Anglesey Mining PLC AGM Statement / Retirement of Director

05 Settembre 2019 - 12:00PM

UK Regulatory

TIDMAYM

- Significant progress with QME optimisation studies

- Retirement of Director

September 5, 2019: At the Annual General Meeting held in London today, the

Chairman, John Kearney, presented an update on the activities of the Company,

As previously reported to shareholders, in 2018 Anglesey entered into a Project

Development and Cooperation Agreement with QME Mining Technical Services, a

division of QME Ltd, to carry out an agreed programme of design, engineering

and optimisation studies relating to the future development of the Parys

Mountain zinc, copper lead project, located on the island of Anglesey in Wales.

The primary objective of this exercise is to determine the optimum production

plan for the future Parys Mountain mine and we are very pleased to be able to

today report that significant progress has been made with very encouraging

results.

QME review and optimisation

As described in our recent Annual Report, QME completed detailed reviews of

mine development capital and mine operating costs of the basic mine plan, using

their extensive experience in mine development in Ireland and throughout

Europe, and identified the potential for improvements in the development plans

contained in the 2017 Scoping Study.

QME developed a model to estimate the mine operating costs for the life of

mine. As indicated in the Annual Report QME has confirmed an expected operating

cost of $US48 per tonne. This figure is generally in line with the projected

operating costs estimated by Micon International and Fairport Engineering in

the 2017 Scoping Study, although, as might be expected, some specific cost

items were higher and some lower.

The QME review work suggests support for the application of a lower cut-off for

mine planning purposes than used in the 2017 Scoping Study.

In 2012 Micon produced a detailed Resource Estimate for the Parys Mountain

property and used a range of cut-off grades to produce a matching range of

resources, including a total Indicated Resource of 6.97 million tonnes at $0

cut-off. At the time a cut-off of $US80 per tonne was used for resource

reporting purposes. This resulted in a published indicated resource across the

White Rock and Engine zone ore bodies of 2.1 million tonnes and a further

inferred resource in the same ore bodies of 0.65 million tonnes.

In the 2017 Scoping Study Micon used the same resource base. This study

utilised a cut-off of $60 per tonne and applied mine planning, dilution and

recovery criteria which generated a mineable tonnage of 2.1 million tonnes,

which as a coincidence, was very similar to the 2012 resource tonnage

calculated at a cut-off of $80 per tonne.

Higher tonnage available for mining

Using the same geological data set as used by Micon but applying a cut off of

$US48 per tonne in accordance with the forecast operating costs as noted above,

QME has now estimated that a larger tonnage of material could be available for

mining.

The QME work suggests that at the production cut-off of $48 per tonne, a global

6.9 million tonnes would be available within Parys Mountain's White Rock and

Engine Zones for consideration in a detailed life-of-mine schedule and

associated financial analysis and to be incorporated into an updated Scoping

Study or Feasibility Study.

This 6.9 million global tonnes is substantially higher than the mineable

tonnage of 2.1 million tonnes, used in the 2017 Scoping Study for mine planning

and financial modelling. It is important to note that QME made no changes to

the underlying resource estimates which were calculated by Micon in 2012.

Applying a 10% dilution and 98% recovery, would result in some 7.3 million

tonnes being available for conversion into 'potentially mineable tonnage'

within the current global resource in all categories.

As a further refinement, QME also looked at mining criteria and developing

potential stoping blocks within this 7.3 million 'potentially mineable tonnage'

and in doing so eliminated some material not located in economically mineable

locations. Based on these assumptions approximately 5.25 million tonnes in

situ would fall within these designed stoping blocks.

Longer potential minelife or higher production rate

Using this updated 2019 block model, there is an opportunity to develop a new

2019 mineable block model by re-defining the mining shapes and the stoping

plan, followed by a new development plan and schedule.

If a mining plan was developed using this lower cut-off grade, then at a

constant 1,000 tonnes per day mill throughput rate as used in the 2017 Scoping

Study, the project life would be significantly extended from the initial eight

years indicated in the Scoping Study to approximately 18-year mine life.

However, it does have to be noted that by reducing the cut-off, the grade of

material that would be delivered to the mill would be lower overall than that

used in the 2017 scoping study.

The economic trade-off between a longer mine life and reduced head-grade will

need to be further studied to determine what, if any, would be the net

financial benefit. It will then likely require further studies to determine if

there is an 'optimum' cut-off grade that maximises the financial returns.

In addition, this new 2019 "potentially mineable tonnage", would justify and

support an increase in the throughput rate and it should also be possible to

increase the effective mining rate, up to say 500,000 tonnes per year, which

would improve front-end revenue and cash flow, although at a higher capital

cost, and would result in a mine life of approximately 10 years.

Summary of QME project improvements

The Agreement with QME has seen the development of a substantial amount of work

on mine planning and design and project optimisation on the Parys Mountain

project at no cost to Anglesey and at no dilution to Anglesey's current

shareholders.

The QME studies have indicated that the project can be improved if the

potential mineable tonnage can be increased by using a lower cut-off grade and

generating a revised mine development plan. It should be emphasised that this

optimisation work will have to be supported by an updated scoping study or

pre-feasibility study.

In the meantime, QME has suggested that additional studies are carried out and

this second stage of the process remains ongoing.

These additional studies will also look at utilising some of the inferred

resources into the mining plan, continuing review to determine theoptimum

cut-off grade, and the use of updated metal prices. While the inclusion of

inferred resources does not meet the strict criteria for feasibility studies

used by banks for loan evaluation, given the detailed geological knowledge of

Parys Mountain now available it is useful to include some of this inferred

resource for comparative financial modelling.

This second stage of the QME exercise is ongoing with completion scheduled for

the end of 2019. Subject to financing being available, this work would then

form the basis for commissioning an updated scoping or preliminary feasibility

study.

Retirement of Director

David Lean, who has been a director of the Company for almost eighteen years,

has indicated that he wishes to retire from the Company at the 2019 Annual

General Meeting and will not stand for re-election. The board wish to thank

him for his sound advice and tireless efforts during all this period

For further information, please contact:

Bill Hooley, Chief Executive +44 (0)7785-572517

Danesh Varma, Finance Director +44 (0)7740-932766

END

(END) Dow Jones Newswires

September 05, 2019 06:00 ET (10:00 GMT)

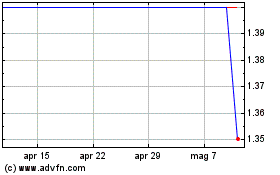

Grafico Azioni Anglesey Mining (LSE:AYM)

Storico

Da Mar 2024 a Apr 2024

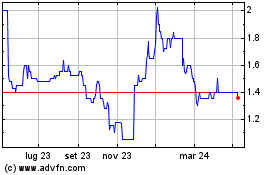

Grafico Azioni Anglesey Mining (LSE:AYM)

Storico

Da Apr 2023 a Apr 2024