TIDMVLG

RNS Number : 0377N

Venture Life Group PLC

20 September 2019

This announcement replaces RNS number 8813M issued on 19

September 2019, correcting note 4.1. All other information in the

announcement remains unchanged.

19 September 2019

VENTURE LIFE GROUP PLC

("Venture Life" or the "Group")

Unaudited interim results for the six months ended 30 June

2019

Venture Life Group plc (AIM: VLG), a leader in developing,

manufacturing and commercialising products for the self-care

market, presents its unaudited interim results for the six months

ended 30 June 2019.

Financial highlights:

-- Revenues increased 14% to GBP9.4 million (H1 2018: GBP8.3 million)

-- Gross profit increased 18% to GBP3.5 million (H1 2018: GBP3.0 million)

-- Gross profit margin percentage increased to 37.3% (H1 2018: 36.0%)

-- Increased investment in Dentyl marketing and new medical devices

-- Adjusted EBITDA increased 5.5% to GBP0.7 million (H1 2018: GBP0.7 million)

-- Profit before tax, amortisation and exceptional items

increased to GBP0.3 million (H1 2018: GBP0.1 million)

-- Adjusted profit per share[1] of 0.04p (H1 2018: adjusted loss of 0.3p)

-- Net cash generated from operating activities of GBP1.3 million (H1 2018: GBP0.2 million)

-- Cash at period end of GBP10.9 million (31 December 2018: GBP9.6 million)

Commercial highlights:

-- Lloyds Pharmacy to launch Dentyl in the UK

-- Increased distribution of Dentyl in Superdrug

-- BB Mints launch into Morrisons

-- Launch of UltraDEX in ASDA grocery chain and Well Pharmacy,

the 3(rd) largest pharmacy chain in the UK, behind Boots and

Lloyds

-- UltraDEX Whitening mouth rinse launched in Superdrug

-- UltraDEX and Dentyl marketing campaigns launched to UK consumers

-- 4 long-term development and manufacturing agreements completed

-- 7 new international partnering agreements signed, including Dentyl line extensions in China

-- VLG's products launched with 11 international partners in H1 2019

Post-period end highlights:

-- Long-term international agreement signed on Dentyl in France

-- Venture Life Group plc was once again included in the 'London

Stock Exchange's 1000 Companies to Inspire Britain 2019' list, for

the fourth consecutive year

[1]Adjusted profit per share is loss after tax excluding

amortisation, exceptional items and share-based payments.

Jerry Randall, Chief Executive Officer of Venture Life,

commented: "In the first half of 2019 we saw revenue growth of 14%

with strong cash generation from operating activities of GBP1.3

million. Despite a challenging trading environment, I am pleased

with the Group's continued commercial progress, particularly the

seven new international partnering agreements signed, which further

expand the Venture Life footprint and reach. These agreements

include increased distribution of the Dentyl range in China as well

as the launch of UltraDEX in ASDA and Well Pharmacy, and the launch

of Dentyl into Lloyds Pharmacy in the UK. Traditionally, we enjoy a

stronger second half and, with a very healthy order book, we expect

that to be the case this year.

Meanwhile, our development and manufacturing business has made

positive headway in the first half of 2019. Revenues grew 10% to

GBP6.6 million with four long-term agreements completed.

As the UK moves closer towards a possible Brexit at the end of

October, we have undertaken significant mitigation planning against

associated risk and remain well-prepared to manage possible

disruptions to the business, including ensuring there is adequate

UK stock and good short-term supply. Despite the challenges,

Venture Life has a strong pipeline ahead and we approach the future

with confidence."

For further information, please contact:

Venture Life Group PLC

Jerry Randall, Chief Executive Officer +44 (0) 1344 578004

Andrew Waters, Chief Financial Officer

Cenkos Securities Ltd (Nomad and Broker) +44 (0) 20 7397 8900

Stephen Keys / Cameron MacRichie (Corporate Finance)

Russell Kerr / Michael Johnson (Sales)

Alma PR +44 (0) 203 405 0208

Helena Bogle/ Hilary Buchanan / Jessica Joynson venturelife@almapr.co.uk

Non-Executive Chair's and Chief Executive Officer's

Statement

Overview

The Group is pleased to report significant progress across all

areas of the business. In the first half of 2019, revenues grew by

14% to GBP9.4 million (H1 2018: GBP8.3 million), with improvements

in EBITDA, profit before tax and profit after tax. Significantly,

there has been strong cash generation from operating activities of

GBP1.3 million (H1 2018: GBP0.2 million).

Revenues for the Venture Life brands business were GBP2.8

million, a 22% increase on the first half of 2018, while revenues

from the Development and Manufacturing business, where we develop

and manufacture products on behalf of third parties, grew 10% to

GBP6.6 million. The growth in the Venture Life brands revenue has

been driven by the impact of full year revenues from the Dentyl

brand, which was acquired by the Group in August 2018. The

increased revenue growth, combined with our current product

offering, has also improved the gross profit margin, which rose to

37.3%, up from 36.0% in the first half of 2018. Increased

investment in Dentyl marketing and higher investment in product

assets for the new medical device regulations offset this increased

gross margin, along with some one-off costs incurred within the

period.

Revenues in the first half were ahead of last year, although

they have been lower than anticipated, primarily due to delayed

orders from two of our Chinese partners, as referenced in our 2018

Full Year Results, which did not generate any revenue during the

period, due to specific market reasons. Our Chinese partner for

Dentyl experienced some product packaging issues in the first half

of 2019 that affected its sell-through, and consequently delayed

new orders from Venture Life. However, we are pleased to report

that these issues have been resolved, sell out in China has

resumed. Additionally, we have signed new agreements with this

partner on Dentyl Toothpaste and Dentyl Fresh Breath Beads

(formally BB Mints), the latter of which will start contributing

revenue in the second half of 2019 and we expect them to continue

to be important contributors to our revenues and profitability

going forward.

Our Chinese partner for Lubatti bought a significant amount of

stock in H1 2018 (GBP0.6 million); whilst there were no orders in

H1 2019, we are beginning to see new orders come through and there

is further commitment to the brand as we move into H2 and beyond.

For some of their key brands, there has been a strategic shift from

off line to online stores exclusively, as footfall declines and the

rise in online sales has an ever greater impact; Lubatti is one of

these brands and is responding well to this new approach.

Even after taking account of these challenges, the Group had

strong cash generation in the first half and, consistent with prior

years, has a strong order book (35% higher than at the same point

last year), meaning that we expect to see second half revenues

significantly higher than those in the first half.

To ensure our product supply to the UK market remains

uninterrupted, we prepared ourselves for a possible Brexit impact

in March 2019, which entailed minor cost. We are preparing for a

similar situation in October 2019, chiefly by ensuring that there

is adequate stock in the UK and that our international

manufacturers are able to continue supply in the short term. In the

longer term, with a major part of the Group's operations based in

Italy and distributing to multiple countries, we believe the

operational impact of Brexit will be limited. Even with the

pressurised sales environment of the UK grocery and high street

retailers, we are pleased our UK brands continue to have robust

sales and hold their position.

Following on from the 2018 fundraise, we continue to review

strategic M&A opportunities. During the period we considered an

opportunity for a potentially transformational transaction for the

Group in terms of size and scope. As shareholders would expect, we

conducted extensive due diligence which, on this occasion, led us

to ultimately decide not to proceed with this transaction, with

there being an exceptional cost of GBP90,000. We will update

shareholders on any future opportunities as appropriate.

Venture Life Brands

The Venture Life brands business revenues for the first half of

2019 were GBP2.8 million, a 22% increase on first half of 2018. Of

this, GBP2.4 million came from UltraDEX and Dentyl in the UK, with

the remainder from international sales.

The two largest Venture Life brands are our oral care products -

UltraDEX and Dentyl, which are mainly sold in the UK.

UK - UltraDEX

UltraDEX revenues for the first half were GBP1.3 million (H1

2018: GBP1.4 million), outperforming the oral market generally,

which, whilst still declining, is expected to do so at slower rate

in 2019. We believe that UltraDEX's out-performance is a result of

loyal customer retention, a premium, well-developed product and our

efforts to obtain new listings for the product. Whilst the wider

market conditions in the UK are expected to remain challenging,

taking these strengths together, we expect to outperform the UK

mouthwash market again in 2019.

Confirmation was received in H1 2019 that UltraDEX (both rinse

and spray) will launch in ASDA from September onwards, in addition

to Well Pharmacy, the third largest pharmacy chain in the UK.

Superdrug has also confirmed they will launch UltraDEX Spray both

on and off-shelf as well as launch UltraDEX Whitening. We believe

these developments further demonstrate the strength of our

brands.

As well as there being many reasons to be satisfied with the

brands performance, this has to be balanced with one de-list of the

brand in one of our smaller grocer distributors and no repeat of

the new product pipe fill seen last year. With the oral care sector

under pressure, it has been difficult to gain new users into the

new products in the consumer setting, and the One-Go and Fresh

Breath Kit will be delisted from two of the larger pharmacy

distributors from July 2019. Management have been quick to identify

better opportunities and the Fresh Breath Kit will instead be

positioned towards the dental channel, as this presents a practical

solution for dental practitioners and patients alike.

It is pleasing to report that Alliance (the wholesale arm of

Walgreens Boots Alliance) will launch UltraDEX Whitening later in

2019. There are also a number of initiatives in place for the

remainder of the year that we anticipate will positively impact H2

2019. The new UltraDEX marketing campaign began towards the end of

the period, with a focus on sampling to drive trial and purchase,

and initiatives for increasing brand awareness via social media.

Further marketing initiatives are planned for H2 2019.

UK - Dentyl

Dentyl revenues were GBP1.1 million in the first half of 2019,

in line with management's expectations. The impact of order

patterns before we acquired the brand acquisition and legacy

delists/one-offs seen in 2018 prior to the acquisition continued to

affect the business in the first half and are expected to continue

throughout 2019. However, we have seen some positive gains in the

UK market; a key pharmacy retailer increased distribution of Dentyl

in H1 2019 and ASDA increased distribution of the Dentyl Fresh

Clove during H1 2019. Additionally, Morrisons launched BB Mints and

AAH, a pharmacy wholesaler, agreed to list both Dentyl and BB Mints

- with the latter paving the way for Dentyl to be launched in

pharmacies. Furthermore, Lloyds pharmacy also launched Dentyl

Smooth Mint and will promote Dentyl Fresh Clove in store also.

International

The International Brands business delivered revenues of GBP0.5m

during the period (H1 2019: GBP0.9m), with the decline mainly due

to the lack of orders from our Chinese partner for Lubatti, as

mentioned.

With the acquisition of Dentyl in August 2018, we also acquired

a new partner in China. As previously announced, there have been

some issues with product packaging, which have now been resolved.

This has however impacted the promotion of Dentyl in China during

H1 2019, and the partner is now rebuilding momentum through a fresh

marketing approach. We expect orders of Dentyl mouthwash to resume

by the end of the year or early next year. We are pleased to report

that we have strengthened our relationship with our key partner and

new agreements were signed on Dentyl Fresh Breath Beads (previously

BB Mints) and Dentyl Toothpaste (to launch in 2020). We expect

further newsflow from this partner as we move into the second half

of the year.

We have a strong order book for H2 2019, with seven new

long-term distribution agreements having been signed in H1 2019,

and one post-period end, which will have a positive impact on H2

2019 and beyond. Our first significant deal on Dentyl was signed in

France with our existing partner La Brosse et Dupont, that will

launch Dentyl into the mass market in Q1 2020. Dentyl is now

present in eight markets and interest remains strong.

Customer Brands

Development and Manufacturing

Our Development and Manufacturing business (Biokosmes) in Italy

services both our own Venture Life brands as well as our customer

brands. We continue to increase output through the plant, which in

turn will utilise the operational leverage we have and deliver

increased profitability to the business.

The revenues for the customer brands business grew 10% to GBP6.6

million in the first half of 2019, with growth coming from existing

partners and new partners. Some of the highlights include:

-- A range of new products developed for Menarini in 2018,

launched in Italy in 2019. These products will begin to be launched

internationally, including Asia, and we are expecting to see

growing revenues from this partner.

-- A new long-term agreement signed with Athena Cosmetics

Corporation in the US, to manufacture two products. First

production will commence from August 2019 and a second

manufacturing order is expected before the end of 2019.

-- A new long-term agreement has been signed with AlfaSigma in

Italy, to develop and manufacture a new product. Development is due

to finish in October 2019, with first production confirmed by the

end of 2019.

-- A manufacturing order to produce a new product to be sold by

Italfarmaco in Chile, with potential to expand to further

international markets.

-- Development and production of a new product for B3Glam, Italy, to be sold in the US.

-- Development has commenced for Logus Pharma in Italy, to produce a Medical Device.

-- A new long-term agreement with Italian pharmaceutical company

Giellepi S.P.A, to develop and manufacture a new Medical Device by

the end of 2019.

In addition, we have developed a new medical device -

DermaRisOn(R) which helps to restore the skin barrier and to

prevent and treat various dermatitis, irritations and skin

inflammations. We are now promoting this product to pharmaceutical

partners in the international business arena.

Our Development and Manufacturing business has built an

excellent reputation within our industry for the development and

manufacture of products for sale globally, validated by the

approvals from regulatory authorities in many markets. This

regulatory expertise allows Venture Life and our customers to

develop new products with the assurance that these can be sold in

the major global markets.

The recent changes in the regulatory rules for medical devices

also represent a significant opportunity for Venture Life. It is

obligatory for customers to undertake a review of their medical

devices in order to ensure they comply with new regulations. We are

undertaking these reviews both for our own products and customers'

products, which will enhance the value for our business in the

future and we are investing heavily in 2019 in order to maximise

this opportunity. We believe that this new compliance will secure

significant future revenues for the Group.

In addition we have invested in the facility's product labeling

capabilities. We have implemented procedures, machinery and

internal skills to be aligned with new UDI (unique device

identification) labeling requirements, to ensure we offer the

highest level of manufacturing expected by customers. The first UDI

operations have been successfully implemented and we expect new

business opportunities to arise from this investment.

Outlook

Whilst the market conditions for retailers in the UK remain

challenging, we believe that Venture Life has the brands and the

expertise to continue to perform strongly. The marketing

initiatives that have been put in place are expected to have an

impact in the second half of the year, which is traditionally our

stronger period, and the Company is well set to capitalise on

opportunities and deliver a positive outcome for the year.

Financial Review

Statement of comprehensive income

Group revenue for the six-month period was GBP9.4 million, an

increase of 14% on the GBP8.3 million reported for the same period

in 2018. The growth included the Dentyl sales following the brand's

acquisition during H2 2018. On a like-for-like basis, Group revenue

was flat in the six-month period compared to the first six months

of 2018.

The Venture Life Brands business, including Dentyl, increased

22%, with revenues for the six-month period of GBP2.8 million

compared to GBP2.3 million reported in H1 2018.

The Development and Manufacturing business continued to

represent the larger proportion of Group revenue. Revenues were

GBP6.6 million in H1 2019 compared to GBP6.0 million for H1 2018

(up 10%) and reflecting different revenue phasing compared to the

prior year. The current manufacturing order book is well ahead of

the same period last year, and the Group expects a stronger H2

2019.

The Group generated gross profit of GBP3.5 million, representing

a gross margin of 37.3%. This compares to a gross margin of 36.0%

for the same period in 2018 on a reported basis. This slight

improvement was due to the counteracting effects of cost increases

for raw materials and other components offset by a higher margin

product mix.

Administrative expenses increased in the period to GBP3.6

million from GBP3.0 million in H1 2018 due to several factors, some

of which were one-off, including our marketing campaign for Dentyl

in the UK. We have also incurred higher R&D expenditures as a

result of changes to the medical device regulations. We will

continue to have this higher level of R&D expenditure in the

second half of the year, however the Group will benefit from this

short-term cost through securing long-term future revenues for the

Group. The Group had some significant changes in the finance

function at the start of 2019, which precipitated some one-off

costs in the first half. Of the total increase in administrative

costs of GBP0.6 million, we estimate more than half to be one-off

in nature in 2019 with the balance representing small

administrative cost growth and investment in Dentyl marketing.

H1 2019 generated a positive adjusted EBITDA of GBP0.7 million,

up 5.5% compared to H1 2018 of GBP0.7 million.

The loss after tax remained slightly ahead of the prior year at

GBP0.4m (H1 2018: loss of GBP0.5 million). Loss per share was 0.45p

(H1 2018: loss of 1.35p).

The Adjusted profit per share was 0.15p compared to an adjusted

loss per share of 0.36p in H1 2018.

Unaudited Interim Condensed Consolidated Statement of

Comprehensive Income

For the six months ended 30 June 2019

Six months Six months Year ended

ended ended 31 December

30 June 30 June 2018

Note 2019 2018

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Revenue 4.1 9,394 8,260 18,770

Cost of sales (5,891) (5,284) (11,482)

------------ ------------ -------------

Gross profit 3,503 2,977 7,288

Operating expenses (3,217) (2,727) (5,534)

Amortisation of intangible assets 5 (338) (277) (625)

------------ ------------ -------------

Total administrative expenses (3,555) (3,004) (6,159)

Other income 41 27 94

Operating (loss)/profit before

exceptional items (11) - 1,223

------------ ------------ -------------

Exceptional items 6 (90) (54) (172)

Operating (loss)/profit (101) (54) 1,051

------------ ------------ -------------

Finance costs (17) (223) (341)

(Loss)/profit before tax (118) (277) 710

------------ ------------ -------------

Tax 7 (255) (221) (474)

(Loss)/Profit for the period

attributable to the equity shareholders

of the parent (374) (498) 236

------------ ------------ -------------

Other comprehensive (loss)/income

which may be subsequently reclassified

to the income statement 8 - (4) 18

Total comprehensive (loss)/profit

for the period attributable

to equity shareholders of the

parent (374) (502) 254

------------ ------------ -------------

Basic (loss)/profit per share

(pence) attributable to equity

shareholders of the parent 9 (0.45) (1.35) 0.42

Diluted Basic (loss)/profit

per share (pence) attributable

to equity shareholders of the

parent 9 (0.45) (1.35) 0.38

Adjusted profit/(loss) per share 9 0.15 (0.36) 2.06

Diluted Adjusted profit /(loss)

per share 9 0.14 (0.36) 1.83

Unaudited Interim Condensed Consolidated Statement of Financial

Position

As at 30 June 2019

Note 30 June 30 June 31 December

2019 2018 2018

(Unaudited) (Unaudited) (Audited)

ASSETS GBP'000 GBP'000 GBP'000

Non-current assets

Intangible assets 11 20,486 16,131 20,542

Property, plant and equipment 4,394 4,811 4,591

24,880 20,942 25,133

------------ ------------ ------------

Current assets

Inventories 4,326 4,327 3,869

Trade and other receivables 6,345 5,170 7,020

Cash and cash equivalents 10,932 1,496 9,623

------------ ------------ ------------

21,603 10,993 20.512

------------ ------------ ------------

TOTAL ASSETS 46,483 31,935 45,645

------------ ------------ ------------

EQUITY & LIABILITIES

Capital and reserves

Share capital 12 251 111 251

Share premium account 12 30,824 13,289 30,824

Merger reserve 12 7,656 7,656 7,656

Convertible bond reserve - 109 -

Foreign currency translation

reserve 252 230 252

Share-based payment reserve 678 586 609

Retained earnings (7,886) (8,224) (7,512)

------------ ------------

Total equity attributable

to equity holders of the

parent 31,775 13,757 32,080

------------ ------------ ------------

Liabilities

Current liabilities

Trade and other payables 5,364 4,794 4,868

Taxation 255 334 -

Interest bearing borrowings 1,136 2,063 1,911

Convertible bond - 1,847 -

Vendor loan notes - 71 -

------------ ------------ ------------

6,755 9,109 6,779

------------ ------------ ------------

Non-current liabilities

Interest bearing borrowings 6,390 6,039 5,157

Vendor loan notes - 1,740 -

Statutory employment provision 994 944 1,062

Deferred tax liability 569 346 567

------------ ------------ ------------

7,953 9,069 6,786

------------ ------------ ------------

Total liabilities 14,708 18,178 13,565

------------ ------------ ------------

TOTAL EQUITY & LIABILITIES 46,483 31,935 45,645

------------ ------------ ------------

Unaudited Interim Condensed Consolidated Statement of Changes in

Equity

As at 30 June 2019

Foreign

Share Convertible currency Share-based

Share premium Merger bond translation payment Retained Total

capital account reserve reserve reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------- ------- ------- ----------- ----------- ----------- -------- --------

Balance at 1

January 111 13,289 7,656 109 234 497 (7,711) 14,185

Impact of

adoption of

IFRS9 on opening

balances - - - - - - (37) (37)

Balance at 1

January 2018

(Audited) 111 13,289 7,656 109 234 497 (7,748) 14,148

-------- ------- ------- ----------- ----------- ----------- -------- --------

Loss for the

period - - - - - - (461) (461)

Foreign exchange

for period - - - - (4) - - (4)

-------- ------- ------- ----------- ----------- ----------- -------- --------

Total

comprehensive

income/(expense) - - - - (4) - (498) (502)

-------- ------- ------- ----------- ----------- ----------- -------- --------

Transactions with

shareholders:

Share options

charge - - - - - 89 - 89

Dividends - - - - - - (15) (15)

-------- ------- ------- ----------- ----------- ----------- -------- --------

Balance at 30

June 2018

(Unaudited) 111 13,289 7,656 109 230 586 (8,224) 13,757

-------- ------- ------- ----------- ----------- ----------- -------- --------

Profit for the

period - - - - - - 712 712

Foreign exchange

for period - - - - 22 - - 22

-------- ------- ------- ----------- ----------- ----------- -------- --------

Total

comprehensive

income - - - - 22 - 712 734

-------- ------- ------- ----------- ----------- ----------- -------- --------

Transactions with

shareholders:

Issue of share

capital 140 17,535 - - - - - 17,675

Repayment of Bond - - - (109) - - 14 (95)

Share options

charge - - - - - 23 - 23

Dividend - - - - - - (14) (14)

-------- ------- ------- ----------- ----------- ----------- -------- --------

Balance at 31

December 2018

(Audited) 251 30,824 7,656 - 252 609 (7,512) 32,080

-------- ------- ------- ----------- ----------- ----------- -------- --------

Loss for the

period - - - - - - (374) (374)

Foreign exchange - - - - - - - -

for period

-------- ------- ------- ----------- ----------- ----------- -------- --------

Total

comprehensive

(expense) - - - - - - (374) (374)

-------- ------- ------- ----------- ----------- ----------- -------- --------

Transactions with

shareholders:

Share options

charge - - - - - 69 - 69

Dividends - - - - - - - -

-------- ------- ------- ----------- ----------- ----------- -------- --------

Balance at 30

June 2019

(Unaudited) 251 30,824 7,656 - 252 678 (7,886) 31,775

-------- ------- ------- ----------- ----------- ----------- -------- --------

Unaudited Interim Condensed Consolidated Statement of Cash

Flows

For the six months ended 30 June 2019

Six months Six months Year ended

ended ended

30 June 30 June 31 December

2019 2018 2018

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Cash flow from operating activities:

(Loss)/profit before tax (119) (277) 710

Finance cost 17 223 341

Operating (loss)/profit (102) (54) 1,051

Adjustments for:

- Depreciation of property, plant

and equipment 352 343 756

- Amortisation of intangible assets 338 277 625

- Finance costs (17) (162) (276)

- Disposal of capitalised development

costs - - 148

- Share-based payment expense 69 89 112

------------- ------------- -------------

Operating cash flow before movements

in working capital 641 493 2,452

Taxation received/(paid) - - (565)

(Increase) in inventories (457) (766) (259)

Decrease/(Increase) in trade and

other receivables 675 (38) (1,868)

Increase in trade and other payables 428 511 478

------------- ------------- -------------

Net cash generated by operating activities 1,286 200 238

------------- ------------- -------------

Cash flow from investing activities:

Acquisition of Dentyl Business - - (4,200)

Purchases of property, plant and

equipment (155) (152) (271)

Development expenditure in respect

of intangible assets (282) (233) (744)

Net cash used by investing activities (437) (385) (5,215)

------------- ------------- -------------

Cash flow from financing activities:

Net proceeds from issuance of ordinary

shares - - 17,675

Repaid Convertible Bond - - (1,900)

Repaid vendor loan note - - (1,790)

Repayment of deferred consideration - - (410)

Drawdown in interest-bearing borrowings 701 586 200

Leasing obligation repayments (242) (251) (528)

Dividends paid - (15) (14)

------------- -------------

Net cash from financing activities 459 320 13,233

------------- ------------- -------------

Net increase in cash and cash equivalents 1,308 135 8,256

Net foreign exchange difference 1 - 6

Cash and cash equivalents at beginning

of period 9,623 1,361 1,361

------------- ------------- -------------

Cash and cash equivalents at end

of period 10,932 1,496 9,623

------------- ------------- -------------

Notes to the Unaudited Interim Condensed Consolidated Financial

Statements for the six months ended 30 June 2019

1. Corporate information

The Interim Condensed Consolidated Financial Statements of

Venture Life Group plc and its subsidiaries (collectively, the

Group) for the six months ended 30 June 2019 ("the Interim

Financial Statements") were approved and authorised for issue in

accordance with a resolution of the directors on 18 September

2019.

Venture Life Group plc ("the Company") is domiciled and

incorporated in the United Kingdom, and is a public company whose

shares are publicly traded. The Group's principal activities are

the development, manufacture and distribution of healthcare and

dermatology products.

2. Basis of preparation

The Interim Financial Statements have been prepared in

accordance with IAS 34, 'Interim financial reporting' as adopted by

the European Union. The Interim Financial Statements do not include

all the information and disclosures required in the annual

financial statements, and should be read in conjunction with the

Group's Consolidated Financial Statements for the year ended 31

December 2018 ("the 2018 Consolidated Financial Statements") which

have been prepared in accordance with IFRS as adopted by the

European Union.

The financial information contained in the Interim Financial

Statements, which are unaudited, does not constitute statutory

accounts in accordance with the Companies Act 2006. The financial

information for the year ended 31 December 2018 is extracted from

the statutory accounts for that year which have been delivered to

the Registrar of Companies and on which the auditor issued an

unqualified opinion that did not include an emphasis of matter

reference or statement made under section 498(2) or (3) of the

Companies Act 2006.

3. Accounting policies

The accounting policies adopted in the preparation of the

Interim Financial Statements are consistent with those followed in

the preparation of the 2018 Consolidated Financial Statements.

Foreign currencies

The assets and liabilities of foreign operations are translated

into sterling at exchange rates ruling at the balance sheet date.

Revenues generated and expenses incurred in currencies other than

sterling are translated into sterling at rates approximating to the

exchange rates ruling at the dates of the transactions. Foreign

exchange differences arising on retranslation of assets and

liabilities of foreign operations are recognised directly in the

foreign currency translation reserve.

The sterling/euro exchange rates used in the Interim Financial

Statements and prior reporting periods are as follows:

Six months Six months Year ended

ended ended 31 December

Sterling/euro exchange rates 30 June 2019 30 June 2018 2018

Average exchange rate for

the period 1.14 1.136 1.129

Exchange rate at the period

end 1.14 1.129 1.121

4. Segmental Information

Management has determined the operating segments based on the

reports reviewed by the Group Board of Directors (Chief Operating

Decision Maker) that are used to make strategic decisions. The

Board considers the business from a line-of-service perspective and

uses operating profit/(loss) as its profit measure. The operating

profit/(loss) of operating segments is prepared on the same basis

as the Group's accounting operating profit/(loss).

In line with the 2018 Consolidated Financial Statements, the

operations of the Group are segmented as Brands, which includes

sales of healthcare and skin care products under distribution

agreements and direct to UK retailers, and Development and

Manufacturing.

4.1 Segment Revenue and Results

The following is an analysis of the Group's revenue and results

by reportable segment.

Development Consolidated

Brands and Manufacturing Eliminations Group

GBP'000 GBP'000 GBP'000 GBP'000

Six months to 30 June 2019

Revenue

External sales 2,786 6,608 - 9,394

Inter-segment sales - 680 (680) -

-------- ------------------- ------------- -------------

Total revenue 2,786 7,288 (680) 9,394

-------- ------------------- ------------- -------------

Results

Operating (loss)/profit

before exceptional items

and excluding central administrative

costs 109 860 - 969

-------- ------------------- ------------- -------------

Development Consolidated

Brands and Manufacturing Eliminations Group

GBP'000 GBP'000 GBP'000 GBP'000

Six months to 30 June 2018

Revenue

External sales 2,279 5,981 - 8,260

Inter-segment sales - 1,357 (1,357) -

-------- ------------------- ------------- -------------

Total revenue 2,279 7,338 (1,357) 8,260

-------- ------------------- ------------- -------------

Results

Operating (loss)/profit

before exceptional items

and excluding central administrative

costs (68) 842 - 774

-------- ------------------- ------------- -------------

Development Consolidated

Brands and Manufacturing Eliminations Group

Year to 31 December 2018 GBP'000 GBP'000 GBP'000 GBP'000

Revenue

External sales 6,627 14,887 - 21,514

Inter-segment sales - (2,744) (2,744) (2,744)

-------- ------------------- ------------- -------------

Total revenue 6,627 12,143 (2,744) 18,770

-------- ------------------- ------------- -------------

Results

Operating profit before

exceptional items and excluding

central administrative

costs 404 2,333 - 2,737

-------- ------------------- ------------- -------------

The reconciliation of segmental operating loss to the Group's

operating loss before exceptional items excluding central

administrative costs is as follows:

Six months Six months Year ended

ended

30 June ended 31 December

2019

(Unaudited) 30 June 2018

2018

(Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Operating profit before exceptional

items and excluding central administrative

costs 969 774 2,737

Central administrative costs (980) (774) (1,514)

Exceptional expenses (90) (54) (172)

Operating (loss)/profit (101) (54) 1,051

Net finance cost (17) (223) (341)

------------ ------------ -------------

(Loss)/profit before tax (118) (277) 710

------------ ------------ -------------

5. Amortisation of intangible assets

Six months Six months Year ended

ended

30 June ended 31 December

2019

(Unaudited) 30 June 2018

2018

(Unaudited) (Audited)

Amortisation of: GBP'000 GBP'000 GBP'000

Acquired intangible assets (77) (151) (144)

Patents, trademarks and other intangible

assets (75) (79) (162)

Capitalised development costs (186) (47) (319)

------------ ------------ -------------

(338) (277) (625)

------------ ------------ -------------

6. Exceptional items

Six months Six months Year ended

ended

30 June ended 31 December

2019

(Unaudited) 30 June 2018

2018

(Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Costs incurred in acquisitions (90) (54) (172)

Total exceptional items (90) (54) (172)

------------ ------------ -------------

Exceptional items in the period related to fees incurred in the

exploration of acquisition opportunities.

7. Taxation

The Group calculates the income tax expense for the period using

the tax rate that would be applicable to the expected total annual

earnings. The major components of income tax expense in the Interim

Condensed Statement of Comprehensive Income are as follows:

Six months Six months Year ended

ended ended 31 December

30 June 2019 30 June 2018

2018

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Current income tax 255 278 531

Deferred income tax expense related

to origination and reversal of

timing differences - (57) (57)

-------------- ------------ -------------

Income tax expense recognised

in statement of comprehensive

income 255 221 474

-------------- ------------ -------------

The current income tax expense is based on the profits of the

Development and Manufacturing business based in Italy. The UK based

businesses on a combined basis are currently loss making and so

there are no UK income tax charges due in respect of trading for

the first six months to 30 June 2019.

The Group has not recognised the deferred tax asset on losses

made by the UK based businesses on a combined basis as although

management are expecting the UK based businesses on a combined

basis to become profitable, it is not currently certain when there

will be sufficient taxable profits against which to offset such

losses.

At the period end the estimated tax losses amounted to

GBP9,888,000 (30 June 2018: GBP9,472,000; 31 December 2018:

GBP9,257,000).

8. Other comprehensive income/(expense)

Other comprehensive income/(expense) represents the foreign

exchange difference on the translation of the assets, liabilities

and reserves of Biokosmes which has a functional currency of Euros.

The movement is shown in the foreign currency translation reserve

between the date of acquisition of Biokosmes, when the GBP/EUR rate

was 1.193 and the balance sheet date rate at 30 June 2019 of 1.14

(at 31 December 2018 of 1.121 and at 30 June 2018 of 1.129) and is

an amount that may subsequently be reclassified to profit and

loss.

9. Earnings per share

Six months Six months Year ended

ended ended 30 December

30 June 2019 30 June 2018

2018

(Unaudited) (Unaudited) (Audited)

Weighted average number of ordinary

shares in issue 83,711,106 36,837,106 55,715,531

(Loss)/Profit attributable to

equity holders of

the Company (GBP'000) (374) (498) 254

Basic (loss)/profit per share

(pence) (0.45) (1.35) 0.42

Diluted (loss)/profit per share

(pence) (0.45) (1.35) 0.38

Adjusted profit /(loss) per share

(pence) 0.15 (0.36) 2.06

Diluted Adjusted profit /(loss)

per share (pence) 0.14 (0.36) 1.83

In circumstances where the Basic and Adjusted results per share

attributable to ordinary shareholders are a loss then the

respective diluted figures are identical to the undiluted figures.

This is because the exercise of share options would have the effect

of reducing the loss per ordinary share and is therefore not

dilutive under the terms of IAS 33.

10. Dividends

Amounts recognised as distributions to equity holders in the

period:

Six months Six months Year ended

ended ended 31 December

2018

30 June 2019 30 June 2018 (Audited)

(Unaudited) (Unaudited)

GBP'000 GBP'000 GBP'000

Final dividend - 15 14

-------------- ------------- -------------

11. Intangible assets

The intangible assets of the group of GBP20.5 million (31

December 2018: GBP16.1m) include goodwill, development costs,

patents and trademarks and customer relationships.

At the reporting date goodwill generated from the acquisitions

of Biokosmes Srl in March 2014 and Periproducts Limited in March

2016 accounted for GBP13.1 million of the intangible assets of the

Group (GBP13.1 million at 31 December 2018). There were no

movements in goodwill during the period (increase in goodwill of

GBP Nil in the 6 months to June 2018), nor have there been any

impairment of goodwill during this time (6 months to June 2018: GBP

Nil).

12. Share capital and share premium

Ordinary Ordinary Share Merger

shares of Shares premium reserve

0.3p each

No. GBP'000 GBP'000 GBP'000

Audited at 31 December 2018

and Unaudited at 30 June 2019 83,712,106 251 30,824 7,656

---------- -------- -------- --------

There were no movements in share capital or share premium

between 31 December 2018 and 30 June 2019.

13. Related party transactions

The following transactions with related parties are considered

by the Directors to be significant for the interpretation of the

Interim Condensed Financial Statements for the six-month period to

30 June 2019 and the balances with related parties at 30 June 2019

and 31 December 2018:

Under the terms of the Share Purchase Agreement dated 28

November 2013 and signed between the Company and the vendors of

Biokosmes, one of whom was Gianluca Braguti, the vendors agreed to

indemnify the Company in full for any net liability arising from

certain litigation cases which had not settled at the time of

completion of the acquisition on 27 March 2014. At the period end

the amount due to the Company under the indemnity totalled

EUR250,935, of which Gianluca Braguti's liability is EUR248,426.

Settlement of this liability will be made when the final

outstanding case is concluded.

Key transactions with other related parties

Braguts' Real Estate Srl (formally known as Biokosmes

Immobiliare Srl), a company 100% owned by Gianluca Braguti a

director and shareholder of the Group provided property lease

services to the Development and Manufacturing business totalling

EUR230,000 in the six months to 30 June 2019 (EUR230,000 in the six

months to 30 June 2018). At 30 June 2019, the Group owed Braguts'

Real Estate Srl EUR297,000 (EUR297,000 at 31 December 2018).

14. Financial instruments

Set out below is an overview of financial instruments held by

the Group as at:

30 June 2019 30 June 2018 31 December 2018

----------------------------- -----------------------------

Loans and Total financial Loans and Total financial Loans and Total financial

receivables assets receivables assets receivables assets

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Financial assets:

Trade and other

receivables

(a) 6,345 6,345 5,055 5,055 6,868 6,868

Cash and cash

equivalents 10,932 10,932 1,496 1,496 9,623 9,623

Total 17,277 17,277 6,551 6,551 16,491 16,491

------------ --------------- ------------ --------------- ------------ ---------------

30 June 2019 30 June 2018 31 December 2018

--------------------------- --------------------------- ---------------------------

Liabilities Total Liabilities Total Liabilities Total

(amortised financial (amortised financial (amortised financial

cost) liabilities cost) liabilities cost) liabilities

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Financial

liabilities:

Trade and other

payables (b) 5,636 5,636 4,794 4,794 5,107 5,107

Leasing

obligations 2,984 2,984 3,470 3,470 3,226 3,226

Convertible

bond - - 1,847 1,847 - -

Vendor loan

notes - - 1,811 1,811 - -

Interest

bearing

debt 4,543 4,543 4,632 4,632 3,842 3,842

----------- -------------- ----------- -------------- ----------- --------------

Total 13,162 13,162 16,554 16,554 12,175 12,175

----------- -------------- ----------- -------------- ----------- --------------

(a) Trade and other receivables excludes prepayments

(b) Trade and other payables excludes deferred revenue

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR DGGDCSGBBGCC

(END) Dow Jones Newswires

September 20, 2019 02:00 ET (06:00 GMT)

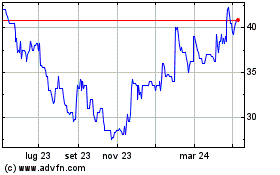

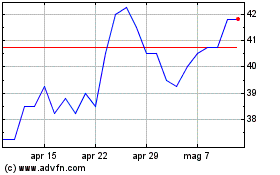

Grafico Azioni Venture Life (LSE:VLG)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Venture Life (LSE:VLG)

Storico

Da Apr 2023 a Apr 2024