TIDMTMMG

RNS Number : 5347N

The Mission Marketing Group PLC

25 September 2019

The Mission Group plc

Interim results for the six months to 30 June 2019

The Mission Group plc ("MISSION", "the Group" or "the Company")

is pleased to announce its unaudited interim results for the six

months ended 30 June 2019 and sets out its new positioning.

Interim results

-- Revenue from continuing operations* up 9% to GBP39.2m (2018: GBP36.1m)

-- Headline** profit before tax up 10% to GBP3.4m (2018: GBP3.1m)

-- Headline** diluted EPS up 9% to 3.12 pence (2018: 2.85 pence)

-- Net bank debt GBP5.1m (30 June 2018: GBP7.8m)

-- A strong second-half bias again predicted

-- Pathfindr progressing well

Dividend

-- Interim dividend increased by 10% to 0.77p (2018: 0.70p)

-- Payable on 29 November 2019 to shareholders on the register at 1 November 2019

Repositioning of MISSION

-- New positioning to reflect Mission's coming of age

-- A real and credible alternative to the established agency networks

-- Focus will be on developing creative partnerships, not just marketing communications

-- Collaboration and co-working moving to a new level

-- Fewer but larger Agencies

* Continuing operations exclude the results of BroadCare, sold

on 12 November 2018

** Headline results are calculated on continuing operations and

excluding the profit/loss on investments, acquisition-related items

and start-up losses

David Morgan, Chairman, commented: "The Group continues to make

good progress and I am really pleased with how James Clifton is

settling into his role as Chief Executive. Today's evolved

positioning as the alternative group for ambitious brands, with a

new visual identity, is a bold and confident statement about what

Mission is today and where it can be tomorrow"

An interview with James Clifton, Chief Executive, can be viewed

today at: http://www.themission.co.uk/investors/results-centre

Enquiries:

James Clifton, Chief Executive

Peter Fitzwilliam, Finance Director

The Mission Group plc 020 7462 1415

Mark Percy / James Thomas / Sarah Mather

(Corporate Advisory)

Shore Capital (Nomad and Broker) 020 7408 4090

MISSION is a collective of creative Agencies led by

entrepreneurs who encourage an independent spirit. Employing 1,150

people in the UK, Europe, Asia and US, the Group combines the

expertise of Integrated and Specialist Agencies to bring

commercially effective solutions to business challenges.

www.themission.co.uk

Summary of the period

So far 2019 has been a successful and transitional year for

MISSION.

There is no doubt that within MISSION we have created unique

skills and processes which enhance what we do for our Clients

within an ever-changing marketplace. This approach has set us apart

from our competitors and enhanced the performance of our Agencies

and the Group as a whole. So earlier this year we took a long hard

look at ourselves and what makes us special and this autumn we are

launching a new look MISSION, more of which below.

But it is what's behind the face that matters most.

The first half of 2019 has panned out as we expected in

delivering our revenue and profit targets whilst maintaining a

strong balance sheet. Our Agencies performed well, with major new

contracts being won and existing Client support continuing.

Whilst the day to day issues are of paramount importance, our

continued growth forms the platform from which we are embracing a

determined positioning, refining our structure and creating greater

opportunities for our people. As part of this, the promotion of

James Clifton to Group CEO in April is already having a significant

impact. James' objective is to build on our multi-Agency approach

that ensures our Clients get a best in class team with unparalleled

resources working on their business.

Our policy of going where our Clients wish us to be continues.

Major global wins this year from Cummins, Docker and Fuji Xerox,

supplemented by new Clients in our recently opened Seattle Agency,

plus our expanded Asia presence, are helping us strengthen our

footprint in those territories. In addition we have recently opened

an office in Munich, the Group's first opening in Mainland Europe.

We will continue to grow overseas but in a measured and risk-averse

manner.

So in a market that continues to be challenging, we are growing

our businesses and strengthening our resources in a way that

provides us with a level of confidence that will take us into 2020

and beyond.

Our fuse technology division is seeing some exciting new

initiatives develop, a couple of which should be ready for launch

in 2020, whilst our Pathfindr Asset Management System continues to

expand its Client base with some excellent new contracts. It is

gratifying to note that wherever Pathfindr is trialed, it quite

quickly becomes the system of choice; so much so that we will be

accelerating our investment and reaching out into new markets.

Trading results

Comparisons

The Group's BroadCare business was sold in November 2018 and, as

a result, the following financial comparisons and commentary are

based on like-for-like trading from continuing operations.

In addition, the Group has implemented IFRS 16: Leases and 2018

comparatives have been restated accordingly. The impact of IFRS 16

on the Group's net profitability is insignificant but the bringing

onto the balance sheet of future lease commitments and the

reclassification of operating lease costs into depreciation and

interest costs affects EBITDA and leverage ratios. The impact of

the application of IFRS 16 is included in Note 2 and, where

significant, referred to in the commentary below.

Billings and revenue

Turnover ("billings") for the six months ended 30 June 2019

increased by 5% to GBP82.3m (2018: GBP78.1m), while operating

income ("revenue") increased by 9% to GBP39.2m (2018: GBP36.1m),

continuing our track record of consistent revenue growth over many

years and achieving our target growth of at least 5% pa.

Profit, margins and earnings per share

Headline operating profits increased by 5% to GBP3.6m (2018:

GBP3.4m). Headline operating profit margins were slightly lower in

the first six months, at 9.2% (2018: 9.6%), primarily due to

changes in phasing of spend by certain large Clients. As in prior

years, we expect our trading to have a strong bias towards the

second half and, coupled with further efficiency improvements

anticipated from our Shared Services initiative, we expect overall

margins to increase as a result.

Financing costs reduced to GBP0.3m (2018: GBP0.4m) reflecting

lower net bank debt levels, and headline profit before tax

increased by 10% to GBP3.4m (2018: GBP3.1m), in line with our

target growth of at least 10% pa.

Adjustments to headline profits in 2019, at GBP1.0m, were higher

than the prior year (2018: GBP0.6m) due to an increase in the

estimate of future contingent consideration obligations. After

these adjustments, reported profit before tax was GBP2.4m (2018:

GBP2.5m).

The Group estimates an effective tax rate on headline profits

before tax of 20% (2018: 20%), resulting in a 9% increase in

headline earnings to GBP2.7m for the six months (2018: GBP2.5m),

and reported profit after tax of GBP1.8m (2018: GBP2.0m). Fully

diluted headline EPS increased 9% to 3.12 pence (2018: 2.85

pence).

Balance sheet and cash flow

Two key balance sheet ratios measured and monitored by the Board

are the ratios of net debt and total debt, including acquisition

liabilities, to headline EBITDA ("leverage ratios"). The adoption

of IFRS 16 increases both EBITDA and debt. The increase in EBITDA

from the reclassification of operating lease costs into

depreciation and interest costs is GBP2.6m in a full year. The

recognition of future lease payments as balance sheet liabilities

increases total debt by over GBP7m. There is no impact from the

adoption of IFRS 16 on net cash flow, nor on bank covenant tests,

which remain calculated on a pre-IFRS 16 basis, but the standard

increases the debt leverage ratios by approximately x0.5.

Net bank debt at 30 June 2019 was GBP5.1m (30 June 2018:

GBP7.8m). Together with lease liabilities, net debt totalled

GBP12.7m (30 June 2018: GBP17.1m), resulting in a reduced leverage

ratio of net debt to headline EBITDA of x0.9 (30 June 2018:

x1.3).

GBP3.2m of acquisition obligations from prior years were settled

in the first half of the year and after adjustments to estimated

future contingent consideration payments, the total estimated

acquisition liability at 30 June 2019 totalled GBP9.1m (30 June

2018: GBP11.0m). Including estimates of acquisition liabilities

(calculated by reference to current levels of profitability), total

debt leverage reduced to x1.4 (30 June 2018: x1.9).

Virtually all of the Group's acquisition obligations are

dependent on post-acquisition earn-out profits. GBP2.3m is expected

to fall due for payment in cash within 12 months and a further

GBP5.9m in the subsequent 12 months. The Directors believe that the

strength of the Group's cash generation can comfortably accommodate

these obligations. Furthermore, to achieve maximum earn-outs, the

acquired Agencies would need to perform very strongly, which would

generate much of the cash required to meet these obligations.

Dividend

Reflecting the growth in headline earnings, the Directors have

declared an interim dividend of 0.77p, representing a 10% increase

over last year, payable on 29 November 2019 to shareholders on the

register at 1 November 2019. The ex-dividend date is 31 October

2019.

A new MISSION

All agency groups strive for cooperation and collaboration

within their organisations. From its inception, MISSION has been

different from the rest. Founded as a cooperative of like-minded

entrepreneurs, we have flourished best when MISSION has supported

rather than directed, harnessing the innate ambition and

independent spirit of our Agency CEOs. We have grown revenue and

profit each year over the last decade, winning prestigious and

progressively bigger business. We have acquired businesses with

fantastic reputations that elevate our standing in the sector. At

the same time, we have retained virtually all the founders of the

businesses we have acquired, providing them with opportunities to

develop and grow both their businesses and themselves from an

increasingly international platform.

Over the years, we have progressively developed methodologies

and structures to encourage and support collaboration and

multi-agency working. We truly believe we have found an alternative

and better way to help our Clients.

As a group of collaborative specialists, we are no longer purely

a marketing communications group, selling our marketing wares.

Instead we are a business partner with a range of creative skills

to help solve business challenges. In recognition of this, we have

re-named our group The Mission Group PLC ("MISSION") and put

MISSION at the forefront of our new business activity as the

alternative group for ambitious brands, with a new visual identity.

In addition, we have refined our business structure to create a

simplified, more effective service offering. Three key structural

changes are: the merger of bigdog and krow into a single integrated

agency, retaining the name krow; the expansion of Story into Leeds

and Newcastle, taking on our Robson Brown agency; and the merger of

April Six and RLA into a single agency to leverage both

complementary skillsets and the existing April Six international

footprint.

This new-look MISSION celebrates and drives forward the Group's

open, collaborative culture whilst retaining the entrepreneurial

spirit on which it has been built.

Outlook

As in previous years, we expect the majority of our profit to be

generated in the second half of the year. Despite the heightened

level of Brexit uncertainty, we remain on track to deliver against

expectations. We feel confident in ourselves and our ability to

establish trusted creative partnerships with Clients that deliver

real business growth. We are excited about MISSION's prospects.

Condensed Consolidated Income Statement for the six months ended

30 June 2019

Continuing Discontinued Continuing Discontinued

operations operations Total operations operations Total

Six Six months Six months Six Year ended Year ended Year

months to to months ended

to to

30 June 30 June 30 June 30 June 31 December 31 December 31

2019 2018 2018 2018 2018 2018 December

2018

Unaudited Unaudited Unaudited Unaudited Audited Audited Audited

(Restated) (Restated) (Restated) (Restated)

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

TURNOVER 3 82,300 78,112 1,116 79,228 159,916 1,476 161,392

Cost of sales (43,140) (42,056) (127) (42,183) (82,331) (221) (82,552)

---------- ------------ -------------- ----------- ------------ -------------- -----------

OPERATING

INCOME 3 39,160 36,056 989 37,045 77,585 1,255 78,840

Headline

operating

expenses (35,545) (32,608) (451) (33,059) (67,666) (776) (68,442)

---------- ------------ -------------- ----------- ------------ -------------- -----------

HEADLINE

OPERATING

PROFIT 3,615 3,448 538 3,986 9,919 479 10,398

(Loss) / profit

on investments - - - - (312) 2,981 2,669

Acquisition

adjustments 5 (925) (508) - (508) (1,010) - (1,010)

Start-up costs (74) (74) - (74) (139) - (139)

---------- ------------ -------------- ----------- ------------ -------------- -----------

OPERATING

PROFIT 2,616 2,866 538 3,404 8,458 3,460 11,918

Share of results

of associates

and joint

ventures 69 (9) - (9) (1) - (1)

---------- ------------ -------------- ----------- ------------ -------------- -----------

PROFIT BEFORE

INTEREST

AND TAXATION 2,685 2,857 538 3,395 8,457 3,460 11,917

Net finance

costs 6 (289) (361) - (361) (735) - (735)

-------------- -----------

PROFIT ON

ORDINARY

ACTIVITIES

BEFORE

TAXATION 2,396 2,496 538 3,034 7,722 3,460 11,182

Taxation 7 (608) (527) (108) (635) (1,710) (96) (1,806)

-------------- -----------

PROFIT FOR THE

PERIOD 1,788 1,969 430 2,399 6,012 3,364 9,376

---------- ------------ -------------- ----------- ------------ -------------- -----------

Attributable to:

Equity holders

of the

parent 1,757 1,910 430 2,340 5,901 3,364 9,265

Non-controlling

interests 31 59 - 59 111 - 111

---------- ------------ -------------- ----------- ------------ -------------- -----------

1,788 1,969 430 2,399 6,012 3,364 9,376

---------- ------------ -------------- ----------- ------------ -------------- -----------

Basic earnings

per share

(pence) 8 2.10 2.30 0.52 2.82 7.08 4.04 11.12

Diluted earnings

per share

(pence) 8 2.04 2.24 0.50 2.75 6.91 3.94 10.85

Headline basic

earnings

per share

(pence) 8 3.20 2.92 0.52 3.44 8.67 0.46 9.13

Headline diluted

earnings

per share

(pence) 8 3.12 2.85 0.50 3.35 8.46 0.45 8.90

Condensed Consolidated Statement of Comprehensive Income for the

six months ended 30 June 2019

Continuing Discontinued Continuing Discontinued

operations operations Total operations operations Total

Six Six months Six months Six months Year ended Year ended Year ended

months to to to

to

30 June 30 June 30 June 30 June 31 December 31 December 31 December

2019 2018 2018 2018 2018 2018 2018

Unaudited Unaudited Unaudited Unaudited Audited Audited Audited

(Restated) (Restated) (Restated) (Restated)

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

PROFIT FOR THE

PERIOD 1,788 1,969 430 2,399 6,012 3,364 9,376

Other

comprehensive

income

- items that may

be reclassified

separately to

profit or loss:

Exchange

differences on

translation

of foreign

operations 226 7 - 7 73 - 73

----------- ------------ -------------- ------------ ------------ -------------- ------------

TOTAL

COMPREHENSIVE

INCOME

FOR THE PERIOD 2,014 1,976 430 2,406 6,085 3,364 9,449

Attributable to:

Equity holders

of the parent 1,926 1,907 430 2,337 5,933 3,364 9,297

Non-controlling

interests 88 69 - 69 152 - 152

----------- ------------ -------------- ------------ ------------ -------------- ------------

2,014 1,976 430 2,406 6,085 3,364 9,449

----------- ------------ -------------- ------------ ------------ -------------- ------------

Condensed Consolidated Balance Sheet as at 30 June 2019

As at As at As at

30 June 30 June 31 December

2019 2018 2018

Unaudited Unaudited Audited

(Restated) (Restated)

Note GBP'000 GBP'000 GBP'000

FIXED ASSETS

Intangible assets 9 95,629 96,079 96,121

Property, plant and equipment 3,100 3,003 3,125

Right of use assets 6,875 8,415 7,733

Investments in associates

and joint ventures 69 306 -

Investments 100 - -

Deferred tax assets 20 44 23

---------- ----------- ------------

105,793 107,847 107,002

---------- ----------- ------------

CURRENT ASSETS

Stock 1,062 684 850

Trade and other receivables 44,985 38,444 39,727

Cash and short term deposits 2,811 6,102 5,899

---------- ----------- ------------

48,858 45,230 46,476

---------- ----------- ------------

CURRENT LIABILITIES

Trade and other payables (41,057) (37,875) (37,060)

Corporation tax payable (1,110) (877) (668)

Bank loans 10 - (13,852) -

Acquisition obligations 11 (2,398) (3,084) (3,258)

---------- ----------- ------------

(44,565) (55,688) (40,986)

---------- ----------- ------------

NET CURRENT ASSETS / (LIABILITIES) 4,293 (10,458) 5,490

---------- ----------- ------------

TOTAL ASSETS LESS CURRENT

LIABILITIES 110,086 97,389 112,492

NON CURRENT LIABILITIES

Bank loans 10 (7,906) - (9,886)

Lease liabilities (5,163) (6,754) (6,022)

Acquisition obligations 11 (6,707) (7,889) (8,537)

Deferred tax liabilities (393) (538) (451)

---------- ----------- ------------

(20,169) (15,181) (24,896)

---------- ----------- ------------

NET ASSETS 89,917 82,208 87,596

---------- ----------- ------------

CAPITAL AND RESERVES

Called up share capital 8,530 8,436 8,436

Share premium account 43,015 42,506 42,506

Own shares (419) (304) (299)

Share-based incentive reserve 607 465 498

Foreign currency translation

reserve 286 82 117

Retained earnings 37,295 30,445 35,826

---------- ----------- ------------

EQUITY ATTRIBUTABLE TO EQUITY

HOLDERS OF THE PARENT 89,314 81,630 87,084

Non controlling interests 603 578 512

---------- ----------- ------------

TOTAL EQUITY 89,917 82,208 87,596

---------- ----------- ------------

Condensed Consolidated Cash Flow Statement for the six months

ended 30 June 2019

Six months Six months Year ended

to to

30 June 30 June 31 December

2019 2018 2018

Unaudited Unaudited Audited

(Restated) (Restated)

GBP'000 GBP'000 GBP'000

Operating profit 2,616 3,404 11,918

Depreciation and amortisation

charges 2,329 2,309 4,738

Movements in the fair value of

contingent consideration 479 (30) (67)

Profit on disposal of fixed assets (73) (4) (5)

Loss on write down of investment - - 312

Profit on disposal of BroadCare - - (2,981)

Non cash charge for share options,

growth shares and shares awarded 122 144 183

Increase in receivables (5,258) (735) (2,022)

Increase in stock (212) (16) (182)

Increase / (decrease) in payables 4,075 558 (210)

---------- ------------- -------------

OPERATING CASH FLOW 4,078 5,630 11,684

Net finance costs (266) (319) (826)

Tax paid (221) (722) (1,906)

---------- ------------- -------------

Net cash inflow from operating

activities 3,591 4,589 8,952

---------- ------------- -------------

INVESTING ACTIVITIES

Proceeds on disposal of fixed

assets 150 23 30

Purchase of property, plant and

equipment (640) (286) (1,014)

Investment in software development (85) (45) (377)

Proceeds from disposal of BroadCare - - 4,099

Acquisition of subsidiaries - (2,750) (2,990)

Acquisition of investments (100) - -

Payment of obligations relating

to acquisitions made in prior

periods (2,555) (1,749) (1,748)

Cash disposed of and costs of

disposal of BroadCare - - (584)

Cash acquired with subsidiaries - 553 553

---------- ------------- -------------

Net cash outflow from investing

activities (3,230) (4,254) (2,031)

---------- ------------- -------------

FINANCING ACTIVITIES

Dividends paid - - (1,546)

Dividends paid to non-controlling

interests - - (149)

Repayment of lease liabilities (1,244) (1,161) (2,446)

(Repayment of) / increase in bank

loans (2,000) 750 (3,125)

Issue of shares to minority interests 3 - -

(Purchase) / disposal of own

shares held in EBT (434) 311 311

---------- ------------- -------------

Net cash outflow from financing

activities (3,675) (100) (6,955)

---------- ------------- -------------

(Decrease) / increase in cash/equivalents (3,314) 235 (34)

Exchange differences on translation

of foreign subsidiaries 226 7 73

Cash/cash equivalents at beginning

of period 5,899 5,860 5,860

---------- ------------- -------------

Cash and cash equivalents at

end of period 2,811 6,102 5,899

---------- ------------- -------------

Condensed Consolidated Statement of Changes in Equity for the

six months ended 30 June 2019

Share-based

incentive Total

reserve Foreign attributable

currency to equity Non-controlling

Share Share Own GBP'000 translation Retained holders interest Total

capital premium shares reserve earnings of parent equity

(Restated) (Restated) GBP'000 (Restated)

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- --------- --------- --------- ------------ ------------- ------------ -------------- ----------------- ------------

At 1 January

2018 8,436 42,506 (602) 341 85 28,072 78,838 509 79,347

Profit for

period - - - - - 2,340 2,340 59 2,399

Exchange

differences

on

translation

of foreign

operations - - - - (3) - (3) 10 7

--------------- --------- --------- --------- ------------ ------------- ------------ -------------- ----------------- ------------

Total

comprehensive

income for

period - - - - (3) 2,340 2,337 69 2,406

Share option

charge - - - 80 - - 80 - 80

Growth share

charge - - - 44 - - 44 - 44

Shares awarded

and sold

from own

shares - - 298 - - 33 331 - 331

At 30 June

2018 8,436 42,506 (304) 465 82 30,445 81,630 578 82,208

--------------- --------- --------- --------- ------------ ------------- ------------ -------------- ----------------- ------------

Profit for

period - - - - - 6,925 6,925 52 6,977

Exchange

differences

on

translation

of foreign

operations - - - - 35 - 35 31 66

--------------- --------- --------- --------- ------------ ------------- ------------ -------------- ----------------- ------------

Total

comprehensive

income for

period - - - - 35 6,925 6,960 83 7,043

Share option

credit - - - (11) - - (11) - (11)

Growth share

charge - - - 44 - - 44 - 44

Shares awarded

and sold

from own

shares - - 5 - - 2 7 - 7

Dividend

paid - - - - - (1,546) (1,546) (149) (1,695)

--------------- --------- --------- --------- ------------ ------------- ------------ -------------- ----------------- ------------

At 31 December

2018 8,436 42,506 (299) 498 117 35,826 87,084 512 87,596

--------------- --------- --------- --------- ------------ ------------- ------------ -------------- ----------------- ------------

Profit for

period - - - - - 1,757 1,757 31 1,788

Exchange

differences

on

translation

of foreign

operations - - - - 169 - 169 57 226

--------------- --------- --------- --------- ------------ ------------- ------------ -------------- ----------------- ------------

Total

comprehensive

income for

period - - - - 169 1,757 1,926 88 2,014

New shares

issued 94 509 - - - - 603 3 606

Share option

charge - - - 65 - - 65 - 65

Growth share

charge - - - 44 - - 44 - 44

Own shares

purchased

by EBT - - (434) - - - (434) - (434)

Shares awarded

and sold

from own

shares - - 314 - - (288) 26 - 26

At 30 June

2019 8,530 43,015 (419) 607 286 37,295 89,314 603 89,917

--------------- --------- --------- --------- ------------ ------------- ------------ -------------- ----------------- ------------

Notes to the unaudited Interim Report for the six months ended

30 June 2019

1. Accounting Policies

Basis of preparation

The condensed consolidated interim financial statements for the

six months ended 30 June 2019 have been prepared in accordance with

the IAS 34 "Interim Financial Reporting" and the Group's accounting

policies.

The Group's accounting policies are in accordance with

International Financial Reporting Standards as adopted by the

European Union and are set out in the Group's Annual Report and

Accounts 2018 on pages 53-58. The comparative figures extracted

have been adjusted as described in Note 2, following the first time

adoption of IFRS 16. These are consistent with the accounting

policies which the Group expects to adopt in its 2019 Annual

Report. The Group has not early-adopted any Standard,

Interpretation or Amendment that has been issued but is not yet

effective.

The information relating to the six months ended 30 June 2019

and 30 June 2018 is unaudited and does not constitute statutory

financial statements as defined in Section 434 of the Companies Act

2006. The comparative figures for the year ended 31 December 2018

have been extracted from the Group's Annual Report and Accounts

2018, on which the auditors gave an unqualified opinion and did not

include a statement under section 498 (2) or (3) of the Companies

Act 2006. The Group Annual Report and Accounts for the year ended

31 December 2018 have been filed with the Registrar of

Companies.

Going concern

The Directors have considered the financial projections of the

Group, including cash flow forecasts, the availability of committed

bank facilities and the headroom against covenant tests for the

coming 12 months. They are satisfied that the Group has adequate

resources for the foreseeable future and that it is appropriate to

continue to adopt the going concern basis in preparing these

interim financial statements.

Accounting estimates and judgements

The Group makes estimates and judgements concerning the future

and the resulting estimates may, by definition, vary from the

actual results. The Directors considered the critical accounting

estimates and judgements used in the financial statements and

concluded that the main areas of judgement are:

-- Potential impairment of goodwill;

-- Contingent deferred payments in respect of acquisitions;

-- Revenue recognition policies in respect of contracts which straddle the period end; and

-- Valuation of intangible assets on acquisitions.

These estimates are based on historical experience and various

other assumptions that management and the Board of Directors

believe are reasonable under the circumstances.

New standards, interpretations and amendments to existing

standards

The Group has adopted IFRS 16 Leases for the first time. The

impact on the financial statements of this new standard is detailed

in Note 2.

2. Adoption of IFRS 16 Leases

The Group has applied IFRS 16 Leases for the first time, using

the full retrospective approach, with restatement of comparative

information. IFRS 16 changes how the Group accounts for leases

previously classified off balance sheet as operating leases under

IAS 17, by removing the distinction between operating and finance

leases and requiring the recognition of a right of use asset and a

lease liability at the commencement of all leases except for short

term leases and leases of low value assets.

Applying IFRS 16 for all leases (except as noted below), the

Group:

-- Recognises right of use assets and lease liabilities in the

consolidated balance sheet, initially measured at present value of

future lease payments;

-- Recognises depreciation on right of use assets and interest

on lease liabilities in the consolidated income statement; and

-- Separates the total amount of cash paid into a principal

portion (presented within financing activities) and interest

(presented within operating activities) in the consolidated cash

flow statement.

For short term leases (lease term of 12 months or less) and

leases of low value assets (such as computer equipment), the Group

has opted to recognise a lease expense on a straight line basis as

permitted by IFRS 16. This expense is presented within operating

expenses in the consolidated income statement.

Financial impact of initial application of IFRS 16

The tables below show the amount of adjustment for each

financial statement line item affected by the application of IFRS

16 for the current and prior periods.

The impact of IFRS 16 on the Group's profitability is

insignificant, with the primary impact being one of

reclassification: from operating lease expenses to depreciation and

interest costs. The impact on the balance sheet is to recognise the

Group's operating lease commitments, most of which relate to

Agencies' premises rentals and which were previously reported in

the Notes to the financial statements, as assets and liabilities on

the face of the balance sheet. The value of these right of use

assets and corresponding liabilities will fluctuate over time as

lease terms expire and new leases are entered into.

Impact on profit or loss

Six months Six months Year ended

to to

30 June 30 June 31 December

2019 2018 2018

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

Decrease in operating

lease expenses i 1,333 1,319 2,649

Increase in depreciation

expense i (1,117) (1,071) (2,194)

----------- ----------- ------------

Increase in headline

operating profit 216 248 455

Increase in finance

costs i (126) (130) (266)

----------- ----------- ------------

Increase in headline

PBT, headline PAT

and profit for the

period 90 118 189

----------- ----------- ------------

Impact on earnings per share

Six months Six months Year ended

to to

30 June 30 June 31 December

2019 2018 2018

Increase in reported and headline

earnings per share:

Basic earnings per share (pence) 0.11 0.14 0.23

Diluted earnings per share (pence) 0.10 0.14 0.22

The above increases apply to both earnings per share from total

operations and earnings per share for continuing operations. There

is no change in earnings per share from discontinued

operations.

Impact on assets, liabilities and equity

as at 1 January 2018

As previously IFRS 16 adjustments As restated

reported

Note GBP'000 GBP'000 GBP'000

Property, plant and equipment ii 3,489 (219) 3,270

i,

Right of use assets ii - 8,016 8,016

--------------------

Impact on total assets 7,797

Other creditors and accruals iii (9,845) (246) (10,091)

Short term lease liabilities i (86) (2,227) (2,313)

Long term lease liabilities i (129) (6,131) (6,260)

Impact on total liabilities (8,604)

Retained earnings 28,879 (807) 28,072

--------------------

Impact on assets, liabilities and equity

as at 30 June 2018

As previously IFRS 16 adjustments As restated

reported

Note GBP'000 GBP'000 GBP'000

Goodwill iv 90,450 398 90,848

Property, plant and

equipment ii 3,175 (172) 3,003

Right of use assets i, ii - 8,415 8,415

Trade and other receivables iii 38,436 8 38,444

Impact on total assets 8,649

Other creditors and

accruals and deferred

income iii (21,658) (185) (21,843)

Short term lease liabilities i (88) (2,484) (2,572)

Long term lease liabilities i (85) (6,669) (6,754)

--------------------

Impact on total liabilities (9,338)

Retained earnings 31,134 (689) 30,445

--------------------

Impact on assets, liabilities and equity

as at 31 December 2018

As previously IFRS 16 adjustments As restated

reported

Note GBP'000 GBP'000 GBP'000

Goodwill iv 91,354 398 91,752

Property, plant and

equipment ii 3,250 (125) 3,125

Right of use assets i, ii - 7,733 7,733

Impact on total assets 8,006

Other creditors and

accruals iii (9,623) (224) (9,847)

Short term lease liabilities i (90) (2,417) (2,507)

Long term lease liabilities i (39) (5,983) (6,022)

--------------------

Impact on total liabilities (8,624)

Retained earnings 36,444 (618) 35,826

--------------------

Impact on assets, liabilities and equity

as at 30 June 2019

As if IAS 17 IFRS 16 adjustments As restated

still applied

Note GBP'000 GBP'000 GBP'000

Goodwill iv 91,354 398 91,752

Property, plant and

equipment ii 3,178 (78) 3,100

Right of use assets i, ii - 6,875 6,875

Impact on total assets 7,195

Other creditors, accruals iii (15,312) (220) (15,532)

Short term lease liabilities i (88) (2,340) (2,428)

Long term lease liabilities i - (5,163) (5,163)

--------------------

Impact on total liabilities (7,723)

Retained earnings 37,823 (528) 37,295

--------------------

Notes:

i The application of IFRS 16 to leases previously classified as

operating leases under IAS 17 resulted in the recognition of right

of use assets and lease liabilities. It also resulted in a decrease

in operating leases expenses and an increase in depreciation and

interest expenses.

ii Equipment under finance lease arrangements previously

presented within property, plant and equipment is now presented

within the line item right of use assets. There has been no change

in the amount recognised.

iii Amounts previously recorded in prepayments or accruals under

IAS 17 as a result of differences between operating lease expenses

recognised and amounts paid have been derecognised and the amount

factored into the measurement of the lease liability. The

recognition of accruals for dilapidation costs has also been

adjusted and the amount factored into the measurement of the right

of use assets.

iv Goodwill of companies acquired after 1 January 2018 has been

impacted as a result of the change in net assets as at acquisition

date arising from the application of IFRS 16.

3. Segmental Information

Business segmentation

For management purposes the Board monitors the performance of

its separate operating units, each of which carries out a range of

activities, as a single business segment. However, since different

activities have different revenue characteristics, the Group's

turnover and operating income has been disaggregated below to

provide additional benefit to readers of these financial

statements.

In previous periods, the profitability by activity has been

disclosed. However, following the implementation of a Shared

Services function from the start of 2018 and the resulting transfer

of certain Agency-specific contracts onto centrally-managed

arrangements, a significant portion of the total operating costs

are now centrally managed and segment information is therefore now

only presented down to the operating income level.

Advertising Media Exhibitions Public Group

& Digital Buying & Learning Relations

Six months to 30 June 2019 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------ -------- ------------ ----------- --------

Turnover 49,746 18,195 9,860 4,499 82,300

------------ -------- ------------ ----------- --------

Operating income 31,560 1,880 2,361 3,359 39,160

------------ -------- ------------ ----------- --------

Advertising Media Exhibitions Public Group

& Digital Buying & Learning Relations

Six months to 30 June 2018 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------ -------- ------------ ----------- --------

Turnover - continuing operations 43,216 20,953 9,249 4,694 78,112

- discontinued operations 1,116 - - - 1,116

------------ -------- ------------ ----------- --------

- total Group 44,332 20,953 9,249 4,694 79,228

------------ -------- ------------ ----------- --------

Operating income - continuing 28,170 1,932 2,528 3,426 36,056

- discontinued 989 - - - 989

------------ -------- ------------ ----------- --------

- total Group 29,159 1,932 2,528 3,426 37,045

------------ -------- ------------ ----------- --------

Advertising Media Exhibitions Public Total

& Digital Buying & Learning Relations

Year to 31 December 2018 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------ -------- ------------ ----------- --------

Turnover - continuing operations 96,615 36,473 17,488 9,340 159,916

- discontinued operations 1,476 - - - 1,476

------------ -------- ------------ ----------- --------

- total Group 98,091 36,473 17,488 9,340 161,392

------------ -------- ------------ ----------- --------

Operating income - continuing 61,805 3,469 5,202 7,109 77,585

- discontinued 1,255 - - - 1,255

------------ -------- ------------ ----------- --------

- total Group 63,060 3,469 5,202 7,109 78,840

------------ -------- ------------ ----------- --------

Geographical segmentation

The following table provides an analysis of the Group's

operating income by region of activity:

Six months Six months Year ended

to to

30 June 30 June 31 December

2019 2018 2018

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

From continuing operations

UK 34,544 32,134 68,519

Asia 2,125 1,948 5,061

USA 2,491 1,974 4,005

----------- ----------- ------------

39,160 36,056 77,585

----------- ----------- ------------

From discontinued operations

UK - 989 1,255

--- ---- ------

From continuing and

discontinued operations

UK 34,544 33,123 69,774

Asia 2,125 1,948 5,061

USA 2,491 1,974 4,005

------- ------- -------

39,160 37,045 78,840

------- ------- -------

4. Reconciliation of Reported Profit to Headline Profit

In order to provide a clearer understanding of underlying

profitability, headline profits exclude exceptional items,

acquisition-related items, and start-up costs. Start-up costs

derive from organically started businesses and comprise the trading

losses of such entities until the earlier of two years from

commencement or when they show evidence of becoming sustainably

profitable.

Six months Six months Year ended

to to 31 December

30 June 30 June 2018

2019 2018 Audited

Unaudited Unaudited (Restated)

(Restated)

PBT PAT PBT PAT PBT PAT

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

From continuing operations

Headline profit 3,395 2,716 3,078 2,486 9,183 7,334

Acquisition-related items

(Note 5) (925) (867) (508) (457) (1,010) (895)

Impairment of Watchable - - - - (312) (312)

Start-up costs (74) (61) (74) (60) (139) (115)

------ ------ ------ ------ -------- ------

Reported profit 2,396 1,788 2,496 1,969 7,722 6,012

------ ------ ------ ------ -------- ------

From discontinued operations

Headline profit - - 538 430 479 383

Profit on sale of BroadCare - - - - 2,981 2,981

Reported profit - - 538 430 3,460 3,364

From continuing and discontinued

operations

Headline profit 3,395 2,716 3,616 2,916 9,662 7,717

Profit on sale of BroadCare - - - - 2,981 2,981

Acquisition-related items

(Note 5) (925) (867) (508) (457) (1,010) (895)

Impairment of Watchable - - - - (312) (312)

Start-up costs (74) (61) (74) (60) (139) (115)

------ ------ ------ ------ -------- ------

Reported profit 2,396 1,788 3,034 2,399 11,182 9,376

------ ------ ------ ------ -------- ------

Start-up costs in 2019 relate to the launches of April Six's new

ventures in China and Germany. Start-up costs in 2018 related to

April Six's new venture in China, and trading losses at Mongoose

Promotions (now profitable).

5. Acquisition Adjustments

Six months Six months Year ended

to to 31 December

30 June 30 June 2018

2019 2018 Audited

Unaudited Unaudited

GBP'000 GBP'000 GBP'000

(Increase) / decrease in fair

value of contingent consideration (479) 30 67

Amortisation of intangible assets

recognised on acquisitions (446) (401) (915)

Acquisition transaction costs

expensed - (137) (162)

----------- ----------- -------------

(925) (508) (1,010)

----------- ----------- -------------

The movement in fair value of contingent consideration relates

to a revision in the estimate payable to vendors of businesses

acquired in prior years. Acquisition transaction costs relate to

professional fees associated with the acquisitions.

6. Net Finance Costs

Six months Six months

to to Year ended

30 June 30 June 31 December

2019 2018 2018

Unaudited Unaudited Audited

(Restated) (Restated)

GBP'000 GBP'000 GBP'000

Net interest on bank loans,

overdrafts and deposits (140) (198) (394)

Amortisation of bank debt arrangement

fees (23) (29) (66)

Interest expense on leases liabilities (126) (134) (275)

----------- ----------- ------------

Net finance costs (289) (361) (735)

----------- ----------- ------------

7. Taxation

The taxation charge for the period ended 30 June 2019 has been

based on an estimated effective tax rate on headline profit on

ordinary activities of 20% (30 June 2018: 20%).

8. Earnings Per Share

The calculation of the basic and diluted earnings per share is

based on the following data, determined in accordance with the

provisions of IAS 33: "Earnings per Share".

Six months Six months Year to

to to

30 June 30 June 31 December

2019 2018 2018

Unaudited Unaudited Audited

(Restated) (Restated)

GBP'000 GBP'000 GBP'000

Earnings

Reported profit for the year

From continuing operations 1,788 1,969 6,012

Attributable to:

Equity holders of the parent 1,757 1,910 5,901

Non-controlling interests 31 59 111

----------- ----------- ------------

1,788 1,969 6,012

----------- ----------- ------------

From discontinued operations - 430 3,364

Attributable to:

Equity holders of the parent - 430 3,364

Non-controlling interests - - -

----------- ----------- ------------

- 430 3,364

----------- ----------- ------------

From continuing and discontinued

operations 1,788 2,399 9,376

Attributable to:

Equity holders of the parent 1,757 2,340 9,265

Non-controlling interests 31 59 111

----------- ----------- ------------

1,788 2,399 9,376

----------- ----------- ------------

Headline earnings (Note 4)

From continuing operations 2,716 2,486 7,334

Attributable to:

Equity holders of the parent 2,685 2,427 7,223

Non-controlling interests 31 59 111

----------- ----------- ------------

2,716 2,486 7,334

----------- ----------- ------------

From discontinued operations - 430 383

Attributable to:

Equity holders of the parent - 430 383

Non-controlling interests - - -

----------- ----------- ------------

- 430 383

----------- ----------- ------------

From continuing and discontinued

operations 2,716 2,916 7,717

Attributable to:

Equity holders of the parent 2,685 2,857 7,606

Non-controlling interests 31 59 111

2,716 2,916 7,717

From continuing operations

Basic earnings per share (pence) 2.10 2.30 7.08

Diluted earnings per share (pence) 2.04 2.24 6.91

From discontinued operations

Basic earnings per share (pence) - 0.52 4.04

Diluted earnings per share (pence) - 0.50 3.94

From continuing and discontinued

operations

Basic earnings per share (pence) 2.10 2.82 11.12

Diluted earnings per share (pence) 2.04 2.75 10.85

Headline basis:

From continuing operations

Basic earnings per share (pence) 3.20 2.92 8.67

Diluted earnings per share (pence) 3.12 2.85 8.46

From discontinued operations

Basic earnings per share (pence) - 0.52 0.46

Diluted earnings per share (pence) - 0.50 0.45

From continuing and discontinued

operations

Basic earnings per share (pence) 3.20 3.44 9.13

Diluted earnings per share (pence) 3.12 3.35 8.90

A reconciliation of the profit after tax on a reported basis and

the headline basis is given in Note 4.

9. Intangible Assets

30 June 30 June 31 December

2019 2018 2018

Unaudited Unaudited Audited

(Restated) (Restated)

GBP'000 GBP'000 GBP'000

Goodwill 91,752 90,848 91,752

Other intangible assets 3,877 5,231 4,369

95,629 96,079 96,121

---------- ----------- ------------

Goodwill

Six months Six months Year ended

to 30 June to 30 June 31 December

2019 2018 2018

Unaudited Unaudited Audited

(Restated) (Restated)

GBP'000 GBP'000 GBP'000

Cost

At 1 January 96,025 89,064 89,064

Recognised on acquisition of

subsidiaries - 6,057 6,961

At 30 June / 31 December 96,025 95,121 96,025

------------ ------------ -------------

Impairment adjustment

At beginning and end of period 4,273 4,273 4,273

Net book value 91,752 90,848 91,752

------- ------- -------

In accordance with the Group's accounting policies, an annual

impairment test is applied to the carrying value of goodwill,

unless there is an indication that one of the cash generating units

has become impaired during the year, in which case an impairment

test is applied to the relevant asset. The next impairment test

will be undertaken at 31 December 2019.

Other Intangible Assets

Six months to Six months

to Year ended

30 June 30 June 31 December

2019 2018 2018

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Cost

At 1 January 9,389 7,210 7,210

Additions 85 2,689 3,011

Disposals - - (832)

At 30 June / 31 December 9,474 9,899 9,389

---------- ------------- --------------

Amortisation and impairment

At 1 January 5,020 4,050 4,050

Amortisation charge for

the period 577 618 1,286

Disposals - - (316)

At 30 June / 31 December 5,597 4,668 5,020

---------- ------------- --------------

Net book value 3,877 5,231 4,369

---------- ------------- --------------

Other intangible assets consist of Client relationships, trade

names and software development and licences.

10. Bank Loans and Net Bank Debt

30 June 30 June 31 December

2019 2018 2018

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Bank loan outstanding 8,000 13,875 10,000

Adjustment to amortised cost (94) (23) (114)

---------- ----------- ------------

Carrying value of loan outstanding 7,906 13,852 9,886

Less: Cash and short term deposits (2,811) (6,102) (5,899)

---------- ----------- ------------

Net bank debt 5,095 7,750 3,987

---------- ----------- ------------

The borrowings are repayable

as follows:

Less than one year - 13,875 -

In one to two years - - -

In more than two years but less

than three

years 8,000 - 10,000

8,000 13,875 10,000

Adjustment to amortised cost (94) (23) (114)

---------- ----------- ------------

7,906 13,852 9,886

Less: Amount due for settlement

within 12 - (13,852) -

months (shown under current liabilities)

---------- ----------- ------------

Amount due for settlement after

12 months 7,906 - 9,886

---------- ----------- ------------

On 14 September 2018, the Group signed a new three year

revolving credit facility of GBP15.0m, expiring on 28 September

2021, with an option to extend the facility by a further GBP5.0m

and an option to extend by one year. Interest on the facility is

based on LIBOR plus a margin of between 1.25% and 2.00% depending

on the Group's debt leverage ratio, payable in cash on loan

rollover dates.

In addition to its committed facilities, the Group has available

an overdraft facility of up to GBP3.0m with interest payable by

reference to National Westminster Bank plc Base Rate plus

2.25%.

11. Acquisition Obligations

The terms of an acquisition may provide that the value of the

purchase consideration, which may be payable in cash or shares or

other securities at a future date, depends on uncertain future

events such as the future performance of the acquired company. The

Directors estimate that the liability for payments that may be due

is as follows:

Cash Shares Total

GBP'000 GBP'000 GBP'000

30 June 2019

Less than one year 2,308 90 2,398

Between one and two years 5,930 294 6,224

In more than two but less than - - -

three years

In more than three but less

than four years 483 - 483

8,721 384 9,105

------ ---- ------

A reconciliation of acquisition obligations during the period is

as follows:

Cash Shares Total

GBP'000 GBP'000 GBP'000

At 31 December 2018 10,820 975 11,795

Obligations settled in the

period (2,555) (614) (3,169)

Adjustments to estimates of

obligations 456 23 479

At 30 June 2019 8,721 384 9,105

--------- --------- ---------

12. Post balance sheet events

There have been no material post balance sheet events.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR SEIFWLFUSESU

(END) Dow Jones Newswires

September 25, 2019 02:00 ET (06:00 GMT)

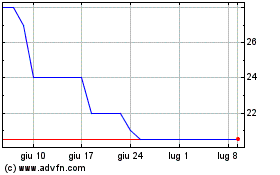

Grafico Azioni The Mission (LSE:TMG)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni The Mission (LSE:TMG)

Storico

Da Apr 2023 a Apr 2024