") and the internet

of things ("IoT").

The investment in SVV is conditional on approval of the

amendment of the Company's investing policy at the forthcoming AGM

which is expected to be held during October 2019.

On the basis that the investment takes place, the Company will

invest up to a further GBP2.1 million into SVV over the life of the

fund thereby resulting in an overall investment of up to GBP3.2

million, subject to, inter alia, regulatory conditions. Further

details will be included in the notice of AGM to be sent to

shareholders in the coming weeks.

The Directors believe that the proposed investment is an

attractive and effective way to develop a core holding of

investments in the technology sector and allow the Company to

access the expertise of the SVV management team to assist with

further investments in this sector. In particular:

-- the Company will be able to access an established portfolio

of investments that have progressed beyond the initial investment

stage, some of which have already established a market position and

are generating revenue.

-- the initial investment to be made by Pires effectively puts

the Company in a similar position as if it had invested at the

inception of the fund alongside the other investors. Pires will

therefore have an interest in 13% of the underlying portfolio at

valuations equivalent to that at which the SVV investments were

originally made. The NAV of the fund as at 30 June 2019 was EUR8.3

million.

-- VR Education Holdings plc (a virtual reality education

platform) is already listed on AIM with a market valuation of

GBP12.6 million. Admix operates in a similar sector to Bidstack

Group plc, a company already listed on AIM. Furthermore, an

approach has been received for one of the other portfolio

companies, valuing it at a multiple of the valuation at the time of

the initial investment.

SVV Fund

SVV, an Alternative Investment Fund ("AIF") is a sub-fund of

Suir Valley Funds ICAV, an Irish Collective Asset Management

Vehicle registered in Ireland. The Alternative Investment Fund

Manager ("AIFM") of SVV is Shard Capital AIFM LLP.

SVV invests in a broad range of software companies but retains a

focus on companies in the AR/VR, AI and IoT sectors. The AIFM will

seek to identify and progress towards exit opportunities from the

time of the SVV's first investment in a portfolio company.

Whilst the fund has a life to March 2027, the proceeds realised

by SVV through any realisations of its investments will be

distributed to investors at the time of the realisation (as is

common with funds of this nature) and therefore the return on this

investment is expected to be received throughout the life of

SVV.

Currently EUR23.5 million (excluding the proposed investment by

Pires) has been committed to be invested in SVV, with circa EUR8.4

million invested in the fund to date. Other investors in SVV

include a governmental institution, financial institutions and

family offices.

SVV Portfolio

The SVV portfolio currently comprises:

Company Description

Admix Limited Fully programmatic monetization platform

for 3D spacial developers (e.g. console,

PC and mobile game developers)

https://admix.in/

-------------------------------------------------

Ambisense Limited AI and IoT platform for real-time environmental

monitoring and protection (e.g. Greenhouse

Gas) through AI prediction

https://ambisense.net/

-------------------------------------------------

Artomatix Limited AI platform that automates 3D content creation

for AR/VR, video games, movies and VFX,

cutting the costs of production for key

processes by up to 80%.

https://artomatix.com/

-------------------------------------------------

Provision Provider of IoT cameramatics for commercial

fleets

https://www.provisioncameramatics.com/

-------------------------------------------------

NDRC Arclabs Fund EU accelerator providing propriety deal

I Limited flow

https://www.ndrc.ie/

-------------------------------------------------

Nova Leah Limited Cyber security assessment and protection

platform for IoT medical devices

https://www.novaleah.com/

-------------------------------------------------

VividQ Limited Software platform for real-time holographic

3D display for AR

https://www.vivid-q.com/

-------------------------------------------------

VR Education Holdings A virtual reality education platform

Plc https://immersivevreducation.com/

-------------------------------------------------

WIA Technologies IoT developer platform with 55,000+ developers

Limited https://www.wia.io/

-------------------------------------------------

Warducks Limited AR games studio with multiple hit titles

https://www.warducks.com/

-------------------------------------------------

More detail on SVV can be found on its website

https://surevalleyventures.com.

Additional board appointment

On the basis that the proposed investment takes place and,

subject to the approval of the Company's Nomad, the Company intends

to appoint Cian Hughes to the board. Cian is a venture partner in

SVV and has extensive experience in the technology sector. Cian has

worked for a number of major technology companies including Lotus

Inc (now part of IBM), Intel Corporation and Palm Inc. Cian also

has significant experience in the fields of venture capital,

accelerators, software solutions and mobile platforms. Going

forward, Cian will provide the relevant expertise to enable the

Company to develop its investment portfolio within the technology

sector.

Peter Redmond, Chairman said:

"I am very pleased that we are able to potentially access an

investment in SVV which we believe has significant potential to

create value for shareholders. Building on our recent successful

investment performance, this will enable us to diversify our

investment risk while taking it into a sector which we believe

currently has potential for significant developments and sizeable

gains. Going forward, while subject to approval of the amendment to

the Company's existing investing policy at the forthcoming AGM, we

are excited to be working with the SVV team with their proven

record and expertise in cutting edge technologies and to seek

further such investments in the future."

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

For more information please contact:

Pires Investments plc: +44 20 7917 6826

Peter Redmond, Chairman

-----------------

Nominated Advisor: +44 20 7213 0880

-----------------

Cairn Financial Advisers LLP

-----------------

Liam Murray

Tony Rawlinson

-----------------

Broker: +44 20 7469 0935

-----------------

Peterhouse Capital Limited

-----------------

Duncan Vasey/Lucy Williams

-----------------

Caution regarding forward looking statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should" "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCFFLLBKKFZBBZ

(END) Dow Jones Newswires

September 02, 2019 02:00 ET (06:00 GMT)

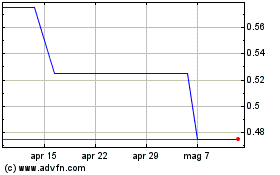

Grafico Azioni Mindflair (LSE:MFAI)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Mindflair (LSE:MFAI)

Storico

Da Apr 2023 a Apr 2024