TIDMSNG

RNS Number : 0512O

Synairgen plc

30 September 2019

Press release

Synairgen plc

('Synairgen' or the 'Company')

Interim results for the six months ended 30 June 2019

Southampton, UK - 30 September 2019: Synairgen plc (LSE: SNG),

the respiratory drug discovery and development company, today

announces its unaudited interim results for the six months ended 30

June 2019.

Highlights (including post period-end)

Operational

-- Phase II trial of inhaled interferon beta (IFN-beta) for

Chronic Obstructive Pulmonary Disease (COPD) patients progressing

well, with four new sites added in 2019

-- At 30 June 2019, 43 confirmed virus-positive patients had

been dosed. At 27 September 2019, this had increased to 55 patients

and we now have over 200 patients who have passed screening and are

in the pool waiting to develop cold/flu symptoms and provide the

remaining 65 dosed patients to meet our target of 120. The trial is

expected to complete dosing in Q1 2020, with results available in

Q2 2020

-- In July 2019, a blinded data analysis showed that respiratory

viruses were having a significant impact on the COPD patients

enrolled in the trial when they got cold/flu infections, providing

an opportunity for inhaled IFN-beta to reduce symptom severity and

show clinical benefit

-- We are also engaging with different clinical teams to

evaluate the potential of IFN-beta in many other patient types who

become severely ill with these common, and normally benign,

respiratory viral infections

-- Pharmaxis, our Australian-based partner for the antifibrotic

LOXL2 inhibitor programme, continues to pursue its strategy for the

programme

Financial

-- Research and development expenditure of GBP1.69 million (30

June 2018: GBP1.38 million) as the Company advanced its clinical

trial of inhaled interferon beta for COPD patients

-- The loss from operations for the six months ended 30 June

2019 was GBP2.21 million (30 June 2018: GBP1.86 million loss)

-- Cash and bank deposits of GBP3.52 million at 30 June 2019 (30

June 2018: GBP5.31 million). In August 2019, post period-end, the

Company received its 2018 research and development tax credit of

GBP0.84 million

Richard Marsden, CEO of Synairgen, commented: "During the first

half of the year, the Company has made good progress on its inhaled

broad-spectrum antiviral candidate IFN-beta, designed to treat

viral chest infections in patients with COPD. Such infections are a

major drain on healthcare resource and represent a significant

unmet need in terms of therapeutic treatment options. We believe

IFN-beta is a highly promising, and commercially attractive,

therapeutic that could alleviate symptoms, help manage

exacerbations and reduce healthcare costs. We look forward to

completing the trial early in 2020 with results expected in

Q2."

For further enquiries, please contact:

Synairgen plc

Richard Marsden, Chief Executive Officer

John Ward, Finance Director

Tel: + 44 (0) 23 8051 2800

finnCap

Geoff Nash, Max Bullen-Smith (Corporate Finance)

Alice Lane (ECM)

Tel: + 44 (0) 20 7220 0500

Consilium Strategic Communications (Financial Media and

Investor

Relations)

Mary-Jane Elliott, Sue Stuart, Olivia Manser

synairgen@consilium-comms.com

Tel: +44 (0) 20 3709 5700

Notes for Editors

About Synairgen

Synairgen is a respiratory drug discovery and development

company founded by University of Southampton Professors Stephen

Holgate, Donna Davies and Ratko Djukanovic. The business, focused

primarily on asthma and COPD, uses its differentiating human

biology BioBank platform and world-renowned international academic

KOL network to discover and develop novel therapies for respiratory

disease.

Synairgen is currently running a two-part Phase II trial

evaluating SNG001, the Company's wholly-owned inhaled interferon

beta (IFN-beta) therapeutic candidate. The Phase II trial, called

SG015, has been designed to assess the safety of SNG001 in COPD

patients and its clinical benefit in these patients when they have

a cold or flu infection, a major driver of COPD exacerbations.

Synairgen is quoted on AIM (LSE: SNG). For more information

about Synairgen, please see www.synairgen.com

Chairman's and Chief Executive Officer's Review

OPERATING REVIEW

Summary

During the first six months of the year, the Company has made

good progress on its wholly-owned broad spectrum antiviral product

to treat viral chest infections. At 30 June 2019 we had dosed 43

patients and at the date of this report, as we enter the 2019/2020

virus season, this has increased to 55 out of the target 120

patients. Also post period-end, as announced in July, we could see

from the data that patients were having significant changes in

their symptoms due to respiratory viruses, meaning that there is a

potential for a therapeutic to show benefit. Separately,

Synairgen's partner in the LOXL2 programme, Pharmaxis, has

continued its licensing discussions during the period, which in

time could potentially yield financial benefit to Synairgen.

Inhaled IFN-beta in COPD

2019 trial activity

The Company is focussed on completing its Phase II trial of

inhaled interferon beta (IFN-beta) to prevent or treat the major

clinical problem caused by common cold and flu viruses in patients

with COPD. The trial commenced in October 2018, and in the first

half of this year the Company has seen an uplift in number of

patients being dosed, the trigger for which is that a patient tests

positive for a respiratory virus. At the end of June, 43 out of the

targeted 120 patients had been dosed, and at the date of this

report this had increased to 55. The peak season for viruses runs

from September to March and we forecast dosing will be completed in

Q1 2020, with data becoming available in Q2 2020. A "severe" winter

virus season will accelerate the dosing completion and a "mild"

winter will delay it.

During 2019, the Company has added 4 new sites to the trial and

increased the number of patients who have passed screening and are

waiting to develop cold/flu symptoms by 50%. At the date of this

report, some 400 patients have been screened and approximately 300

have passed and became eligible for dosing when they get a cold/flu

infection. Allowing for patients who have been dosed or who have

withdrawn from the study, we currently have over 200 patients

available to dose the remaining 65 patients as we enter the cold

virus season. The pool of patients has been enlarged to mitigate

against the risk of a repeat of the last winter, where an unusually

low number of circulating viruses (reported by Public Health

England) led to fewer patients being dosed, particularly during the

2018 Autumn, than we had originally forecast.

Review of blinded trial COPD symptom data

We conduct a continuous quality control process to check the

integrity of the data as it is received. We do this in a blinded

fashion i.e. without disclosure of which patients are on placebo

and which patients are on active treatment.

Post period-end, as announced in July, a review of the blinded

patient symptom data using the Breathlessness Cough and Sputum

Score (BCSS score) for the first 40 patients showed that the

patients in the trial are being adversely affected by the viruses.

A change in the BCSS score of 1 or more is considered to be

clinically relevant.(1) As we are seeing an average increase in

BCSS score of more than 2, there is clearly an opportunity for

inhaled IFN-beta to reduce symptom severity and show clinical

benefit.

The clinical problem

Exacerbations of COPD are a major drain on healthcare resource,

and are the second most common cause of unplanned hospital

admission in England.(2) The peak for these admissions coincides

with the virus season. Viruses are implicated in 40% of

exacerbations,(3) with bacteria being the other major cause.

Patients are currently treated with oral steroids and antibiotics.

They will frequently receive antibiotics even if the cause is

suspected to be viral; this is because viral infections often

precipitate a bacterial chest infection. There is a serious gap in

the therapeutic options available to combat these severe lung

infections. A successful product would alleviate symptoms, prevent

exacerbations, reduce healthcare resource utilisation and reduce

antibiotic prescribing. The directors believe that such a product

could be very successful with annual revenues exceeding $1 billion,

just for COPD, with further potential in other patient groups where

these normally benign viruses cause serious illness.

Inhaled IFN-beta development

IFN-beta is a critical, naturally-occurring protein produced by

cells early in the infection cycle. IFN-beta orchestrates the

body's antiviral defences until the body develops antibodies to

eventually clear the virus. It can take a couple of weeks to mount

an effective antibody response. In this time, if defences are

compromised by disease, or if an organ, such as the lung in the

case of COPD, is affected by disease, then the impact of the virus

can be very severe. IFN-beta protects COPD cells from viral

infection, and in the context of a viral chest infection we believe

IFN-beta will help fight the infection and protect as yet

uninfected cells and regions of the lungs. There are hundreds of

respiratory viruses that can cause exacerbations of COPD. IFN-beta,

because it stimulates many different intra and extra cellular

antiviral pathways, has been shown to be effective in tests against

all of the cold and flu viruses that we have encountered in the

trial thus far, namely: rhinovirus; influenza; RSV; coronavirus;

and parainfluenza.

In the trial, patients wait in a 'pool' receiving daily text

messages to record symptoms. When a patient has a change in

symptoms, he or she contacts the trial site and is tested for the

presence of a respiratory virus. In past trials only half to two

thirds of patients had confirmed viral infections compromising

interpretation of the data. The novel technology being used in this

trial enables us to confirm the presence of a respiratory virus

within one hour. The obvious benefit is that the data set will not

be diluted by patients who did not have a respiratory viral

infection and who could not benefit from treatment. This is

particularly important in COPD where exacerbations can be caused by

bacterial infections. Virus-positive patients receive either

placebo or IFN-beta for two weeks. We will analyse the drug's

effects on COPD symptoms, lung function, virus load, exacerbations,

and safety. We will also assess biomarkers of inflammation and

antiviral activity with a view to identifying prognostic markers

that would help in the selection of patients for follow-on clinical

trials.

Future progression and Business Development

The current trial of inhaled IFN-beta paves the way for a Phase

IIb trial in COPD patients, and our plan is to partner to be able

to conduct this trial. We have an ongoing dialogue with several of

the largest pharmaceutical companies who, due to the magnitude of

the opportunity, are keen to review the data from this trial.

Other opportunities for an inhaled broad spectrum antiviral

Beyond COPD, we recognise that inhaled IFN-beta could help many

other different patient types who succumb to these common, and

usually benign, respiratory viral infections. Such patient groups

include:

-- Acute admissions due to respiratory viral infections.

Vulnerable groups include: diabetic patients, the elderly, and

patients with other lung conditions e.g. cystic fibrosis,

bronchiectasis;

-- Paediatric patients with severe breathing difficulties/wheeze

e.g. bronchiolitis, as well as premature infants with persistent

viral infection;

-- Some immunocompromised patient populations undergoing

oncology treatment regimens who can have difficulty clearing

respiratory viral infections; and

-- Some rarer genetic conditions where patients fail to mount an

adequate antiviral response may also derive benefit from inhaled

IFN-beta.

We are currently engaging with the different clinical teams

across the UK who focus on these different patient groups to assess

the clinical problem caused by viruses and to map a route into the

clinic. All of these indications, including the niche ones, are of

great interest to potential pharmaceutical partners.

LOXL2 Programme

Pharmaxis, our Australian-based partner for the antifibrotic

LOXL2 inhibitor programme, has updated the market (on 25 July 2019)

stating that they continue to be in licensing discussions.

Synairgen will receive circa 17% of Pharmaxis' licence

receipts/royalties, net of allowable expenses.

Board changes

In April 2019, Paul Clegg announced his intention to retire from

the Board as a non-executive director after the 2019 AGM in June.

We thank Paul for his significant contribution and advice to

Synairgen over the last 10 years and for his Chairmanship of the

Remuneration and Nomination Committee. Iain Buchanan became the new

Chairman of the Remuneration and Nomination Committee.

FINANCIAL REVIEW

With effect from 1 January 2019, the Group has adopted IFRS 16

(Leases). The adoption of this standard has had no financial impact

on either the current or comparative periods. Please refer to Note

1 for further details.

Statement of Comprehensive Income

The loss from operations for the six months ended 30 June 2019

was GBP2.21 million (six months ended 30 June 2018: GBP1.86 million

loss, year ended 31 December 2018: GBP4.13 million loss). Research

and development expenditure increased from GBP1.38 million in the

six months ended 30 June 2018 to GBP1.69 million for the six months

ended 30 June 2019 as the Group advanced the Phase II study in

COPD. Other administrative costs for the period of GBP0.52 million

were in line with the comparative period (six months ended 30 June

2018: GBP0.51 million).

The research and development tax credit increased from GBP0.33

million to GBP0.42 million. The 2019 credit of GBP0.42 million

comprises a current period credit of GBP0.37 million and a prior

period adjustment of GBP0.05 million. The increase from GBP0.33

million to GBP0.37 million is explained by the increased R&D

expenditure.

The loss after tax for the period was GBP1.77 million (six

months ended 30 June 2018: GBP1.52 million loss) and the basic loss

per share was 1.62p (six months ended 30 June 2018: loss of

1.66p).

Statement of Financial Position and cash flows

At 30 June 2019, net assets amounted to GBP4.30 million (30 June

2018: GBP5.09 million, 31 December 2018: GBP6.03 million),

including net funds (comprising cash balances and bank deposits) of

GBP3.52 million (30 June 2018: GBP5.31 million, 31 December 2018:

GBP5.33 million).

The principal elements of the GBP1.81 million decrease in net

funds over the six months ended 30 June 2019 (six months ended 30

June 2018: GBP1.54 million decrease, year ended 31 December 2018:

GBP1.51 million decrease) were:

-- Cash used in operations of GBP1.83 million (six months ended

30 June 2018: GBP1.55 million outflow; year ended 31 December 2018:

GBP3.89 million outflow);

-- Research and development tax credits received of GBPnil (six

months ended 30 June 2018: GBPnil; year ended 31 December 2018:

GBP0.07 million);

-- Capital expenditure of GBPnil (six months ended 30 June 2018:

GBP0.01 million; year ended 31 December 2018: GBP0.39 million)

-- Net proceeds from fundraising of GBPnil (six months ended 30

June 2018: GBPnil; year ended 31 December 2018: GBP2.67

million)

The Group received its 2018 research and development tax credit

of GBP0.84 million post period-end in August 2019.

Going concern

The directors have prepared detailed financial forecasts to

estimate the likely cash requirements of the Group over the next

twelve months, given its stage of development and lack of recurring

revenues. In preparing these financial forecasts, the directors

have made certain assumptions with regards to the timing and amount

of future expenditure over which they have control. The directors

have attempted to take a balanced and prudent view in preparing

these forecasts, recognising the intrinsic variability in the

timing and costs of the SG015 Phase II clinical trial. This

variability is primarily a function of the inherent

unpredictability of the severity and timing of the winter

virus/cold season, which is a key factor in determining how quickly

sufficient patients will be dosed to achieve a statistically

meaningful result.

In common with many other similar biotechnology companies

Synairgen relies on equity financing at key milestone events during

the development of its programmes. Currently Synairgen does not

hold 12 months' cash resources from the date of this report to

September 2020. With our current estimate of the expected SG015

patient dosing pattern to reach 120 dosed patients, the directors

consider that the Group has adequate cash resources to complete the

clinical trial. The directors remain confident that in the event

that the trial timeline moves back or when the Group needs

additional resources to commercialise the results of the trial, it

will be able to secure such additional finance.

The directors believe that it remains appropriate to prepare the

financial statements on a going concern basis. Because, as at the

date of approval of these consolidated interim results, any

additional finance that may result from future equity funding has

neither been sought, nor committed, our ability to raise such

finance represents a material uncertainty as to the Group's ability

to continue as a going concern.

OUTLOOK

Synairgen has been preparing for a busy winter, and is well

poised to complete its Phase II clinical trial. We have increased

the number of sites in the trial and increased the number of

patients waiting to catch a cold, and commence treatment. We

anticipate that the final patients will be dosed in Q1 2020, with

data available in Q2. Potential partners for the programme await

positive data and we look forward to providing updates to the

market on our progress on all fronts.

Simon Shaw Richard Marsden

Chairman Chief Executive Officer

27 September 2019

References

1. Leidy NK et al. The breathlessness, cough and sputum scale:

the development of empirically based guidelines for interpretation.

Chest 2003 Dec; 124)6):2182-91

2. Department of Health. An Outcomes Strategy for Chronic

Obstructive Pulmonary Disease (COPD) and Asthma in England.

Published July 2011

3. Wilkinson TMA et al. A prospective, observational cohort

study of the seasonal dynamics airway pathogens in the aetiology of

exacerbations in COPD. Thorax 2017;0;1-9. Doi:

10.1136/thoraxjnl=2016-209023

Consolidated Statement of Comprehensive Income

for the six months ended 30 June 2019

Unaudited Unaudited Audited

Six months Six months Year

ended 30 ended 30 ended 31

June June December

2019 2018 2018

Notes GBP000 GBP000 GBP000

Revenue - 26 105

Research and development expenditure (1,686) (1,384) (3,232)

Other administrative expenses (520) (506) (1,005)

--------------------------------------- -------- ------------ ------------ ------------

Total administrative expenses (2,206) (1,890) (4,237)

Loss from operations (2,206) (1,864) (4,132)

Finance income 17 18 36

Loss before tax (2,189) (1,846) (4,096)

Tax credit 2 417 329 795

--------------------------------------- -------- ------------ ------------ ------------

Loss and total comprehensive

loss for the period (1,772) (1,517) (3,301)

--------------------------------------- -------- ------------ ------------ ------------

Loss per ordinary share 3

Basic and diluted loss per ordinary

share (pence) (1.62)p (1.66)p (3.47)p

------------------------------------------------- ------------ ------------ ----------

Consolidated Statement of Changes in Equity (unaudited)

for the six months ended 30 June 2019

Share Share Merger Retained

capital premium reserve Deficit Total

GBP000 GBP000 GBP000 GBP000 GBP000

At 1 January 2018 914 25,771 483 (20,609) 6,559

Recognition of share-based

payments - - - 45 45

Total comprehensive

loss for the period - - - (1,517) (1,517)

At 30 June 2018 914 25,771 483 (22,081) 5,087

Issue of ordinary

shares 180 2,700 - - 2,880

Transaction costs

in respect of share

issue - (209) - - (209)

Recognition of share-based

payments - - - 53 53

Total comprehensive

loss for the period - - - (1,784) (1,784)

At 31 December 2018 1,094 28,262 483 (23,812) 6,027

Recognition of share-based

payments - - - 48 48

Total comprehensive

loss for the period - - - (1,772) (1,772)

At 30 June 2019 1,094 28,262 483 (25,536) 4,303

---------------------------- --------- --------- --------- --------- --------

Consolidated Statement of Financial Position

as at 30 June 2019

Unaudited Unaudited Audited

30 30 31

June June December

2019 2018 2018

Notes GBP000 GBP000 GBP000

Assets

Non-current assets

Intangible assets 22 37 29

Property, plant and equipment 333 15 374

----------------------------------- ------ ---------- ---------- ----------

355 52 403

----------------------------------- ------ ---------- ---------- ----------

Current assets

Inventories 42 56 56

Current tax receivable 1,212 400 795

Trade and other receivables 162 199 216

Other financial assets -

bank deposits 4 - 1,250 50

Cash and cash equivalents 3,520 4,056 5,284

----------------------------------- ------ ---------- ---------- ----------

4,936 5,961 6,401

----------------------------------- ------ ---------- ---------- ----------

Total assets 5,291 6,013 6,804

----------------------------------- ------ ---------- ---------- ----------

Liabilities

Current liabilities

Trade and other payables (988) (926) (777)

----------------------------------- ------ ---------- ---------- ----------

Total liabilities (988) (926) (777)

----------------------------------- ------ ---------- ---------- ----------

Total net assets 4,303 5,087 6,027

----------------------------------- ------ ---------- ---------- ----------

Equity

Capital and reserves attributable

to equity holders of the

parent

Share capital 1,094 914 1,094

Share premium 28,262 25,771 28,262

Merger reserve 483 483 483

Retained deficit (25,536) (22,081) (23,812)

----------------------------------- ------ ---------- ---------- ----------

Total equity 4,303 5,087 6,027

----------------------------------- ------ ---------- ---------- ----------

Consolidated Statement of Cash Flows

for the six months ended 30 June 2019

Unaudited Unaudited Audited

Six months Six months Year

ended 30 ended 30 ended 31

June June December

2019 2018 2018

GBP000 GBP000 GBP000

Cash flows from operating

activities

Loss before tax (2,189) (1,846) (4,096)

Adjustments for:

Finance income (17) (18) (36)

Depreciation 41 3 24

Amortisation 7 8 16

Share-based payment charge 48 45 98

Cash flows from operations

before changes in working

capital (2,110) (1,808) (3,994)

Decrease in inventories 14 - -

Decrease in trade and other

receivables 54 440 426

Increase/(Decrease) in trade

and other payables 211 (177) (326)

----------------------------------- ------------ ------------ ----------

Cash used in operations (1,831) (1,545) (3,894)

Tax credit received - - 71

----------------------------------- ------------ ------------ ----------

Net cash used in operating

activities (1,831) (1,545) (3,823)

----------------------------------- ------------ ------------ ----------

Cash flows from investing

activities

Interest received 17 12 27

Purchase of property, plant

and equipment - (6) (386)

Decrease in other financial

assets 50 750 1,950

----------------------------------- ------------ ------------ ----------

Net cash generated from investing

activities 67 756 1,591

----------------------------------- ------------ ------------ ----------

Cash flows from financing

activities

Proceeds from issuance of

ordinary shares - - 2,880

Transaction costs in respect

of share issues - - (209)

----------------------------------- ------------ ------------ ----------

Net cash generated from financing

activities - - 2,671

----------------------------------- ------------ ------------ ----------

(Decrease)/Increase in cash

and cash equivalents (1,764) (789) 439

Cash and cash equivalents

at beginning of period 5,284 4,845 4,845

----------------------------------- ------------ ------------ ----------

Cash and cash equivalents

at end of period 3,520 4,056 5,284

----------------------------------- ------------ ------------ ----------

Notes to the Interim Financial Information

for the six months ended 30 June 2019

1. Basis of preparation

Basis of accounting

The interim financial information, which is unaudited, has been

prepared on the basis of the accounting policies expected to apply

for the financial year to 31 December 2019 and in accordance with

recognition and measurement principles of International Financial

Reporting Standards (IFRSs) as endorsed by the European Union. With

the exception of the adoption of IFRS 16, further detail on which

is given below, the accounting policies applied in the preparation

of this interim financial information are consistent with those

used in the financial statements for the year ended 31 December

2018.

The interim financial information does not include all of the

information required for full annual financial statements and does

not comply with all the disclosures in IAS 34 'Interim Financial

Reporting'.

Adoption of new standards

IFRS 16 Leases

IFRS 16 introduces significant changes to lessee accounting by

removing the distinction between operating and finance leases,

requiring the recognition of a right-of-use asset and a lease

liability at commencement for all leases, except for short-term

leases and leases of low value assets. The Group adopted IFRS 16

Leases on 1 January 2019 by applying the modified retrospective

approach. At 1 January 2019 the Group had one lease with the

University of Southampton for property and equipment, which ended

on 31 July 2019, without an extension option. As permitted by the

practical expedients on transition to IFRS 16, the Group has made

use of the recognition exemption for short-term leases (less than

12 months of lease term from the date of initial application) and

has continued to recognise the lease costs of a straight line basis

over the remaining term of the lease.

Subsequent to the period-end, a new two year lease has been

signed effective from 1 August 2019, with annual lease commitments

of GBP168,000. In the year-end financial statements the Group will

recognise a right-of-use asset and lease liability for the present

value of these payments.

Financial information

The financial information for the year ended 31 December 2018

does not constitute the full statutory accounts for that period.

The Annual Report and Financial Statements for the year ended 31

December 2018 have been filed with the Registrar of Companies. The

Independent Auditor's Report on the Annual Report and Financial

Statements for the year ended 31 December 2018 was unqualified, did

not draw attention to any matters by way of emphasis, and did not

contain a statement under 498(2) or 498(3) of the Companies Act

2006.

Going Concern

The directors have prepared detailed financial forecasts to

estimate the likely cash requirements of the Group over the next

twelve months, given its stage of development and lack of recurring

revenues. In preparing these financial forecasts, the directors

have made certain assumptions with regards to the timing and amount

of future expenditure over which they have control. The directors

have attempted to take a balanced and prudent view in preparing

these forecasts, recognising the intrinsic variability in the

timing and costs of the SG015 Phase II clinical trial. This

variability is primarily a function of the inherent

unpredictability of the severity and timing of the winter

virus/cold season, which is a key factor in determining how quickly

sufficient patients will be dosed to achieve a statistically

meaningful result.

In common with many other similar biotechnology companies

Synairgen relies on equity financing at key milestone events during

the development of its programmes. Currently Synairgen does not

hold 12 months' cash resources from the date of this report to

September 2020. With our current estimate of the expected SG015

patient dosing pattern to reach 120 dosed patients, the directors

consider that the Group has adequate cash resources to complete the

clinical trial. The directors remain confident that in the event

that the trial timeline moves back or when the Group needs

additional resources to commercialise the results of the trial, it

will be able to secure such additional finance.

Notes to the Interim Financial Information

for the six months ended 30 June 2019 (continued)

1. Basis of preparation (continued)

The directors believe that it remains appropriate to prepare the

financial statements on a going concern basis. Because, as at the

date of approval of these consolidated interim results, any

additional finance that may result from future equity funding has

neither been sought, nor committed, our ability to raise such

finance represents a material uncertainty as to the Group's ability

to continue as a going concern.

These consolidated interim financial statements do not include

the adjustments that would arise if the Group was unable to

continue as a going concern. Should the Group be unable to obtain

funding such that the going concern basis of preparation was no

longer appropriate, adjustments would be required which would

include adjusting the balance sheet value of assets to their

recoverable amounts and to provide for further liabilities that

might arise.

Approval of financial information

The 30 June 2019 interim financial information was approved by a

duly appointed and authorised committee of the Board of Directors

on 27 September 2019.

2. Tax credit

The tax credit of GBP417,000 (six months ended 30 June 2018:

GBP329,000; year ended 31 December 2018: GBP795,000) comprises an

estimate of the research and development tax credit receivable in

respect of the current period of GBP374,000 and a prior period

adjustment of GBP43,000 in respect of 2018.

GBP838,000 was received in August 2019 in respect of the 2018

research and development tax credit.

3. Loss per ordinary share

Unaudited Unaudited Audited

Six months Six months Year

ended 30 ended 30 ended 31

June June December

2019 2018 2018

Loss attributable to equity

holders of the Company (GBP000) (1,772) (1,517) (3,301)

Weighted average number of

ordinary shares in issue 109,433,442 91,399,072 95,262,984

The loss attributable to shareholders and the weighted average

number of ordinary shares for the purposes of calculating the

diluted loss per ordinary share are identical to those used for

basic loss per share. This is because the exercise of share options

would have the effect of reducing the loss per ordinary share and

is therefore antidilutive. At 30 June 2019 there were 8,737,515

options outstanding (30 June 2018: 7,281,348 options outstanding;

31 December 2018: 6,087,819 options outstanding).

4. Other financial assets

Other financial assets comprise Sterling fixed rate bank

deposits of greater than three months' maturity at the time of

deposit.

INDEPENT REVIEW REPORT TO SYNAIRGEN PLC

Introduction

We have been engaged by the Company to review the financial

information in the interim results for the six months ended 30 June

2019 which comprises the Consolidated Statement of Comprehensive

Income, the Consolidated Statement of Changes in Equity, the

Consolidated Statement of Financial Position, the Consolidated

Statement of Cash Flows and the related notes 1 to 4.

We have read the other information contained in the interim

results and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the financial information.

Directors' responsibilities

The interim report, including the financial information

contained therein, is the responsibility of and has been approved

by the directors. The directors are responsible for preparing the

interim report in accordance with the rules of the London Stock

Exchange for companies trading securities on AIM which require that

the interim results be presented and prepared in a form consistent

with that which will be adopted in the Company's annual accounts

having regard to the accounting standards applicable to such annual

accounts.

Our responsibility

Our responsibility is to express to the Company a conclusion on

the financial information in the interim results based on our

review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity", issued by the Financial Reporting Council for use

in the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK) and consequently does not enable us to obtain

assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Material uncertainty related to going concern

We draw attention to Note 1 to the interim financial

information, which indicates that the Group and Parent Company are

likely to require further funding in order to meet their

obligations as they fall due across the 12 months to 30 September

2020, which is yet to be agreed. As stated in Note 1, these events

or conditions indicate that a material uncertainty exists that may

cast significant doubt on the Group and Parent Company's ability to

continue as a going concern. Our opinion is not modified in this

respect.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the interim results for the six months ended 30 June 2019 is not

prepared, in all material respects, in accordance with the rules of

the London Stock Exchange for companies trading securities on

AIM.

Use of our report

Our report has been prepared in accordance with the terms of our

engagement dated 17 August 2018 to assist the Company in meeting

the requirements of the rules of the London Stock Exchange for

companies trading securities on AIM and for no other purpose. No

person is entitled to rely on this report unless such a person is a

person entitled to rely upon this report by virtue of and for the

purpose of our terms of engagement or has been expressly authorised

to do so by our prior written consent. Save as above, we do not

accept responsibility for this report to any other person or for

any other purpose and we hereby expressly disclaim any and all such

liability

BDO LLP

Chartered Accountants

Reading

United Kingdom

27 September 2019

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR EAFNNAFENEAF

(END) Dow Jones Newswires

September 30, 2019 02:02 ET (06:02 GMT)

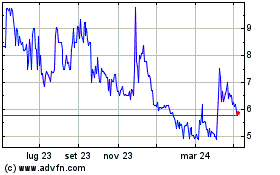

Grafico Azioni Synairgen (LSE:SNG)

Storico

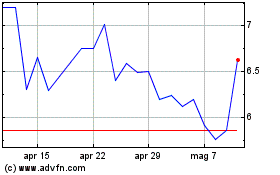

Da Mar 2024 a Apr 2024

Grafico Azioni Synairgen (LSE:SNG)

Storico

Da Apr 2023 a Apr 2024