TIDMTST

RNS Number : 7210L

Touchstar PLC

10 September 2019

10 September 2019

Touchstar plc

Interim results for the

Six months ended 30 June 2019

The Board of Touchstar plc ((AIM:TST) 'Touchstar', the 'Company'

or 'the Group'), suppliers of mobile data computing solutions and

managed services to a variety of industrial sectors, is pleased to

announce its interim results for the six months ended 30 June

2019.

This announcement includes inside information as defined in

Article 7 of the Market Abuse Regulation No. 596/2014 and is

disclosed in accordance with the Company's obligations under

Article 17 of those obligations.

Key Financials:

30 June 2019 30 June 2018

Increase of 16%

* Revenues GBP3,635,000 GBP3,244,000

Reduced by 63%

* Trading loss * GBP(215,000) GBP(590,000)

Significantly reduced by 89%

* Trading loss after tax * GBP(45,000) GBP(413,000)

* EPS - Adjusted * (0.63)p (4.90)p Improved by 89%

Reduced by 12%

* Operating loss GBP(518,000) GBP(590,000)

Reduced by 14%

* Loss after tax GBP(357,000) GBP(415,000)

* EPS - Basic loss (4.21)p (4.90)p Improved by 14%

* Refer to note 3 for definition

Commenting on the results, Ian Martin, Chairman of Touchstar,

said:

"The levels of engagement and customer interest in our new

generation of products continues to develop favorably. It is thus

pleasing to report that the confident words of the past have turned

into positive fact.

In the six months ending 30 June 2019, the Group's revenue rose

15.6% to GBP3.6m, margins improved over 7.6% and the after-tax

trading loss reduced by 89% to just GBP45,000."

For further information, please contact:

Touchstar plc Ian Martin 01274 741860

Mark Hardy 01274 741860

Mike Coe/Chris

WH Ireland - Nominated Adviser Savidge 0117 945 3472

Information on Touchstar plc can be seen at:

www.touchstarplc.com

CHAIRMAN'S INTERIM STATEMENT 2019

The last twelve months have been a critical period for Touchstar

as we have been putting in place the foundations to create a modern

business. The next year is arguably more important, it is now time

to deliver, not promise, to reward shareholders for the faith they

have invested in us.

It is thus pleasing to report significant progress.

In the six months ended 30 June 2019, the Group's revenue rose

15.6% (excluding adjustment for IFRS 15 in 2018) to GBP3.6m,

margins improved over 7.6% and the after-tax trading loss reduced

by 89% to just GBP45,000.

Are we there yet? Nowhere close, we need to continue to drive

the business forward and build upon the first half of this year,

return the Company to profitability and then establish a reliable

track record over many years. Only then can we say "that was a job

well done".

Financial Results

The statutory reporting for the period does not tell the whole

story. I would encourage shareholders to read on as potentially

lost amidst the headline numbers are positive trends. In

particular, the growth rate of the ongoing business was 18.6% in

the first six months of this financial year; whilst the growth rate

for the whole Group (including the mainly discontinued On Board

division ("On-board")) was a very credible 15% (excluding

adjustment for IFRS 15 in 2018).

We informed shareholders in the year end results of the

corrective action we were taking at our On-board division, the

objective of which was to stop the erosion to the Group's

profitability and cash resources. This restructuring has been

completed and On-board is now effectively a discontinued operation.

An impairment charge was taken last year and the restructuring

completed in this first half year, resulting in an exceptional

charge of GBP303,000 (six months ended 30 June 2018: Nil). There is

also an associated cash outflow, to cover predominately redundancy

costs, this has negatively impacted the results for this reported

period.

The Group results for the six months ended 30 June 2019 show a

healthy top line revenue growth of 15.6% to GBP3.645m (six months

ended 30 June 2018 GBP3.145m, excluding adjustment for IFRS 15). If

one excludes On-board, the revenue growth from the continuing

operations was an even more impressive 18.6%, rising to GBP3.368m

(six months ended 30 June 2018: GBP2.839m excluding adjustment for

IFRS 15). Sales growth is being driven by Touchstar's new products

and services which are becoming more established.

Margins rose to 51.9% (six months ended 30 June 2018: 48.2%)

reflecting the continuation of the move to a more software and

solution orientated sale. The level of ongoing recurring licence

and support revenues also rose to GBP1.2m representing a third of

revenues for the six months.

Improved margins combined with the revenue growth resulted in

the after-tax loss before exceptional costs being reduced by 87% to

GBP54,000 (six months ended 30 June 2018: GBP415,000 reported

including adjustment for IFRS 15). Adjusted loss per share was

lower at 0.63p (six months ended 30 June 2018: loss of 4.90p per

share).

As of 30 June 2019, the Group had Net Debt of GBP204,000 (six

months ended 30 June 2018: net cash GBP180,000).

The Group's cashflow in the six months to 30 June 2019 was

adversely impacted by two factors. The first was that substantial

monies due from the HMRC for prior investment in the business were

delayed, due to a processing backlog at HMRC. These monies,

amounting to GBP456,000, were received in August. The second was

the sizeable cash outflow arising from restructuring, which was

over GBP170,000 (30 June 2018: nil). The benefits of the

restructuring are now starting to flow.

Current Trading

We remain on track to meet expectations. The levels of

engagement and customer interest in our new generation of products

continues to develop favourably. It is imperative we maintain this

energy going forward. The long-term fundamentals of organisations

having a growing appetite to capture, consume, move and use mobile

data remain in place.

Topical short-term issues such as Brexit will continue to cause

delay to our client's investment plans, bringing an unevenness to

trading on a month by month basis. This report gives evidence we

are currently overcoming that headwind, the 15% revenue growth

being testament to this.

Touchstar's progress is only happening because the whole

organisation is working hard, focusing on the things we can

control, actively getting in front of customers, delivering great

service and looking after every pound. I really appreciate this

commitment; I am really proud of the people I work alongside.

CONCLUSION

We have made good progress in the year to date, this needs to be

sustained not only over the next few months but the next few years.

This will not be easy but pleasingly we are now starting to see the

rewards of the considerable effort being applied.

I Martin

Executive Chairman

10 September 2019

Unaudited consolidated income statement for the six months ended

30 June 2019

Six months ended 30 June Year ended 31 December

2019 2018 2018

GBP'000 GBP'000 GBP'000

------------------------------------- ------------------ ----------------------- -----------------------

Revenue 3,635 3,244 6,898

Operating loss before exceptional

items (215) (590) (982)

Exceptional costs (303) - (334)

-------------------------------------- ------------------ ----------------------- --------------------------

Operating loss (518) (590) (1,316)

Finance costs (9) (2) (4)

-------------------------------------- ------------------ ----------------------- --------------------------

Loss before income tax (527) (592) (1,320)

Income tax credit 170 177 404

-------------------------------------- ------------------ ----------------------- --------------------------

Loss for the period attributable to

the owners of the parent (357) (415) (916)

------------------ ----------------------- --------------------------

Loss per ordinary share (pence) attributable to owners of the parent during the

period:

Pence per share Pence per share Pence per share

Loss per share - Basic (4.21)p (4.90)p (10.94)p

Loss per share - Adjusted (note 6) (0.63)p (4.90)p (6.95)p

Unaudited consolidated statement of changes in equity for the

six months ended 30 June 2019

Retained

earnings/

Share premium (accumulated Total

Share capital account losses) equity

GBP'000 GBP'000 GBP'000 GBP'000

------------------------- -------------- -------------- -------------- --------

For the six months ended 30 June 2019

-----------------------------------------------------------------------------------

Balance at 31 December

2018 424 1,119 849 2,392

Loss for the period - - (357) (357)

Balance at 30 June 2019 424 1,119 492 2,035

------------------------- -------------- -------------- -------------- --------

For the six months ended 30 June 2018

------------------------------------------------- ------

Balance at 1 January 2018 315 - 1,856 2,171

Revenue recognised under

IAS 18 adjusted for IFRS

15 - - (91) (91)

--------------------------- ---- ------ ------ ------

Revised balance 1 January

2018 315 - 1,765 2,080

Share issue 109 1,191 - 1,300

Cost of share issue - (72) - (72)

Loss for the period - - (415) (415)

Balance at 30 June 2018 424 1,119 1,350 2,893

--------------------------- ---- ------ ------ ------

For the year ended 31 December 2018

-----------------------------------------------------------

Balance at 1 January 2018 315 - 1,856 2,171

Revenue recognised under

IAS 18 adjusted for IFRS

15 - - (91) (91)

--------------------------- ---- ------ ------ ------

Revised balance 1 January

2018 315 - 1,765 2,080

Share issue 109 1,191 - 1,300

Cost of share issue - (72) - (72)

Loss for the year - - (916) (916)

Balance at 31 December

2018 424 1,119 849 2,392

--------------------------- ---- ------ ------ ------

Unaudited consolidated statement of financial position at 30

June 2019

30 June 2019 30 June 31 December

2018 2018

GBP'000 GBP'000 GBP'000

------------------------------- ------------- -------- ------------

Non-current assets

Intangible assets 1,429 1,305 1,352

Property, plant and equipment 199 210 228

Right of use asset 643 - -

Deferred tax assets 157 168 157

-------------------------------- ------------- -------- ------------

2,428 1,683 1,737

------------------------------- ------------- -------- ------------

Current assets

Inventories 1,161 1,414 1,210

Trade and other receivables 1,895 1,708 1,928

Current tax recoverable 656 449 487

Cash and cash equivalents 1,839 1,788 2,112

-------------------------------- ------------- -------- ------------

5,551 5,359 5,737

------------------------------- ------------- -------- ------------

Total assets 7,979 7,042 7,474

-------------------------------- ------------- -------- ------------

Current liabilities

Trade and other payables 1,743 1,257 1,444

Lease liabilities 160 - -

Contract liabilities 1,071 957 1,365

Borrowings 2,043 1,608 1,816

-------------------------------- ------------- -------- ------------

5,017 3,822 4,625

Non-current liabilities

Deferred tax liabilities 269 179 269

Lease liabilities 519 - -

Contract liabilities 139 148 188

Total liabilities 5,944 4,149 5,082

-------------------------------- ------------- -------- ------------

Unaudited consolidated statement of financial position at 30

June 2019 (continued)

30 June 2019 30 June 31 December

2018 2018

GBP'000 GBP'000 GBP'000

Capital and reserves attributable

to owners of the parent

Share capital 424 424 424

Share premium account 1,119 1,119 1,119

Profit and loss account 492 1,350 849

------------------------------------ ------------- -------------- ------------

Total equity 2,035 2,893 2,392

------------------------------------ ------------- -------------- ------------

Total equity and liabilities 7,979 7,042 7,474

------------------------------------ ------------- -------------- ------------

Unaudited consolidated cash flow statement for the six months

ended 30 June 2019

30 June 2019 30 June 31 December

2018 2018

GBP'000 GBP'000 GBP'000

--------------------------------------------------- -------------- ------------

Cash flows from operating activities

Operating loss (518) (590) (1,316)

Depreciation 118 42 70

Amortisation 242 211 379

Development impairment - - 334

Right-of-use asset impairment 61 - -

Movement in:

Inventories 51 (27) 177

Trade and other receivables - 548 328

Trade and other payables (29) (499) 136

------------------------------------------ -------- -------------- --------------

Cash generated (used in)/from operating

activities (75) (315) 108

Interest paid (9) (2) (4)

Corporation tax received - - 290

------------------------------------------ -------- -------------- --------------

Net cash generated (used in)/from

operating activities (84) (317) 394

------------------------------------------ -------- -------------- --------------

Cash flows from investing activities

Purchase of intangible assets (319) (380) (929)

Purchase of property, plant and

equipment (14) (15) (61)

Net cash used in investing activities (333) (395) (990)

------------------------------------------ -------- -------------- --------------

Cash flows from financing activities

Lease liability payments (83) - -

Share issue - 1,300 1,300

Cost of share issue - (72) (72)

Net cash used in financing activities (83) 1,228 1,228

------------------------------------------ -------- -------------- --------------

Net increase/ (decrease) in cash

and cash equivalents (500) 516 632

Cash and cash equivalents at start

of the year 296 (336) (336)

------------------------------------------ -------- -------------- --------------

Cash and cash equivalents at end

of the year (204) 180 296

------------------------------------------ -------- -------------- --------------

Cash and cash equivalents

Cash at bank and in hand 1,839 1,788 2,112

Less: bank overdraft (included

within borrowings) (2,043) (1,608) (1,816)

Net debt/cash (204) 180 296

------------------------------------------ -------- -------------- --------------

Notes to the interim report and accounts for the six months

ended 30 June 2019

1. General information

Touchstar plc is a public company limited by share capital

incorporated and domiciled in the United Kingdom. The Company has

its listing on AIM. The address of its registered office is 1

George Square, Glasgow, G2 1AL.

2. Status of interim report and accounts

The financial information comprises the consolidated interim

balance sheet as at 30 June 2019, 30 June 2018 and the year ended

31 December 2018 along with related consolidated interim statements

of income and cash flows for the six months to 30 June 2019 and 30

June 2018 and year ended 31 December 2018 of Touchstar plc

(hereinafter referred to as 'financial information').

This financial information for the half year ended 30 June 2019

has neither been audited nor reviewed and does not comprise

statutory accounts within the meaning of the section 434 of the

Companies Act 2006. This financial information was approved by the

Board on 9 September 2019.

The figures for the year ended 31 December 2018 have been

extracted from the audited annual report and accounts that have

been delivered to the Registrar of Companies. The auditors,

PricewaterhouseCoopers LLP, reported on those accounts under

section 495 of the Companies Act 2006. Their report was unqualified

and did not contain a statement under section 498 of that Act.

3. Basis of preparation

The interim report and accounts have been prepared, in

accordance with IAS34 Interim Financial Reporting, using accounting

policies to be applied in the annual report and accounts for the

year ended 31 December 2019. These are consistent with those

included in the previously published annual report and accounts for

the year ended 31 December 2018, which have been prepared in

accordance with IFRS as adopted by the European Union except for

operating lease accounting policy where IFRS 16 Leases has been

applied from 1 January 2019.

New accounting standard

Previously operating lease costs for both properties and

vehicles were recognised on a monthly basis within operating

expenses in accordance with IAS 17. Under IFRS 16 these leases will

be bought onto the Group's balance sheet from the date of adoption.

The Group has elected to apply the modified retrospective approach

with the cumulative effect of initially applying the standard as an

adjustment to the opening balance of the retained earnings as at 1

January 2019.

The cumulative effect of the changes made to our consolidated 1

January 2019 balance sheet for the adoption of IFRS 16 Leases were

as follows:

Balance at Adjustments Balance at

31 December due to IFRS 1 January

2018 16 2019

GBP'000 GBP'000 GBP'000

----------------------------- ----------------- ----------------- -----------------

Consolidated balance sheet

Non- current assets

Right of use asset - 734 734

Current assets

Trade and other receivables 1,929 (33) 1896

Current liabilities

Trade and other payables 2,998 (17) (2,982)

Lease liabilities - (163) (163)

Non-current liabilities

Lease liabilities - (555) (555)

----------------------------- ----------------- ----------------- -----------------

There was no impact on the closing figures for the balance sheet

at 30 June 2019.

Non - GAAP financial measures

For the purposes of this interim announcement and annual report

and accounts, the Group uses alternative non-Generally Accepted

Accounting Practice ('non-GAAP') financial measures which are not

defined within IFRS. The Directors use the measures in order to

assess the underlying operational performance of the Group and as

such, these measures are important and should be considered

alongside the IFRS measures.

The following non-GAAP measure referred to in the interim

announcement relates to Trading profit.

'Trading loss' is separately disclosed, being defined as

operating profit/(loss) adjusted to exclude restructuring costs

along with other non-recurring costs such as onerous leases and

associated costs on the early vacation of a property relating to

Onboard retail. These exceptional costs related to items which the

management believe did not accurately reflect the underlying

trading performance of the business in the period. The Directors

believe that the trading profit/(loss) is an important measure of

the underlying performance of the Group.

Going Concern

The directors have a reasonable expectation that the Group has

adequate resources to continue operating for the foreseeable

future, and for this reason they have adopted the going concern

basis of preparation in the consolidated interim financial

statements. The financial statements may be obtained from Touchstar

plc, 7 Commerce Way, Trafford Park, Manchester, M17 1HW or online

at www.touchstarplc.com.

4. Critical accounting estimates and assumptions

The Group makes estimates and assumptions concerning the future.

The resulting accounting estimates will, by definition, seldom

equal the related actual results. The estimates and assumptions

that have a significant risk of causing a material adjustment to

the carrying amounts of assets and liabilities within the next

financial year are discussed below.

Development expenditure

The Group recognises costs incurred on development projects as

an intangible asset which satisfies the requirements of IAS 38. The

calculation of the costs incurred includes the percentage of time

spent by certain employees on the development project. The decision

whether to capitalise and how to determine the period of economic

benefit of a development project requires an assessment of the

commercial viability of the project and the prospect of selling the

project to new or existing customers.

5. Income tax credit

Six months ended Year ended

30 June 31 December

2019 2018 2018

GBP'000 GBP'000 GBP'000

---------------------------------- ----------------- ----------------- --------------

Corporation Tax

Current tax (170) (140) (468)

Adjustments in respect of prior

years - (37) (37)

Deferred tax - - 101

---------------------------------- ----------------- ----------------- --------------

Total current tax (170) (177) (404)

---------------------------------- ----------------- ----------------- --------------

6. Earnings per share

Earnings per ordinary share (pence) attributable to owners of the parent during the

period:

Year ended 31 December

Six months ended 30 June

Loss per share 2019 2018 2018

------------------------------ --------------------------- --------------------------- -----------------------

Basic (4.21)p (4.90)p (10.94)p

Adjusted (0.63)p (4.90)p (6.95)p

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares in issue during the year. The calculation

of adjusted earnings per share excludes exceptional costs of

GBP303,000 (31 December 2018 GBP334,000) (note 7).

Reconciliations of the earnings and weighted average number of

shares used in the calculation are set out below:

For six-month period 30 June 2019 30 June 2018

------------------------------- ----------------------------------------- ------------------------------------------

Loss Weighted average number of Loss Weighted average number of

GBP'000 shares (in thousands) GBP'000 shares (in thousands)

------------------------------- --------- ------------------------------ --------- -------------------------------

Basic EPS

Shares in issue 1 January 8,475 6,309

Share issue - 2,166

------------------------------- --------- ------------------------------ --------- -------------------------------

Loss attributable to owners of

the parent (518) 8,475 (415) 8,475

Exceptional costs (note 7) 303 -

Adjusted EPS

Loss attributable to owners of

the parent before exceptional

items (215) 8,475 (415) 8,475

------------------------------- --------- ------------------------------ --------- -------------------------------

For year ended 31 December 2018

-------------------------------------------- ----------------------------------------------------------------

Loss Weighted average number of shares (in

GBP'000 thousands)

Basic EPS

Shares in issue 1 January 6,309

Share issue 2,166

-------------------------------------------- ------------------- -------------------------------------------

Loss attributable to owners of the parent (916) 8,475

Exceptional costs (note 7) 334

-------------------------------------------- ------------------- -------------------------------------------

Adjusted EPS

Loss attributable to owners of the parent

before exceptional items (582) 8,475

-------------------------------------------- ------------------- -------------------------------------------

7. Exceptional costs

30 June 2019 30 June 31 December

2018 2018

GBP'000 GBP'000 GBP'000

------------------------------------------ -------------- ------------

Restructuring expenses:

Redundancy costs 166 - -

Onerous lease associated future 76 - -

costs

Onerous lease impairment 61

Development expenditure impairment - - 334

------------------------------------- ---- -------------- --------------

303 - 334

------------------------------------- ---- -------------- --------------

The exceptional costs incurred early 2019 relate to management's

decision to significantly reduce running costs for the Onboard

product with support for the existing clients moved to the main

offices in Manchester. The Kenilworth office where Onboard was

situated has now been closed.

The development expenditure impairment for 31 December 2018

relates to the write off of the carrying value for NOVOStar

development; the Onboard Retail product.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR EAKNNEESNEFF

(END) Dow Jones Newswires

September 10, 2019 02:00 ET (06:00 GMT)

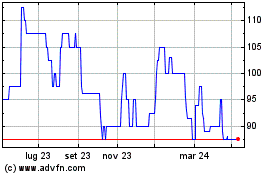

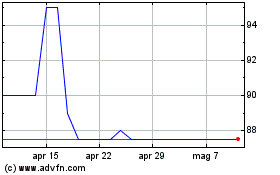

Grafico Azioni Touchstar (LSE:TST)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Touchstar (LSE:TST)

Storico

Da Apr 2023 a Apr 2024