TIDMZEG

RNS Number : 8801N

Zegona Communications PLC

27 September 2019

NOT FOR DISTRIBUTION, PUBLICATION OR RELEASE, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN OR INTO OR FROM THE UNITED STATES

OR CANADA, AUSTRALIA, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR ANY

MEMBER STATE OF THE EUROPEAN ECONOMIC AREA (OTHER THAN THE UNITED

KINGDOM AND SPAIN) OR ANY OTHER JURISDICTION IN WHICH THE

DISTRIBUTION, PUBLICATION OR RELEASE WOULD BE UNLAWFUL.

ZEGONA COMMUNICATIONS PLC ("Zegona")

LEI: 213800ASI1VZL2ED4S65

27 SEPTEMBER 2019

Interim report for the six months ended 30 June 2019

Zegona announces its interim results for the six months ended 30

June 2019.

Enquiries

Tavistock (Public Relations adviser - UK)

Tel: +44 (0)20 7920 3150

Jos Simson - jos.simson@tavistock.co.uk

Lulu Bridges - lulu.bridges@tavistock.co.uk

IMPORTANT NOTICES

This announcement has been prepared in accordance with English

law, the Listing Rules and the Disclosure Guidance and Transparency

Rules and information disclosed may not be the same as that which

would have been prepared in accordance with the laws of

jurisdictions outside England.

The distribution of this announcement in jurisdictions outside

the United Kingdom may be restricted by law and therefore persons

into whose possession this announcement comes should inform

themselves about, and observe such restrictions. Any failure to

comply with the restrictions may constitute a violation of the

securities law of any such jurisdiction.

About Zegona

Zegona was established in 2015 with the objective of investing

in businesses in the European Telecommunications, Media and

Technology sector and improving their performance to deliver

attractive shareholder returns. Zegona is listed on the standard

listing segment of the Official List of the Financial Conduct

Authority and the Main Market for listed securities of the London

Stock Exchange, and is led by former Virgin Media executives Eamonn

O'Hare and Robert Samuelson.

About Euskaltel

Zegona's principal asset is its investment in Euskaltel.

Euskaltel is the leading converged telecommunications provider in

the North of Spain, with a network covering nearly 2.3 million

households. It provides high speed broadband, data rich mobile,

advanced TV and fixed communications services to residential and

business customers under the Euskaltel, R Cable and Telecable

brands. Euskaltel is listed on the Madrid stock exchange.

ZEGONA COMMUNICATIONS PLC

Unaudited Condensed Consolidated Interim Financial

Statements

For the six months ended 30 June 2019

MANAGEMENT REPORT

Investment in Euskaltel

A positive movement in Euskaltel's share price from EUR6.99 at

31 December 2018 to EUR8.15 at 30 June 2019 generated a gain on the

fair value of Zegona's investment in Euskaltel of EUR30.0 million

for the six months ended 30 June 2019 (2018: EUR25.9 million). We

also received EUR3.8 million of dividend income from Euskaltel

during the period (2018: EUR3.4 million).

In early 2019 we raised more than GBP100 million of new equity

and entered into flexible financing facilities to fund an increase

in our Euskaltel ownership. Following this, we have become the

largest shareholder in Euskaltel, increasing our ownership from 15%

to over 20% as at 30 June 2019 through market purchases.

Zegona is working constructively with the Euskaltel board of

directors to improve the performance of the business. This has

resulted in Euskaltel making a number of changes that Zegona

believes are advantageous for the business. In particular, José

Miguel García (the ex-CEO of Jazztel) was appointed as CEO of

Euskaltel by its board with unanimous agreement on 5 June 2019, and

his appointment was overwhelmingly endorsed by Euskaltel's

shareholders at the Extraordinary Shareholder Meeting on 10 July

2019. At the same shareholder meeting, Zegona's Chief Executive

Officer Eamonn O'Hare and Chief Operating Officer Robert Samuelson

were also confirmed as proprietary directors on Euskaltel's

board.

In his first months as CEO, José Miguel has made a fast start

with significant progress in implementing a new plan for the

business. Highlights include:

Integrating three operating companies into one business. This is

designed to simplify operations and reduce costs. A new

organisation structure is already in place, with key hires on board

and a streamlined senior executive team. This has created clearer

accountability for results and a stronger and more agile

leadership. José Miguel is also creating a single technical

platform, whilst integrating the sales strategies of the three

brands, taking best practice from each and expanding the more

efficient on-line/direct channels.

Improving the customer proposition. Euskaltel is focussed on

reducing churn and enabling ARPU growth. A new mobile offer has

been launched in partnership with Samsung, giving customers a

high-quality handset and large data allowance at highly attractive

rates. In addition, Euskaltel has increased broadband speed for its

customers at no extra cost. A carefully targeted 'more-for-more'

price rise has also been implemented.

Expanding nationally. With its more efficient operating

platform, a new highly-experienced management team, and the option

of utilising the Virgin brand, the company is well-placed to grow

in the 85% of Spanish households where it currently does not

compete. Winning a small share of this large and growing market can

be transformative for the company's financial performance. Detailed

planning has commenced, and discussions initiated with key

partners.

Euskaltel's new CEO and strategy have been well received by

local and national Spanish media, with significant press

coverage.

With José Miguel now running the Euskaltel business and our

strengthened position on the board, we are confident that

Euskaltel's new direction will drive value for Zegona's

shareholders.

Outlook

In addition to supporting Euskaltel's performance improvement

through our representation on the Euskaltel board, we continue to

see many attractive investment opportunities both in Spain and the

wider European TMT market. These are driven by a number of

underlying trends that create attractive opportunities across a

broad range of assets which Zegona believes it is well placed to

capitalise on. We are looking forward to discussing some of the

opportunities available to Zegona shareholders, both through the

investment in Euskaltel and other opportunities, on a conference

call to be held at 15:00 BST on 3 October 2019.

Dividend

Zegona has made two dividend payments in 2019, with 2.5 pence

per share paid on 1 March and a further 2.5 pence per share on 6

September. In total, 5.0 pence per share or GBP8.7 million has been

paid to shareholders in 2019.

Zegona has been consistent in its commitment to paying

dividends, with more than GBP30 million being paid to shareholders

since 2016. We remain committed to our policy of passing 100% of

all Euskaltel dividends received to our shareholders.

Risks

The principal risks and uncertainties faced by the Group have

not changed significantly since our annual report for the year

ended 31 December 2018 (the "2018 Annual Report").

Risk title Risk rating Change in risk assessment

since the 2018 Annual Report

-------------------------------- ------------ ------------------------------

Risks related to the investment High <--> No change

in Euskaltel

Acquisition of targets Moderate <--> No change

Key management Moderate <--> No change

Disposal of investment Moderate <--> No change

Brexit Moderate <--> No change

Foreign exchange Low <--> No change

These risks have the potential to affect the Group's results and

financial position during the remainder of 2019. A more detailed

explanation of risks and uncertainties is set out on pages 7 to 10

of the 2018 Annual Report.

RESPONSIBILITY STATEMENT

Statement of Directors' Responsibility

We confirm to the best of our knowledge:

-- the unaudited condensed consolidated interim financial

statements have been prepared in accordance with IAS 34 Interim

Financial Reporting; and

-- the interim management report includes a fair review of the

information required by Disclosure and Transparency Rule 4.2.7R and

Disclosure and Transparency Rule 4.2.8R.

Neither the Company nor the directors accept any liability to

any person in relation to the half-year financial report except to

the extent that such liability could arise under English law.

Accordingly, any liability to a person who has demonstrated

reliance on any untrue or misleading statement or omission shall be

determined in accordance with section 90A and schedule 10A of the

Financial Services and Markets Act 2000.

Details on the Company's Board of Directors can be found on the

Company website at www.zegona.com.

By order of the Board

Eamonn O'Hare

Chairman and CEO

26 September 2019

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six months ended

30 June

2019 2018

------------- ------------

Unaudited

---------------------------

Note EUR000 EUR000

Continuing operations

Administrative and other operating

expenses:

Corporate costs (1,898) (1,829)

Significant project costs (280) (61)

------------- ------------

Operating loss (2,178) (1,890)

Finance income 4 33,911 29,270

Finance costs 4 (326) (146)

Exchange differences 2,321 (488)

------------- ------------

Profit for the period before

income tax 33,728 26,746

Income tax - (34)

------------- ------------

Profit for the period attributable

to equity holders of the parent 33,728 26,712

============= ============

cents cents

Earnings per share

Basic and diluted earnings per

share attributable to ordinary

equity holders of the parent 16.8 21.2

The accompanying notes are an integral part of the unaudited

condensed consolidated interim financial statements.

CONDENSED CONSOLIDATED STATEMENT OF OTHER COMPREHENSIVE

INCOME

For the six months

ended 30 June

2019 2018

----------- --------

Unaudited

---------------------

EUR000 EUR000

Profit for the period 33,728 26,712

Other comprehensive (loss)/income -

items that will or may be reclassified

subsequently to profit or loss

Exchange differences on translation

of foreign operations (2,565) 479

Total comprehensive income for the period,

net of tax, attributable to equity holders

of the parent 31,163 27,191

=========== ========

The accompanying notes are an integral part of the unaudited

condensed consolidated interim financial statements.

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 As at 31

June 2019 December

2018

----------- ----------

Unaudited Audited

----------- ----------

Note EUR000 EUR000

Assets

Non-current assets

Property, plant and equipment 1 2

Intangible assets - 1

Non-current financial assets 6 303,587 187,332

303,588 187,335

Current assets

Trade and other receivables 90 2,128

Other current financial assets 7 4,966 4,826

Cash and cash equivalents 34,579 3,138

----------- ----------

39,635 10,092

----------- ----------

Total assets 343,223 197,427

=========== ==========

Equity and liabilities

Equity

Share capital 2,855 1,763

Other reserves 310,743 205,623

Share-based payment reserve 105 105

Foreign currency translation reserve (5,941) (3,376)

Retained earnings 23,672 (10,056)

----------- ----------

Total equity attributable to equity

holders of the parent 331,434 194,059

Current liabilities

Trade and other payables 881 3,368

881 3,368

Non-current liabilities

Bank borrowings 10,908 -

----------- ----------

10,908 -

Total equity and liabilities 343,223 197,427

=========== ==========

The accompanying notes are an integral part of the unaudited

condensed consolidated interim financial statements.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Foreign

Share-based currency Available

Share Other payment translation for sale Retained

capital reserves reserve reserve reserve earnings Total equity

------------- ------------ ------------ ------------ ---------- ---------- -------------

Note EUR000 EUR000 EUR000 EUR000 EUR000 EUR000 EUR000

Balance at 1

January

2019 1,763 205,623 105 (3,376) - (10,056) 194,059

Profit for the

period - - - - - 33,728 33,728

Other

comprehensive

loss - - - (2,565) - - (2,565)

Issue of

shares,

net of

directly

attributable

costs 1,092 108,793 - - - - 109,885

Dividend paid 9 - (3,673) - - - - (3,673)

------------- ------------ ------------ ------------ ---------- ---------- -------------

Balance at 30

June

2019

(unaudited) 2,855 310,743 105 (5,941) - 23,672 331,434

============= ============ ============ ============ ========== ========== =============

Balance at 31

December

2017 1,763 215,158 105 (891) (41,360) 21,390 196,165

Adjustments on

initial

application

of IFRS

9 - - - - 41,360 (41,360) -

Balance at 1

January

2018 1,763 215,158 105 (891) - (19,970) 196,165

Profit for the

period - - - - - 26,712 26,712

Other

comprehensive

income - - - 479 - - 479

Dividend paid - (5,622) - - - - (5,622)

------------- ------------ ------------ ------------ ---------- ---------- -------------

Balance at 30

June

2018

(unaudited) 1,763 209,536 105 (412) - 6,742 217,734

============= ============ ============ ============ ========== ========== =============

The accompanying notes are an integral part of the unaudited

condensed consolidated interim financial statements.

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

For the six months ended

30 June

2019 2018

Unaudited

-----------------------------

EUR000 EUR000

Operating activities

Profit before income tax 33,728 26,746

Adjustments to reconcile profit before

income tax to operating cash flows:

Depreciation of property, plant and equipment 1 1

Net foreign exchange differences (2,321) 488

Finance income (33,911) (29,270)

Finance costs 326 146

Working capital adjustments:

Decrease in trade and other receivables

and prepayments 2,038 99

Decrease in trade and other payables (2,587) (2,003)

Interest received 19 4

Interest paid (140) -

-------------- -------------

Net cash flows used in operating activities (2,847) (3,789)

============== =============

Investing activities

Net proceeds from loans receivable - 616

Market purchases of shares in Euskaltel (86,255) -

Dividends received 3,752 3,404

-------------- -------------

Net cash flows (used in)/from investing

activities (82,503) 4,020

============== =============

Financing activities

Dividend paid to shareholders (3,673) (5,622)

Issue of shares, net of directly attributable 109,885 -

costs

Loan drawdown, net of borrowing costs 10,824 -

-------------- -------------

Net cash flows from/(used in) financing

activities 117,036 (5,622)

============== =============

Net increase/(decrease) in cash and cash

equivalents 31,686 (5,391)

Net foreign exchange difference (245) (9)

Cash and cash equivalents at 1 January 3,138 10,224

Cash and cash equivalents at 30 June 34,579 4,824

============== =============

The accompanying notes are an integral part of the unaudited

condensed consolidated interim financial statements.

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

1. GENERAL INFORMATION

The unaudited condensed consolidated interim financial

statements of Zegona Communications plc (the "Company" or the

"Parent") and its subsidiaries (collectively, the "Group" or

"Zegona") for the six months ended 30 June 2019 (the "Interim

Financial Statements") were authorised for issue in accordance with

a resolution of the directors on 26 September 2019. The Company is

incorporated in England and Wales and domiciled in the United

Kingdom. It is a public limited company with company number

09395163 and has its registered office at 20 Buckingham Street,

London, WC2N 6EF.

2. SIGNIFICANT ACCOUNTING POLICIES

(a) Basis of preparation

The Interim Financial Statements have been prepared in

accordance with IAS 34 Interim Financial Reporting and are

presented on a condensed basis. The Interim Financial Statements do

not constitute statutory accounts within the meaning of section

434(3) of the Companies Act 2006 (the "Companies Act").

The Interim Financial Statements do not include all the

information and disclosures required in the annual financial

statements, and should be read in conjunction with the Group's

annual financial statements as at 31 December 2018 which are

available on the Company's website, www.zegona.com. However,

selected explanatory notes are included to explain events and

transactions that are significant to an understanding of the

changes in the Group's financial position and performance since the

last annual financial statements.

Information from 31 December 2018 is based on the statutory

accounts for the year ended 31 December 2018, which were delivered

to the Registrar of Companies and on which the auditor's report was

unqualified and did not contain a statement under section 498(2) or

498(3) of the Companies Act.

(b) Going concern

The Interim Financial Statements have been prepared on the going

concern basis, which assumes that the Group will continue to be

able to meet its liabilities as they fall due for the foreseeable

future.

(c) New standards, interpretations and amendments adopted by the Group

The accounting policies adopted in the preparation of the

Interim Financial Statements are consistent with those followed in

the preparation of the Group's annual consolidated financial

statements for the year ended 31 December 2018, which were prepared

in accordance with International Financial Reporting Standards as

adopted by the European Union. The Group has not early adopted any

other standard, interpretation or amendment that has been issued

but is not yet effective.

Standards issued but not yet effective

The Group intends to adopt the following standards, amendments

and interpretations, if applicable, when they become effective and

endorsed by the European Union. Adopting these standards will not

have a material impact on the Group.

Standard Effective date

Amendments to IFRS 3 Business Combinations 1 January 2020

Amendments to IAS 1 and IAS 8: Definition of 1 January 2020

Material

IFRS 17 Insurance Contracts 1 January 2021

(d) Critical accounting judgements and estimates

The preparation of the Interim Financial Statements requires the

Directors to consider estimates and assumptions that affect the

reported amounts of assets and liabilities and the disclosure of

contingent assets and liabilities. Estimates and judgements are

continually evaluated and are based on historical experience and

other factors including expectations of future events that are

believed to be reasonable under the circumstances. Actual results

may differ from these estimates.

There have been no material changes to the significant

judgements and estimates made by the Directors as at and for the

year ended 31 December 2018.

The Directors have continued to assess their conclusion on the

accounting treatment for Zegona's investment in Euskaltel of 37.2

million shares, or approximately 20.85% of its ordinary shares and

voting rights, as detailed in note 6.

3. SEGMENT INFORMATION

Central Investment

Six months to 30 June 2019 costs in Euskaltel Consolidated

-------- -------------- -------------

EUR000 EUR000 EUR000

Depreciation and amortisation (1) - (1)

Other operating expenses (2,177) - (2,177)

-------- -------------- -------------

Operating loss (2,178) - (2,178)

Finance income 159 33,752 33,911

Finance costs (326) - (326)

Exchange differences 2,321 - 2,321

(Loss)/profit for the period (24) 33,752 33,728

======== ============== =============

Central Investment

Six months to 30 June 2018 costs in Euskaltel Consolidated

-------- -------------- -------------

EUR000 EUR000 EUR000

Depreciation and amortisation (1) - (1)

Other operating expenses (1,889) - (1,889)

-------- -------------- -------------

Operating loss (1,890) - (1,890)

Finance income 4 29,266 29,270

Finance costs (146) - (146)

Exchange differences (488) - (488)

-------- -------------- -------------

(Loss)/profit before tax (2,520) 29,266 26,746

Income tax (34) - (34)

-------- -------------- -------------

(Loss)/profit for the period (2,554) 29,266 26,712

======== ============== =============

4. FINANCE INCOME AND COSTS

For the 6 months ended

30 June

2019 2018

Note EUR000 EUR000

Dividend income 3,752 3,404

Gain on fair value of investment

in Euskaltel 30,000 25,862

Gain on fair value of contingent

consideration 7 140 -

Interest on loans - 2

Bank interest 19 2

------------ -----------

Finance income 33,911 29,270

============ ===========

Loss on fair value of contingent

consideration 7 - (146)

Costs of bank borrowings (326) -

------------ -----------

Finance costs (326) (146)

============ ===========

Dividend income

The Group received a dividend on 7 February 2019 from Euskaltel

at a rate of EUR0.140 per share, totalling EUR3.75 million. In the

comparative period, the Group received a dividend on 1 February

2018 from Euskaltel at a rate of EUR0.127 per share, totalling

EUR3.40 million.

Gain on fair value of investment in Euskaltel

The change in fair value incorporates the increase in the

Euskaltel share price from EUR6.99 at 31 December 2018 to EUR8.15

at 30 June 2019.

5. FINANCIAL INSTRUMENTS

The classification by category of the financial instruments held

by the Group at 30 June 2019 is as follows:

Note Current Non-current

EUR000 EUR000

Financial assets measured at amortised

cost

Cash and cash equivalents 34,579 -

-------- -------------

34,579 -

Financial assets measured at fair value

through profit or loss

Investment in Euskaltel (level 1) 6 - 303,587

Contingent consideration (level

3) 7 4,966 -

-------- -------------

4,966 303,587

Total financial assets 39,545 303,587

======== =============

Financial liabilities measured at

amortised cost

Trade and other payables 881 -

Bank borrowings 8 - 10,908

-------- -------------

Total financial liabilities 881 10,908

======== =============

For the financial assets measured at fair value, the Directors

have determined that no transfers have occurred between levels in

the fair value hierarchy from 31 December 2018 to 30 June 2019. The

Directors consider that the carrying amounts of the financial

instruments measured at amortised cost equate to their fair

values.

6. NON-CURRENT FINANCIAL ASSETS

As at 30 As at 31

June 2019 December

2018

EUR000 EUR000

Investment in Euskaltel 303,587 187,332

Total 303,587 187,332

=========== ==========

Investment in Euskaltel

Euskaltel is listed on the Bilbao, Madrid, Barcelona and

Valencia Stock Exchanges through the Stock Market Interconnection

System (Continuous Market). As part of the purchase agreement for

the Euskaltel shares acquired on 26 July 2017, Zegona agreed to

standard lock-in provisions in relation to those shares. These

provisions fully lapsed on 26 July 2019.

For all periods up to 30 June 2019, Zegona concluded that the

ability it had to contribute to Euskaltel's board and committees

did not confer the power to participate in Euskaltel's financial

and operating policy decisions and therefore the criteria for

equity accounting within IAS 28 Investments in Associates and Joint

Ventures were not met. Zegona had therefore accounted for its

investment in Euskaltel as a financial asset measured at fair value

through profit or loss in accordance with IFRS 9 Financial

Instruments. Zegona will continue to re-evaluate this conclusion in

future periods, including assessing the impact of developments in

recent months around Zegona's increased investment, board

representation and Euskaltel management changes, and may conclude

that it is appropriate to apply equity accounting.

Zegona has granted security to Euskaltel by a share pledge over

1,663,158 of its shares in Euskaltel with respect to certain

credits generated in favour of Telecable. At 30 June 2019,

3,431,268 shares are unpledged, with the remainder granted as

security to Barclays by a share pledge with respect to the loan

facility as described in note 8.

7. OTHER CURRENT FINANCIAL ASSETS

The other current financial assets balance of EUR5.0 million (31

December 2018: EUR4.8 million) comprises solely the contingent

consideration receivable from the sale of Telecable. This compares

to a base case model present value of EUR6.9 million (31 December

2018: EUR6.7 million) and Zegona's best estimate of the

undiscounted cash flow that it will receive of EUR7.1 million (31

December 2018: EUR7.1 million). The contingent consideration is

payable by Euskaltel in cash up to a maximum amount of EUR15

million upon confirmation that a range of net tax assets are

available to Euskaltel and may be used to offset its future tax

payments.

Note EUR000

Balance at 31 December 2018 4,826

Change in unrealised fair value recognised

in profit or loss 4 140

Balance at 30 June 2019 4,966

=======

The eventual amount to be received depends on several factors

that are entirely specific to Euskaltel. These factors include the

availability of tax assets, the extent to which there will be

sufficient taxable profits to utilise these assets, and assumptions

around the outcome of certain open interactions with the Spanish

tax authorities. There have been no material updates to these

significant unobservable inputs since 31 December 2018.

The fair value of the contingent consideration has been

calculated using a probability-weighted discounted cash flow model

that calculates the present value of the expected cash flows for 12

different plausible combinations of outcomes. The fair value was

determined by calculating a weighted average of those cash flows

according to the probability of each scenario occurring. As a

result of this analysis, a fair value of EUR5.0 million (31

December 2018: EUR4.8 million) was assigned to the contingent

consideration. This value recognises the possibility of certain

material downside cases that Zegona currently considers to be

unlikely to occur (particularly in relation to the merger approval

discussed below not being granted) and therefore the eventual

amount received could be greater than this fair value.

The significant unobservable inputs used in the base case (which

had a present value of EUR6.9 million (31 December 2018: EUR6.7

million), being management's assessment of the present value of the

most likely outcome) and the impact of each input on the value of

the base case at the reporting date, holding the other inputs

constant, are shown below:

Merger approval:

--------------------------------------------------------------------

The likelihood of receiving a binding ruling by the Spanish

General Directorate of Taxation confirming certain tax assets

are eligible for use upon a qualifying merger of the Telecable

entities.

Input used in the base case model: Sensitivity of the base case:

Successful If the merger is unsuccessful,

the revised base case present

value would be EUR1.0 million

Usability of available assets:

---------------------------------------------------------------------

The proportion of the available net tax assets that are deemed

to be usable by the Telecable entities in future periods to

offset future taxable profits according to the terms of the

SPA.

Input used in the base case model: Sensitivity of the base case:

84% usable Usability scenarios ranged

from 48% to 100%, causing the

present value of the base case

to range from EUR4.0 million

to EUR8.2 million

Timing of merger approval:

---------------------------------------------------------------------

The time it will take to receive a positive tax ruling on the

merger described above (which is not relevant for scenarios

where the merger is not approved).

Input used in the base case model: Sensitivity of the base case:

6 months If the timing is increased

to 18 months, the revised base

case present value would be

EUR6.5 million

8. BANK BORROWINGS

The Company has been provided with facilities of up to GBP30

million by Barclays Bank plc and Virgin Holdings Limited.

During the period, the Company has drawn down GBP10 million

under the Barclays facility. Interest is payable quarterly in

arrears on the drawn amount at a rate of 2.6% per annum above the

3-month LIBOR interest rate. A commitment fee of 0.6% per annum is

payable on the undrawn amount of GBP20 million. The Company has the

right to prepay the loan at any time, but if it does so before the

first anniversary of the date of the draw down, it must pay a make

whole amount calculated at 2.6% per annum multiplied by the prepaid

amount for the period between the date of prepayment and that first

anniversary.

The Barclays facility matures on 14 January 2021, and any

amounts owed will become immediately repayable on the occurrence of

certain events of default including a drop in the value of

Euskaltel shares to EUR3.42 or below, a change of control of

Euskaltel or Zegona and other customary events of default. The

Barclays facility is secured by a charge over some Euskaltel shares

as detailed in note 6.

The Company has not drawn down any amounts under the Virgin

facility. From the date on which funds are drawn down, interest

will accrue daily at an annual interest rate of LIBOR plus 5%,

payable quarterly in arrears. The Virgin facility matures on 30

April 2020.

9. DIVIDEND PAID

The Company declared an interim dividend on 31 January 2019 at a

rate of 2.5p per share, totalling EUR3.7 million. The dividend was

paid on 1 March 2019. In the comparative period, the Company

declared an interim dividend on 22 March 2018 at a rate of 3.9p per

share, totalling EUR5.6 million, which was paid on 24 April

2018.

10. RELATED PARTY TRANSACTIONS

Mark Brangstrup Watts is a designated member of Marwyn Capital

LLP ("Marwyn"), which provides corporate finance advice and various

office services to the Company. During the period, services

totalling EUR34k were received from Marwyn (2018: EUR34k). In

addition, Mark's Non-Executive Director fees are paid to Marwyn.

Marwyn was owed a total amount of EUR12k at 30 June 2019 (2018:

EUR12k), which was unsecured.

Mark Brangstrup Watts is an ultimate beneficial owner of Axio

Capital Solutions Limited ("Axio"), which provides company

secretarial, administrative and accounting services to the Group.

During the period, services totalling EUR235k were received from

Axio (2018: EUR302k). Axio was owed an amount of EUR19k at 30 June

2019 (2018: EUR22k), which was unsecured.

11. CONTINGENT LIABILITY

The European Commission issued a press release on 2 April 2019

announcing that, in certain circumstances, the UK Controlled

Foreign Company Financing Exemptions unduly exempted some

multinational groups from these rules. The actions that the UK tax

authorities will take in response to this press release are

uncertain and Zegona continues to monitor the situation. No

provision has been made as it is not currently deemed probable that

Zegona will be required to settle its possible obligation in

relation to this matter. Zegona is still evaluating its potential

exposure which could be up to a theoretical maximum of EUR5

million.

12. POST BALANCE SHEET EVENTS

Interim dividends

Zegona received a dividend on 9 July 2019 from Euskaltel at a

rate of EUR0.17 per share, totalling EUR6,332,498.

Zegona declared an interim dividend on 2 August 2019 at a rate

of 2.5 per share, totalling GBP5,548,379, equivalent to

EUR6,083,880 on the date of announcement. The dividend was paid on

6 September 2019.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR UNSURKRAKUUR

(END) Dow Jones Newswires

September 27, 2019 02:01 ET (06:01 GMT)

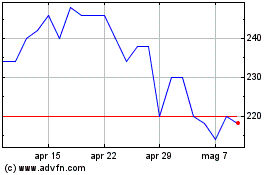

Grafico Azioni Zegona Communications (LSE:ZEG)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Zegona Communications (LSE:ZEG)

Storico

Da Apr 2023 a Apr 2024