TIDMSTCM

RNS Number : 0891M

Steppe Cement Limited

12 September 2019

Steppe Cement Ltd

Interim Results for the Half Year ended 30 June 2019

and General Market Update

1. Interim Results

Steppe Cement Ltd ("Steppe Cement" and "the Company") posted a

consolidated profit after tax of USD 3.1 million for the six months

ended 30 June 2019.

6 months 6 months % of change

ended ended

30 June 30 June

19 18

Sales (Tonnes) 780,315 738,228 6%

------------- ------------- ----------------

Consolidated turnover (KZT million) 14,079 10,539 34%

------------- ------------- ----------------

Consolidated turnover (USD Million) 37.1 32.8 13%

------------- ------------- ----------------

Consolidated profit after tax (USD Million) 3.1 0.2

------------- ------------- ----------------

Profit per share (Cents) 1.4 0.1

------------- ------------- ----------------

Average exchange rate (USD/KZT) 379 326 -16%

------------- ------------- ----------------

-- The Company continued to maintain prices from last summer

while taking advantage of the slight increase of volumes in the

first few months of 2019.

-- The average ex-factory price increased from 11,560 KZT /tonne

to 15,148 KZT /tonne or 31% during the period.

-- Steppe Cement's gross margin increased from 32% to 37% in USD terms.

-- Selling expenses decreased in USD terms but increased in KZT

by 12% on per tonne basis due to inflation in transport costs.

-- Administrative expenses were reduced by 3% in KZT.

-- The Kazakh Tenge depreciated by 16% compared to the first

half of 2018. However, the devaluation took part mostly in the

second half of 2018 and therefore the Company only booked foreign

exchange losses of USD 0.04 million in 1H 2019.

-- The Company generated operating profit before working capital

changes of USD 7.9 million in 1H 2019 against USD 5.3 million in

2018.

-- The Kazakhstan economy grew at 3.8% up to April 2019.

-- Reported inflation has been 5.5% up to the end of August 2019.

2. Production costs

-- Production costs increased by 17% in KZT mostly due to the

lower level of clinker production as both lines were stopped for

longer than usual annual maintenance in 1H 2019.

-- The volumes lost in 1H should be recovered in the second half

as less maintenance stops are planned.

3. Update on the Kazakh cement market

-- The Kazakh cement market decreased by 3% during the first

half of the year. Steppe Cement expects a market of about 8.4

million tonnes for the full year 2019, a 3% decrease compared to

2018.

-- Steppe Cement increased its local market share from 15.5% in

1H2018 to 17% in 1H2019. We expect to maintain or increase slightly

this share for the full year. Exports represented 13% of the

volumes in the 1H2019 similar to last year's.

-- Imports into Kazakhstan have remained stable at 0.34 million

tonnes in 2019 and they represent 8% of the market.

-- Exports from Kazakhstan have decreased slightly to 0.87

million tonnes from 0.92 million last year.

-- Exports from Kazakhstan represent 19% of local production.

-- Overall production of all factories in Kazakhstan has

decreased by 4% to 4.6 million tonnes for the 1H2019.

-- Currently 80% of production in the country is coming from dry

lines, an increase of 2% compared to last year's level.

4. Financing

The debt position of the company as of 30 June 2019 was USD10.7

million (USD 4.6 million current and USD 6.1 million long

term):

-- A long-term USD 5.1 million loan outstanding to Halyk Bank

for the purchase of the wagons and repayable monthly till November

2021 at 6.5% p.a. and secured with the pledge of the wagons.

-- A loan of KZT 1.178 billion with Halyk Bank JSC subsidised by

the government for capital investment at 6% p.a.

-- A loan of KZT 500 million with Halyk Bank JSC subsidised by

the government for working capital at 6% p.a.

-- We have maintained KZT3.9 billion of available working

capital lines from Halyk Bank, Altyn Bank and VTB Bank. The current

rates are 6% p.a. in USD and 13% p.a. in KZT respectively. As of 30

June 2019 we had the equivalent of USD 1.1 million outstanding from

these working capital loans.

At the same time we carried a balance of USD 10.8 million in

cash of which USD 8.3 million were subsequently used to pay a

dividend.

As of 31 August 2019, the total debt was USD 9 million (53% in

USD and the rest in KZT)

The total bank debt net of cash amounted to USD 5.1 million.

A pdf copy of the announcement and the full interim financial

statements is available on the company's website at

www.steppecement.com.

Steppe Cement's AIM nominated adviser and broker is RFC Ambrian

Limited.

Nominated Adviser: Contact Stephen Allen or Andrew Thomson at

+61 8 94802500.

Broker: Contact Charlie Cryer at +44 20 3440 6800

SUMMARY OF INTERIM FINANCIAL STATEMENTS

FOR THE PERIODED 30 JUNE 2019 (UNAUDITED)

(In United States Dollars)

The Notes to the Interim Financial Statements form an integral

part of the Condensed Financial Statements. Please visit the

Company's website at www.steppecement.com to view the full interim

financial statements.

STEPPE CEMENT LTD

(Incorporated in Labuan FT, Malaysia under the Labuan Companies

Act, 1990)

AND ITS SUBSIDIARY COMPANIES

CONDENSED CONSOLIDATED STATEMENT OF PROFIT AND LOSS

FOR THE PERIODED 30 JUNE 2019 (UNAUDITED)

The Group The Company

6 months ended 6 months ended

30 June 2019 30 June 2018 30 June 30 June 2018

2019

USD'000 USD'000 USD'000 USD'000

Revenue 37,122 32,838 629 50

Cost of sales (23,515) (22,114) - -

----------------- ----------------- ------------ -----------------

Gross profit 13,607 10,724 629 50

Selling expenses (6,584) (6,450) - -

General and administrative

expenses (2,380) (2,838) (147) (145)

----------------- ----------------- ------------ -----------------

Operating profit/(loss) 4,643 1,436 482 (95)

Interest income 147 15 ^ ^

Finance costs (554) (942) - -

Net foreign exchange

(loss)/gain (36) (500) 3 21

Other income, net 148 396 - -

----------------- ----------------- ------------ -----------------

Profit/(Loss) before

income tax 4,348 405 485 (74)

Income tax expense (1,266) (199) - (2)

----------------- ----------------- ------------ -----------------

Profit/(Loss) for the

period 3,082 206 485 (76)

================= ================= ============ =================

Attributable to:

Shareholders of the

Company 3,082 206 485 (76)

Profit per share:

Basic and diluted (cents) 1.4 0.1

================= =================

^ Insignificant amount.

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE PERIODED 30 JUNE 2019 (UNAUDITED)

The Group The Company

6 months ended 6 months ended

30 June 2019 30 June 2018 30 June 2019 30 June 2018

USD'000 USD'000 USD'000 USD'000

Profit/(Loss) for the

period 3,082 206 485 (76)

Other comprehensive

income/(loss):

Item that may be

reclassified

subsequently to profit

or loss

Exchange differences

arising on translation

of foreign subsidiary

companies 759 (1,756) - -

Total other comprehensive

income/(loss) for the

period 759 (1,756) - -

----------------- ----------------- ----------------- -----------------

Total comprehensive

income/(loss) for the

period 3,841 (1,550) 485 (76)

================= ================= ================= =================

Attributable to:

Shareholders of the

Company 3,841 (1,550) 485 (76)

================= ================= ================= =================

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2019 (UNAUDITED)

The Group The Company

Unaudited Audited Unaudited Audited

30 June 2019 31 Dec 2018 30 June 2019 31 Dec 2018

USD'000 USD'000 USD'000 USD'000

Assets

Non-Current Assets:

Property, plant

and equipment 52,733 54,612 - -

Investment in subsidiary

companies - - 26,500 26,500

Loan to subsidiary

company - - 30,160 30,170

Lease receivable 960 - - -

Advances and prepaid

expenses 291 191 - -

Other assets 2,247 2,203 - -

Total Non-Current

Assets 56,231 57,006 56,660 56.670

----------------- ---------------- ----------------- ----------------

Current Assets

Inventories 12,205 13,381 - -

Trade and other

receivables 4,393 3,500 9,308 8,884

Lease receivable 612 - - -

Income tax receivable 171 175 - -

Loans and advances

to subsidiary companies - - 9,671 9,634

Advances and prepaid

expenses 2,860 2,313 13 7

Cash and cash equivalents 10,777 5,720 83 23

Total Current Assets 31,018 25,089 19,075 18,548

----------------- ---------------- ----------------- ----------------

Total Assets 87,249 82,095 75,735 75,218

================= ================ ================= ================

The Group The Company

Unaudited Audited Unaudited Audited

30 June 2019 31 Dec 2018 30 June 31 Dec 2018

2019

USD'000 USD'000 USD'000 USD'000

Equity and Liabilities

Capital and Reserves

Share capital 73,761 73,761 73,761 73,761

Revaluation reserve 2,182 2,349 - -

Translation reserve (115,507) (116,266) - -

Retained earnings/

(Accumulated loss) 91,000 96,113 (7,478) 399

----------------- ---------------- -------------- ----------------

Total Equity 51,436 55,957 66,283 74,160

----------------- ---------------- -------------- ----------------

Non-Current Liabilities

Borrowings 6,084 6,607 - -

Deferred taxes 3,028 2,055 - -

Deferred income 1,610 1,629 - -

Provision for site

restoration 224 65 - -

Total Non-Current

Liabilities 10,946 10,356 - -

----------------- ---------------- -------------- ----------------

Current liabilities

Trade and other

payables 15,521 6,615 8,362 -

Accrued and other

liabilities 3,484 2,682 1,090 1,058

Borrowings 4,569 5,217 - -

Taxes payable 1,293 1,268 - -

Total Current Liabilities 24,867 15,782 9,452 1,058

----------------- ---------------- -------------- ----------------

Total Liabilities 35,813 26,138 9,452 1,058

----------------- ---------------- ----------------

Total Equity and

Liabilities 87,249 82,095 75,735 75,218

================= ================ ============== ================

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE PERIODED 30 JUNE 2019 (UNAUDITED)

Non-distributable Distributable

The Group Share Revaluation Translation Retained Total

capital reserve reserve earnings

USD'000 USD'000 USD'000 USD'000 USD'000

Balance as at

1 January

2019 73,761 2,349 (116,266) 96,113 55,957

------------- ---------------------- ---------------- ------------------ ------------

Profit for the

period - - - 3,082 3,082

Other

comprehensive

income - - 759 - 759

------------- ---------------------- ---------------- ------------------ ------------

Total

comprehensive

income for

the

period - - 759 3,082 3,841

Dividend

payable - - - (8,362) (8,362)

Transfer of

revaluation

reserve

relating

to the

depreciation

of property,

plant

and equipment

through use - (167) - 167 -

------------- ---------------------- ---------------- ------------------ ------------

Balance as at

30 June 2019 73,761 2,182 (115,507) 91,000 51,436

============= ====================== ================ ================== ============

Non-distributable Distributable

The Group Share Revaluation Translation Retained Total

capital reserve reserve earnings

USD'000 USD'000 USD'000 USD'000 USD'000

Balance as at

1 January

2018 73,761 2,680 (106,741) 89,817 59,517

------------- ---------------------- ---------------- ------------------ ------------

Profit for the

period - - - 206 206

Other

comprehensive

loss - - (1,756) - (1,756)

------------- ---------------------- ---------------- ------------------ ------------

Total

comprehensive

(loss)/income

for the

period - - (1,756) 206 (1,550)

Dividend

payable - - - (2,891) (2,891)

Transfer of

revaluation

reserve

relating

to the

depreciation

of property,

plant and

equipment

through use - (186) - 186 -

------------- ---------------------- ---------------- ------------------ ------------

Balance as at

30 June 2018 73,761 2,494 (108,497) 87,318 55,076

============= ====================== ================ ================== ============

The Company Share capital Accumulated Total

losses

USD'000 USD'000 USD'000

Balance as at 1 January 2019 73,761 399 74,160

Total comprehensive income for the

period - 485 485

Dividend payable - (8,362) (8,362)

------------------ ---------------- ------------

Balance as at 30 June 2019 73,761 (7,478) 66,283

================== ================ ============

Balance as at 1 January 2018 73,761 (5,275) 68,486

Total comprehensive loss for the

period - (76) (76)

Dividend payable - (2,891) (2,891)

------------------ ---------------- ------------

Balance as at 30 June 2018 73,761 (8,242) 65,519

================== ================ ============

CONDENSED CONSOLIDATED CASH FLOW STATEMENT

FOR THE PERIOD ENDED 30 JUNE 2019 (UNAUDITED)

The Group The Company

6 months ended 6 months ended

30 June 2019 30 June 30 June 2019 30 June

2018 2018

USD'000 USD'000 USD'000 USD'000

OPERATING ACTIVITIES

Profit/(Loss) before income

tax 4,348 405 485 (73)

Adjustments for non-cash

items 3,530 4,870 (631) (21)

----------------- ------------ ----------------- ------------

Operating Profit/(Loss)

Before Working Capital Changes 7,878 5,275 (146) (94)

(Increase)/ Decrease in:

Inventories 1,531 (1,309) - -

Trade and other receivables, (3,401) (2,169) (430) (12)

advances and prepaid expenses

Loans and advances from - - (27) -

subsidiary companies

Increase/(Decrease) in:

Trade and other payables, 1,517 4,038 34 45

accrued and other liabilities

Loans and advances to subsidiary

companies - - - 138

----------------- ------------ ----------------- ------------

Cash Generated From/(Used

In) Operations 7,525 5,835 (569) 77

Income tax paid (85) - - -

Interest paid (420) (947) - -

----------------- ------------ ----------------- ------------

Net Cash Generated From/(Used

In) Operating Activities 7,020 4,888 (569) 77

----------------- ------------ ----------------- ------------

INVESTING ACTIVITIES

Purchase of property, plant

and equipment (844) (2,437) - -

Purchase of other assets (29) (28) - -

Interest received 147 15 629 -

----------------- ------------ ----------------- ------------

Net Cash Used In Investing

Activities (726) (2,450) 629 -

----------------- ------------ ----------------- ------------

FINANCING ACTIVITIES

Proceeds from borrowings 4,515 7,253 - -

Repayment from borrowings (5,805) (9,013) - -

----------------- ------------ ----------------- ------------

Net Cash Used In Financing

Activities (1,290) (1,760) - -

----------------- ------------ ----------------- ------------

NET INCREASE IN CASH AND

CASH EQUIVALENTS 5,004 678 60 77

EFFECTS OF FOREIGN EXCHANGE

RATE CHANGES 54 (69) - -

CASH AND CASH EQUIVALENTS

AT BEGINNING OF THE PERIOD 5,719 3,045 23 13

----------------- ------------ ----------------- ------------

CASH AND CASH EQUIVALENTS

AT END OF THE PERIOD 10,777 3,654 83 90

================= ============ ================= ============

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR EALNAFFDNEEF

(END) Dow Jones Newswires

September 12, 2019 02:00 ET (06:00 GMT)

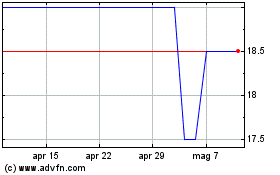

Grafico Azioni Steppe Cement (LSE:STCM)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Steppe Cement (LSE:STCM)

Storico

Da Apr 2023 a Apr 2024