EUROPE MARKETS: Brexit Uncertainty Sweeps Across Europe, Sending Stocks Lower

03 Settembre 2019 - 1:57PM

Dow Jones News

By Callum Keown

European stocks edged lower on Tuesday as Brexit uncertainty

swept across the continent ahead of a crunch day for British

MPs.

The Stoxx 600 fell 0.4% ahead of the British Parliament's Brexit

showdown later in the day.

The German DAX dropped 0.3%, while the French CAC declined 0.5%.

The internationally focused FTSE 100 avoided the heavier losses,

sliding just 0.1%, as sterling dropped below $1.20 to its lowest

level since October 2016.

What's moving the markets?

Brexit concerns have intensified, weighing on European stocks as

the U.K. Parliament prepares for a crucial few days.

British Prime Minister Boris Johnson has threatened a snap

election if a group of rebel MPs

(http://www.marketwatch.com/story/boris-johnson-urges-rebel-tories-not-to-chop-the-legs-with-brexit-delay-2019-09-02)succeed

in blocking a no-deal exit from the European Union through a bill

being put forward on Tuesday.

The heightened uncertainty caused stocks to open lower and the

prospect of an election led the pound to slide

(http://www.marketwatch.com/story/british-pound-fells-further-pressure-drops-below-120-on-election-speculation-2019-09-03)

0.7% to $1.1984.

Investors turned away from risky assets in favor of havens, as

the yields on Italian and German 10-year bonds hit record lows.

Russ Mould, investment director at AJ Bell, said: "The market

hates uncertainty and that extends to politics.

"The current chaos around the U.K. exiting the EU threatens to

push down sterling even further unless we get a clear idea of what

is happening and when."

Positivity over a potential resolution to the U.S.-China trade

war was tempered by reports that Beijing's request to delay tariffs

has been denied and that negotiators are struggling to schedule

dates for a meeting this month.

Which stocks are active?

Travel and leisure stocks were hit on Tuesday as budget airline

EasyJet (EZJ.LN) fell 4.5% after being downgraded by Kepler

Cheuvreux from hold to reduce.

The Restaurant Group (RTN.LN) dropped 11.5% after posting heavy

losses in the wake of its takeover of Wagamama, the Asian-themed

fast-food chain. The company swung to a pretax loss of GBP87.7

million in the first half of 2019, compared with a GBP12.2 million

profit over the same period in the previous year.

British plumbing and heating distributor Ferguson (FERG.LN) rose

2.3% as it revealed plans to separate its U.K. operations and focus

on its U.S. business.

(END) Dow Jones Newswires

September 03, 2019 07:42 ET (11:42 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

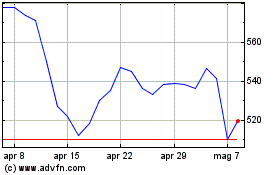

Grafico Azioni Easyjet (LSE:EZJ)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Easyjet (LSE:EZJ)

Storico

Da Apr 2023 a Apr 2024