Market News:

FTSE 100 7,289.99 -1.44 -0.02%

FTSE 250 19,774.92 -144.15 -0.72%

FTSE AIM All-Share 874.69 -6.41 -0.73%

The FTSE 100 closed down 1.44, or 0.02%, at 7,289.99 on

Wednesday. London-listed shares of travel company TUI AG led the

fallers, declining 3.4% to 927 pence a share, while British

American Tobacco PLC led the gainers and closed up 3.3% at 2,924.50

pence.

Top News:

Sainsbury 2Q FY 2020 Total Sales Up 0.1%; Full Year In Line With

Views

J Sainsbury PLC (SBRY.LN) said Wednesday that total sales,

excluding fuel, rose 0.1% in the second quarter of fiscal 2020,

benefiting from stronger trading across its grocery, general

merchandise and clothing segments.

Companies News:

1PM FY 2019 Pretax Profit Rises Slightly; 50% of FY 2020 Revenue

Secured

Finance provider 1pm PLC (OPM.LN) on Wednesday reported a

slightly increased pretax profit for fiscal 2019 as it benefited

from recent acquisitions, but said it expects to book higher

one-off costs next year as the board rebrands the company for

future growth.

7digital Group to Raise Minimum GBP150,000 via Share Placing

7digital Group PLC (7DIG.LN) said Wednesday that it plans to

raise a minimum of 150,000 pounds ($186,795) via a share placing,

which will be used towards its streamlined product and

organizational strategy.

Alexander Mining to Sell MetaLeach Subsidiary, Become Cash

Shell

Alexander Mining PLC (AXM.LN) said Wednesday that it plans to

sell its MetaLeach mineral-processing technology subsidiary and

become a cash shell under the rules of London's junior AIM

market.

Aston Martin Tumbles as Pricey $150 Million Bond Sale Gives

Investors License to Sell

Aston Martin's struggling stock has tumbled lower after the

luxury car maker raised $150 million in expensive debt.

Babcock International Backs FY 2020 Guidance After in Line

1H

Babcock International Group PLC (BAB.LN) on Wednesday reaffirmed

guidance for revenue, operating profit and free cash flow for

fiscal 2020 after a first-half performance in line with

expectations.

Boohoo 1H FY 2020 Pretax Profit Up 84%; Backs Full Year

Guidance

Boohoo Group PLC (BOO.LN) said Wednesday that pretax profit rose

84% in the first half of fiscal 2020 benefiting from strong revenue

growth across its brands and geographies.

Carclo to Complete FY 2019 Accounts in Coming Weeks; Reshuffles

Management

Carclo PLC (CAR.LN) said Wednesday that preparation and auditing

of its fiscal 2019 is expected to be completed in the coming weeks,

and said it is reshuffling its management team.

Coral Products Sees Sales, Profits Below Views in First Four

Months of FY 2020

Coral Products PLC (CRU.LN) shares tumbled in early trading

Wednesday after the company warned that sales and profits were

below management's expectations in the first four months of fiscal

2020.

PZ Cussons Fiscal 2020 Results Seen Flat On Prior Year

PZ Cussons PLC (PZC.LN) said Wednesday that it expects flat full

year results in fiscal 2020, due to challenging conditions across

its key geographies in the first half of the year, though it

anticipates improvement in the second half.

Halma: Trading in Line With Views; Strong Growth in US, UK

Halma PLC (HLMA.LN) on Wednesday said trading in the period from

April 1 was in line with the board's expectations, and that its

order intake was ahead compared with the same period last year.

Hornby Says Five-Month Sales, Margin Higher

Hornby PLC (HRN.LN) said Wednesday that sales and margins for

the first five months of fiscal 2020 were higher on year, but said

its full-year outcome is subject to its performance over

Christmas.

Mi-Pay 1H Pretax Loss Narrowed; Cautions on 2019 Performance

Mi-Pay PLC (MPAY.LN) on Wednesday reported a narrowed pretax

loss for the first half of 2019 as both revenue and payment

transactions processed rose, but it cautioned on its full-year

expectations due to the loss of one of its larger contracts and

challenging market conditions.

Mission Marketing 1H Pretax Profit Down 4%; Expects Stronger

2H

Mission Marketing Group PLC (TMMG.LN) on Wednesday reported a 4%

fall in pretax profit for the first half of 2019 as it booked

higher costs, and said it expects most of its profit to be

generated in the second half.

Netcall FY 2019 Pretax Profit Leaps; Confident for FY 2020

Netcall PLC (NET.LN) on Wednesday reported a significant

increase in pretax profit for fiscal 2019 on lower costs, and said

the board is confident for the company's prospects.

Safestay Expects to Beat 2018 Revenue, Adjusted Ebitda; Shares

Rise

Shares in Safestay PLC (SSTY.LN) rose Wednesday after the

company said it expects revenue and adjusted Ebitda for the year to

exceed 2018's results despite reporting a widened pretax loss for

the first half of 2019.

Scientific Digital Imaging FY 2020 in Line With Market Views

Scientific Digital Imaging PLC (SDI.LN) said Wednesday that its

financials are in line with market expectations for fiscal

2020.

Shaftesbury: Portfolio Continues to Perform Well

Shaftesbury PLC (SHB.LN) Wednesday said its property portfolio

continued to perform well, and that its tenant-selection strategy

ensured it remains largely unaffected by high-profile retail

failures.

United Utilities Expects Higher 1H Revenue, Underlying Operating

Profit

United Utilities Group PLC (UU.LN) said Wednesday that it

expects to report higher revenue and underlying operating profit

for the first half, and that its performance is in line with

expectations.

Market Talk:

Don't Trim Sterling Hedging: Cambridge Associates

1408 GMT - Sterling-based investors shouldn't change their

currency hedge ratios or their allocations to sterling-denominated

assets based on potential Brexit outcomes, says Michael Salerno,

senior investment director on Cambridge Associates' global

investment research team. While the U.K. parliament's recent

legislation has "effectively taken an October 31 crash-out scenario

off the table," a possible general election means "all bets would

be off." The U.K. faces "a polarized electorate" and "an

increasingly fragmented party structure", he warns. GBP/USD falls

0.9% to its lowest in almost two weeks at 1.2373. EUR/GBP rises

0.5% to 0.8874.

Aston Martin Slips Further into Junk Territory: S&P

1403 GMT - S&P Global Ratings has downgraded Aston Martin

Lagonda further down into junk territory, or to CCC+ from B-, after

the U.K.-based luxury sports car manufacturer priced $150 million

in senior secured notes due April 15, 2022 at a 12% coupon. "We

believe that AML has reached the ceiling in terms of the amount of

term debt and cash interest burden that it can sustainably service,

given our expectation that S&P-adjusted leverage will be more

than 30x in fiscal 2019," says S&P. The success of Aston

Martin's DBX luxury SUV car, which is expected to be launched next

year, "is critical to its ambitious growth strategy and ongoing

creditworthiness".

Boohoo Booming But Jury Remains Out on New Brands

1352 GMT - Boohoo is achieving strong results across its

business, but questions remain about whether the online clothing

retailer will be able to repeat the trick with newly acquired

brands, says Hargreaves Lansdown. Boohoo reported an 84% rise in

pretax profit, fueled by rising sales in all three of its major

brands, particularly overseas. The group's rising cash pile should

allow it to invest in recently acquired premium clothing lines

Karen Millen and Coast, HL says. "These more mature brands are a

bit of departure for the group - which has been squarely aimed at

teenagers," says HL's Nicholas Hyett. "It's a potentially lucrative

market if the group can crack it, but only time will tell." Shares

fall 0.1%.

Brexit Delay to Lift Pound to $1.25-$1.29: UBS

1245 GMT - UBS stays overweight on sterling versus the dollar

and says a delay to Brexit would lift the U.K. currency to between

$1.25 and $1.29. "We still believe that a no-deal Brexit on 31

October, the current deadline, is unlikely," it says. However, if

there were a no-deal Brexit, the pound would fall to around $1.12.

If the U.K. leaves the EU with a deal similar to that agreed by

former Prime Minister Theresa May, sterling would rise to around

$1.35. Predicting Brexit "remains difficult" and UBS advises "being

nimble on sterling" and says the longer-term risk-return on U.K.

equities "looks uncertain." GBP/USD is last down 0.1% at

1.2381.

Contact: London NewsPlus, Dow Jones Newswires;

+44-20-7842-9319

(END) Dow Jones Newswires

September 25, 2019 12:24 ET (16:24 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

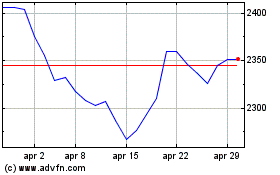

Grafico Azioni British American Tobacco (LSE:BATS)

Storico

Da Mar 2024 a Apr 2024

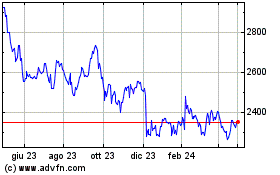

Grafico Azioni British American Tobacco (LSE:BATS)

Storico

Da Apr 2023 a Apr 2024