Johnson Matthey PLC Johnson Matthey Capital Markets Day (8779M)

19 Settembre 2019 - 8:01AM

UK Regulatory

TIDMJMAT

RNS Number : 8779M

Johnson Matthey PLC

19 September 2019

Johnson Matthey Capital Markets Day - delivering sustainable

growth and value

Today, Johnson Matthey will hold a Capital Markets Day in which it will

provide an update on its strategy for sustained growth and value creation,

at a group level and across its sectors. This growth is underpinned by

use of our world class science to address challenges posed by fundamental

global trends including climate change, energy transition, population

and longevity and resource challenges. Johnson Matthey has leading positions

in high margin, technology driven growth markets and the company expects

to deliver attractive and sustainable growth and returns over the medium

term:

-- Delivering mid to high single digit EPS CAGR

-- Expanding group ROIC to 20%, and

-- Continuing a progressive dividend

Clean Air: sustained growth for the next decade

Our Clean Air business will deliver mid single digit growth in operating

performance to 2025 and sustained growth for the next decade. In the

early years, we expect good growth as we start to see benefits from new

legislation in Asia and tighter legislation in Europe. Over the medium

term, we expect growth to accelerate with the full benefits of the new

legislation in China and India coming through, which will more than double

the size of our Asian business. In the longer term, growth is expected

to moderate assuming penetration of pure battery electric vehicles increases

substantially.

Efficient Natural Resources: growth accelerating and guidance upgraded

In Efficient Natural resources, we have undergone a period of restructuring,

reorganisation and investment in R&D which has improved efficiency and

built the platform for growth. These changes and the commercialisation

of new technologies as we move into adjacent areas will drive higher

growth for the overall sector. This gives us confidence in upgrading

our financial guidance, to deliver mid to high single digit growth in

operating performance to 2025.

Health: platform built for breakout growth, passed the point of inflection

We have made strong progress on operational improvements in Health and

our increased investment has built a deeper and broader pipeline of new

products. The business has now passed the inflection point and we are

confident of delivering breakout growth with an additional GBP100m of

operating profit from our generic and innovator pipeline by 2025.

New Markets: strong progress in Battery Materials

In New Markets, we are focused on Battery Materials and have made strong

progress to commercialise eLNO(R) , our portfolio of next generation,

ultra-high energy density cathode materials. Customer feedback from testing

remains positive, in particular our ability to provide customised solutions

and we have now moved to full cell testing with two customers. We expect

our first commercial plant to be on stream in 2022 and to be supplying

platforms in production in 2024. Our total investment when we have commercial

production from our plant will amount to circa GBP350m.

Efficiencies remain a strong focus

We remain focused on building a more efficient business to strengthen

our platform for growth and increase our agility. Today we commit to

a further GBP40m in procurement savings over three years beginning 2020/21,

giving total group savings announced of GBP145m since 2017/18. Of the

additional GBP40m, two thirds will benefit the income statement and at

least half will be reinvested.

Expanding return on invested capital to 20%

In order to deliver sustainable growth and value creation across the

group and our sectors, we are investing in a number of strategic growth

projects. The growth capex comprises spend on our new Clean Air plants

in Poland, China and India, the commercialisation of eLNO, modernisation

of our refineries in Efficient Natural Resources and upgrades to our

IT systems. In future, maintenance capex will continue to be c.0.8-0.9x

depreciation and we will further invest in strategic projects if they

meet our disciplined investment criteria.

We continue to have a disciplined approach to our working capital position.

We are targeting an improvement in non precious metal working capital

to 50 days over the medium term, and expect to deliver GBP350m of savings

in precious metal working capital, comprising GBP250m in backlog reduction

and a further GBP100m of refinery efficiencies.

Over the medium term, these investments and the growth and efficiency

they will generate give us confidence in expanding our ROIC to 20%.

Outlook unchanged for first half and full year 2019/20

Our group guidance, at constant rates, for the first half and the year

ended 31(st) March 2020 remains unchanged. We expect growth in operating

performance at constant rates to be within our medium term guidance of

mid to high single digit growth.

-- In terms of phasing, we expect performance to be more heavily weighted

to the second half

-- By sector, Clean Air performance is expected to be slightly below the

prior year. This is expected to be compensated by better performance

in Efficient Natural Resources driven by actions taken to improve efficiency,

and other ongoing efficiencies across the group

We continue to expect capex of up to GBP500m in the fiscal year 2019/20.

At current foreign exchange rates (GBP:$ 1.218, GBP:EUR 1.104, GBP:RMB

8.71) translational foreign exchange movements for the year ending 31(st)

March 2020 are expected to benefit sales by GBP128 million and underlying

operating profit by GBP21 million.

Commenting on the capital markets day, Robert MacLeod, Chief Executive

said:

"Everything we do at Johnson Matthey is about helping to create a world

that is cleaner and healthier. We apply our world class science to address

key global challenges, solving our customers' most challenging and increasingly

complex problems. We are delivering on our strategy and will continue

to execute with determination. As the world changes ever faster, we are

increasingly excited by the significant opportunities we see for sustained

growth and value creation."

Ends

Enquiries:

Investor Relations Director of Investor Relations 020 7269 8241

Martin Dunwoodie Senior Investor Relations Manager 020 7269 8235

Louise Curran Investor Relations Manager 020 7269 8242

Jane Crosby

Media 020 7269 8407

Sally Jones Director of Corporate Relations 020 7353 4200

David Allchurch Tulchan Communications

Note:

1. eLNO is a trade mark of Johnson Matthey Public Limited Company

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCLLFEDASITLIA

(END) Dow Jones Newswires

September 19, 2019 02:01 ET (06:01 GMT)

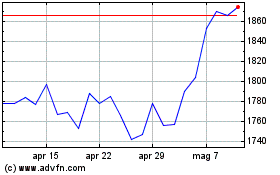

Grafico Azioni Johnson Matthey (LSE:JMAT)

Storico

Da Mar 2024 a Apr 2024

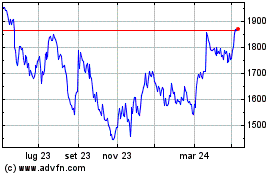

Grafico Azioni Johnson Matthey (LSE:JMAT)

Storico

Da Apr 2023 a Apr 2024