Tritax EuroBox PLC Completion of a lease re-gear in Belgium (2758L)

05 Settembre 2019 - 8:01AM

UK Regulatory

TIDMEBOX TIDMBOXE

RNS Number : 2758L

Tritax EuroBox PLC

05 September 2019

05 September 2019

Tritax EuroBox plc

(the "Company")

COMPLETION OF A LEASE RE-GEAR IN BELGIUM TO ONE OF THE

WORLD'S LEADING EYE CARE COMPANIES

The Board of Tritax EuroBox plc (tickers: EBOX (Sterling), BOXE

(Euro)), which invests in Continental European logistics real

estate assets, is pleased to announce the completion of a lease

re-gear at the Company's property in Bornem, a prime logistics

location near Antwerp in Belgium.

This modern, well specified facility was acquired by the Company

as part of a portfolio in October 2018 and was let to two occupiers

with interconnected business activities. The principal tenant was

Alcon-Couvreur NV, one of the world's leading eye care companies,

on a lease expiring on 31 August 2027 with a break option in August

2022. The second tenant was Pharma Distri Centre ("PDC"), a

third-party logistics supplier to Alcon, occupying the property on

a lease expiring on 31 January 2020.

The Company has negotiated a re-geared lease whereby Alcon

Laboratories Belgium ("Alcon") will take occupation of the entire

premises and remove the 2022 break option, delivering a combined

WAULT to expiry of 7.2 years. Swiss based, Alcon Pharma Ltd will be

the guarantor to the new lease.

This asset management initiative lengthens the income profile

and enhances the value of this well-located asset and follows the

successful letting of the adjacent vacant unit in March 2019 to

Belgische Distributiedienst NV ("BD NV"), part of the BD myShopi NV

group. This unit had been vacant for over 18 months prior to the

Company's acquisition of the property.

Bornem is located in the prime logistics corridor in Belgium,

between Antwerp and Brussels, and benefits from good port and

airport connectivity, with the Port of Antwerp c.35km north and

Brussels Airport c.35km to the south.

Nick Preston, Fund Manager of Tritax EuroBox, commented:

"We are delighted to continue to deliver our identified business

plans in Belgium so soon after acquisition, demonstrating not only

the quality of the property and its location, but also the value of

our informed stock picking, identifying assets where we can add

value in the near term"

This lease re-gear, along with the letting of the adjacent unit

in March this year has increased and lengthened the income profile

and enhanced the value of this well-located asset."

FOR FURTHER INFORMATION, PLEASE CONTACT:

Tritax Group +44 (0) 20 7290 1616

Nick Preston

James Dunlop

Jefferies International Limited +44 (0) 20 7029 8000

Gary Gould

Stuart Klein

Kempen & Co N.V. +31 (0) 20 348 8500

Dick Boer

Thomas ten Hoedt

Maitland/AMO (Communications

Adviser) +44 (0) 20 7379 5151

James Benjamin tritax-maitland@maitland.co.uk

The Company's LEI is: 213800HK59N7H979QU33.

NOTES:

Tritax EuroBox plc invests in and manages a well-diversified

portfolio of well-located Continental European logistics real

estate assets that are expected to deliver an attractive capital

return and secure income to shareholders. These assets fulfil key

roles in the logistics and distribution supply-chain focused on the

most established logistics markets and on the major population

centres across core Continental European countries.

Occupier demand for Continental European logistics assets is in

the midst of a major long-term structural change principally driven

by the growth of e-commerce. This is evidenced by technological

advancements, increased automation and supply-chain optimisation,

set against a backdrop of resurgent economic growth across much of

Continental Europe.

The Company is targeting, on a fully invested and geared basis,

an initial Ordinary Share dividend yield of 4.75% p.a.(1) , which

is expected to increase progressively through regular indexation

events inherent in underlying lease agreements, and a total return

on the Ordinary Shares of 9.0% p.a.(1) over the medium-term. The

Company intends to pay dividends on a quarterly basis with

shareholders able to receive dividends in Sterling or Euro.

Further information on Tritax EuroBox plc is available at

www.tritaxeurobox.co.uk

1. Euro denominated returns, by reference to IPO issue price.

These are targets only and not profit forecasts. There can be no

assurances that these targets will be met and they should not be

taken as indications of the Company's expected or actual future

results.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCUGUWCBUPBPGC

(END) Dow Jones Newswires

September 05, 2019 02:01 ET (06:01 GMT)

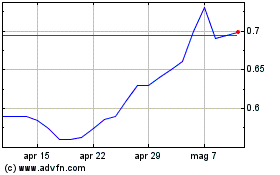

Grafico Azioni Tritax Eurobox (LSE:BOXE)

Storico

Da Mar 2024 a Apr 2024

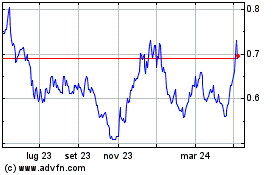

Grafico Azioni Tritax Eurobox (LSE:BOXE)

Storico

Da Apr 2023 a Apr 2024