TIDMRAI

RNS Number : 7351L

RA International Group PLC

10 September 2019

10 September 2019

RA INTERNATIONAL GROUP PLC

("RA International" or the "Company" and, together with its

subsidiaries, the "Group")

Interim results for the six months period ended 30 June 2019

RA International Group plc (AIM: RAI), a leading provider of

services to remote locations in Africa and the Middle East, is

pleased to announce its interim results in respect of the six

months ended 30 June 2019.

6 months 6 months

ended ended

30 June 30 June

2019 2018

USD'000 USD'000

Revenue 23,044 26,112

Underlying profit (1) 2,546 7,654

Profit 2,623 4,819

Normalised EPS (cents) (2) 1.5 5.5

Basic EPS (cents) 1.5 3.4

Net Cash (end of period) (3) 25,830 27,978

INTERIM HIGHLIGHTS

-- Contracted revenue backlog of USD 166m at 30 June 2019, up

39.5% from USD 119m at 31 December 2018

-- USD 65.8m of contracts awarded during the period including:

-- Master service agreement with IAP for global supply

chain services. The first task order issued is for

up to USD 8.5m over five years;

-- Significant contract with Facilities Development

Corporation to provide construction services in

connection with the refurbishment and upgrade of

the U.S. Embassy in Denmark;

-- USD 9.8m contract to provide vehicle and equipment

fleet operation and first line maintenance services

in up to 10 locations in East Africa for a large

humanitarian organisation;

-- USD 9.0m contract with a western government to provide

construction and facilities management services

over the next three years in East Africa;

-- USD 10.7m construction contract with a large humanitarian

client to provide accommodation facilities for peacekeeping

troops in a Central African country; and a

-- USD 7.8m contract with a large humanitarian organisation

to supply and install modified shipping containers

as accommodation and offices in an East African

country.

-- Operating cash flow of USD 3.9m (H1 18: USD 3.8m) driven by

a period of strong receivable collections

-- Underlying Operating Profit of USD 3.3m (H1 18: USD 8.3m)

and Operating Profit of USD 2.7m (H1 18: USD 8.2m)

-- In support of its Mozambique entrance strategy, acquired a

shareholding in Royal Food Solutions S.A and a large plot

of land in the North of the country

POST PERIOD HIGHLIGHTS

-- Encouraging start to H2 19 with monthly activity levels increasing

in line with expectations and profit margins returning to historical

levels

-- Revenue anticipated to be recognised in H2 19 from the Group's

USD 166m revenue backlog should lead to the Group meeting turnover

expectations in 2019 while profitability is projected to be broadly

in line with expectations

Soraya Narfeldt, CEO of RA International, commented:

We are pleased and encouraged by the value of contracts awarded

to the Group in H1 19 and whilst the delay in being awarded a

particular contract has impacted on first half financials, the

Company is set for a strong second half of the year. All contracts

expected to significantly contribute to H2 19 revenue have now

commenced and we continue to bid for large, long-term contracts in

line with our strategic plan.

Notes to summary table of financial results:

(1)Underlying profit represents profit before non-reoccurring

exceptional items and unrealised FX charges.

(2)Normalised earning per share represents basic earnings

per share excluding exceptional items and unrealised FX charges.

(3)Net cash represents the end of period cash balance less

term loans and notes outstanding.

Enquiries:

RA International Group PLC Via Hudson Sandler

Soraya Narfeldt, Chief Executive Officer

Lars Narfeldt, Chief Operating Officer

Andrew Bolter, Chief Financial Officer

Cenkos Securities PLC (Nominated Adviser

and Broker)

Derrick Lee

Peter Lynch +44 (0)131 220 6939

Hudson Sandler LLP (Financial PR & IR) +44 (0)207 796 4133

Daniel de Belder rainternational@hudsonsandler.com

Nelly Akpaka

Background of the Company

RA International is a leading provider of services to remote

locations in Africa and the Middle East. The Company offers its

services through three channels: construction, integrated

facilities management and supply chain, and services three main

client groups: humanitarian and aid agencies, governments and

commercial customers, predominantly in the oil and gas and mining

sectors. It has a strong customer base, largely comprising UN

agencies, western governments and global corporations.

The Company provides comprehensive, flexible, mission critical

support to its clients enabling them to focus on the delivery of

their respective businesses and services. Focusing on integrity and

values alongside making on-going investment in its people,

locations and operations has over time created a reliable and

trusted brand within its sector.

CHIEF EXECUTIVE'S REVIEW

Overview

I am pleased to update the Company's shareholders on our

performance for the six months ending 30 June 2019 (the "Period" or

"First Half"). In line with our strategic objectives, we have

continued to grow our customer base, diversify geographically,

target longer-term contracts and cross-sell to new and existing

customers. Our strategy is beginning to bear fruit as evidenced by

our growing contracted revenue backlog which was USD 166m at 30

June 2019, increasing 39.5% since 31 December 2018.

Group revenue during the First Half was USD 23.0m (H2 18: USD

28.7m, H1 18: USD 26.1m) and underlying profit was USD 2.5m (H2 18:

USD 5.5m, H1 18: USD 7.7m).

The level of revenue and underlying profit partly reflects

certain delays the Group experienced in converting large bids into

contract awards. These delays were however resolved by the end of

the Period and the Group was awarded contracts with an aggregate

value of USD 65.8m during H1 19. Revenue recognition for most

contracts awarded in H1 19 will only begin in the second half of

the year and consequently the Company is confident of a

significantly stronger H2 19 and delivering on 2019 market

expectations.

During the First Half we placed significant focus on

diversifying our customer base and bidding on larger, longer-term

contracts. We achieved notable success in both being invited to

tender for larger contracts and being awarded several projects from

new customers with whom we are already bidding on other contracts.

We see growing our customer base and winning longer-term contracts

as the primary drivers of sustainable long-term business

growth.

Contracts

As stated in our 2018 Annual Report, our strengthened balance

sheet has enabled us to bid for larger contracts which if awarded

to the Group would be transformational in nature. Being a quoted

company has also enhanced our profile and brought us a number of

new opportunities, particularly with western governments. One

example is a new contract whereby we will be undertaking

construction works at the US embassy in Denmark. We primarily bid

on this contract to provide us with the track record and experience

required to undertake similar contracts in Africa; and less than 2

months following this contract win we were awarded a similar

contract in South Sudan where we have now materially increased our

footprint. We are optimistic that we will win additional work in

South Sudan allowing us to maintain a significant footprint in the

country for years to come.

During the First Half, the Group was awarded a large number of

significant contracts. These include a USD 9.8m long-term contract

with the United Nations to provide vehicle and equipment fleet

operation and first line maintenance services in East Africa and a

government contract with a value of up to USD 9.0m for construction

and facilities management services. This government contract was

originally expected to be signed in H2 18.

We have continued to see an increase in the number of hybrid

projects whereby two or more of the Group's services have been

delivered on behalf of our clients. Hybrid projects typically

involve the construction and operation of infrastructure, however

one recent contract awarded to the Group is for the supply and

installation of modified shipping containers. This contract, for

USD 7.8m, is primarily a supply chain contract and would not have

been awarded to the Group had we not had the relevant construction

experience and capability to install these facilities.

Besides significant new contract wins, as a result of our

excellent service and the trust our clients have in our delivery

capability, we have increased the value of a number of our existing

contracts. In some instances, we are extending our geographical

reach and scope of work to accommodate our clients' needs.

Operations

Our geographical presence continues to expand; the Company

currently has operations in 9 countries, primarily in remote

locations in Africa. During the Period we significantly expanded

our operations in Mozambique. In addition to acquiring a parcel of

land in Northern Mozambique to build a large camp facility, we also

acquired a shareholding in Royal Food Solutions S.A, a family-owned

provider of integrated facilities management services.

In H1 19 the Group continued to add resources to its Nairobi

based Project Management Office ("PMO"), both through new hires and

relocating staff from our Dubai head office and various operating

areas to the PMO. We believe that by centralising our project

execution function we can enhance our clients' experience through

simplifying communication channels and clarifying project

management responsibility. Additionally, as we continue to expand

our geographic footprint, we anticipate incremental efficiencies to

be realised given that the PMO will control resource allocation

across all project locations.

Current Trading and Outlook

The start of the second half of the year has been encouraging

with monthly activity levels increasing in line with expectations

and profit margins returning to historical levels. Revenue

anticipated to be recognised in H2 19 from the Group's USD 166m

revenue backlog should lead to the Group meeting turnover

expectations in 2019 while profitability is projected to be broadly

in line with expectations. All contracts which are expected to

contribute to H2 19 revenue have now commenced and the Board does

not anticipate any changes or delays to these projects.

We are very pleased by the Group's current level of trading

activity and expect this momentum to carry on into next year. Our

team continues to do an exceptional job and it is validating that

recent investments made in enhancing our operational capacity have

proved warranted given the increasing number, size, and complexity

of projects we are undertaking.

Soraya Narfeldt

Chief Executive Officer

10 September 2019

FINANCIAL REVIEW

Overview

During the first few months of 2019 the Group experienced delays

in converting certain large bids into contract awards; however, by

the end of the Period the Group had been awarded contracts with an

aggregate value of USD 65.8m. As the majority of these contracts

were awarded in the last two months of H1 19 and, in most cases,

the recognition of revenue will begin in the third quarter of the

year, the profit contribution from these contracts in the Period

was insignificant.

Some recently awarded contracts, including a USD 7.8m supply

contract awarded to the Group on 30 June 2019, are short term

contracts ("STCs") which are expected to be fully or substantially

completed in H2 19. Revenue from STCs totalled USD 0.8m in H1 19

and it is anticipated this figure will be USD 12.4m in H2 19. While

we had previously anticipated that the impact of STCs would

decrease as the Group's contract portfolio transitioned to larger,

longer-term contracts, this is unlikely to occur in the short-term

as the Group is seeing increased demand for supply chain services

for which project revenue is often recognised over a period of 1 to

3 months.

6 months 6 months 6 months

ended Ended ended

30 June 31 December 30 June

2019 2018 2018

USD'000 USD'000 USD'000

Unaudited Unaudited Unaudited

Notes Restated Restated

(1) (1)

Revenue 23,044 28,693 26,112

Gross profit 7,140 9,731 11,217

Gross margin 31.0% 33.9% 43.0%

Underlying profit (2) 2,546 5,471 7,654

Underlying profit margin 11.0% 19.1% 29.3%

Profit 2,623 5,008 4,819

Profit margin 11.4% 17.5% 18.5%

Basic EPS (cents) 1.5 2.9 3.4

Normalised EPS (cents) (3) 1.5 3.2 5.5

Net cash (end of period) (4) 25,830 27,804 27,978

(1) Balances have been restated to reflect the impact of IFRS

16. See note 5 for details.

(2) Underlying profit is calculated by deducting exceptional

items and unrealised differences on translation of foreign balances

from profit.

(3) Normalised earnings per share is calculated by dividing

underlying profit by the weighted average number of ordinary shares

outstanding during the period.

(4) Net cash represents the end of period cash balance less

loans and notes outstanding.

Revenue

Reported revenue for H1 19 was USD 23.0m (H2 18: USD 28.7m, H1

18: USD 26.1m). This represents an 11.9% decrease when compared

with H1 18 and is primarily due to a short-term decrease in revenue

from one operating location which resulted from an extended period

of negotiation on a significant contract. This contract has now

been awarded to the Company and it is anticipated that it will

contribute over USD 6.0m in revenue during H2 19.

The Company's revenue backlog at 30 June 2019 stood at USD 166

million. Taking into account the forecast revenue contribution from

STCs in H2 19, the turnover expected to be delivered from this

backlog in the current year is already sufficient to meet the

Company's revenue expectations for 2019. As noted previously, all

contracts which are expected to contribute to H2 19 revenues have

now commenced and the Board does not anticipate any changes or

delays to these projects.

Profit Margin

Gross margin in H1 19 was 31.0% (H2 18: 33.9%, H1 18: 43.0%).

Excluding the impact of the operating location experiencing

decreased turnover as a result of an extended period of negotiation

on a significant contract, gross margin was 38.1% which is in line

with the Group's expectations.

Due to the dynamic nature of the contract award process and the

Group's commitment to ensure it could execute the project works to

the timeframe required by its customer, the Group maintained a

fairly stable labour presence in country during H1 19 despite

monthly revenue from operations decreasing by approximately 50%

when compared with 2018. These staff were allocated to internal

projects which were significantly accelerated during the

Period.

Maintaining staff levels was a strategic decision which is

believed by the Group to have directly led to a significant project

award. It is anticipated that gross margin generated in H2 19 from

this operation will be consistent with historical levels.

Underlying operating profit margin in H1 19 was 14.4% (H2 18:

21.9%, H1 18: 31.6%). The decrease in gross margin was the primary

driver for this variance although administrative expenses increased

by USD 0.8m from H1 18. The increase in administrative expenses is

largely a result of the Group adding a number of senior management

around the time of Admission to AIM on 29 June 2018 and also a

result of significant investment being made in connection with

staff training and process restructuring so as to ensure the

structure is in place to bid, win and manage the larger and more

complex projects for which the Group is bidding and

undertaking.

Finance costs of USD 0.3m were reported in the Period (H2 18:

USD 0.3m, H1 18: USD 0.6m). USD 0.2m relates to interest charges on

lease liabilities which have been recorded in accordance with IFRS

16.

Earnings Per Share

Normalised earnings per share, being underlying profit divided

by the weighted number of shares outstanding in the period, was 1.5

cents per share in the period (H2 18: 3.2 cents, H1 18: 5.5 cents).

Basic earnings per share was 1.5 cents (H2 18: 2.9 cents, H1 18:

3.4 cents) and is equal to diluted earnings per share.

Cashflow

Net cash flow from operations was USD 3.9m in the Period (H2 18:

USD 7.6m, H1 18: USD 3.8m) which represented 143.6% cash

conversion; slightly higher than recent results (H2 18: 139.4%, H1

18: 45.7%). The strong cash conversion ratio was driven by a period

of strong collections of accounts receivable balances. Accounts

receivable balances at 30 June 2019 totalled USD 5.8m (H2 18: USD

10.0m, H1 18: USD 9.7m), of which 69.8% is not yet due (H2 18:

59.2%, H1 18: 39.6%). This was partially offset by the build-up of

inventory relating to a number of significant construction and

supply projects ongoing over the Period end or due to commence in

H2 19, including a project with AECOM for the construction of an

asphalt runway and several contracts with the United Nations.

Balance Sheet

Property, plant and equipment increased by USD 4.2m during H1

19. The Group continued to construct and lease accommodation and

office facilities in East Africa to humanitarian organisations and

purchased land in Northern Mozambique. Additionally, the Group

expanded its heavy equipment fleet to service ongoing or soon to

commence construction projects.

Goodwill of USD 0.1m was recognised in the Period and relates to

the purchase of Royal Food Solutions S.A.

Dividend

A dividend of 1p per share totalling USD 2.2m was declared and

authorised during H1 19 (H2 18: nil, H1 18: USD 0.1m) and was

subsequently paid on 3 July 2019. The Company anticipates declaring

an annual dividend when it reports its earnings for the fiscal year

ended 31 December 2019.

Andrew Bolter

Chief Financial Officer

10 September 2019

[1] Cash conversion is calculated as cashflow generated from

operations divided by operating profit.

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 30 June 2019

6 months 6 months 6 months

ended ended ended

30 June 31 December 30 June

2019 2018 2018

USD'000 USD'000 USD'000

Notes Unaudited Unaudited Unaudited

Restated* Restated*

Revenue 23,044 28,693 26,112

Direct costs (15,904) (18,962) (14,895)

---------------- ---------------- ----------------

Gross profit 7,140 9,731 11,217

Administrative expenses (3,812) (3,438) (2,978)

---------------- ---------------- ----------------

Underlying operating profit 3,328 6,293 8,239

Acquisition costs (36) (76) (6)

Holding company expenses (569) (505) -

---------------- ---------------- ----------------

Operating profit 2,723 5,712 8,233

Investment revenue 169 33 1

Finance costs (346) (274) (580)

---------------- ---------------- ----------------

Underlying profit 2,546 5,471 7,654

Unrealised differences on translation

of foreign balances 77 (437) 73

Exceptional items - (26) (2,908)

---------------- ---------------- ----------------

Profit and total comprehensive

income for the period 2,623 5,008 4,819

Basic and diluted earnings per

share (cents) 2 1.5 2.9 3.4

Normalised basic and diluted earnings

per share (cents) 2 1.5 3.2 5.5

*Balances have been restated to reflect the impact of IFRS 16.

See note 5 for details.

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 June 2019

As at As at As at

30 June 31 December 30 June

2019 2018 2018

USD'000 USD'000 USD'000

Notes Unaudited Audited Unaudited

Restated* Restated*

Assets

Non-current assets

Property, plant, and equipment 6 22,855 18,624 12,774

Goodwill 138 - -

---------------- ---------------- ----------------

22,993 18,624 12,774

---------------- ---------------- ----------------

Current assets

Inventories 5,837 4,263 4,013

Trade and other receivables 13,458 15,962 17,308

Cash and cash equivalents 7 25,830 27,804 29,271

---------------- ---------------- ----------------

45,125 48,029 50,592

---------------- ---------------- ----------------

Total assets 68,118 66,653 63,366

Equity and liabilities

Equity

Share capital 24,300 24,300 24,300

Share premium 18,254 18,254 18,256

Merger reserve (17,803) (17,803) (17,803)

Share based payment reserve 32 16 -

Retained earnings 34,434 34,013 29,005

---------------- ---------------- ----------------

Total equity 59,217 58,780 53,758

---------------- ---------------- ----------------

Non-current liabilities

Lease liabilities 2,469 2,532 2,284

Employees' end of service benefits 328 350 308

---------------- ---------------- ----------------

2,797 2,882 2,592

---------------- ---------------- ----------------

Current liabilities

Term loans and notes - short-term

portion - - 1,293

Lease liabilities 122 111 66

Trade and other payables 5,982 4,880 5,657

---------------- ---------------- ----------------

6,104 4,991 7,016

---------------- ---------------- ----------------

Total liabilities 8,901 7,873 9,608

---------------- ---------------- ----------------

Total equity and liabilities 68,118 66,653 63,366

*Balances have been restated to reflect the impact of IFRS 16.

See note 5 for details.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six months ended 30 June 2019

Additional Share Based

Share Contributed Share Merger Payment Retained

Capital Capital Premium Reserve Reserve Earnings Total

Notes USD'000 USD'000 USD'000 USD'000 USD'000 USD'000 USD'000

As at 1

January 2018

restated* 272 1,809 - - - 22,733 24,814

Total

comprehensive

income

for the

period

restated* - - - - - 4,819 4,819

Share exchange 19,612 (1,809) - (17,803) - - -

Issue of share

capital 4,416 - 18,256 - - - 22,672

Non-cash

employee

compensation - - - - - 1,578 1,578

Dividends

declared and

paid 3 - - - - - (125) (125)

---------------- ---------------- ---------------- ---------------- ---------------- ---------------- ----------------

As at 30 June

2018

restated* 24,300 - 18,256 (17,803) - 29,005 53,758

Total

comprehensive

income

for the

period - - - - - 5,008 5,008

Issue of share

capital - - (2) - - - (2)

Share based

payments - - - - 16 - 16

---------------- ---------------- ---------------- ---------------- ---------------- ---------------- ----------------

As at 31

December 2018

restated* 24,300 - 18,254 (17,803) 16 34,013 58,780

Total

comprehensive

income

for the

period - - - - - 2,623 2,623

Share based

payments - - - - 16 - 16

Dividends

declared and

authorised 3 - - - - - (2,202) (2,202)

---------------- ---------------- ---------------- ---------------- ---------------- ---------------- ----------------

As at 30 June

2019 24,300 - 18,254 (17,803) 32 34,434 59,217

*Balances have been restated to reflect the impact of IFRS 16.

See note 5 for details.

CONSOLIDATED STATEMENT OF CASH FLOWS

For the six months ended 30 June 2019

6 months 6 months 6 months

ended ended ended

30 June 31 December 30 June

2019 2018 2018

USD'000 USD'000 USD'000

Notes Unaudited Unaudited Unaudited

Restated Restated

Operating activities

Profit for the period 2,623 5,008 4,819

Adjustments for non-cash and other items:

Depreciation on property, plant, and equipment 1,124 876 634

Loss on disposal of property, plant, and equipment 38 113 7

Investment revenue (169) (33) (1)

Finance costs 346 274 580

Unrealised differences on translation of foreign

balances (77) 437 (73)

Provision for employees' end of service benefits 68 59 57

Share based payments 16 16 -

Exceptional items - 26 2,908

---------------- ---------------- ----------------

3,969 6,776 8,931

Working capital adjustments:

Inventories (1,266) (250) (1,337)

Accounts receivable, deposits, and other

receivables 2,757 1,339 (3,966)

Accounts payable and accruals (1,459) (219) 161

---------------- ---------------- ----------------

Cash flows generated from operations 4,001 7,646 3,789

Employees' end of service benefits paid (90) (17) -

Stock-based compensation and related costs - - (24)

---------------- ---------------- ----------------

Net cash flows from operating activities 3,911 7,629 3,765

---------------- ---------------- ----------------

Investing activities

Release of cash margin against guarantees issued - 2,000 -

Purchase of property, plant, and equipment (5,700) (6,524) (2,159)

Proceeds from disposal of property, plant, and

equipment 73 23 74

Acquisition of subsidiary (net of cash acquired) (106) - (565)

---------------- ---------------- ----------------

Net cash flows used in investing activities (5,733) (4,501) (2,650)

---------------- ---------------- ----------------

Financing activities

Repayment of term loans and notes - (1,263) (573)

Payment of lease liabilities (52) (75) (29)

Investment revenue received 169 33 1

Finance costs paid (346) (269) (584)

Dividends paid 3 - - (125)

Share listing costs - (397) (935)

Issue of share capital (net of issue costs paid) - (187) 22,859

---------------- ---------------- ----------------

Net cash flows (used in) / from financing activities (229) (2,158) 20,614

---------------- ---------------- ----------------

Net (decrease) / increase in cash and cash

equivalents (2,051) 970 21,729

Cash and cash equivalents as at start of the period 27,804 27,271 5,469

Effect of foreign exchange on cash and cash

equivalents 77 (437) 73

---------------- ---------------- ----------------

Cash and cash equivalents as at end of the period 25,830 27,804 27,271

1 BASIS OF PREPARATION

The principal activity of RA International Group plc ("RAI" or

the "Company") and its subsidiaries (together the "Group") is

providing services in demanding and remote areas. These services

include construction, integrated facilities management, and supply

chain services.

RAI was incorporated on 13 March 2018 as a public company in

England and Wales under registration number 11252957. The address

of its registered office is One Fleet Place, London, EC4M 7WS. The

Company acquired, by way of share for share exchange (the

"Exchange") the entire issued share capital of RA International

FZCO and its subsidiaries ("RA") on 12 April 2018. The Group

reorganisation is treated as a common control transaction, for

which there is no specific accounting guidance under International

Financial Reporting Standards ("IFRS"). Consequently, the

integration of the Company has been accounted for using merger

accounting principles. The policy, which does not conflict with

IFRS, reflects the economic substance of the transaction.

The adoption of merger accounting presents the Company as if it

had always been the parent of the Group. As the Company was not

incorporated until 13 March 2018, the condensed interim

consolidated financial statements of the Group represent a

continuation of consolidated financial statements of RA

International FZCO, the former parent of the Group. The financial

information set out in these interim condensed consolidated

financial statements does not constitute the Group's statutory

financial statements within the meaning of section 434 of the

Companies Act 2006.

The unaudited condensed interim financial statements for the six

months ended 30 June 2019 have been prepared in accordance with IAS

34, 'Interim Financial Reporting'. They do not include all the

information required for full annual financial statements and

should be read in conjunction with the consolidated financial

statements of RAI for the year ended 31 December 2018. The

unaudited condensed financial information has been prepared using

the same accounting policies and methods of computation as the

Annual Report for the year ended 31 December 2018, except for the

adoption of IFRS 16 (see note 5). The same accounting policies and

methods of computation will be used to prepare the Annual Report

for the year ended 31 December 2019. The financial statements of

the Group are prepared in accordance with IFRS.

2 EARNINGS PER SHARE

The Group presents basic earnings per share ("EPS") data for its

ordinary shares. Basic EPS is calculated by dividing the profit

attributable to ordinary shareholders of the Group by the weighted

average number of ordinary shares outstanding during the period.

Diluted earnings per share is calculated by dividing the profit

attributable to ordinary shareholders of the Group by the weighted

average number of ordinary shares outstanding during the period

plus the weighted average number of ordinary shares that would be

issued on conversion of all the dilutive potential ordinary shares

into ordinary shares.

Normalised earnings per share is calculated by dividing

underlying profit by the weighted average number of ordinary shares

outstanding during the period.

6 months 6 months 6 months

ended ended ended

30 June 31 December 30 June

2019 2018 2018

Unaudited Unaudited Unaudited

Restated Restated

Profit for the period (USD'000) 2,623 5,008 4,819

Basic weighted average number

of ordinary shares 173,575,741 173,575,741 140,371,001

Effect of warrants - - -

Effect of employee share options - - -

---------------- ---------------- ----------------

Diluted weighted average number

of shares 173,575,741 173,575,741 140,371,001

Basic earnings per share (cents) 1.5 2.9 3.4

Diluted earnings per share (cents) 1.5 2.9 3.4

Underlying Profit (USD'000) 2,546 5,471 7,654

Normalised basic earnings per

share (cents) 1.5 3.2 5.5

Normalised diluted earnings per

share (cents) 1.5 3.2 5.5

3 DIVIDS

During the interim period, a dividend of 1 pence (USD 0.01) per

share (173,575,741 shares) totalling GBP 1,736,000 (USD 2,202,000)

was declared and authorised (H2 18: USD nil, H1 18: USD 12,500 per

share (10 shares) totalling USD 125.000). The dividend declared and

authorised during the interim period was paid to ordinary

shareholders on 3 July 2019.

4 SEGMENT INFORMATION

For management purposes, the Group is organised into one segment

based on its products and services, which is the provision of

services in demanding and remote areas. Accordingly, the Group only

has one reportable segment. The Group's Chief Operating Decision

Maker ("CODM") monitors the operating results of the business as a

single unit for the purpose of making decisions about resource

allocation and assessing performance. The CODM is considered to be

the Board of Directors.

Operating segments

Revenue, operating results, assets and liabilities presented in

the financial statements relate to the provision of services in

demanding and remote areas.

Revenue by service channel:

6 months 6 months 6 months

ended ended ended

30 June 31 December 30 June

2019 2018 2018

USD'000 USD'000 USD'000

Unaudited Unaudited Unaudited

Restated Restated

Construction 8,041 16,942 12,537

Integrated facilities management 13,292 10,674 12,471

Supply chain services 1,711 1,077 1,104

---------------- ---------------- ----------------

23,044 28,693 26,112

The Group allocates a contract to a specific service channel

based on the nature of the primary deliverable to the customer. The

Group does not allocate revenue to multiple service channels from a

contract. If the Group were to allocate revenue to multiple service

channels from its contracts, a significant value of construction

revenue would be reclassified to the other service channels;

additionally, a significant value of integrated facilities

management revenue would be reclassified to supply chain

services.

Geographic segment

The Group primarily operates in Africa and the CODM considers

Africa and Other to be the only geographic segments of the Group.

The below geography split is based on the location of project

implementation.

Revenue by geographic area of project implementation:

6 months 6 months 6 months

ended ended ended

30 June 31 December 30 June

2019 2018 2018

USD'000 USD'000 USD'000

Unaudited Unaudited Unaudited

Restated Restated

Africa 22,998 22,982 25,021

Other 46 5,711 1,091

---------------- ---------------- ----------------

23,044 28,693 26,112

Non-current assets by geographic area:

6 months 6 months 6 months

ended ended ended

30 June 31 December 30 June

2019 2018 2018

USD'000 USD'000 USD'000

Unaudited Unaudited Unaudited

Restated Restated

Africa 21,985 16,607 11,934

Other 1,008 2,017 840

---------------- ---------------- ----------------

22,993 18,624 12,774

5 CHANGES IN ACCOUNTING POLICIES AND DISCLOSURES

New and amended standards and interpretations

The Group applied IFRS 15 Revenue from Contracts with Customers

for the first time in 2018 and IFRS 16 Leases for the first time in

2019, using a fully retrospective approach. The effect of the

changes resulting from the adoption of these new accounting

standards has been reflected in the figures for H1 18 and H2 18 in

the Statement of Comprehensive Income, Statement of Financial

Position, Statement of Changes in Equity and Statement of

Cashflows.

The Group has not early adopted any standards, interpretations

or amendments that have been issued but are not yet effective.

IFRS 16 Leases

IFRS 16 was issued in January 2016 and replaces IAS 17 Leases,

IFRIC 4 Determining Whether an Arrangement Contains a Lease, SIC-15

Operating Leases-Incentives and SIC-27 Evaluating the Substance of

Transactions Involving the Legal Form of a Lease. IFRS 16 sets out

the principles for the recognition, measurement, presentation, and

disclosure of leases and requires lessees to account for all leases

under a single on-balance sheet model similar to accounting for

finance leases under IAS 17. The standard includes two recognition

exemptions for lessees - leases of 'low-value' assets and

short-term leases. At the commencement date of a lease, lessees

recognise a liability relating to future lease payments (i.e., the

lease liability) and an asset representing the right to use the

underlying leased asset during the lease term (i.e., the

right-of-use asset). Lessees are required to separately recognise

the interest expense on the lease liability and the depreciation

expense on the right-of-use asset.

Lessees are also required to remeasure the lease liability upon

the occurrence of certain events such as a change in lease term or

in future lease payments resulting from a change in an index or

reference rate used to determine those payments. The lessee will

generally recognise the amount of the remeasurement of the lease

liability as an adjustment

to the right-of-use asset.

(a) Recognition of leases

Before the adoption of IFRS 16, lease costs were recognised as

expenses in the period of asset use. The Group has chosen to adopt

the fully retrospective approach and as such has restated prior

period results as if IFRS 16 had always been in place.

As a result, 2018 opening retained earnings decreased by USD

287,000 to reflect the impact of IFRS 16 in periods previous to 1

January 2018. A right-of-use asset of USD 2,092,000 was also

recognised together with associated aggregate lease liabilities of

USD 2,379,000 as at 1 January 2018.

H1 18 reported direct costs have decreased by USD 155,000, with

finance costs increasing by USD 213,000. H2 18 direct costs

decreased by USD 156,000, administrative expenses increased by USD

9,000 and finance costs increased by USD 234,000.

Property, plant and equipment has increased by USD 2,005,000 in

H1 18 and USD 2,229,000 in H2 18, with lease liabilities increasing

by USD 2,350,000 and USD 2,643,000 respectively.

On the Statement of Cashflows, net cash flows from operating

activities increased by USD 242,000 in H1 18 and USD 278,000 in H2

18, with net cash flows from financing activities decreasing by USD

242,000 and USD 278,000 respectively.

The Group has chosen to take advantage of the exemptions for

leases of 'low-value' assets and short-term leases. Rental expense

relating to these leases will continue to be fully recognised in

direct costs and administrative expenses.

6 PROPERTY, PLANT AND EQUIPMENT

Machinery,

motor

vehicles,

Land and furniture Leasehold

and

buildings equipment improvements Total

USD'000 USD'000 USD'000 USD'000

Cost:

At 1 January 2019 restated* 12,419 10,515 451 23,385

Additions 1,981 3,700 19 5,700

Acquired on business combination - 31 - 31

Disposals (241) (594) - (835)

---------------- ---------------- ---------------- ----------------

At 30 June 2019 14,159 13,652 470 28,281

---------------- ---------------- ---------------- ----------------

Depreciation:

At 1 January 2019 restated* 1,473 3,233 55 4,761

Charge for the period 383 708 33 1,124

Relating to disposals (19) (440) - (459)

---------------- ---------------- ---------------- ----------------

At 30 June 2019 1,837 3,501 88 5,426

---------------- ---------------- ---------------- ----------------

Net carrying amount:

At 30 June 2019 12,322 10,151 382 22,855

Machinery,

motor

vehicles,

Land and furniture Leasehold

and

buildings equipment improvements Total

USD'000 USD'000 USD'000 USD'000

Cost:

At 1 July 2018 restated* 9,628 6,902 148 16,678

Additions restated* 2,904 3,655 303 6,862

Disposals (113) (42) - (155)

---------------- ---------------- ---------------- ----------------

At 31 December 2018 restated* 12,419 10,515 451 23,385

---------------- ---------------- ---------------- ----------------

Depreciation:

At 1 July 2018 restated* 1,177 2,695 32 3,904

Charge for the periodrestated* 298 555 23 876

Relating to disposals (2) (17) - (19)

---------------- ---------------- ---------------- ----------------

At 31 December 2018 restated* 1,473 3,233 55 4,761

---------------- ---------------- ---------------- ----------------

Net carrying amount:

At 31 December 2018 restated* 10,946 7,282 396 18,624

Machinery,

motor

vehicles,

Land and furniture Leasehold

and

buildings equipment improvements Total

USD'000 USD'000 USD'000 USD'000

Cost:

At 1 January 2018 restated* 8,488 6,010 126 14,624

Additions 1,123 1,013 22 2,158

Acquired on business combination 17 52 - 69

Disposals - (173) - (173)

---------------- ---------------- ---------------- ----------------

At 30 June 2018 restated* 9,628 6,902 148 16,678

---------------- ---------------- ---------------- ----------------

Depreciation:

At 1 January 2018 restated* 945 2,391 26 3,362

Charge for the period restated* 232 396 6 634

Relating to disposals - (92) - (92)

---------------- ---------------- ---------------- ----------------

At 30 June 2018 restated* 1,177 2,695 32 3,904

---------------- ---------------- ---------------- ----------------

Net carrying amount:

At 30 June 2018 restated* 8,451 4,207 116 12,774

*Balances have been restated to reflect the impact of IFRS 16.

See note 5 for details.

Included in the carrying amount of land and buildings at 30 June

2019 are right-of-use assets of USD 2,110,000 (H2 18: USD

2,229,000, H1 18: USD 2,005,000) on which depreciation was charged

of USD 119,000 (H2 18: USD 113,000, H1 18: USD 87,000).

7 CASH AND CASH EQUIVALENTS

Cash and cash equivalents in the consolidated statement of

financial position comprised of cash at bank of USD 25,830,000 (H2

18: USD 27,804,000, H1 18: USD 29,271,000). Of the total balance of

cash and cash equivalents, USD 3,193,000 (H2 18: USD 1,719,000, H1

18: USD 2,000,000) represents restricted cash.

The balance of restricted cash held by the Group at 30 June 2019

and 31 December 2018 relates to cash held in Group bank accounts

which cannot be withdrawn on demand. The balance of restricted cash

held by the Group at 30 June 2018 relates to cash margin provided

to a commercial bank against the issuance of a guarantee to a

subsidiary. Due to the respective terms, restricted cash is

considered to be liquid.

8 APPROVAL OF INTERIM FINANCIAL STATEMENTS

The condensed interim financial statements were approved by the

board of directors on 09 September 2019.

INDEPENT REVIEW REPORT TO RA INTERNATIONAL GROUP PLC

Introduction

We have been engaged by the Company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 30 June 2019 which comprises the Interim Condensed

Consolidated Statement of Financial Position, the Interim Condensed

Consolidated Income Statement, the Interim Condensed Consolidated

Statement of Comprehensive Income, the Interim Condensed

Consolidated Statement of Changes in Equity, the Interim Condensed

Consolidated Statement of Cash Flows and related notes 1 to 8. We

have read the other information contained in the half yearly

financial report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the condensed set of financial statements.

This report is made solely to the company in accordance with

guidance contained in International Standard on Review Engagements

2410 (UK and Ireland) "Review of Interim Financial Information

Performed by the Independent Auditor of the Entity" issued by the

Auditing Practices Board. To the fullest extent permitted by law,

we do not accept or assume responsibility to anyone other than the

company, for our work, for this report, or for the conclusions we

have formed.

Directors' Responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the Disclosure Guidance and Transparency Rules of the United

Kingdom's Financial Conduct Authority.

As disclosed in note 1, the annual financial statements of the

group are prepared in accordance with IFRSs as adopted by the

European Union. The condensed set of financial statements included

in this half-yearly financial report has been prepared in

accordance with International Accounting Standard 34, "Interim

Financial Reporting", as adopted by the European Union.

Our Responsibility

Our responsibility is to express to the Company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

Scope of Review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity" issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK) and consequently does not enable us to obtain

assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

June 2019 is not prepared, in all material respects, in accordance

with International Accounting Standard 34 as adopted by the

European Union and the Disclosure Guidance and Transparency Rules

of the United Kingdom's Financial Conduct Authority.

Ernst & Young LLP

Edinburgh

11 September 2019

Notes:

1. The maintenance and integrity of the RA International Group

PLC website is the responsibility of the directors; the work

carried out by the auditors does not involve consideration of these

matters and, accordingly, the auditors accept no responsibility for

any changes that may have occurred to the financial statements

since they were initially presented on the website.

2. Legislation in the United Kingdom governing the preparation

and dissemination of financial statements may differ from

legislation in other jurisdictions.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR UGUUGBUPBPUB

(END) Dow Jones Newswires

September 10, 2019 02:01 ET (06:01 GMT)

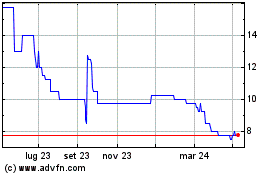

Grafico Azioni Ra (LSE:RAI)

Storico

Da Mar 2024 a Apr 2024

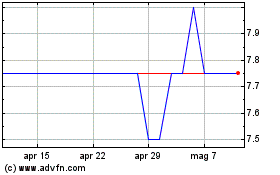

Grafico Azioni Ra (LSE:RAI)

Storico

Da Apr 2023 a Apr 2024