Pound Advances As Parliament To Vote On Brexit Delay

04 Settembre 2019 - 9:10AM

RTTF2

The pound spiked up against its major counterparts in the early

European session on Wednesday, as a bill seeking Brexit delay is

set to vote in the Commons after Prime Minister Boris Johnson lost

control of Parliament.

Tory rebels and opposition MPs voted last night in favor of

debating the bill, which is seen passing today.

The legislation forces the PM to ask for a Brexit extension from

Brussels until January 31, except MPs approve a new deal, or vote

on a no-deal Brexit, by October 19.

No 10 said he will seek a snap general election, to be held on

October 15.

The Labour leader Jeremy Corbyn confirmed that his party would

not vote for an election unless no-deal Brexit is ruled.

Data from IHS Markit showed that the UK service sector growth

remained subdued in August reflecting slower growth in output and

new orders.

The IHS Markit/Chartered Institute of Procurement & Supply

Purchasing Managers' Index fell more-than-expected to 50.6 in

August from 51.4 in July. The reading was forecast to drop to

51.0.

The currency has been trading higher against its major

counterparts in the Asian session.

The pound strengthened to a 5-day high of 1.2197 versus the

dollar, after falling to 1.2082 at 5:00 pm ET. The pair had closed

yesterday's deals at 1.2082. The pound is likely to find resistance

around the 1.27 level.

The pound hit a 5-day high of 129.51 against the yen, following

a decline to 127.94 at 5:00 pm ET. At yesterday's trading close,

the pair was quoted at 127.94. On the upside, 136.5 is likely seen

as the next resistance level for the pound.

The latest survey from Jibun Bank showed that Japan services

sector activity accelerated in August, with a PMI score of

53.3.

That's up from 51.8 in July and it moves further above the

boom-or-bust line of 50 that separates expansion from

contraction.

Reversing from a low of 1.1918 seen at 5:00 pm ET, the pound

firmed to a 2-day high of 1.2016 versus the franc. At Tuesday's

close, the pair was worth 1.1923. The pound is seen facing

resistance around the 1.25 level.

Following a decline to 0.9081 at 5:45 pm ET, the pound climbed

to a 2-day high of 0.9032 against the euro. The pair had ended

yesterday's trading session at 0.9078.The next possible resistance

for the pound is seen around the 0.88 level.

Data from IHS Markit showed that the euro area private sector

logged a moderate growth in August, though the pace of expansion

improved slightly more than initially estimated.

The final composite output index rose to 51.9 in August from

51.5 in July. The flash score was 51.8. Any reading above 50

indicates expansion in the sector.

Looking ahead, U.S. and Canadian trade data for July and Fed

Beige book report are slated for release in the New York

session.

The Bank of Canada will announce its interest rate decision at

10:00 am ET. The BoC is widely expected to keep its policy rate

steady at 1.75 percent.

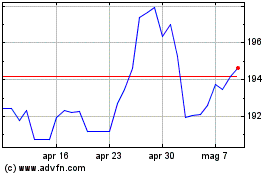

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Mar 2024 a Apr 2024

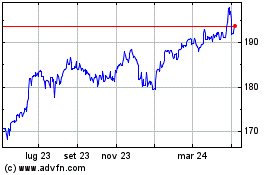

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Apr 2023 a Apr 2024