Red Mountain Capital Buys Yuma Energy Debt, Signs Letter of Intent for Restructuring

11 Settembre 2019 - 1:17AM

Dow Jones News

By Josh Beckerman

Yuma Energy Inc. (YUMA), which said in May 2018 that it would

explore strategic alternatives, said Red Mountain Capital Partners

bought the company's senior secured bank debt and has signed a

non-binding letter of intent for a potential restructuring

agreement.

Red Mountain bought about $35 million of bank debt and related

liabilities from Yuma's lending group, led by Societe Generale.

Yuma Energy shares rose 26% after hours to $2.31.

The oil and gas company said the move "is the first step toward

strengthening our capital base, improving our liquidity and

positioning the company to pursue growth opportunities."

The letter of intent calls for Red Mountain and Yuma to work

toward a restructuring approved by Yuma's board by Sept. 30, and

would include the exchange of senior secured debt for debt

convertible into newly issued Yuma common stock.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

September 10, 2019 19:02 ET (23:02 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

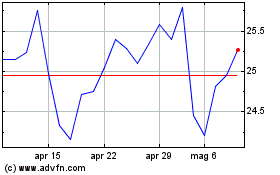

Grafico Azioni Societe Generale (EU:GLE)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Societe Generale (EU:GLE)

Storico

Da Apr 2023 a Apr 2024