TIDMTLY

RNS Number : 8755N

Totally PLC

27 September 2019

27 September 2019

Totally plc

("Totally", the "Company" or the "Group")

Notice of General Meeting

Totally plc (AIM:TLY), the provider of a range of out of

hospital services to the healthcare sector in the UK, announces

that later today the Company will post a notice of general meeting

("General Meeting") to shareholders. The General Meeting will be

held at 9.30 a.m. on 15 October 2019 at the Company's registered

office, Cardinal Square West, 10 Nottingham Road, Derby DE1

3QT.

The purpose of the General Meeting is to seek the approval of

shareholders to a reduction of the share capital of the Company,

involving the cancellation of the Company's share premium account

("Capital Reduction"). The purpose of the Capital Reduction is to

create distributable reserves to enable the Company to pay

dividends or make distributions to its Shareholders and/or to

undertake a buy back of its Ordinary Shares.

A copy of the circular containing the Notice of General Meeting

will shortly be available on the Company's website at

www.totallyplc.com.

Extracts from the circular are set out below and should be read

in conjunction with the full text of the circular.

Defined terms used in this announcement have the same meaning as

set out in the circular.

For further information please contact:

Totally plc 020 3866 3335

Wendy Lawrence, Chief Executive

Bob Holt, Chairman

Allenby Capital Limited (Nominated Adviser

& Joint Corporate Broker) 020 3328 5656

Nick Athanas

Liz Kirchner

Canaccord Genuity Limited (Joint Corporate

Broker) 020 7523 8000

Bobbie Hilliam

Alex Aylen

Yellow Jersey PR 020 3004 9512

Georgia Colkin

Joe Burgess

Notes to Editors

Totally plc aims to become a leading out of hospital healthcare

service provider in the UK, helping to address some of the biggest

challenges faced by the UK healthcare sector.

By working to deliver preventative and responsive care through

its subsidiaries across multiple disciplines, Totally's goal is to

improve people's health, reduce healthcare reliance, re-admissions

and emergency admissions.

Totally, via its subsidiaries, operates within the UK's

outsourced healthcare market, estimated to be worth in excess of

GBP20bn per year for the NHS alone. Out of hospital services

include care in the community, GP surgeries, patients' homes,

prisons and other public sector organisations, places of work as

well as mobile locations and urgent care solutions.

The Company is currently engaged in delivering a progressive buy

and build consolidation strategy within the UK's fragmented

healthcare market and looks to further capitalise on the attractive

opportunities that its disruptive, outcome-based, outsourced

healthcare service model offers, to ultimately deliver value to

shareholders as it continues to build critical mass.

www.totallyplc.com

Premier Physical Healthcare and Optimum Physiotherapy -

occupational physiotherapy to NHS, prisons and the police force as

well as private clients

Wholly owned subsidiaries of Totally plc, providing a

comprehensive range of treatments and advice for musculoskeletal

injuries and conditions. The businesses deliver physiotherapy and

podiatry to NHS patients, have contracts with various police forces

and prison sites and provide occupational health and ergonomic

services to corporate and private clients. Totally completed the

acquisition of Premier Physical Healthcare Limited on 1 April 2016

and Optimum Sports Performance Centre Limited on 14 November

2016.

www.premierphysicalhealthcare.co.uk

www.optimum-hcs.com

About Health Limited - provider of community based dermatology

services and referral management services

A wholly owned subsidiary of Totally plc and a leading provider

of dermatology and referral management services to the NHS in the

UK. About Health has been providing community based health services

under contract to the NHS since 2009 and the company is CQC

registered. Totally completed the acquisition of About Health

Limited on 15 June 2016.

www.abouthealthgroup.com

Vocare Limited - leading UK urgent care provider

A wholly owned subsidiary of Totally plc, the Vocare Group is

one of the leading national specialist providers of urgent care

services in the country. Headquartered in Newcastle upon Tyne, it

provides innovative healthcare services to approximately 9.2

million patients across the UK through urgent care centres, GP

out-of-hours services, integrated urgent care centres and the NHS

111 service - working in close collaboration with the NHS and other

healthcare providers in local areas nationwide. Totally completed

the acquisition of Vocare Limited on 24 October 2017.

www.vocare.org.uk

Greenbrook Healthcare - leading provider of NHS urgent care

centres

A wholly owned subsidiary of Totally plc, Greenbrook Healthcare

is an innovative primary care organisation caring for NHS patients

across London and the home counties. The business delivers services

for NHS patients in a growing number of GP Practices, Walk-in

Centres, Urgent Care Centres and community services. Totally

completed the acquisition of Greenbrook Healthcare on 20 June

2019.

www.greenbrook.nhs.uk

1. Background to, and reasons for, the Capital Reduction

As at 31 March 2019, the Company had retained losses of

GBP4,252,262.42 and continues to have a negative distributable

reserves position meaning that it is unable to declare dividends or

make distributions to Shareholders or buy back its Ordinary

Shares.

The Company has, however, built up a substantial Share Premium

Account through the issue of shares for cash at values in excess of

the nominal value of those shares. As at the date of this

announcement, the balance standing to the credit of the Share

Premium Account is GBP16,408,326.07. This share premium account

constitutes a non-distributable reserve for the purposes of the

Companies Act. The Company is therefore seeking the approval of

Shareholders to cancel the Share Premium Account in its entirety

which, subject to the confirmation of the High Court, will enable

the Company to eliminate the retained losses and create

distributable reserves equal to the balance.

The distributable reserves will be available for the Directors

to use for the purposes of paying dividends or making distributions

and/or undertaking a buy back of its Ordinary Shares, should

circumstances in the future make it desirable to do so.

Further details of the Capital Reduction are set out in the

paragraphs below.

2. Capital Reduction - Share Premium Account

Share premium is treated as part of the capital of a company and

arises on the issue by a company of shares at a premium to their

nominal value. The premium element is credited to the share premium

account.

The share premium account is a non-distributable capital reserve

and a company's ability to use any amount credited to that reserve

is limited by the Companies Act. However, with the approval of its

shareholders by way of a special resolution and subsequent

confirmation by the High Court, a company may reduce or cancel its

share premium account and in certain circumstances either return

all or part of the sum arising to shareholders as a return of

capital, or credit some or all of such sum arising to its profit

and loss account.

To the extent that the release of such a sum from the share

premium account creates or increases a credit on the profit and

loss account, that sum represents a company's distributable

reserves.

As mentioned above, the cancellation of the Share Premium

Account will eliminate the Company's retained losses and create

distributable reserves equal to the balance.

3. Capital Reduction - Procedure

In order to effect the Capital Reduction, the Company firstly

requires the authority of its Shareholders by the passing of the

Resolution at the General Meeting to approve the cancellation of

the Share Premium Account.

Secondly, the Capital Reduction must be confirmed by the High

Court, to which the Company will make an application if the

Resolution is passed. The Court Hearing to confirm the Capital

Reduction is expected to be held on 5 November 2019. Shareholders

will have the right to attend the Court Hearing in person or

through counsel or other suitably qualified persons to support or

oppose the sanction of the Capital Reduction.

The Capital Reduction will then take effect when the Court Order

confirming it, and a statement of capital approved by the High

Court, have been delivered to and registered by the Registrar of

Companies. The Effective Date of the Capital Reduction is currently

expected to be 5 November 2019 (or otherwise within a few working

days after the Court Hearing, which is currently expected to be on

or around 5 November 2019).

In order to approve the Capital Reduction, the High Court will

need to be satisfied that the interests of the Company's creditors

will not be prejudiced by the Capital Reduction. The Company will

have to give such undertakings or other forms of creditor

protection as the High Court may require (if any) for the benefit

of the Company's creditors at the date on which the Capital

Reduction becomes effective. These may include seeking the consent

of the creditors to the cancellation of the Share Premium Account

or the provision by the Company to the High Court of an undertaking

to deposit a sum of money into a blocked account created for the

purposes of discharging creditors of the Company.

The Board reserves the right (where necessary by application to

the High Court) to abandon, discontinue or adjourn any application

to the High Court for confirmation of the Capital Reduction, and

hence the Capital Reduction itself, if the Board believes that the

terms required to obtain confirmation are unsatisfactory to the

Company or if as the result of any material unforeseen event the

Board considers that to continue with the Capital Reduction is

inappropriate or inadvisable.

4. Effect of the Capital Reduction

If approved by Shareholders and confirmed by the High Court, the

Capital Reduction will result in the creation of distributable

reserves which will allow the Company to pay dividends or make

distributions and/or undertake a buy back of its Ordinary Shares in

due course, should it be appropriate or desirable to do so. The

Capital Reduction will not affect the number of Ordinary Shares in

issue, the nominal value per Ordinary Share or the voting or

dividend rights of any Shareholder.

5. The General Meeting

Set out at the end of the circular is a notice convening the

General Meeting to be held on 15 October 2019 at the Company's

registered office, Cardinal Square West, 10 Nottingham Road, Derby

DE1 3QT at 9.30 a.m., at which the Resolution will be proposed for

the purposes of approving the Capital Reduction.

The Resolution, which will be proposed as a special resolution,

is to cancel the total amount standing to the credit of the Share

Premium Account of the Company, being GBP16,408,326.07 as at the

date of this announcement. As a special resolution, the Resolution

requires votes in favour representing 75 per cent. or more of the

votes cast (in person or by proxy) at the General Meeting in order

to be passed.

6. Action to be taken

A Form of Proxy for use in connection with the General Meeting

accompanies the circular. Whether or not you intend to be present

at the General Meeting, you are requested to complete, sign and

return the Form of Proxy in accordance with the instructions

thereon to Share Registrars Limited at The Courtyard, 17 West

Street, Farnham, Surrey GU9 7DR, as soon as possible, but in any

event so as to be received by no later than 9.30 a.m. on 11 October

2019, or, in the event of an adjournment of the meeting, 48 hours

before the adjourned meeting (excluding non-working days).

If you hold your shares in uncertificated form in CREST, you may

appoint a proxy or proxies by utilising the CREST electronic proxy

appointment service in accordance with the procedures described in

the CREST Manual as set out in the Notice of General Meeting at the

end of the circular. Proxies submitted via CREST must be received

by Share Registrars Limited (ID 7RA36) no later than 9.30 a.m. on

11 October 2019, or, in the event of an adjournment of the meeting,

48 hours before the adjourned meeting (excluding non-working days).

The appointment of a proxy using the CREST electronic proxy

appointment service will not preclude a Shareholder from attending

and voting in person at the General Meeting should they wish to do

so.

7. Recommendation

The Directors consider that the proposal to be considered at the

General Meeting is in the best interests of the Company and its

shareholders as a whole and is most likely to promote the success

of the Company. Accordingly, the Directors unanimously recommend

that you vote in favour of the Resolution to be proposed at the

General Meeting as they intend to do in respect of their own

beneficial holdings currently amounting to 5.17 per cent. of the

issued share capital of the Company.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NOGSEUFAMFUSEDU

(END) Dow Jones Newswires

September 27, 2019 02:01 ET (06:01 GMT)

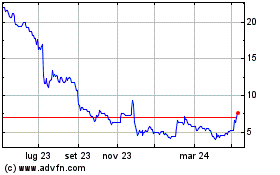

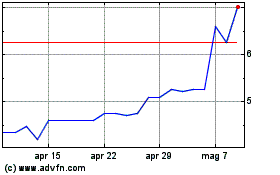

Grafico Azioni Totally (LSE:TLY)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Totally (LSE:TLY)

Storico

Da Apr 2023 a Apr 2024