TIDMSML

RNS Number : 1693O

Strategic Minerals PLC

30 September 2019

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

30 September 2019

Strategic Minerals plc

("Strategic Minerals", "SML", the "Group" or the "Company")

Interim Results - Half Year to 30 June 2019

Strategic Minerals plc (AIM: SML; USOTC: SMCDY), a producing

mineral company actively developing projects prospective for

battery materials, is pleased to announce its unaudited interim

results for the half year ended 30 June 2018.

Financial Highlights:

-- Accounting after tax loss of US$1,182,000 (H1 2018 profit of

US$2,406,000). Cash after tax loss of US$256,000 (H1 2018 profit of

US$35,000).

-- Pre-tax profit of US$675,000 (H1 2018: US$1,246,000) from the

Company's Cobre operation, prior to intercompany management

charges, continues to underpin corporate cash flow. The contracted

profit level reflects the impact of the major Cobre client

suspending shipments and maintenance works conducted at other

client operations. While sales from other clients have begun to

rebound, it is not anticipated that the major client will resume

taking shipments and the Company has initiated legal proceedings

against the major client. In line with anticipated lower sales

levels, cost reduction measures have been implemented in the second

half of 2019.

-- Directors exercised 17.5m options (John Peters, 16m and Alan

Broome, 1.5m) and acquired further stock in the company.

-- Investment of US$39,784 into Cornwall Resources Limited

("CRL"), the owner of the Redmoor Tin-Tungsten project.

-- Issue of 2,866,730 SML shares, in March 2019, at a deemed

price of 1.9067 pence per share as part payment for the acquisition

of Leigh Creek Copper Mine Pty Ltd ("Leigh Creek" or "LCCM").

-- In September 2019, the Board of SML undertook a review of the

CARE tenements and those at Hanns Camp. In light of this review,

the Company is considering exiting its involvement and, in

anticipation of this, an impairment of US$760,000 has been included

in the six month period to 30 June 2019.

-- In June 2019, the Company undertook an equity fundraising

that saw it issue 63,571,425 shares at 1.40 pence per share and

netting US$1,059,000. Only US$91,000 of this amount was received

prior to 30 June 2019 with the balance, US$968,000, received post

30 June 2019.

-- Unrestricted cash and cash equivalents at 30 June 2019 were

US$319,000 (31 Dec 2018: US$1,988,000). The reduction in cash

balances reflects the lower than expected cash flows from Cobre and

the cost of re-commencing operations at Leigh Creek.

Corporate Highlights:

-- Leigh Creek successfully brought back into production, involving:

o retreatment of leach pads;

o US$1,834,000 spent on refurbishment of plant, testing and

preparing the site for full time operations; and

o activation of the off-take agreement.

-- Entering into contracts for the acquisition of the balance of

the Redmoor Tin-Tungsten project. This was subsequently settled on

25 July 2019.

-- Access to the Cobre magnetite stockpile was rolled over in

mid-January ahead of the normal roll over at the end of

February.

-- Redmoor scoping study update completed indicating NPV (@8%)

of US $94m, IRR 19.4% Life of Mine Operating Margin 46% and payback

in less than 4 years.

Commenting, John Peters, Managing Director of Strategic

Minerals, said:

"The first half of 2019 has offered some challenges, with the

major client at Cobre suspending payments, affecting cash reserves.

However, the Company has shown resilience and remains on track to

deliver the Board's strategy.

"During the period, significant investment has been made in

restarting treatment of leach pads at Leigh Creek Copper Mine. This

was critical in demonstrating the Company's ability to resurrect

operations ahead of expected government approval to mine the larger

Paltridge North deposit. Additionally, funding which was originally

allocated for exploration of the Hanns Camp site, that has not

proved as prospective for nickel sulphide as expected, has now been

redirected towards the development of Leigh Creek.

"Also during the period, the Company entered into arrangements

to acquire the balance of the Redmoor Tin-Tungsten project. Full

ownership of Redmoor will allow SML to gain control on project

timing and investment in this potentially world class mining

opportunity.

"The Board has been mindful of the change in expected cash flow

and has been putting into place strategies to provide for

continuity of progress on the Company's key projects. It is

expected that the working capital position will be addressed in

2020 once regular sales commence at Leigh Creek. In the meanwhile,

the Board continues to exercise strict financial and technical

discipline. Furthermore, the Company now believes that it has

consolidated three excellent operating/near-operating/brownfields

projects, all likely to significantly add to the Companies

perceived net value."

For further information, please contact:

+61 (0) 414 727

Strategic Minerals plc 965

John Peters

Managing Director

Website: www.strategicminerals.net

Email: info@strategicminerals.net

Follow Strategic Minerals on:

Vox Markets: https://www.voxmarkets.co.uk/company/SML/

Twitter: @SML_Minerals

LinkedIn: https://www.linkedin.com/company/strategic-minerals-plc

Facebook: https://www.facebook.com/search/top/?q=strategic%20minerals%20plc

+44 (0) 20 3470

SP Angel Corporate Finance LLP 0470

Nominated Adviser and Broker

Ewan Leggat

Lindsay Mair

Stephen Wong

Notes to Editors

Strategic Minerals plc is an AIM-quoted, operating minerals

company actively developing projects prospective for battery

materials. It has an operation in the United States of America and

Australia along with development projects in the UK and Australia.

The Company is focused on utilising its operating cash flows, along

with capital raisings, to develop high quality projects aimed at

supplying the metals and minerals being sought in the burgeoning

electric vehicle/battery market.

In September 2011, Strategic Minerals acquired the distribution

rights to the Cobre magnetite tailings dam project in New Mexico,

USA, a cash-generating asset, which it brought into production in

2012 and which continues to provide a revenue stream for the

Company. This operating revenue stream is utilised to cover company

overheads and invest in development projects orientated to

supplying the burgeoning electric vehicle/battery market.

In January 2016, the portfolio was expanded with the acquisition

of shares in Central Australian Rare Earths Pty Ltd, which holds

tenements in Western Australia prospective for cobalt, nickel

sulphides and rare earth elements. The Company has since acquired

all shares in Central Australian Rare Earths Pty Ltd. In September

2018, the Company entered contracts for the sale of certain CARE

tenements identified as gold targets.

In May 2016, the Company entered into an agreement with New Age

Exploration Limited and, in February 2017, acquired 50% of the

Redmoor Tin-Tungsten project in Cornwall, UK. The bulk of the funds

from the Company's investment were utilised to complete a drilling

programme that year. The drilling programme resulted in a

significant upgrade of the resource. This was followed in 2018 with

a 12-hole 2018 drilling programme has now been completed and the

resource update that resulted was announced in February 2019. In

March 2019, the Company entered into arrangements to acquire the

balance of the Redmoor Tin-Tungsten project in Cornwall. This was

completed on 24 July 2019

In March 2018, the Company completed the acquisition of the

Leigh Creek Copper Mine situated in the copper rich belt of South

Australia and brought the project into limited production in April

2019, with full production expected in 2020.

Chairman's Statement

I am satisfied with the Company's achievements, in what has been

a particularly challenging period.

Financial results

The results for the first half of 2019 reflect a tougher stage

of development for the Company, as difficulties with our major

client at Cobre emerged and projects took longer to develop. It is

not expected that these conditions will change dramatically over

the remainder of 2019. However, despite these obstacles, I am

confident in the ability of the Board and management team to

deliver the Company's strategy. In 2020, the Company expects cash

flow and profitability to improve dramatically, as full scale

production commences at Leigh Creek Copper Mine.

As at 30 June 2019, unrestricted cash on hand was US$319,000,

prior to the receipt of a further US$968,000 from the late June

equity raise. In the interests of preserving cash and ensuring that

each of our projects are appropriately funded, the Board has been

actively developing a capital plan and allocation policy to move

the Company forward.

Operating profit of US$675,000 from the Cobre magnetite

stockpile, prior to intercompany management fees, marked a

significant decrease from the first half of 2018 (US$1,246,000) and

reflected the drop in sales volumes associated with Cobre's major

client not purchasing product in accordance with its contract.

Corporate overheads of US$1,211,000 were down on the same period

last year (H1 2018 US$1,386,000) and the Board has implemented a

series of cost-reduction initiatives in light of reduced sales at

Cobre.

Strategic Focus

The continued profitability of the Cobre operations, even

without the sales associated with the major client, provides

comfort in relation to coverage of operating costs and allowed the

Company to continue its three-pronged approach to diversified

materials concentrating on:

1. Coal and Bulk Materials- potential projects in this sector

that are tied to current contracts and further offtake arrangements

at attractive prices.

2. Advanced Materials- considering project opportunities in

materials where it expects demand to increase over the coming years

(such as Rare Earths, Lithium and Graphite).

3. Metals- identifying those projects exposed to metals that it

expects to have price improvements over the next three to five

years such as Cobalt, Nickel, Gold, Copper and Tin/Tungsten.

On the back of this strategy, the Company continues to invest in

development programmes, particularly those associated with Leigh

Creek Copper Mine (copper) and Redmoor (tin/tungsten/copper

focused).

Cobre Operations

During 2018, the major client at Cobre ceased taking material

and entered into arrangements that compensated the Company in lieu

of delivery. However, in 2019, the Company has received no payment

from the client and is currently undertaking legal recourse.

The first half of the year's sales at Cobre were also impacted

by plant maintenance works by a further two clients, although this

now appears to have been cleared and non-major client sales now

appear to have been restored to previous levels.

Leigh Creek Copper Mine

Significant resources have been funnelled into testing and

preparing the site for full scale operation. The restarting of the

heaps, while not providing the flow of copper hoped for, was a

strategically important occurrence. It demonstrated the ability of

the existing plant to treat the planned production from the

Paltridge North Deposit with the Company seeking to develop this

project in 2020.

In preparing to fund this production, the Company has entered

discussions with various funding sources and is confident that 2020

will see full scale production commence at Leigh Creek.

Redmoor Tin-Tungsten Project

2018 saw a full drilling program and a substantial increase in

the inferred resource base. In this half year, a scoping/mining

plan study was completed which highlighted how potentially

lucrative the project could be.

With this in mind, the Company negotiated to acquire the other

half of the project, with completion taking place in July 2019.

Control of the full project places the Company in an ideal position

to direct the timing and funding of the Redmoor Tin-Tungsten

project.

CARE

During the first half of 2019, development at Hanns Camp was

minimised to ensure availability of cash for the Leigh Creek Copper

Mine project.

After further desktop review, the suspected nickel sulphide

anomalies do not appear as strong as thought and the Company has

taken a conservative approach in these financials and written down

the value of the Hanns Camp tenements.

Issue of Capital

During the half year, the Company issued a total of 63,571,425

shares at 1.40 pence per share and netting US$1,059,000.

Safety

The Company continues to maintain a high level of safety

performance with SML and its subsidiaries having no reportable

environmental or personnel incidents recorded in the period.

This year marks a pace change for the organisation. I would like

to take this opportunity to thank my fellow Directors, our

management and staff in New Mexico, South Australia, Cornwall and

Western Australia, along with our advisers, for their support and

hard work on our behalf during the period. Additionally, I would

like to thank our clients, contractors, suppliers and partners for

their continued backing. I look forward to further progressing our

key strategic goals in 2020.

Alan Broome AM

Non-Executive Chairman

30 September 2019

STRATEGIC MINERALS PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE PERIODED 30 JUNE 2019

6 months 6 months Year to

to to

30 June 30 June 31 December

2019 2018 2018

(Unaudited) (Unaudited) (Audited)

$'000 $'000 $'000

Continuing operations

Revenue 1,395 2,120 3,355

Cost of sales (229) (391) (650)

_________ _________ _________

Gross profit 1,166 1,729 2,705

Bargain purchase gain on LCCM Acquisition - 2,464 2,162

Administrative expenses (1,211) (1,386) (2,569)

Depreciation (19) (36) (64)

Share based payment (163) (92) (268)

Share of net losses of associates and

joint ventures (38) 1 (27)

Profit on financial assets held at 1 - -

fair value through profit or loss

Impairment charge (760) - -

Foreign exchange gain/(loss) (2) 7 (6)

_________ _________ _________

(Loss)/ profit from operations (1,026) 2,687 1,933

_________ _________ _________

(Loss)/ profit before taxation (1,026) 2,687 1,933

Income tax (expense)/credit (156) (281) (460)

_________ _________ _________

Profit/(loss) for the period (1,182) 2,406 1,473

Other comprehensive income

Exchange gains/(losses) arising on

translation

of foreign operations (62) (93) (685)

_________ _________ _________

Total comprehensive (loss)/ Income (1,244) 2,313 788

_________ _________ _________

(Loss)/ profit for the period attributable

to:

Owners of the parent (1,244) 2,313 788

_________ _________ _________

Total comprehensive (loss)/income attributable

to:

Owners of the parent (1,244) 2,313 788

_________ _________ _________

(Loss)/ profit per share attributable $ $ $

to the ordinary equity holders of the

parent:

Continuing activities - Basic (0.08) 0.19 0.11

-- Diluted (0.08) 0.17 0.11

STRATEGIC MINERALS PLC

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2019

30 June 30 June 31 December

2019 2018 2018

(Unaudited) (Unaudited) (Audited)

$'000 $'000 $'000

Assets

Non-current assets

Intangible Asset 562 - 564

Deferred Exploration and evaluation

costs 342 6,174 1,037

Other Receivables 140 111 141

Property, plant and equipment 7,026 295 5,170

Investments in joint ventures- equity

accounted 2,264 1,755 2,248

Restricted cash - 100 100

_________ _________ _________

10,334 8,435 9,260

_________ _________ _________

Current assets

Inventories 7 3 4

Financial Assets held at fair value

through profit and loss 21 - 20

Trade and other receivables 1,302 1,204 285

Cash and cash equivalents 319 1,988 1,840

Prepayments 119 81 32

_________ _________ _________

1,768 3,276 2,181

_________ _________ _________

Total Assets 12,102 11,711 11,441

_________ _________ _________

Equity and liabilities

Share capital 2,202 2,087 2,095

Share premium reserve 48,454 47,118 47,205

Merger reserve 20,240 20,240 20,240

Foreign exchange reserve (956) (302) (894)

Share options reserve 431 (29) 330

Other reserves (23,023) (23,023) (23,023)

Accumulated loss (37,752) (35,515) (36,632)

_________ _________ _________

Total Equity 9,596 10,576 9,321

_________ _________ _________

Liabilities

Non-Current Liabilities

Provision for Mining Royalties 435 - 435

Environmental Liability 361 - 361

________ ________

796 - 796

Current liabilities

Deferred Consideration - 74 70

Trade and other payables 1,029 356 354

Environmental Liability - 111 -

Deferred revenue 525 594 900

Income Tax Payable 156 - -

_________ _________ _________

1,710 1,135 1,324

_________ _________ _________

Total Liabilities 2,506 1,135 2,120

_________ _________ _________

Total Equity and Liabilities 12,102 11,711 11,441

________ ________ ________

STRATEGIC MINERALS PLC

CONSOLIDATED STATEMENT OF CASH FLOW

FOR THE PERIODED 30 JUNE 19

6 months 6 months Year to

to to

30 June 30 June 31 December

2019 2018 2018

(Unaudited) (Unaudited) (Audited)

$'000 $'000 $'000

Cash flows from operating activities

(Loss)/profit after tax (1,182) 2,406 1,473

Adjustments for:

Bargain purchase of Leigh Creek Copper

Mine Pty Ltd - (2,464) (2,162)

Loss on sale of tenements - - 245

Gain on financial assets held at fair

value through profit and loss (1) - 12

Impairment charge 760 - -

Depreciation of property, plant and

equipment 19 36 64

Share of net loss / (profit) losses

from associates 38 (1) 27

Non Cash Director Remuneration - 213 -

(Increase) / decrease in inventory (3) 4 3

(Increase) / decrease in trade and

other receivables (50) (193) 690

Increase / (decrease) in trade and

other payables 251 (91) 119

(Increase) / decrease in prepayments (87) (69) (20)

Increase /(decrease) in deferred revenue (375) 594 900

(Decrease)/ Increase in income tax

payable 156 (648) (648)

Share based payment expense 163 92 268

_________ _________ _________

Net cash flows from operating activities (311) (121) 971

_________ _________ _________

Investing activities

Acquisition of PPE Development Asset - - (1,214)

Increase in PPE Development Asset (1,212) - (797)

Increase in deferred exploration and

evaluation (91) (1,443) (237)

Sale of tenements - - 70

Investment in joint arrangements (40) (107) (639)

Acquisition of PPE (57) (26) -

_________ _________ _________

Net cash used in investing activities (1,400) (1,576) (2,817)

_________ _________ _________

Financing activities

Net proceeds from issue of equity share

capital 91 - -

_________ _________ _________

Net cash from financing activities 91 - -

_________ _________ _________

Net increase / (decrease) in cash and

cash equivalents (1,620) (1,697) (1,846)

Cash and cash equivalents at beginning

of period 1,840 3,706 3,706

Release of restricted cash 100 - -

Exchange gains / (losses) on cash and

cash equivalents (1) (21) (20)

_________ _________ _________

Cash and cash equivalents at end of

period 319 1,988 1,840

_________ _________ _________

STRATEGIC MINERALS PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE PERIODED 30 JUNE 2019

Share Share Foreign

Share premium Merger options Other exchange Retained Total

capital reserve reserve reserve reserves reserve earnings Equity

$'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

________ ________ ________ ________ ________ ________ ________ ________

Balance at

1 January 2018

- audited 2,009 45,935 20,240 137 (23,023) (209) (38,180) 6,909

________ ________ ________ ________ ________ ________ ________ ________

Gain/(Loss) for

the period - - - - - - 1,473 1,473

Foreign exchange

translation - - - - - (685) - (685)

________ ________ ________ ________ ________ ________ ________ ________

Total

comprehensive

income for the

year - - - - - (685) 1,473 788

Shares issued in

the year 86 1,270 - - - - - 1,356

Expenses of

share

issue - - - - - - -

Transfer - - - (75) - - 75 -

Share based

payments - - - 268 - - - 268

________ ________ ________ ________ ________ ________ ________ ________

Balance at

31 December

2018-

audited 2,095 47,205 20,240 330 (23,023) (894) (36,632) 9,321

________ ________ ________ ________ ________ ________ ________ ________

Profit for the

period - - - - - - (1,182) (1,182)

Foreign exchange

translation - - - - - (62) - (62)

________ ________ ________ ________ ________ ________ ________ ________

Total

comprehensive

income for the

half year - - - - - (62) (1,182) (1,244)

Shares issued in

the year 107 1,322 - - - - - 1,429

Expenses of

share

issue - (73) - - - - - (73)

Transfer - - - (62) - - 62 -

Share based

payments - - - 163 - - - 163

________ ________ ________ ________ ________ ________ ________ ________

Balance at

30 June 2019 -

Unaudited 2,202 48,454 20,240 431 (23,023) (956) (37,752) 9,596

________ ________ ________ ________ ________ ________ ________ ________

All comprehensive income is attributable to the owners of the

parent.

The accompanying accounting policies and notes form an integral

part of these financial statements

STRATEGIC MINERALS PLC

NOTES FORMING PART OF THE CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

FOR THE PERIODED 30 JUNE 2019

1. General information

Strategic Minerals Plc ("the Company") is a public company

incorporated in England and Wales. The consolidated interim

financial statements of the Company for the six months ended 30

June 2019 comprise the Company and its subsidiaries (together

referred to as the "Group").

2. Accounting policies

Basis of preparation

These consolidated financial statements have been prepared using

policies based on International Financial Reporting Standards (IFRS

and IFRIC interpretations) issued by the International Accounting

Standards Board ("IASB") as adopted for use in the EU. IAS 34 is

not required to be adopted by the Company and has not been applied

in the preparation of this interim information. The consolidated

financial statements do not include all disclosures that would

otherwise be required in a complete set of financial statements and

should be read in conjunction with the 2018 Annual Report. The

financial information for the half years ended 30 June 2019 and 30

June 2018 does not constitute statutory accounts within the meaning

of Section 434(3) of the Companies Act 2006 and is unaudited.

The annual financial statements of Strategic Minerals Plc are

prepared in accordance with IFRSs as adopted by the European Union.

The comparative financial information for the year ended 31

December 2018 included within this report does not constitute the

full statutory accounts for that period. The statutory Annual

Report and Financial Statements for 2018 have been filed with the

Registrar of Companies. The Independent Auditors' Report on that

Annual Report and Financial Statement for 2018 was unqualified, and

included an emphasis on matter paragraph regarding the Group's

ability to continue as a going concern and did not contain a

statement under 498(2) or 498(3) of the Companies Act 2006.

Going concern basis

These financial statements have been prepared on the assumption

that the Group is a going concern.

When assessing the foreseeable future, the Directors have looked

at the Group's working capital requirements for the period to

October 2020 being the period for which projections have been

prepared and the minimum period the Directors are required to

consider.

The Directors have reviewed the Group's current cash resources,

funding requirements and ongoing trading of the operations. As the

Group has lost a key customer, the directors have been required to

raise further funding through debt and cut the spending on the

other group assets as appropriate. As at the date of this report,

there is no certainty regarding the group's ability to execute

these transactions. These conditions indicate the existence of

material uncertainties which may cast significant doubt as to the

Group and Company's ability to continue as a going concern. In the

event that the Group is unable to raise sufficient funds, the Group

may be unable to realise its assets and discharge its liabilities

in the normal course of business. The financial statements do not

include the adjustments that would result if the Group and Company

was unable to continue as a going concern.

The same accounting policies, presentation and methods of

computation are followed in these condensed consolidated financial

statements as were applied in the Group's latest annual audited

financial statements except for policies stated below.

Joint arrangements

Under IFRS 11 Joint Arrangements, investments in joint

arrangements are classified as either joint operations or joint

ventures. The classification depends on the contractual rights and

obligations of each investor, rather than the legal structure of

the joint arrangement. Strategic Minerals Limited has one joint

operation at 30 June 2019.

Joint operations

A joint operation is a joint arrangement whereby the parties

have joint control of the arrangement have rights to the assets and

obligations for the liabilities, relating to the arrangement.

Strategic Minerals Plc recognises its direct right to the assets,

liabilities, revenues and expenses of the joint operations and its

share of any jointly held or incurred assets, liabilities, revenues

and expenses.

Joint Ventures

A joint venture is a joint arrangement whereby the parties that

have joint control of the arrangement have the rights to the net

assets of the joint arrangement. Interests in joint ventures are

accounted for using the equity method, after initially being

recognised at cost in the consolidated statement of financial

position.

Business Combinations

Business Combinations occur where an acquirer obtains control

over one or more businesses. A business combination is accounted

for by applying the acquisition method unless it is a combination

involving entities or businesses under common control. The business

combination will be accounted for from the date that control is

obtained, whereby the fair value of identifiable assets acquired

and liabilities (including contingent liabilities assumed) is

recognised.

All transaction costs incurred in relation to business

combinations, other than those associated with the issue of a

financial instrument are recognised as expenses in profit and loss

when incurred

The acquisition of a business may result in the recognition of

goodwill or gain from a bargain purchase.

New, revised or amending accounting standards and

interpretations

IASB has issued a number of IFRS and IFRIC amendments or

interpretations since the last annual report was published. It is

not expected that any of these will have a material impact on the

Group.

IFRS "16 Leases" (effective for periods beginning on or after 1

January 2019) requires lessees to use single on-balance sheet model

and recognise all lease assets and liabilities on the balance

sheet. Management have completed an internal review of existing

leases and operating contracts. All existing arrangements are

short-term in nature and as such have not been accounted for under

IFRS 16. The adoption of IFRS 16 does not have an impact on the

Group's financial statements.

3. Critical accounting estimates and judgements

The Group makes certain estimates and assumptions regarding the

future. Estimates and judgements are continually evaluated based on

historical experience and other factors, including expectations of

future events that are believed to be reasonable under the

circumstances. In the future, actual experience may differ from

these estimates and assumptions. The estimates and assumptions that

have a significant risk of causing a material adjustment to the

carrying amounts of assets and liabilities within the next

financial year are discussed below.

Judgements

(a) Joint arrangement and joint operation

The Company holds a 50% interest in Cornwall Resources Limited

("CRL") which owns the Redmoor Tin-Tungsten project in the United

Kingdom with the other shareholder being New Age Exploration

Limited ("NAE"). Under the shareholders agreement with NAE, CRL is

operated as a 50:50 joint venture with each party being entitled to

appoint one Director. Based on this, the Group considers that they

have joint control over the arrangement. Under IFRS 11, this joint

arrangement is classified as a joint venture and has been included

in the consolidated financial statements using the equity

method.

Estimates and assumptions

(a) Carrying value of intangible assets

In assessing the continuing carrying value of the exploration

and evaluation costs carried the Company has made an estimation of

the value of the underlying tenements and exploration licenses

held.

(b) Share based payments, warrants and options

The fair value of share-based payments recognised in the

statement of comprehensive income is measured by use of the Black

Scholes model after taking into account market based vesting

conditions and conditions attached to the vesting and exercise of

the equity instruments. The expected life used in the model is

adjusted based on management's best estimate, for the effects of

non-transferability, exercise restrictions and behavioural

considerations. The share price volatility percentage factor used

in the calculation is based on management's best estimate of future

share price behaviour based on past experience.

(c) Carrying value of amounts owed by subsidiary

undertakings

IFRS9 requires the parent company to make assumptions when

implementing the forward- looking expected credit loss model. This

model is required to be used to assess the intercompany loan

receivables from its subsidiaries for impairment. Arriving at an

expected credit loss allowance involved considering different

scenarios for the recovery of the intercompany loan receivables,

the possible credit losses that could arise and probabilities for

these scenarios.

The following were considered; the exploration project risk, the

future sales potential of product, value of potential reserves and

the resulting expected economic outcomes of the project.

4. Segment information

The Group has four main segments during the period:

-- Southern Minerals Group LLC (SMG) - This segment is involved

in the sale of magnetite to both the US domestic market and

historically transported magnetite to port for onward export

sale.

-- Head Office - This segment incurs all the administrative

costs of central operations and finances the Group's operations. A

management fee is charged for completing this service and other

certain services and expenses. The investment in the Redmoor

project in Cornwall, United Kingdom is held by this segment.

-- Australia - This segment holds the Central Australian Rare

Earths Pty Ltd tenements in Australia and incurs all related

operating costs.

-- Development Asset - This segment holds the Leigh Creek Copper

Mine Development Asset in Australia and incurs all related

operating costs.

Factors that management used to identify the Group's reportable

segments

The Group's reportable segments are strategic business units

that carry out different functions and operations and operate in

different jurisdictions.

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision-maker.

The chief operating decision maker has been identified as the board

and management team which includes the Board and the Chief

Financial Officer.

Measurement of operating segment profit or loss, assets and

liabilities

The Group evaluates segmental performance on the basis of profit

or loss from operations calculated in accordance with EU Adopted

IFRS but excluding non-cash losses, such as the effects of

share-based payments.

Segment assets exclude tax assets and assets used primarily for

corporate purposes. Segment liabilities exclude tax liabilities.

Loans and borrowings are allocated to the segments in which the

borrowings are held. Details are provided in the reconciliation

from segment assets and liabilities to the Group's statement of

financial position.

6 Months to 30 June Head Office SMG Australia Development Inter Total

2019 (Unaudited) Asset Segment

Elimination

$'000 $'000 $'000 $'000 $'000 $'000

Revenue - 1,395 - - - 1,395

Cost of sales - (229) - - - (229)

_______ ______ _______ _______ _______ _______

Gross Profit - 1,166 - - - 1,166

Depreciation - (16) (3) - - (19)

Overhead expenses (552) (475) (184) - - (1,211)

Management fee 100 (100) - - -

Impairment Charge - - (760) - - (760)

Share based expense (163) - - - - (163)

Write back of provisions 1,744 - - (1,744) -

Equity accounting

profit(loss) (38) - - - - (38)

Foreign Exchange - - (2) - - (2)

Gain on Shares available

for resale - - 1 - - 1

________ ________ ________ ________ ________ ________

Segment profit/(loss)

from operations 1,091 575 (948) - (1,744) (1,026)

________ ________ ________ ________ ________ ________

Segment profit/(loss)

before taxation 1,091 575 (948) - (1,744) (1,026)

________ ________ ________ ________ ________ ________

6 Months Head Office SMG Australia UK Inter Total

to Segment

30 Elimination

June

2018

(Unaudited)

$'000 $'000 $'000 $'000 $'000 $'000

Revenue 2 2,118 - - - 2,120

Cost

of

sales - (391) - - - (391)

_______ ______ _______ _______ _______ _______

Gross

Profit 2 1,727 - - - 1,729

Other

Income - - 2,464 - - 2,464

Depreciation - (36) - - - (36)

Overhead

expenses (838) (445) (103) - - (1,386)

Management

fee 200 (200) - - - -

Share

based

expense (92) - - - - (92)

Write

back

of

provisions (379) - - - 379 -

Equity

accounting

loss 1 - - - - 1

Foreign

Exchange 8 - - - (1) 7

________ ________ ________ ________ ________ ________

(1,098) 1,046 2,361 - 378 2,687

Segment

profit/(loss)

from

operations (1,098) 1,046 2,361 - 378 2,687

________ ________ ________ ________ ________ ________

Segment

profit/(loss)

before

taxation (1,098) 1,046 2,361 - - 2,687

________ ________ ________ ________ ________ ________

Year to 31 December Head SMG Australia Development Intra Total

2018(Audited) Office Asset Segment

Elimination

$'000 $'000 $'000 $'000 $'000 $'000

Revenue 3 3,350 2 - - 3,355

Cost of sales - (650) - - - (650)

________ _______ ________ ________ ________ ________

Gross profit 3 2,700 2 - - 2,705

Other Income - - - 2,162 - 2162

Depreciation - (64) - - - (64)

Overhead expenses (1,250) (850) (224) - - (2,324)

Management fee 380 (380) - - - -

Loss on available

for sale assets - - (12) - - (12)

Loss on sale of tenements - - (245) - - (245)

Share-based payments

charge (268) - - - - (268)

(Loss)/ gain on intercompany

loans 1,899 - - - (1,899) -

Share of net loss

from associates (27) - - - - (27)

Foreign exchange

gain (loss) (149) - - - 155 6

________ ________ ________ ________ ________ ________

Segment profit /

(loss) from operations 588 1406 (479) 2,162 (1,744) 1,933

________ ________ ________ ________ ________ ________

As at 30 June 2019 (Unaudited) Head Office SMG Development Australia Total

Asset

$'000 $'000 $'000 $'000 $'000

Additions to non-current

assets (excluding deferred

tax) 37 - 1,272 91 1,400

________ ________ ________ ________ ________

Reportable segment assets

(excluding deferred

tax) 3,324 579 5,849 2,350 12,102

Reportable segment liabilities 108 762 1,528 108 2,506

________ ________ ________ ________ ________

Total Group Liabilities 2,506

________

As at 30 June 2018 (Unaudited) Head Office SMG Development Australia Total

Asset

$'000 $'000 $'000 $'000 $'000

Additions to non-current

assets (excluding deferred

tax) 107 - - 1,469 1,576

________ ________ ________ ________ ________

Reportable segment assets

(excluding deferred

tax) 3,098 2053 - 6,560 11,711

Reportable segment liabilities 189 680 - 266 1,135

________ ________ ________ ________ ________

Total Group Liabilities 1,135

________

As at 31 December 2018(Audited) Head Office SMG Development Australia Total

Asset

$'000 $'000 $'000 $'000 $'000

Additions to non-current

assets (excluding deferred

tax) 639 - 2,011 237 2,887

________ ________ ________ ________ ________

Reportable segment assets

(excluding deferred

tax) 2,576 1,511 5,722 1,632 11,441

________ ________ ________ ________ ________

Reportable segment liabilities 129 978 901 112 2,120

________ ________ ________ ________ ________

Total Group liabilities 2,120

________

External revenue by Non-current assets

location of customers by location of assets

2019 2018 2019 2018

$'000 $'000 $'000 $'000

United States 1,395 2,118 177 395

United Kingdom - 2 2,264 1,755

Australia - - 7,893 6,285

_______ _______ _______ _______

1,395 2,120 10,334 8,435

_______ _______ _______ _______

Revenues from Customer A totalled $351,140 (2018: $362,051),

which represented 25% (2018: 17%) of total domestic sales in the

United States, Customer B totalled $563,945 (2018: $627,977) which

represented 40% (2018: 30%) of total sales and Customer C totalled

$375,000 (2018: $506,186) which represented 27% (2018: 24%). There

were no export sales in the year (2018: Nil).

5. Operating loss

Administration costs by nature

6 months 6 months

to to Year to

30 June 30 June 31 December

2019 2018 2018

(Unaudited) (Unaudited) (Audited)

$'000 $'000 $'000

Operating gain/loss is stated after

charging/(crediting):

Directors' fees and emoluments 401 414 665

Depreciation 19 36 64

Equipment rental 145 130 248

Equipment maintenance 26 34 46

Share of net loss (profit) from

joint operations 38 (1) 27

Auditors' remuneration 13 8 76

Salaries, wages and other staff

related costs 274 276 514

Insurance 15 11 -

Legal, professional and consultancy

fees 178 329 476

Loss on sale of tenements - - 245

Impairment charge 760 - -

Loss (gain)on financial assets held

at fair value through profit and

loss (1) - 12

Travelling and related costs 51 69 95

Foreign exchange 2 (7) (6)

Share based payments 163 92 268

Other expenses 108 126 204

6. Intangible Assets

Exploration/

evaluation

costs

Cost $'000

At 1 January 2018 1,242

Additions to 30 June 2018* 4,932

At 30 June 2018 ( unaudited) 6,174

Reallocation to Development Asset* (4,932)

Disposals (347)

Additions in the year 237

Foreign exchange difference (95)

At 31 December 2018 ( audited) 1,037

Additions to 30 June 2019 91

Foreign exchange difference (26)

Impairment Charge* (760)

At 30 June 2019 (unaudited) 342

At 30 June 2019, the Group has raised an impairment assessment

based on its decision to exit a number of CARE tenements.

7. Investments in Associates Investments

(Unaudited)

Cost $'000

At 1 January 2019 2,248

Acquisition of joint venture interests 40

Share of equity (loss)profit in joint ventures (38)

Foreign exchange difference 14

As at 30 June 2019 2,264

On 25 July 2019, the Company settled the acquisition of New Age

Exploration Limited's ("NAE") 50% holding in Cornwall Resources Ltd

("CRL"). Details of the settlement are included in Note 12.

8. Property, plant and

equipment

Railway Development Plant and

infrastructure Asset Machinery Total

$'000 $'000 $'000 $'000

Group

Cost

At 1 January 2018 3,498 - 199 3,697

Additions for period - - 190 190

Acquired in business combination - - 74 74

________ ________ ________ ________

At 30 June 2018 3,498 - 463 3,961

Acquired in business combination - 4,559 - 4,559

Additions - 797 - 797

Disposals (3,498) - - (3,498)

Foreign exchange difference - (449) (2) (451)

________ ________ ________ ________

At 31 December 2018 - 4,907 461 5,368

________ ________ ________ ________

Additions - 1,834 57 1,891

Disposals - - - -

Foreign exchange difference - (16) - (16)

________ ________ ________ ________

At 30 June 2019 - 6,725 518 7,243

________ ________ ________ ________

Depreciation

At 1 January 2018 (3,498) - (132) (3,630)

Charge in the six months - - (36) (36)

________ ________ ________ ________

At 30 June 2018 (3,498) - (168) (3,666)

Charge in the year - - (28) (28)

Disposals 3,498 - - 3,498

Foreign exchange difference - - (2) (2)

________ ________ ________ ________

At 31 December 2018 - - (198) (198)

________ ________ ________ ________

Charge for the period - - (19) (19)

________ ________ ________ ________

As at 30 June 2019 - - (217) (217)

________ ________ ________ ________

Carrying Value

At 30 June 2018 - - 295 295

________ ________ ________ ________

At 31 December 2018 - 4,907 263 5,170

________ ________ ________ ________

At 30 June 2019 - 6,725 301 7,026

________ ________ ________ ________

9. Dividends

No dividend is proposed for the period.

10. Earnings per share

Earnings per ordinary share have been calculated using the

weighted average number of shares in issue during the relevant

financial year as provided below.

6 months 6 months Year to

to to

30 June 30 June 31 December

2019 2018 2018

(Unaudited) (Unaudited) (Audited)

Weighted average number of shares-Basic 1,391,249,064 1,275,230,925 1,366,949,045

(Loss)/earnings for the period ($1,182,000) $2,406,000 $1,473,000

(Loss)/earnings per share in the

period-Basic ($0. 0008) $0.0019 $0.0011

11. Share capital and premium

2019 2019 2018 2018

No $'000 No $'000

Allotted, called up and

fully paid

Ordinary shares 1,467,631,282 50,656 1,376,193,127 49,205

__________ __________ __________ __________

In February 2019, the Company issued 17,500,000 ordinary shares

due to options being exercised at an exercise price of 1 pence.

In March 2019, the Company issued 2,866,730 ordinary shares at a

price of GBP 0.19 to Resilience Mining Australia Ltd, in respect of

its acquisition of Leigh Creek Copper Mine Pty Ltd.

As a result of a placement in June 2019 the Company issued

63,571,425 ordinary shares at a price of GBP 0.14. The total

proceeds of the placement after fees was GBP 834,375 ($1,059,000).

Of this amount $91,000 was received in June 2019, with the balance

$968,000 received in July 2019.

Share options and warrants

The number of options and warrants as at 30 June 2019 and a

reconciliation of the movements during the half year are as

follows:

Date of Granted as Exercised Granted as Exercise Date of Date of

Grant at 31 December at 30 June price vesting expiry

2018 2019

10.04.15 8,000,000 (8,000,000) - 1.00p 19.05.17 30.06.19

06.01.17 9,500,000 (9,500,000) - 1.00p 19.05.17 30.06.19

15.02.18 72,000,000 - 72,000,000 2.75p 01.04.20 30.06.20

15.02.18 38,500,000 - 38,500,000 3.75p 01.01.21 30.06.21

15.02.18 17,500,000 - 17,500,000 5.00p 01.01.22 30.06.22

09.08.18 35,250,000 - 35,250,000 2.75p 01.04.20 30.06.20

09.08.18 10,750,000 - 10,750,000 3.75p 01.01.21 30.06.21

3030

09.08.18 4,750,000 - 4,750,000 5.00p 01.01.22 30.06.22

----------------- -------------- -------------

19,250,000 (17,500,000) 178,750,000

----------------- -------------- -------------

12. Post balance date events

On 25 July 2019, the Company settled the acquisition of New Age

Exploration Limited's ("NAE") 50% holding in Cornwall Resources Ltd

("CRL"). Details of the settlement are:

-- An initial A$290,000 payment, taking total cash paid to

A$300,000 and agreeing an 11 month payment schedule for the balance

of A$2,700,000.

-- Payments of A$300,000 to made quarterly before 31 October

2019, 31 January 2020 and 30 April 2020 with balance to be paid on

or before 26 June 2020.

-- The interest rate on the balance of A$2,700,000 is 5% pa,

calculated on a daily balance basis, payable at the end of each

calendar quarter to allow for early repayment.

-- SML has provided NAE with a charge over the Company's shares

in CRL, a debenture charge over CRL's property and, in the event of

default, NAE has the option to convert any outstanding balances to

SML shares at 90% of the VWAP for SML shares in the 10 trading days

prior to the issue of the conversion notice.

Copies of this interim report will be made available on the

Company's website, www.strategicminerals.net.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR URAARKRAKOAR

(END) Dow Jones Newswires

September 30, 2019 07:47 ET (11:47 GMT)

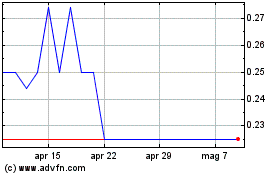

Grafico Azioni Strategic Minerals (LSE:SML)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Strategic Minerals (LSE:SML)

Storico

Da Apr 2023 a Apr 2024