EUROPE MARKETS: European Airlines Skid After Air France-KLM Warning

09 Settembre 2019 - 11:27AM

Dow Jones News

By Steve Goldstein, MarketWatch

European stock markets listless

Shares of Air France-KLM on Monday nosedived on a warning over

bookings, and other airlines weakened, in mostly listless Eurpean

stock markets on Monday.

Air France-KLM shares (AF.FR) plunged 9% as the airline said

"close-in bookings in the peak travel period are weaker than

foreseen in view of softening macro-economic environment."

Mark Simpson, an analyst at Goodbody Stockbrokers, said

consensus operating profit forecasts of 1.3 billion euros "will

likely move lower on the implied implications for yields on weaker

close in bookings." The guidance had been for stable pricing for

the network airlines.

Separately, a French minister told Le Parisien that Air France

"wanted to make an offer" for the bankrupt airline Aigle Azur,

Reuters reported

(https://uk.reuters.com/article/uk-air-france-klm-aigle-azur/air-france-klm-shares-slump-on-reports-of-rescue-of-bankrupt-aigle-azur-idUKKCN1VU0MQ?il=0).

Other European airlines including easyJet (EZJ.LN) ,

International Consolidated Airlines Group (IAG.LN) , Ryanair

Holdings (RY4C.DB) (RY4C.DB) and Deutsche Lufthansa (LHA.XE) also

lost ground. British Airways, a unit of International Consolidated

Airlines Group, separately was forced to cancel nearly all of its

flights

(http://www.marketwatch.com/story/british-airways-grounds-nearly-all-flights-as-pilots-strike-2019-09-09)due

to an airline strike.

Broader markets showed little movement. The Stoxx Europe 600

index weakened 0.03% to 387.01.

The German DAX gained 0.14% to 12208.19, the French CAC 40

dropped 0.08% to 5599.38 and the U.K. FTSE 100 declined 0.07% to

7277.42.

U.S. stock futures were a bit stronger.

There was a slight bit of positive news on the U.S.-China trade

war front as Politico reported that China offered to make modest

U.S. agricultural purchases -- if the U.S. relaxed restrictions on

Huawei and also delayed the next tariff increase.

U.K. economic data came in better than forecast, with monthly

GDP rising by 0.3% and industrial production edging upward in

July.

Of other notable movers, Lloyds Banking Group (LLOY.LN)

(LLOY.LN) dropped 1% after becoming the latest British bank to

report rising claims for payment protection insurance, saying it

will have to take an additional charge in the range of GBP1.2

billion to GBP1.8 billion ($2.2 billion). It halted its stock

buyback program.

ProSiebenSat.1 Media (PSM.XE) rallied over 4% as UBS upgraded

the company to buy from neutral, saying it's too cheap to ignore

despite the macro headwinds.

(END) Dow Jones Newswires

September 09, 2019 05:12 ET (09:12 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

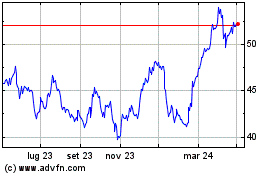

Grafico Azioni Lloyds Banking (LSE:LLOY)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Lloyds Banking (LSE:LLOY)

Storico

Da Apr 2023 a Apr 2024