By Saabira Chaudhuri

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 27, 2019).

Imperial Brands PLC became the first global tobacco company to

lay out the financial impact of the U.S. crackdown on vaping

products, as the maker of Blu e-cigarettes warned its sales and

profit would be lower than expected this year.

The disclosure from Imperial, whose traditional cigarette brands

include Davidoff and Winston, shows how the Trump administration's

plans, announced earlier this month, to ban most vaping products in

the U.S. are already affecting the tobacco industry's fortunes.

Shares of Imperial fell 13% Thursday. The U.K.-based company's

approach to next-generation nicotine products is far more focused

on e-cigarettes than that of its major rivals.

The U.S. vaping market -- valued at $5.6 billion last year,

according to data provider Euromonitor -- is dominated by products

from e-cigarette startup Juul Labs Inc. However, big tobacco

companies have pushed into the category to offset the decline in

traditional cigarette sales.

Imperial bought the Blu e-cigarette brand in 2015 from Reynolds

American Inc., a deal that allowed Reynolds to clear its $25

billion purchase of Lorillard Inc. British American Tobacco PLC,,

which now owns Reynolds, sells a rival device called Vuse.

Until recently, vaping was seen as an opportunity for the

industry, but now its future looks uncertain in the U.S. and

elsewhere. India said last week it was banning the sale of all

e-cigarettes, while China has stopped online sales of Juul's

products.

Imperial expects full-year sales growth of 2%. It previously

pegged growth at the upper end of a range of 1% to 4%. Earnings per

share are expected to be flat, compared with the company's prior

forecast of 4% to 8% growth.

The company singled out the recent developments in the U.S.,

saying the vaping environment had "deteriorated considerably over

the last quarter with increased regulatory uncertainty, including

individual U.S. state actions."

Imperial said the U.S. market for prefilled e-cigarettes, which

was growing at about 13% in May, slowed to 2% growth in August and

was now negative. It said an increasing number of wholesalers and

retailers have stopped ordering or promoting vaping products

Citing a surge in underage vaping, the Trump administration said

in September it planned to ban all e-cigarettes except those

formulated to taste like tobacco. The move comes amid not only a

rise in teenage vaping but also hundreds of potential cases of

pulmonary illness -- and even some deaths -- linked to vaping

products, many containing marijuana.

U.S. health officials had viewed e-cigarettes as a safer

alternative to smoking, and vaping products were allowed to remain

on the market pending review by the Food and Drug Administration.

E-cigarette makers now face a May deadline to apply for a FDA

review of vaping products they want to continue selling.

Meanwhile, the FDA has asked consumers to avoid buying vaping

devices on the street and not to add substances to products bought

in stores.

For Imperial there is a lot at stake. Unlike BAT and Philip

Morris International Inc., which have rolled out tobacco-heating

devices they say are safer than conventional cigarettes, Imperial

has focused on vaping products, a more-developed next-generation

category it says has greater sales potential.

The company said it believed next-generation products still

offered a "significant opportunity." It estimated net revenue for

the business globally would grow about 50% this year, compared with

growth of 245% for the first six months of the year.

Next-generation products accounted for 5.4% of Imperial's

revenue in the Americas for the six months to March 31 at GBP61

million ($75.3 million).

RBC analyst James Edwardes Jones said Imperial's announcement

should concern investors.

"To the extent that it calls Imperial Brands' and the tobacco

industry's longer-term business model into question, we believe

that the implications should not be underestimated," he said.

Imperial's warning comes a day after Philip Morris and tobacco

giant Altria Group Inc., which owns a stake in Juul, called off

merger talks in part because of regulatory uncertainty. Also on

Wednesday, Juul's chief executive stepped down.

Altria CEO Howard Willard said the proposed U.S. ban on

e-cigarette flavors would hurt Juul's business and the sale of

vaping products next year, though it was unclear exactly what

restrictions the FDA was preparing.

Altria and Philip Morris have said they would now focus on

launching their joint cigarette alternative in the U.S. Unlike

Juul, their product -- a heat-not-burn tobacco device called IQOS

-- has been reviewed and authorized by the FDA.

BAT, which sells Camel and Newport, plans to file in the coming

weeks for an FDA review of Vuse, whose sales have been dwarfed by

Juul.

BAT's head of scientific research, David O'Reilly, said that as

far as he knew, no product developed or made by his company has

been involved in the illnesses reported in the U.S. He said

governments should pass regulation to improve product standards,

especially around testing and reporting of the ingredients used in

vaping liquids.

Japan Tobacco Inc., which sells its Logic e-cigarette brand in

the U.S., said it isn't aware of any its products being linked to

the U.S. illnesses and that it supports increased regulation.

Imperial has said all of its vaping products and ingredients

undergo thorough scientific assessment before manufacture and

sale.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

September 27, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

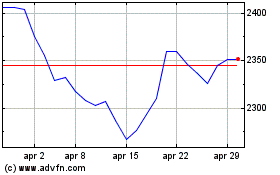

Grafico Azioni British American Tobacco (LSE:BATS)

Storico

Da Mar 2024 a Apr 2024

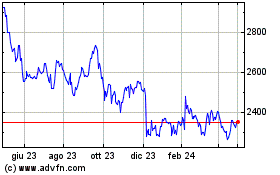

Grafico Azioni British American Tobacco (LSE:BATS)

Storico

Da Apr 2023 a Apr 2024