Pound Higher As U.K. Top Court Rules Against PM Johnson's Parliament Suspension

24 Settembre 2019 - 11:51AM

RTTF2

The pound firmed against its key counterparts in the European

session on Tuesday, as U.K. Supreme Court ruled that Prime Minister

Boris Johnson's decision to suspend Parliament was unlawful,

thwarting his plan to deliver Brexit on October 31.

The court found that Johnson lied to the Queen and the move to

shut down Parliament was unlawful, void and of no effect.

The 11-judge court concluded that Johnson's decision to advise

the Queen to prorogue was unlawful as it had the effect of

frustrating or preventing the ability of Parliament to carry out

its constitutional functions.

Lady Hale, president of the UK Supreme Court, said the effect of

the prorogation was "extreme" as the Commons "has a right to a

voice."

The ruling gives a historic blow to the PM, who had vowed to

deliver Brexit by October 31 deadline.

Figures from the Office for National Statistics showed that the

UK budget deficit narrowed in August.

Public sector net borrowing, excluding banks, was GBP 6.4

billion, compared to a GBP 6.9 billion deficit seen in the same

period last year.

The pound was lower early in the European session, as investors

cautiously awaited the landmark court ruling on Johnson's five-week

suspension of U.K. parliament.

The currency was trading mixed in the previous session, by

rising against the yen and the franc but holding steady against the

euro and the greenback.

The pound appreciated 0.6 percent to 1.2490 against the

greenback, from a low of 1.2414 it recorded at 4:00 am ET. The pair

had closed Monday's deals at 1.2429. Next near term resistance for

the pound is likely seen around the 1.28 level.

After falling to 133.55 versus the yen at 3:45 am ET, the pound

rebounded 0.8 percent to hit a 2-day high of 134.61. The pair was

valued at 133.67 when it ended trading on Monday. The pound is seen

facing resistance around the 138.00 mark.

Survey results from IHS Markit showed that Japan's private

sector expanded at a slightly slower pace in September as

manufacturing activity contracted further.

The Jibun Bank flash composite output index fell to 51.2 from

51.9 in August. Nonetheless, a reading above 50 indicates

expansion.

The pound was up by 0.6 percent at 1.2364 against the franc,

after falling as low as 1.2293 at 4:30 am ET. The pound had

finished Monday's trading session at 1.2306 against the Swiss

franc. The currency may locate resistance around the 1.27 region,

if it rises again.

The U.K. currency added 0.5 percent to hit a 2-day high of

0.8806 against the euro, rebounding from a low of 0.8853 seen at

4:00 am ET. The euro-pound pair was quoted at 0.8838 at Monday's

close. Further rally is likely to take the pound to a resistance

around the 0.86 mark.

Survey results from the Munich-based Ifo institute showed that

German business confidence improved slightly in September as the

better assessment of the current situation offset the worst decline

in expectations over a decade.

The Ifo business climate index rose more-than-expected to 94.6

from 94.3 in August. The expected reading was 94.5.

Looking ahead, U.S. consumer sentiment index for September is

due in the New York session.

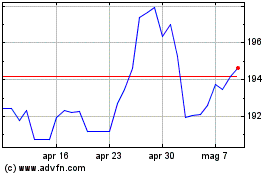

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Mar 2024 a Apr 2024

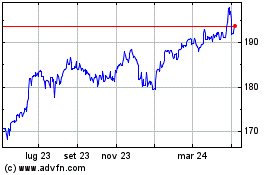

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Apr 2023 a Apr 2024