Hygea VCT plc Update For The Quarter Ended 30 September 2019

08 Ottobre 2019 - 8:00AM

UK Regulatory

TIDMHYG

Seneca Growth Capital VCT Plc (the "Company")

Update for the quarter ended 30 September 2019

The Directors and the investment manager of the Company, Seneca Partners

Limited, have reviewed the valuation of the Company's portfolios as at

30 September 2019.

The unaudited net asset value per share ("NAV") of an ordinary share as

at 30 September 2019 was 34.6p per share. This is an increase of 1.0p

from the previously published unaudited NAV as at 30 June 2019 of 33.6p,

due to the changes in the value of the quoted investments, net of the

associated performance fee. The quoted investments of the ordinary share

pool are valued at the closing bid prices. As at 30 September 2019,

shares in Scancell plc were valued at 7.0p (30 June 2019: 6.5p) and

shares in Omega Diagnostics plc were valued at 11.3p (30 June 2019:

9.7p). The Directors also reviewed the unquoted investments held in the

portfolio and concluded that all valuations remain appropriate.

The unaudited NAV of a B share as at 30 September 2019 was 95.2p per B

share. This is a decrease of 4.3p from the previously published

unaudited NAV as at 30 June 2019 of 99.5p due to changes in the value of

the quoted investment, as well as the impact of ordinary running costs

incurred in the quarter ended 30 September 2019. The quoted investment

of the B share pool is valued at the closing bid price. As at 30

September 2019, shares in SkinBioTherapeutics plc were valued at 15.25p

(30 June 2019: 19.5p). The Directors also reviewed the unquoted

investments held in the portfolio and concluded that all valuations

remain appropriate. The decrease in the NAV per B share is limited by

the impact of the cost cap which restricts the burden of ordinary

running costs on the B share class to 3% of the NAV of the B shares.

During the quarter the Company also issued a prospectus on 16 July 2019

in relation to an offer for subscription for further B shares to raise,

in aggregate, up to GBP10 million with an over-allotment facility of up

to a further GBP10 million (before issue costs) (the "Offer"). The Offer

is expected to close no later than 5.00 p.m. on 3 April 2020 in relation

to the tax year 2019/20, and no later than 5.00 p.m. on 9 July 2020 in

relation to the tax year 2020/21 (unless the Offer has been fully

subscribed by an earlier date or previously extended by the Board to a

date no later than 13 July 2020).

The Directors are not aware of any post period end events that would

materially impact the Company itself or the value of investments held.

For further information, please contact:

John Hustler, Seneca Growth Capital VCT Plc at

john.hustler@btconnect.com

Richard Manley, Seneca Growth Capital VCT Plc at

Richard.Manley@senecapartners.co.uk

(END) Dow Jones Newswires

October 08, 2019 02:00 ET (06:00 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

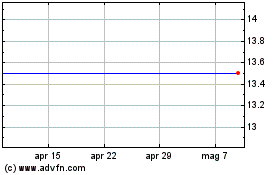

Grafico Azioni Seneca Growth Capital Vct (LSE:HYG)

Storico

Da Mar 2024 a Apr 2024

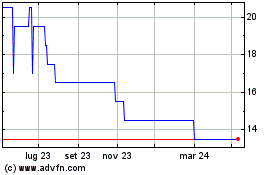

Grafico Azioni Seneca Growth Capital Vct (LSE:HYG)

Storico

Da Apr 2023 a Apr 2024