TIDMJUP

RNS Number : 5474P

Jupiter Fund Management PLC

11 October 2019

Trading Update and Notice of Results

-------------------------------------

11 October 2019

Jupiter Fund Management plc ("Jupiter", the "Group") today

issues its trading update in respect of the three months to 30

September 2019.

HIGHLIGHTS

-- Net outflows in the quarter of GBP1.3bn.

-- AUM at 30 September 2019 of GBP45.1bn, a decrease of GBP0.8bn

in the quarter.

ASSETS UNDER MANAGEMENT AND FLOWS

30 June Market/FX 30 September

2019 Q3 net flows movement 2019

GBPm GBPm GBPm GBPm

==================== ======= ===================== ========= ============

Mutual funds 38,983 (956) 434 38,461

==================== ======= ===================== ========= ============

Segregated mandates 5,568 (348) 46 5,266

==================== ======= ===================== ========= ============

Investment trusts 1,357 (11) 16 1,362

==================== ======= ===================== ========= ============

Total 45,908 (1,315) 496 45,089

==================== ======= ===================== ========= ============

Net mutual fund outflows were GBP1.0bn during the quarter, of

which GBP1.1bn outflows were from our European Growth strategy,

principally within the UK and Continental Europe. Since our

announcement on 1 July 2019, Alexander Darwall has pursued his

intention to set up an independent firm and now intends to leave

Jupiter in mid-November. The transfer of management

responsibilities to Alexander's successors on the Jupiter European

Fund and Jupiter European Growth SICAV took place on 1 October

2019.

Segregated mandates saw GBP0.3bn net outflows during the

quarter. Within this, two clients withdrew assets totalling

GBP0.7bn and two new mandates were opened in the period totalling

GBP0.4bn.

The Flexible Macro (SICAV) and Global High Yield Short Duration

Bond (SICAV) funds were launched during the quarter, adding to our

Multi-Asset and Fixed Income strategies respectively.

NOTICE OF RESULTS

Jupiter will be issuing results for the year ending 31 December

2019 on 28 February 2020 and will host an analyst presentation to

discuss the results at 9:00am. The presentation will be held at The

Zig Zag Building, 70 Victoria Street, London, SW1E 6SQ.

For further information Investors Media

please contact:

Jupiter Alex Sargent/Investor Despina Constantinides/Corporate

Relations Communications

+44 (0)20 3817 1534/1065 +44 (0)20 3817 1196/1278

Powerscourt Justin Griffiths

+44 (0)20 7324 0496

LEI Number: 5493003DJ1G01IMQ7S28

Forward-looking statements

This announcement contains forward-looking statements with

respect to the financial condition, results and business of the

Group. By their nature, forward-looking statements involve risk and

uncertainty because they relate to events, and depend on

circumstances, that will occur in the future. Jupiter's actual

results may differ materially from the results expressed or implied

in these forward-looking statements. Nothing in this announcement

should be construed as a profit forecast.

Historic flow and AUM data by quarter

--------------------------------------

Flows and AUM by

quarter

====================== ================== ======= ======= ======= ======= ======= =======

Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

====================== ================== ======= ======= ======= ======= ======= =======

Total

====================== ================== ======= ======= ======= ======= ======= =======

Opening AUM 50,180 46,853 48,235 47,721 42,673 44,061 45,908

Gross inflows 3,224 3,154 2,760 2,784 3,259 3,280 4,014

Gross outflows (4,474) (4,171) (3,593) (4,310) (3,741) (3,883) (5,329)

Net flows (1,250) (1,017) (833) (1,526) (482) (603) (1,315)

Market / FX movements (2,077) 2,399 319 (3,522) 1,870 2,450 496

Closing AUM 46,853 48,235 47,721 42,673 44,061 45,908 45,089

Mutual funds

====================== ================== ======= ======= ======= ======= ======= =======

Opening AUM 43,745 41,072 41,998 41,473 36,940 37,473 38,983

Gross inflows 3,093 3,051 2,600 2,379 2,697 3,034 3,017

Gross outflows (4,022) (4,046) (3,373) (4,119) (3,688) (3,608) (3,973)

Net flows (929) (995) (773) (1,740) (991) (574) (956)

Market / FX movements (1,744) 1,921 248 (2,793) 1,524 2,084 434

Closing AUM 41,072 41,998 41,473 36,940 37,473 38,983 38,461

Segregated mandates

====================== ================== ======= ======= ======= ======= ======= =======

Opening AUM 5,208 4,614 4,961 4,901 4,577 5,348 5,568

Gross inflows 129 100 155 404 561 246 996

Gross outflows (435) (117) (217) (186) (48) (269) (1,344)

Net flows (306) (17) (62) 218 513 (23) (348)

Market / FX movements (288) 364 2 (542) 258 243 46

Closing AUM 4,614 4,961 4,901 4,577 5,348 5,568 5,266

Investment trusts

====================== ================== ======= ======= ======= ======= ======= =======

Opening AUM 1,227 1,167 1,276 1,347 1,156 1,240 1,357

Gross inflows 2 3 5 1 1 0 1

Gross outflows (17) (8) (3) (5) (5) (6) (12)

Net flows (15) (5) 2 (4) (4) (6) (11)

Market / FX movements (45) 114 69 (187) 88 123 16

Closing AUM 1,167 1,276 1,347 1,156 1,240 1,357 1,362

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTLLFERILLILIA

(END) Dow Jones Newswires

October 11, 2019 02:00 ET (06:00 GMT)

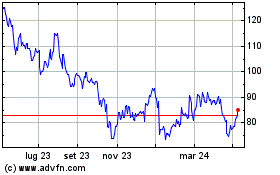

Grafico Azioni Jupiter Fund Management (LSE:JUP)

Storico

Da Mar 2024 a Apr 2024

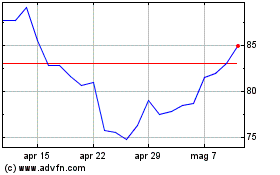

Grafico Azioni Jupiter Fund Management (LSE:JUP)

Storico

Da Apr 2023 a Apr 2024