SSP Group PLC Pre Close Trading Update (6956N)

26 Settembre 2019 - 8:00AM

UK Regulatory

TIDMSSPG

RNS Number : 6956N

SSP Group PLC

26 September 2019

LEI: 213800QGNIWTXFMENJ24

26 September 2019

Pre Close Trading Update

SSP Group plc ("SSP" or "the Group"), a leading operator of food

and beverage outlets in travel locations worldwide, issues a Pre

Close Trading Update for the fourth quarter of its financial year

ending 30 September 2019, covering the period from 1 July to 30

September 2019.

Group

SSP had a good fourth quarter and made further progress on its

strategic initiatives. Total Group revenue is expected to increase

by approximately 7.8% on a constant currency basis, comprising

like-for-like sales growth of approximately 1.8% and net contract

gains of approximately 6.0%. At actual exchange rates, total Group

revenues for the period are expected to increase by approximately

10% year-on-year.

Overall, the trends seen in like-for-like sales growth in the

third quarter have continued into the fourth quarter. In the UK,

the air sector has been fairly resilient over the fourth quarter,

while rail has remained softer, albeit benefitting from a lower

level of disruption in the rail network. In Continental Europe,

like-for-like sales continued to be held back by slower passenger

growth and the impact of airport redevelopment in the Nordic

countries and in Spain. In North America, like-for-like sales

growth has been affected throughout the quarter by the grounding of

Boeing Max 737 aircraft and the transfer of passengers away from

our terminals at some airports. In the Rest of the World, like for

like sales growth has been mixed with good performances in Egypt

and the Middle East continuing to be offset, as anticipated, by the

cessation of operations at Jet Airways in India, weaker Chinese

passenger numbers and more recently the protests in Hong Kong. For

the full year we expect like-for-like sales growth for the Group to

be just below 2.0%.

After another strong quarter, net contract gains for the full

year are expected to be just above our previous expectations, at

around 5.5%, and as usual they will be accompanied by pre-opening

costs. Net contract gains have been driven by significant growth in

North America and Continental Europe and we have recently commenced

operations in Brazil, a new territory for SSP.

Outlook

Despite the many external challenges, particularly towards the

end of the year, SSP has performed well and guidance for FY19

remains unchanged. Looking into 2020, many of these challenges will

remain as well as ongoing economic uncertainty and the expectation

of airline capacity cuts. That said, the diversity of the business

and flexibility of the model leave us well placed to benefit from

the significant structural growth opportunities in our markets and

to create further value for shareholders.

Currency

Trading results from outside the UK are converted into Sterling

at the average exchange rates for the period. Our estimate of the

overall impact on revenue of the movement of foreign currencies

(principally the Euro, US Dollar, Swedish Krona, and Norwegian

Krone) during the full year 2019 compared to the 2018 average is

expected to be around 1%.

2019 Full Year Results Announcement

The Group's results for the year ending 30 September 2019 are

expected to be released on 20 November 2019.

CONTACTS

Investor and analyst enquiries

Sarah John, Director of Investor Relations, SSP Group plc

+44 (0) 203 714 5251; E-mail: sarah.john@ssp-intl.com

Media enquiries

Peter Ogden / Lisa Kavanagh, Powerscourt

+44 (0) 207 250 1446; E-mail: ssp@powerscourt-group.com

NOTES TO EDITORS

About SSP

SSP is a leading operator of food and beverage concessions in

travel locations, operating restaurants, bars, cafés, food courts,

lounges and convenience stores in airports, train stations,

motorway service stations and other leisure locations. With over 50

years of experience, today we have more than 37,000 employees,

serving approximately one and a half million customers every day.

We have business at approximately 140 airports and 280 rail

stations, and operate more than 2,600 units in 33 countries around

the world.

SSP operates an extensive portfolio of more than 500

international, national, and local brands. Among these are local

heroes such as Brioche Doree in Paris, LEON in London, and Hung's

Delicacies in Hong Kong. Our range also includes proprietary brands

created for the travel sector including Upper Crust, Cabin Bar and

Ritazza, as well as international names such as M&S, Burger

King, Starbucks, Jamie's Deli and YO! Sushi. We also create

stunning bespoke concepts such as Five Borough Food Hall in JFK,

New York and Norgesglasset Bar in Oslo Airport.

www.foodtravelexperts.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTFMGZLVKDGLZM

(END) Dow Jones Newswires

September 26, 2019 02:00 ET (06:00 GMT)

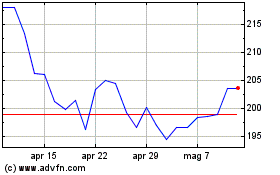

Grafico Azioni Ssp (LSE:SSPG)

Storico

Da Mar 2024 a Apr 2024

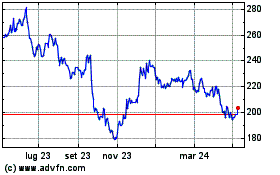

Grafico Azioni Ssp (LSE:SSPG)

Storico

Da Apr 2023 a Apr 2024