Pound Slides As U.K. Inflation Slows To 32-Month Low, Brexit Worries Flare Up

18 Settembre 2019 - 8:47AM

RTTF2

The pound depreciated against its major counterparts in the

European session on Wednesday, as U.K. consumer price inflation

eased to a 32-month low in August and Brexit uncertainty

intensified after European president Jean-Claude Juncker cautioned

that the risk of a no-deal Brexit was palpable.

Data from the Office for National Statistics showed that

consumer price inflation eased to 1.7 percent from 2.1 percent in

July. The rate was forecast to ease moderately to 1.9 percent.

This was the lowest rate since December 2016 and well below the

central bank's 2 percent target.

On a monthly basis, consumer prices gained 0.4 percent in

August, slightly slower than the expected 0.5 percent.

Core inflation that exclude prices of energy, food, alcoholic

beverages and tobacco, slowed to 1.5 percent from 1.9 percent in

July.

Another report from ONS showed that input prices declined for

the first time since mid 2016 on crude prices. Input prices

declined 0.8 percent on year in contrast to a 0.9 percent rise in

July.

On a monthly basis, input prices dropped 0.1 percent reversing

July's 0.6 percent increase.

Output price inflation eased to 1.6 percent from 1.9 percent a

month ago.

Month-on-month, input prices dropped 0.1 percent after rising

0.3 percent in July.

Separately, the ONS said average house prices increased 0.7

percent in July, the lowest annual rate since September 2012.

Prices had increased 1.4 percent in June.

On a monthly basis, average house prices decreased 0.3 percent

in July.

Speaking to the European Parliament, Juncker said that no real

progress in Brexit talks had been made, as the U.K. had not

negotiated on an alternative plan to the backstop.

Michel Barnier, the European Union's chief negotiator, said that

the UK "should not pretend to be negotiating" a Brexit deal with

the EU.

Even if the UK is leaving the EU without a deal, the problems at

the core of the Brexit talks would be resolved.

The currency held steady against its major counterparts in the

Asian session, excepting the euro.

The pound declined to 1.2439 against the greenback, following an

advance to 1.2506 at 8:00 pm ET. The pound is poised to challenge

support around the 1.22 mark.

After an uptick to 1.2420 against the Swiss franc at 3:30 am ET,

the pound pulled back to 1.2376. The pound is seen finding support

around the 1.20 mark.

The pound depreciated to 134.60 against the yen, after having

climbed to 135.24 at 11:00 pm ET. The pound is likely to challenge

support around the 130.5 region, if it drops again.

Data from the Ministry of Finance showed that Japan posted a

merchandise trade deficit of 136.329 billion yen in August.

That beat forecasts for a shortfall of 365.4 billion yen

following the 250.7 billion yen deficit in July.

The U.K. currency dropped to 0.8881 against the euro, from a

high of 0.8851 recorded at 5:45 pm ET. Next key support for the

pound is possibly seen around the 0.90 level.

Data from the Eurostat showed that Eurozone inflation was stable

in August at its lowest level in nearly three years.

Headline inflation was 1 percent in August, the same as in July.

The rate was the lowest since November 2016.

Looking ahead, Canada consumer price index and U.S. housing

starts and building permits, all for August, are scheduled for

release in the New York session.

At 2:00 pm ET, the Fed announces its decision on interest rates.

Economists widely expect the Fed to cut federal funds rate to

between 1.75 percent and 2.00 percent.

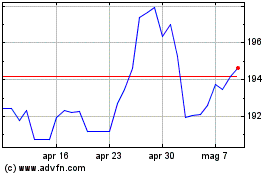

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Mar 2024 a Apr 2024

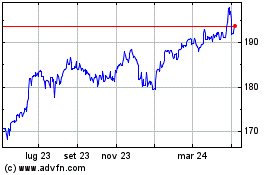

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Apr 2023 a Apr 2024