Current Report Filing (8-k)

12 Settembre 2019 - 11:19PM

Edgar (US Regulatory)

0000910329

false

0000910329

2019-09-11

2019-09-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 12, 2019

MEDIFAST, INC.

(Exact name of registrant as specified in

its charter)

|

Delaware

(State or other

jurisdiction of incorporation)

|

001-31573

(Commission

File Number)

|

13-3714405

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

100 International Drive, Baltimore, Maryland 21202

|

|

(Address of Principal Executive Offices) (Zip Code)

|

|

|

|

Registrant's telephone number, including area code:(410) 581-8042

|

|

|

|

N/A

(Former Name or Former Address, if Changed

Since Last Report)

|

Securities registered pursuant to Section

12(b) of the Act:

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

MED

|

New York Stock Exchange

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange

Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

¨

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

¨

|

Item 5.02 Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(e) Compensatory Arrangements with Certain Officers.

Executive Severance Plan.

On September 12, 2019, the Board of Directors

(the “Board”) of Medifast, Inc. (the “Company”) and the Compensation Committee of the Board approved

severance payments and benefits for executive officers, which are to be reflected in an executive severance plan (the

“Plan”). The Plan is designed to provide incentives for eligible persons to exert maximum efforts for the

Company’s success, and to retain those persons, even in the face of a potential Change in Control (as defined in the

Plan). The Plan applies to the CEO and certain other executives who are direct reports to the CEO including William Baker,

IV, and Nicholas Johnson, as executive officers of the Company.

The Plan provides certain payments and benefits to participants

upon a termination by the Company without cause or a termination by the participant with good reason, each as defined in the Plan.

Upon a qualifying termination that is prior to or more than two years following a Change in Control (as defined in the Plan) of

the Company, and subject to the participant’s execution of a release of claims, the participant will be entitled to the following:

|

|

·

|

A cash payment equal to one times (1.5 times for the CEO) the sum of the participant’s annual base salary and the participant’s

target bonus, paid in a lump sum no later than 30 days following termination;

|

|

|

·

|

All stock options held by the participant as of the date of separation which are not already vested and exercisable will become

vested and will be exercisable for ninety days following the date of separation;

|

|

|

·

|

All unvested restricted shares, deferred shares, or restricted stock units (RSUs) held by the participant as of the date of

separation which are subject solely to time-vesting requirements will accelerate and vest on a pro rata basis based on the number

of months during the vesting period that the participant remained employed;

|

|

|

·

|

All unvested/unearned performance share units (PSUs) will vest on a pro-rata basis, based on the number of months during the

performance period that the participant remained employed, and will be paid out at the end of the performance period based on the

actual achievement of the performance factors.

|

Upon a qualifying termination that is during the two years following

a Change in Control (as defined in the Plan) of the Company, and subject to the participant’s execution of a release of claims,

the participant will be entitled to the following:

|

|

·

|

A cash payment equal to 1.5 times (2.5 times for the CEO) the sum of the participant’s annual base salary and the participant’s

target bonus, paid in a lump sum no later than 30 days following termination;

|

|

|

·

|

All stock options held by the participant as of the date of separation which are not already vested and exercisable will become

vested and will be exercisable for ninety days following the date of separation;

|

|

|

·

|

All unvested restricted shares, deferred shares, or RSUs held by the participant as of the date of separation which are subject

solely to time-vesting requirements will accelerate and vest;

|

|

|

·

|

All unvested/unearned PSUs will vest on a pro-rata basis, based on the number of months during the performance period that

the participant remained employed, and will be paid within 30 days following termination based on the target performance level.

|

Also in connection with the adoption of the Plan, Mr. Chard

entered into an amendment to his employment letter agreement dated October 3, 2016 providing that provisions of the agreement that

would provide payments or benefits upon termination of employment will be deleted and all severance payments and benefits will

be governed by the Plan.

Item

8.01. Other Events.

On September 12, 2019, the Company

issued a press release announcing the declaration of a cash dividend by the Board.

The full text of the press release is attached as Exhibit 99.1 to this Form 8-K and is incorporated herein by reference.

Item

9.01. Financial Statements and Exhibits.

Signature

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

MEDIFAST, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Timothy Robinson

|

|

|

|

Timothy Robinson

Chief Financial Officer

|

|

|

|

|

Dated: September 12, 2019

|

|

|

|

|

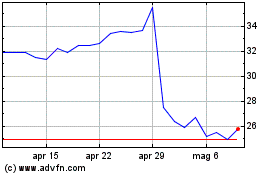

Grafico Azioni Medifast (NYSE:MED)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Medifast (NYSE:MED)

Storico

Da Apr 2023 a Apr 2024